“Manufacturing Champions” + Equipment renewal + Mobile Internet of Things

1. “Made in China” flag bearers: MIIT picks a new set of industrial champions

At a glance: The Ministry of Industry and Information Technology (MIIT) issued instructions for the selection and review of “Manufacturing Champions” – a title awarded to firms deemed to be leaders in a particular industrial field. It outlined selection processes for a new round of Manufacturing Champions in 2024, and the review of firms chosen in the third and sixth rounds. The policy includes a series of attachments, such as:

- Details of the company information required of applicants, such as the firm’s economic performance, degree of specialization, the domestic and global market share of key products, innovation capabilities, contribution to resolving weaknesses in the domestic supply chain etc.

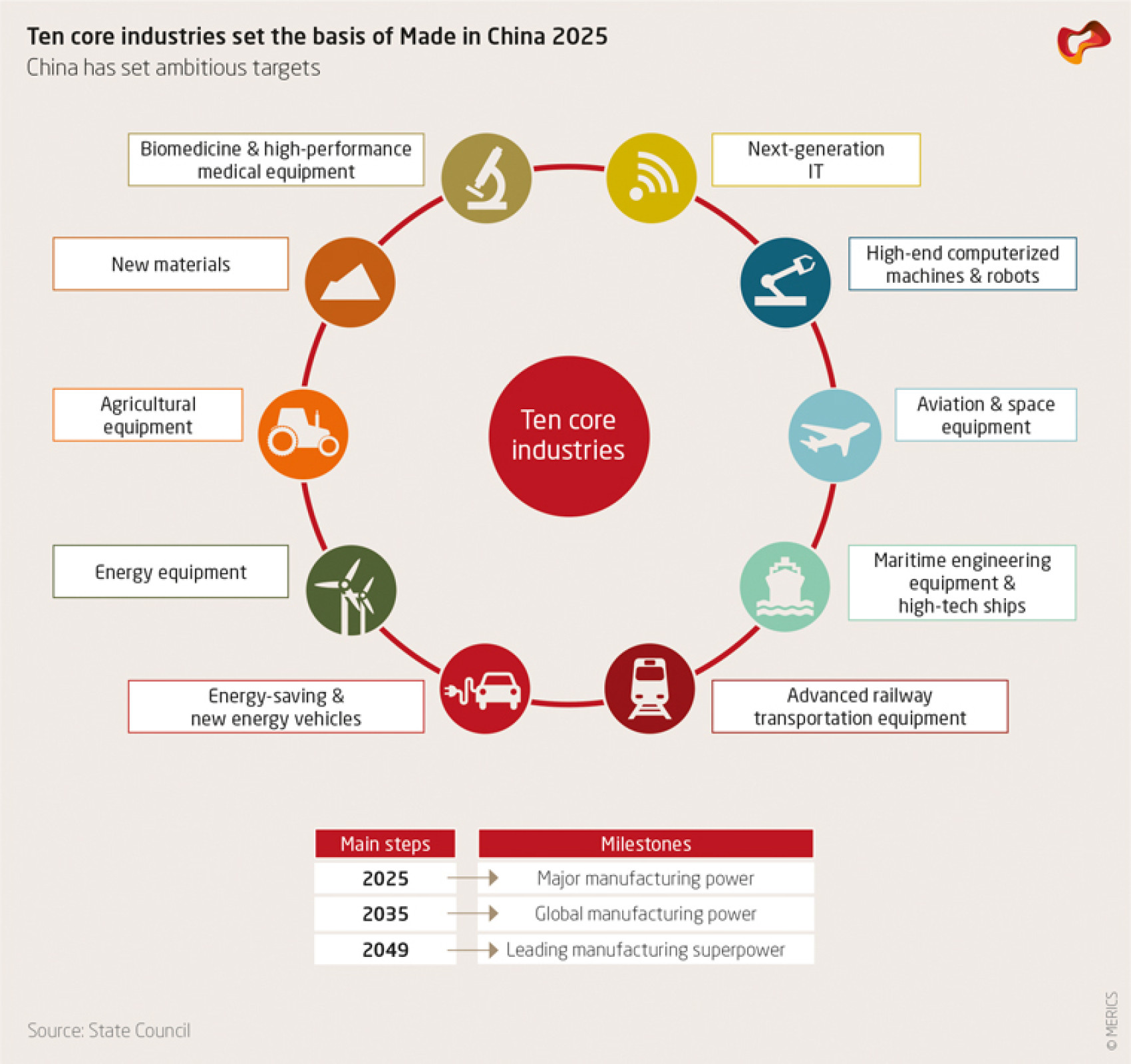

- A list of nine key technology areas and numerous sub-categories for the selection of firms, covering virtually all the key sectors outlined in the Made in China 2025 strategy (see exhibit)

- Quotas for each province and centrally administered city government, stipulating how many firms they can recommend to the central authorities for final selection

MERICS comment: Eight rounds of Manufacturing Champions had been announced since 2016, leading to the selection of 1,557 companies. They get benefits that include preferential policies on land, labor and energy use, support to access loan and equity capital, and support for recruitment, research and development (R&D) activities and international expansion.

The Manufacturing Champions program shows the ongoing implementation of the “Made in China 2025” strategy and China’s self-reliance push. A key objective is to build supply chain security and resilience. The program also shows how China’s leadership is applying competitive forces to industrial policy, to make policy support more targeted. Companies are reassessed every three years and their status may be revoked if they fail to meet the requirements.

