China's toolkit against sanctions + Shaping global narratives + Three-child policy

TOP STORY: China fights back against Western sanctions and blacklists

The United States and China took steps in the first days of June to extend the legal foundations of what is now an ever more formalized relationship of mutual mistrust. On June 3, US President Joe Biden signed an executive order that bars US investors from putting their money into stocks and bonds of 59 Chinese companies linked to the PRC’s “military-industrial complex” and its surveillance technology sector. The ban, effective on August 2, replaces and strengthens the Trump administration’s measures aimed at preventing US investments from supporting Chinese companies that undermine US security and values.

In addition to targeting a longer list of firms, many of which are subsidiaries of state-owned defense companies, the investment ban identifies the use of surveillance tech for domestic repression and human rights abuses in China as posing a threat to the United States. The E.O. also clarifies that the US Treasury, not the Department of Defense, will drive future designations.

These are only the latest in a long series of trade and investment restrictions targeting Chinese firms and technology as the strategic rivalry between the two countries continues to intensify. The US Senate further passed legislation on Tuesday to provide more than USD 250 billion in support for the US tech industry to counter China’s ascendency in a number of key technology fields. China’s Foreign Ministry said the bill, known as the Innovation and Competition Act, displayed a Cold War mentality.

US blacklists of more Chinese firms come on top of political sanctions imposed on China over its crackdown on human rights and democracy in Xinjiang and Hong Kong. The US, the EU, Britain and Canada sanctioned Chinese officials over Xinjiang abuses in March, to which Beijing responded with broad countersanctions.

