ICT infrastructure + IPR enforcement + Battery innovation

MERICS' Top 5

1. Rapid rollout of ICT infrastructure to support industrial upgrading

At a glance: The Ministry of Industry and Information Technology (MIIT) released a 14th Five-Year Plan (FYP) for the information and communication technology (ICT) industry. Over the coming years, authorities envisage the establishment of a ubiquitous, high speed digital infrastructure. The government has set ambitious targets for 2025, taking 2020 as the baseline year, such as:

- Grow accumulated investment in ICT infrastructure from CNY 2.5 trillion to CNY 3.7 trillion

- Increase 5G user penetration from 15 to 56 percent

- Boost the number of 5G base towers per 10,000 people from 5 to 26

- Expand data center computing power from 90 to 300 ExaFLOPS (computer performance measure)

MERICS comment: The plan reflects China’s ambition to become a “cyber superpower” and emphasizes the deployment of new generation communications network infrastructure, such as 5G, gigabit fiber optic networks, IPv6, Internet of Things (IoT), etc. On November 20, Vice Premier Liu He reaffirmed the importance of digitalization for the country’s industrial modernization. Policymakers intend to leverage China’s current technological advantage in 5G through its application in manufacturing and an accelerated expansion of the Industrial Internet. This can be seen, for example, in the MIIT’s promotion of such 5G application scenarios.

Investment in digital infrastructure has been stepped up since early 2020 to offset the economic impact of Covid-19. According to an MIIT spokesperson, so far China has installed more than 1.15 million 5G base towers, accounting for over 70 percent of the world’s total. Should stimulus be required in the months ahead to counter a slowdown in growth, it is likely the rollout of digital infrastructure will be further sped up to increase productivity across the economy.

Clear government backing and a common regulatory structure are significant advantages in the development of China’s digital ecosystem. Early adoption of new technologies like 5G and IoT systems enhances the international competitiveness of local companies and increases the incentive for foreign firms to be in China and develop emerging tech there. This poses a challenge for Europe. A lag in the uptake of digital infrastructure could undermine its attractiveness as a testing and production base for emerging technologies.

(工业和信息化部关于印发“十四五”信息通信行业发展规划的通知) (Link)

Issuing body: MIIT

Date: November 16, 2021

2. Focus on high-quality patents and stricter IPR enforcement to stimulate Chinese innovation

At a glance: The State Council issued the 14th FYP on the protection and utilization of intellectual property rights (IPR). The plan builds on the recently released high-level guidelines for IPR development over the next 15 years. It outlines the need for further legislation to strengthen the enforcement of IPR. Notable targets for 2025 include:

- Increase the number of high-value invention patents from 6.3 to 12 per 10,000 people

- Strengthen IP royalty trade from CNY 319.4 billion to CNY 350 billion

- More than double overseas patents from 40,000 to 90,000

- Settle 85 percent of IPR civil cases at the initial level where the case is submitted

MERICS comment: China is the world’s leading manufacturing hub, yet much of the technology underpinning those manufacturing processes is owned by non-Chinese firms. Policymakers aim to reform the IPR system to boost local tech capabilities and increase the share of high value-added production captured by Chinese firms. On the one hand, this includes state aid for high-quality patents through awards and grants. Strategic emerging sectors such as AI, blockchain or green technology are singled out by policymakers because these are general purpose technologies that can be applied in different sectors. On the other hand, authorities are gradually improving IPR enforcement and related legislation, including the protection of trade secrets. While these changes are intended primarily to support Chinese companies, they also benefit foreign firms and enhance China’s attractiveness as a destination to conduct R&D.