The outcome of this year’s selection and review process could impact foreign firms in China as it will boost or limit the performance of their local partners or competitors. Foreign companies wanting to gauge the level of government backing given to local firms in their sector should look at this and similar titles, such as the Little Giant status.

Article: Notice on the Selection of Manufacturing Champions in 2024 and Reevaluation Work (工业和信息化部办公厅关于开展2024年制造业单项冠军企业遴选认定和复核评价工作的通知) (Link)

Issuing body: MIIT

Date: September 4, 2024

2. China promotes more equipment renewal in key industries

At a glance: The MIIT released guidelines on equipment renewal and technological transformation in 27 industrial sectors and four focus areas. The industrial sectors include petrochemicals, automotive, machinery and pharmaceuticals, while the focus areas cover industrial software, industrial internet equipment, green and energy saving equipment, and safety and emergency equipment. Key goals by 2027 include:

- Promote the CNC (computerized numerical control) deployment rate of key processes to ensure it exceeds 85 percent, while the adoption of digital research and development (R&D) and design tools should exceed 75 percent in the petrochemical industry

- Upgrade two million sets of industrial software and 800,000 sets of industrial operating systems to enhance supply chain resilience in sectors such as petrochemicals, automobiles or pharmaceuticals

- Improve production efficiency, quality and environmental protection for automobiles and components, focusing on vehicle stamping, welding, painting, and assembly and parts manufacturing

- Achieve a digital R&D and design tools adoption rate of 90 percent for industrial machine tool enterprises

MERICS comment: The new guidelines with their overarching focus on numerous different sectors and areas show Beijing is sticking to its equipment renewal scheme. Policies in this field in 2024 have included a plan for equipment renewal in key energy sectors, subsidy rules for new energy city buses and power battery renewal, measures for the replacement of old consumer goods, as well as a plan for industrial equipment renewal. The new rules set numerical targets linked to technological transformation and green goals, such as the usage of digital R&D and design tools or high-efficiency and low-emissions production.

