Pharma industry + BeiDou + Data center hubs

MERICS TOP 5

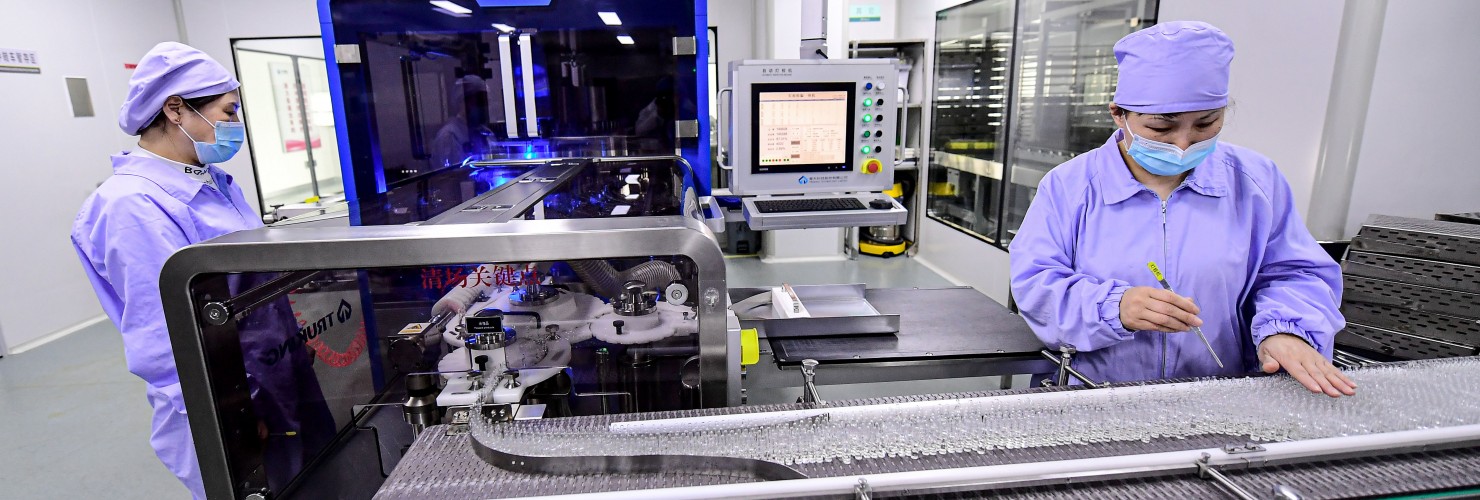

1. Five-year plan pushes for higher value-added production in pharma

At a glance: Nine ministries and agencies released their 14th Five-Year Plan (FYP) for the pharmaceutical industry. The plan aims to make China’s pharma industry more innovation-driven and resilient. Key targets for 2025 listed in the policy include:

- Increase value-added production by five percent annually and become internationally competitive in advanced pharmaceuticals (including medicinal chemistry and biomedicine)

- Encourage innovative drugs to be registered in China first

- Make supply chains more stable and controllable by strengthening access to drugs prone to shortages

- Boost R&D spending and integrate digital technologies like AI and big data into all parts of the pharmaceutical value chain

MERICS comment: The pharmaceutical industry aligns with almost all of Beijing’s key strategic goals, including self-reliance, boosting local innovation, developing emerging industries and moving up the value chain. Yet these priorities are bad news for Chinese consumers in the short-term. For instance, even though Biontech has formed a strategic alliance with Fosun to produce Covid-vaccines in China, Chinese authorities have so far refused to approve the vaccine and only greenlighted less effective, domestically produced vaccines. Equally, this signals bad news for foreign firms in the long run. They will likely lose out on business opportunities as soon as a Chinese rival can offer an adequate alternative.

