Lab leader, market ascender: China's rise in biotechnology

Key findings

- Biotechnology has been a priority sector for China for two decades and is now promoted as a leading technology of the "new-quality productive forces." Public funding for research in the field has been consistent and generous, totaling at least CNY 20 billion (EUR 2.6 billion) in 2023. Judged by leading publications and Patent Cooperation Treaty (PCT) patents, China’s innovation capabilities have surpassed Europe in most biotech areas, and the US in some.

- China’s research and innovation capabilities in biotechnology are ahead of its domestic demand in healthcare, chemicals, energy, agriculture and other downstream markets.

- China’s biotech sector needs access to overseas markets and investors, especially for its most advanced products. If this access is increasingly limited, China’s biotech sector is at risk of confinement to the lower and middle ranges of the supply chain. Currently, China’s main strengths are in areas where cost effectiveness is key, particularly in manufacturing active pharmaceutical ingredients, in providing contract research and in generating so-called me-too and me-better versions of existing treatments.

- European and American pharma firms have been investing heavily in Chinese biotech companies. This illustrates the growing innovativeness of China’s biotech sector, which benefits from a range of government incentives.

- The potential benefits to public health, the environment and Europe’s economy from collaboration should be harnessed where possible. The rapid development of testing kits, treatments and vaccines during the Covid-19 pandemic also underscores that collaboration with China, however difficult, leads to better outcomes for patients. There is more room for global collaboration than in some other areas of critical technology.

- Europe needs to match the strategic intent and policy support China offers its biotech sector, by both strengthening the environment for local capital investments and ensuring that collaboration serves EU interests.

Beijing’s biotech rise amid growing tech rivalry

Biotech, the use of biological systems and organisms to develop products or processes for medical, industrial, energy or agricultural applications, is widely recognized as a strategic technology because of its potential to transform humanity’s control over nature. Governments worldwide are racing to secure their positions in the field. In 2022, China for the first time issued a five-year plan for the bioeconomy with broad goals for 2025 in biopharma, bio-agriculture, bio-manufacturing and bio-security.1 The main objective is to overcome technological challenges and achieve independence in science and technology.2

Beijing’s aspiration to reduce its dependence on foreign links reflects the increasingly contested nature of cooperation in the biotech sector. The European Commission has proposed actions to boost biotechnology and biomanufacturing, raising the possibility of a European Biotech Act.3 Former European Central Bank President Mario Draghi’s influential report on EU competitiveness includes pharma (which partly overlaps with biotech) among the ten sectors that Europe should invest in.4 In the US, biotech is firmly framed as part of its rivalry with China. The Biosecure Act, first presented in May 2024, seeks to ban government procurement from Chinese firms such as BGI Genomics, Wuxi Apptec, and Wuxi Biologics.5

This government-led pursuit of biotech dominance threatens to reverse the trend of expanding cross-border collaborations. A survey of 124 US biotech firms in May 2024 found that 79 percent engage with China-based contract manufacturers.6 Cutting such ties could prove to be highly disruptive, slowing innovation on all sides.

This report explores the goals, trends and international ties of China’s biotech sector, to help inform Europe’s own strategy on biotechnology. Europe already has a strong foundation, with several firms among the world’s leaders.7 Both strengthening domestic capabili- ties and finding the right balance between engagement and risk mitigation with China will be crucial for Europe’s long-term success.

China has invested significantly in biotech R&D

Beijing has consistently promoted the biotech sector since the mid-2000s, dedicating significant resources to China’s research capabilities. Although it is now one of the leading publishers of high-quality scientific research, this advantage has contributed little to industrial build-up. Policymakers are working to create greater synergies between the academic and corporate worlds, hoping to generate improved returns on their investments.

China’s biotech policy ambitions have expanded over time

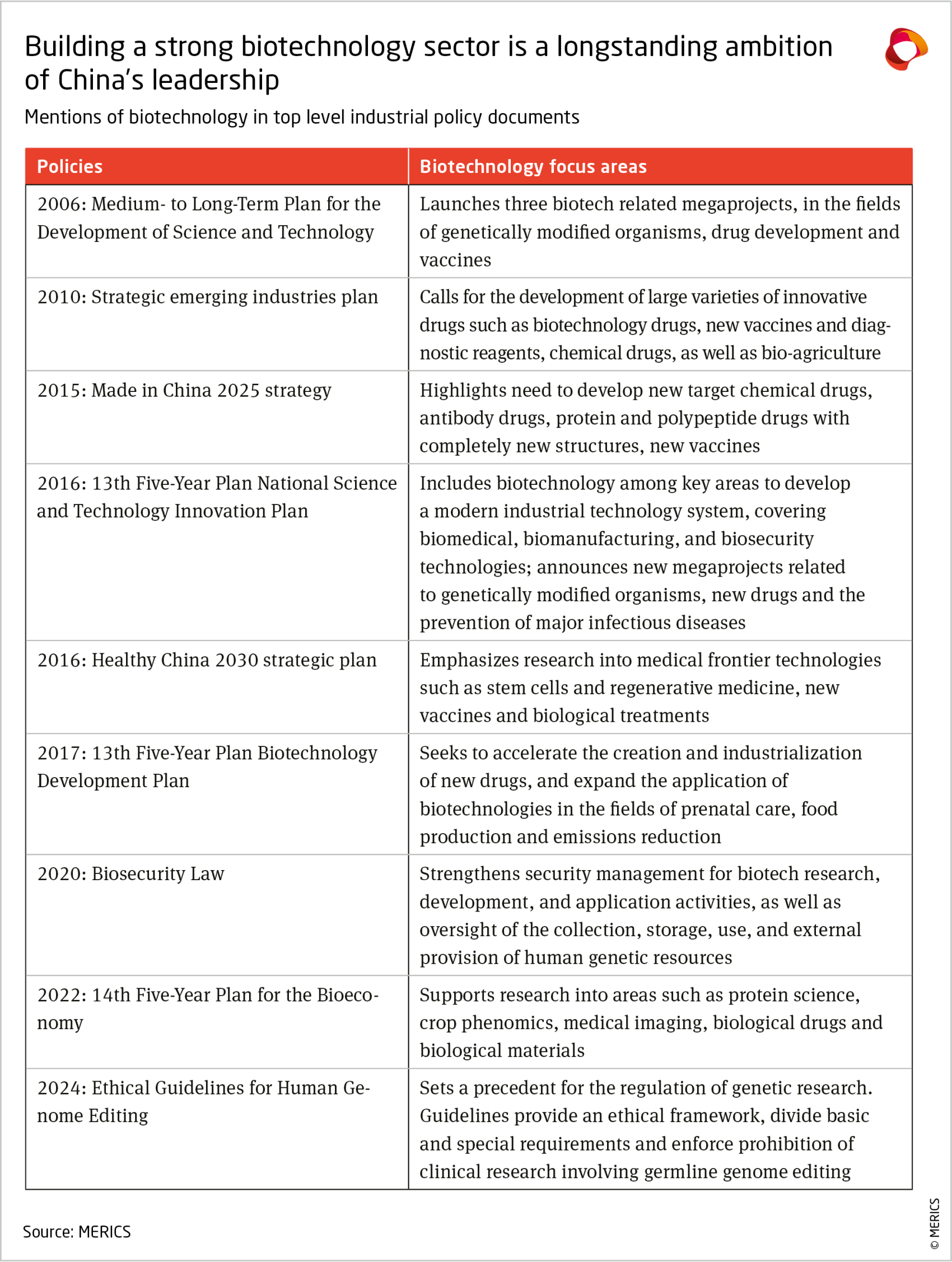

A fixture of China’s industrial policy of the last two decades, biotechnology has recently emerged as one of Beijing’s top priority sectors.8 In 2024, China’s government work report mentioned “innovative drugs” for the first time and biomanufacturing was cited as a key economic growth engine.9 It features prominently as part of the “new-quality productive forces,” a political term that since mid-2024 frames Beijing’s innovation and industrial policy goals.10

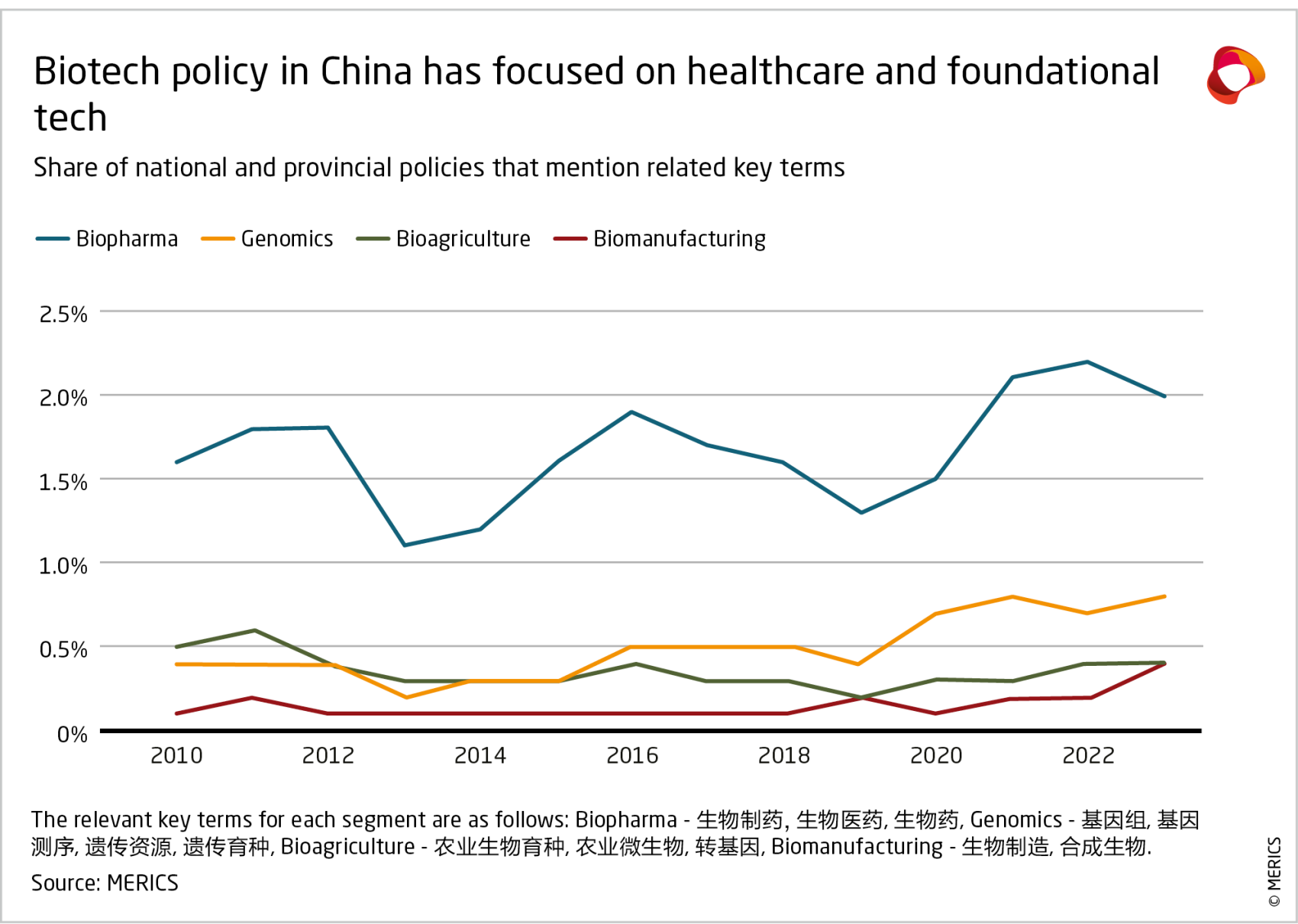

Biotechnology has gradually gained more attention in China’s policy making, including an industry-specific plan issued in 2022 (see Exhibit 2). While earlier plans focused on enhancing China’s R&D capabilities in areas such as biomedicine and genetically modified organisms (GMOs), subsequent policies have sought to convert R&D findings into applications and promote industrial development. The scope of support has expanded beyond healthcare and agriculture to include industrial, energy and environmental applications.11

Policy guidance often calls for cutting-edge innovations and the promotion of “future industries” in areas such as gene sequencing, biomedical materials and brain-computer interfaces.12 While these are expected to help transform a wide range of industries in the future, the government has not pushed for widespread adoption so far. For instance, national and provincial policies mention terms associated with genomics (in particular, genetic resources 遗传资源) about twice as often as those associated with biomanufacturing and bio-agriculture, reflecting the government’s efforts to control the collection and use of genetic information. Most of China’s efforts and successes in biotechnology are in the earlier stages of the innovation chain, as outlined in the next sections.