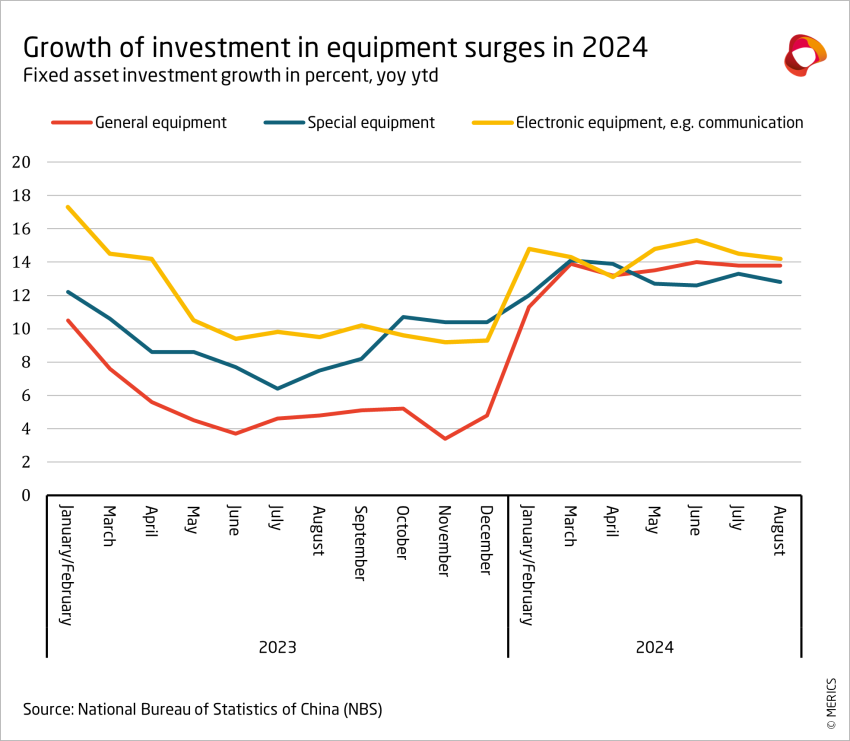

China’s policymakers are doing more than encouraging investment in manufacturing overall. Their focus on industrial upgrading and equipment renewal is generating particularly strong investment growth in equipment sectors (see exhibit). This trend could pose an even more serious and long-term competitive challenge to foreign manufacturers than China’s overcapacity, as its companies are upgrading their production processes along with expanding their output capacity. This investment growth has especially sharp implications for foreign machinery and equipment companies, as growing demand for equipment is likely to benefit Chinese competitors most.

Article: Guidelines for Equipment Renewal and Technological Transformation in Key Industrial Sectors (工业和信息化部办公厅关于印发工业重点行业领域设备更新和技术改造指南的通知) (Link)

Issuing body: MIIT

Date: September 20, 2024

3. A vision for 2027: China to establish a comprehensive mobile IoT ecosystem

At a glance: The MIIT released a notice to expand the application of the mobile Internet of Things (IoT), an information infrastructure that deploys mobile communication technologies and networks for the connection of people and machines, such as home appliances or industrial machines. The notice focuses on the digital upgrading of industry. Key goals by 2027 include:

- Improve the mobile IoT ecosystem, based on 4G and 5G, and make it more intelligent, secure and reliable

- Achieve large-scale RedCap (Reduced Capabilities: a 5G tier with reduced performance and cost) coverage in cities above the county level

- Construct more than five mobile IoT industrial clusters and build more than ten mobile IoT industry demonstration bases

- Cultivate several application fields with 100 million connections and several with 10 million connections

MERICS comment: The mobile IoT exemplifies China’s push to achieve industrial upgrading and productivity growth by leveraging advanced technological solutions. According to government sources, the number of mobile IoT terminals with IPv6 (Internet Protocol version 6) addresses reached 535 million in China in 2023 and the number of mobile IoT connections in China reached almost 2.55 billion in July 2024. State media has reported that in Shanghai smart factories’ production efficiency increased by 50 percent on average, while their operating costs fell 30 percent and energy consumption per unit dropped 13.8 percent.

China’s advanced mobile telecommunications network could prove an advantage in leveraging mobile IoT applications. European companies may want to consider integrating mobile IoT into their production networks in China too, to boost their competitiveness. However, they also need to be aware of possible interoperability issues arising from the US-Chinese decoupling trend in supply chains. To mitigate these geopolitical risks, foreign firms are increasingly pursuing a “dual-systems approach”, creating separate supply chains and digital services for China and the rest of the world.

