US-China relations + German debates on China

Update

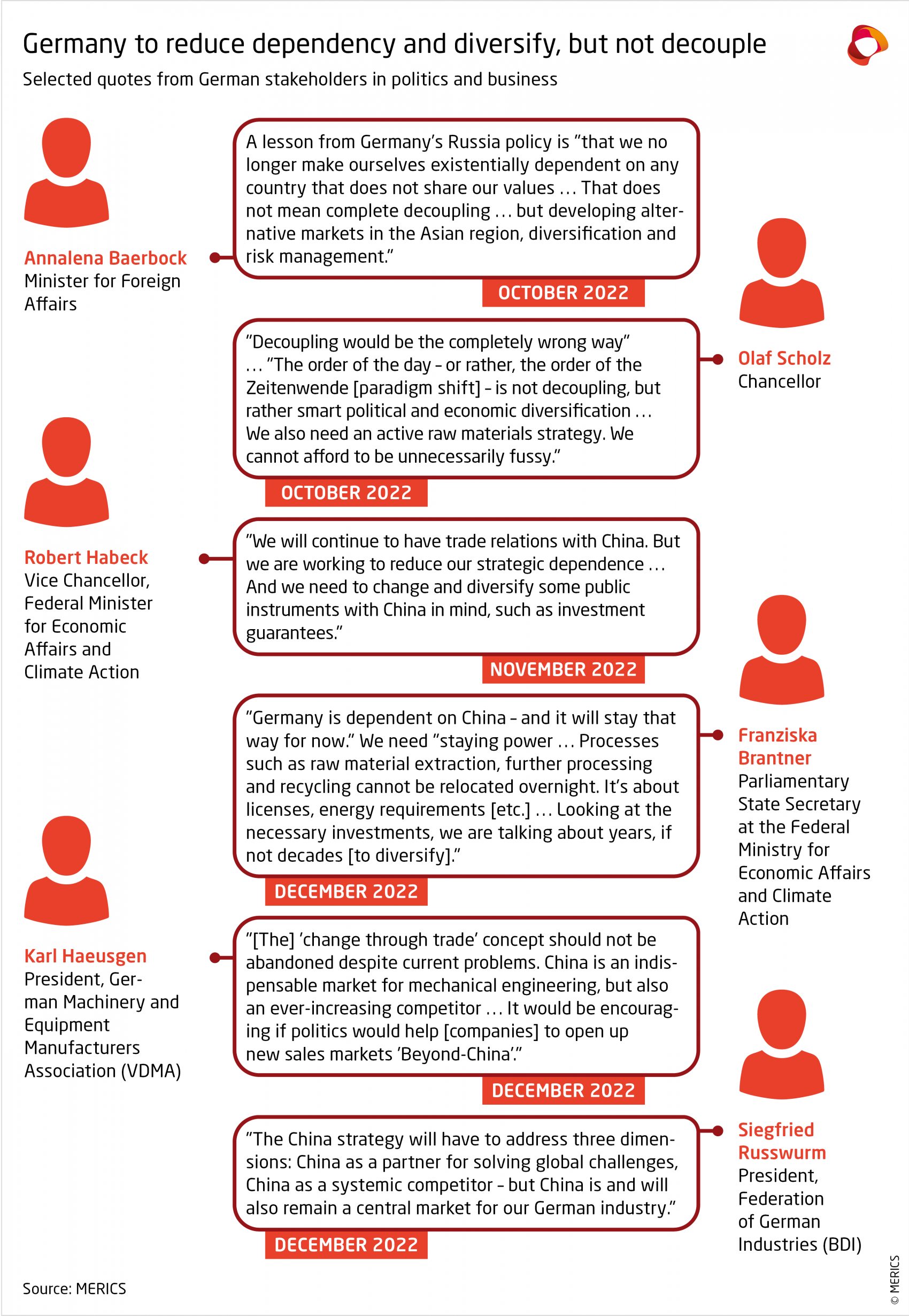

German dependency, diversification and decoupling debates on China

Ahead of the publication of Germany’s new China strategy, debate intensifies Berlin’s approach to China. Policymakers seem to agree on one thing: Diversification yes, decoupling no.

What you need to know:

- China-strategy leak and update on the drafting process: A draft of the German China strategy and a China strategy paper of the Economy Ministry were leaked late last year, triggering a flurry of reactions. Chinese ambassador Wu Ken criticized the draft of the German China strategy that circulated on Chinese social media platform WeChat as being “guided by ideology,” causing each of the coalition parties to push back. Industry associations such as APA or BDI called for “a balanced approach.” Publicly the government tries to convey unity on issues related to the China strategy. Commentators have noted, however, that the Chancellor's Office would prefer less policy detail, perhaps to give greater leeway, whereas the Ministry of Foreign Affairs (MFA) pushed for a thorough and policy-oriented document.

