2. Xi’s policies serve strategic national goals beyond growth

You are reading chapter 2 of the report "The party knows best: Aligning economic actors with China's strategic goals". Click here to go back to the table of contents.

Key findings

- Xi Jinping economic thought is expanding the roles of the party and state to guide economic actors towards Beijing’s strategic goals.

- Economic liberalization as a goal in and of itself is dead in Beijing. Xi uses market forces as a tool when convenient, but only as a part of a broader party-state toolkit.

- The leadership has no intention of isolating China. dual circulation strategy aims to alter China’s position in the global economy – remaining open to the global economy while boosting domestic consumption and climbing global value chains.

- Beijing has begun to heavily emphasize the “New type of all-of-nation system” to close key technology gaps, and economic actors are increasingly playing along.

- In Xi’s view, the private sector had become detached from national interests and drove up systemic risks in the financial sector, an issue that could only be addressed with more control.

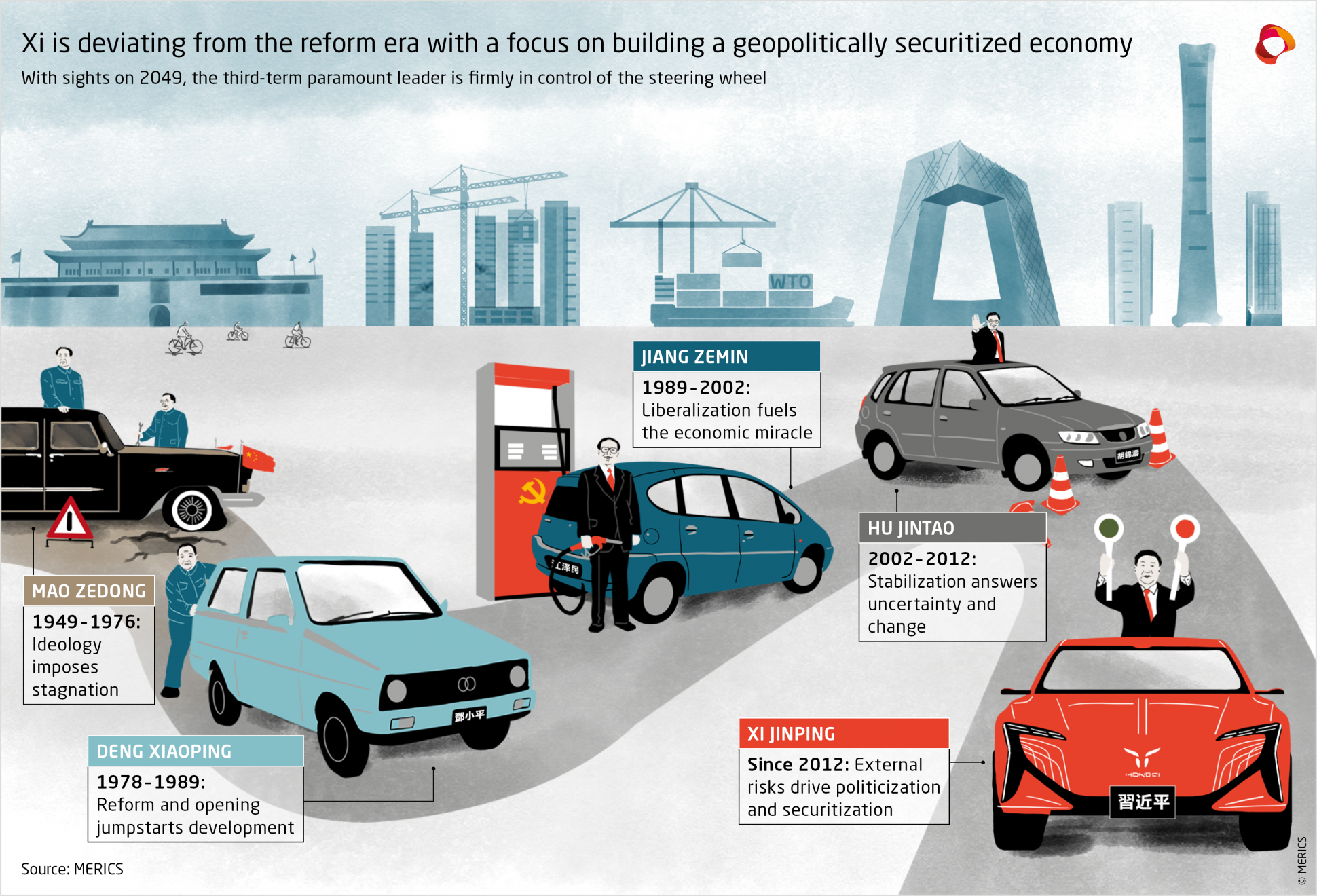

After the Mao years, China experienced four stages of economic development, each characterized by a distinct approach to political economy in respective generations of leadership: Deradicalization (reform and opening up), liberalization, stabilization, and now, under Xi, securitization, which means assessing all political economy issues as though they were security issues for China. During his first two terms, Xi harnessed the CCP’s greatly diminished confidence in market forces as the central driver in resource distribution after the global financial crisis to advance his economic ideology.

As Deng Xiaoping deradicalized the economy in the 1980s, state-owned enterprises (SOEs) remained the undisputed champions, with privately owned enterprises (POEs) only allowed at the cottage industry level, as pragmatism and experimentation took hold.2 As POEs emerged, the Jiang Zemin era of the 1990s saw the reforms of his premier, Zhu Rongji, who liberalized the economy with a focus on SOE reform under the mantra of “grasp the large and let go the small” (抓大放小). The state held onto hundreds of the country’s most important firms, Lenin’s “commanding heights” of the economy, while the rest were privatized or allowed to collapse.

From then on, the national SOEs were largely used to advance the strategic goals of the CCP. Under Hu Jintao in the 2000s, liberalization slowed and SOEs retrenched to stabilize the economy in light of the global financial crisis. SOEs developed infrastructure, supported employment, provided social security, and maintained China's industrial foundation, independent of market forces. Meanwhile, POEs pursued profits, job creation, development, and innovation. Trust in market forces stagnated under Hu, after growing under Deng and Jiang, and then deteriorated under Xi (see Exhibit 3).

2.1 Xi breaks from the reform era and envisions strategic roles for all companies

