Course correction: China’s shifting approach to economic globalization

Key findings

- China’s leadership is trying to strike a balance between securitization and remaining globally integrated. Beijing’s policy response to new geopolitical realities will have profound implications for the trajectory of domestic reforms and China’s future global economic integration.

- China’s commitment to hedged integration with the global economy has not changed, despite the hostile international environment. But it is increasingly on China’s terms – in stark contrast to the old liberalization mantra. China needs to remain connected to the global economy to achieve its goals of becoming a modern, technologically advanced, and prosperous country.

- China seeks to reduce its reliance on essential external inputs. Trade and investment links are being reshaped to be more resilient and to further China’s development goals. The role of international exchanges has switched focus from exports and foreign investment to accessing strategic technology and know-how.

- China aims to internalize global value chains and finance by leveraging its large domestic market. Onshoring the production of critical inputs by foreign companies in areas vital for China builds economic self-reliance and contributes to developing indigenous alternatives, bringing their technology and production within the CCP’s jurisdiction.

- Contrary to some interpretations, the DCS is not universally bad news for foreign companies. Expansions in market access in non-sensitive areas or in sectors in which China aims to onshore value chains mean new opportunities. However, protectionism, securitization efforts, new cybersecurity rules, and efforts to build supply chain resilience are simultaneously pushing out some foreign companies.

- Beijing’s pursuit of managed integration means its treatment of foreign firms differs according to the industry and its strategic priority. Its variable approaches can be summarized as follows:

• Protect market share where local companies are globally competitive, such as in network equipment

• Onshore foreign technology where possible, for example in the chemicals sector

• Create new opportunities for non-sensitive foreign investment, like in the automotive sector

• Import foreign technology where necessary, such as aerospace components

• Integrate with global financial markets and promote the yuan abroad, for example with greater access to foreign financial service providers - China’s changing views on global economic integration means that foreign firms are granted access to a market that resembles a fortress that is currently being reinforced. Foreign operations in China are de facto on a pathway to becoming more like a local Chinese entity rather than integrated in global networks. They are not decoupling from China, but rather decoupling their China operations from their global ones.

1. China adjusts its approach towards globalization amid rising geopolitical frictions

China’s gradual integration into the global economy has fueled its rise for 40 years. Yet this once-axiomatic economic driver has recently become far more contested, and its place within the party-state’s strategic vision for future development is consequently less certain. In the past, optimism about China’s integration into the global economy helped prevent any major confrontations. But today global interconnectedness is increasingly seen as a strategic vulnerability in China (and elsewhere) as growing economic rivalry and systemic differences have thrown up political frictions. In response, China’s leadership has adjusted their approach to international economic engagement – with profound implications for the trajectory of domestic reforms and China’s future global integration.

The policy shift towards the Dual Circulation Strategy (DCS) set out by President Xi Jinping in April 2020 focuses on managing China’s interdependence with the world by emphasizing indigenous innovation and self-reliance. The shift has generated concern among Western politicians and observers, as it disrupts long-held, largely tacit beliefs that the eventual outcome of China’s integration into the world economy would be gradual convergence of its economic and perhaps even political systems with Western norms.

However, dual circulation does not signal any return to pre-reform Mao-era isolation. China’s leadership is adapting its approach to globalization to manage risks in a more volatile global setting. Despite the seemingly profound changes, the shift does not represent a radical transformation in Beijing’s views on globalization and opening up.

China’s embrace of globalization and the liberalization of its economy since the 1980s was always marked by caution and experimentation; it was a strategy of hedged integration. At each step, the CCP leadership was mindful of economic and political risks, careful to balance the country’s needs and fears as they evolved (see Exhibit 2).1 Although the motivation and priorities for opening up have changed with China’s economic development stages, the key building blocks include:

- Catalyzing economic reform: Propelling structural reforms, and pushing back against conservative vested interests

- Strengthening marketization and competition: Exposing Chinese companies to foreign competition to improve domestic supply, productivity, profitability, and innovation

- Securing technology and innovation: Accessing foreign technology and know-how to enable economic development and innovation

- Attracting capital inflow: Foreign investment boosts domestic growth, upgrades industry, and improves efficiency in China’s financial markets.

- Deepening economic ties: Strong trade and investment ties help expand China’s economic power. Real and prospective of opening China’s market (even if just partially) helps secure market access for Chinese companies abroad for exports and investment.

China’s engagement with the world is also no longer only a one-way street. Whereas China previously had to reform its economy to attract foreign investment, foreign companies can no longer afford to miss out on China’s vast market opportunities. Since 2010, China has expanded its economic footprint: Chinese companies are venturing overseas and buying foreign entities.

China’s greater international ambitions – most visible in the Belt and Road Initiative (BRI) launched in 2013 to connect and unlock new markets – reflect its growing economic weight and are accompanied by a perception of liberal market economies as being in relative decline, and potentially inferior to China’s political and economic system. Nonetheless, Beijing still needs to secure access to foreign technology, know-how, and capital.

The shifting landscape of global economic relations requires China’s leadership to rethink its approach – and is empowering conservative forces in China. Long-entrenched skepticism about Western principles of market forces (and democracy) is making a comeback. A greater focus on securitization, self-reliance, and – perhaps most dangerously – nationalism and ideology are fundamentally changing how China engages with the world.

2. Ambitions and vulnerabilities tie China to the world economy

Confidence and insecurity feature strongly in Chinese debates on how to pursue external economic engagement. This contradictory mix is the product of China’s current stage of development and reflects the fact that its overall economic power remains quite small. China has expanded its economic leverage in some areas, for example by consolidating global supply chains within its borders, and Chinese firms have attained leading positions in industries such as telecommunications, high-speed rail, and digital technologies. Yet it is still weak in crucial areas, such as foundational technology and international finance, so it holds limited chokepoints over other advanced economies.

