Keeping value chains at home

How China controls foreign access to technology and what it means for Europe

Key findings

- In a shifting geopolitical environment, China’s government is sharpening and testing its tools for controlling technology-related outflows. As domestic firms climb up value chains, there is increased emphasis on controlling foreign access to retain critical innovation capacity within China.

- The party state uses dual-use export controls flexibly. It seeks to present itself as a responsible stakeholder contributing to non-proliferation, while supporting its domestic industries and signalling the ability to mobilize controls for other ends if needs be, such as retaliation.

- China is unique in having a parallel, civilian technology export control regime geared towards protecting domestic innovation and industrial capacity. This regime is increasingly deployed to establish and defend China’s supply chain dominance.

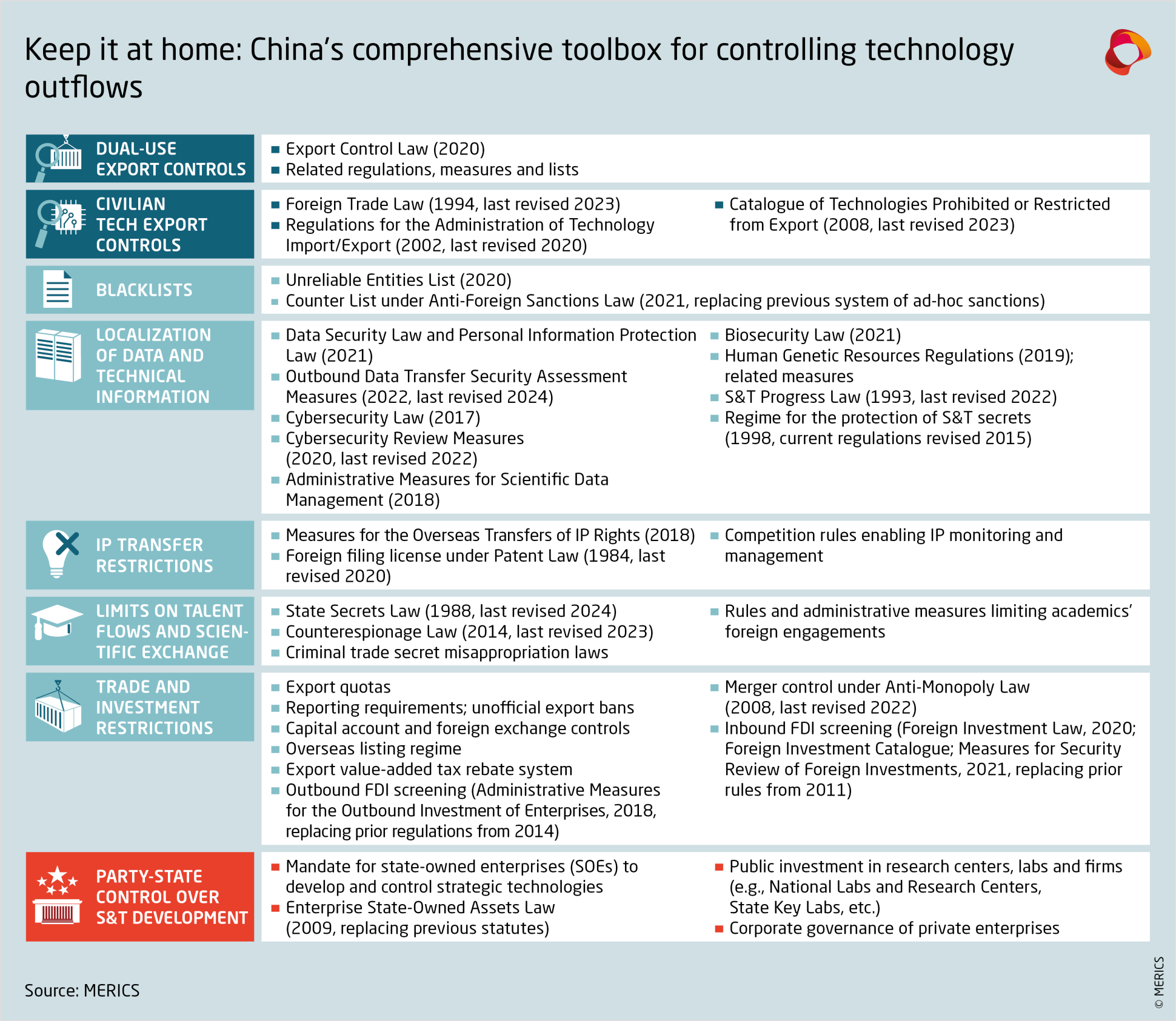

- Xi Jinping’s push for “comprehensive national security” has resulted in other instruments also being repurposed to manage technology outflows. China’s toolbox is unmatched by any OECD economy when monitoring and limiting cross-border flows of capital, data, talent and IP.