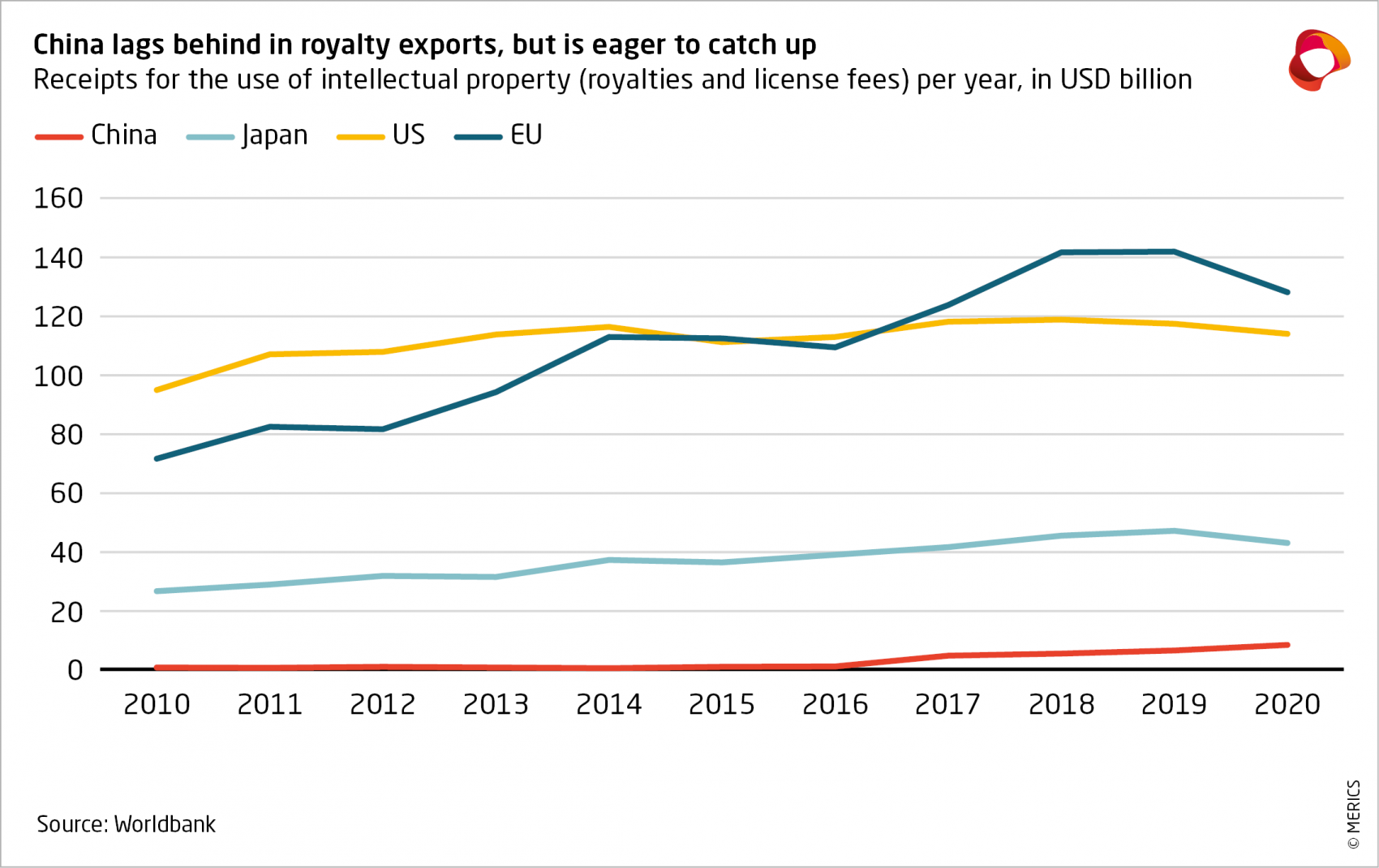

The plan’s target for royalty trade signals that Chinese firms will further embed themselves in global IP markets. While China will remain a net importer of IP for now, receipts from the sale of standard essential patents (SEPs) are steadily picking up, albeit from a low base (see exhibit). This presents opportunities for foreign firms: China will likely continue to purchase overseas IP and stay part of the current global IP regime. But there are risks, too, as Chinese firms establish SEPs and increase competition in high value-added segments of global value chains.

