Bracing for geopolitical competition – insights from the MERICS China Forecast 2024

In 2024, we are entering a year marked by crucial elections in Taiwan, the European Union, and the United States. These elections will significantly influence the global geopolitical landscape and shape the European Union's perspectives and policies regarding China. The persistent tension between the United States and China will continue to mold China's foreign policy. However, deteriorating economic conditions will intensify domestic challenges within Chinese society. At the same time, ongoing conflicts in regions such as Ukraine and the Middle East will undoubtedly impact Europeans' views on China.

MERICS’ survey of 650 China experts and observers suggests that throughout 2024, China will focus on fortifying itself for geopolitical competition. This may play out most intensely in the economic sphere, where Beijing is expected to bolster the party-state’s ability to respond to pressure from the West’s de-risking policies and to steady its domestic economic base. EU-China relations seem to be gradually deteriorating, while 2024 holds significant uncertainties regarding the fallout from EU and US election.

The results of our survey were presented at the MERICS China Forecast 2024 conference on January 17, 2024. Watch the recording here.

China Politics 2024: Securitization of everything

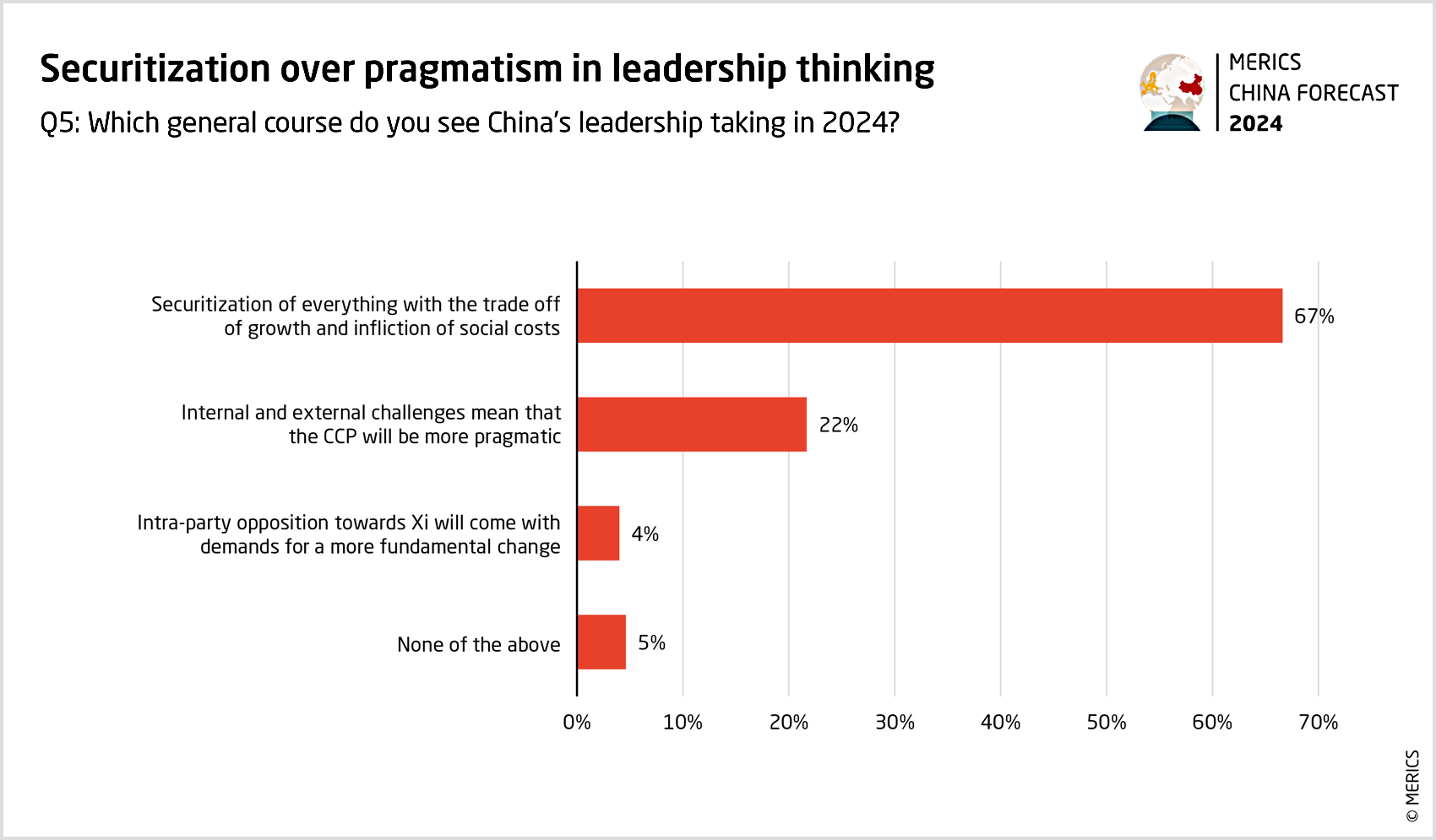

The “securitization of everything” (turning regular political or economic issues into matters of national security) and the choice of ideology over pragmatism under President Xi Jinping will characterize the Chinese leadership’s course in 2024. Two-thirds (67 percent) of the respondents expect that in the wake of intensifying US-China competition Beijing will be ready to trade off growth and inflict social costs on the population in the name of securitization. Pragmatism is unlikely to make a comeback with only 22 percent of respondents expecting such a shift. A mere four percent expect to see intra-party opposition in the Chinese Communist Party (CCP) towards Xi Jinping with demands for a more fundamental policy change.

Fortifying the economic and political base is also expected to be the key theme of Beijing’s comprehensive security agenda. The respondents expect securitizing against dependencies and de-risking policies to top the agenda, with fending off potential domestic dissent and instabilities and managing tensions in the Taiwan Strait close behind. Security cooperation with Russia scored the lowest on the list of priorities in the survey, underscoring that for Beijing cooperation with Russia is a result of wider geopolitical calculations rather than a goal in itself.

Domestically, economic stress linked to issues like the real estate crisis, youth unemployment or labor conditions is seen as the most likely to cause public dissent, making it a political security concern for Beijing.

China Economy 2024: Fortifying through control

China’s economic policies in 2024 are likely to focus on domestic political security and party-state control. That outlook is particularly important as the third CCP plenum, delayed to 2024, is set to define China’s economic direction for the coming years.