Xi initially wanted to continue Hu’s approach to the SOE–POE divide, as expressed in the 2013 Third Plenum Decision document naming both state ownership and market forces as central pillars to development. But faced with emerging and clear risks in 2015-18, Xi shifted course and pushed back against more reform-minded factions in the party. Key triggers were:

- Financial instability: Highly leveraged companies, fears of a housing bubble, financial market turbulence in 2015-16. This triggered a deleveraging campaign in 2016 and set the seeds for crackdowns on real estate (and tech) to control speculative investments and markets not aligned with national strategic goals.

- Foreign dependencies: Already suspicious of the US, trust in China’s dependency on foreign tech evaporated with the US trade and tech wars starting in 2018 and US President Donald Trump’s threats to block telecommunications firm ZTE from American technology.

The steady shifts in Xi’s management of the economy are underscored by an attempt to construct or at least project a coherent economic governance model. As a somewhat clearer picture of his vision for the economy emerges (internally promoted as “Xi Jinping economic thought for a New Era”), Deng’s era of opening up and reform looks like a transitional period, now possibly succeeded by an era of security and control.

According to China’s leaders, the country is on a path to completing a “historic transformation from standing up and becoming prosperous, to growing strong.”3 (从站起来、富起来到强起来4) China’s reform process and global integration have substantially advanced living standards and science and technology capabilities. But to “reach the new development stage of socialist modernization” (社会主义现代化) by 2035, the CCP under Xi Jinping is resorting to policies that held back China’s development for decades: ideology, centralization, securitization, and reversing the separation of party and state.

After the 19th Party Congress in 2017 and the subsequent Central Economic Work Conference, Xi Jinping economic thought became the CCP’s central ideology shaping China’s economic development. Loyalty to Xi and his agenda have always mattered most, as manifested in Xi’s omnipresent anti-corruption campaign launched in 2012. But beyond loyalty and ideological adherence, Xi Jinping Thought also demands competence – Xi still believes that technocrats are best placed to advance the country and has promoted STEM graduates to leadership positions during his tenure at a higher pace than under Hu Jintao.5

Those cascading requirements – loyalty, ideological alignment, and competence – were on full display in the selection of cadres elevated to top leadership at the 20th Party Congress. Competing factions, such as the Communist Youth League, were sidelined while close contacts of Xi rose to the surface.6 Anyone with a voice that could have pushed back on Xi’s strategies was suppressed, be it Li Keqiang or Hu Jintao’s protégé, Hu Chunhua. Meanwhile, promotions were in line for Xi loyalists like Li Qiang, who stuck to the zero-Covid ideological position that locked down Shanghai for weeks in 2022.

