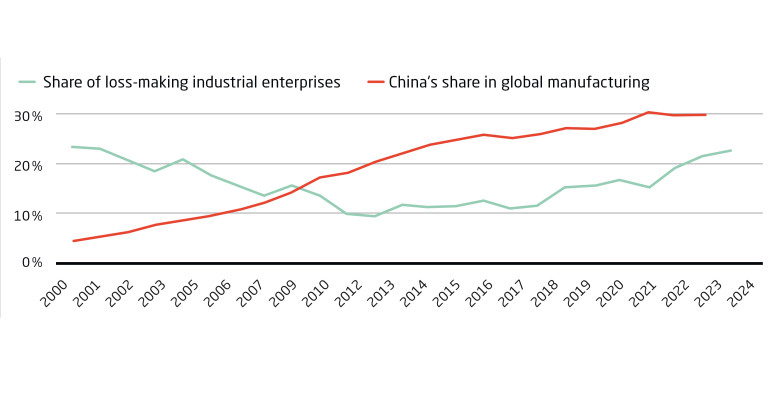

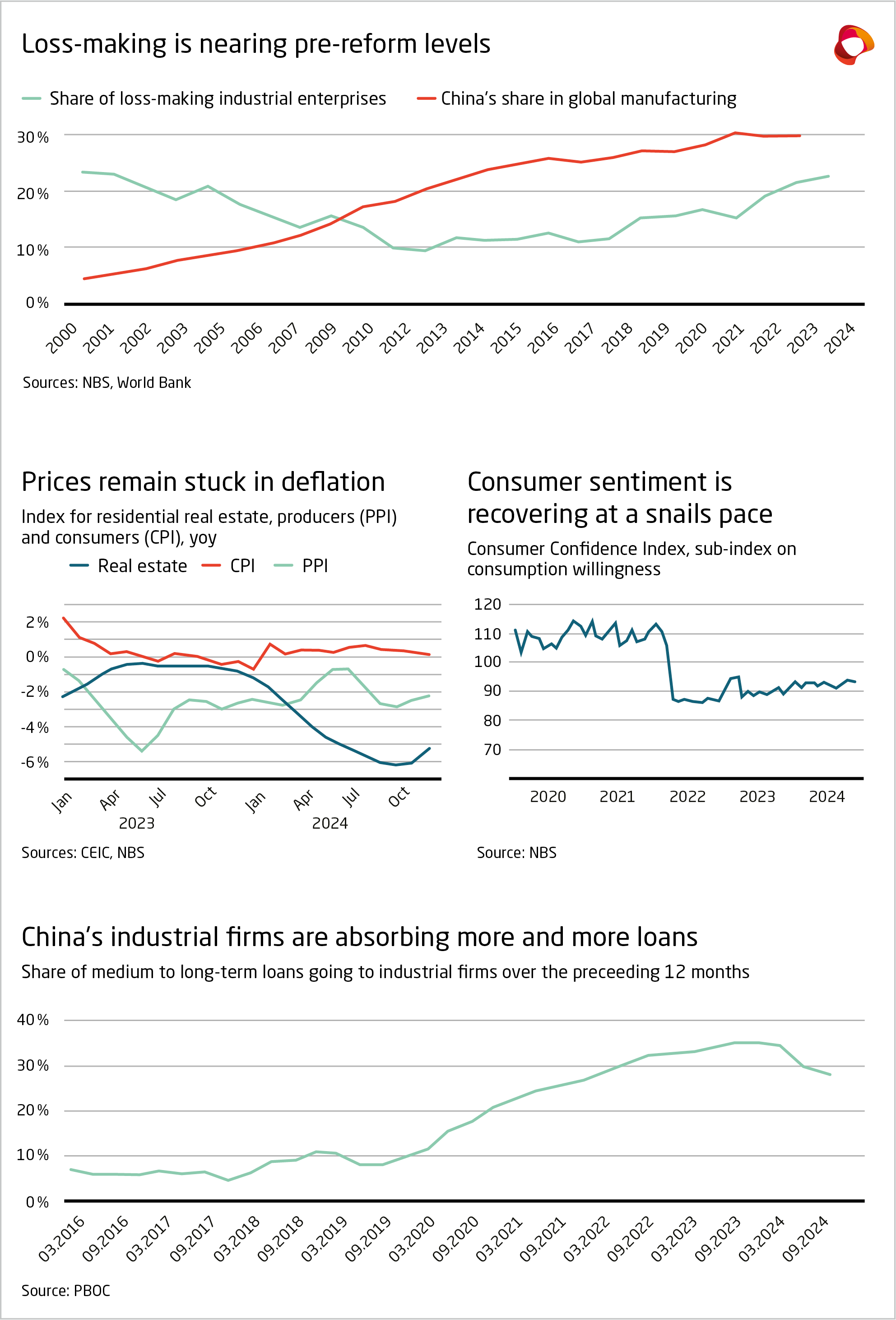

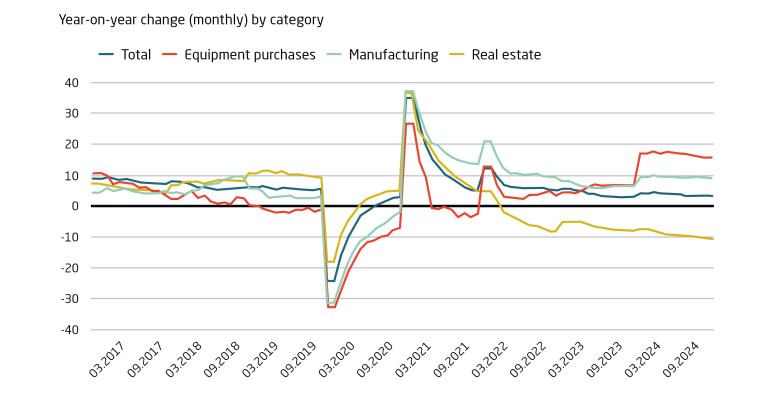