Policy name: 14th Five-Year Plan for National Intellectual Property Protection and Utilization (国务院关于印发“十四五”国家知识产权保护和运用规划的通知) (Link)

Issuing body: State Council

Date: October 28, 2021

3. MIIT pushes battery makers to double down on innovation

At a glance: MIIT released a draft regulation regarding China’s lithium-ion battery industry. The document sets out non-binding guidelines for lithium-ion battery producers and establishes restrictions on new battery plants. The draft measures propose officials should:

- Curb new manufacturing projects that simply expand production capacity

- Encourage companies to enhance technological innovation and improve battery quality, by spending at least three percent of revenue on R&D and focusing on invention patents

- Ensure that lithium-ion batteries meet technical requirements, such as specifications on energy density, life cycle and capacity retention rate

MERICS comment: The production of lithium-ion batteries is a key sector for China, located at the intersection of greening and industrial upgrading. China now holds the biggest market share in automotive battery production, allowing it to capture a large part of the value-added in the electric vehicle supply chain through its dominance in this critical technology. But batteries also have other uses, including supporting the global renewable energy expansion. Chinese companies like CATL, which recently announced breakthroughs in sodium-ion batteries, are working at the cutting-edge of battery technology. Despite these successes, central authorities are seemingly concerned that the strength of Chinese suppliers may result in overcapacity and eventual complacency in developing the latest battery technology.

The measures push for more innovation and improvements in the quality of the domestic battery industry, as a response to increased global competition. Battery technology is far from mature and technological breakthroughs could still upheave the commercial landscape. Startups like Volkswagen-backed Quantumscape intend to leapfrog competitors with solid-state batteries. These promise higher energy densities and could allow foreign carmakers to diversify their suppliers. In the past, Chinese firms might have bought these startups, as Wanxiang did with bankrupt US battery maker A123 in 2012. But increasing scrutiny of overseas Chinese investment in strategic sectors makes this more difficult. Another concern for Chinese authorities may be that other advanced economies are beginning to pool resources to develop alternatives to Chinese suppliers. The EU’s European Battery Alliance, for instance, combines public and private money to promote research and innovation along the entire value chain.

Policy name: Lithium-ion Battery Industry Regulatory Conditions (2021) (Draft for Comment)

(锂离子电池行业规范条件(2021年本)(征求意见稿)) (Link)

Issuing body: MIIT

Date: November 18, 2021

4. China eyes moving up the value chain in drug ingredients

At a glance: The National Development and Reform Commission (NDRC) and MIIT released an implementation plan for the active pharmaceutical ingredient (API) industry. Targets for 2025 include:

- Develop high value-added and high-growth APIs

- Foster several internationally competitive API companies

- Cultivate new advantages in international competition, for instance by increasing the scale and concentration of production

- Enhance the resilience of China’s API supply chain system

Attached to the policy are examples of specific technologies, including advanced manufacturing technology, to promote industrial upgrading and innovation.

MERICS comment: China’s leading position in the production of many APIs is at risk. India, the United States and the EU have initiated supply chain reviews and, to varying degrees, proposed diversifying their API supply chains away from China. This is not only related to the Covid-19 pandemic, but also part of a bigger trend to strengthen resilience and industrial production in these economies. To make Chinese API suppliers more attractive and cement their position in the global pharmaceutical supply chain, China intends to cultivate new advantages. For instance, by improving production efficiency through increasing economies of scale and improving production technologies.

But that’s not all. So far China has primarily produced low-value, generic APIs. To cater to the increasing global demand for advanced medicines, which will only rise as China’s own population ages, and to strengthen China’s own supply chain security of pharmaceuticals, the government plans to establish production centers for high-end APIs.

The plan offers an opportunity for certain European firms. To attract high value-added production of APIs and related high-tech equipment, China may roll out the “red-carpet”. Companies engaged in the production of high-end APIs and equipment could benefit from streamlined approval processes and licenses to set up wholly foreign-owned entities. However, it also means that European firms that are unable or unwilling to produce in China will face more competition from Chinese firms that move up the value chain.