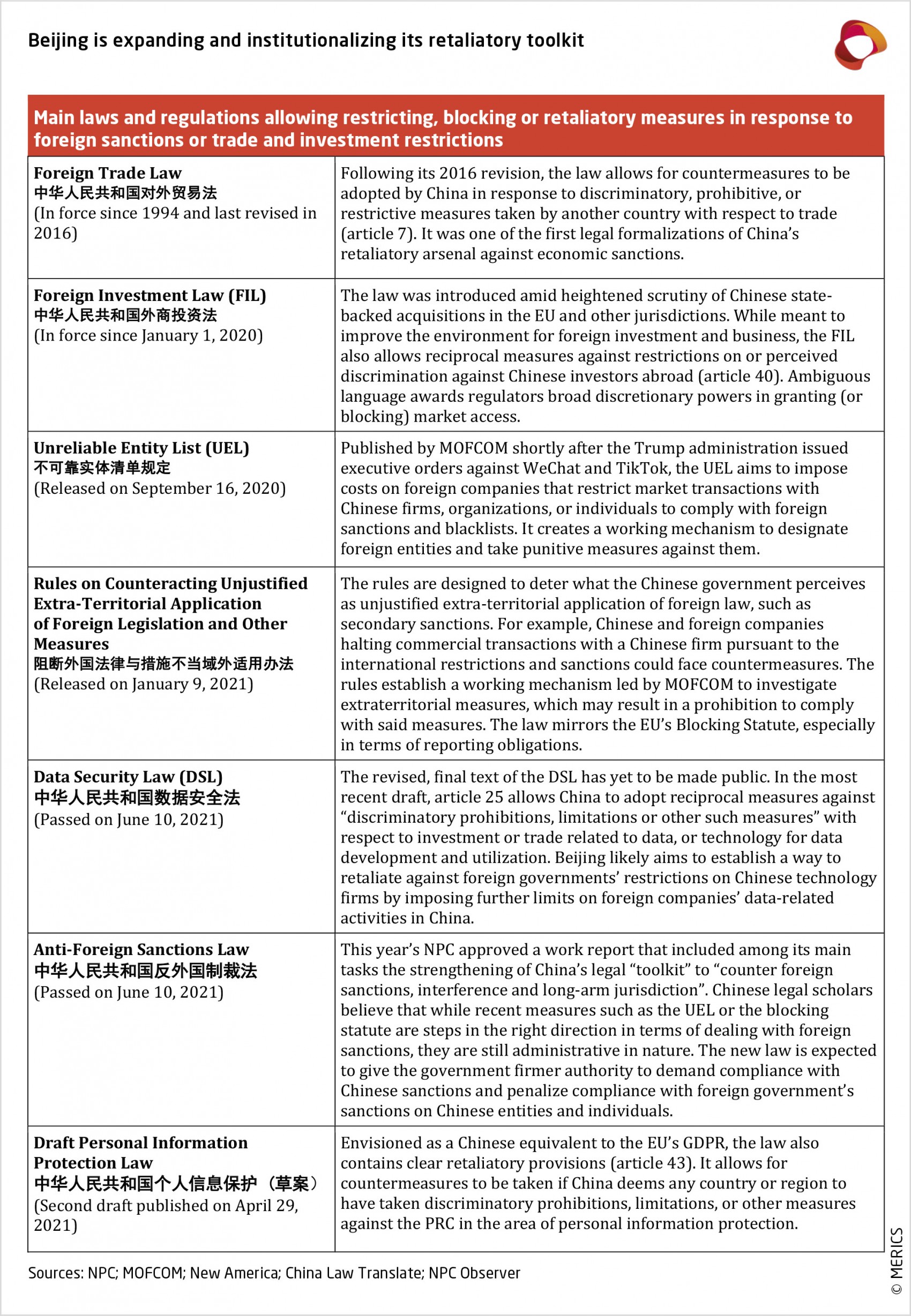

In light of these actions, Beijing is expanding its own retaliatory toolkit against sanctions and other acts it regards as discriminatory or otherwise unjustified treatment (see table below).

On June 10, the National People’s Congress Standing Committee enacted China’s first “Anti-Foreign Sanctions Law,” which was first proposed in March. Chinese legal experts say it will finally start levelling the playing field and give Beijing the kind of legal powers that Washington and Brussels already have at their disposal. State-owned media outlet Global Times framed the new law as a response to Washington’s “aggression” in an article about the US competition bill.

MERICS analysis: “Beefing up the legal instruments for countering foreign sanctions and extra-territorial effects of other countries’ jurisdiction is a priority of China’s legislative work this year. China’s regime to impose and counter sanctions is still much less expansive compared to those of the US and the EU. Chinese state media also highlighted the move from administrative decisions to a more formalized framework as a boost for the legitimacy of China’s actions. Companies doing business with China must be prepared to face a growing number of pitfalls there and in the US, as they may be caught in the crossfire between conflicting sanctions regimes and blacklists.” Rebecca Arcesati, Analyst MERICS

Media coverage and sources:

- Reuters: Biden order bans investment in dozens of Chinese defense, tech firms

- SCMP: China passes Anti-Foreign Sanctions Law

- Global Times: China's top legislature passes anti-foreign sanctions law, underscoring determination to safeguard China's core interests

- Global Times: China hits back at US competition bill

- CCTV [CN]: The 29th Meeting of the Standing Committee of the 13th National People's Congress passed a number of bills and two decisions

Struggling for love: The CCP’s quest for shaping global narratives

The facts: Trustworthy, lovable, respectable – this is how China should be viewed internationally, according to a speech by Xi Jinping at a recent Politburo study session on the dissemination of China’s views and positions. But while some international commentary saw a potential shift towards more amicable language after a backlash against China’s wolf warrior diplomacy, the study session itself was still firmly focused on China’s “struggle” against Western states in the quest for global discourse power.

The overarching goal is to create a favorable environment for China’s rise. Accordingly, streamlining domestic and global propaganda and effectively “guiding” international public opinion were on top of the agenda.

Restrictions and arrests surrounding the remembrance of the 32nd anniversary of the Tiananmen protests on June 4 in Hong Kong and Macao reflect the party’s increasing resolve to control how it is perceived beyond mainland Chinese society. Candles lit by EU and US consulates in Hong Kong to commemorate the Tiananmen protests were promptly condemned by Beijing as “absolutely intolerable” acts of “infiltration” and “sabotage”.

What to watch: Beyond these defensive moves to safeguard what the party state considers to be its core interests, offering alternative narratives to contest Western ones has emerged as a priority. China’s diplomacy and external propaganda will likely continue to reflect its determination to prevail in what the party state views as a battle over global influence. Democracies should prepare for an even stronger push by China to control debates beyond its borders.

