Country Profile: Germany

You are reading the country profile for Germany. Click here to go back to the country profiles overview page.

1. Introduction

Germany released its first ever China strategy in July 2023, a major step towards reshaping China policy. The strategy represented progress on building consensus within the coalition government. But struggles remain over how best to balance business and politics, and national and European approaches. Whereas Spain is a good example of a truly Europeanized China policy, Germany’s business interests often put it at the other end of the spectrum.

Germany is still trying to come up with a new approach to replace change through trade (“Wandel durch Handel”) which has largely been left behind. The influence of German businesses with interests in China cannot be overstated and creates tensions between those who favor de-risking and diversification, and those that want to double-down on economic engagement. Germany’s China policy is evolving, and further changes should be expected. But growing public skepticism towards China and the overall direction of travel in Brussels and in Berlin suggest that security and geopolitical concerns are likely to play a larger role. Germany is unlikely to go back to a trade-first approach.

2. Key Categories

Economy

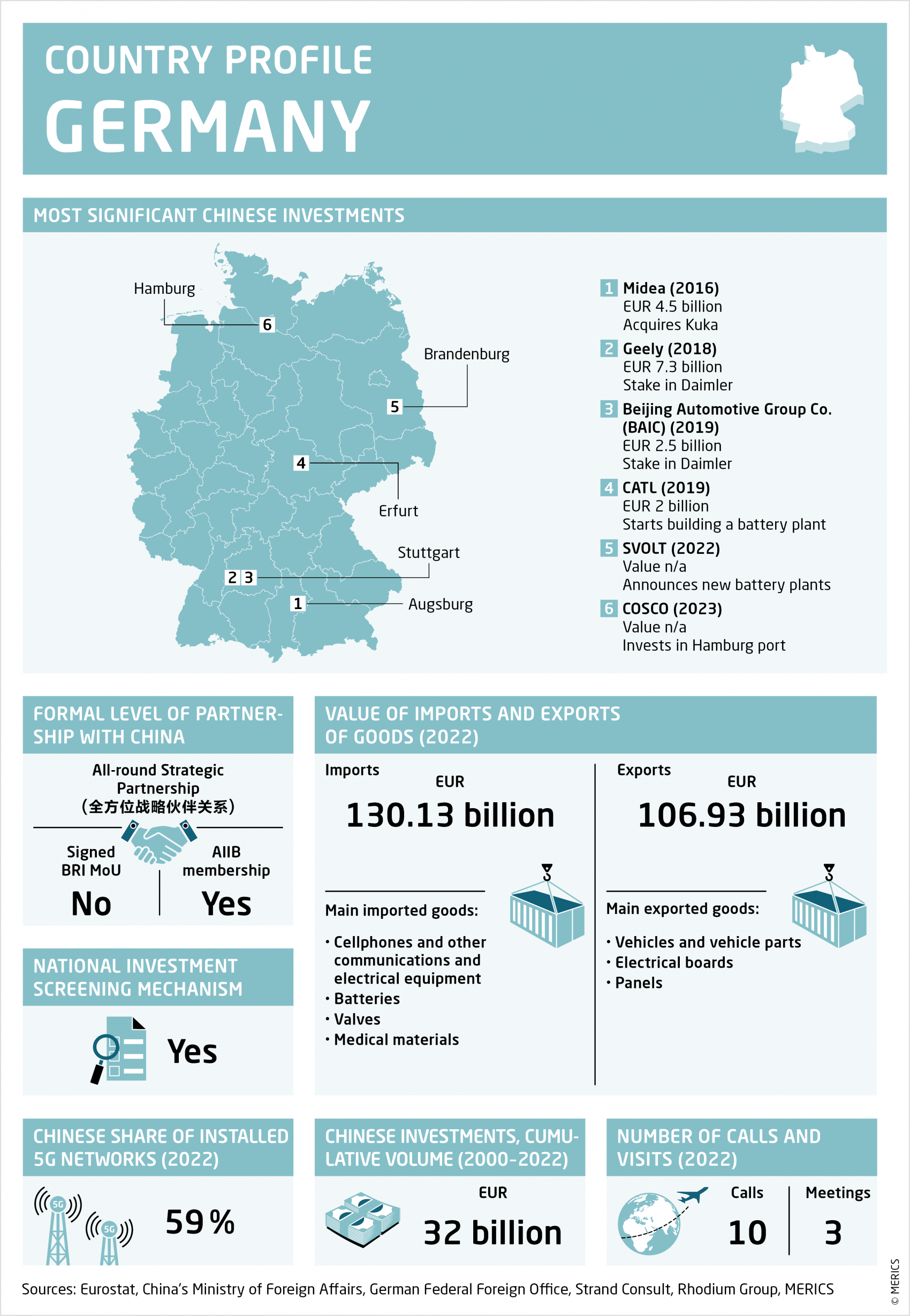

In 2022, China was Germany’s largest trading partner, for the seventh year in a row, with almost 9 percent of German imports and just under 7 percent of exports. The trade relationship is highly asymmetrical: in 2022 Germany’s trade deficit with China was EUR 23.18 billion.

