China high on the EU's agenda this fall + Lithuania + Berlin's Indo-Pacific Strategy

Story of the month: EU’s event-packed fall will set the tone for its China policy in 2022

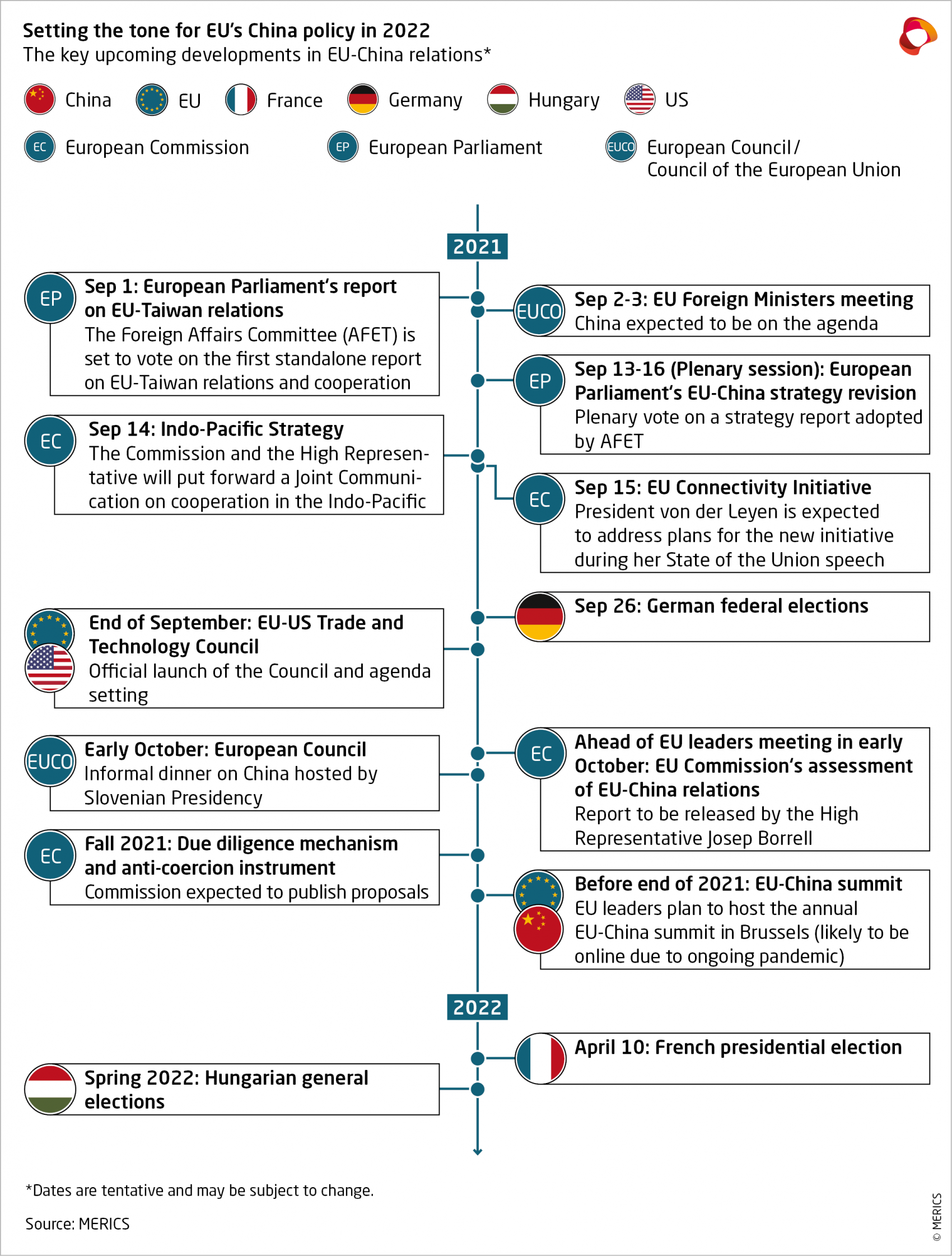

As the EU gets back to work after the summer break, its looking like China will be high on the agenda this fall. The turbulent first half of 2021 set the scene, with the exchanging of sanctions, the freezing of the Comprehensive Agreement on Investment (CAI) and the intensifying of transatlantic ties. Further developments this fall will indicate the direction the EU may take on China over the course of the next year.

Brussels to reevaluate and gear up its China policy

EU High Representative Josep Borrell is conducting a reassessment of the EU’s China policy. His evaluation, expected to be unveiled by early October, will be similar to the one conducted in April in which the Commission found no grounds for the 2019 EU-China Strategic Outlook strategy to be updated. The assessment will likely propose changes to the EU’s China policy this time round. The inclusion of the term “systemic rivalry” is going to be an important indicator of the Commission’s resolve in the face of Beijing’s demands. Reportedly, Chinese diplomats are pushing the Commission to drop the use of term in this evaluation.

Another indication of the Commission’s direction will be the strength of legal measures included in the new due diligence mechanism and anti-coercion instrument proposals of which are set to be unveiled this fall. The two legal tools may impact the operations of European businesses in China and the EU’s way of addressing China’s economic coercion activities.

The European Parliament will hold a plenary vote on its recommendations for a new China strategy. The MEPs are expected to support a multifaceted approach to China, but also argue for a more assertive stance by calling for mandating European efforts to track Chinese disinformation and endorsing the development of a Bilateral Investment Treaty with Taiwan. The question remains here whether the Commission’s and Parliament’s assessments will increasingly converge on China or whether divergences exemplified in their differing stance on CAI will persist.

European Council will find new dynamic on China

Later this year, Angela Merkel, whose position frequently impacted the EU’s China policy, will be replaced by a new chancellor. In turn, this means that the European Council will be restructured. CDU/CSU and the SPD’s leaderships do not appear to be more assertive towards China than any of their predecessors. Should the Greens, however, join the coalition, that is likely to change.

Any signs of a chance in the dynamics will come to light at the earliest at the EU’s Foreign Ministers meeting in later September and the EU leaders meeting in early October. Come Spring next year, it’s Hungary and France’s turn to elect new governments. An unlikely departure of the authoritarian government of Viktor Orbán would result in a shift of Hungarian-China policy and leave Beijing without its closest ally among European leaders. Whereas Macron has been Merkel’s partner in leading the EU’s China policy. A power shift at the Elysée could endanger the strength of the Franco-German entente.

The Council could have a stronger basis for a more cohesive European China policy should Macron retain the presidency in France, the CDU/CSU or SPD lead a coalition government in Germany and Draghi remain as the Italian Prime Minister.

EU will define its ambitions in Asia policy

The EU is looking to strengthen its position in Asia beyond China. The Commission’s release of a proposal for the EU Indo-Pacific strategy uncovers some of the details of a flexible and soft-power driven strategy. While the overall narrative aims at including China, mention of Freedom of Navigation Exercises and collaboration with “like-minded” countries reveal the strategy’s actual direction. Similarly, Von der Leyen’s State of the Union address is likely to contain clues about the EU’s commitments in the region, especially in reference to the EU’s new connectivity initiative. By developing these new strategies and initiatives, the EU will give more substance to the concept of strategic autonomy.

Transatlantic cooperation faces a test

This fall will also bring the launch of the EU-US Trade and Technology Council, which may be the key to transatlantic cooperation. The initial meetings could form the technocratic means for transatlantic coordination on issues pertaining to China and translate the positive EU-US momentum of the first half of the year into concrete policies.

Any current momentum may be affected by the EU’s reevaluation following the US withdrawal from Afghanistan. Subsequent unsuccessful attempts by leaders to shift the American stance on the pace of withdrawal also showed the limitations of Europe’s influence. Consequently, throughout the fall European leaders may be eager to double down on the strategic autonomy agenda and become more clear-eyed about cooperation with the US, including the EU’s readiness to distance itself from China.

Setting the course

The agenda of the next months will reveal how committed the EU leaders are to strategic autonomy and how they will seek to practically shape relations with Beijing and Washington. The realization coming from the EU's limited influence in the situation in Afghanistan was a hard pill to swallow. After this setback in transatlantic rapprochement, support is growing within the EU for greater autonomous capacity. Over the coming year, the bloc will likely seek better ways to protect its interests in both relations with Washington and Beijing. At the same time, it will keep developing transatlantic coordination and keep the channels of communication with China open.

