Europe's competition with China in third markets

No. 4, December 2022

What you need to know: China’s global competitiveness

The MERICS Global China Inc. Tracker began as a tool to track Beijing’s efforts to become the developing world’s dominant infrastructure partner through the Belt and Road Initiative (BRI). China’s role as an economic partner has matured in the years since the BRI was launched in 2013, and so too has its impact on Europe. China Inc. increasingly looks to higher value chain projects such as renewable energy, or 5G rollouts. Corporate foreign direct investment (FDI) is taking over from traditional BRI infrastructure projects as Chinese firms seek to build market share abroad.

We are therefore rebranding this quarterly report the ‘China Global Competition Tracker’ to reflect the political, economic, corporate, and technological competitiveness of China across the world. The tracker’s core components will largely remain the same, but the focus will shift to implications for European actors meeting China as a competitor in third markets.

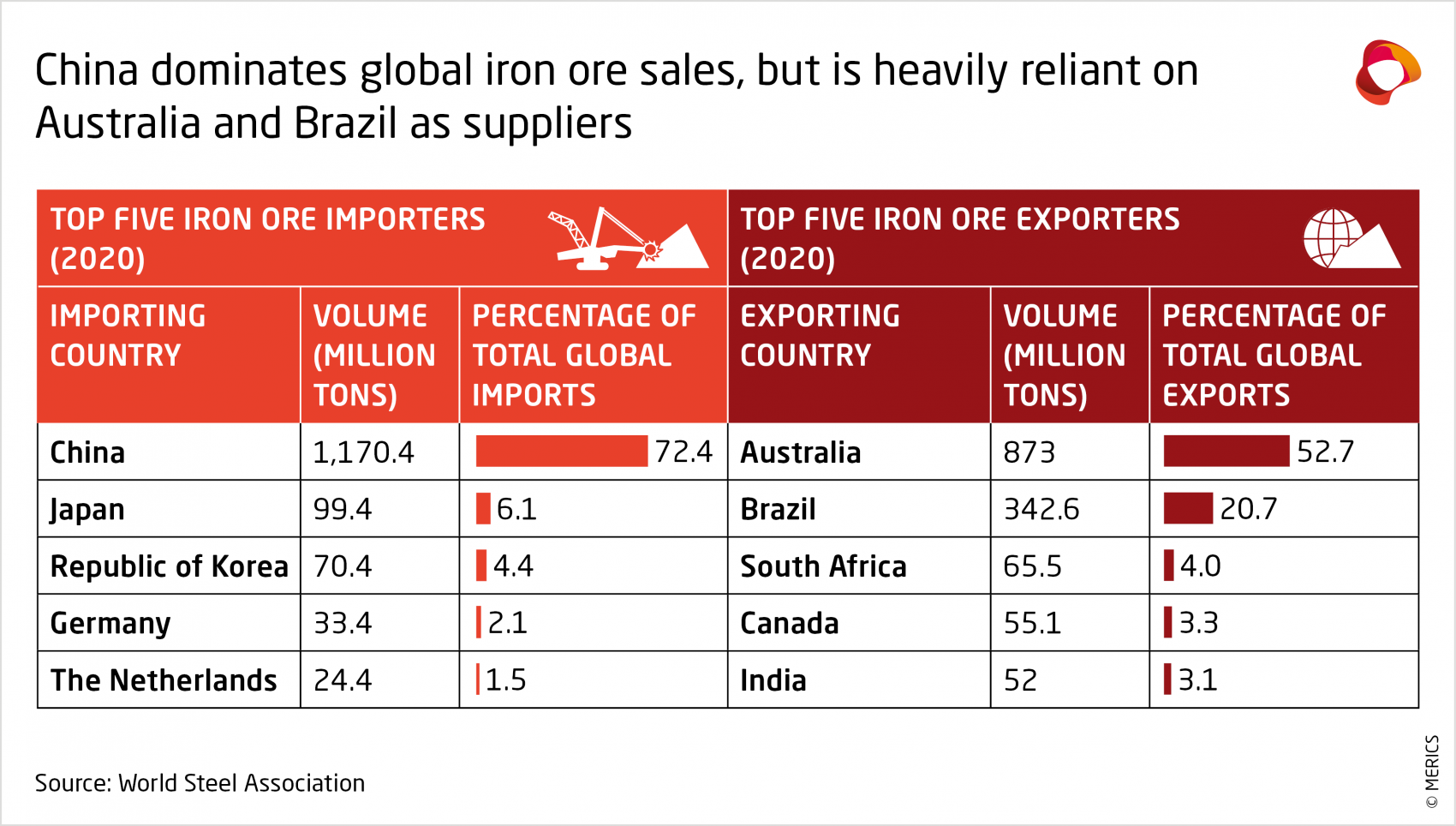

In this edition, Jacob Gunter looks at China’s efforts to secure supplies of an often over-looked basic resource – iron ore. China’s vast steel industry demands massive supplies of iron ore and depends on imports from Australia and Brazil. Beijing and Canberra are increasingly at odds, while shipments from Brazil must travel one of the longest possible distances between any two countries on earth. China has a two-pronged strategy to address this. First, diversification towards existing and new sources, but this is insufficient to fully offset China’s dependency. Second, Beijing is creating a new SOE, the China Mineral Resources Group, to centralize China’s iron trading. This promises drastic changes to global iron and steel markets. Europe could see significantly lower prices for Chinese steel, with implications for European steelmakers, and for steel-intensive sectors like the automotive, shipbuilding, and rail industries.