Germany has stayed among the EU’s most attractive destinations for Chinese investors since 2017, in years when Chinese FDI in Europe fell steadily. It attracted EUR 1.9 billion from Chinese firms in 2022, mostly in greenfield battery plant investments and the takeover of a medical equipment maker.

The German economy is less dependent on China than its public widely believes but the relationship has long been shaped by fears of economic retaliation from Beijing. There seems to be a shift among policymakers and small- and medium-sized enterprises (SMEs), partly because of the economic pain caused by Germany’s dependence on Russian gas. It was a wake-up call that made de-risking and lessening dependencies on China into a key issue in Berlin. However, German multinationals are heavily invested in China and unwilling to disrupt the relationship.

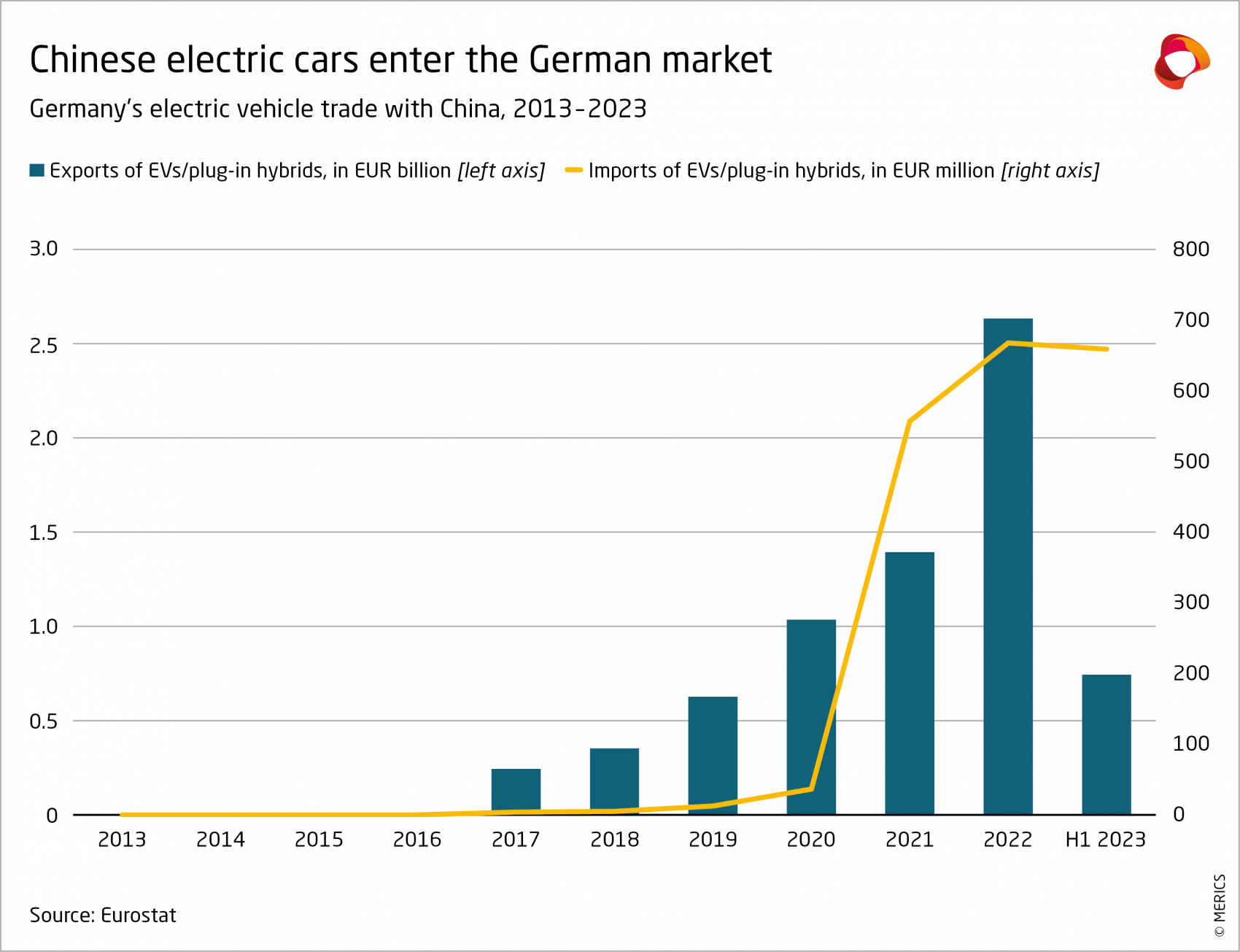

Concerns center on rare earths and batteries as Germany’s vital automotive sector is starting to feel competitive pressures in electric vehicles (EVs). Since 2020, imports of Chinese EVs have accelerated, eroding German carmakers’ market dominance. Chinese EVs are far cheaper than European ones thanks to state subsidies and China’s near-monopoly in EV batteries. This dynamic, replicated across Europe, has prompted an EU anti-dumping investigation into Chinese EVs, unveiled by European Commission President Ursula Von der Leyen in her 2023 State of the Union speech.