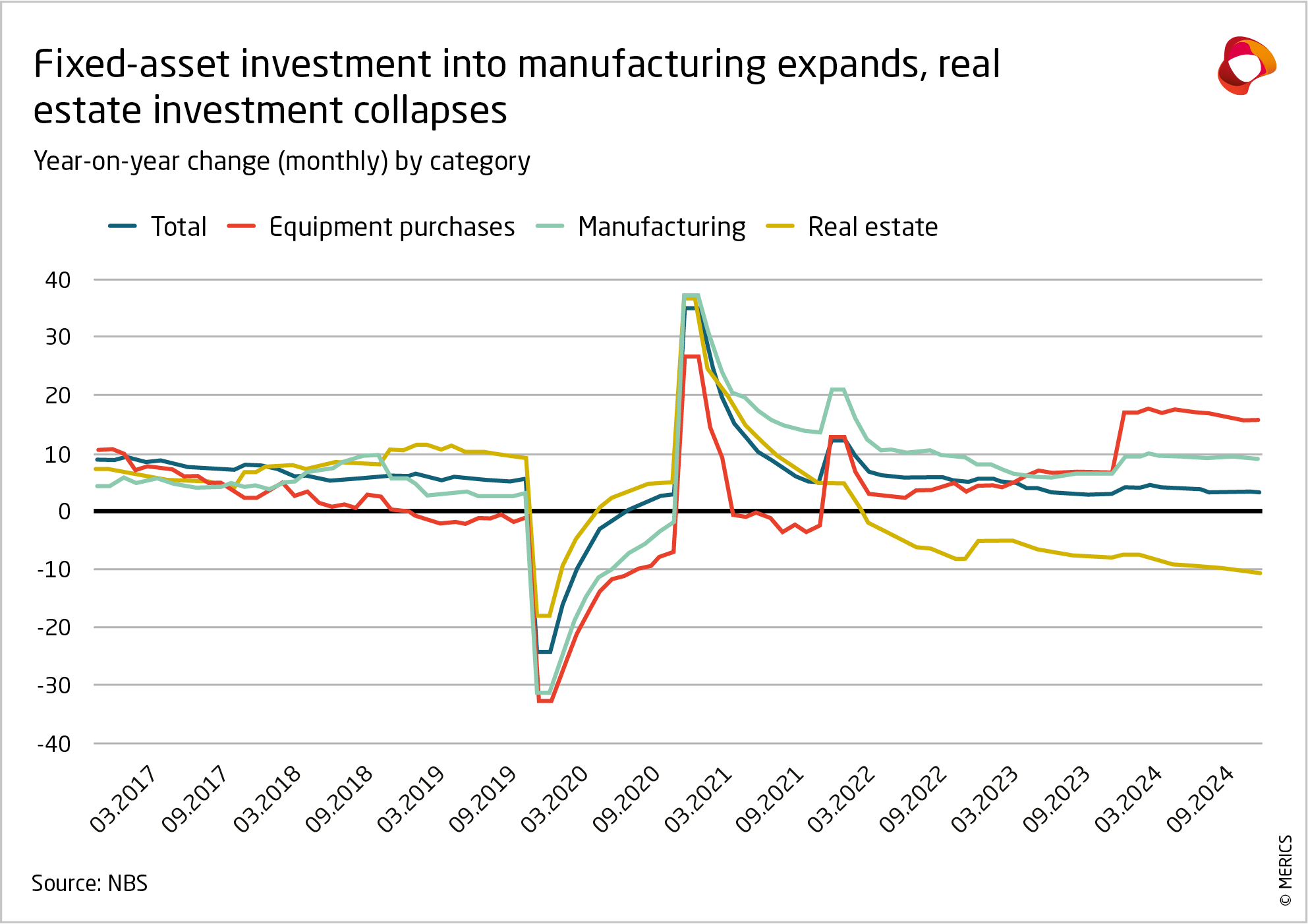

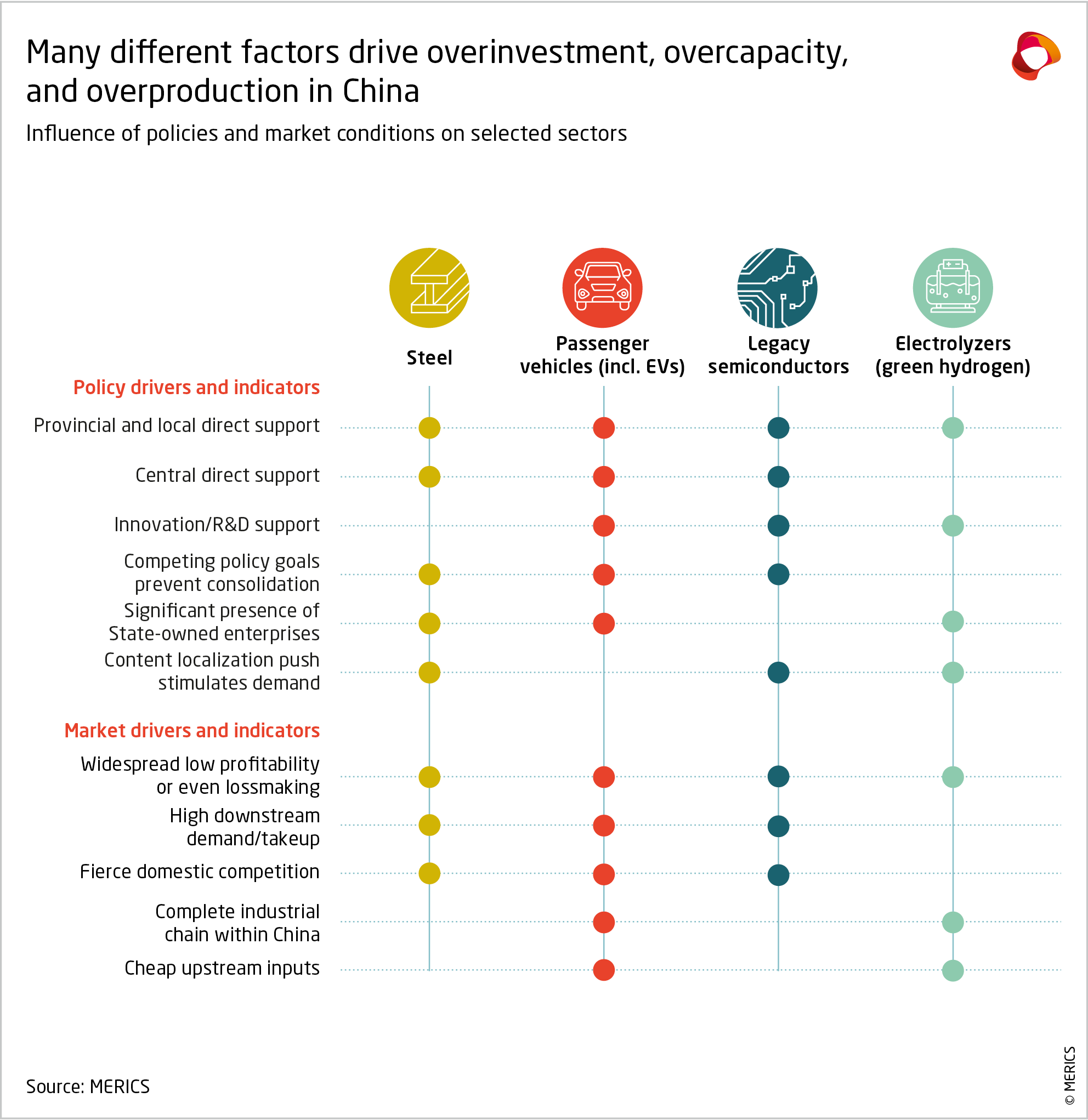

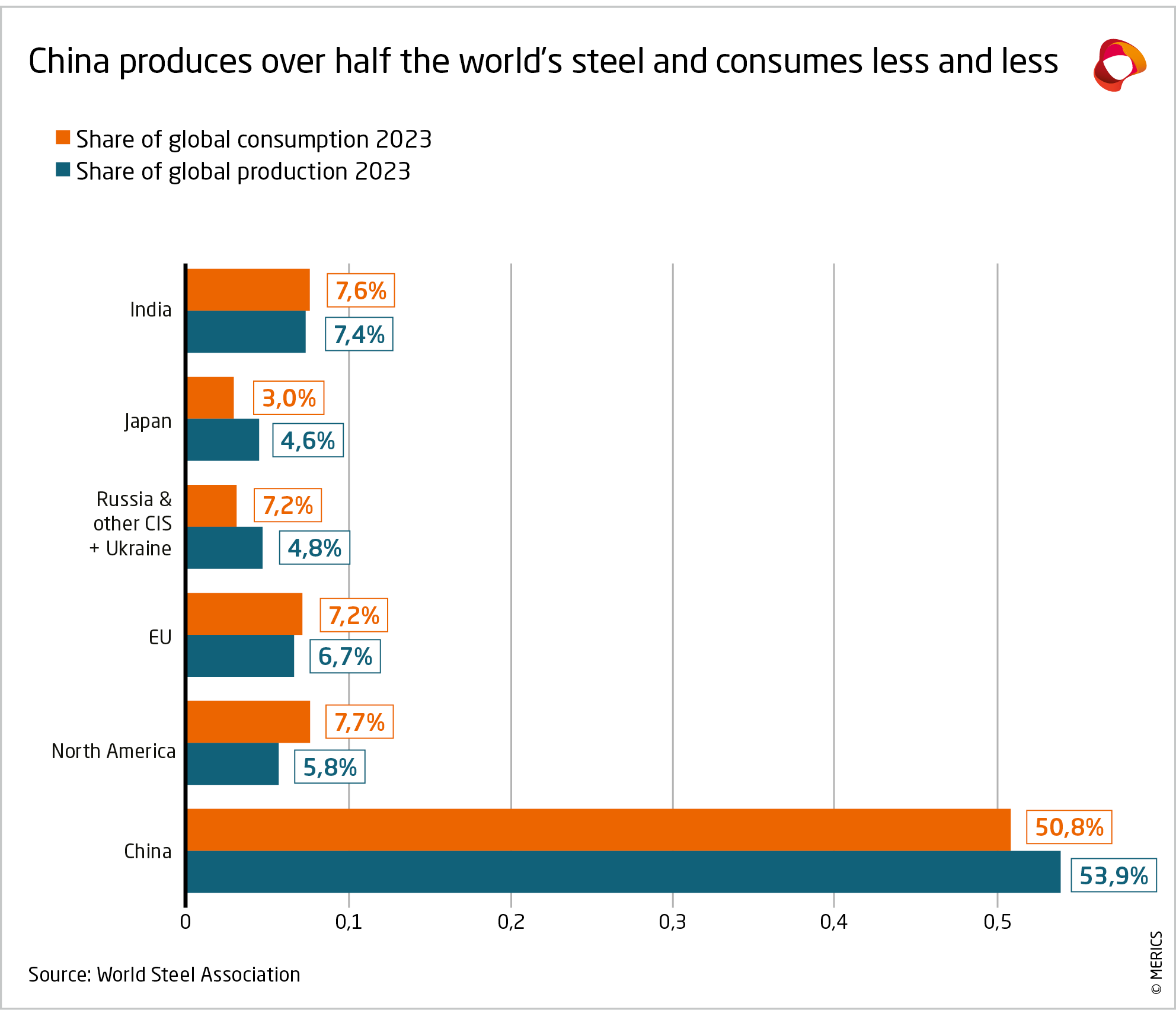