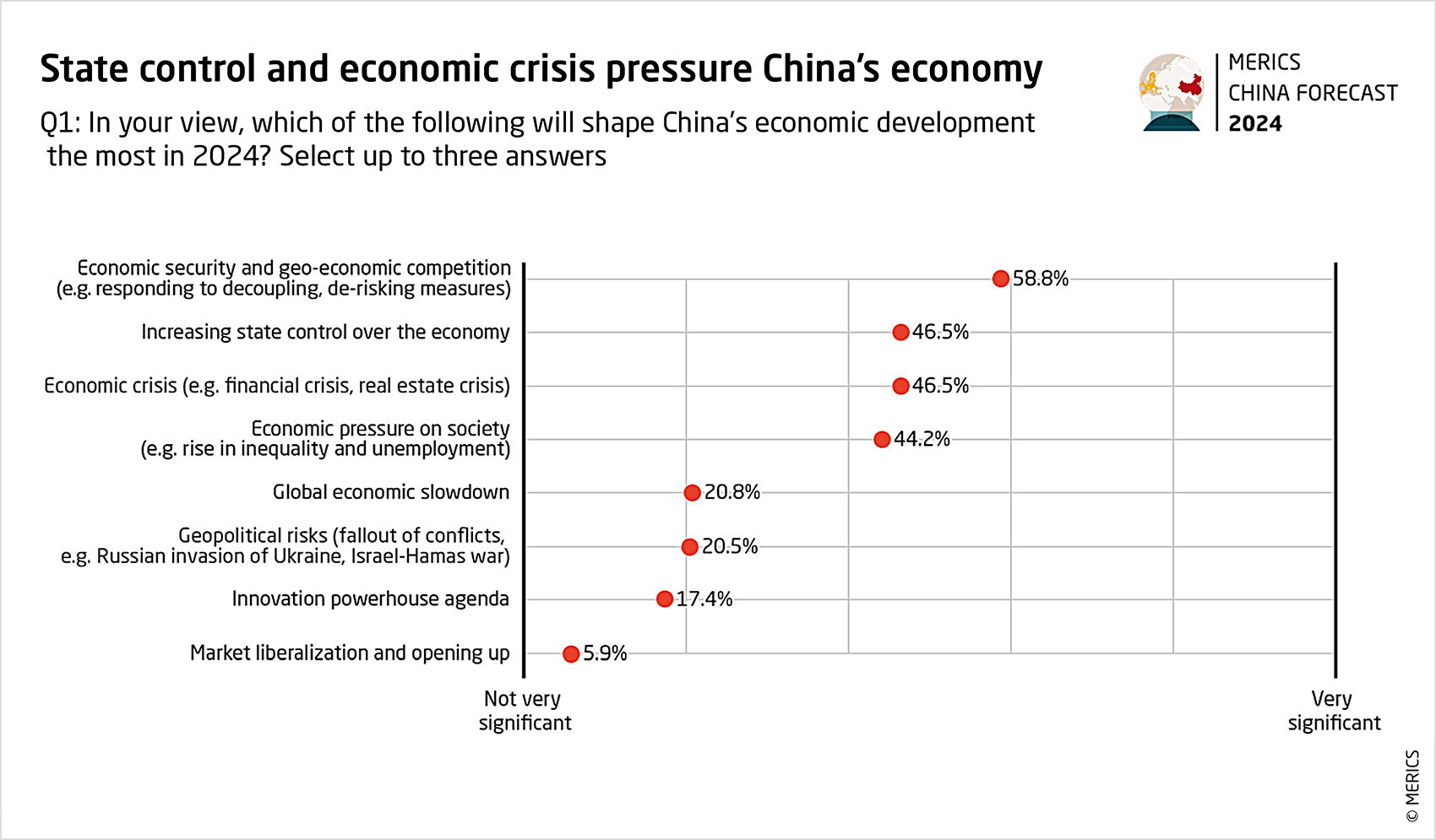

Following the securitization trend, China’s economic development policies are expected to be geared primarily towards responding to economic security concerns and geo-economic competition. Notably, this means economic development will be much less linked to geopolitical risks or the global economic slowdown. The domestic issues of concern, which scored high, include economic crises (such as financial or real estate) and economic pressure on society, while innovation policies or market liberalization fall far behind.

Answers to several questions indicate that respondents expect Beijing to turn towards increasing state control over the economy to address these challenges. Boosting consumer spending, decreasing youth unemployment and regaining investors’ trust are also expected to be high on Beijing’s agenda, but likely under clear party-state guidance. The “common prosperity” agenda – policies aimed at redistributing wealth – is expected to make limited practical progress, as underscored by low expectations for supporting small enterprises, low-income households or further reducing income inequality.

Increased state interference is also seen as potentially damaging for research and development in China, alongside issues such as decreasing access to Western technology and science cooperation and cross-border data flows.

China in the world in 2024: Navigating competition and elections

Geopolitical competition with the US will continue to dominate China’s outlook on the world. Rapprochement between China and Russia is likely to stay on a similar course to 2023, when China’s relationship with Russia improved while that with Western countries deteriorated. Following the same trajectory in 2024, relations with the Global South will continue to improve slightly, with the exception of relations with India, which are expected to deteriorate.

China-United States competition to intensify with some hopes for stabilization

Against the backdrop of intensifying competition and uncertainty linked to elections, US-China relations are expected to deteriorate in 2024 according to 45 percent of respondents (8 percent say significantly). Yet opinions are divided on the direction of US-China relations. 25 percent of respondents expect relations to improve somewhat, and 28 percent expect no change. Comparing the surveys for 2023 and 2024, the percentage of respondents who expect China-US relations to deteriorate is unchanged at 45 percent.