Read more:

- Politico: EU mulls review of China policy, again

- European Parliament: MEPs set out their vision for a new EU strategy for China

- MERICS: EU-US Trade and Technology Council will be a litmus test for transatlantic coordination on China

- FT: Afghan withdrawal is a blow for NATO and Europe

- The Diplomat: The EU’s Indo-Pacific Strategy in 10 Points

- FT: Germany’s Baerbock sets out sharp break with Merkel era for Greens

- MERICS: The EU’s new connectivity agenda

- European Council: A Globally Connected Europe: Council approves Conclusions

Lithuania doubles down on a values-based security gambit in China policy

On August 10, China recalled its Ambassador from Lithuania and asked the Baltic state to reciprocate. The move was Beijing’s response to Lithuania’s plans to establish "The Taiwanese Representative Office in Lithuania." While 18 EU countries already host similar institutions, this would be the first to use “Taiwan” rather than “Taipei” in its official name.

The Chinese authorities criticized the plans stating that Lithuania would effectively be establishing a de-facto Embassy which is in violation of the “One China” policy. The Lithuanian side disagrees, voicing its continued support for the policy, while reserving the right to develop relations with Taiwan – which would also mean them opening a representative office on the island. The European External Action Service spokesperson cautiously supported Lithuania’s position but described the issue as a bilateral matter. Vilnius also received support from 13 chairs of Foreign Affairs Committees including that of the European Parliament. The chairs encouraged the Lithuanian government to maintain the current course.

The Beijing-backed Global Times ran a series of articles calling Lithuania a country that “has gone the furthest on the anti-China path in Europe” to attract the US’ favor and called for China, Russia and Belarus to jointly “punish” the Baltic state. According to Lithuanian media, direct freight train connections between China and Lithuania could get unofficially halted and China suspended the export approval of Lithuanian food products without a formal notice.

MERICS take: The intensification of relations with Taiwan is part of a wider foreign policy pursued by Lithuania. Since the current government took power in October 2020, the country has adopted a more assertive approach towards Beijing in a values-based security gambit. Earlier this year Lithuania decided to quit the 17+1 framework altogether over its alleged inefficiency and negative impact on European unity, and the Lithuanian Sejmas labelled Beijing’s activity in Xinjiang a genocide.

Given the challenge posed by its Russian neighbor, the country’s security is reliant on a continued commitment of its larger allies to a democratic, rules-based system. Symbolic gestures of standing up for democratic values allows Lithuania to amplify its voice in Washington, but also in Brussels, as the Lithuanian authorities are pushing the EU to revisit the idea of the 27+1 format.

The economic costs remain limited, as Chinese investments in the country were estimated at around EUR 82 million at the end of 2020 while the China-Lithuania freight train line has only been operating for a year without achieving significant volumes. Embracing greater relations with Taiwan may allow to offset such financial costs.

What to watch: Other Baltic and Central and Eastern European capitals will likely be watching the efficacy and price of Lithuania’s foreign policy gambit. However, other capitals and Brussels should also take note of China’s semi-official modus operandi in deploying or threatening to deploy economic coercion without official statements.

The case of Lithuania may be a particular one given their limited economic ties with China and Beijing’s perception of disparity of power in relations with Vilnius. However, the European policymakers should take note of how China responds to an EU member state government’s challenge to one of Beijing’s “red lines.” Lithuania’s case should be taken into consideration while drafting the EU anti-coercion instrument to make sure it can respond to Beijing’s semi-official strong-arm activity.

Read more:

- SCMP: China recalls envoy to Lithuania over Taiwan’s move to open de facto embassy

- Ministry of Foreign Affairs of the PRC: Statement on China’s Decision to Recall Its Ambassador to Lithuania

- Global Times: China, Russia can cooperate to punish Lithuania

- Delfi.lt [LT]: China cancels August and September trains to Lithuania

- CHOICE: What’s Behind Poland’s Sudden Change of Heart About China?

- MERICS: The future of 17+1 after Lithuania’s departure

German Frigate’s mission shows the limits of Berlin’s Indo-Pacific strategy

On July 26, the German frigate Bavaria left Germany’s shores at Wilhelmshaven to begin the country’s first Indo-Pacific mission in 20 years. The trip will take her through the Horn of Africa, Singapore, Japan, South Korea and Australia. On the return voyage, Bavaria will sail through the South China Sea to potentially make a stop in a Shanghai – should Beijing allow it. When crossing the South China Sea, the ship will not go through the contested 12 nautical miles, nor the Strait of Taiwan. Unlike French and British ships, the German vessel will not take part in any Freedom of Navigation Operation (FONOP), shedding doubts on the future participation of Germany in such exercises.

The frigate Bavaria is the last of five vessels to have left Europe in an attempt to increase European presence in the region and pursue their Indo-Pacific strategies. The German strategy is concerned with peace and security, deepening regional relations, preserving open ship routes, free trade and protecting the environment. However, the strategy document hardly mentions the People’s Republic of China.

MERICS take: Germany’s deployment of the frigate is an important step to put some weight behind its Indo-Pacific strategy, but it is also an indication of the tensions in Berlin’s China policy. On one hand, the deployment shows Berlin’s commitment to being present in the region after years of neglect and strengthens its ties with regional partners. On the other hand, it falls short in counterbalancing China’s assertiveness in the region. To stay clear of potential controversies with Beijing, the Bavaria will not join allies in FONOP.

Berlin also agreed to hold regular Asia consultations with Beijing and envisioned a stop of the Bavaria in Shanghai to signal that Germany’s Indo-Pacific engagement is not directed at China.

A possible rejection from Beijing of the Bavaria to dock in China may encourage those in Berlin who seek a more assertive China policy. Elections might guarantee more space for such an approach anyways and alter the country’s China policy. Perhaps that is why Beijing is buying time. It is waiting for the election results before deciding whether to accept Germany’s gesture of goodwill.

What to watch: Most important for the mission of the frigate Bavaria is its potential stop in Shanghai, and its route in the South China Sea to provide small clues on future developments of both the German Indo-Pacific strategy and China policy. The mission of the Bavaria will continue under the new German government, and potential new missions may be launched, making developments even more relevant not only for Germany but also for the EU. As Brussels works on its own Indo-Pacific strategy, the German position, whatever it will be, will influence the outcome.

Read more:

- German Federal Government: Policy Guidelines for the Indo-Pacific

- The Diplomat: How a German Frigate in the South China Sea May Upend Beijing-Berlin Relations

- European University Institute: The Indo-Pacific concepts of France, Germany and the Netherlands in comparison: implications and challenges for the EU

- Nikkei Asia: German frigate heads to South China Sea; seeks to dock at Shanghai

- SCMP: Beijing to Berlin: clarify warship’s intentions in South China Sea or forget Shanghai visit

- Rhodium Group: Berlin and Beijing: German China Policy After Merkel

Short takes

Cosco green-lighted to increase ownership of Piraeus port to 67 percent

The Greek Court of Audit decided to give Cosco the possibility to increase its current 51 percent ownership. The Greek state retains the right to veto strategic decisions. A related bill will soon be submitted to the Parliament.

Renault seeks to reenter China through joint venture with China’s Geely

The JV seeks to sell petrol-electric cars on the Chinese market produced using Geely’s tech, supply chains and manufacturing combined with Renault’s sales and marketing.

Ericsson won 3 percent share in 5G radio equipment tender by China Telecom and China Unicom

Ericsson’s share in China Mobile equipment still decreased to 2 percent from 11 percent a year ago. Nokia has not received any shares in the tender.

Chinese vaccines increasingly recognized as a valid proof of immunity for travel in EU

EU countries that recognize Sinopharm: Austria, Cyprus, Greece, Hungary, Malta, Spain and Sweden.

EU countries that recognize Sinovac: Austria, Cyprus, Finland, Greece, Netherlands, Spain and Sweden.

- Schengen Visa Info: EU Travel: Covishield, Sinopharm & Sinovac Vaccines Are Most Widely Accepted by EU Countries After Those Authorized by EMA

Swiss Embassy calls Chinese state media out on fake news

Wilson Edwards, a made-up Swiss biologist, was quoted in articles describing alleged US efforts to politicize WHO’s work. The referenced Chinese state media articles were deleted after complaints by Swiss Embassy that the man didn’t exist.