China is a global powerhouse in biotech research

According to OECD data, China overtook the US and the EU to become the world’s leading source of impactful publications in biotech in 2016. By 2022, it had about 3-4 times Europe’s output.13 China’s universities and labs employed about 30 percent of top academic talent in the world during 2019-2023, more than the US (27 percent) or Europe (12 percent), according to the Australian Strategic Policy Institute’s (ASPI) analysis of highly cited papers.14

In 2023, China was the top country for most-cited papers in the fields of synthetic biology (accounting for 61 percent of global share), genomic sequencing and analysis (42 percent), novel antibiotics and antivirals (30 percent) and biological manufacturing (29 percent).15 This output is the result of extensive public research funding, which is likely to have exceeded CNY 20 billion (EUR 2.6 billion) in 2023. Unknown but large amounts of funding go to science and technology megaprojects in brain science, seeds and health protection.16 The National Natural Science Foundation of China (NSFC), which supports basic research, spent at least CNY 8.5 billion, or 34 percent of its budget, on life science and healthcare research.17 The National Key R&D Projects likely spent around the same amount through calls for projects such as synthetic biology and biomacromolecules and microbiome.18 Structural funding also supports public labs, with over a fifth of China’s 540 State Key Labs focused on biology.19

China’s large-scale collection of genetic data supports these research efforts. The 2020 Biosecurity Law labels human genetic and other biological information and material a national resource under state control.20 This data is gathered through the National GeneBank, operated as a public-private partnership together with BGI Genomics.21 The platform has capacity for 46 petabytes of data, and launched a whole genome database of Chinese ethnic minority populations in 2024.22 It aims to support research in precision medicine, future agriculture, marine development and microbes.23

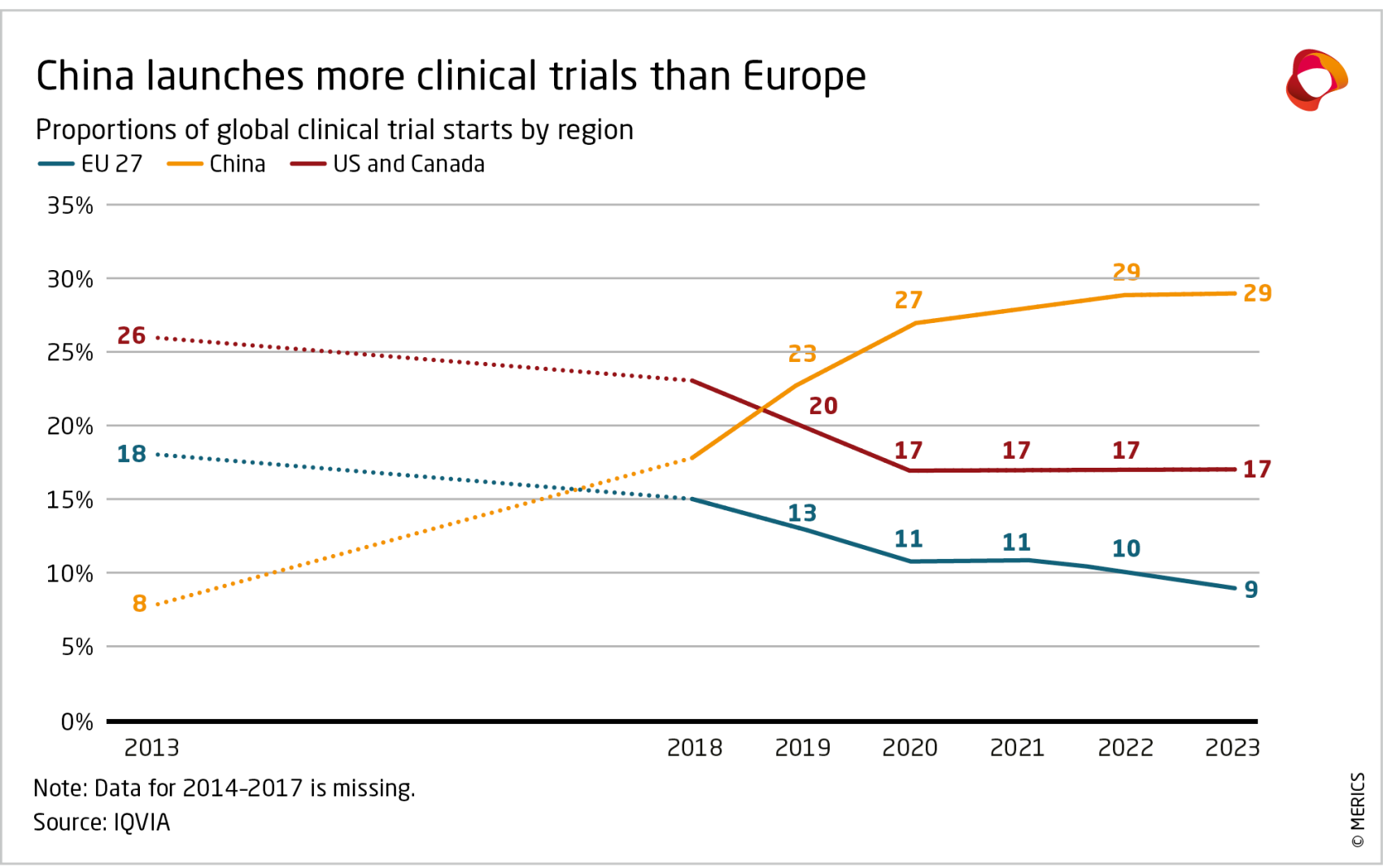

The government is also successfully promoting China as a location for clinical trials. Al - though getting official approval in China often still takes longer than in Europe (about 25 weeks compared to about 12 in Germany),24 China’s large public hospitals significantly reduce patient recruitment timelines and costs, making China attractive for multinational corporations. In 2023, 29 percent of new clinical trials involved China, while Europe was involved in only 16 percent, according to the European Federation of Pharmaceutical Industries and Association (EFPIA).25

Research commercialization relies on state support

Despite its strengths in the R&D space, China has made only modest advances in its industrial build-up. China made up about 4.8 percent of the global biotech market in 2024, whereas the US accounted for 35 percent and Europe 31 percent.26 To address the gap between research output and commercial capabilities, the Chinese government is taking steps to promote technology transfer. These measures include incentives for labs and firms to co-innovate,27 reforms to intellectual property ownership,28 as well as preferential access to capital for state-selected small and medium-sized enterprises in high-tech sectors.29

The number of biotech PCT patents registered by China increased from 119 in 2010 to 1,918 in 2023, according to data compiled by the World Intellectual Property Organization (WIPO).30 In comparison, in 2023, the EU27 and the US registered 1,369 and 3,721 PCT patents. respectively.

Beijing promotes the application of these patents and research commercialization, for example through innovation alliances like the Biotechnology Future Industry (Yangtze River Delta) Innovation Alliance. Launched in June 2024 at Nantong University, it brings together universities, labs, hospitals, (state-owned) firms and government officials in the wider Shanghai region.31 Another instrument is government guidance funds. For instance, in 2023, the State Development and Investment Corporation (SDIC), China’s largest investment holding company, was tasked to lead public investment in biomanufacturing.32 Next to setting up several investment funds with provincial governments, SDIC launched the Biomanufacturing Innovation Academy in Tianjin in December 2024, with an RMB 6 billion investment and a mission to commercialize research in enzyme preparations, amino acids, nutritious food additives and functional sugars.33

Shanghai: A jewel in China’s biotech crown

Shanghai stands out as China’s most advanced biotech cluster. The city is home to 3,000 life-science companies that employ over 270,000 people and invested USD 15 billion in research and development in 2022. The local government has attracted firms through free leasing of land, tax rebates for international talent and support for equipment purchase. In August of 2024, a further USD 4 billion in subsidies was pledged for biomedicine companies conducting clinical trials in the city.34 In late 2024, the Shanghai government announced it will work to turn the city into a “globally influential” center for medical AI before 2027.35

China’s biotech firms begin to show their mettle

Even though China’s innovation capabilities appear to be running ahead of its domestic market, it has still managed to cultivate a cohort of successful biotechnology companies. These players have pursued varied development pathways, including:

- Producing highly innovative drug prototypes for sale to big pharma, in the case of China’s biopharma startups

- Offering integrated contract research, development and manufacturing services, as WuXi Apptec and WuXi Biologics have done

- Transitioning from research-based to commercial operations, like BGI did with its sequencing services

- Pursuing gradual technological improvement and cost reductions, like in the case of MGI’s DNA sequencer technology

These models show how Chinese firms can build on the strengths of China’s biotech ecosystem to produce highly competitive products and services. Yet the limited size of China’s domestic market also reveals some key weaknesses. Notably, China’s standard industrial playbook focusing on scale and cost reduction does not yet apply in the biotech sector. In biopharma, quality standards take priority over cost savings, and in other areas traditional forms of manufacturing are still more cost effective. This chapter will look at the key catalysts and obstacles for industrial development in the biopharma, biomanufacturing and genomics segments.