Confidence stems from China’s economic dynamism and resilience. China’s share of the global economy jumped from 4.0 percent in 2001 to 17.4 percent by 2020.2 GDP per capita growth averaged 8.1 percent a year in the same period.3 China managed to avoid significant financial shocks during the 1997/98 Asian Financial Crisis and Global Financial Crisis in 2008/09. Beijing draws further evidence of the benefits of its economic model from the swift economic recovery after the Covid-19 outbreak in 2020.

China has become increasingly emboldened in international affairs, which is often perceived overseas as an attempt to dominate others. Yet domestically this is viewed as China simply defending its core interests. China remains aware of its relative weakness. The sense of injustice suffered at the hands of imperialist forces in the “century of humiliation” from the Opium War to 1949 has been translated into a domestic political strength as pushback from advanced economies is readily seen as a bid to undermine a “weaker” China.

Beijing is already convinced that the United States is pursuing a policy of containment against China.4 Official narratives are dominated by the view that the United States and its allies are working to stall China’s rise and maintain a monopoly on core technologies.5 Deteriorating China-EU relations stoke these concerns. Scholars highlight the risks of China’s dependence on other nations for technology and know-how as likely to hinder industrial upgrading and warn that foreign companies could leave.6

Conservative voices in the public arena have gained increased prominence amid economic antagonism. Previously, external pressure to conform with international expectations was a useful means to stimulate domestic reform; it is now seen as hostile. The leftist, statist wing of the CCP has long preferred a path of self-reliance; such voices feel vindicated by US moves against Huawei and ZTE threatening to cut off supply of high-end semiconductors. The self-reliance campaign, which has been running in the background for decades, has become a national priority that demands a “new type of whole of nation approach (新型举国体制),” as announced in the 2020 Central Economic Work Conference.7 This means extensive government support for strategic industries, targeted mergers and acquisitions of critical foreign tech and tightened national security regulations.

Nevertheless, China’s approach to hedged integration has not changed. Opening up remains essential when it is to China’s advantage – and also because China’s dependence is widely acknowledged.8 Overall, Chinese intellectuals and policymakers remain committed to economic integration, but increasingly on China’s terms – in stark contrast to the old liberalization mantra. Justin Lin Yifu (林毅夫) of Peking University contends that, should the US block access to certain high-tech products, supply would be maintained through trade with other advanced economies in Europe and Asia.9 Scholars such as Hu Ran (胡然) argue that complete tech decoupling between the US and China is not possible.10

The bottom line is that China needs to remain connected to the global economy to achieve its goals of becoming a modern, technologically advanced, and prosperous country. China’s political ambition does not yet match its economic and technological reality. Reinforced global connections are vital to becoming more self-sufficient and upgrading the economic structure. Accordingly, China’s leadership has developed a new blueprint for engagement with the world economy.

3. The dual circulation strategy: Cornerstone policy for navigating globalization's new realities

The Dual Circulation Strategy (国内国际双循环 or双循环 for short, hereafter: DCS) is China’s overarching plan for further economic development and managing global integration. It was first mentioned in a speech by Xi Jinping at a meeting of the Central Financial and Economic Affairs Commission in April 2020. It seeks to address China’s core challenges for the coming decades, ranging from external risks like protectionism and technological dependencies to domestic challenges like inadequate innovation capabilities, income inequality and environmental degradation.11 The DCS is enshrined in China’s 14th Five-Year Plan for economic development, which includes a mid-term outlook until 2035.12

The new flagship strategy marks a definitive break with the Great International Circulation Strategy pioneered by Deng Xiaoping which concentrated on export and investment-led growth. The key idea of the DCS is to strengthen the domestic market (internal or domestic circulation), while optimizing China’s integration into global markets (external orinternational circulation).13 The two main goals are to:

- Increase domestic consumption and innovation to become the chief drivers of economic development

- Reduce the reliance on essential external inputs and supplement domestic economic activity through global integration

3.1 Views on the DCS differ within China’s elite

Internally, an extensive debate has unfolded on how to interpret the DCS, with senior bureaucrats advancing their preferences on how to achieve its broad goals.

- On one side are voices like that of former central bank advisor Yu Yongding (余永定), who calls for a “relatively independent and complete” Chinese industrial system. He highlights the importance of upgrading manufacturing capabilities.14

- Others, such as Vice Premier Liu He (刘鹤), stress market-oriented reforms as key to strong domestic circulation. Liu sees the DCS as an opportunity to implement more liberal market reforms such as making more credit available to private businesses.15

- Some prominent voices contend that the DCS provides momentum for further opening up. Former vice president of the State Council’s Development Research Center, Wang Yiming (王一鸣), stresses the “obvious and significant” contributions of foreign companies to China’s technological progress and favors further relaxing restrictions on foreign investment.16