Article: Notice on Promoting the Development of the Mobile Internet of Things "Intelligent Connection of Everything" (工业和信息化部办公厅关于推进移动物联网“万物智联”发展的通知) (Link)

Issuing body: MIIT

Date: September 12, 2024

4. Beijing seeks to harness synergies in digital and green transitions

At a glance: The Cyberspace Administration of China (CAC) published a strategy for leveraging synergies in the digital and green transformations. The guidelines emphasize using digital technologies such as AI, big data, and cloud computing to advance green initiatives, while also applying green tech to digital hardware and facilities. Key goals of the policy include:

- Promote environmentally friendly, low-carbon digital infrastructure through green data centers, smart energy systems, and low-carbon digital products

- Use digital technologies to enhance environmental and low-carbon performance in sectors such as power generation, transportation, and manufacturing

- Advance internationalization by integrating green standards into global trade and finance

- Encourage cross-sectoral collaboration to develop replicable green solutions

MERICS comment: Documents such as the “2022 Digital Green Synergy White Paper" or the "Green and Low-Carbon Action Plan for the Information and Communications Industry (2022-2025)" show that this idea is not new. Greening and digitalization are both central to China’s vision of development, so creating synergies between them is a logical step.

For European companies active in China, the new guidelines have mixed implications. On the plus side, the government’s efforts to strengthen digital and green services could enhance productivity and reduce the environmental impact of operations. Additional efforts to green the digital tech sector could offer some new opportunities for European suppliers of related technology, given the EU’s stricter environmental regulations and relative strength in green products, such as energy efficient cooling products.

Yet the strategy also presents European firms with risks. Government efforts to leverage digital technology in greening efforts will likely strengthen Chinese firms’ home market advantage among providers of related technologies, such as AI and cloud computing. Leading Chinese tech firms such as Alibaba, Tencent and Baidu have a substantial presence so there will be limited space for foreign companies to provide related services. European companies that choose to incorporate Chinese digital solutions into their operations will also need to carefully manage data security risks.

Article: Implementation Guidelines for the Synergistic Development of the Digital and Green Transformations (Link)

Issuing body: CAC

Date: August 24, 2024

5. Tracking CO2: China introduces carbon footprint certification pilot

At a glance: The State Administration for Market Regulation (SAMR) and three other ministries announced a pilot program for product carbon footprint certification. The pilot will quantify and verify the total greenhouse gas emissions produced over a product’s life cycle. It will cover industries ranging from lithium batteries and photovoltaics to cement and steel. It will run for three years in selected regions with a focus on efforts to:

- Target industries that have significant potential for emissions reductions and strong market demand, and which rely to a significant degree on foreign trade

- Capture industrial chains that are primarily located in one region or province, allowing for the relatively complete collection of supply chain carbon footprint data, with each province expected to run two pilots

- Enhance the availability, reliability and timeliness of carbon footprint data and improve measures to track and steer certification activities

- Align certification outcomes with green financing initiatives

MERICS comment: This pilot goes some way to expanding government oversight of carbon emissions and will facilitate increasing the scope and effectiveness of China’s emission trading system (ETS). The system has been criticized for a lack of data integrity, toothless legislation, and limited market coverage. By year-end, the ETS is expected to be widened to cover the steel, cement and aluminum sectors, expanding coverage to about 60 percent of China’s carbon emissions.

The motivation for the pilot program is twofold. Firstly, Beijing is committed to decarbonization, over the long-term, and eager to maintain its strong manufacturing base in the process. Tracking the effectiveness of different initiatives will be an important part of achieving both goals. Second, Beijing appears eager to maintain access to foreign markets. As of July 1, 2024, EU importers of products that fall under the EU’s Carbon Border Adjustment Mechanism (CBAM) must monitor and report on the actual embedded emissions of imported products. For Chinese officials, it makes sense to strengthen the coverage and reliability of local companies’ data before the pricing of CBAM imports is adjusted based on carbon emissions from 2026 onwards.