Biopharma: China’s innovation leaders rely on international integration

Regulatory reform paves way for China’s rise in biopharma

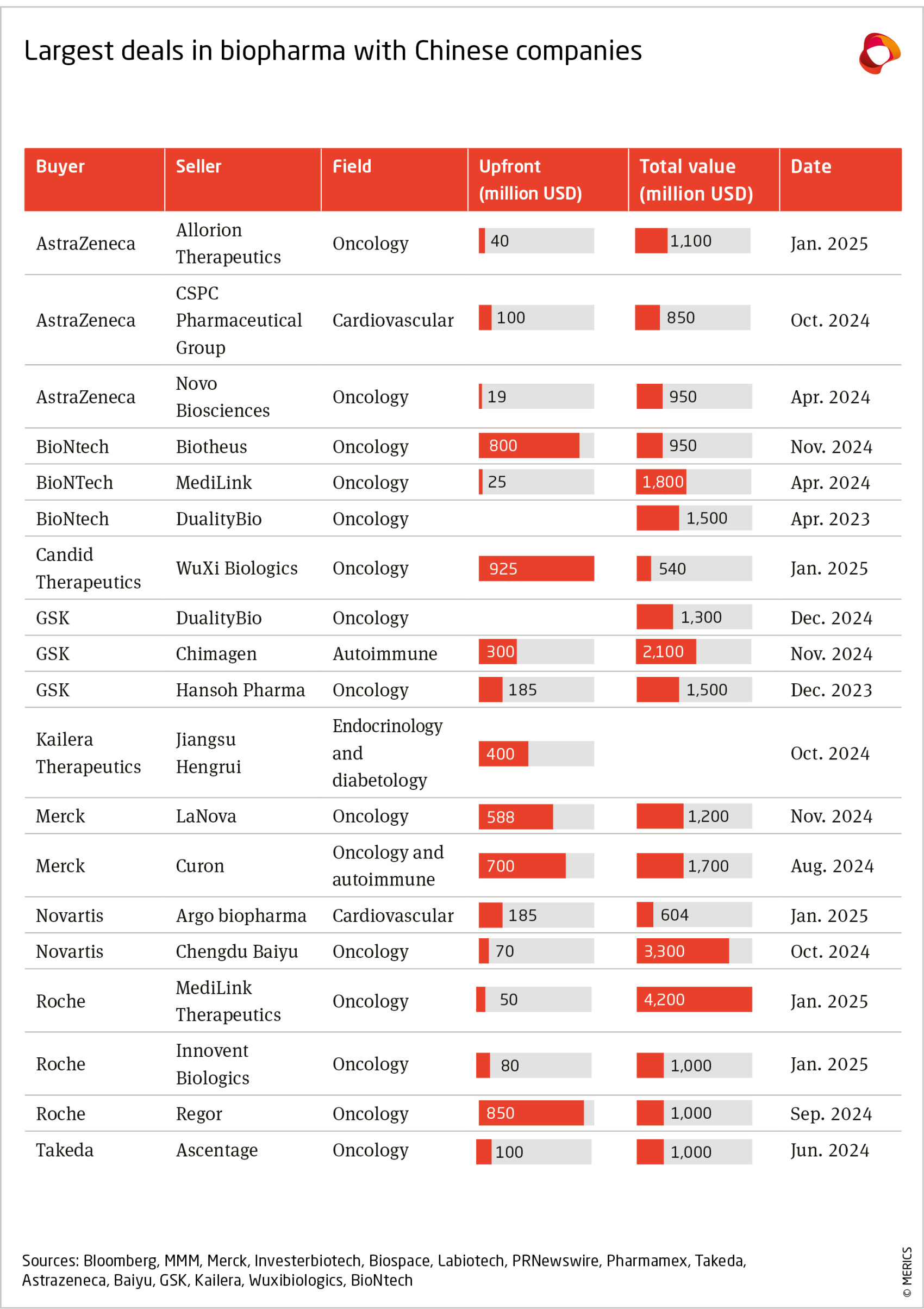

China’s enhanced innovation capabilities have led to a surge in interest from multinational biopharma firms in drugs developed in China. EU and US pharma firms have ramped up acquisitions and out-licensing deals in China, which grant them some or all of the rights to develop, promote and sell a treatment.36 Estimates compiled by DealForma show that the total amount of upfront payments that Chinese firms receive as part of larger deals for their R&D-stage biotech assets has grown every year since 2018, to reach over USD 2.5 billion in 2024 (until November).37 Since AstraZeneca acquired China’s Gracell Biotechnology in December 2023, there have been ten other deals involving Western and Chinese firms potentially worth over USD 1 billion in total (see appendix).38 Additionally, more pharmaceuticals developed in China are being approved for the US and European markets; in 2024, most notably the anti-cancer drugs Fruzaqla and Ryzneuta.39

Reforms to China’s drug review and approval system, coupled with the steady government support for R&D activities (see Chapter 2) provided the basis for China’s growing capabilities in the biopharma sector. Two rounds of reforms were made in 2015 and 2017 to implement higher standards, streamline review procedures and expand the acceptance of overseas clinical trial data.40 In 2017, the China Food and Drug Administration (the precursor to today’s National Medical Products Administration, NMPA) joined the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH). Gradual implementation of ICH guidelines facilitated the integration of China’s drug administration system with international practices.41 China’s share of global commercial clinical drug trials has doubled since 2018 to reach 18 percent in 2023 (see Exhibit 4).42 The number of generic drug varieties approved by authorities increased from 112 to 742 between 2018 and 2023, while approvals of innovative and biologic drugs have also grown in tandem (see Exhibit 5).43

China’s most innovative firms depend on overseas partners and sales

Although China has successfully built a pipeline of valuable biopharma products, the growing number of partnerships with multinational corporations (MNCs) reveals a key weakness in China’s domestic market for biopharma products. To keep healthcare costs from ballooning along with its huge ageing population, China’s government has rigorously restricted the cost of medication. It does so through a negotiated launch price, the National Reimbursable Drug List (NRDL), which is linked to China’s public medical insurance schemes, and a complex, multi-tiered procurement system for public hospitals.44 Average price reductions between 2019 and 2024 for new drugs added to the insurance list ranged from 50 to 65 percent.45

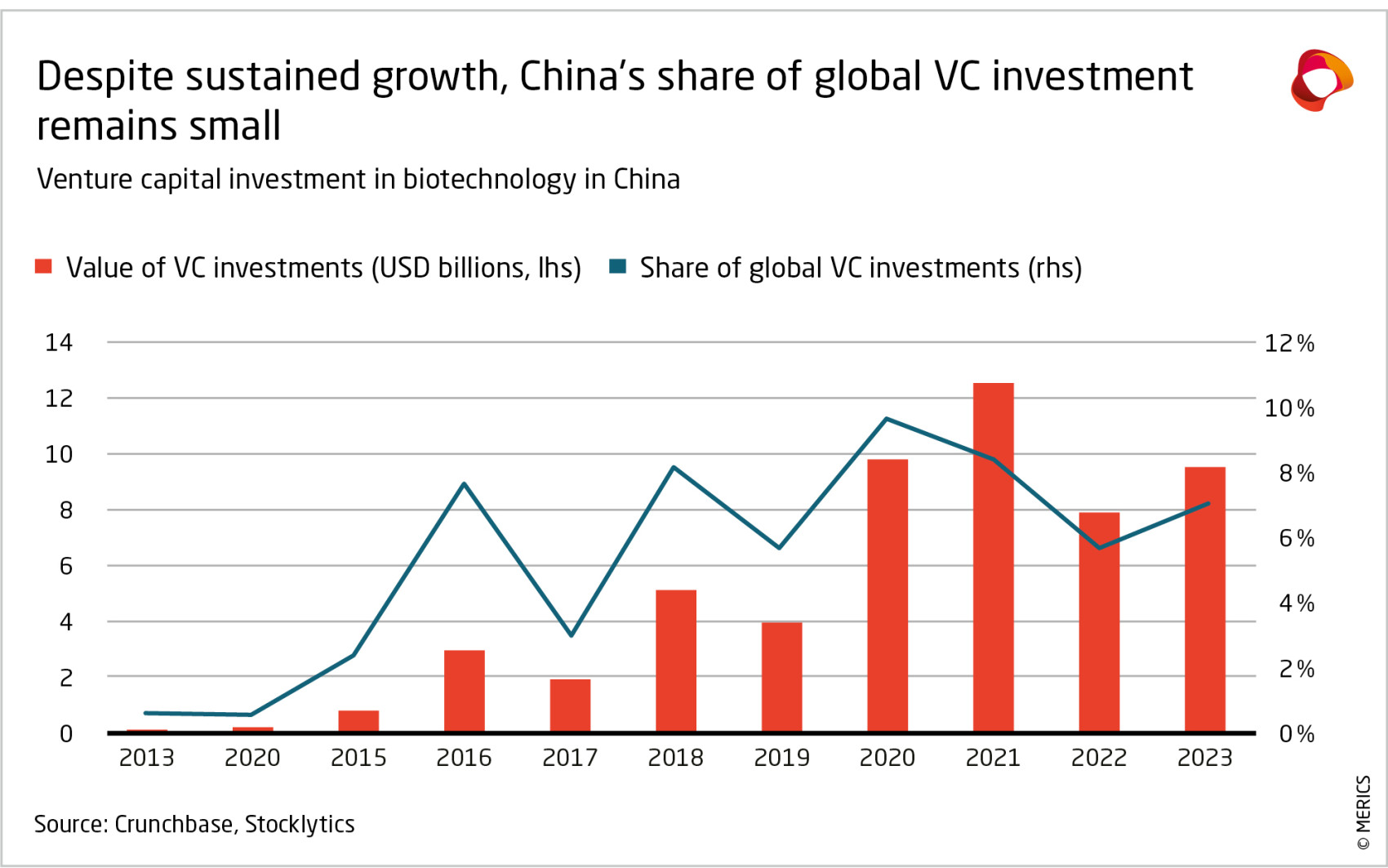

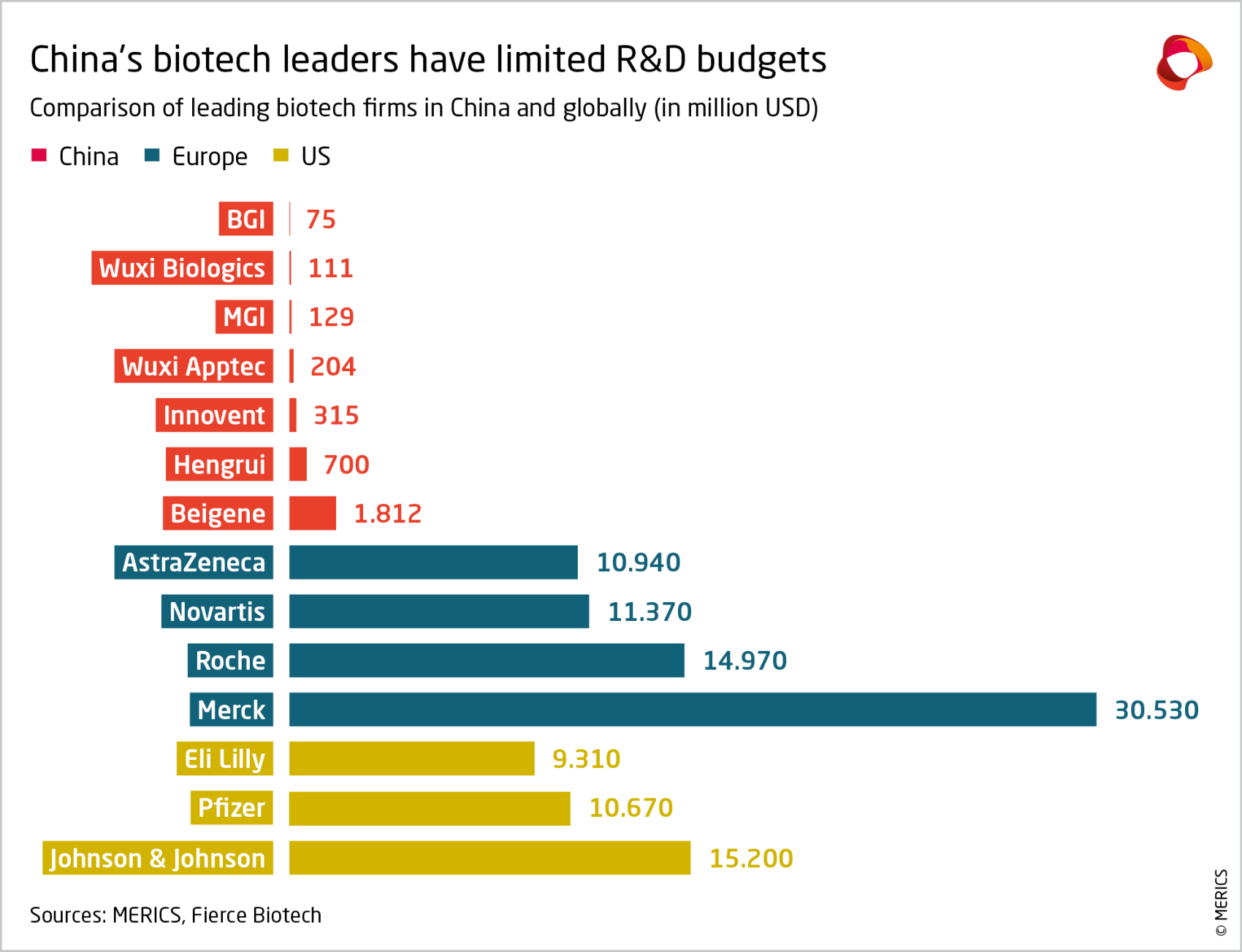

This approach limits the size of China’s domestic market, constrains the profitability of firms within China, and dampens investor interest. In 2023, China represented only 7.5 percent of the global pharma sales market, while Europe accounted for 23 percent and the US and Canada 53 percent.46 Venture capital investments in the sector have been declining since 2021, prompting Chinese media to talk of an investment winter. Although the stock of the 300 leading companies on the Shanghai and Shenzhen exchanges rose about 15 percent in 2024, those in the pharma and biology sector fell 13 percent.47 The outcome is that Chinese firms lack the financial power to compete at the frontier of innovative drugs. On average, top Chinese biopharma firms invest a smaller percentage of their revenue in R&D (10 percent) than their Western competitors (about 20 percent).48

With few prospects at home, Chinese biopharma firms working in advanced areas such as antibody-drug conjugates (ADC), cell therapies and innovative antibodies, which tend to result in high costs per patient, are focused on the North American and European markets. MNCs are stepping in to front the enormous costs involved in clinical trials and help navigate regulations across countries. For example, Chinese firm Legend Biotech developed its bone marrow cancer treatment – Carvykti – in collaboration with the US firm Johnson & Johnson, who invested USD 350 million in 2017 and another USD 200 million in the following years for meeting milestones.49 Based on sales reaching USD 900 million in 2024, the drug is expected to generate USD 1.9 billion in 2025 and to peak at about USD 5 billion per year.50

The way forward: Officials weigh improvements to the system

The drawbacks of China’s focus on cost reduction, not only for industrial development but also public health, are a matter of ongoing debate within China. “Don’t give me subsidies, give me a market,” an anonymous industry insider told Caixin in November 2024.51 Improve the pricing policy and capital and talent will flock to the sector, added Xiaobin Wu, the president and COO of Beigene.52 Authorities are considering new rules for the pricing of innovative drugs and their inclusion in the public medical insurance scheme to help boost the profitability of local drug developers.53 Yet the specifics of proposed reform measures are hotly contested. If they are approved and implemented, they will likely be incremental changes at best and not significantly change the investment climate.