3.2 Internalizing globalization to safeguard China’s continued development

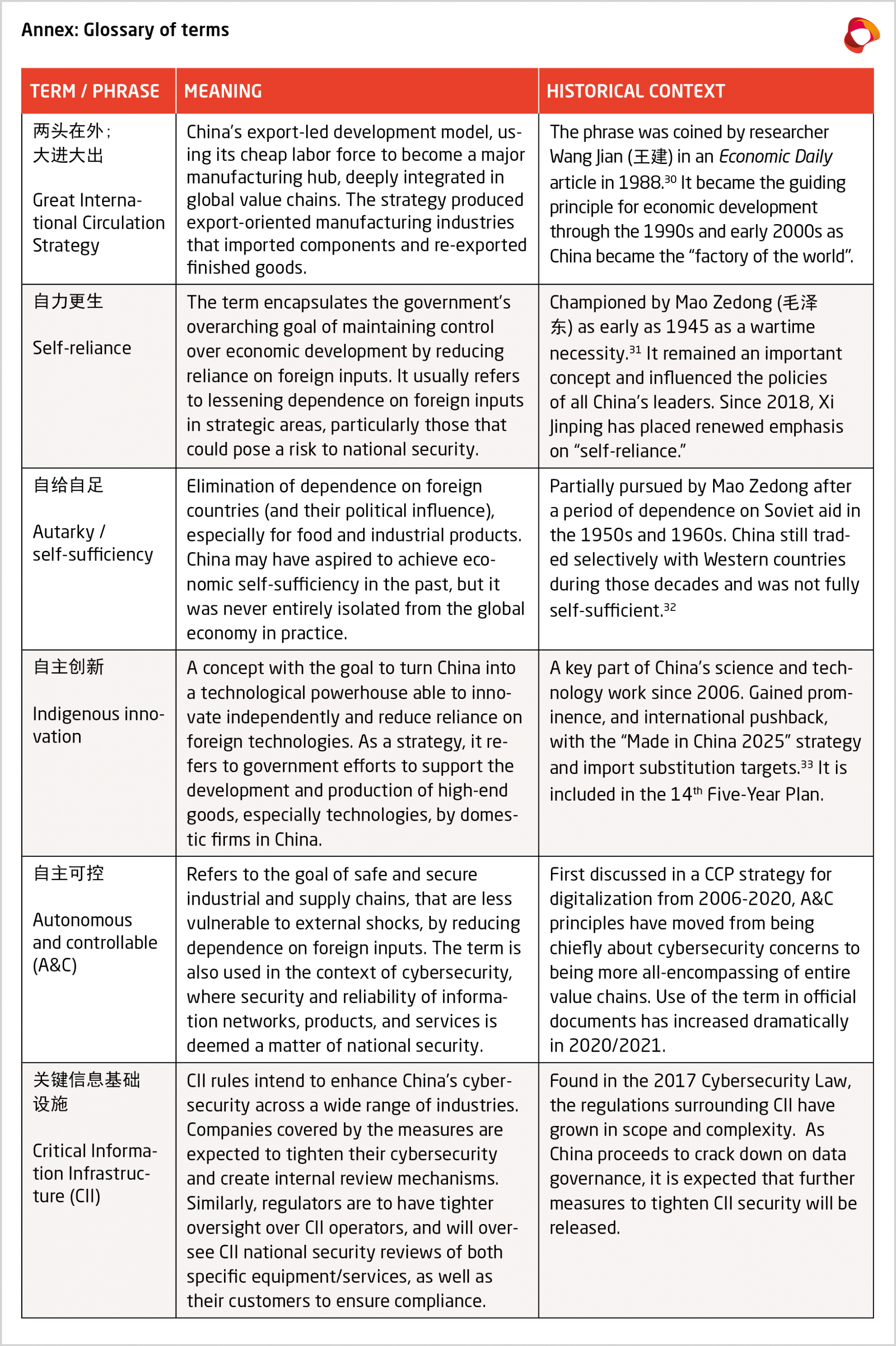

Under the DCS, trade and investment links are being reshaped to be more resilient and to further China’s development goals. The role of the external circulation has switched focus from exports and foreign investment to accessing strategic technology and know-how. This equates to an attempt to internalize globalization, rather than relying on global supply chains. Self-reliance (自力更生), a key concept of the DCS, does not imply ceasing to engage with the rest of the world; it refers to the CCP’s long-standing desire to maintain control over its economic development (see glossary in annex).17

Although China’s pursuit of targeted regional and global integration includes a role for free trade agreements, Xi Jinping’s rhetoric of continued commitment to reform and opening up in international fora should be questioned.18 The fact that China joined the Regional Comprehensive Economic Partnership (RCEP) in 2020 and now wishes to join the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) reflects its need to secure vital trade links and avoid isolation, rather than any firm commitment to increasing market access for foreign firms. Neither agreement was initiated by China, but participation in RCEP and CPTPP can bolster its central position in global trade networks.

The DCS allows for more, selective openness as officials seek to attract foreign firms that can foster technologically advanced industries and boost competition, thereby accelerating the performance of Chinese firms. Foreign financial institutions are important to increase the efficiency of capital allocation. More broadly, China aims to absorb global value chains so that access to certain goods cannot be cut off by foreign governments.