Policy name: Implementation Plan to Promote the High-Quality Development of the API Industry (关于推动原料药产业高质量发展实施方案的通知)(Link)

Issuing bodies: NDRC, MIIT

Date: November 9, 2021

5. Draft regulations for cross-border data transfers expand government oversight

At a glance: The Cybersecurity Administration of China (CAC) released a draft of security assessment guidelines for cross-border data transfers. According to the measures, in many cases companies that process data gathered in China must evaluate the risks of transferring the data abroad and receive approval from central authorities before exporting data. The draft:

- Clarifies under which circumstances data handlers need to conduct a security self-assessment, for example when the transfer involves “important data” or the personal information of over 1 million people

- Specifies that data transfer assessments should be completed within 45 days under normal circumstances

- Requires data transfer requests to be reassessed every two years

MERICS comment: The Cybersecurity Law, effective since 2017, states that critical information infrastructure operators must undergo a security assessment when exporting data abroad. The draft measures indicate that the scope for supervision of such transfers will be vastly expanded. In their current form, the guidelines effectively grant the CAC full oversight and decision-making power over all cross-border data transfers. With data viewed as a matter of national security, it can be expected that Chinese authorities will gradually increase restrictions on data sharing. For example, in November access to shipping location data along China’s coast was drastically reduced for foreign shipping companies.

But Chinese officials cannot be too strict on data exports, otherwise they risk cutting China off from the global economy. Data transfers are essential for the standard business operations of multinational companies. Applications for data transfers in non-strategic industries, such as consumer goods, are likely to be approved without issue. Foreign enterprises deemed of high importance for China’s development goals could receive preferential treatment in their applications.

In any case, the additional regulatory burden will increase costs for affected firms and could discourage data transfers between local operations and international headquarters. Localization of data processing and storing will generate separate digital ecosystems, one within and one outside of China. Such limitations could reduce China’s attractiveness as a manufacturing base and weaken the benefits of R&D cooperation for foreign firms in China.

Policy name: Measures for Data Export Security Evaluation (Draft for Comments) (国家互联网信息办公室关于《数据出境安全评估办法(征求意见稿)》公开征求意见的通知) (Link)

Issuing body: CAC

Date: October 29, 2021

Worth Noting

Policy news

- November 3: NDRC releases an implementation plan for upgrading coal-fired power plants, setting minimum efficiency standards to reduce coal consumption (NDRC notice (CN))

- November 9: Ten government agencies led by the NDRC issue the 14th FYP for National Clean Production (NDRC notice (CN); Global Times article (EN))

- November 10: The Ministry of Transport (MOT) opens applications to participate in pilot projects related to autonomous driving and smart shipping (MOT notice (CN))

- November 11: MIIT and the National Medical Products Administration launch an initiative to research and develop innovative forms of AI medical care equipment, technologies and products (MIIT notice (CN))

- November 14: CAC issues draft regulations on the administration of cyber data security, setting different protection measures for ordinary, important and core data (CAC notice (CN); Caixin article (EN))

- November 15: The NDRC sets the minimum energy efficiency standards for energy intensive industries such as steel and cement in 2021 (NDRC notice (CN); South China Morning Post article (EN))

- November 22: MOT releases a list of 31 energy-saving and low-carbon technologies in the transport industry to be supported, such as hydrogen fuel cell buses (MOT notice (CN))

- November 23: The Ministry of Commerce issues the 14th FYP on foreign trade, with measures to expand trade in services, green and digital trade (MOFCOM notice (CN); South China Morning Post article (EN))

Corporate news

- November 1: Yahoo ends its presence in China, citing an "increasingly challenging business and legal environment” (Sina article (CN); Reuters article (EN))

- November 3: Tencent announces it is making three computer chips of its own design, namely an AI computing chip, a video processor, and a network interface controller for cloud computing (Sina article (CN); Caixin article (EN))

- November 3: Chinese semiconductor equipment manufacturer, Naura Technology Group, raises CNY 8.5 billion in funds for investments in equipment and R&D through a private placement (Yicai article (EN))

- November 25: Baidu and Pony.ai receive the first licenses to charge passengers for self-driving taxis in Beijing (Sohu article (CN); South China Morning Post article (EN))

- November 26: Public documents reveal that Tesla plans to invest CNY 1.2 billion in revamping the assembly lines of its Shanghai Gigafactory (Gasgoo article (EN))

- November 28: Xiaomi announces plans to set up its EV headquarters and open its first EV factory in Beijing (Beijing E-Town announcement (CN); Reuters article (EN))