There are also broader concerns about the efficacy of some drugs provided through the central procurement system. Many doctors suspect companies are cutting corners to meet the drastic price reductions demanded by authorities. In January 2025, the National Healthcare Security Administration began to investigate potential quality risks after members of Shanghai’s political advisory body and doctors flagged issues with some generic drugs such as laxatives, blood pressure medicine and anesthetic drugs.54

While some adjustments are possible, an overhaul to the current system appears unlikely given the broader priorities of the central government.55 The percentage of GDP that China spends on healthcare has already increased steadily as the population ages.56 Beijing wants to avoid this rising further and is pursuing an anti-corruption campaign in the healthcare sector to cut down on inefficient spending.57

Biomanufacturing: Modest progress to date masks huge future potential

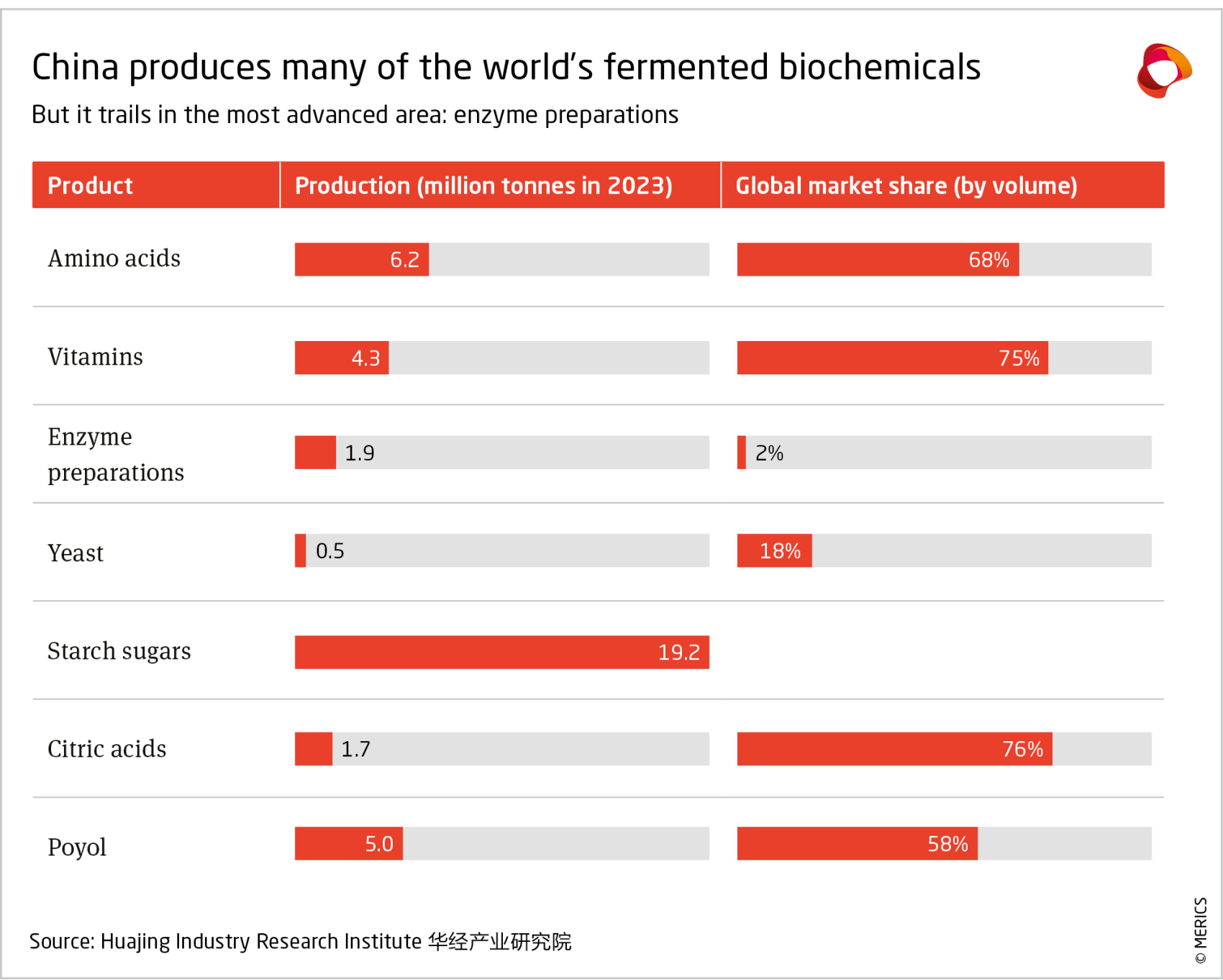

China’s biomanufacturing sector could benefit from several industrial sectors where China makes up a large share of global production and demand. For example, China accounts for 40 percent of the global market in chemicals.58 Biomanufacturing offers an opportunity to leverage biological systems, such as microorganisms and enzymes, to produce chemicals and materials using renewable resources.59 Up to 60 percent of chemical inputs could be replaced with more sustainable substitutes this way.60

China’s 2022 14th Five-Year Plan for the Bioeconomy calls for raising the relative importance of the sector in China’s overall manufacturing layout.61 Government funding and guidance is supporting researchers and startups to push technological boundaries and beginning to deliver results. China produces over three fifths of high impact academic papers in synthetic biology.62

However, the commercialization of these technologies is still in its early stages. In 2023, the biomanufacturing industry only represented 2.4 percent of China’s manufacturing industry in terms of added value, whereas this figure was 11 percent in the US and 6.2 percent in Europe.63 China’s share of the global biomanufacturing market is small, at 11 percent, compared to the US and Europe, which held 36 percent and 31 percent.64

The key factor holding back the scaling of biomanufacturing is cost. This is particularly true in China, since its competitiveness in chemicals is based on its cost advantage. For many chemical precursors, biomanufacturing is two or three times as expensive.65 However, this gap is progressively smaller for food, specialty chemicals and biopharma use, mainly due to the smaller scales and stricter quality requirements that drive up the cost for all production methods. As a result, the bulk of the biomanufacturing market value in China is focused on healthcare outputs (73 percent), followed by agriculture (10 percent), energy (9 percent) and chemicals (5 percent).66

China’s shift toward bio-based materials across a range of industries will progress gradually over the next couple of decades. Yet the current investments in research capabilities suggest that they are positioning themselves to take a central role in future innovation.67 One expert argued that China leads in synthetic biology, and that collaboration is crucial for Europe. Another noted that Chinese researchers have much better access to company-based fermentation facilities than their European counterparts.

Genomics: China’s champion in equipment chips away at US dominance

Through BGI Group, China’s government has successfully nurtured a national champion and begun to chip away at its dependence on foreign technology in the field of genomics. The company was originally founded in 1999 as a non-governmental research institute and spin-out from the Chinese Academy of Sciences. From 2007 onwards, it began to commercialize its services, which today range from DNA sequencing to precision medicine solutions. The company produces its own genetic sequencers, mass spectrometers and medical imaging systems through its subsidiary MGI.

Close government ties and access to foreign technology have provided the tailwind for BGI’s growth to date. The company has been responsible for the construction and operation of the government-funded China National GeneBank since its establishment. It developed its genetic sequencing services using third-party reagents and sequencers provided by the US firm – and global market leader – Illumina. Most famously, it bought 128 devices from Illumina in 2010 using a CNY 10 billion loan from the China Development Bank.68 BGI has also established a wide network of overseas research centers and expanded through acquisitions, including the US firm Complete Genomics in 2013.

More and more customers in China are now opting for local genetic sequencing equipment. The domestic market share of BGI’s subsidiary MGI in DNA sequencers grew to 47 percent in 2024.69 Meanwhile, Illumina’s market share in China dropped from 59 percent to 26.5 percent between 2020 and 2024. Moreover, China added Illumina to its Unreliable Entities List in February 2025, banning it from exporting to China.70 This illustrates how China is using its domestic market to nurture a national champion, following the playbook of mobile phones and new energy vehicles.71

However, MGI is yet to make major inroads into the global market for genomics equipment. In 2024, Illumina still accounted for about 90 percent of the US and European markets for DNA sequencers.72 In 2023, MGI generated CNY 2.91 billion (EUR 380 million) in revenue, just a fraction of Illumina’s intake in the same year (EUR 4.17 billion).73

Corporate and geopolitical tensions mean BGI and its subsidiaries now face an uphill battle against foreign genomics companies. Relations between BGI and Illumina have been fraught ever since they became direct competitors after BGI acquired Complete Genomics and expanded into the manufacturing of sequencers.74 BGI’s global reputation has also suffered from scrutiny over its handling of sensitive data, its ties with the Chinese government and the People’s Liberation Army, and its collection of genetic data on ethnic minorities in Xinjiang.75

European engagement with China draws scrutiny

The European Union, China and the United States have all recognized the strategic value of the biotech sector as well as the associated risks. Each has adopted its own approach to managing these challenges. Distinguishing between the different factors of concern, we can assess the likely level of disruption to Europe’s ongoing engagement with China.

Securing the supply of critical medicines has been a central focus of the EU’s biotech initiatives to date. The offshoring of production over many years has led to the build-up of dependencies on China and India to produce active pharmaceutical ingredients (APIs), chemical raw materials and certain medicines.76 For instance, in 2021, China accounted for about 79% of all EU antibiotic API imports by volume.77 Shortages of widely used essential medicines have become more frequent over recent years and were exacerbated during the Covid-19 pandemic.78

The European Commission is seeking to address the situation through the Critical Medicines Alliance (launched in October 2023) and the proposed Critical Medicines Act, which

aim to promote diversification and more local manufacturing.79 While, if successful, these efforts would decrease imports from China, they will likely remain narrow in scope and

have limited impact on Europe’s overall biotech ties to China.

China’s regulation of biodata and cross-border data flows has expanded over recent years and is already causing headaches for some collaborations. Europe’s approach to health data regulation prioritizes the ownership and rights of individuals, whereas in China health data is treated as a national resource. The EU has strict requirements for transferring personal data outside the EU, including health data. China’s regulations on cross-border data transfers are still evolving and have so far been limited to qualified green channels in

selected industries.80 Stricter data localization requirements in China and the EU’s emphasis on data protection limit the ability to share health data freely between partners and may

slow down collaborative research efforts. The different approaches pose a hurdle for cooperation in fields such as personal medicine, but not an insurmountable barrier.81 Ultimately, biotech companies and research institutions will face increased costs and administrative burdens to ensure compliance with both EU and Chinese data regulations.