Xi’s Economic Thought is laying the key building blocks for China’s economic system. It is defining the role of the state for guiding economic actors and expectations for companies and society, as well as how China engages with the rest of the world. Even more ideological are the goals laid out by the CCP and the means by which Xi intends to reach them. Economic liberalization as a goal in and of itself is dead in Beijing. It is not seen as compatible with the political system. Xi Jinping’s ideological choice has been to extract the tool of market forces from the scrap heap of economic liberalization and to use it only for specific goals – while building out new economic measures in which the party-state plays a central role.

The CCP dominates the economic system in a similar way it does the political system through strategic guidance and controlling market mechanisms and by demanding strict obedience from those companies and individuals that can contribute to national strategic goals.

2.2 Xi’s economic thought is a continuation in some areas and a clean break in others

Some of the clearest origins of what would later become Xi Jinping economic thought were revealed in August 2020 when Qiushi, the CCP’s chief theory journal, published a speech he had delivered on November 23, 2015, one of his earliest speeches as paramount leader overviewing his ideological perspective on China’s political economy. The speech, made during a study session of the Politburo, outlines key priorities in Xi’s political economic strategy in a post-Third Plenum and pre-19th Party Congress interregnum. Titled “Unceasingly open up the borders of contemporary Chinese Marxist political economy” (不断开拓当代中国马克思主义政治经济学新境界), it focuses on six key goals:7

- First, adhere to the people-centered development philosophy. (第一,坚持以人民为中心的发展思想)

- Second, adhere to the new development concept. (第二,坚持新的发展理念)

- Third, uphold and improve the basic socialist economic system. (第三,坚持和完善社会主义基本经济制度)

- Fourth, uphold and improve the basic socialist distribution system. (第四,坚持和完善社会主义基本分配制度)

- Fifth, adhere to the direction of socialist market economic reform. (第五,坚持社会主义市场经济改革方向)

- Sixth, adhere to the basic national policy of opening up. (第六,坚持对外开放基本国策)

Over the rest of his first and second terms in office, these core tenets of what would become Xi Jinping economic thought were matched with Xi-specific slogans and campaigns.

The core goal: Adhere to a people-centered development philosophy. This is Xi’s primary aim for his New Era. At the 19th Party Congress, Xi changed the “principal contradiction” at the core of CCP thinking from was “between the ever-growing material and cultural needs of the people and backward social production” to “between unbalanced and inadequate development and the people’s ever-growing needs for a better life.” Instead of the previous approach of development at all costs, Xi has now put “quality over quantity” into the development mix.

Subsidiary goals: Adhere to the new development concept of quality over quantity. Xi frequently emphasizes the need to focus on quality development rather than merely driving up the numbers – meaning people-centered development. However, Xi also often elaborates that the “New Development Concept” must balance innovation, coordination, greening, openness, and “sharing.”

The economic model: Uphold and improve the basic socialist economic system and adhere to socialist market economic reform. This has been interpreted in the West as raising the role of market forces in allocating resources. Xi has repeated many times that there are two pillars to China’s economic model, one public and one non-public. In other words, socialism with Chinese characteristics only works with both strong SOE and strong POE sides to the economy, referred to as “the two unwaverings” – meaning unwavering support for both.

Economic distribution: Uphold and improve the basic socialist distribution system. In China, the basic socialist distribution system is based on “distribution according to work,” although multiple parallel systems for distribution exist (…我们确立了按劳分配为主体、多种分配方式并存的分配制度). Xi would later spotlight distribution in prioritizing “common prosperity.” The term dates back to Mao but is known from Deng Xiaoping’s famous quote, “Let some get rich first… then lead the rest into common prosperity.” Xi quickly clarified that China will not revert to broad redistribution. Common prosperity is a goal, but not via means like “welfare universalism.”

Over the rest of his first and second terms in office, these core tenets of what would become Xi Jinping economic thought were matched with Xi-specific slogans and campaigns.