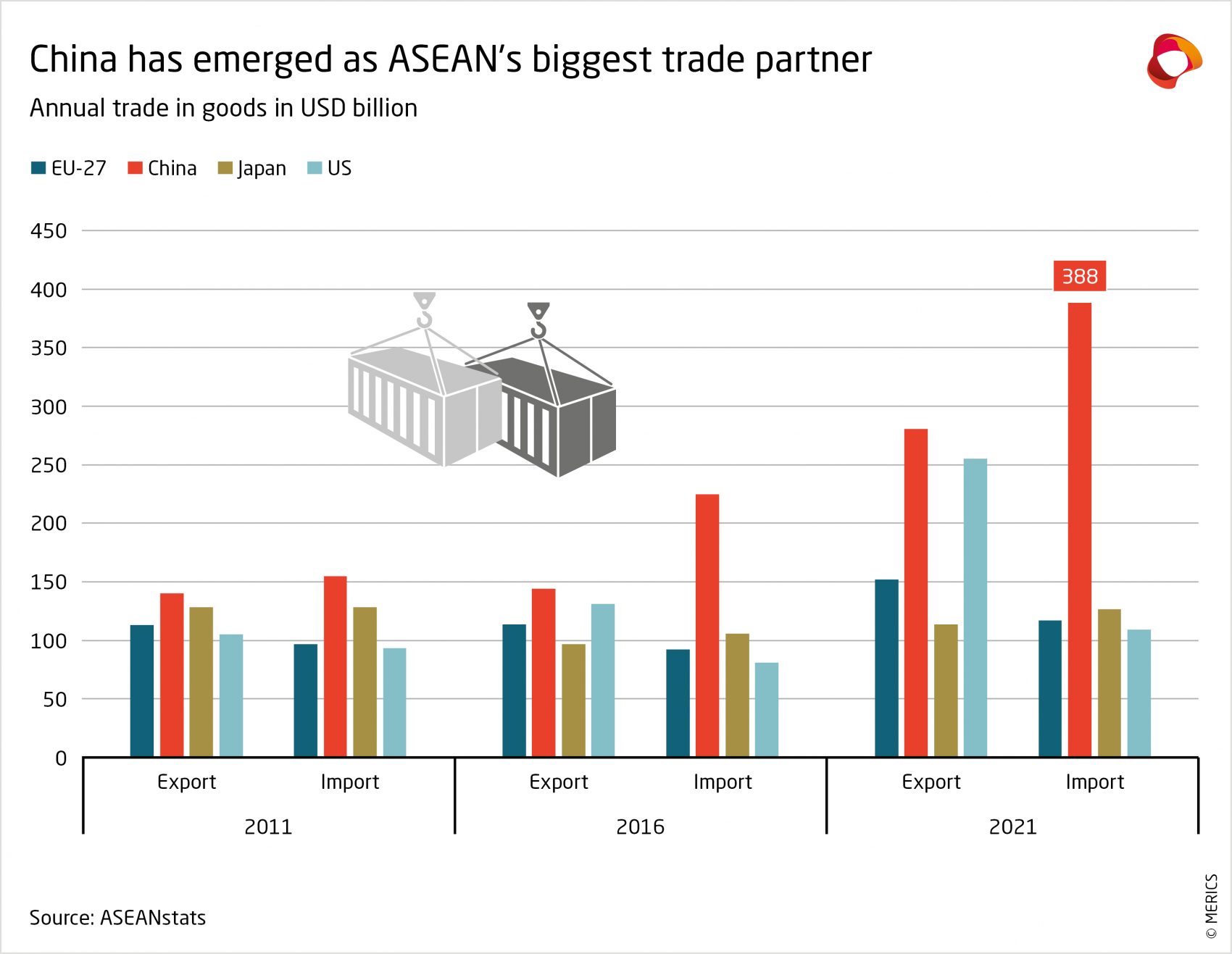

In our Regional Spotlight section, Aya Adachi explores global competition for economic influence in the Association for Southeast Asian Nations (ASEAN) region. China is the chief trade player in the ASEAN region and an important partner for infrastructure. But it has not achieved similar prominence in FDI – its investments have trailed behind even South Korea’s in the last decade. China barely matches either EU or US investment in southeast Asia and lags behind Japan. For Europe, deeper economic ties with ASEAN and its member countries are valuable in the broader competition with Beijing, as well as being good business for European companies.

Francesca Ghiretti zooms in on the EU itself and explains how the EU is responding to the challenge of competing with China and assesses its successes and shortcomings. She argues that Brussels made progress in 2022 building up a toolkit to manage how economic challenges and distortions from China impact the European common market. Measures to build greater resilience are in the pipeline. But when it comes to external competition with China, Brussels has yet to make significant progress.

Key Player: China’s iron ore dilemmas, the new purchasing monopoly and the global distortions it could bring

China’s dependency on imported iron ore is little discussed, except perhaps in the context of iron’s striking omission from the restrictions Beijing imposed on Australian imports (such as barley, wine, coal, and lobster) in late 2020, in retaliation for Canberra’s call for an inquiry into the origins of Covid-19. China’s decision to leave iron ore imports off the list expressed a simple truth: without imported iron ore China could not maintain the immense steel output that its industries demand. To mitigate its dependence on imports, Beijing is attempting to diversify iron ore suppliers while creating a new monopoly to manage all iron ore trading and strengthen China’s bargaining position in global markets.

A push for higher domestic production has yielded results, but nothing close to the scale needed – China only produces about one fifth of the iron it consumes. Beijing must therefore continue to look abroad for supplies. Regardless of President Xi Jinping’s political emphasis on self-reliance, China does not have the capacity to boost iron ore output to a level that would enable it to decrease reliance on Australia, Canada, and Ukraine. The first two are considered politically troublesome, especially Australia, while Ukraine’s relationship with China is strained by Beijing’s ties with Russia. However, fellow BRICS nations can provide ore, notably Brazil which is a major source of iron, and South Africa to a lesser degree. Russia and India tend to consume most of their iron production domestically.

China faces a quandary as it tries to diversify and stabilize supplies in its favor, as it must weigh up the commercial inefficiency of distant deposits in Brazil and elsewhere against political risks in Australia. Beijing has embarked on twin efforts: diversification of import sources and reshaping global iron markets via a new state-owned monopoly.

Diversifying iron ore imports

One key problem for Beijing in trying to diversify iron ore imports is that the mineral is economically crucial and hence politicized. First, many countries treat steel, and therefore iron, as strategic goods relevant to national security. They are willing to protect domestic iron and steel firms from foreign competitors, and even subsidize them to ensure their success. Many iron producing countries, such as Russia, will not export at scale to China because they need to feed their own steel sector. Second, developing countries often need large amounts of iron and steel as they urbanize and build out infrastructure. Domestic supplies of iron and steel is absorbed by local demand, as in India. The combination of protection, subsidies, and strong domestic demand can make it difficult for foreign mining and steel companies or their exports to penetrate these markets which are ringfenced and saturated. For instance, it would be hard for China’s iron miners to break into the mining sector in countries like Brazil and South Africa - major exporters of iron ore – to produce ore themselves.

Instead, China has to rely on well-established firms in iron ore exporting countries: in Australia this means Rio Tinto, BHP, and Fortescue Metals Group Ltd; Anglo-American and its subsidiary, Kumba Iron Ore in South Africa; and Vale in Brazil. For the time being, much of the iron and steel industry in Ukraine is disrupted by war, but even if trade resumes once the fighting dies down, pre-war export numbers would be only a small percentage of the supplies needed by China’s steel industry. Finally, Russia’s iron ore exports are limited by the demands of its large steel industry. As Russian ore exports to Europe could be off the table for the foreseeable future, they may make a minor additional contribution to meeting China’s iron ore shortfalls.

Another option would be for Beijing to try to develop extraction and logistics operations in iron-rich regions of the world that have yet to industrialize far enough to exploit their own resources in a cost-competitive way. The highly efficient industrialized export production from Australia and Brazil would be difficult to break into. But iron ore deposits such as those in the Republic of Guinea’s southeastern Simandou region offer a better prospect.

Guinea’s government has recently broken the iron-rich Simandou region into four blocks, after a series of project delays and multiple switches of the firms in charge of the project. Two blocks are controlled by the Winning Consortium Simandou (a joint venture consisting of the Singaporean Winning International Group – mainly involved in shipping; China Hongqiao Group Limited – mainly involved in aluminum; and United Mining Supply Group – a Guinean logistics provider). The other two blocks are controlled jointly by the British-Australian firm Rio Tinto and the Aluminum Corp. of China, known as Chinalco.

The plan is for a JV made up of the Guinean government, Rio Tinto, and Winning Consortium Simandou to develop a railway and port to move ore from the interior to the coast for export - a difficult rail construction project due to the mountainous terrain. The whole project will cost a considerable amount of capital, and previous efforts to develop mines in the mountain range failed for various reasons, including the impatience shown by Guinea’s governments at the slow pace of previous attempts (see this Bloomberg feature on the challenges and impacts of the project). It may be that this time is different, but even if the Simandou project can get ore to market at competitive prices, doing so will itself disrupt the global price of this commodity.

A new state-owned monopoly

Although iron ore remains abundant globally, it is also only profitable to mine the richest locations. At this point, those are either saturated, as in Australia and Brazil; used chiefly to supply domestic demand, as in India and China itself; or are in challenging locations, like Simandou in Guinea. As China has limited scope to dilute its reliance on Australian mining giants on the supply side, Beijing has developed a plan to adjust the demand side of the equation in China’s favor.

China Mineral Resources Group was created in July 2022. The new SOE is set to take over China’s entire iron production value chain – from domestic mining and refining to buying imports and managing overseas investment.

The changes to China’s domestic mining and refining setup will have little impact globally. But the concentration of purchasing power into a single entity could upend the iron ore market, as well as anything downstream that is significantly impacted by iron (and steel) prices.

From a pure supply and demand perspective, China will continue to need massive iron ore imports to maintain its steel industry (98 percent of all iron ore goes into steelmaking) which accounts for 71 percent of global iron ore imports. The global market is shaped by three players, as Australia supplies 53 percent of global iron ore exports and Brazil 21 percent – or 74 percent combined – and China represents more than 72 percent of demand.

However, the buyer and seller dynamic is set by company-to-company trade. Australia doesn’t mine and export iron ore; mining firms like Rio Tinto, BHP, and Fortescue Metals Group Limited do. Similarly, Brazil doesn’t mine and export iron ore. That is done by firms like Vale, Anglo-American, and Companhia Siderúrgica Nacional. And until now, iron ore from all these suppliers was bought not by China but by steelmakers like Baowu, Ansteel, and Shagang.

The arrival of China Mineral Resources Group changes this dynamic – building a single actor to manage all iron ore import purchasing will effectively mean that ‘China’ as a single entity will exist in the global market as the biggest buyer. Meanwhile, exports will continue to be supplied by mining companies that are in competition with one another, even when headquartered in the same country.

Implications for competing with China Inc.

From Beijing’s perspective, the logic is clear – a handful of companies, largely based in Australia, wield cartel-like powers over iron prices, so China’s best way to counter this is by playing the same game and consolidating purchasing power within a single firm. In many ways, this is the endgame in a debate that has lasted for decades in China, and emerged most acutely in 2009 when the China Iron and Steel Association (CISA) attempted to lead Chinese steelmakers and traders in a boycott of Australian iron due to high prices. That effort ultimately failed, but the ambition to consolidate the entire country’s buying power clearly remained.

The impact of this new market dynamic remains unknown. Comparisons with other sectors are difficult as few markets have one customer with so much demand and only a handful of major suppliers able to meet it. The market is entering uncharted territory, and it may turn out that China’s centralizing of iron ore buying power will fail to overcome the selling power of the concentrated sources in Australia and Brazil. The Brazil and Australian-based firms seem confident for now: Rio Tinto, BHP, and VALE all signed agreements with China Mineral Resources at the 2022 China International Import Expo in Shanghai.

However, if Beijing can succeed in leveraging China’s collective buying power in iron ore to drive down prices, the implications become clearer:

- First, a dramatic price reduction would obviously impact iron producers. It could have a significant impact on global prices or even lead to lower iron ore prices for the China market than for others.

- Second, it could lead to drastically lower prices from China’s steelmakers. China already has long-standing overcapacity, thanks to heavy subsidies and support for state-owned steel mills, which has depressed global steel prices. The existing situation is already a threat to steelmakers in other countries, including many steel mills in Europe.

- Third, it could impact the competitiveness of any Chinese exports that are made from steel components – e.g., the chassis, engine, and other components of automobiles, or the steel in modern container ships, or that used in the rail industry. German automakers, Italian shipbuilders, and French rail companies could all face further price competition.

- Finally, if the strategy succeeds, Beijing is likely to try and replicate it for other imports. President Xi Jinping often mentions China’s “ultra-large scale market advantage” (超大规模市场优) geoeconomic strength as a single, large, unified market, and this steel strategy leverages that idea. Beijing has already begun to consolidate national buying power in other areas, such as in key generic pharmaceuticals, to obtain drastically lower prices. Success with iron imports could encourage more, similar steps.

Regional spotlight: The competition for Southeast Asia

Premier Li Keqiang painted a picture of “rising uncertainties and destabilizing factors,” including “the Cold War mentality resurfacing” on November 11 when he addressed the 25th joint summit of China and the Association of South East Asian Nations (ASEAN). But he declared “picking sides should not have to be our choice” and announced, “a new promising chapter of ASEAN and China friendship cooperation”. Expanding economic cooperation between ASEAN and China remains a priority, as was signaled in the summit announcement of the Free Trade Area (FTA) upgrade and promotion of innovation-driven industrialization.

Trade between ASEAN and China has grown exponentially since 2002, when they signed a Framework Agreement that laid the basis for their free trade area. The ASEAN region has emerged as China’s largest trade partner in Asia and its third largest globally, after the European Union and the United States. In 2002, only 5 percent of Southeast Asia’s exports went to China, compared to 16 percent to the United States. Now, China's trade volume with Southeast Asia is almost two times that of the United States.

However, it would be too simplistic to assume China’s trade ascendancy means it is winning the economic competition in the region. Total Chinese FDI between 2012 and 2021 amounted to USD 97.9 billion, trailing behind the United States, the EU and Japan (see next graph). China's FDI in the ASEAN region has been stronger in some areas than others, as its digital giants have expanded there. But in sectors such as infrastructure, construction, manufacturing and climate change mitigation it has invested less than its competitors.

China’s strengths and weaknesses

Chinese tech giants Alibaba and Tencent were among the region’s first foreign investors in digital services and are ahead of Google, Facebook and Visa in creating an ecosystem for e-commerce and e-services. They have built e-commerce platforms, mobile payment systems, delivery service, ride apps, e-commerce logistics and cloud computing. Chinese cloud computing providers may have gained first mover advantage in Southeast Asia, even though they remain no match for Amazon and Microsoft at the global level.

ASEAN members have been primary recipients of Chinese construction projects under the BRI, though it is arguably one of the few regions of the world where the BRI faces serious, sustained competition. Japan’s Partnership for Quality Infrastructure (PQI) is an alternative source of funding. Japan’s initiative emphasizes openness and transparency of procurement, debt sustainability and economic efficiency, in contrast to the BRI. Together with the Japan-ASEAN Connectivity Initiative it has launched in 2020, PQI has been successful in the region. Current infrastructure Japanese investments are worth a total of USD 330 billion. By comparison, projects involving Chinese financiers were estimated at USD 100 billion Chinese investments in manufacturing in ASEAN have grown, amounting to USD 15.8 billion between 2012 and 2021, but remain far below that of Japan (USD 52.7 billion), the United States (USD 36.4 billion) and EU (USD 37.4 billion). Whereas economic relations between China and ASEAN thus remain mostly centered around trade, China’s competitors maintain deeper economic ties with ASEAN countries, thereby helping to create jobs and bring along technology and contribute to local tax revenue.

However, the ASEAN region is a large recipient of Chinese investments in renewables. As the world’s largest producer of solar photovoltaic and wind power equipment, Beijing has prioritized helping ASEAN to achieve a clean energy transition, under both the BRI and ASEAN-China cooperation Framework. With 17 projects and 4.9 billion USD China is most active in solar energy followed by five wind energy and five waste-to-energy deals making up 1.3 billion and 760 million USD respectively. China’s investments activities range from building and acquiring renewable power plants and photovoltaic device manufacturing. Furthermore, there is significant untapped potential for a greening strategy that goes beyond renewables to include climate change adaptation and mitigation, ecology and green finance – all areas China is trying to drive forward in. However, ASEAN continues to benefit from other actors with a strong presence in the region, such as Germany which has been involved in 247 climate-related development cooperation projects in Southeast Asia. They have mainly been focused on climate change mitigation and adaptation – for instance, on tackling greenhouse gas emissions and on preserving and restoring natural carbon sinks.