To achieve the FYP’s targets Beijing needs to strike a balance between conflicting goals. Aside from promoting innovation, Beijing is also pursuing a cost-cutting policy to keep the healthcare budget affordable, primarily through volume-based procurement and the National Reimbursement Drug List. They give the government, the sole buyer, substantial bargaining power and enable it to demand price cuts of up to 90 percent in exchange for market access. Foreign pharmaceutical companies have two strategies: lower prices and focus on volume or enter low-volume, high-profit niche markets. The latter is increasingly pursued by these companies as they are unable or unwilling to lower prices further. Overall, cost-cutting might increase the proportion of drugs made by Chinese firms — primarily generics — but it also lowers their profits, which could run counter to the government’s goal of promoting the development of innovative drugs which require heavy R&D investment.

Article: 14th Five-Year Plan for the Pharmaceutical Industry (关于印发“十四五”医药工业发展规划的通知) (Link)

Issuing bodies: MIIT; NDRC; MOST; MOFCOM;NHC; MEM; NHSA; NMPA; SATCM

Date: January 31, 2022

2. China accelerates commercial applications of its homegrown satellite system

At a glance: The Ministry of Industry and Information Technology (MIIT) published guiding opinions to promote civil applications of China’s BeiDou Navigation Satellite System. The release outlines measures to accelerate the mass adoption of BeiDou by companies and strengthen China’s satellite navigation industry. Goals for 2025 include:

- Achieve breakthroughs in the development of BeiDou chips and key components, with a focus on positioning accuracy and increased energy efficiency

- Promote the mass adoption of satellite connectivity services, including text messaging, connected cars, and the IoT

- Advance the entire BeiDou industry ecosystem to cover all upstream and downstream links including terminals, software, and applications

- Cultivate over 20 “little giant” enterprises and champions in the satellite manufacturing industry

MERICS comment: Developing an indigenous navigation satellite system has been a top priority for China and one where it is eager to show off its success. While Europe’s GALILEO system remains stuck in the piloting stage, China’s BeiDou was already fully operational in 2020. In the same year, China’s Premier Li Keqiang included BeiDou in the “new infrastructure” initiative, spurring further growth in the satellite sector. In line with competing satellite producers, China has begun mass producing chips for consumer products to send and receive the BeiDou signal on earth.

The policy ties in with China’s push for self-reliance and is a renewed signal to domestic companies to advance this technological frontier. Not only will adoption be pushed by Chinese directives, but if BeiDou achieves “100 times more accuracy” foreign firms will have no choice but to opt for BeiDou to maintain a competitive advantage with their products. The ripple effect of partner countries adopting the BeiDou system will have drastic consequences for offerings in international markets.

But China’s objectives go beyond civil interests alone. Satellite navigation is a dual-use technology whose applications include missile guidance and target tracking. China not only gains an important step towards military autonomy, it also grants China an opportunity to share and sell its technology to close partners. Pakistan, eager to reduce its reliance on GPS, was the first country to utilize BeiDou for its armed forces.

Article: Opinions on the Promotion and Application of BeiDou in the Field of Mass Consumption (工业和信息化部关于大众消费领域北斗推广应用的若干意见) (Link)

Issuing body: MIIT

Date: January 28, 2022

3. What tech crackdown? Ministries launch data center hubs

At a glance: The central government approved the construction of four computing hubs to serve the economic clusters around Beijing, Shanghai, Chongqing and Guangzhou. Data center clusters will be built in each region to increase the nation's data processing capacity. Local officials are instructed to:

- Develop high-density, high-energy-efficiency, low-carbon data centers, with over 80 percent of power consumed by IT equipment, rather than cooling and other overheads that supports the equipment

- Improve network service quality and security as well as the efficient scheduling of computing power

- Optimize the connection and coordination of computing processing power in the east and west of China

MERICS comment: China’s demand for computing power is expected to grow at over 20 percent annually in the coming years, as businesses migrate to cloud operations, adopt big-data based technologies such as 5G and AI, and exploit online business models. Along with data center hubs announced at the end of December planned for Inner Mongolia, Guizhou, Gansu and Ningxia, these data center nodes complete the overall layout design for China’s national integrated big data center system. The network is designed to spread the load of computing needs between the coastal and inland regions and capitalize on the plentiful supply of renewable energy in the western regions. This will reduce the carbon footprint of energy-hungry data centers.