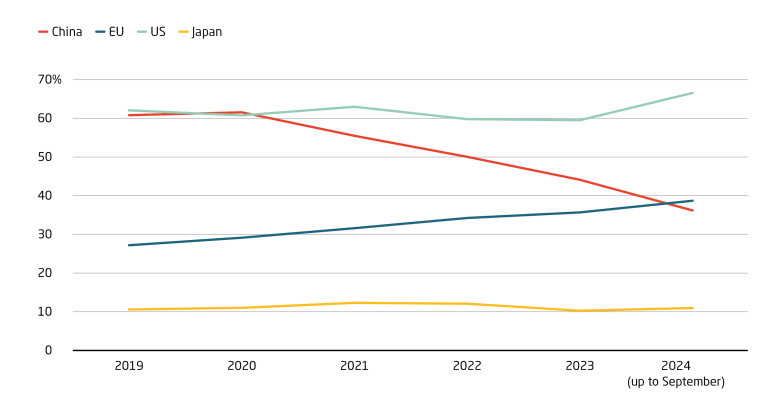

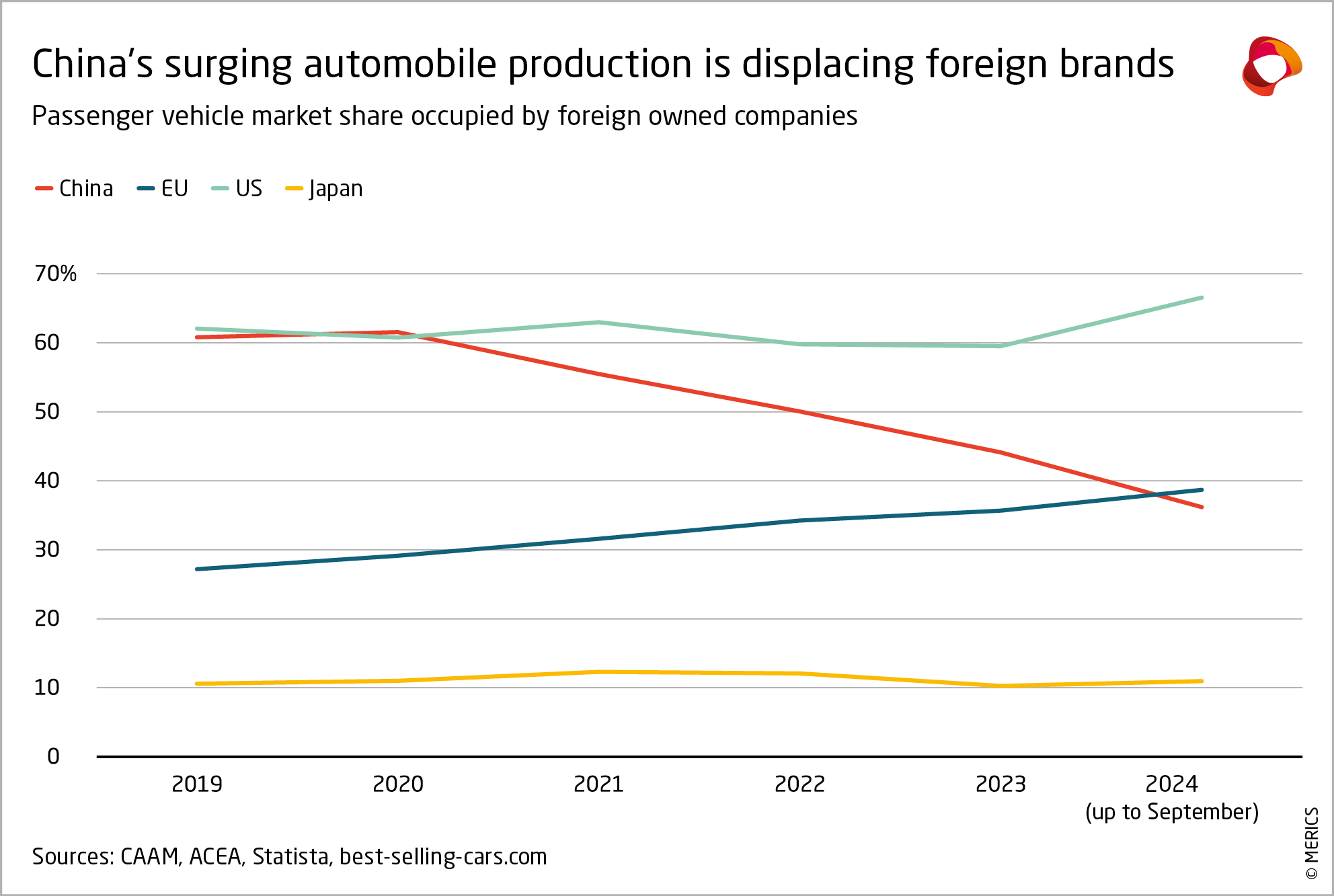

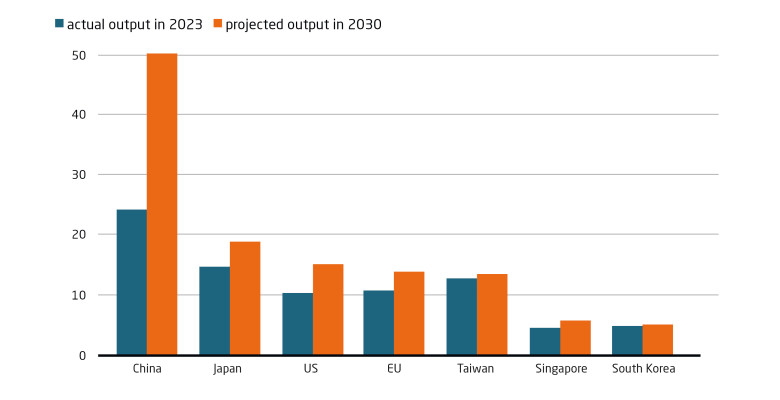