Managing the degree of market access is another key policy consideration, with diverging assessments of the associated economic and national security risks across the EU, China, and the US. Current discussions in Europe focus on openness and the need to make the European market more attractive for firms to conduct clinical trials and market innovative

products.82 China’s focus on cultivating home-grown players – to the detriment of foreign firms – will put downward pressure on EU-China corporate ties. Surveys among Europe-

an companies in China consistently rank the pharmaceutical sector among the most challenging for market access.83 The Chinese government is taking only small steps to expand market access. For instance, new measures released in September 2024 allow foreign enterprises to develop and manufacture cell and gene therapies (CGT) in four free trade zones and sell them nationwide.84 While many pharma MNCs saw their sales in China increase substantially between 2016-2021, sales for most firms peaked in 2021 and their share of revenue derived from China is still relatively small (in the order of 10-15 percent) due to the market size constraints (see section 3.1).85

Innovative drug development is an outlier, where ties may even increase. European bio-pharma companies are turning to China as patents on key treatments approach expiry by 2030.86 This is driving an uptick in: Licensing deals: In late 2024, AstraZeneca, GSK, and Merck announced significant deals with Chinese firms (see Appendix).87

- Acquisitions: AstraZeneca’s takeover of Gracell Biotechnologies, a company that develops cell therapies, for USD 1.2 billion and BioNTech’s planned acquisition of Biotheus, a developer of cancer drugs, for USD 800 million, were announced in 2023 and 2024 respectively.88

- R&D operations: Boehringer Ingelheim expanded its footprint in 2020 with a EUR 445 million investment in its China External Innovation Hub, and in 2023 it pledged an additional EUR 508 million to expand its R&D operations in China.89

- Scouting: Roche and Bayer have set up incubators in China that allow them to nurture and eventually acquire high-potential therapies.90

The US could disrupt this trend. If proposed legislation such as the Biosecure Act is passed, then European firms would also be required to find alternative supply chains and possibly R&D partners, so they can continue to market their products in the United States. While the bill has bipartisan support, President Donald Trump’s position on the act is not clear and could lead to it being watered down or indefinitely sidelined.

EU-China research collaboration will only become more challenging in the context of intensifying geopolitical competition. As China has risen to become a major contributor to

biotech research, ties between European and Chinese researchers have also grown.91 Such partnerships are highly valued by European academics.92 For instance, when it renewed its partnership with the Chinese Academy of Sciences (CAS) in May 2024, the Max Planck Institute highlighted joint research on regenerative biomedicine as one of the key outcomes to date.93 At the same time, these partnerships are increasingly scrutinized by policymakers. In mid-2024, Copenhagen University and Aarhus University ended their long-standing cooperation with BGI, after Danish intelligence services pointed to the potential military and surveillance applications of joint projects.94

Caution among European policymakers about sharing knowledge with China will slow down joint research projects. International cooperation, via knowledge-sharing and industrial collaboration, is listed among the necessary steps required for the EU to seize opportunities in the Commission’s communication on biotechnology and biomanufacturing

released in March 2024.95 China is notably absent from the list of key international partners outlined in the document. Yet cooperation on environmentally-focused areas of biotechnol-

ogy will likely continue. Under Horizon Europe – the EU’s key funding program for research and innovation – collaboration is ongoing under the Food, Agriculture and Biotechnology flagship initiative.96

Maintaining European competitiveness through collaboration

China has pursued a strategic and pragmatic agenda to advance its biotechnology ambitions. It has harmonized some of its regulations with international norms to attract clinical trials and foreign direct investment. It seeks to structurally favor national champions and other domestic firms by organizing loans and capital investments, promoting domestic supply-chain integration and adjusting centralized procurement, among other things.

In several biotechnology fields, China now contributes research and innovation that is more sophisticated than what its domestic demand in healthcare, chemicals, energy, agriculture and other downstream markets warrant. Unlike in other industries, where China’s competitive advantage often stems from low-cost, “good enough” production, biotechnology demands higher standards. In the case of biopharma, government policy in fact constrains demand for innovative products.

Consequently, many of China’s emerging biotech players to date have relied on foreign capital and markets. This set-up benefits European firms and citizens. Chinese state support reduces the risk of drug discovery, the costs of clinical trials and the cost of prototyping and producing various bioplastics, amino acids or active pharmaceutical ingredients. Broadly speaking, it is in Europe’s interest to continue this situation.

But some aspects of the current engagement are problematic for Europe. Supply-chain vulnerabilities loom large. Further outsourcing to China threatens to worsen medicine shortages, accelerate Europe’s industrial decline, and erode its global competitiveness. Meanwhile, Chinese firms – along with the China-based operations of European firms – are steadily moving up the value chain. Chinese firms are aided by a skewed flow of data, and European research institutes are increasingly attuned to the ethical and dual-use risks of joint research.

Europe has an opportunity to build on the strong position it already holds in pharmaceuticals, life science and advanced chemicals to be a global leader in biotechnology. The challenge for policymakers is to reduce vulnerabilities and risks, while also maintaining or expanding engagement where it is safe to do so. Given China’s pragmatic approach, there appears to be room for negotiation on issues such cross-border data regulations. The bio-tech boom is yet to fully materialize, and a carefully calibrated engagement with Beijing will be crucial for Europe to maximize its gains.

In seeking solutions, Europe can learn from China’s strategic and pragmatic approach. China pursues global collaboration where it needs foreign capital and technology and self-reliance where it can’t or doesn’t need access to foreign resources . While remaining open to Chinese talent, firms and investments, Europe should carefully conduct investment screening, secure the supply of critical goods and materials, and reconsider its data sharing regime to ensure collaboration serves EU interests.

Europe needs to match the strategic intent and policy support that China is offering its bio-tech sector. Biotech is a vast and diverse sector where Europe has significant strengths.97 Europe can leverage its large market, strong IP protection and advantages in basic research. Like China, it needs to improve commercialization, and especially its environment for capital investments. In venture capital, the US is very far ahead of Europe, with Asia a close third.98

Planned laws in Europe will help to address some of these challenges.99 The Critical Medicines Act seeks to reduce dependencies relating to critical medicines, such as antibiotics,

insulin and painkillers, while the Biotech Act will facilitate the transition from the lab to production and marketing new innovations. The growing risk of disruption to globalized supply chains and innovation networks, or of Europe being relegated to a minor player in the biotech revolution, warrants ambitious action now.

- Endnotes

1 NDRC, “国家发展改革委关于印发《‘十四五’生物经济发展规划》的通知 (Notice of the National Development and Reform Commission on Printing and Distributing the ‘14th Five-Year Plan for Bioeconomic Development’),” 2021, https://www.ndrc.gov.cn/xxgk/zcfb/ghwb/202205/t20220510_1324436.html?code=&state=123.

2 | NDRC, “国家发展改革委新闻发布会 介绍‘十四五’生物经济发展规划有关情况 (National Development and Reform Commission Press Conference: Introduction to the ‘14th Five-Year Plan for Bioeconomic Development’),” 2022, https://www.ndrc.gov.cn/xwdt/wszb/swjjfzgh/?code=&state=123.

3 | European Commission, “Actions to boost biotechnology and biomanufacturing in EU,” 2024, https://ec.europa.eu/commission/presscorner/detail/en/ip_24_1570.

4 | Mario Draghi, “The Draghi Report: A Competitiveness Strategy for Europe,” 2024, https://commission.europa.eu/topics/eu-competitiveness/draghi-report_en.

5 | Select Committee on the CCP, Democrats, “Krishnamoorthi, Wenstrup Introduce Bipartisan BIOSECURE Act to Safeguard American Patients and Tax Dollars from Biotechnology Firms in China,” 2024, http://democrats-selectcommitteeontheccp.house.gov/media/press-releases/krishnamoorthi-wenstrup-introduce-bipartisan-biosecure-act-safeguard-american; Brad R. Wenstrup, “BIOSECURE Act,” 2024, 2024-05-10, https://www.congress.gov/bill/118th-congress/house-bill/8333; However, at the same time, cross-border collaborations in biotechnology are increasing: Hogan Lovells, “BIOSECURE Stalls, Will Not Become Law in 2024,” 2024, https://www.hoganlovells.com/en/publications/biosecure-stalls-will-not-become-law-in-2024.

6 | Biotechnology Innovation Organization, “BIO Survey Reveals Dependence on Chinese Biomanufacturing,” 2024, https://www.bio.org/gooddaybio-archive/bio-survey-reveals-dependence-chinese-biomanufacturing.

7 | Jorge Santos da Silva and Franck Le Deu, “Biotech in Europe: A Strong Foundation for Growth and Innovation” (McKinsey, 2020), https://www.mckinsey.com/industries/life-sciences/our-insights/biotech-in-europe-a-strong-foundation-for-growth-and-innovation#/.

8 | Center for Security and Emerging Technology, “CSET Original Translation: China’s 14th Five-Year Plan,” 2021, https://cset.georgetown.edu/publication/china-14th-five-year-plan/.

9 | Li Qiang, “政府工作报告 —— 2024年3月5日在第十四届全国人民代表大会第二次会议上 (Government Work Report — March 5, 2024, at the Second Session of the 14th National People’s Congress),” 2024, https://npcobserver.com/wp-content/uploads/2024/03/2024-Government-Work-Report_ZH.pdf; Securities Daily, “全链条支持创新药发展实施方案审议通过 产业链上市公司迎发展良机 (Full-Chain Support for Innovative Drug Development Plan Approved, Listed Companies in the Industry Chain Embrace Growth Opportunities),” Xinhua News Agency, 2024, http://www.news.cn/digital/20240709/95725bb218794255911ed082c664f264/c.html.

10 | Central Government of China, “中华人民共和国国民经济和社会发展第十四个五年规划和2035年远景目标纲要 (Outline of the People’s Republic of China 14th Five-Year Plan for National Economic and Social Development and Long-Range Objectives for 2035),” 2021, https://cset.georgetown.edu/wp-content/uploads/t0284_14th_Five_Year_Plan_EN.pdf; Central Government of China, “中共中央关于进一步全面深化改革 推进中国式现代化的决定 (Decision of the CPC Central Committee on Further Deepening Reform and Advancing Chinese-Style Modernization),” 2024, https://web.archive.org/web/20240806035410/https:/www.gov.cn/zhengce/202407/content_6963770.htm.

11 | NDRC, “国家发展改革委关于印发《‘十三五’生物产业发展规划》的通知 (Notice of the National Development and Reform Commission on Printing and Distributing the ‘13th Five-Year Plan for the Development of the Bioindustry’),” 2017, https://www.ndrc.gov.cn/xxgk/zcfb/ghwb/201701/t20170112_962220.html; NDRC, “国家发展改革委关于印发《‘十四五’生物经济发展规划》的通知 (Notice of the National Development and Reform Commission on Printing and Distributing the ‘14th Five-Year Plan for Bioeconomic Development’).”

12 | MIIT, “工业和信息化部等七部门关于推动未来产业创新发展的实施意见 (Implementation Opinions of Seven Departments, Including the Ministry of Industry and Information Technology, on Promoting the Innovative Development of Future Industries),” 2024, https://www.miit.gov.cn/zwgk/zcwj/wjfb/yj/art/2024/art_ad15b0f08a714fd8888c0e31468b8c54.html.

13 | ‘Impactful’ here means that it is in the 10% most cited papers: Sandra Barbosu, “How Innovative Is China in Biotechnology?,” ChinaInnovationSeries (ITIF, 2024), https://itif.org/publications/2024/07/30/how-innovative-is-china-in-biotechnology/; based on: OECD, “OECD Data Explorer,” accessed February 12, 2025, https://data-explorer.oecd.org/.

14 | ASPI, “Synthetic Biology - Critical Technology Tracker - Flow of Talent,” n.d., https://techtracker.aspi.org.au/tech/synthetic-biology/flow-of-human-talent/?c1=cn&c2=european-union.

15 | ASPI.

16 | State Council, “国务院关于印发‘十三五’国家科技创新规划的通知 (Notice of the State Council on Printing and Distributing the ‘13th Five-Year National Science and Technology Innovation Plan’),” 2016, https://www.gov.cn/zhengce/content/2016-08/08/content_5098072.htm.

17 | The figures are based on the programs for which a budgetary breakdown according to research area is available, such as the General Program, Key Program and Young Scientists Fund: National Natural Science Foundation, “国家自然科学基金委员会 2023 年度部门决算 (National Natural Science Foundation of China 2023 Departmental Final Accounts),” 2024, https://www.nsfc.gov.cn/Portals/0/fj/fj20240725_01.pdf.