- Debate on China strategy fuels debate on economic dependence: Economically speaking, Germany is the most China-dependent nation in Europe. However, studies that distinguish Germany’s vulnerabilities from its dependencies reveal a diverse picture, and the case for decoupling remains underwhelming. The debate gained momentum early last year when Russia's invasion of Ukraine raised urgent questions about structural energy dependence. The debate has evolved from a stage of mere recognition of dependence to the current stage where measures are being taken. The focus of government action currently lies on reducing import dependence of raw materials used in the automotive or solar industry. More actions are set to follow for imports in the pharmaceutical, electronic and textile industries.

- German actors on economic dependence: The Chancellor, Vice Chancellor, and Foreign Minister are busy traveling Latin America, Africa, and India to find alternative exporters for specific goods that are currently majorly sourced from China. The government is calling on companies to diversify and is attempting to eliminate incentives, possibly by being more restrictive on providing investment guarantees for China. Medium-sized companies appear to be more active in this respect. Despite heightened geopolitical tensions and a potential cut in business ties due to a Taiwan conflict, larger German firms still look to strengthen their investments in China.

What to watch:

Germany is hurrying to diversify imports in certain vulnerable areas, such as raw material imports, but taking its time in others, for example, to assess companies' dependency levels. Disclosure requirements for companies are one way discussed to get a clearer picture of the situation.

Important divisions between the MFA and Chancellery remain and will shape the final strategy. Traditionally the Chancellery tends to have the final say when it comes to major decisions on foreign policy and China. The Liberals (FDP) and main opposition party CDU/CSU have called for the establishment of a national security council which could serve as a platform for more coordinated foreign policymaking and better representation of viewpoints when it comes to decisions on China.

Read more:

- Handelsblatt [DE]: Chinas Ambassador in Berlin Wu Ken: "Cold War Mentality"

- Position paper of „Asien-Pazifik-Ausschuss der deutschen Wirtschaft“ (APA) [DE]: Chancen nutzen - Risiken verringern Empfehlungen der deutschen Wirtschaft für die China-Strategie der Bundesregierung. January 2023

- Handelsblatt [DE]: Debate about German China strategy makes economy nervous

Short takes

The European Commission releases a list of 70 Global Gateway projects

The initiative, expected to feature EUR 300 billion of public and private investment by 2027, is now acquiring a clearer list of objectives. The, so far internal, list primarily covers a range of infrastructure projects, including an undersea optical fiber cable connecting MENA countries and a hydropower plant in Cameroon. There are also indications that the Commission is planning to appoint a special envoy to the Global Gateway.

The EU’s WTO cases against China move forward

As the EU and China failed to resolve two trade disputes – one related to economic coercion towards Lithuania and another to an enforcement of intellectual property rights – the WTO has now established dedicated dispute panels to resolve the issue. The WTO bodies can be expected to produce the final report in nine to ten months, unless China lodges an appeal, which likely adds a further three months to the process.

EU to launch a new center tracking Chinese and Russian interference

The Information Sharing and Analysis Centre on foreign information manipulation and interference (FIMI), announced by High Representative Josep Borrell on February 7, will coordinate efforts of the EU27 and relevant civil society organizations. Parallel to the announcement, the European External Action Service (EEAS) released its first report on FIMI threats. While Russia remains the key actor of concern for the EU, the EEAS has been building its capacity to tackle FIMI originating from China.

Wang Yi’s apparently shortened trip to Europe

Despite previous signals, Wang, now in his new capacity as the CCP’s top diplomat, will not travel to Brussels for exchanges with EU actors. As of now, it appears that he still scheduled to travel to Germany to join the Munich Security Conference.

New Czech President becomes first EU head of state to exchange call with Taiwanese President

Petr Pavel held the phone call a day after winning the Czech presidential elections. Two days later he stated in a public interview that “China and its regime are not a friendly country at the moment.” In the past and during the campaign, he has made several comments that suggest he will push for a more assertive China policy. This will be in sharp contrast to his predecessor, Miloš Zeman, a long-time proponent of engagement with Beijing.

- Euractiv: China fumes at new Czech President over Taiwan

- CHOICE: End of an Era in Czech-Chinese Relations as Czechs Vote for a New President