Taiwan Strait uncertainty to stretch through 2024

Participants of the survey expect the level of tension in the Taiwan Strait to remain uncertain throughout the year. With the widespread expectation that tensions will increase, debates are now focused on the outcome of Taiwan’s Presidential elections (The survey was conducted before the election on January 13). Moreover, the survey indicates that the result of the US election in November will also be significant for China’s policy towards Taiwan.

China’s support for Russia’s war on Ukraine to remain steady or expand, but not military equipment aid

Respondents expect China to maintain its support for Russia at current levels amid its war on Ukraine (47.69 percent) or to expand its economic and political support (36 percent). But they do not expect China to increase support with lethal military equipment (10 percent).

EU-China relations in 2024: Gradual deterioration

EU-China relations at large appear to be gradually deteriorating, with political divergence spilling over into the economic realm when compared with past surveys. Back in 2020, the defining contradiction of EU-China relations was that of “hot economics, cold politics,” but now the results for these two dimensions are much less detached from each other – as underscored by current robust economic security discussions. In turn, the respondents show more optimism about prospects for people-to-people exchanges, likely in a rebound from the pandemic years.

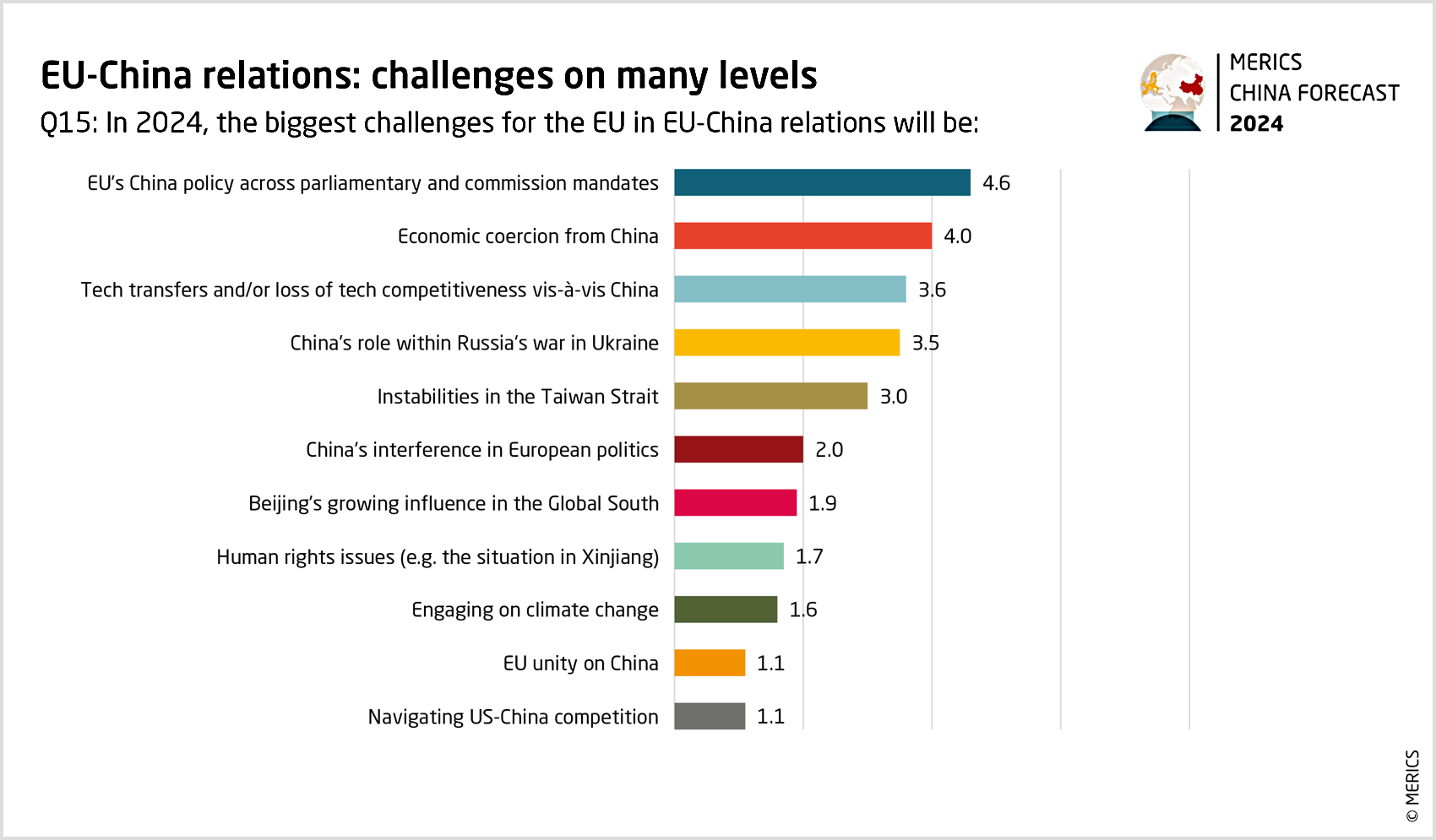

Overlapping with de-risking policy objectives, respondents see as top challenges the question of EU unity on China, tech transfers and/or loss of tech competitiveness vis-à-vis China, China’s role in Russia’s war on Ukraine and navigating US-China competition. Notably, human rights issues scored the lowest on the key challenges list. Compared to the survey for 2023, China’s role regarding Ukraine was seen as significantly greater, but for 2024, the priority has diminished. Such a shift could suggest a change of European mindset.

A substantial and concrete constructive agenda appears to remain a question mark. The most likely areas for progress in EU-China cooperation in 2024 are climate change policies and business opportunities for companies. Others lag behind, notably with around 15 percent of respondents seeing no likely cooperation progress and very limited possibilities to work with China on global governance and the reform of the international order. The results for 2023 and 2024 look similar. Climate change policy and business opportunities are areas where respondents see the greatest possibility for EU-China cooperation. But compared to 2023, the possibility for China and the EU to cooperate in other domains has decreased significantly.