MERICS analysis: “Rather than a step back from assertive language, the speech signifies a new level of ambition. Especially the new policy focus on establishing a ‘Chinese narrative system’ (中国叙事体系) marks an expansion of previous efforts to promote Chinese positions and values. The goal is to shape global narratives – be it through persuasion or pressure.” Katja Drinhausen, Senior Analyst MERICS

Media coverage and sources:

- Xinhua: Summary of Xi’s speech (in Chinese)

- China Daily: Shape global narratives for telling China's stories

- New York Times: China’s leader wants a ‘lovable’ country. That doesn’t mean he’s making nice

- Reuters: Hong Kong locks down Tiananmen vigil park amid tight security, arrests organiser

- China Media Project: Powers of Persuasion

China lifts two-child restriction, unveils three-child policy

The facts: All married couples in China can now have three children. The government made the announcement to end the two-child limit weeks after the once-a-decade census which revealed that birthrates have been declining for four consecutive years. But a poll by party-state media Xinhua found that 90 percent of respondents would not consider a third child. The poll was quickly taken offline.

Escalating costs of raising children, sky-high housing prices, long working hours and lack of adequate childcare facilities have been cited as main reasons why couples are put off. The government has promised supporting measures to assist couples in the cities to have children, which may include longer maternity leave and baby bonuses.

Those promises are however inadequate to address underlying issues such as workplace discrimination against women. Employers unwilling to pay for women to go on-leave after giving birth are already hesitant to hire females. The policy is unlikely to move the needle on birthrates as China’s urbanized and higher educated women are getting married later and are more likely to prefer small families or stay single.

Meanwhile, at the provincial levels, local governments may hesitate to implement the policy as fines issued to couples who break birth control rules have provided revenue for their coffers.

What to watch: State media can be expected to turn up the dial on pro-natalist campaigns extolling traditional roles of mother and homemaker to cajole couples to have more than one child. Censorship on online content advocating for women’s rights is already being stepped up. A number of popular web forums and social media accounts belonging to feminists supporting women who choose to stay child-free and single have been shut down.

MERICS analysis: Apart from demographics, the policy is further indication of the patriarchal ruling regime in China. Despite strong labor market participation, women are still expected to bear the main burden of child-bearing and raising. The legal retirement age for women is still five years less than for man, with the expectation that they will take care of grandchildren. These structural issues have a clear impact on women’s career options, especially in the public sector. As per MERICS research and analysis, women representation in high leadership positions in the Chinese Communist Party remains marginal.

More on the topic: Read “Women hold up half the sky, but men rule the party”, short analysis by MERICS analyst Valarie Tan.

Media Coverage and sources:

- SCMP: ‘Too much pressure’: mixed reaction to China’s new 3-child policy

- The New York Times: China Says It Will Allow Couples to Have 3 Children, Up From 2

- The New York Times: The Real Reason Behind China’s Three-Child Policy

- Quartz: China’s propaganda journey from “only one child is good” to the three-child policy

- FP: With Three-Child Policy, China Is Missing the Point

METRIX

51.1%

In May, China’s monthly imports grew to USD 218.4 billion and were 51.1 percent higher than in the same month in 2020. This is one of the strongest monthly growth rates in year-on-year comparison ever. However, this year's figures also started from a low base: Last May, imports had dropped by 16.7 percent due to the corona pandemic. Source: SCMP

VIS-À-VIS: Jude Blanchette on the Chinese Communist Party at 100

“We're seeing a step change in the role of the CCP in the economic system”

MERICS China Briefing spoke with Jude Blanchette, Freeman Chair in China Studies at the Center for Strategic and International Studies (CSIS) in Washington, as part of a series of interviews about the Chinese Communist Party (CCP) at 100. He talked about the sources of the party’s resilience, its integration into Chinese society – and whether it has the wherewithal to make China a superpower by the middle of the century. Questions by Nis Grünberg, Senior Analyst MERICS

How has the CCP managed to stay at the center of Chinese politics for a century?

One important factor is the CCP’s ability to mobilize, aggregate resources and channel them towards objectives. These can be financial resources, or human capital. The CCP is able to channel resources in ways that market economies and democracies might not be able to do. The second attribute which has kept the party resilient is its openness to innovation and experimentation. This seems somewhat ironic because we tend to think of Leninist systems as rigid. But, partly because the CCP has been such a keen student of the Soviet Union's atrophy and decline, and also because of some of the unique characteristics about how the party itself evolved to its own unique exigencies, there has always been a willingness to try new things to adapt.

The final element of resilience is the integration of the party into society. As a Leninist party, it maintains an element of being elite and party membership is not open to everyone. Nonetheless, the party has long tried to integrate into almost all elements of society such that it feels omnipresent. That has allowed it to recognize risks early and innovate when it feels the need to.