ASEAN’s balancing act

ASEAN members are hugely diverse, ranging from least developed countries, such as Laos or Cambodia, to middle income nations such as Thailand and Malaysia, or those like Indonesia and Vietnam which are poor measured by GDP per capita but big by GDP. In addition to these varied opportunities and advantages, ASEAN’s vast and dynamic market is already highly integrated in global value chains compared to countries in South Asia or East Africa.

ASEAN is actively using its leverage to manage competition to its advantage and remains intent on avoiding choosing sides between China and the United States. This neutrality is a strategic choice, as well as stemming from lack of any likely overall agreement or unity on the matter. ASEAN’s neutrality has helped it become a preferred destination for foreign companies shifting their manufacturing bases out of China. ASEAN members have tried to make the most of the US-China trade war with incentives to attract foreign investors to move their China production there. Vietnam has become an alternative destination for electronics manufacturers, while Indonesia and Thailand are vying to be the center of a regional electric vehicle supply chain. As a result, imports and exports between ASEAN and China almost doubled between 2016 and 2021, indicating that the US-China trade war has redirected economic ties. Flows of total foreign direct investment (FDI) into manufacturing in ASEAN increased almost threefold from USD 21.3 billion in 2016 to USD 62.1 billion in 2018. This development was accompanied by increases in Chinese exports in materials and parts products to ASEAN, so China remains a key supplier of intermediary goods.

Implications for Europe

ASEAN’s institutionalized neutrality has promoted competition from all sides. As diversification efforts continue to unfold, ASEAN is likely to continue to be a preferred destination for investments. In 2022, as China went into renewed lockdowns, the Asian Development Bank Forecast Report projected growth in developing Asia would surpass that of China. Foreign companies will have to compete against each other and against Chinese counterparts.

The EU should make the most of what is still an open field for competition among outside players vying to strengthen their positions in the region. The EU’s Indo Pacific Strategy and Global Gateway could make headway there, and there is a lot of demand from development-focused leaders within ASEAN for more competitors to get involved as they wish to secure the best opportunities from such rivalry. A good place to start would be by promoting how much "the EU does" in the region.

The EU improved its internal toolkit for resilience, but still struggles with competition in third markets

During 2022, the EU intensified policy efforts to make its own market stronger and more resilient. The process was accelerated by the new pressures unleashed by Russia’s invasion of Ukraine. However, EU efforts to assess - and reduce - its strategic dependencies predate the war, with concerns about China’s market distorting practices and economic coercion among the drivers.

Managing dependencies from China and building European resilience

The EU followed-up on the assessment of its strategic dependencies made in 2021 with a fresh review and deeper dive into six areas where Europe has strategic dependencies: rare earths and magnesium, chemicals, solar panels, cybersecurity and IT software. China features heavily in all of them, both indirectly, such as European reliance on cyber defense systems developed in the United States but manufactured in China, as well as directly, such as through China dominant position in Europe’s supply of:

- Rare earths (more than 60 percent)

- Refining (more than 80 percent)

- Permanent magnets (at least 90 percent)

- Global magnesium output (89 percent)

- In solar panels, China holds the largest global share throughout the supply chain of: polysilicon (more than70 percent), wafers (more than 90 percent), cells (more than 70 percent), modules (about 70 percent).

The follow-up report’s publication coincided with broader efforts at building supply chain resilience in the common market, such as through the EU’s Chips Act (December 2022) to boost local production of semiconductors and the Battery Regulation which creates requirements for the recycling of battery components such as cobalt, lead, lithium and nickel. It also comes just before the expected 2023 adoption of the Critical Raw Materials Act to strengthen EU supplies. All of these are set to be coordinated between the EU Parliament, Council, Commission and European External Action Service, including people from the China desk, who have been working how to better operationalize these policies across the 27 member states. The three pillars of the Chips Act are i) building technological capabilities; ii) investing in production; iii) identify and respond to supply crises. For the first pillar, building technological capabilities, the EU has made an effort to put together different centers around Europe and offer funding for smaller realities such as startups and small companies.

In that sense, the Commission agenda carries difficult-to-reconcile tensions between those who pay more attention to the EU’s competitiveness vis à vis the rest of the world versus those who are more intensely focused on ensuring that Brussels’ industrial polices do not undermine internal cohesion across the union. Intra-EU competition for subsidies amongst member states would create winners and losers on one hand, but there is also growing recognition that failing to act indefinitely will mean that other markets will advance their own resilience efforts as Europe lags behind.

The EU has done well in identifying dependency risks, and there have been some positive signs such as the construction of a semiconductors plant by Intel and Infineon in Germany or the agreement between the French government and STMicroelectronics and GlobalFoundries. However, overall, the EU has made less progress on advancing the plans and resources to deal with them. Other countries are moving much faster in implementing their own industrial policies, most notably, China and the US.

China has brought industrial policies and self-reliance back into fashion. While building self-reliance is a broad, all of industry goal, it is most noteworthy in the semiconductor field. China offers incentives that include five-year tax exemptions for firms that produce advanced chips. For example, producers of chips of between 28 and 65 nanometers earn a five-year 50 percent corporate tax waiver. It has pledged USD 1.4 trillion dollars in support to the semiconductor industry to achieve the goal of meeting 70 percent of domestic production by 2025, though, it is unclear how much of that money has actually been spent. Nevertheless, efforts to bootstrap the industry using indigenous technology are struggling - in 2021, China’s domestic production was still only 16 percent, demonstrating that even in a much more coordinated system such as that of China the results of attempts to increase self-sufficiency are mixed and heavily dependent on the characteristics of the sector.

Meanwhile, the US has been aggressively pursuing expansion of its semiconductor industry for similar resiliency purposes. DC has launched a two-pronged plan to cement its position. With one hand, it has struck out at China’s aims through new restrictions on China’s access to American technology relating to the chips industry. With the other, it offers massive subsidies for American and foreign chipmakers to onshore production in the US. Among the many participants in the new subsidies scheme is the Taiwan Semiconductor Manufacturing Co Ltd (TSMC), the industry’s crown jewel, which is building a plant in Arizona that now seems likely to make advanced chips (3 nanometers) there.

As the EU struggles to move the needle on addressing its dependencies, there are lessons to be learned from China and the US, who have already moved ahead.

Despite the advantages of China’s system for implementation of industrial policies, the difficulty in producing advanced chips means that China is still relying on Taiwan and South Korea for advanced semiconductors. The EU is similarly dependent on South Korea and Taiwan but is neither doing enough to try to replace them, as China is doing, or to incentivize them to onshore into the domestic market, as the US has done. Part of that is the slow pace of policymaking, but another element is the balance that Brussels is trying to strike between its current ties with China and its need to build strong ties with Taiwan to attract its chipmakers. Doing so will be tricky without enraging China or crossing Beijing’s ever shifting redlines. Doing so implies that economic ties, including semiconductors supply chains, must evolve cautiously and are subject to precarious developments from Beijing.

Maintaining that balance may be worth it, but it comes at the cost of being able to advance Europe’s own need for supply chain resilience at a time when the US has moved ahead with closer ties with Taiwan and TSMC, relations with Beijing be damned if it means that they get the foundries that they seek.

Whatever the case, China and the US are in many ways leaving the EU behind. China’s self-reliance campaign is only strengthening, and the US has shown a willingness to ruffle feathers, either with restrictions on China, or market distorting practices that hit Europe as well, like the CHIPS Act and the Inflation Reduction Act (IRA). As external pressure builds, there is even a growing appetite at the head of the Commission where President Ursula von der Leyen has announced the intention to ease the EU rules on state aid – that if everyone else is playing the industrial policy game, then Europe must start playing as well.

Competing with China in third markets

The EU’s work on its internal dependencies and vulnerabilities is a step in the right direction, albeit too slow. Externally, Brussels is struggling to keep pace with its competitors, especially China, in third markets. It falls down on two issues: its approach to international development and its over-reliance on traditional free trade agreements.

There is a lot of positive things about Brussels adopting a strong development agenda and minting the EU’s Global Gateway development initiative. However, there is currently a lack of a strategic agenda. Global Gateway has been assigned to the Commission’s Directorate-General for International Partnerships (DG INTPA) which does not have a track record of strategic, geopolitical or geoeconomic approaches to development. DG INTPA advances a traditional development agenda rooted in implementation of the UN Sustainable Development Goals (SDGs). By contrast, China’s BRI and Global Development Initiative contain a strong geostrategic component, something the EU’s Global Gateway had early on but seems to have lost since. In other words, the EU is concerned about international development as an end in and of itself, while China views it as a tool to advance its strategic interests.

Furthermore, the EU’s efforts to compete in third markets through a proactive development initiative like Global Gateway is diluted by overlapping strategies from member states, as well as poor coordination between policymakers and corporate leaders. If a German development initiative builds out a new green energy hub in a developing country, it is “Germany” that has done that, not “the EU.” Similarly, if railway consortium made up of various European private firms built out a new rail line somewhere, it is not “Europe” that built it, but just multinationals doing normal business. In comparison, whenever Chinese companies do anything, whether under a development scheme like the BRI or on their own initiative, it is often billed as, “China” having done whatever project was completed. For example, as pointed out in the ASEAN competition entry to this tracker, the EU is top-investor in the Asia-Pacific region, so it has the potential to be an important geoeconomic actor in there, though it is often China and the BRI that swallow up the development narrative in the region.

Perhaps this is one reason why the EU focuses so much on negotiating deep and comprehensive FTAs with partners – they are the most successful instrument the EU has available to act in unison and as a single market. FTAs, though complicated to negotiate, have proved to be an excellent geoeconomic tool for Europe, though with three noticeable faults:

- they require a long time;

- once concluded, they do not limit the scattered and uncoordinated action of European actors;

- they exclude countries that do not meet EU criteria for an FTA but with whom it is important to engage with at a different level.

In 2022, the EU concluded an FTA with New Zealand, reopened negotiations with India, and continued negotiations with Australia, and the Latin American MERCORSUR grouping; the latter seems to have better prospects under the new Brazilian government. With India, the EU is trying out a new pragmatic approach by establishing a Trade and Technology Council (TTC) to mitigate the length of time it requires to conclude an FTA. In shared areas of interest, India and the EU may find ways to coordinate on alternative, non-market access driven platforms. Eventually, agreements can provide the needed flexibility and agility while the slower FTA agreement process continues.

However, while the EU is still largely committed to traditional use of market access to incentivize economic engagement with third parties the US and China are moving quickly with other tactics. The United States, for example, responded to the failure of Trans-Pacific Partnership (TPP) and Transatlantic Trade and Investment Partnership (TTIP), by opting for a more flexible framework like that offered by the Indo-Pacific Economic Forum (IPEF) (where India was able to opt out of the trade pillar).

Meanwhile, China pursues an ad hoc approach to strengthening economic ties with different types of partners depending on what can and can’t be agreed to bilaterally. It has also stepped up its regional game in places like Africa. From December, it will guarantee tariff-free access to the Chinese market for 98 percent of taxable products coming from nine African countries, which will boost imports. Beijing has also been nimble in its ability to integrate with regional trade and investment blocs, such as the RCEP (Regional Comprehensive Economic Partnership – which will bring together advanced and less advanced economies with a plan for progressive tariff reductions over 20 years) which China has already joined, and the CPTPP (Comprehensive and Progressive Agreement on Trans-Pacific Partnership), which it is trying to accede to.

The EU could benefit from taking a more nimble, flexible approach to engage with countries that do not meet the requirements for FTAs but can be important strategic partners through scaled down trade and investment deals. It should build on some areas of success at a more flexible approach, as it did by joining the US-led Mineral Security Partnership, and the Trade and Technology Council (TTC) with India.

Conclusion

Europe is doing its homework on how to become a more resilient actor – especially from China. Even with a system where co-ordination between the public and private sectors is not easy, vital steps forward are being made, though if things continue to move slowly, Europe may find itself outpaced and left behind by Chinese and American industrial policy.

Unfortunately, the progress of the EU’s strategy towards third markets appears to be lagging comparatively behind as the bloc suffers from fragmentation among its actors and over-reliance on slow and inflexible FTAs as a ‘one-size-fits-all solution’. Access to the common market is one of the strongest assets the EU has, and it would boost its global competitiveness if it was willing to scale down full FTAs with more flexible approaches that do not include comprehensive market access for the time being. That could generate real, timely results which might also help build confidence in European solutions, which itself could build up and supersede the fragmentation issues already discussed.

Global China Inc. Updates

BRI Politics and Trade

China grants zero-tariff status to 10 least-developed countries (LDCs)

On November 9, China announced that it will extend its zero-tariff treatment to 10 LDCs: Afghanistan, Benin, Burkina Faso, Guinea-Bissau, Lesotho, Malawi, Sao Tome and Principe, Tanzania, Uganda and Zambia. The policy came into effect on December 1 and will be applicable to 98 percent of taxable items, including agricultural goods and production materials. The policy aims to accelerate these countries’ growth, and is likely to be extended to other LDCs that have diplomatic relations with China, putting Beijing in an advantageous position as it competes with its rivals for influence in the global south.

China strengthens bilateral partnerships with Indonesia and Thailand

On November 16, the Chinese and Indonesian governments signed 5 bilateral agreements in the fields of economy, maritime, and trade following the G20 Summit in Bali. Following the APEC summit, China and Thailand also signed 5 agreements aimed at: strengthening security, trade and sustainability; cooperating on the Belt and Road Initiative; and signing an MoU on establishing a working group on investment and economic cooperation. These agreements build on China’s growing ties with Southeast Asia, which will likely continue to emerge as a field of strategic competition between China and others as discussed in the above entry on competition in ASEAN.

Kenya goes public with its Chinese contracts

On November 5, the Kenyan government released three documents from a loan contract signed in 2014 with China’s ExIm bank for Kenya’s Standard Gauge Railway (SGR). Kenya’s new Transport and Infrastructure minister released the contracts to remove public uncertainties that the previous Kenyan leadership had staked the valuable Mombasa Port as collateral for the initial USD 3.6 billion railway project loans. One clause states that any significant disagreements about the SGR would be resolved in China over Kenya, however it is unclear if this implies Chinese authorities would have the last word in such disagreements. The records also indicate that the Kenyan government was required by law to maintain the confidentiality of the agreement’s specifics. The incident serves as a reminder of the shortcomings of transparency on the BRI, an area in which Europe’s Global Gateway could present itself as a credible alternative partner.

Transport and Logistics

Chinese capabilities are displayed at Qatar World Cup

Qatar imported 1,500 Chinese-made Yutong buses, including 888 electric buses to use at the FIFA World Cup. The success has led the company to announce its plan to build a factory in the Gulf state, helping Qatar achieve the country’s ‘National Vision 2030’ of becoming 100% electric. While a Chinese firm won the bid for electric buses, the government also signed an MoU with the European ABB in September 2021 to install charging stations – perhaps a sign of how middle-powers can play off competitors to build out different parts of their system. Additionally, the Lussel Stadium building project was awarded to CRCC International back in 2016. The Chinese company served as the general contractor for the design and building of the World Cup stadium, breaking the pattern of European and American contractors historically winning such bids.

Alibaba’s Cainiao goes global in Pakistan and Brazil

Alibaba’s Cainiao Logistics continues to develop foreign e-commerce operations. In partnership with Pakistani e-commerce Daraz Group, the Chinese company completed an automated express distribution center in mid-October. The distribution center is said to be one of the most technologically advanced logistics facilities in South Asia. Additionally, the company recently named Sao Paulo as its LatAm headquarters about the same time as launching Brazil’s first parcel distribution center, adding to its regional network of sorting centers in Mexico and Chile. The Hangzhou-based company plans to build more sorting centers in Brazil, and to set up 1,000 smart drop-off lockers in 10 major cities by 2025. Even as China’s digital champions are being hit at home as well as in the US and Europe, they are also expanding their global footprint and seizing market share in emerging economies.

Manufacturing and Construction

Germany compromises over Hamburg COSCO deal

Following criticism over an initial deal between Hamburg port terminal and China’s shipping company COSCO, the German chancellory approved the deal after reducing COSCO’s stake from 35 percent to 24.9 percent. The Ministry of Economics announced that the compromise would fall under the threshold to have voting rights on terminal management. The Chinese shipping company is also prohibited from having contractual veto rights in future strategic business decisions, though at the time of printing, COSCO had not yet accepted or denied the compromise. The investment is the first in a European port since the new EU investment screening mechanism was put in place.