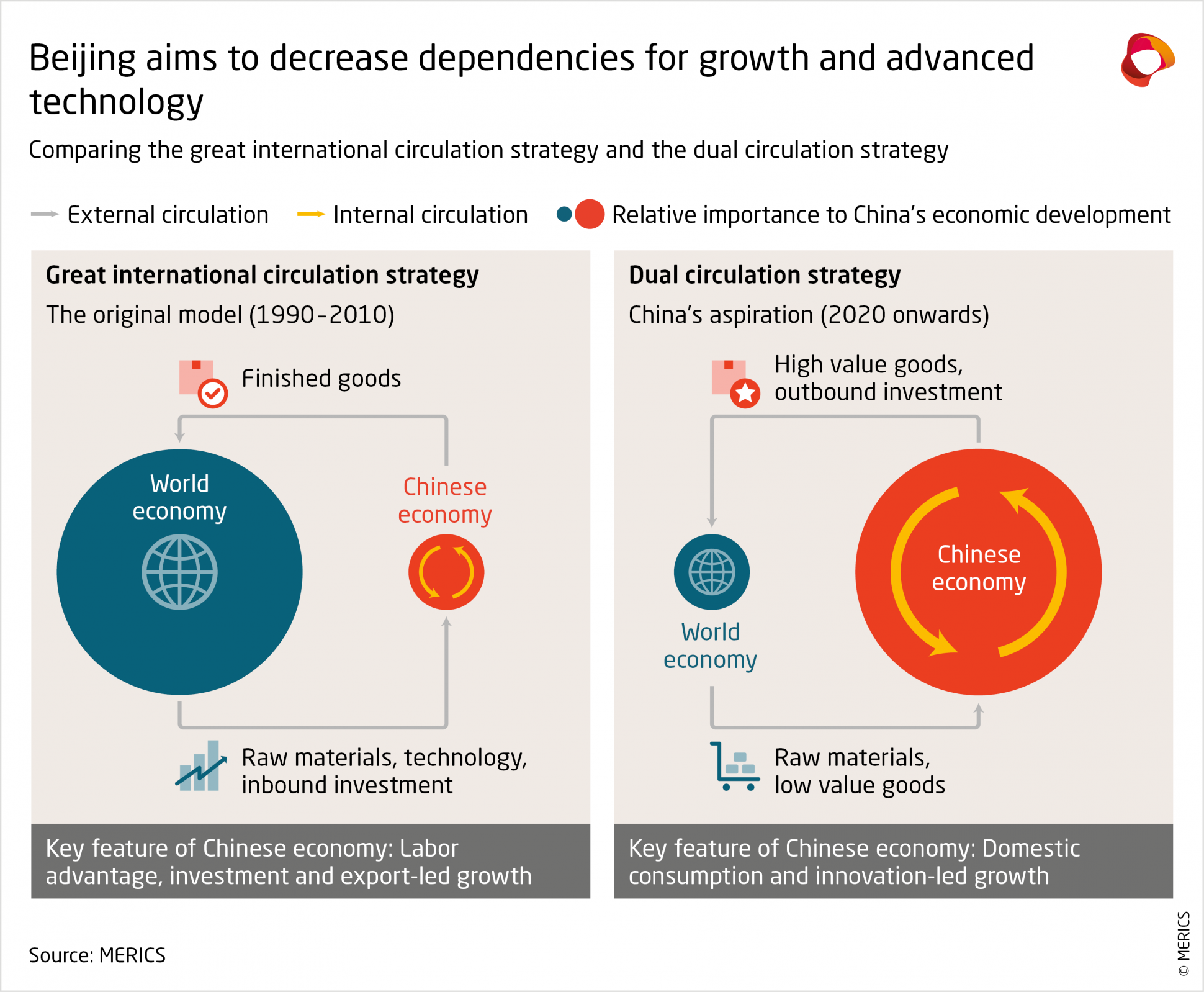

China’s global economic position: Adhere to the basic national policy of opening up. Xi has no intention of isolating China and is instead eager to grow China’s role in the global economy. His signature foreign economic policy has been the Belt and Road Initiative (BRI), China’s major infrastructure project to connect Asia, Africa and Europe via land and sea. This would grow into Beijing’s dual circulation strategy which aims to alter China’s position in the global economy – remaining open to the global economy while boosting domestic demand. Unlike Deng’s idea to drive growth by luring technology, investment, and raw materials to produce low – to mid-value goods for export, Xi aims to import raw materials and lower-value goods and export higher-value goods, tech, and outbound investment.