18 | Nanjing Agricultural University, “国家重点研发‘合成生物学’‘生物大分子与微生物组’‘干细胞研究与器官修复’等专项申报通知 (Notice on the Application for National Key R&D Programs Such as ‘Synthetic Biology,’ ‘Biomacromolecules and Microbiome,’ and ‘Stem Cell Research and Organ Repair’),” 2022, https://kxyjy.njau.edu.cn/info/1023/11302.htm.

19 | Emily Weinstein et al., “Map of China’s State Key Laboratory System,” 2022, https://skl-map.cset.tech/.

20 | Kyle McKibbin and Mahsa Shabani, “Genomic Data as a National Strategic Resource: Implications for the Genomic Commons and International Data Sharing for Biomedical Research and Innovation,” Journal of Law, Medicine & Ethics 51, no. 2 (2023): 301–13, https://doi.org/10.1017/jme.2023.77; China Law Translate, “Biosecurity Law of the P.R.C.,” 2020, https://www.chinalawtranslate.com/biosecurity-law/.

21 | Global Times, “China National GeneBank Capable of Storing Millions of Biological Samples,” 2024, http://en.people.cn/n3/2024/0422/c90000-20159848.html.

22 | National Genomics Data Center, “国家基因组科学数据中心 (National Genomics Data Center),” accessed February 12, 2025, https://ngdc.cncb.ac.cn/?lang=zh; Yan He et al., “A Comprehensive Whole Genome Database of Ethnic Minority Populations,” Scientific Reports 14, no. 1 (2024): 13954, https://doi.org/10.1038/s41598-024-63892-1.

23 | Bo Wang et al., “国家基因库:共有、共为、共享 (The China National GeneBank—owned by all, completed by all and shared by all),” 遗传 41, no. 8 (2019): 761–72, https://doi.org/10.16288/j.yczz.19-148.

24 | 86 months on average in China, against 37 month in Europe in oncology: Center for Drug Evaluation, National Medical Products Administration, “中国新药注册临床试验进展年度报告(2023年) (Annual Report on the Progress of Clinical Trials for New Drug Registration in China (2023)),” 2024, https://www.cnpharm.com/upload/resources/file/2024/05/20/157093.pdf; Zhang Lu, “北京临床试验启动用时将压缩至25周以内 (Beijing to Reduce Clinical Trial Startup Time to Within 25 Weeks),” Beijing News, 2024, https://www.bjnews.com.cn/detail/1717681856129313.html; EFPIA, “60,000 Fewer Clinical Trial Places for Europeans, despite Global Surge in Research Projects,” 2024, https://efpia.eu/news-events/the-efpia-view/statements-press-releases/60-000-fewer-clinical-trial-places-for-europeans-despite-global-surge-in-research-projects/.

25 | EFPIA, “60,000 Fewer Clinical Trial Places for Europeans, despite Global Surge in Research Projects.”

26 | Grand View Research, “U.S. Biotechnology Market Size, Share & Trends Analysis Report By Technology (Nanobiotechnology, Tissue Engineering and Regeneration), By Application (Health, Food & Agriculture), And Segment Forecasts, 2024 - 2030,” accessed February 12, 2025, https://www.grandviewresearch.com/industry-analysis/us-biotechnology-market-report; Grand View Research, “China Biotechnology Market Size & Outlook, 2023-2030,” accessed February 12, 2025, https://www.grandviewresearch.com/horizon/outlook/biotechnology-market/china; Grand View Research, “Europe Biotechnology Market Size & Outlook, 2030,” accessed February 12, 2025, https://www.grandviewresearch.com/horizon/outlook/biotechnology-market/europe.

27 | State Council, “国务院办公厅关于完善科技成果评价机制的指导意见 (Guiding Opinions of the General Office of the State Council on Improving the Evaluation Mechanism for Scientific and Technological Achievements),” 2021, https://www.gov.cn/zhengce/content/2021-08/02/content_5628987.htm.

28 | Xue-Fang Yao, “Characteristics and Outcomes of the Drug Patent Linkage System in China,” Globalization and Health 20, no. 1 (2024): 31, https://doi.org/10.1186/s12992-024-01035-x.

29 | Jeroen Groenewegen-Lau and Michael Laha, “Controlling the Innovation Chain” (Merics, 2023), https://merics.org/en/report/controlling-innovation-chain; Gregor Sebastian, Alexander Brown, and François Chimits, “Accelerator State: How China Fosters ‘Little Giant’ Companies” (Merics, 2023), https://merics.org/en/report/accelerator-state-how-china-fosters-little-giant-companies.

30 | WIPO, “WIPO IP Statistics Data Center,” 2024, https://www3.wipo.int/ipstats/pmh-search/search-result?type=PMH&selectedTab=pct&indicator=1011&reportType=4001&fromYear=2010&toYear=2024&pmhOffSelValues=&pmhOriSelValues=CN,US,JP,KR,R3,AT,BE,BG,HR,CY,CZ,DK,EE,FI,FR,DE,GR,HU,IE,IT,LV,LT,LU,MT,NL,PL,PT,RO,SK,SI,ES,SE&pmhClassSelValues=1,3,8,11,13,15,16,24,26,32; Barbosu, “How Innovative Is China in Biotechnology?”

31 | Xinhua News Agency, “建设高质量创新联合体 (Building High-Quality Innovation Consortia),” 2022, http://www.xinhuanet.com/politics/20221227/9b5b7e72ea664fefbc9f714a579829d5/c.html; Nantong Municipal Bureau of Science and Technology, “成立两个多月,生物医药未来产业(长三角)创新联合体迎来7家新伙伴 (Two Months After Its Establishment, the Future Biomedical Industry (Yangtze River Delta) Innovation Consortium Welcomes Seven New Partners),” 2024, https://kjj.nantong.gov.cn/ntskjj/bmdt/content/69056d39-55ae-4e9f-bba0-165b420e7fc8.html; Sinopharm, “未来启航 | 基因治疗领域、合成生物领域创新联合体正式成立 (Future Set Sail | Innovation Consortia in Gene Therapy and Synthetic Biology Officially Established),” 2024, https://www.sinopharm.com/2024-07/05/c_19646.htm; Beijing International Center for Science and Technology Exchange, “京港生物健康创新联合体正式启动 (Beijing-Hong Kong Biotech and Health Innovation Consortium Officially Launched),” 2023, https://www.bast.net.cn/art/2023/12/3/art_33422_17485.html.

32 | SASAC, “国务院国资委部署专项行动 央企聚焦15个方向发展战略性新兴产业 (State-Owned Assets Supervision and Administration Commission (SASAC) Launches Special Action: Central Enterprises Focus on 15 Key Areas for Developing Strategic Emerging Industries),” 2023, https://www.gov.cn/lianbo/bumen/202307/content_6894007.htm.

33 | Yan Qi, “常德:着力打造合成生物产业战略新高地 (Changde: Striving to Build a Strategic High Ground for the Synthetic Biology Industry),” 21st Century Business Herald, 2025, https://www.21jingji.com/article/20250117/herald/cf8f0ece6828151896bcf2ecf49d85d4.html.

34 | Gemma Conroy, “How ‘Made in China 2025’ Helped Supercharge Scientific Development in China’s Cities,” Nature, 2024, https://doi.org/10.1038/d41586-024-03522-y.

35 | Shanghai Municipal People’s Government, “上海市人民政府办公厅关于印发《上海市发展医学人工智能工作方案(2025—2027年)》的通知 (Notice of the General Office of the Shanghai Municipal People’s Government on Printing and Distributing the ‘Shanghai Medical AI Development Plan (2025–2027)’),” 2024, https://www.shanghai.gov.cn/nw12344/20241224/0f60c01551784720899dbb911e9d5f08.html; Shen Xinmei, “China’s Tech Push: Shanghai Aims to Be Global Medical AI Hub by 2027,” South China Morning Post, 2024, https://www.scmp.com/tech/policy/article/3292460/us-china-tech-war-shanghai-aims-be-global-medical-ai-hub-2027.

36 | Bloomberg, “Big Pharma’s Bet on China Biotech Is a Rare Trade Bright Spot,” 2024, https://www.bloomberg.com/news/articles/2024-12-02/big-pharma-s-bet-on-china-biotech-is-a-rare-trade-bright-spot.

37 | Rachel Cheung, “Big Pharma Doubles Down on China,” The Wire China, 2024, https://www.thewirechina.com/2024/11/03/big-pharma-doubles-down-on-china/.

38 | Annalee Armstrong, “Big Pharma Rushes to China for Deal Prospecting Despite Regulatory Uncertainty,” BioSpace, 2025, https://www.biospace.com/business/big-pharma-rushes-to-china-for-deal-prospecting-despite-regulatory-uncertainty; James Waldron, “BioNTech Pays $25M to Strengthen ADC Bond with China’s MediLink,” Fierce Biotech, 2024, https://www.fiercebiotech.com/biotech/biontech-pays-25m-upfront-strengthen-adc-bond-chinas-medilink; Innovent Biologics, “Innovent Enters into Exclusive Global License Agreement with Roche for Novel DLL3 Antibody Drug Conjugate,” 2025, https://www.prnewswire.com/news-releases/innovent-enters-into-exclusive-global-license-agreement-with-roche-for-novel-dll3-antibody-drug-conjugate-302340668.html; Bloomberg, “Big Pharma’s Bet on China Biotech Is a Rare Trade Bright Spot.”

39 | Hutchmed, “HUTCHMED Announces European Commission Approval for FRUZAQLA® (Fruquintinib) Received by Takeda,” 2024, https://www.hutch-med.com/european-commission-approval-for-fruzaqla-fruquintinib/; Evive, “Evive Biotech Announce EC Approval of Ryzneuta® (Efbemalenograstim Alfa Injection) for Chemotherapy-Induced Neutropenia (CIN),” 2024, https://www.evivebiotech.com/en/newsd/index?id=57; Li Jiaying, “Chinese-Made New Drugs Big Hit Overseas,” China Daily, 2024, https://www.chinadaily.com.cn/a/202407/24/WS66a062c7a31095c51c50fa01.html.

40 | PhIRDA, “佳文荐读丨中国药品监管40年变迁与思考 (Recommended Reading | 40 Years of Changes and Reflections on China’s Drug Regulation),” 2025, https://www.phirda.com/artilce_37586.html?module=trackingCodeGenerator; Kiki Han et al., “The Dawn of China Biopharma Innovation” (McKinsey, 2021), https://www.mckinsey.com/industries/life-sciences/our-insights/the-dawn-of-china-biopharma-innovation.

41 | China Med Device, “CFDA Updates: China Joins ICH,” 2017, https://chinameddevice.com/cfda-updates-china-joins-ich/.

42 | Daria Mosolova, “Europe Falls behind China in Playing Host to Clinical Drug Trials,” Financial Times, 2024, https://archive.is/J2Dpq; Based on: EFPIA, “60,000 Fewer Clinical Trial Places for Europeans, despite Global Surge in Research Projects.”

43 | CCTV News, “‘十四五’以来获批国产创新药市场规模达1000亿元 (Since the ‘14th Five-Year Plan,’ the Market Size of Approved Domestic Innovative Drugs Has Reached 100 Billion Yuan),” 2024, https://content-static.cctvnews.cctv.com.

44 | Bérengère Macabeo et al., “Access to Innovative Drugs and the National Reimbursement Drug List in China: Changing Dynamics and Future Trends in Pricing and Reimbursement,” Journal of Market Access & Health Policy 11, no. 1 (2023): 2218633, https://doi.org/10.1080/20016689.2023.2218633; Zhou Xinda et al., “In Depth: How China’s Pricing Regime Penalizes Innovative Drugmakers,” Caixin Global, 2024, https://www.caixinglobal.com/2024-06-14/in-depth-how-chinas-pricing-regime-penalizes-innovative-drugmakers-102206130.html.