Politics

Germany’s new China strategy acknowledges China is now a major challenge to German interests. It represents a newfound consensus within the three-party coalition government of the SPD, the Greens and the FDP, which is shared by the opposition CDU.

Until very recently, relations with China were shaped by “Wandel durch Handel”, the view that trade relations would eventually lead to Beijing’s convergence with democratic values. This approach sidelined more sensitive or contentious issues, especially in the security space. The debated has shifted since 2019 when 5G rose up the agenda and is increasingly focused on risks and challenges.

The German Federation of Industries (BDI) was the first European actor to label China a competitor, partner and rival, in a 2019 policy paper. The German government was reluctant to adopt this framing, until it became the basis for the EU’s approach to China relations. China policy has since moved to the center of public debate to become a domestic political issue; three major political parties have each issued their own China strategies. Only the Greens have not, though they were one of the driving forces behind the 2023 national document.

Berlin maintains one of the highest levels of political engagement with Beijing among EU member states. In 2022, they had 14 high-level government contacts (above vice-minister level), calls or in-person meetings, and Chancellor Olaf Scholz visited Beijing. Multiple German ministries have long had regular high-level dialogues with Chinese counterparts ranging from human rights to security and the economy.

Security

China’s behavior and investment patterns are increasingly seen as a security issue. Germany has begun to develop and strengthen its defensive toolbox to reduce vulnerabilities, in line with the EU’s approach, and has tightened foreign investment screening multiple times in recent years.

Chinese investments increasingly trigger screening and public debate. The 2019 debate over Huawei’s involvement in building Germany’s 5G infrastructure proved so contentious that it led then-Chancellor Angela Merkel to face an uprising within her CDU party at her China-friendly line that forced her to accept more restrictive legislation. Three years later, in 2022, COSCO’s investment in the Port of Hamburg also triggered an extended screening process and exposed strong divisions within the governing coalition of the SPD, the Greens and the FDP.

Security cooperation and engagement with China has cooled. In 2019, Germany held a medical joint military exercise with the PLA – making it one of the few EU member states to cooperate with the PLA so closely. It was the second edition of what were meant to be regular exercises, but “Combined Aid” it has not been repeated. Germany also suspended its 2009 extradition treaty with Hong Kong after China suppressed pro-democracy protests.

German industry has not stopped exporting dual-use items, exploiting gaps in existing export control regimes. The German government does not publish data on this trade, but reports suggest German firms continue to sell certain items, such as vehicle engines. German firm MTU previously supplied the engines currently used in the PLA’s Song-class submarines, though sales appear to have stopped.

Society

Public opinion on China has worsened over the last four years (Pew found a record 76 percent of German respondents had unfavorable views of China in 2023, compared to 56 percent in 2019), contributing to Germany’s policy shift.

People-to-people exchanges have continued: Germany’s sizeable Chinese diaspora has remained stable (149,550 in 2022). Likewise the number of Chinese students at German universities held steady during the Covid pandemic (40,055 in 2021 or 11.5 percent of all foreign students). Tourist arrivals showed signs of recovery in 2022 (reaching 178,483 arrivals) but remained far below the 2019 level of 1.5 million Chinese tourists. It remains too soon to say if numbers will fully recover or if the worsening of relations will affect tourism in a lasting way.

German universities are also pushing back against growing pressure from the government and expert community to restrict or cancel some longstanding relationships and cooperation arrangements with Chinese academic institutions or to stop hosting Germany’s 19 Confucius Institutes. However, the risks of academic collaboration with China are becoming increasingly clear to academic institutions. In July 2023, for example, the Friedrich Alexander University of Erlangen-Nuremberg temporarily suspended students and researchers holding scholarships from the state-run China Scholarship Council. Education and Research Minister Bettina Stark-Watzinger hailed the move. She has called China a systemic rival in science and research and warned of the risk of espionage from some Chinese students in Germany.

You were reading the country profile for Germany. You can return to the country profiles overview page here.

This MERICS analysis is part of the project “Dealing with a Resurgent China” (DWARC) which has received funding from the European Union’s Horizon Europe research and innovation programme under grant agreement number 101061700.

Views and opinions expressed are however those of the author(s) only and do not necessarily reflect those of the European Union. Neither the European Union nor the granting authority can be held responsible for them.