The addition of new data centers could reduce data storage and processing costs for businesses and enable faster processing times. They also provide the foundation for the growth of data-based industries. The recently released economic plans for 2022 of local governments include numerous measures to boost emerging industries, which could benefit both local and foreign companies operating in China. For instance, Beijing will promote industrial clusters focused on blockchain, AI and VR/AR, while Zhejiang province will promote brain-like intelligence and aims to grow the added value of the digital economy by 12 percent. Despite the crackdown on big tech and tightening of anti-monopoly and data regulations, government support for the tech sector overall has not abated.

Article: NDRC Approves Four National Computing Hubs in the Beijing-Tianjin-Hebei, Yangtze River Delta, Chengdu-Chongqing Economic Circle and Guangdong-Hong Kong-Macao Greater Bay Area Regions (国家发展改革委等部门关于同意京津冀地区【长三角、成渝地区、粤港澳大湾区】启动建设全国一体化算力网络国家枢纽节点的复函) (Link 1; Link 2; Link 3; Link 4)

Issuing bodies: NDRC, CAC, MIIT, NEA

Date: February 16, 2022

4. Reap what you sow: Mechanization and seed research to boost crop yields

At a glance: The State Council issued a 14th FYP to promote the development of China’s agricultural sector and rural areas. A quarter of China’s population is employed in agriculture, but the sector is, by international standards, deemed to be extremely unproductive. Planners are eager to improve food security amid potential external shocks including climate change and a more hostile foreign environment. Key targets for 2025 listed in the policy include:

- Keep grain supplies stable at an output of at least 1.3 trillion kg (in 2021 output China reached that target with 1.36 trillion kg) and promote self-sufficiency in grain production

- Improve China’s agricultural competitiveness by increasing the mechanization rate of harvesting and crop cultivation from 71 to 75 percent

- Promote agricultural R&D with a focus on seeds, machinery and equipment, and environmental sustainability

MERICS comment: Improving agricultural productivity is not only a matter of food security, but due to China’s aging population it is also a necessary step to free up workers for manufacturing and services. To achieve these goals, China is eyeing mechanization and better seed quality, which a senior Chinese official called “the chips of agriculture”. Improving seed quality has been a long-time priority, but now policymakers are stepping up their efforts. In 2021, seeds appeared for the first time as an independent chapter in China’s annual “No. 1 Central Document” that outlines agriculture policy priorities. The FYP renews the pledge for more support and subsidies for more advanced agricultural equipment and promoting innovation in seed development, particularly corn and soybeans.

For foreign producers, this can be good news in the short term. Hikes in subsidies to replace agricultural equipment benefit foreign manufacturers, as China relies on imports for high-tech machinery. In seeds too, China remains dependent on foreign supplies and know-how. Higher rural incomes — which the FYP also supports — could spur demand across sectors. However, competition in the domestic market is likely to increase in the long run. China will funnel more subsidies to facilitate homegrown solutions, for instance as part of its Nanfa Technology City project, hailed as China’s Silicon Valley for seeds.

Article: 14th Five-Year Plan for the Promotion of Agriculture and Rural Modernization (关于印发“十四五”推进农业农村现代化规划的通知) (Link)

Issuing body: State Council

Date: February 11, 2022

5. CAC issues draft regulations for machine-generated content

At a glance: On January 28, the Cyberspace Administration of China (CAC) issued a draft law regulating the use of deep synthesis technology, referring to the creation of machine-generated or edited digital content, including text, images, audio, video and virtual scenes. If passed, the legislation would require providers and users of such content to:

- Respect social norms and ethics, and adhere to the correct political direction (of the Chinese Communist Party)

- Ensure content does not endanger national security, undermine social stability, spread false information or violate the rights and interests of others

- Obtain the consent of individuals when biometric information such as faces and voices are edited

- Include disclosures for deep synthesis content to alert the public of its nature; incorporate provenance markers such that the origins of content can be traced

MERICS comment: The draft law reflects China’s proactive approach to regulating new technologies. For Chinese authorities, the priority is to maintain control over the public discourse and maintain its censorship regime. But there are also practical reasons why regulation is necessary. Digitally manipulated media can be used for fraudulent activity or to spread disinformation. The number of deepfake videos, whereby a person’s face, body or voice has been digitally altered so that they appear to be someone else, is growing exponentially online. Calls for restrictions on the use of such technology are increasing in the US, UK and EU but have not yet resulted in new technology regulations.