The outlook for member states’ relationships with China differs between EU countries, but the overall trend of relations is seen maintaining the status quo or deteriorating rather than improving.

France stands out as the only state where close to 40 percent of respondents expect relations to improve somewhat or significantly. But the outlook for Italy-China relations is more negative, with over 45 percent of respondents believing relations will deteriorate – likely in the context of Rome’s withdrawal from China’s Belt and Road Initiative earlier this year. The results for Germany bear strong similarity to the expectations for changes to EU-China relations at large.

The EU’s China policy in 2024: Adjusting and diversifying

The China policies of EU member states are expected to become somewhat more assertive (42 percent) or remain the same (40 percent), in line with the expectation of maintaining the status quo or a gradual deterioration in relations. The respondents also gave the EU an overall 4 out of 10 score for implementing its de-risking agenda so far.

Respondents have a clear message on the EU’s policy within wider geopolitical competition: over half favor diversifying EU partnerships globally and close to 20 percent favor leveraging the EU’s position between the US and China. Only 16 percent want to align more with the US and less than 10 percent favor rebuilding trust with China.

The respondents seem divided on the future of transatlantic cooperation on China, which may be partially due to uncertainties surrounding US elections. Over 40 percent expect no clear change, while almost equal numbers of around 22 percent expect either some decrease or some increase.

The shifting realities make close to 45 percent of respondents believe that a new, major EU-level policy document on China policy is likely or very likely in the next 3 years, with 24 percent seeing it as unlikely or very unlikely.

As Beijing is expected to fortify itself against intensifying geopolitical and geoeconomic competition, it may be prudent for the EU to bolster the consensus on de-risking and diversification policies.

2024 seems to be shaping up as a year of major uncertainties, and Europe cannot afford to take a “wait and see” approach.

The results of the MERICS China Forecast 2024 will be presented at a conference on January 17. To get all the results of the survey, download the PDF:

The MERICS China Forecast 2024 is part of the “Dealing with a Resurgent China” (DWARC) project, which has received funding from the European Union’s Horizon Europe research and innovation programme under grant agreement number 101061700.

Views and opinions expressed do not necessarily reflect those of the European Union. Neither the European Union nor the granting authority can be held responsible for them.