Some core priorities of Xi’s economic thought weren’t part of his 2015 speech. Innovation and technology have begun to play a much more central role in Xi’s economic policymaking. The US trade war gave this momentum, especially actions against Chinese tech companies and recent export controls. Xi has begun to heavily emphasize the “all of nation effort” to close key technology gaps. Consumption-driven growth is also a major focus. This has always been a goal, and is the second half of the dual circulation strategy – external circulation being China’s position in the global economy and internal circulation being domestic consumption as the key driver of growth (rather than exports) (see Exhibit 4).

2.3 The trade war and the pandemic catalyzed deeply rooted self-reliance in Xi’s economic thought

Xi consolidated his power base over his first two terms, but there were limitations as to how aggressively he could push his then still-evolving economic ideology. First, it was difficult to get buy-in for his radical approach to self-reliance from most economic actors at a time when China had virtually complete access to foreign markets and technologies. Second, The CCP’s very legitimacy had, since the crackdown on the Tiananmen Square protests, been dependent on securing economic development gains in return for political silence from the masses – meaning that Xi needed to keep growth strong, irrespective of his ideology. Two things happened to change this: The US-China trade and tech war and the pandemic.

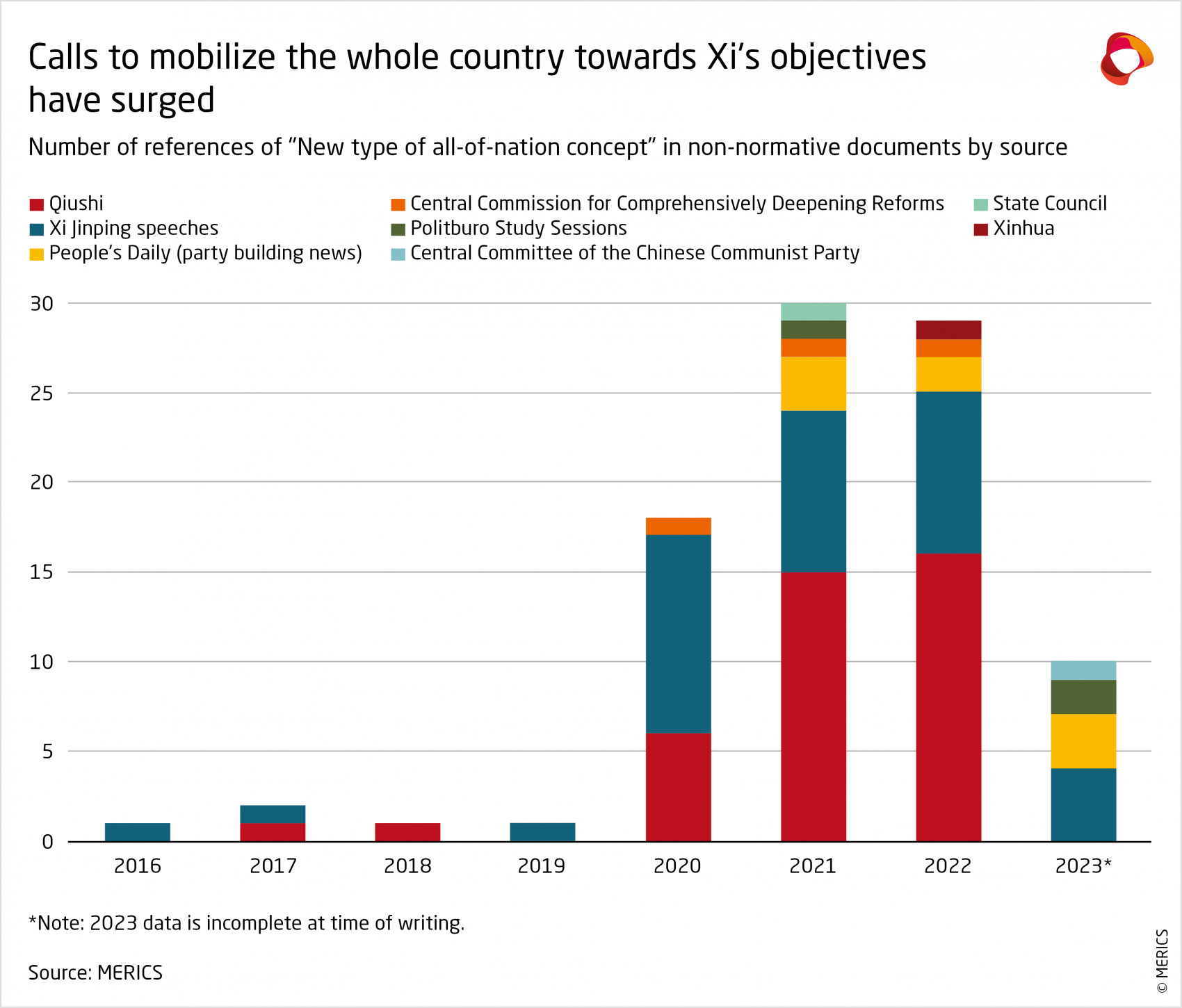

Self-reliance is a long-standing principle in CCP ideology – indeed, of any communist or more generally authoritarian ideology. However, aside from more ideologically conservative types in the CCP and China’s major SOEs, much of China’s private sector, scientific community, and broader society were not behind the idea. The US-China trade war, and the more significant tech war that began with restrictions on Huawei and ZTE, changed that around 2018. Private companies faced being technologically strangled by the US. For the first time in decades, there was truth behind the idea of an all-of-nation effort to close the tech gap and achieve self-reliance. This opened up considerable political space for Xi to push his economic ideology (see Exhibit 5).

The pandemic did something similar. China’s initial failure to contain the virus was later met with an effective zero-Covid policy that, despite its often draconian nature, worked for the first two years. Compared to the rest of the world, China seemed stable and back to “normal life” – something state media was happy to demonstrate with coverage of global chaos next to rosy reports about Beijing’s leadership. This gave Xi political space to deprioritize economic growth as a measure of success in pursuit of other political goals. This is not to say that multiple crackdowns on the tech sector, private tutoring or the real estate sector would not have happened in absence of the pandemic, but the unquestionable legitimacy of Covid measures offered a window of opportunity to advance these goals.

2.4 The transformation from China, Inc. to CCP, Inc.

Xi Jinping economic thought did not emerge by design but evolved in response to weak spots in the domestic economy and shifts in the external environment, marked by confrontation with the US – all of which empowered Xi Jinping’s vision for the economy. The CCP seeks to increasingly dominate the economic system just like the political system. It uses strategic guidance to contain “misguided” market decisions that increase financial risks and fail to advance strategic objectives or “de-risk” from the West. Economic policy is becoming more problem-oriented, preparing the nation for difficulties ahead. One priority is to reestablish the party’s leadership in China’s modernization efforts and foster the securitization of everything.

This has allowed the CCP to reach into the private sector, which in Xi’s view has become detached from national interests and has contributed to systemic risks in the financial sector. As a result, some of China’s most successful and celebrated private companies found themselves up against a wall.

First, a deleveraging campaign launched in 2016 targeted highly indebted companies, especially in the real estate and property sectors, which had contributed to excessive debt and risks to the financial system. While SOEs were also targeted in an effort to improve their performance, regulators started to focus on private companies including the rapidly expanding industrial conglomerate HNA Group and Anbang Insurance Group in 2017. The companies have since ended in bankruptcy or become defunct with their founders imprisoned.8

Some of the most successful companies and entrepreneurs were increasingly seen as rivals to the CCP’s grip on power. Most prominent was the halting of the world’s largest IPO in 2020 – Ant Financial, after founder Jack Ma made comments challenging the state-dominated banking system.9 His subsequent de facto silencing sent a signal to other entrepreneurs about who was in charge, which was combined with a broader crackdown on tech firms accused of “disorderly expansion of capital.” This meant they had done so well that too much capital was flowing their way at the expense of investment in areas designated by Beijing.

This can be seen as a follow up to Xi’s first anti-corruption campaign targeting officials. But this time, the CCP targeted the private sector and entrepreneurs to force their alignment with the ideological and political goals of the party-state. While not a return to a command economy through state takeovers of private firms, it is a new model that raises party interests above both the state and the private sector, thus advancing the transformation from “China, Inc.” to “CCP, Inc.”10

2.5 All economic actors must advance strategic goals

Xi Jinping’s economic vision has expanded over the years. His elevation of the party is a remarkable shift in China’s political economy. Hu Jintao once tried to rein in state-owned enterprises that had wandered from their core industries but failed due to vested interests. Even the People’s Liberation Army (PLA) was notorious prior to Xi for its wide array of investments in the private sector. Leveraging ideology, Xi managed not only to rein in SOEs and get the PLA to divest, but expanded the CCP’s control over private companies.

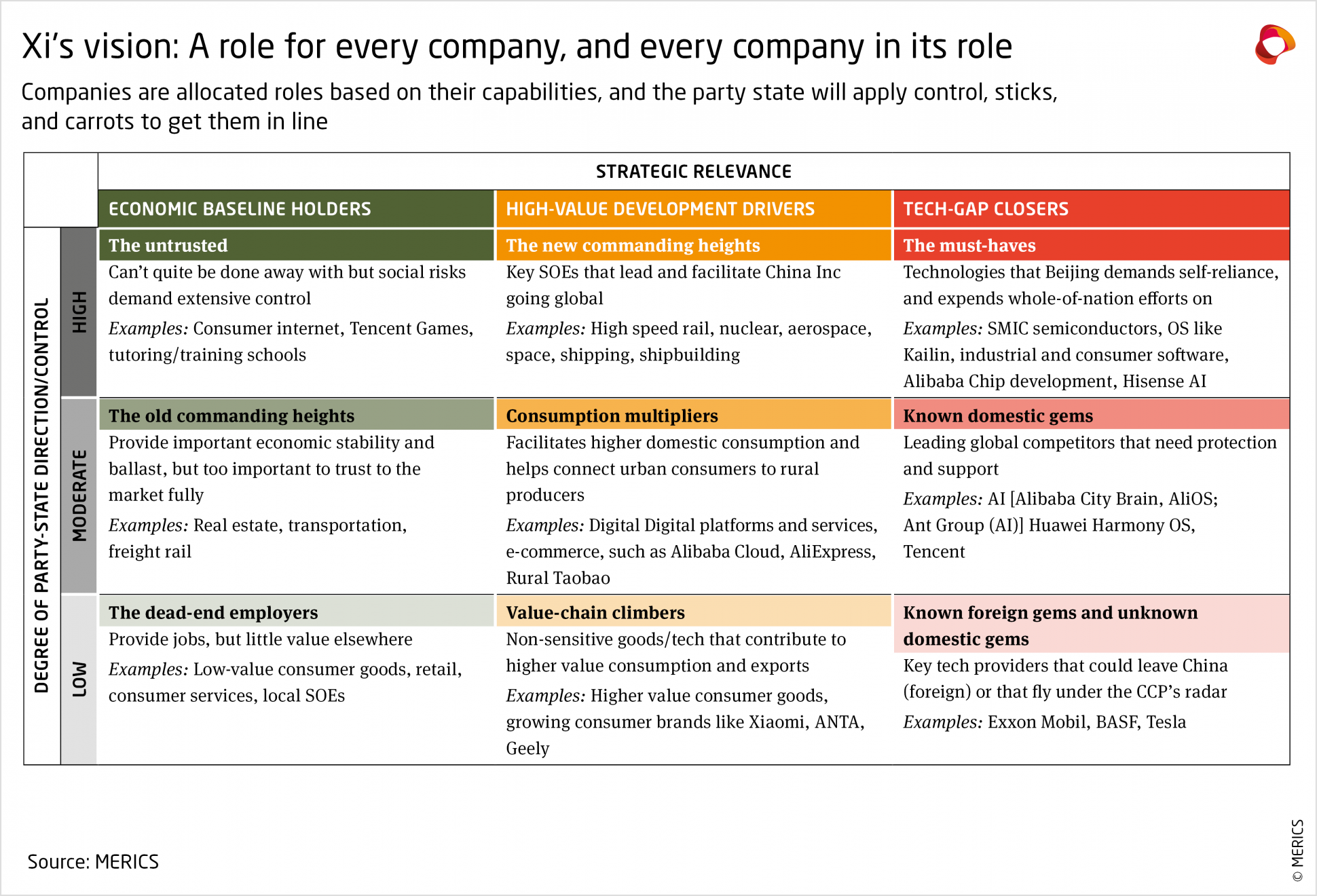

Xi’s tenure in office began with a clear continuation of Hu Jintao’s dual-pillar economic model – POEs were responsible for growth and innovation, SOEs were responsible for stability and intervention. The extent of party involvement depends largely on two factors:

First, the strategic relevance of a given firm. This spans from the most strategically important firms on one end – the “tech gap closers” that help overcome China’s technological deficit in relation to liberal market economies – to the strategically important, though less critical “high-value development drivers” that are the new areas of growth that help China climb global value chains, and also to the least strategically relevant, though still important, “economic baseline holders” that fulfil the roles of maintaining employment, managing logistics and traditional infrastructure, and even to those sectors viewed with hostility from Beijing.

Second, the degree of party-state control/guidance, which operates on a scale from high to low. This is reflected in the areas in which the CCP needs to advance control to drive innovation or consolidate and advance monopolistic national champions at home and abroad, as well as the areas in which the CCP wants to have greater control, such as over digital champions that process vast quantities of consumer data or in the sectors Beijing wants to suppress for political reasons, such as the gaming industry and private tutoring (see Exhibit 6).

This shift from a division of labor in which SOEs had certain roles and POEs had others to one based not on ownership type but on the strategic relevance and degree of control over individual actors creates many niche roles that companies can occupy in Xi’s new economic model.

A series of case studies demonstrating this shift in detail are referred to throughout the text, and the full version of those case studies can be found in the annex of this report. However, perhaps the clearest example of the varied strategic roles companies are meant to play is the planned break-up of Alibaba into six different lines of business, as outlined in the case study below.

Case study: Alibaba falls in line on national strategic goals, breaks itself up

Jacob Gunter

China’s retail and e-commerce giant Alibaba was long a key private company driving extensive growth and innovation, but Beijing has taken a critical view of the company and its founder Jack Ma in recent years. Certain lines of business, such as digital financing, were viewed as risky to socio-economic stability under the party-state campaign against the “disorderly expansion of capital,” while other socio-economic goals under the “common prosperity” banner and “anti-trust” rules have also been impressed on Alibaba.

Meanwhile, the tech giant has been pushed to play more of a role in China’s tech self-reliance campaign, with the expectation clearly to use its innovative potential not only on lines of business that consumers demand, but also those that are strategic bottlenecks for Beijing. In that sense, Alibaba’s decision to split itself into six entities with different lines of business is a prime example of a private company being cowed into aligning with Beijing’s strategic goals.

Direct control and many strikes at Alibaba with regulatory and political sticks

Blocked IPO – In November 2020, Beijing suddenly blocked the IPO of Alibaba’s Ant Financial (set to be the largest in history).11

Regulatory crackdown – Days after this, the State Administration for Market Regulation (SAMR) released anti-trust regulations for comment that were finalized in February 2021. The measures specifically target the internet platform industry. Alibaba’s stock price has yet to recover, with its high of EUR 261/share on October 30, 2020, greatly eclipsing its value of EUR 198 at the end of 2021 and EUR 99 at the end of 2022.12

Golden shares – The party-state has used state-owned investment vehicles to take one percent stakes with special voting rights in two of Alibaba’s units. Zhejiang Media Group seized one percent of Alibaba’s Youku Film and TV unit, while an entity under the Cyberspace Administration of China took a one percent share in Alibaba’s Guangzhou Lujiao.13

Common prosperity – Alibaba created a Common Prosperity fund in September 2021 that will reach a planned USD 15.5 billion by 2025. The funds are planned to support SMEs, enhance insurance for workers in the gig-economy, and promote rural development.14

Tech self-reliance – Alibaba traditionally focused its R&D and R&D collaboration specifically in the design part of the semiconductor value chain but has recently expanded its investments in closing the technology gap in other segments of the value chain.

Alibaba is reshaping itself along Beijing’s objectives

Not only has Alibaba fully aligned with the regulatory crackdown, both data and anti-trust related, but also with Beijing’s self-reliance goals – in terms of the tech it was already developing, like cloud solutions and AI development, and in other technologies Beijing needs, like the broader semiconductor value chain.

In fact, Alibaba has fallen in line so obediently with party-state goals that founder Jack Ma largely has stepped back from the company and public life and the company has split itself into six different entities: China-based e-commerce, global e-commerce, logistics, cloud computing, digital mapping and food delivery, and media and entertainment. The stated goal is to allow these subsidiaries, all run independently by different CEOs, the flexibility to operate in a changing environment, and especially to make it easier for each entity to pursue an IPO when the time is right.

Beyond that goal, splitting up the company will allow for more differentiated political alignment. For example, the media and entertainment entity will need to move slowly and in line with what is politically correct at any given moment without poisoning other lines of the business; dividing up China and global e-commerce will make compliance with different data regimes easier; and separating cloud computing, and with it much of the semi- conductor value chain and innovation on AI and quantum computing, allows the company to contribute to Beijing’s tech and innovation goals without getting bogged down in the sensitivity of other lines of business.