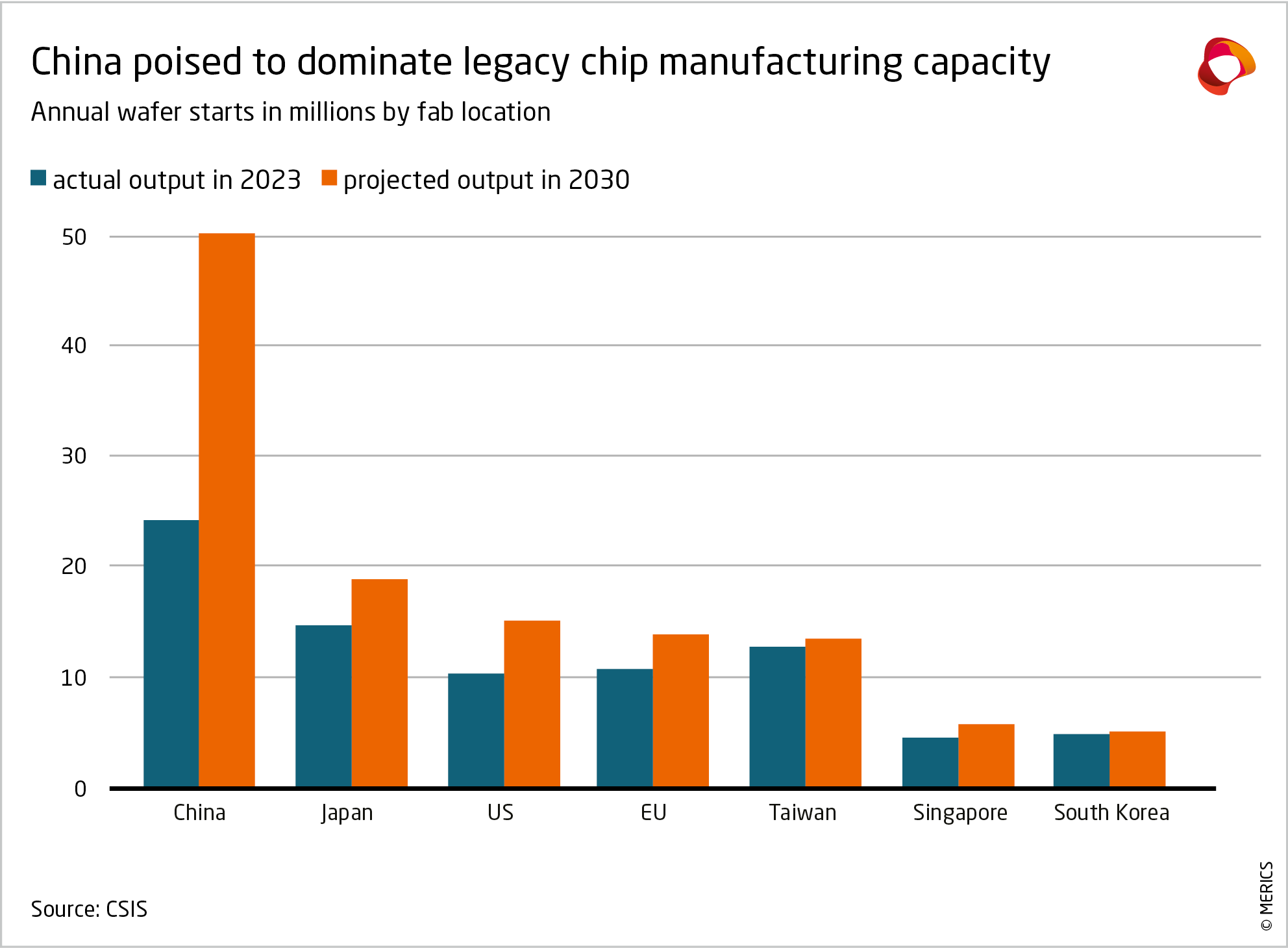

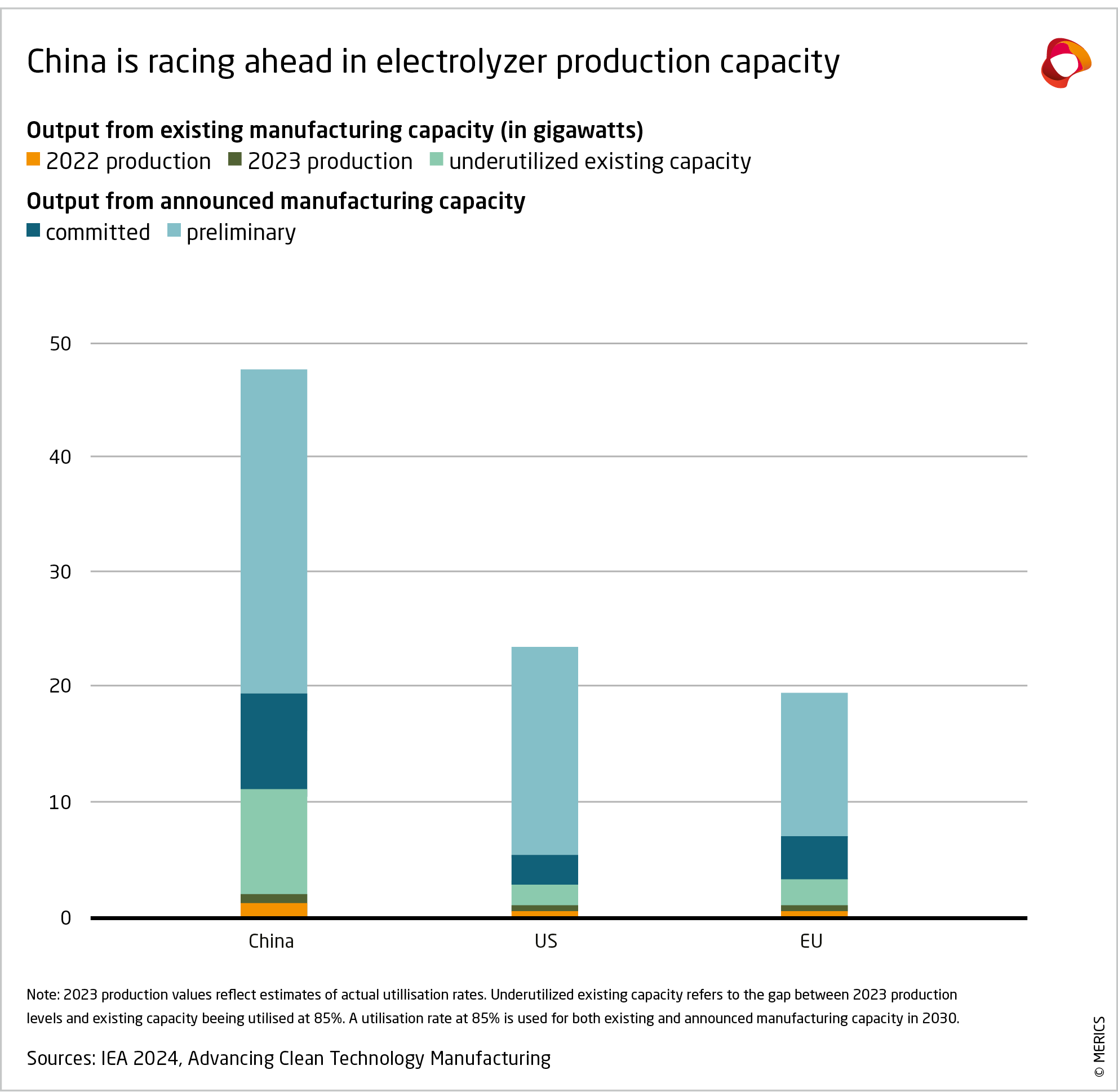