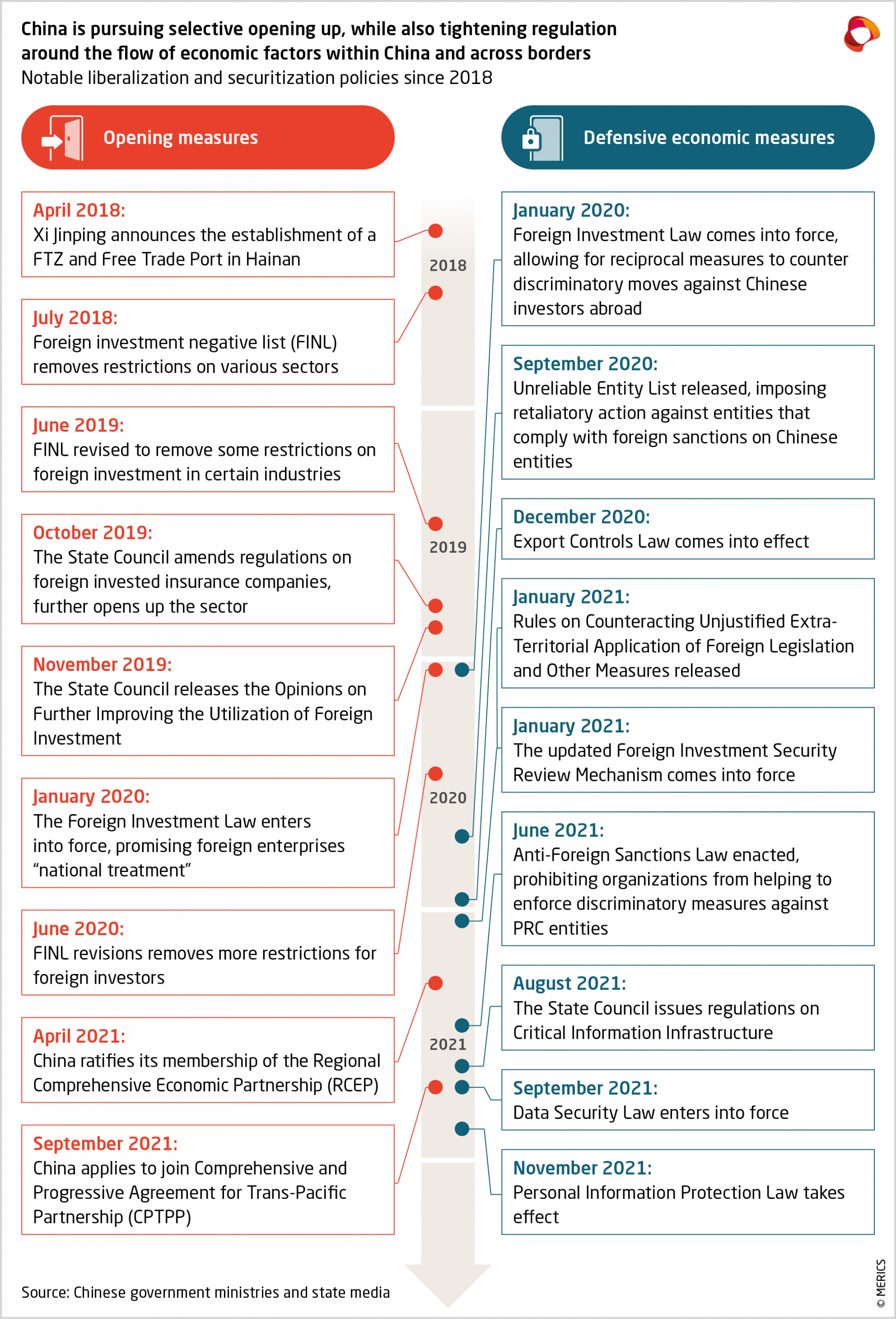

4. A blend of neo-mercantilism and liberalization: "Dual circulation" opens some sectors, securitizes others

China’s state-planners recognize that current cross-border links could be weakened by the actions of foreign governments and are working to develop indigenous technologies, where possible, and onshore foreign providers where necessary. The end goal is to mitigate cross-border risks as soon as possible, then shift towards taking the technological high ground in global value chains and increasing the global position of the yuan. However, this should not be misunderstood as an all-encompassing effort – there are a wide range of non-sensitive industries where China is eager to expand market access and encourage foreign investment to benefit local growth and development. The policy thrust simultaneously liberalizes certain areas of the economy, while tightening and securitizing others.

4.1 Technological self-reliance through local innovation and protectionism

The US-China trade war sent China’s self-reliance campaign into overdrive, especially given restrictions on US technology exports to some Chinese firms. Foundational technologies remain largely imported or foreign made and hence outside Beijing’s control. Hundreds of billions of yuan have therefore been allocated to support innovation, using traditional state-aid mechanisms like financing on favorable terms or subsidies and newer tools like state-guided funds or technology-focused stock exchanges.

Policymakers are rolling out a suite of securitization measures, i.e., new rules to support both economic and national security – the national security dimensions of economic relations. For example, national security reviews are now required for firms investing in areas defined as Critical Information Infrastructure (CII). Typically, this covers any network equipment and related service agreements, as foreign providers are increasingly seen as unreliable. Reviews also extend to sectors that use such network equipment, for instance the banking sector where foreign banks are under pressure to localize their network equipment, service providers, and data management systems.

China also deploys less explicit tools that impact supply chains more broadly. There are unofficial yet growing demands in China for “Autonomous and Controllable” (A&C) technology value chains.19 The implication is that in areas of critical technology, China aims to either develop indigenous production or to fully onshore foreign technology value chains as suppliers.

The A&C principle appears to be spreading and has been adopted by politically savvy Chinese firms as a call to find local suppliers where possible. European industrial software providers have found themselves subject to growing scrutiny from government suppliers and private companies alike. Some have noted that, though current customers still prefer their software, local business leaders believe Chinese alternatives are bound to become necessary at some point unless foreign providers can prove their politically reliability.

4.2 The long-term goal: seizing the technological high ground

In late 2020, Xi Jinping called for work to increase other countries’ dependence on Chinese technology. He said China should tighten the reliance of international value chains on China and forge “assassin’s mace” (杀手锏) technologies – upstream inputs that would allow Beijing to credibly choke off foreign markets as a deterrence. Similarly, calls to strengthen the internationalization of the yuan and China’s role in global finance are aimed at The US-China trade war sent China’s self-reliance campaign into overdrive reducing dependence, particularly on the United States’ financial system and the USD. Essentially, state planners want to gain the same kind of leverage over others that the US has over China’s essential inputs. Doing so would balance out dependencies that Beijing is unable to eliminate in the short-term, as the credible threat of retaliation would ratchet up the cost to other nations of any economic measures targeting China.