You see a new type of system emerging in China. What’s the fundamental change?

From the early 1980s into the mid or late 2000s, the view of economic growth and the economic system was essentially about expanding the pie, building aggregate material wealth. Now, the paradigm is that Xi Jinping has purpose, a direction in which he wants the economy to go, one that is significantly more defined than under any previous leadership. This is clearly going to be the most challenging decade Beijing is confronted with since the death of Mao, so the Chinese leadership cannot afford to have essentially an Adam Smith-like invisible hand allocating resources.

The leadership needs the resources to be channeled towards critical technology sectors. As it perceives the international environment as becoming hostile, they cannot allow blind market forces to determine where Chinese corporates and outward investment go. That to me indicates that we are no longer operating under the same rules that were implicit in how previous leadership groups thought and acted. At the same time, we're seeing a step change in the role of the CCP in the economic system. It is of such magnitude that it is a new paradigm in terms of the explicit de jure role that the CCP is going to play in Chinese society. It is of infinitely greater strength and robustness that was not prior to 2012.

How far do you think the CCP will continue pushing into society go?

That’s the question on everyone's mind. Are we going to see a future in which every Chinese company has a corporate governance structure that elevates the role of the party cell and the party secretary? That has corporate decisions and political decisions moving in tandem? The answer is that we don’t yet know. However, it's important to remember that the underlying thrust of this party integration into society is not about having the party make all of the decisions in Chinese society.

I think it's quite the opposite – the integration of the party is seen by Beijing almost as a prerequisite for the future of complexity that China is heading towards. Installing, or re-empowering party cells within companies is not about some foolhardy central planning 2.0. It’s about concerns in the party about the country continuing to integrate and the world economy becoming more complex, more fractured, and more unpredictable. It’s about the party asking itself how it can make sure it remains aware of what's going on. The big challenge for external observers – including other political systems watching China – is how we are going to conceptualize and treat this evolving political-economic hybrid system.

PROFILE: Costar Group

Costar Group (中光学集团有限公司) is China’s industry leader in optical and photoelectric devices – and it is one of the 59 Chinese defense and tech corporations recently added to an investment blacklist by US President Joe Biden. Costar is a good example of how Chinese state-owned technology companies are often integrated with China’s defense sector and the global economy beyond.

Based in Henan province, the company has worked with Japan’s Canon and Epson, Germany’s Zeiss, and other international players, and is linked with global supply chains through subsidiaries that manufacture optical membranes and equipment. Costar owns Nanyang Lida Optic-Electronics, a large optical manufacturer and supplier listed on the Shenzhen stock exchange and is a major player on the surveillance camera lens market. Moreover, Costar operates research centers that have links to both civilian and military institutions. On its English-language website, Costar Group prides itself on doing business with “national intelligence and national security” forces.

Costar Group is part of the China Southern Industries Group Corporation, one of China’s largest defense contractors (and also on the US blacklist). China Southern is one of the 53 key SOEs managed by Chinese Communist Party cadres. Like other large SOEs, it was carved out of government-operated branches or ministries in the 1980s and 1990s. Many now operate as global corporations – but often also in complex constellations with ties to state organs and the defense sector. Separating large Chinese corporations into private or public, civilian or defense-related is getting increasingly difficult.

Media coverage and sources:

- Costar Group: Official website

- Reuters: US treasury updates list of Chinese entities hit by investment ban

- China Daily: Henan Costar Group

MERICS CHINA DIGEST

MERICS’ Top 3

- TechRadar: China outstrips GPT-3 with even more ambitious AI language model

- CarbonBrief: Explainer: China creates new ‘leaders group’ to help deliver its climate goals

- Quartz: China’s firewall is spreading globally

Politics, society and media:

- Reuters: China’s Guangdong steps up COVID-19 testing as infections mount

- Caixin: Guangzhou’s Battle Against a Potent Virus Variant

- Caixin: ‘Lying Flat’ Is the New Resistance Movement to Materialism

- Bill Bikales: Reflections on poverty reduction in China

- China Law Translate: Keeping China’s Schools Safe by Protecting Students’ Rights?

Economy, finance and technology:

- SCMP: China gets tough on financial sector risk management, extends contingency planning to more institutions

- China Banking News: Chinese Central Bank raises foreign deposit reserve ratio for first time in 14 years to stem renminbi appreciation

- China Daily: China’s PPI rising at highest pace in 13 years

International relations: