EU-US Trade and Technology Council + Sanctions + EUCCC survey

Story of the month: EU-US Trade and Technology Council will be a litmus test for transatlantic coordination on China

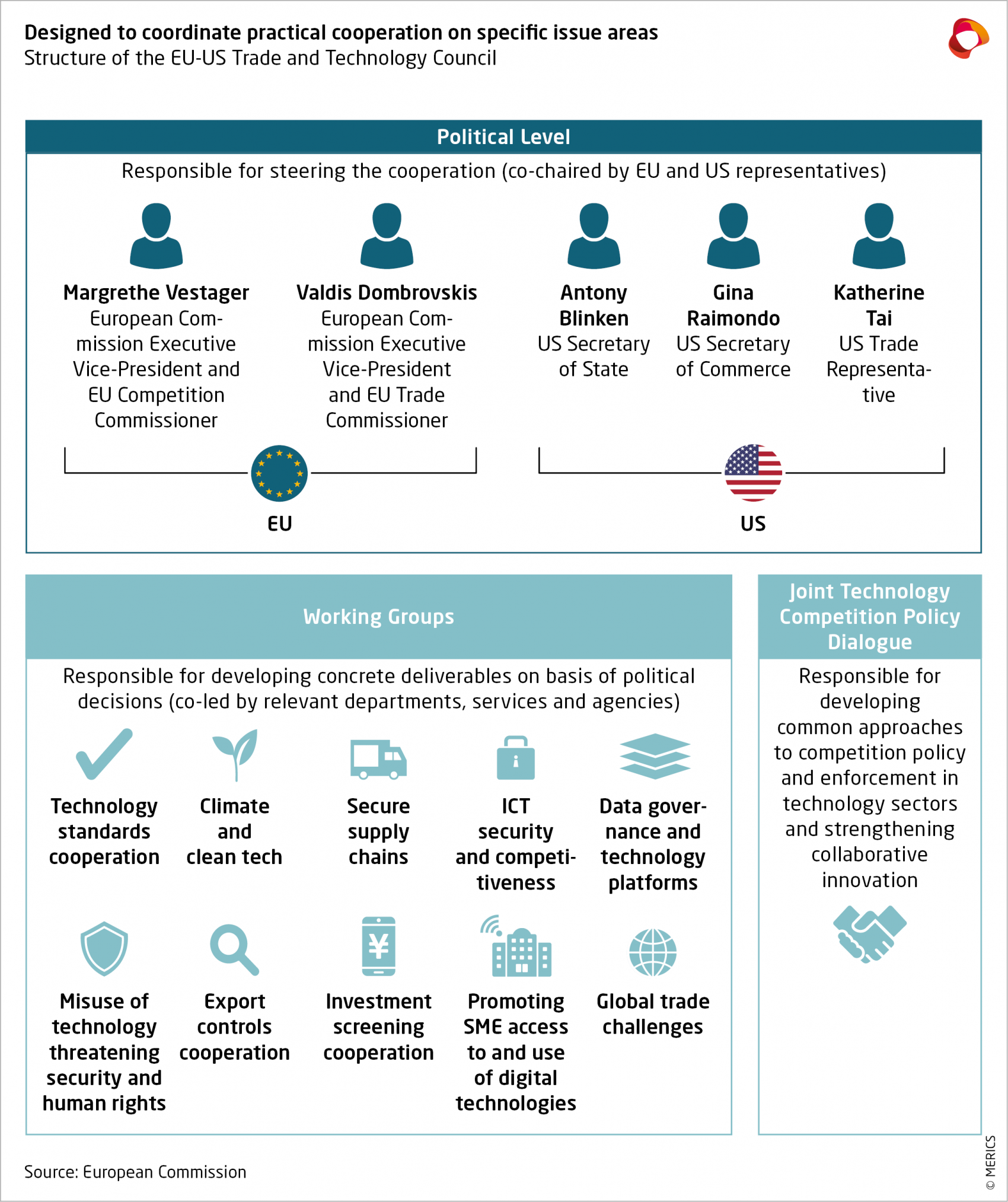

The EU-US summit held in June signaled the transatlantic partners’ ambition to reinvigorate their cooperation – including on issues pertaining to China. The two sides explicitly noted plans to “closely consult and cooperate on the full range of issues in the framework of our respective similar multi-faceted approaches to China”. However, it is the technical Trade and Technology Council (TTC) that may prove to be the most efficient channel for developing common responses to systemic challenges posed by China.

Initially proposed by the European Council in December 2020, the TTC will cover a plethora of issues that will shape the future of global economic and digital governance, from technical standards and collaborative innovation to the security of information and communications technologies.

Supply-chain resilience and technology protection are ripe for cooperation

Among the stated priorities is the security and resilience of supply chains, especially semiconductors. Following the Covid-19 pandemic, discussions about strategic vulnerabilities arising from economic interdependencies with China have gained momentum, with both Brussels and Washington conducting critical supply chain reviews. This is not merely a China issue: Strengthening the innovation and industrial base and building resilience are priorities shared across the Atlantic. However, Beijing’s plans to absorb global value chains and dominate a wide range of sectors and technologies have added urgency. Through the TTC, the two sides could ensure that their efforts to diversify supply chains reinforce each other, rather than creating duplicative or conflicting investments.

Technology protection is another area that presents opportunities for cooperation, given shared concerns about China’s technology transfer programs. The TTC could facilitate the creation of a cooperation mechanism between the Committee on Foreign Investment in the United States (CFIUS) and the EU-wide investment screening regime, which became operational last October. The Council will also work on export controls, where new technologies are pushing the boundaries of policy in terms of approaches, methods and purposes. Meanwhile, the related work stream tackling the “misuse of technology threatening security and human rights” could foster common approaches towards Beijing’s military-civil fusion strategy and tech-enhanced surveillance programs.

TTC could prompt the EU to sharpen its approach to economic security

The new format is no panacea for tackling China-related challenges at the intersection of technology, economics and security. However, it may be useful in aligning approaches – not just across the Atlantic but also within the EU. Member states still have wide-ranging views when it comes to economic and technological security. Through processes such as the investment screening mechanism, the development of risk mitigating measures for 5G security, and a proposed new instrument for deterring and countering economic coercion, Brussels has already pushed national governments to think more strategically about the blurring of boundaries between geopolitics and economics. But the bloc has yet to reach consensus about the geopolitics of technological competition, as well as the structures and actions required to navigate them. By bringing related issues to the top of the agenda of an institutionalized transatlantic format, the TTC could stimulate the EU to intensify internal convergence.

The EU side has more appetite for issue-based cooperation on China

A key constraint for transatlantic cooperation on China remains the divergence on how political the two sides would want it to be. While Washington is keen to alienate Beijing by solidifying a camp of free market democracies through joint political actions, Brussels leans towards using technical, country-neutral instruments to address China-related concerns. The TTC offers a chance for both sides to bring the development of joint responses to challenges posed by China to a practical level, thereby depoliticizing the discussion and diffusing the reservations of Brussels and other European capitals. The TTC would address China within the context of wider challenges, without necessarily pointing the finger at Beijing.

Technical nature means TTC needs to deliver to succeed

The TTC stands to benefit from the political momentum currently existing on both sides of the Atlantic. However, its success will depend on the EU’s and the US’ ability to sustain that momentum and translate it into concrete deliverables. Memory of the failed Transatlantic Trade and Investment Partnership, a comprehensive EU-US trade agreement that fell apart after fifteen rounds of negotiations following the change of administration in the United States, will likely be a cautionary tale for the EU. The TTC will be under pressure to deliver in a relatively short time frame.

The TTC’s ability to deliver will also be a litmus test allowing Brussels to see whether Washington’s interest in transatlantic tech and trade agenda is indeed constructive and affirmative, or if it is merely an extension of its China policy. That was, for instance, the case with the Trump administration’s Clean Network initiative, which reduced the complex task of securing networks to keeping “critical data and our networks safe from the Chinese Communist Party”.

A democratic digital agenda will have to be global in scope

Another challenge for the new Council will likely lie in its ability to deliver on a democratic and value-based vision for digital governance. The Commission was keen to include that as a major goal of transatlantic cooperation. As China promotes its own rules and norms for digital transformation and Internet governance, ensuring that the values democracies uphold are reflected in the technologies and platforms their companies design and control is a growing priority. To tackle this, the TTC will embark on the ambitious task of bridging the transatlantic divide on data governance and online platform regulation.

At the same time, the new format’s announcement stopped short of mentioning how the two sides plan to leverage their renewed digital partnership in support of innovation, connectivity and digital rights in the Global South. This line of effort would be critical to compete with China, given Chinese tech companies’ inroads into developing and emerging markets through the Belt and Road Initiative.

At this stage, the TTC seems to be primarily focused on nurturing a competitive transatlantic tech space and overcoming divisions on the digital rulebook – both important and complex tasks. Further down the line, it will be key to watch how the Council engages other partners and organizations.

Read more:

- European Commission: EU-US: A new transatlantic agenda for global change

- European Commission: EU-US launch Trade and Technology Council to lead values-based global digital transformation

- The White House: Towards a Renewed Transatlantic Partnership

- SCMP: EU, US launch trade, technology council to outcompete China

- MERICS: EU-US summit initiatives strengthen prospects for transatlantic China coordination

China and the EU on a path to intensify trade of international sanctions

China passed its Anti-Foreign Sanctions Law in June, with broad obligations for firms and individuals not to take part in any “undue” sanctions on China, and a blurry exemption mechanism. In addition, the recent arrests of Hong Kong journalists show that China intends to use its National Security Law to silence domestic calls for international sanctions against it.

The European Commission is due to propose two instruments this year that are likely to interact with the new Chinese law. A due diligence instrument will oblige importers to meet sustainable development standards throughout their supply chains, including the requirement that there should be no link to forced labor. An anti-coercion tool will enable collective countersanctions to foreign actions that aim to coerce European public authorities to alter a sovereign decision. Options are wide-ranging for this innovative tool. It is set to include both a negotiation period for de-escalation and teeth if no settlement is found, said the head of the Directorate-General Trade at a recent event.

MERICS take: A world enmeshed with cross-sanctions seems to be emerging. The Biden administration is proactively using sanctions as a key part of its value-based foreign policy. China responded by pushing back on what it describes as Western interferences geared at curbing its development.

The EU has also signaled willingness to act on human rights internationally. Having passed the Global Human Rights Sanctions Regime last year, Europeans have introduced sanctions on China, Myanmar, Russia and Belarus. The German Minister of Foreign Affairs even called for unanimity among member states to be scrapped in order to facilitate such actions. Export controls related to human rights were broadened to cover information technologies products, while a proposition was made to ban artificial intelligence associated with problematic human rights issues from the EU.

Beefed up human rights and anti-sanctions instruments could create a downward spiral. Indeed, China could sanction EU firms that negatively impact a Chinese firm by abiding by one of those EU regulations, be it export controls or human rights due diligence. The EU could then answer with its anti-coercion instrument, and hence spark another round of Chinese sanctions, and so on.

What to watch: Fierce negotiations in Brussels are ongoing and are yet to decide the magnitude of the new tools. The treatment of retaliatory measures on the EU’s human rights actions will be of particular interest in terms of the anti-coercion instrument. On the due diligence obligations, the penalties for breaches will be the deciding factor. Alliance building among G7 like-minded partners will be followed closely, particularly on the Chinese side. As for new Chinese legislation, recent US sanctions and the possible consequences of the arrests in Hong Kong provide a good indication of the use and scope of the instrument.

Read more:

- MERICS: China’s Anti-Foreign Sanctions Law: A warning to the world

- Reuters: HK's Apple Daily raided by 500 officers over national security law

- Politico: Europe Inc. puts Brussels new business rules on ice

- European Parliament: Resolution of 10 March 2021 with recommendations to the Commission on corporate due diligence and corporate accountability

- SCMP: G7 singles out China, calls for renewed Covid-19 origin search and respect for rights in Hong Kong, Xinjiang

- Reuters: U.S. bans imports of solar panel material from Chinese company

As political tensions test Sino-European relations, EU companies are doubling down on China

The annual European Chamber of Commerce in China’s (EUCCC) Business Confidence Survey released on June 9 revealed that, despite increased politization of economic relations, businesses are set on deepening their exposure to the Chinese market. According to the survey, only nine percent of respondents intend to shift investments to other markets, while 59 percent plan to expand their current operations. This marks one of the most optimistic investment outlooks since at least 2014.

The tit-for-tat sanctions in March in relation to Xinjiang, the stalled ratification of the Comprehensive Investment Agreement, the passing of the Supply Chain Ethics Law in Germany, and China enacting the Anti-Sanctions Law, to name a few, seem to have had no impact on investment decisions.

MERICS take: The EUCCC’s survey was conducted in February 2021, preceding the recent escalation of political tensions. However, even if it had been conducted more recently, it seems unlikely the investment sentiment of European businesses would have changed significantly. The trend is confirmed by data on foreign direct investment published by China’s Ministry of Commerce: investment from EU businesses was up by 16.8 percent in the first five months of 2021 year on year. Should EU investment continue to expand over the coming months, it would indicate that companies judge the economic opportunity to be higher than the political risk.

Companies remain buoyant about China’s economic prospects as it emerges from the pandemic induced slump ahead of the rest of the world. Investments also reflect an ongoing shift towards increased localization of operations serving the Chinese market.

But corporate strategy departments will be busy assessing the relevant risk exposure of their long-term investments in a rapidly shifting political landscape. Prospects of improving political relations seem low. As a result, it will become increasingly difficult for foreign companies to navigate conflicting regulations from China, the EU and the United States.

What to watch: Sino-European relations are testing the viability of hot economics and cold politics. This shift brings the risk of political miscalculations and subsequent escalations. Apart from minor warning shots, such as public calls for boycotts of H&M or Adidas following their announcement that they would no longer source cotton from Xinjiang, economic relations have been resilient. But companies will need to consider their risk exposure to being targeted by boycotts or bans, similar to those experienced by South Korean retailer Lotte or Australian commodity exporters. With more legislation potentially affecting relations with China in the EU policy pipeline, companies are likely to up their lobbying activities in Brussels and member states capitals.

Read more:

NATO declares China is a “systemic challenge”, but transatlantic consensus on what to do about it remains far off

In a show of transatlantic unity, NATO leaders have for the first time declared that China presents “systemic challenges to the rules-based international order” and to the security of the Alliance. This year’s summit communique, released on June 14, expressed concerns about China’s military modernization, its threats to the Alliance’s values, and Sino-Russian military cooperation. Coming just a day after the G7 summit, the difference in tone was stark, with NATO taking a much stronger stance on China. This does not constitute a move away from NATO’s traditional focus on Russia, but the communique is proof of a new consensus among allies that they can no longer afford to ignore China.

MERICS take: This newfound consensus among NATO allies is less solid than it seems. The United States and Europe may have managed to find common language on their shared view of the challenge China presents, but agreement on further steps will be harder reach.

Allies disagree over what exactly should be done about Beijing’s ambitions, and even about whether it should be NATO’s role to do so. This is the case across the Atlantic, but also within Europe. Not all European NATO members see China as a pressing security threat. And even among those that do, some are reluctant to discuss the issue within the NATO framework or to appear to be siding with the United States. In a clear example of this, French President Macron told the press just minutes after the communique was released that “the issue of our relationship with China isn’t just a military issue”, so “we should avoid distracting NATO”.

Another point of friction is the Alliance’s relative focus on Russia versus China. In some European countries, especially in Central and Eastern Europe, Russia is still seen as the primary security threat. Recent decisions by Biden not to impose sanctions on Nord Stream 2 and to meet with Russian President Putin right after the NATO summit will have made many in the region nervous that Washington may abandon its strategic focus on Russia for a new prioritization of the Indo-Pacific and China.

What to watch: NATO will now focus on developing a new Strategic Concept – the first in over ten years – to be endorsed at the 2022 leaders’ summit. In spite of the sense of renewed transatlantic cooperation under Biden, the next few months are likely to see increased tensions as members work to formulate the future security tasks of the Alliance. China is bound to be included, but it is still unclear to what extent. Reaching a true working consensus on the nature of the challenges posed by China and how to go about them is likely to be a slow and painful process.

Read more:

- NATO: Brussels Summit Communiqué

- Politico: NATO leaders see rising threats from China, but not eye to eye with each other

- Ministry of Foreign Affairs of Poland: Minister Zbigniew Rau's interview to Rzeczpospolita

- Global Times: Chinese, Russian envoys meet after Putin-Biden summit

- NBC News: Full transcript of exclusive Putin interview with NBC News before summit with Biden

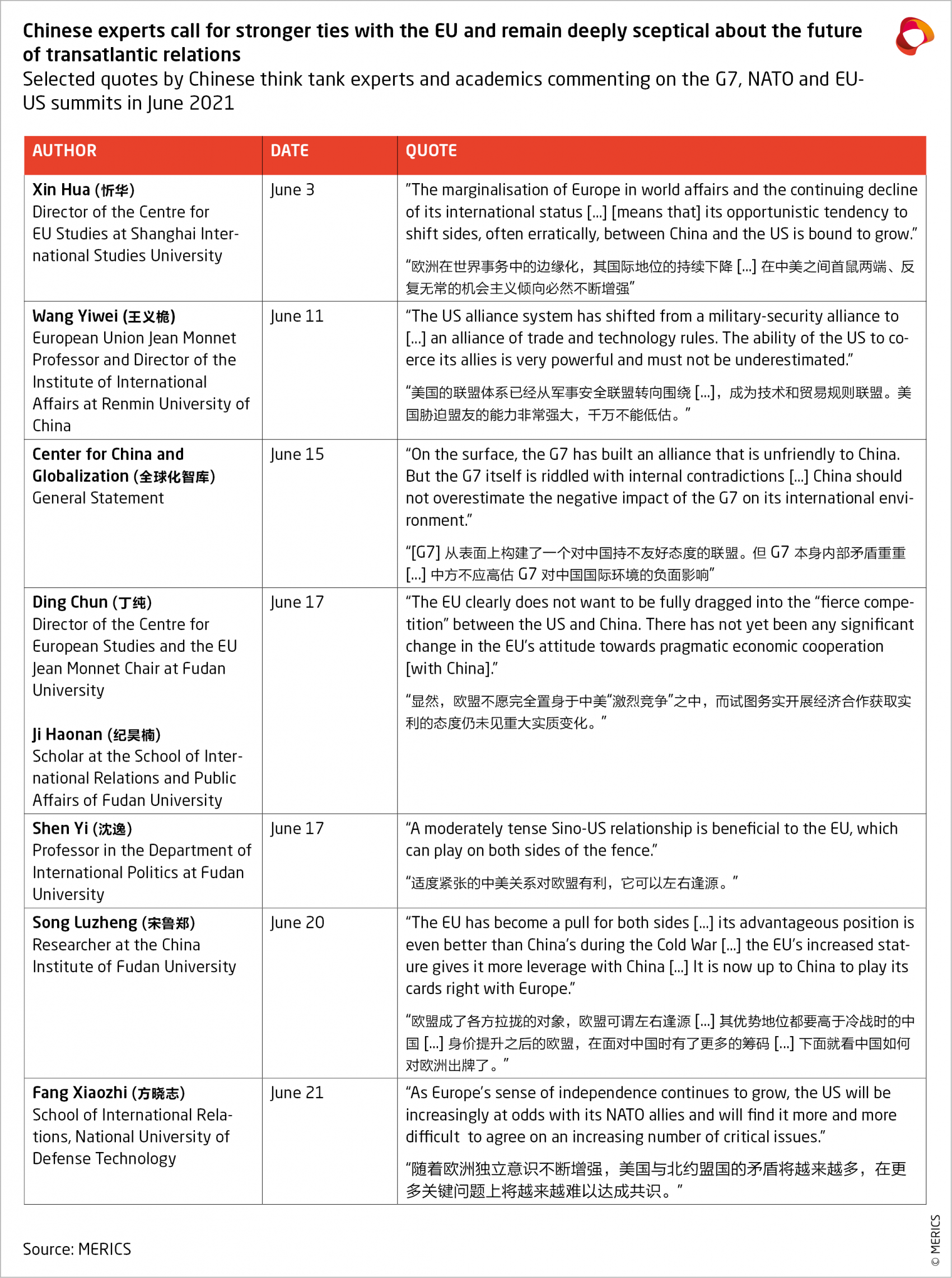

G7, NATO and EU-US summits: Chinese experts call for stronger ties with the EU

While official Chinese statements following the G7, NATO and EU-US summits contained the usual criticisms of the West for its “Cold War mentality”, for forming “small cliques” and engaging in “bloc politics” against China, of greater interest are the many commentaries by Chinese think tanks and academics.

Most hold that pledges made by the G7 are either insufficient when it comes to vaccines for developing countries or will remain unfulfilled when competing with the Belt and Road Initiative. China has the capital, manpower and “institutional advantages” (制度优势) that the G7 lacks, they say. In other words, China can deliver where the West cannot.

The United States is blamed almost entirely for the West’s growing antagonism towards China. As so often, Washington is described as conspiring against Beijing and using democratic alliances as a means of advancing its own strategic interests.

Chinese skepticism about a transatlantic rapprochement

The EU is not only spared such criticism but is lauded for acting as a restraining influence on the summits’ communiqués. Pushbacks by European leaders against the US efforts to solidify a joint, confrontational approach to China are invariably cited as proof of the EU’s desire (and alleged need) to continue engaging with Beijing.

Despite the recent progress in revitalizing transatlantic relations, Chinese experts are focusing most of their attention on the apparent cracks in the EU-US relationship. Most predict that the current rapprochement will not last. As one academic put it, “a reassembled mirror is still a broken mirror, trust cannot be restored overnight”. More importantly, fundamental differences between both sides’ security, economic and political interests are said to be too great to be reconciled. Besides, Washington no longer has the necessary economic clout to “buy” Europe’s allegiance, most argue.

Despite the general optimism and confidence, some fears do occasionally appear in these commentaries. Most prominent among these is the danger of a nascent “anti-China” coalition that could, if successful, pose a security threat to Beijing in the medium term, both militarily by increasing the West’s “interference” in the Asia Pacific, and economically by constricting its trade and investment ties with most developed countries. Another worry is the potential for Brussels and Washington to cooperate more closely on both preserving and setting global standards in multiple fields ranging from trade rules and tech standards to sustainable development and political values.

EU as part of a “tripartite game”

The key to addressing such concerns, most Chinese experts argue, is the EU. For them, the three summits have greatly enhanced Brussels’ position in the US-EU-China “tripartite game”. Their policy recommendations can be summarized as follows: use Europe’s need for growth to deepen economic ties; expand cooperation with the EU wherever possible; reassure Brussels that China does not pose a security threat to Europe; and, most importantly, encourage the development of the EU’s strategic autonomy. No coercive measures were suggested in the 30 or so articles under review.

The Chinese experts’ reactions to the summits suggest that the EU’s non-equidistant approach to navigating Sino-American competition indeed has the potential to put Brussels in a better negotiating position with Beijing. However, Chinese authorities’ balance between self-confidence and anxiety over the “US-led democratic plot to contain China” makes communication channels, already strained by the exchange of sanctions, even harder to navigate.

Should Beijing follow the suggestion of its experts to respond to the transatlantic rapprochement by courting the EU, this may provide an opening to re-engage on constructive aspects of the EU-China relationship – for instance, reopening discussions on the EU-China 2025 Strategic Agenda for Cooperation. However, European capitals need to remain clear-eyed about the fact that, for Beijing, EU-China relations are primarily a piece of the Sino-American competition puzzle.

Read more:

- Global Times op-ed by Xin Hua [CN]: Europe has to rely on itself to reverse its marginalisation in world affairs (Quote 1)

- Global Times op-ed by Wang Yiwei [CN]: The US's ability to fool its allies should not be underestimated (Quote 2)

- Center for China and Globalization (CCG) [CN]: In the face of collective pressure by the G7, China should continue to maintain its strategic determination (Quote 3)

- Global Times op-ed by Ding Chun and Ji Haonan [CN]: At such a delicate time, China and the EU need to move in the same direction (Quote 4)

- Observer op-ed by Shen Yi [CN]: America's G7 'democracy jihad': pretending to enjoy it, but the reality is empty (Quote 5)

- Observer op-ed by Song Luzheng [CN]: Europe is the winner of Biden's first official visit (Quote 6)

- PLA Daily op-ed by Fang Xiaozhi [CN]: NATO allies give the US a hammer blow (Quote 7)