4.3 Onshoring critical input production is a priority, though not always achievable

The DCS does not aim for complete autarky. It is a policy upgrade within China’s well-established managed integration approach, balancing internationalization, and self-reliance.20 To solve the weakness of China’s domestic economy, foreign technology and capital are needed. One strategy is to leverage the importance of China’s domestic market for foreign companies in order to internalize global value chains and finance, bringing them within the CCP’s sphere of influence. It is likely to produce highly selective and strategic market opening measures to foreign companies, based solely on ensuring their business activities support and advance China’s domestic economic development goals. As such, policymakers are not only removing investment restrictions for foreign companies, but also rolling out the red carpet to facilitate onshoring. For example, if foreign semiconductor companies wanted to invest in cutting edge operations in China, Beijing would not only welcome it, but would likely fast-track and incentivize such a deal.

Despite policymakers’ desire to replace or onshore foreign technology, there are many components and supplies where this cannot be achieved anytime soon. Some technology is subject to control by foreign governments; for instance, that of companies supplying the US military, such as airplane components, or those that fall under American export controls, like the most cutting-edge semiconductor tech. Meanwhile, other technology is tightly guarded against the risk of tech transfer or leakage in China by companies that refuse to onshore production of their most advanced components or products and prefer to export them instead.

4.4 Foreign investment in non-sensitive areas welcome if it adds to domestic circulation

Many technologies are not sensitive enough to be subjected to national or economic security concerns. These are already seeing improved market access, as investment in these industries will support China’s domestic growth and consumption. This is already taking place, as the most direct barrier to foreign investment, the Foreign Investment Negative List (which clarifies in which areas foreign investors may not invest in China, or can only do so under certain conditions, like equity caps and joint venture requirements) has been steadily reduced.

Investment restrictions on the finance, downstream manufacturing, transportation, and infrastructure sectors have been progressively cut from the list, generating at least some meaningful new opportunities for foreign companies.21 Seen in the context of technological self-reliance and securitization efforts, these opening measures have a wider significance within a broad parallel set of policy trajectories (see Exhibit 5).

4.5 Beijing’s selective approach to foreign investors

Beijing’s hedged global integration strategy has brought variations in the degree of opening up by sector over time. Strict capital controls were used to maintain economic stability; the state’s chokehold over cyberspace is seen by the CCP as vital to social stability. A flurry of more recent changes has created a more politicized business environment, especially tighter data control, and Beijing’s dramatic regulatory moves against China’s own tech giants.

Contrary to some interpretations, the DCS is not universally bad news for foreign companies, as businesses across a variety of sectors stand to benefit from China’s course correction. Corporate strategy makers will need to identify how their company is positioned within China’s development goals and changing market access regime. Broadly speaking, the treatment of foreign firms can be broken into five categories aligned with Beijing’s priorities.

- Protect market share where local companies are globally competitive: China’s industrial policies promote protectionism where Chinese firms are technologically competitive. The clearest example of this trend exists in telecoms and ITC, where network equipment suppliers Huawei and ZTE have become world-class competitors. China is willing to protect market share for its indigenous champions and squeeze out foreign network equipment makers it once relied on, especially given that China’s champions face US, European and Japanese restrictions. The dire situation is seen in Ericsson’s 2021 Q2 revenue – down 60 percent year-on-year – and its closure of an R&D center.22

- Onshore foreign technology where possible: For years, state-planners pushed foreign chemicals-makers into joint ventures (JVs) with China’s state-owned enterprises (SOEs), blocking full ownership. Then, in 2018, BASF and ExxonMobil were granted approval for massive wholly owned projects in Guangdong.23 The shift was prompted by the refusal of foreign chemical manufacturers to risk technology transfer to local competitors through long-standing, though informal, JV requirements. Decision makers approved the projects, recognizing that it is better to have local production of critical upstream inputs necessary for China’s industrial upgrading under party-state jurisdiction.

- Create new opportunities for non-sensitive foreign investment: The DCS presupposes consumption will take a greater share of China’s economy; the automotive sector is a prime example of goods favored by China’s growing middle class and hence chosen for fresh treatment. Onshoring high-end production and supply chains creates employment and tax revenue, plus the spillover benefits of skilled jobs and R&D investment. By removing JV requirements, China has attracted electric vehicle maker Tesla and truck maker Scania. Once investment in passenger vehicles is fully liberalized in 2022, Europe’s carmakers are likely to strengthen their positions – boosting China’s potential to evolve into a regional export base for major auto brands.24

- Import foreign technology where necessary: Replacing imports in the short term is out of the question in some sectors – for example aerospace – so state planners must accept cross-border risks to develop downstream industries. China’s first passenger narrow-body jet airliner, COMAC’s C919, is being developed by relying on foreign suppliers for crucial components (e.g., avionics, power, and airframe systems). The project vision is to trim Airbus and Boeing’s share of China’s passenger aircraft market.25 The end goal may be to onshore production of components, or develop indigenous providers, but for now, China must import these in order to develop its own aerospace OEM.

- Integrate with global financial markets and promote the yuan abroad: In recent years China has modified its capital controls to enable carefully managed integration with the global financial system. Better market access for foreign service provider like banks and insurers aim to foster better functionality, e.g., in risk management and capital allocation.26 Recent expansion of channels for foreign investors facilitates capital inflows that then fall under CCP jurisdiction, while also partially offsetting the lost access to foreign capital markets caused by both China’s new restrictions on its companies listing abroad as well as the impending delisting of Chinese companies from US markets.27 Further opening is crucial to increase China’s economic power and promote greater internationalization of the yuan, but stability maintenance trumps the appeal of this goal and any relaxation has remained limited.

5. Economic security strategy risks decoupling and tensions

China’s ideal relationship with the world would be to accelerate its economic and technological strength while remaining highly integrated in the global economy, on its own terms. But the politicization of globalization and rising tit-for-tat emphasis on securitization are narrowing the corridors for China’s global integration.

As relations are being reset, the risks of mutual miscalculations are on the rise. China’s turn towards self-reliance and greater assertion in the DCS feeds into an increasingly volatile setting in international relations. The resulting lack of trust is creating an environment where things could easily go terribly wrong with extreme implications on China’s economic relations with Western liberal democracies and its own development. Hardline stances by either side could push China’s economic development trajectory further towards boosting statist and protectionist voices and nationalist sentiment.

China is attempting to increase its relative economic power in the world. But the forceful push might be premature; China’s dependence on technology, finance, and know-how remains high. Unrestricted access to foreign markets has been a major contributor to its economic rise and change in relative economic power. China runs the risk that the DCS’s aims – to secure a selective integration with the world – will undermine its objectives and increasingly isolate it instead. Securitizing economic ties to achieve greater resilience comes at a price and risks harming China’s own development.

Political considerations are beginning to dominate economic policy – an international trend –which in China manifests as nationalist concerns about Western encirclement trying to hold China’s rise back. A downward spiral of divergence and decoupling seems the most likely outcome. Every move by China to pursue self-reliance strengthens voices in liberal market economies to tighten Beijing’s access to foreign technologies, while every move by liberal market economies to restrict China’s access to foreign technologies adds fuel to Beijing’s self-reliance campaign. Unless this nosedive can be arrested, and guardrails that manage decoupling can be developed, it is difficult to see a future for deep economic and technological integration.

European companies face a choice between being considered unreliable by the CCP or doubling down, further localizing operations, and contributing to China’s strategic goals. The challenge will be to show their willingness to meet the expectations of the Chinese government while protecting their global interests and long-term competitiveness. But the implications of missing out on China’s vast market – for growth, innovation, and scale – are daunting.

Implications for Europe

The latest data by the Chinese Ministry of Commerce shows that foreign direct investment (FDI) is up by 22.3 percent in yuan terms year-on-year in the first eight months of 2021. European companies are expanding their presence in order to safeguard business opportunities in China – at the same time that Chinese investment into Europe reached a 10-year low.28 Surveys by the European and German chambers of commerce in China indicate many firms intend to expand current operations and deepen localization.29

Strong investment figures should not be taken as proof that decoupling is not happening. Changing global dynamics and rapidly emerging tech divergence are forcing companies to create firewalled local solutions for China. A shift in the cross-border flow of people, ideas, and goods is already changing the setup of economic relations between Europe and China. The DCS pushes the corporate mantra “in China, for China” to a new level. Foreign companies are localizing supply chains, data, and research to juggle the evolving compliance dilemmas in China, the EU, and the US.

China’s changing views on global economic integration mean that foreign firms are granted access to a market that resembles a fortress currently being reinforced. It comes at the cost of true economic interdependence with globally interlinked supply chains. Foreign firms are being pushed to adopt indigenous alternatives in all areas – suppliers, services, personnel, and partners. As a result, foreign operations in China are de facto on a pathway to becoming more like a local Chinese entity rather than integrated in global networks – they are not decoupling from China, but rather decoupling their China operations from their global ones.

European companies in China can expect new challenges and opportunities as China shifts course. Some, like digital services and network equipment, will be driven out of the market over time. Others face growing opportunities, but with rising costs. Non-sensitive sectors like automakers and consumer goods and electronics providers fit nicely into China’s ambition to expand domestic consumption. China will welcome sectors that can onshore their technology and supply chains to strengthen its industrial base e.g., chemical manufacturers or industrial machinery producers. All European companies will have to explore how much they need to localize their supply chains, manufacturing and network equipment, software, data systems, and human resources in order to align with growing securitization.

European political leaders will have to face the impacts of such corporate decisions. Lost economies of scale will cut into European jobs and global competitiveness. National security threats emanating from China will need to be confronted, and Europe will require its own onshoring and diversification process where key sectors are overly reliant on China. Diplomacy to rebalance the economic relationship must be maintained. However, European decision-makers will need to consider how to mitigate the risks to economic interests and manage the ongoing divergence between China and the world, at least to the extent that China is willing to reciprocate and produce results.

Annex

- Endnotes

-

1 | Center for Strategic & International Studies (2020). “Dual Circulation and China’s New Hedged Integration Strategy.” August 24. https://www.csis.org/analysis/dual-circulation-and-chinas-new-hedged-integration-strategy. Accessed: October 4, 2021.

2 | World Bank Open Data (2021). https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?end=2020&locations=CN-1W&start=2001&view=chart. Accessed: October 4, 2021. Calculation based on figures for nominal GDP (current USD).

3 | World Bank Open Data (2021). https://data.worldbank.org/indicator/NY.GDP.PCAP.KD.ZG?end=2020&locations=CN&start=1979. Accessed: October 4, 2021.

4 | Yu, Miaojie 余淼杰 (2020). ““大变局”与中国经济“双循环”发展新格局 (The "big shift" and the new pattern of "dual circulation" development of the Chinese economy).” Journal of Shanghai University of International Business and Economics (上海对外经贸大学学) 1-10.

5 | Ding, Yifan 丁一凡 (2020). 面对慢全球化,中国有多少底气? (How strong is China in the face of slow globalisation). November 11. Center for International Security and Strategy Tsinghua University. http://ciss.tsinghua.edu.cn/info/ltyc_dks/2628. Accessed: October 4, 2021.

Wang, Yuzhu 王玉柱 (2020). “发展阶段、技术民族主义与全球化格局调整——兼论大国政治驱动的新区域主义 (Development stages, techno-nationalism and the restructuring of the globalization landscape: Discussing the new regionalism driven by great power politics).” 世界经济与政治 (World Economics and Politics) 11: 136-155.6 | Pu, Qingping 蒲清平 and Yang, Conglin 杨聪林 (2020). “构建“双循环”新发展格局的现实逻辑、实施路径与时代价值 (The realistic logic, implementation path and contemporary value of building a ‘dual circulation’ new development pattern).” 重庆大学学报社会科学版 (Journal of Chongqing University Social Science Edition): 1-11.

Huang, Qunhui 黄群慧 (2020). ““双循环”新发展格局:深刻内涵、时代背景与形成建议 (The new development pattern of "dual circulation": Its profound connotation, contemporary background and formation suggestions).” 北京工业大学学报社会科学版 (Journal of Beijing University of Technology Social Science Edition): 1-7.

Ding, Yifan 丁一凡 (2020). 面对慢全球化,中国有多少底气? (How strong is China in the face of slow globalisation). November 11. Center for International Security and Strategy Tsinghua University. http://ciss.tsinghua.edu.cn/info/ltyc_dks/2628. Accessed: October 4, 2021.7 | Xinhua (2020). “中央经济工作会议在北京举行 习近平李克强作重要讲话(Central Economic Work Conference Held in Beijing, Xi Jinping and Li Keqiang Deliver Important Speeches).” December 18. http://www.xinhuanet.com/politics/leaders/2020-12/18/c_1126879325.htm. Accessed: October 4, 2021.

8 | Zhou, Qiren 周其仁 (2019). “中国经济的出路 – 深度好文 (The way out for China’s economy – In-depth article).” July 24. https://www.sohu.com/a/329117318_358836. Accessed: October 4, 2021.

9 | Lin, Justin Yifu 林毅夫 (2021). “What does China’s ‘dual circulations’ development paradigm mean and how it can be achieved?” China Economic Journal, 14(2): 120-127.

10 | Institute of International and Strategic Studies, Peking University (2019). “中美经济脱钩与技术脱钩的可能性及其后果 – 学术研讨会综述 (Seminar Summary: The Possibility and Consequences of Economic and Technological Decoupling between China and the United States)” July 22. https://mp.weixin.qq.com/s/T_pa-vLnQcbbyR_BJJOugQ. Accessed: October 4, 2021.

Qiu, Yuanping 裘援平 (2020). “全球化的时代逻辑与中国 (The contemporary logic of globalization and China).” December 6. https://huazhi.nju.edu.cn/b2/30/c32155a504368/page.htm. Accessed: October 4,

2021.11 | Xi, Jinping 习近平, Qiushi (2020). “国家中长期经济社会发展战略若干重大问题 (Some major issues in the medium and long-term national economic and social development strategy).” October 31. http://www.qstheory.cn/dukan/qs/2020-10/31/c_1126680390.htm. Accessed: October 4, 2021.

12 | Xinhua (2021). “中华人民共和国国民经济和社会发展第十四个五年规划和2035年远景目标纲要 (Outline of the Fourteenth Five-Year Plan for National Economic and Social Development of the People's Republic of China and Vision for 2035).” http://www.xinhuanet.com/2021-03/13/c_1127205564.htm. Accessed: October 4, 2021.

13 | Xi, Jinping 习近平, Qiushi (2021). “把握新发展阶段,贯彻新发展理念,构建新发展格局 (Grasp the new development stage, implement the new development concept and build a new development pattern).”April 30. http://www.qstheory.cn/dukan/qs/2021-04/30/c_1127390013.htm. Accessed: October 4, 2021.

14 | Yu, Yongding 余永定, Sina Finance (2020). “怎样实现从“国际大循环”到 “双循环”的转变?(How to achieve the transition from "international circulation" to "dual circulation"?).” August 18. https://finance.sina.com.cn/zl/china/2020-08-18/zl-iivhvpwy1713127.shtml. Accessed: October 4, 2021.

15 | Wei, Lingling, The Wall Street Journal (2020). “China’s Xi Speeds Up Inward Economic Shift.” August 12. https://www.wsj.com/articles/chinas-xi-speeds-up-inward-economic-shift-11597224602. Accessed: October 4, 2021.

16 | Wang, Yiming 王一鸣, Sina Finance (2020). ““双循环”不在“内外”而在“循环” ("Dual circulation" is not about "inside and outside" but about "circulation").” September 5. https://finance.sina.com.cn/hy/hyjz/2020-09-05/doc-iivhuipp2638159.shtml?mc_cid=c47b5eb18a&mc_eid=2a1ec643bb. Accessed October 4, 2021. Cheng, Siwei 程思炜, Caixin (2020). “王一鸣:外资企业是形成双循环格局的重要媒介 (WangYiming: Foreign companies are an important medium for the formation of the dual circulation pattern).” August 14. https://economy.caixin.com/2020-08-14/101592999.html. Accessed: October 4, 2021.

17 | Xi, Jinping 习近平, Qiushi (2021). “把握新发展阶段,贯彻新发展理念,构建新发展格局 (Grasp the new development stage, implement the new development concept and build a new development pattern).” April 30. http://www.qstheory.cn/dukan/qs/2021-04/30/c_1127390013.htm. Accessed: October 4, 2021.

Liu, He 刘鹤, State Council (2020). “加快构建以国内大循环为主体、国内国际双循环相互促进的新发展格局 (Accelerate the construction of domestic circulation as the main driver and with the domestic and international circulations both promoting a new development model.)” November 25. http://www.gov.cn/guowuyuan/2020-11/25/content_5563986.htm. Accessed: October 4, 2021.18 | CGTN (2017). “Full Text of Xi Jinping keynote at the World Economic Forum in 2017.” January 17. https://america.cgtn.com/2017/01/17/full-text-of-xi-jinping-keynote-at-the-world-economic-forum. Accessed: October 4, 2021.

CGTN (2021). “Full text of Xi Jinping speech at the virtual Davos Agenda event in 2021” January 26.

https://news.cgtn.com/news/2021-01-25/Full-text-Xi-Jinping-s-speech-at-the-virtual-Davos-Agenda-event-Xln4hwjO2Q/index.html. Accessed: October 4, 2021.19 | European Union Chamber of Commerce in China (2021). “Business Confidence Survey 2021.” https://www.europeanchamber.com.cn/en/publications-business-confidence-survey. Accessed October 4, 2021.

20 | Blanchette, Jude and Polk, Andrew, CSIS (2020). “Dual Circulation and China’s New Hedged Integration Strategy” August 24. https://www.csis.org/analysis/dual-circulation-and-chinas-new-hedged-integration-strategy. Accessed: October 4, 2021.

21 | National Development and Reform Commission (2020). “外商投资准入特别管理措施(负面清单)(2020 年版)” June 24. http://www.gov.cn/zhengce/zhengceku/2020-06/24/5521520/files/be781ea640f445b3bb13ac3ad08604b1.pdf. Accessed: October 4, 2021.

Gunter, Jacob, MERICS (2021). “Reality check: How welcome are foreign investors in China?” September 3. https://merics.org/en/short-analysis/reality-check-how-welcome-are-foreign-investors-china. Accessed: October 4, 2021.22 | Che, Pan, South China Morning Post (2021). “Ericsson to close major research centre in Nanjing amid shrinking 5G market share in China.” September 9. https://www.scmp.com/tech/tech-war/article/3148185/ericsson-close-major-research-centre-nanjing-amid-shrinking-5g-market. Accessed: October 4, 2021.

23 | BASF (2019). ”BASF commences its smart Verbund project in Zhanjiang, China.“ November 19. https://www.basf.com/global/en/media/news-releases/2019/11/p-19-403.html. Accessed: October 4, 2021.

Chen, Aizhu 陈爱珠, Reuters (2021). ”China's Guangdong starts building $1 bln Huizhou gas terminal.” July 26th. https://www.reuters.com/business/energy/chinas-guangdong-starts-building-1-bln-huizhougas-terminal-2021-07-26/. Accessed: October 4, 2021.24 | Sebastian, Gregor, MERICS (2021). “In the driver's seat: China's electric vehicle makers target Europe.” September 1. https://merics.org/en/report/drivers-seat-chinas-electric-vehicle-makers-target-europe. Accessed: October 4, 2021.

25 | Airframer (2021). “COMAC C919.” https://www.airframer.com/aircraft_detail.html?model=C919. Accessed: October 4, 2021.

26 | Zenglein, Max, MERICS (2019). “China's caution about loosening cross-border capital flows.” June 19. https://merics.org/en/report/chinas-caution-about-loosening-cross-border-capital-flows. Accessed: October 4, 2021.

27 | Shen, Samuel and Woo, Ryan, Reuters (2021). “China to push on with opening capital markets to foreign investors.” September 6. https://www.reuters.com/world/china/china-will-improve-opening-up-capital-

market-securities-regulator-2021-09-06/. Accessed: October 4, 2021.

Kharpal, Arjun, CNBC (2021). “Chinese tech stocks hammered as U.S. law threatens to delist firms from American exchanges” March 24. https://www.cnbc.com/2021/03/25/chinese-tech-stocks-fall-as-us-secbegins-

law-aimed-at-delisting.html. Accessed: October 4, 2021.28 | MERICS (2021). “Chinese FDI in Europe: 2020 update.” June 16. https://merics.org/en/report/chinesefdi-europe-2020-update. Accessed October 4th, 2021.

29 | AHK (2021). “Business Confidence Survey 2020/2021”. https://china.ahk.de/market-info/economic-data-surveys/business-confidence-survey. Accessed October 4, 2021. European Union Chamber of Commerce in European Union Chamber of Commerce in China (2021). “Business Confidence Survey 2021”. https://www.europeanchamber.com.cn/en/publications-business-

confidence-survey. Accessed October 4, 2021.30 | Wang, Jian 王建, (1988). “选择正确的长期发展战略——关于国际大循环经济发展战略的构想 (Choose Economic Development Strategy).” January 5. 经济日报 (Economic Daily).

31 | Thomas, Neil, MacroPolo (2019). “Mao Redux: The Enduring Relevance of Self-Reliance in China.” April 24. https://macropolo.org/analysis/china-self-reliance-xi-jin-ping-mao/. Accessed October 4, 2021.

32 | Ibid.

33 | McGregor, James, US Chamber of Commerce and APCO Worldwide (2010). “China’s Drive for ‘Indigenous Innovation’: A Web of Industrial Policies.” https://www.uschamber.com/sites/default/files/legacy/reports/100728chinareport_0.pdf. Accessed October 4, 2021.

Acknowledgements

This study was supported by a Ford Foundation grant and is licensed to the public subject to the Creative Commons Attribution 4.0 International License. The authors are thankful for the contribution of the participants of an academic workshop conducted in preparation for this report.