Article: Notice on Carrying Out the Pilot Work of Product Carbon Footprint Labeling Certification (市场监管总局等部门关于开展产品碳足迹标识认证试点工作的通知) (Link)

Issuing body: SAMR

Date: September 10, 2024

Noteworthy

Policy news

- August 28: The MIIT announced a program to train at least 800 leading talents in the operation and management of small and medium-sized enterprises (SMEs) by the end of the year (MIIT notice)

- August 29: The Director of the National Data Bureau, Liu Honglie, revealed that so far CNY 43.5 billion has been invested in the “East data, West computing” project – launched in 2022 – to build eight computing hubs (Xinhua article, South China Morning Post article)

- September 2: The MIIT released a draft plan for the digital transformation of light industry, including the upgrading of equipment and processes in sectors such as home appliances, leather, papermaking, hardware products, plastic products, and bicycles (MIIT notice)

- September 4: The MIIT issued criteria for the recognition of Sino-foreign SME cooperation zones, which are intended to boost innovation, cultivate more high-quality SMEs and open up channels to global markets for Chinese SMEs (MIIT notice)

- September 8: The Ministry of Commerce launched a pilot program for opening up market access in the medical field, allowing foreign companies to develop and apply human stem cell and gene diagnosis treatments in certain free trade zones and to establish wholly foreign-owned hospitals in certain cities (MOFCOM notice, MERICS article)

- September 8: The National Development and Reform Commission (NDRC) released the 2024 edition of its negative list for foreign investment access, abolishing the only two remaining restrictions in the manufacturing sector (NDRC notice, MERICS article)

- September 9: The CAC released version 1.0 of the artificial intelligence (AI) safety governance framework, which seeks to reconcile innovation and the development of AI with preventing AI security risks such as data security (CAC notice)

- September 9: The Ministry of Ecology and the Environment (MEE) published a draft plan to gradually add the cement, iron and steel, and electrolytic aluminum industries to China’s national emission trading system, with the first stage (start of implementation) running from 2024-2026 and the second one (deepening and refinement) starting in 2027 (MEE notice)

- September 10: The CAC issued guidelines to regulate the cross-border flow of personal data in the Guangdong-Hong Kong-Macao-Greater Bay Area, outlining how to implement standard contracts between processors and recipients of personal information (CAC guidelines)

- September 14: The MIIT released a notice on cultivating manufacturing pilot platforms by 2027 to promote technological breakthroughs in traditional, new and future industries across 39 different sectors (MIIT notice)

Corporate news

- August 26: IBM announced it will shut down its entire R&D operation in China, impacting over 1,000 jobs; the decision follows declining demand for its hardware and difficulties in expanding within the Chinese market (Reuters article, Caixin article)

- August 27: Reports revealed that Xpeng Motors has developed a powerful AI-driven smart driving chip to achieve L4 autonomous driving, intensifying competition in China’s EV market, where rivals NIO and Li Auto are also advancing chip technology (EET article)

- August 27: Shenzhen Inovance Technology – a Chinese automation equipment and industrial robot core parts maker – announced a CNY 5 billion investment in a new factory for new energy vehicle electrical components (Yicai article)

- September 3: Two publicly listed Chinese state-owned shipbuilders, namely China CSSC Holdings and China Shipbuilding Industry (CSICL), announced plans to merge, aiming to eliminate competition, enhance military support, and address global vessel shortages (Nikkei article)

- September 5: Media reports revealed that Chinese police have detained five current and former AstraZeneca employees for questioning regarding possible illegal activities; AstraZeneca acknowledged the investigation but stated it has no additional information to share (Reuters article)

- September 18: Multiple sources reported that Mercedes-Benz Group has fully exited its Chinese electric vehicle joint venture with BYD, selling its remaining 10 percent stake after offloading most of it in 2021; BYD now fully owns the Denza brand, which develops luxury EVs (Nikkei article)

- September 19: Chinese drugmaker Sinotherapeutics has received approval to market its generic version of AstraZeneca’s Xigduo XR tablet for diabetes, marking the first such authorization in China (Yicai article, BJNews article)

- September 20: The Huawei Mate XT Ultimate Design, the world's first double-folding, triple-screen smartphone, sold out within seconds of its launch (Yicai article)