45 | BioPharma APAC, “China’s 2024 National Reimbursement Drug List Expands Access to Cutting-Edge Therapies,” 2024, https://www.biopharmaapac.com/news/92/5592/chinas-2024-national-reimbursement-drug-list-expands-access-to-cutting-edge-therapies.html; Zhou Xinda et al., “In Depth: How China’s Pricing Regime Penalizes Innovative Drugmakers”; NHSA, “国家基本医疗保险、工伤保险和生育保险药品目录(2024年) (National Drug List for Basic Medical Insurance, Work Injury Insurance, and Maternity Insurance (2024)),” 2024, https://www.nhsa.gov.cn/module/download/downfile.jsp?classid=0&filename=de66e92b7edd4056ac41c0c4d3c011f3.pdf; 21st Century Business Herald, “2024‘国谈’平均降价63%:91种新药进医保,超4成为‘全球新’创新药 (In 2024, the Average Price Reduction of the ‘National Talks’ Will Be 63%: 91 New Drugs Will Enter the Medical Insurance, and More than 4 Will Become ‘Global New’ Innovative Drugs),” 2024, https://www.21jingji.com/article/20241202/herald/2ec083c023d3c17fa1d8e1ae1aa65d17.html.

46 | EFPIA, “Breakdown of the World Pharmaceutical Market - 2023 Sales,” accessed February 13, 2025, https://www.efpia.eu/publications/data-center/the-pharma-industry-in-figures-economy/world-pharmaceutical-market/.

47 | Zhu Yiyi, “记‘医’2024|医药板块的‘寒冬期’:高增长神话褪去,何时迎破晓时分? (Medical Chronicles 2024 | The ‘Winter Period’ of the Pharmaceutical Sector: As the Myth of High Growth Fades, When Will Dawn Arrive?),” 21st Century Business Herald, 2024, https://m.21jingji.com/article/20241231/herald/4a8b11b5edf07a3fe0d23560a9fce256.html.

48 | Caixin, “全链条支持创新药发展的重中之重 (Top Priority in Full-Chain Support for Innovative Drug Development),” 2024, https://opinion.caixin.com/2024-08-15/102226503.html; Brian Buntz, “Are Big Pharma Giants Getting the Right ROI on Their R&D Investments? A Visual Exploration,” Drug Discovery and Development, 2024, https://www.drugdiscoverytrends.com/are-big-pharma-giants-getting-the-right-roi-on-their-rd-investments-a-visual-exploration/.

49 | Grady McGregor, “The Biotech Urban Legend,” The Wire China, 2023, https://www.thewirechina.com/2023/07/23/the-biotech-urban-legend-cancer-us-china-car-t-cell-therapy/; Amanda Saionz, “Chinese CAR-T Pioneer Legend Biotech in Profile,” PharmaBoardroom, 2024, https://pharmaboardroom.com/articles/legend-biotech-in-profile/.

50 | Investing.com, “Legend Biotech’s SWOT Analysis: Carvykti’s Efficacy Drives Stock Potential amid Competition,” 2025, https://www.investing.com/news/swot-analysis/legend-biotechs-swot-analysis-carvyktis-efficacy-drives-stock-potential-amid-competition-93CH-3833279.

51 | Peng Haibin, “中国药企渴望的支持:‘我要市场,不要补贴’ | 海斌访谈 (The Support Chinese Pharmaceutical Companies Desire: ‘I Want a Market, Not Subsidies’ | Haibin Interview),” Yicai, 2024, https://m.yicai.com/news/102340386.html.

52 | For a profile of Beigene, see: Anastasiia Carrier, “Biotech’s Borders,” The Wire China, 2021, https://www.thewirechina.com/2021/10/10/biotechs-borders/; Barbosu, “How Innovative Is China in Biotechnology?”

53 | NHSA, “关于建立新上市化学药品首发价格形成机制鼓励高质量创新的通知(征求意见稿) (Notice on Establishing the Initial Pricing Mechanism for Newly Marketed Chemical Drugs to Encourage High-Quality Innovation (Draft for Public Consultation)),” ByDrug, 2024, https://bydrug.pharmcube.com/report/detail/3d09a3b7356747ca8cf9b17696476bc3; Xinhua News Agency, “李强主持召开国务院常务会议 (Li Qiang Presides Over the State Council Executive Meeting),” 2024, http://www.nhc.gov.cn/wjw/mtbd/202407/00dd64acd6804634b5ea13a1fdf96989.shtml; Wu Simin, “全链条支持创新药发展政策出台,专家称重点关注两大工作 (Full-Chain Support Policy for Innovative Drug Development Released, Experts Emphasize Two Key Focus Areas),” Yicai, 2024, https://www.yicai.com/news/102180579.html.

54 | Zhou Xinda et al., “Analysis: China’s Rock Bottom Drug Prices Spark Quality Concerns,” Caixin Global, 2025, https://www.caixinglobal.com/2025-02-05/analysis-chinas-rock-bottom-drug-prices-spark-quality-concerns-102285367.html.

55 | Liu He, “国家医保局药品首发价格形成机制再引热议 让高质量创新化学药得到更多价格支持 (National Healthcare Security Administration’s Initial Drug Pricing Mechanism Sparks Renewed Debate, Providing Greater Price Support for High-Quality Innovative Chemical Drugs),” CNpharm, 2024, https://m.cnpharm.com/c/2024-03-28/1040920.shtml.

56 | Chinabaogao, “我国医疗保险行业支出分析:政府及个人现金支出下降 社会支出上升 (Analysis of China’s Health Insurance Industry Expenditures: Government and Individual Cash Expenditures Decline, Social Expenditures Increase),” 2025, https://www.chinabaogao.com/detail/739172.html; NHC, “2023年我国卫生健康事业发展统计公报解读 (Interpretation of the 2023 Statistical Bulletin on the Development of China’s Health Sector),” 2024, http://www.nhc.gov.cn/guihuaxxs/s3586s/202408/e64257205f0d4545a9e3d6da393870db.shtml.

57 | To 5,4% in 2021 according to: OECD, “OECD Health Statistics,” 2024, https://www.oecd.org/en/data/datasets/oecd-health-statistics.html; and to 7.3% of GDP in 2023 according to: NHC, “2023年我国卫生健康事业发展统计公报解读 (Interpretation of the 2023 Statistical Bulletin on the Development of China’s Health Sector),” 2024, http://www.nhc.gov.cn/guihuaxxs/s3586s/202408/e64257205f0d4545a9e3d6da393870db.shtml; Liang Xinlu, “Over 350 Top Figures Punished in China’s Medical Corruption Crackdown in 2024,” South China Morning Post, 2025, https://www.scmp.com/news/china/politics/article/3293019/40000-punished-chinas-medical-corruption-crackdown-including-over-350-top-figures.

58 | Robert D. Atkinson, “How Innovative Is China in the Chemicals Industry?,” ChinaInnovationSeries (ITIF, 2024), https://itif.org/publications/2024/04/15/how-innovative-is-china-in-the-chemicals-industry/.

59 | Jonathan Katz, “Chemical Processing Notebook: Breaking Down Biomanufacturing,” Chemical Processing, 2023, https://www.chemicalprocessing.com/environmental-protection/article/33012962/chemical-processing-notebook-breaking-down-biomanufacturing.

60 | Travers Nisbet et al., “The Bio Revolution: Innovations Transforming Economies, Societies, and Our Lives” (McKinsey, 2020), https://www.mckinsey.com/industries/life-sciences/our-insights/the-bio-revolution-innovations-transforming-economies-societies-and-our-lives.

61 | NDRC, “‘十四五’生物经济发展规划 (‘14th Five-Year Plan for Bioeconomic Development’),” 2021, https://www.ndrc.gov.cn/xxgk/zcfb/ghwb/202205/t20220510_1324436.html.

62 | ASPI, “Synthetic Biology - Critical Technology Tracker - Historical Country Performance,” accessed February 13, 2025, https://techtracker.aspi.org.au/tech/synthetic-biology/historical-performance/?c1=cn&c2=european-union.

63 | China Economic Weekly, “生物制造将成为新增长引擎 (Biomanufacturing Will Become a New Growth Engine),” 2024, http://paper.people.com.cn/zgjjzk/html/2024-03/30/nw.zgjjzk_20240330_5-01.htm.

64 | In 2023, China’s biomanufacturing sector reached RMB 875 billion, according to CCID, a think tank under MIIT: Sina, “年报|2023-2024年中国生物制造产业发展研究年度报告 (Annual Report | 2023-2024 Research Report on the Development of China’s Biomanufacturing Industry),” 2024, https://finance.sina.com.cn/roll/2024-11-22/doc-incwxsyk0676811.shtml; Xinhua mentions that it approaches RMB 1 trillion in 2024, citing “industry internal research”: Xinhua News Agency, “多方抢抓生物制造产业新赛道 (Multiple Parties Seize Opportunities in the Emerging Biomanufacturing Industry),” 2024, http://www.news.cn/fortune/20240829/96945b88c0c544128494869a05c1028f/c.html.

65 | Jean-François Bobier et al., “Breaking the Cost Barrier on Biomanufacturing” (BCG, 2024), https://www.bcg.com/publications/2024/breaking-the-cost-barrier-on-biomanufacturing.

66 | Zhongchuang Industrial Research Institute, “研究报告 | 《中国工业生物技术发展白皮书2024》(Research Report | ‘China Industrial Biotechnology Development White Paper 2024,’” 2024, https://web.archive.org/web/20250106092652/https:/mp.weixin.qq.com/s?__biz=MzAxNTI0ODEzNA==&mid=2653383273&idx=1&sn=f64b0b490b3d0e7830f2c595f971a446&chksm=81304116e30baa643fe0b56f1b84a47486ccd3af75de2c17f07075e76c44efb2a9740dbd02c7&scene=0&xtrack=1.

67 | Atkinson, “How Innovative Is China in the Chemicals Industry?”

68 | David Cyranoski, “Chinese Bioscience: The Sequence Factory,” Nature 464, no. 7285 (2010): 22–24, https://doi.org/10.1038/464022a.

69 | He Liping, “中国出海2.0|拿到‘入场券’,基因测序仪海外突围起步 (China Going Global 2.0 | Gaining the ‘Entry Ticket,’ Gene Sequencers Begin Their Overseas Breakthrough),” Pengpai, 2024, https://m.thepaper.cn/newsDetail_forward_29801156.

70 | Susan Kelly, “Illumina placed on China’s unreliable entity list,” Medtech Dive, 2025, https://www.medtechdive.com/news/Illumina-China-tariffs-unreliable-entity-list/739310/

71 | 36kr, “国产基因测序仪,在夹缝中爆发 (Domestic Gene Sequencers Thrive in a Competitive Niche),” 2024, https://36kr.com/p/2977442466795525.

72 | Stephane Budel, “DeciBio NGS DxBook 2024 - Competitive Landscape ILMN TMO,” LinkedIn, 2024, https://www.linkedin.com/posts/budel_decibio-ngs-dxbook-2024-competitive-landscape-activity-7205974444576542720--jxs.

73 |Illumina, “SEC Filings Details,” 2024, https://investor.illumina.com/financials/sec-filings-details/default.aspx?FilingId=17284204; BGI, “一图读懂!华大基因2023年年报 (Visual Summary! BGI Genomics 2023 Annual Report),” 2024, https://www.bgi.com/news/2024042501.

74 | Antonio Regalado, “China’s BGI Says It Can Sequence a Genome for Just $100,” MIT Technology Review, 2020, https://www.technologyreview.com/2020/02/26/905658/china-bgi-100-dollar-genome/.

75 | Craig Singleton, “Biotech Battlefield: Weaponizing Innovation in the Age of Genomics,” FDD, 2025, https://www.fdd.org/analysis/2025/01/15/biotech-battlefield/; Anna Puglisi, “China’s Hybrid Economy: What to Do about BGI?,” Center for Security and Emerging Technology, 2024, https://cset.georgetown.edu/article/chinas-hybrid-economy-what-to-do-about-bgi/; Miriam Lexmann et al., “Euroviews. When It Comes to Genomics, de-Risking with China Is Not Enough,” Euronews, 2024, https://www.euronews.com/my-europe/2024/05/31/when-it-comes-to-genomics-de-risking-with-china-is-not-enough.

76 | China holds about 20% of global output: Nikkei Asia, “The Great Medicines Migration,” 2022, https://asia.nikkei.com/static/vdata/infographics/chinavaccine-3/.