To some degree, China’s draft law could reduce the chance of fake content being used by malicious netizens or competitors to harm the image of foreign companies, a distinct possibility given the recurrence of popular boycotts against foreign firms in China. But it also places an additional burden on firms, both local and foreign, to carefully manage their use of machine-generated content. Such content can be applied in a wide range of scenarios, including to produce text for news articles, customize advertisements, or operate a customer service bot. The accidental creation of sensitive or harmful content could result in fines, demands for compensation or severe damage to a company’s reputation.

Article: Provisions on the Administration of Deep Synthesis Internet Information Services (Draft for Comments) (国家互联网信息办公室关于《互联网信息服务深度合成管理规定(征求意见稿)》公开征求意见的通知) (Link)

Issuing body: CAC

Date: January 28, 2022

NOTEWORTHY

Policy news

- January 29: The Ministry of Education, National Development and Reform Commission (NDRC) and Ministry of Finance issue opinions on promoting the construction of world-class universities, with a focus on boosting research in core technologies (MOE notice (CN))

- January 30: The CAC and 16 other departments jointly announce new pilot zones and a total of 164 projects for innovative applications of blockchain technology (MIIT notice (CN); Reuters article (EN))

- February 7: MIIT, the NDRC, and the Ministry of Ecology and Environment release guidelines promoting development in the steel industry, notably delaying the peak emissions deadline for the industry from 2025 to 2030 (MIIT notice (CN); Bloomberg article (EN))

- February 9: Shenzhen offers foreign investors up to CNY 100 million to launch new or expand existing projects within the city, as part of a provincial funding program with other municipal governments in Guangdong to provide the same incentives (Shenzhen Municipal Bureau of Commerce notice (CN); Shenzhen Municipal Bureau of Commerce notice (EN))

- February 10: MIIT circulates an updated draft of the Data Security Management Measures in Industry and Information Technology, further tightening data regulations (MIIT notice (CN); South China Morning Post article (EN))

- February 11: MIIT publishes an updated list of new energy vehicles benefiting from subsidies and tax exemptions (MIIT notice (CN))

- February 15: MIIT announces new industrial internet pilot projects, including 5G connected factories and green manufacturing solutions (MIIT notice (CN))

Corporate news

- January 28: Great Wall Motor announces a USD 1.9 billion investment into Brazil, overtaking a former Mercedes Benz factory in São Paulo as its new export hub for Latin America (Great Wall Motors press release (EN); Financial Times article (EN))

- February 9: China’s Luckin Coffee seeks relisting on an American stock exchange, after being delisted from the NASDAQ and handed a fine of USD 300 million by US regulators following a major accounting fraud two years ago (Financial Times article (EN))

- February 11: Chinese companies AutoX, Didi Chuxing, WeRide, DeepRoute, and Pony.ai rank in the top ten most advanced autonomous vehicles as compiled by California’s Department of Motor Vehicles (Yicai Global article (EN))

- February 13: Beijing municipal government claims that Tesla is planning to open a new design center in Beijing in a push for a more localized product offering for the Chinese market (South China Morning Post article (EN))

- February 14: American-Irish medical device manufacturer, Medtronic, announces large scale investments into the Shanghai Free Trade Zone; the initial project phase alone will see CNY 300 million invested (Yicai Global article (EN))

- February 17: The Institute of Software under the Chinese Academy of Sciences (CAS) releases a new quantum computing software called “isQ-Core”, which is already being deployed on the CAS’ quantum computing cloud platform (Xinhua article (CN))