Chinese EV companies continue their Hungary expansion

On October 5, Shanghai Kuaibu New Energy Technology (KBVIP) signed its first photovoltaic (PV), battery storage and electric vehicle (EV) charging pilot project agreement with Hungary’s Intretech. The timing of the project comes soon after CATL, the parent company of KBVIP, announced that it was building a battery factory near Debrecen. The Hungarian city is increasingly becoming an EV manufacturing hub, with BMW having also announced a further 2 billion Euro investment in their factory opening in 2025. While a new EV hub will boost Hungary’s industry, Some fear China’s EV expansion makes the country and Europe too dependent on Chinese battery-makers, and that European automakers are lagging behind their Chinese competitors that are increasing their footprint in the common market.

Egypt goes green with Chinese construction

China State Construction Engineering Corporation Egypt Branch (China Construction Egypt), has completed 20 buildings in Egypt’s New Administrative Capital, a large-scale project of a new capital city in Cairo that has been under construction since 2015. The project uses aluminum molds to replace traditional wooden ones, which has a high recycling rate and greatly reduces material consumption; uses different types of concrete, which saves construction energy consumption; and has installed an on-site water system to purify sewage and wastewater to reduce water wastage. China’s construction efforts overseas are increasingly incorporating greener technology, which not only increases their value as a partner in the eyes of developing countries, but also directly challenges an EU competitive strength.

China Harbor Engineering Company (CHEC) completes Nigeria’s Lekki Port Project

On October 31, CHEC handed over Nigeria’s first deep-sea port located in Lagos, the country’s economic hub. The tripartite project between China, France and Nigeria began in 2020 and is designed to handle 1.2 million standard containers annually, making it one of the largest ports in West Africa. Combined with the upcoming Lagos Free Zone, the project aims to tap into Nigeria's economic potential, increase revenue, and generate an estimated 200,000 jobs in the coming years. The project serves as a reminder that joint project development between China, European players, and recipient countries can still deliver.

Digital and Tech

Europe blocks Chinese takeover of chip firms

Two European semiconductor transactions have been blocked due to growing anxiety surrounding possible Chinese control. On November 9, Germany’s economic ministry barred Elmos Semiconductor, an automotive chipmaker, from selling a foundry in the city of Dortmund to Silex, a Swedish subsidiary of China’s Sai Microelectronics. On November 16, the British government ordered Chinese-owned technology company Nexperia to sell at least 86 percent of Britain's biggest microchip factory, Newport Wafer Fab, 16 months after it took it over in July last year. Both transactions have been blocked due to national security concerns at a time when the US seeks to reduce Chinese access to semiconductor technology and the EU tries to secure its own chip-making capacity.

China and Singapore lead submarine cable network in Southeast Asia

China Telecom Global and Singtel are co-leading a consortium of six carriers to build a USD 300 million undersea fiber-optic cable system that will connect Hong Kong, Singapore, Brunei, the Philippines, and China. The Asia Link Cable (ALC) system will span 6,000 kilometers and is expected to be completed by 2025. ALC will be built on an open cable system design that will reduce dependency on any one provider within the consortium. The cable network serves as a reminder of China’s growing role as a tech provider in third markets.

China’s ZTE boosts Thailand’s digital infrastructure

Thailand’s digital network operator, AIS, has partnered with China’s ZTE, a major worldwide provider of information and communication technology solutions. They launched a 5G innovation center to advance 5G technology, develop solutions for business sectors, and enhance Thailand’s competitive capabilities under Thailand 4.0. As Huawei and ZTE have hit headwinds in liberal market economies, it is increasingly turning to other economies to build market share, which could become a challenge when European competitors want to expand into those same markets in the future.

Energy

China ramps up its gas from Qatar

QatarEnergy signed a 27-year natural gas supply agreement with China’s Sinopec on November 21, making it the ‘longest’ agreement in the history of the LNG industry according to the Gulf state’s energy minister. The gas will come from the North Field East project which began in 2020, half of which is expected to go to Europe, and the other half to Asia. This comes at a time when EU countries have hesitated to sign longer-term deals as they plan to move away from fossil fuels in the short run, all the while reducing its dependency on Russian gas. Furthermore, this move is an important part of China’s efforts to diversify away from the US and Australia, which provide a large share of China’s gas through LNG deliveries.

Sino-French partnership brings PV power to Italy

On October 13, General Technology China Machinery Europe (Italy) Co., Ltd. and Ikarus Srl, a subsidiary company of the French GÉNÉRALE DU SOLAIRE (GDS) Group, signed the general contract for the 7 MW photovoltaic power plant project in Manduria, Italy. China Machinery Europe (Italy) is responsible for the design, procurement, construction, commissioning, trial operation, operation and maintenance of the power station. It is estimated that the annual power generation will reach 11.6 million kWh, saving 2,755 tons of standard coal and reducing the equivalent of 7,540 tons of carbon dioxide emissions.

Myanmar fires up its power plant

On October 10, China Power Construction Group completed a 135-MW gas-fired power plant located in the Kyaukphyu Special Economic Zone (SEZ). The USD 180 million project forms an important part of the China-Myanmar Economic Corridor (CMEC) scheme. It is one of the many energy projects lined-up between the two countries, including hydro power plants in Ye Ywa in Mandalay, Paung Laung in Naypyitaw and Tha Htay in Rakhine; natural gas-fired plants in Tha Hton in Mon State and Thaketa in Yangon; and a solar plant in Minbu in Magwe Region. Myanmar has grown increasingly reliant on China as LMEs and India have held back from cooperating with the local regime over human rights abuses.