77 | Michael Bayerlei, “The EU’s Open Strategic Autonomy in the Field of Pharmaceuticals,” SWP Comment, 2023, https://www.swp-berlin.org/10.18449/2023C02/

78 | Alex Watt, “Exploring Drug Shortages in European Markets: The Causes, Analysis, and Response,” Pharmaceutical Technology, 2024, https://datawrapper.dwcdn.net/f6S9X/1/.

79 | European Commission, “Critical Medicines Alliance,” 2024, https://health.ec.europa.eu/health-emergency-preparedness-and-response-hera/overview/critical-medicines-alliance_en; Gerardo Fortuna and Marta Iraola Iribarren, “Race against Time for EU’s Critical Medicines Act,” Euronews, 2024, https://www.euronews.com/health/2024/12/19/race-against-time-for-eus-critical-medicines-act.

80 | Jie (Jeanne) Huang, “The Rise of Data Property Rights in China: How Does It Compare with the EU Data Act and What Does It Mean for Digital Trade with China?,” Journal of International Economic Law 27, no. 3 (2024): 462–79, https://doi.org/10.1093/jiel/jgae032.

81 | Euractiv, “Sino-EU Personalised Medicine Project, Europe Bridging a Data Divide,” 2024, https://www.euractiv.com/section/health-consumers/interview/sino-eu-personalised-medicines-project-europe-bridging-a-data-divide/; Miriam Lexmann et al., “Euroviews. When It Comes to Genomics, de-Risking with China Is Not Enough.”

82 | Mario Draghi, “The Draghi Report: A Competitiveness Strategy for Europe.”

83 | Alexander Brown and Jeroen Groenewegen-Lau, “Healthcare procurement + Bidding and tendering + Data exports” (Merics, 2024), https://merics.org/de/merics-briefs/healthcare-procurement-bidding-and-tendering-data-exports.

84 | MOFCOM, “商务部 国家卫生健康委 国家药监局关于在医疗领域开展扩大开放试点工作的通知 (Notice of the Ministry of Commerce, National Health Commission, and National Medical Products Administration on Carrying Out Pilot Programs for Expanding Opening-Up in the Medical Sector),” 2024, https://www.mofcom.gov.cn/zwgk/zcfb/art/2024/art_f0a5d342d5054b9bb48ad778df866f83.html.

85 | Rachel Cheung, “The Tipping Point,” The Wire China, 2024, https://www.thewirechina.com/2024/11/10/the-tipping-point-foreign-companies-china/.

86 | Rachel Cheung, “Big Pharma Doubles Down on China.”

87 | Bloomberg, “Big Pharma’s Bet on China Biotech Is a Rare Trade Bright Spot”; Merck, “Merck Enters into Exclusive Global License for LM-299, An Investigational Anti-PD-1/VEGF Bispecific Antibody from LaNova Medicines Ltd.,” 2024, https://www.merck.com/news/merck-enters-into-exclusive-global-license-for-lm-299-an-investigational-anti-pd-1-vegf-bispecific-antibody-from-lanova-medicines-ltd/; GSK, “GSK Enters Agreement to Acquire CMG1A46 from Chimagen Biosciences to Expand Immunology Pipeline,” 2024, https://www.gsk.com/en-gb/media/press-releases/gsk-enters-agreement-to-acquire-cmg1a46-from-chimagen-biosciences/; AstraZeneca, “AstraZeneca Strengthens Its Cardiovascular Pipeline with Agreement for a Pre-Clinical Novel Lipid-Lowering Therapy,” 2024, https://www.astrazeneca.com/media-centre/press-releases/2024/astrazeneca-licenses-lipid-lowering-lpa-asset.html.

88 | AstraZeneca, “AstraZeneca to Acquire Gracell, Furthering Cell Therapy Ambition across Oncology and Autoimmune Diseases,” 2023, https://www.astrazeneca.com/media-centre/press-releases/2023/astrazeneca-to-acquire-gracell-furthering-cell-therapy-ambition-across-oncology-and-autoimmune-diseases.html; BioNTech, “BioNTech to Acquire Biotheus to Boost Oncology Strategy,” 2024, https://investors.biontech.de/news-releases/news-release-details/biontech-acquire-biotheus-boost-oncology-strategy/.

89 | Boehringer Ingelheim, “Where Find Us - Shanghai,” 2021, https://www.boehringer-ingelheim.com/about-us/where-find-us/shanghai; Liu Xiaojie, “Boehringer Ingelheim to Spend Over USD546.6 Million on China R&D in Next Five Years, Country Chief Says,” Yicai, 2023, https://www.yicaiglobal.com/news/german-drugmaker-boehringer-ingelheim-to-invest-over-usd5466-million-in-rd-in-china-over-next-five-years-china-ceo-says.

90 | Rachel Cheung, “Big Pharma Doubles Down on China”; Bayer Global, “Bayer Co.Lab Shanghai Opens as Part of Global Expansion of Life Science Incubator Network,” 2024, https://www.bayer.com/media/en-us/bayer-colab-shanghai-opens-as-part-of-global-expansion-of-life-science-incubator-network/.

91 | Datenna in 2024 found 19 joint EU-China study programs and research centers in biotechnology, primarily based in the UK, Germany, Denmark and France: Datenna, “Sino-EU Academic Collaborations: Identifying Risks & Challenges,” 2024, https://www.datenna.com/datenna-navigating-challenges-and-risks-in-sino-european-academic-collaborations/; These involve BGI partnerships in Denmark since 2012: LCGC Europe eNews, “BGI Opens European Research Centre,” 2012, https://www.chromatographyonline.com/view/bgi-opens-european-research-centre; Nature Index, “An Unlikely Alliance,” 2016, https://www.nature.com/nature-index/news/an-unlikely-alliance; Cooperations of BGI with a Hungarian university since 2022: BGI, “BGI Genomics and the University of Pécs Launches a Joint Laboratory to Accelerate Access to Genetic Testing Applications,” 2022, https://www.bgi.com/global/news/bgi-genomics-partners-with-university-of-pecs-to-accelerate-genetic-testing-applications-access; Collaborations of BGI with Spanish CRG in Joint PhD programmes: CRG, “CRG - BGI Joint International PhD Programme,” 2025, https://www.crg.eu/en/content/training-phd-students-funding-opportunities/crg-bgi-joint-international-phd-programme; Partnerships of the Institute for Industrial Biotechnology of the Chinese Academy of Sciences in Belgium and Germany: Tianjin Institute of Industrial Biotechnology, “TIB-RWTH生物技术联合中心 (TIB-RWTH Joint Center for Biotechnology),” 2024, https://tib.cas.cn/gjhz/gjlhzx/202411/t20241106_7434538.html; Tianjin Institute of Industrial Biotechnology, “TIB-VIB合成生物学联合中心 (TIB-VIB Joint Center for Synthetic Biology),” 2024, https://tib.cas.cn/gjhz/gjlhzx/202411/t20241110_7436826.html.

92 | Kooperation International, “Opportunities and challenges for EU-China STI collaboration stemming from China’s 14th Five-Year Plan,” 2021, https://www.kooperation-international.de/dokumente/berichte-und-studien/detail/info/opportunities-and-challenges-for-eu-china-sti-collaboration-stemming-from-chinas-14th-five-year-pla.

93 | Max Planck Society, “‘In These Challenging Times, We as Scientists Must Stand United,’” 2024, https://www.mpg.de/23671503/50-years-mpg-cas-cooperation.

94 | Omnibus, “Leading Genomics Researcher Resigns From Au Following The University’s Decision To Stop Collaboration With China,” 2024, https://omnibus.au.dk/en/archive/show/artikel/topforsker-inden-for-genomforskning-siger-op-paa-au-efter-universitetets-beslutning-om-at-stoppe-kinesiske-samarbejder-1; Ritzau News, “Copenhagen Uni Ends BGI Group Partnership - Ritzau,” 2024, https://danishnews.ritzau.com/article/fc7718d7-88e1-4560-9aaf-1079b49b72464undefined; Gregers Møller, “Danish Universities Break Away from the Chinese Partners,” Scandasia, 2024, https://scandasia.com/danish-universities-break-away-from-the-chinese-partners/.

95 | European Commission, “Statement by EVP Margrethe Vestager on the European Commission’s communication ‘Building the future with nature: Boosting Biotechnology and Biomanufacturing in the EU,’” 2024, https://ec.europa.eu/commission/presscorner/detail/en/STATEMENT_24_1610.

96 | European Commission, “International Cooperation with China in Research and Innovation,” accessed February 13, 2025, https://research-and-innovation.ec.europa.eu/strategy/strategy-research-and-innovation/europe-world/international-cooperation/bilateral-cooperation-science-and-technology-agreements-non-eu-countries/china_en; European Commission, “Eu-China Food, Agriculture And Biotechnology (Fab) Flagship Initiative,” n.d., https://research-and-innovation.ec.europa.eu/document/download/bb9d6933-2ca5-45a2-999f-cbbddf69a407_en?filename=eu-china_research_in_fab.pdf; David Matthews, “EU and China Remain Stalled on Science and Innovation Roadmap,” Science|Business, 2024, https://sciencebusiness.net/news/horizon-europe/eu-and-china-remain-stalled-science-and-innovation-roadmap; Since 2015, at least 34 EU funded projects in the fields of agricultural, environmental, industrial and medical biotechnology have involved Chinese partners, compared to 150 involving US partners: European Commission, “CORDIS,” accessed February 13, 2025, https://cordis.europa.eu/search?q=(%2Farticle%2Frelations%2Fcategories%2Fcollection%2Fcode%3D%27brief%27%20OR%20(%2Fresult%2Frelations%2Fcategories%2Fcollection%2Fcode%3D%27deliverable%27%2C%27publication%27%20OR%20(%2Fresult%2Frelations%2Fcategories%2Fcollection%2Fcode%3D%27pubsum%27%20OR%20contenttype%3D%27project%27)))%20AND%20(%2Fproject%2Frelations%2Fcategories%2FeuroSciVoc%2Fcode%3D%27%2F25%2F71%2F%27%20OR%20%2Fproject%2Frelations%2Fcategories%2FeuroSciVoc%2Fcode%3D%3D%27%2F25%2F71%27%20OR%20%2Fproject%2Frelations%2Fcategories%2FeuroSciVoc%2Fcode%3D%27%2F27%2F79%2F%27%20OR%20%2Fproject%2Frelations%2Fcategories%2FeuroSciVoc%2Fcode%3D%3D%27%2F27%2F79%27%20OR%20%2Fproject%2Frelations%2Fcategories%2FeuroSciVoc%2Fcode%3D%27%2F25%2F61%2F%27%20OR%20%2Fproject%2Frelations%2Fcategories%2FeuroSciVoc%2Fcode%3D%3D%27%2F25%2F61%27%20OR%20%2Fproject%2Frelations%2Fcategories%2FeuroSciVoc%2Fcode%3D%27%2F21%2F37%2F%27%20OR%20%2Fproject%2Frelations%2Fcategories%2FeuroSciVoc%2Fcode%3D%3D%27%2F21%2F37%27)%20AND%20startDate%3D2015-01-01-2028-03-19%20AND%20(%27china%27)&p=1&num=10&srt=Relevance:decreasing; Euractiv, “Sino-EU Personalised Medicine Project, Europe Bridging a Data Divide.”

97 | Jorge Santos da Silva and Franck Le Deu, “Biotech in Europe: A Strong Foundation for Growth and Innovation.”

98 | Jastra Kranjec, “VC Funding in Biotech Remains Above Pre-Pandemic Levels with $136.3B Raised in 2023,” Stocklytics, 2024, https://stocklytics.com/content/vc-funding-in-biotech-remains-above-pre-pandemic-levels-with-136-3b-raised-in-2023/.

99 | Gerardo Fortuna, “Von Der Leyen Confirms Critical Medicines, Biotech Acts in Pipeline,” Euronews, 2024, https://www.euronews.com/health/2024/07/19/von-der-leyen-confirms-critical-medicines-biotech-acts-in-pipeline.