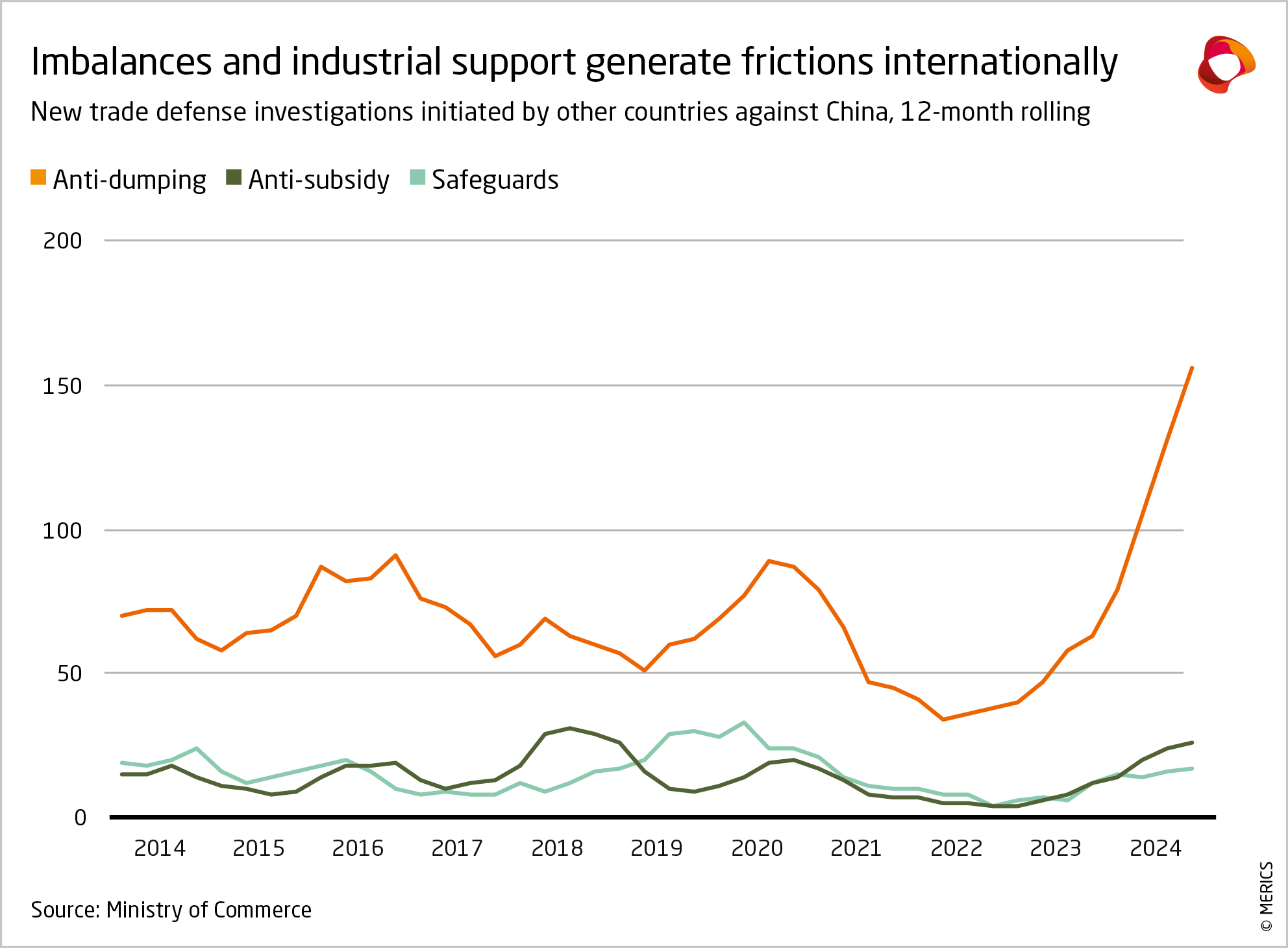

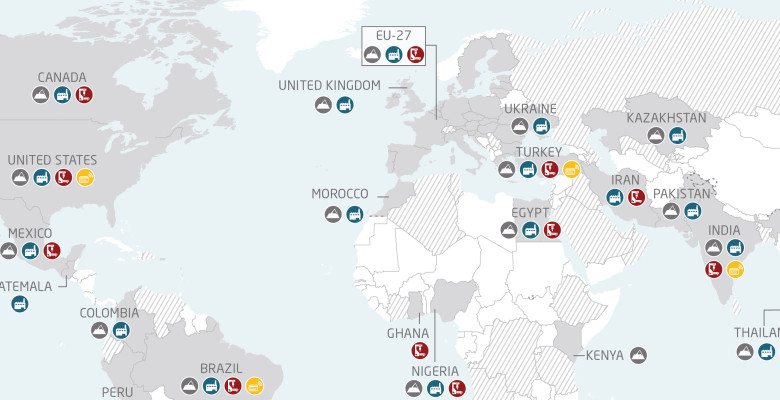

At a glance: China's overcapacites in infographics

China's overcapacity production is a growing concern in Europe and beyond. Explore the graphics below to learn more about the drivers of China's overcapacities and the sectors that have been and are most likely to be affected. For a comprehensive analysis, read our report "Beyond overcapacity: Chinese-style modernization and the clash of economic models" here.