- European governments and firms must prepare for an era where China may be more willing and able to exploit its advantages and leverage along technology value chains, often in a highly opaque manner. At the same time, China still faces constraints and tradeoffs when it comes to instrumentalizing its strengths.

China rapidly builds up capacity to defend and leverage its value chain dominance

In recent years, China has become a more proactive adopter of export controls, affecting technology supply chains of huge economic and strategic importance for Europe. In August 2023, it began requiring a license for exports of gallium and germanium metals and several of their compounds. The move was widely seen as a response to coordinated restrictions on semiconductor technology exports from the United States, Japan and the Netherlands.1 In December, China tightened export controls for some graphite products and banned the export of technology to make rare earth magnets.2 These are just few high-profile cases, but they illustrate the critical importance of understanding how China uses export controls today and how it may do so in the future.

Beijing’s actions reflect profound shifts in both the geopolitical landscape and the way China relates to it. Supply and value chains are being reconfigured and weaponized as countries fiercely compete for technological dominance and choose resilience over globalization. China, meanwhile, is turning from a technology seeker to a technology provider. While its aggressive efforts at appropriating foreign technology have long been a prime cause for concern, foreign governments and firms now face an additional challenge: As Chinese companies ascend critical technology value chains, Beijing appears intent on monitoring and limiting foreign access to those.

The end goal is to manage technology-related outflows to keep supply and value chains in China. Xi Jinping has been adamant about the need for China to become indispensable in global technology production.3 The official concept of “self-reliance and self-empowerment” (自立自强) is often associated with policymakers’ push to make China more self-sufficient in science and technology (S&T). But the second part of the phrase masks a more offensive intent.4 According to Xi, “trump card” (杀手锏, literally “assassin’s mace”) technologies should not only deter foreign governments from denying China the inputs it needs, but also be leveraged asymmetrically to attain technological superiority and hence geopolitical power.5

This trend is only poised to accelerate as the efforts by G7 members countries at establishing China-free supply chains (part of the so-called ‘de-risking’ strategy) threaten to erode China’s indispensability and techno-industrial upgrading.6 This complex external environment provided the context for the recent Third Plenum of the Chinese Communist Party (CCP)’s Central Committee, which took place in July after an unexplained delay. The plenum pledged to “safeguard S&T security” and “build autonomous and controllable industrial and supply chains.” The latter shall be accomplished, inter alia, by reshoring key industries and improving the system of strategic national reserves.7

To anticipate potential risks and disruptions, it is crucial to understand how Chinese export controls sit within a wider drive to develop and retain critical innovation capacity within China. The government has a wide range of instruments not only to shore up China’s value chain dominance but also to control and potentially leverage foreign access to technology inputs and outputs.8 Although many of these predate Western de-risking, how they may get mobilized in this new era of global technology competition deserves attention. Beijing’s strategic motives, means and constraints will significantly shape the nexus of geopolitics and technology in the years to come.

The party state’s toolkit includes:

- Dual-use export controls (Export Control Law, ECL)

- Civilian technology export controls (Foreign Trade Law and Technology Import/Export Regulations, TIER)

- Other instruments (blacklists, localization of data, technical information and intellectual property (IP), restrictions on talent mobility, managed trade and investment, and party-state control of S&T development)

China is not the only country seeking to manage foreign access to ‘sensitive’ technology and the associated value chains, but it stands out for its comprehensive and opaque approach. Many OECD economies have stepped up measures to protect economic security, on top of traditional national security and non-proliferation goals. What makes China unique is the breadth of the instruments it has and the lack of transparency and predictability surrounding their application. The CCP’s sweeping definition of national security,9 coupled with its track record of forcefully extracting geopolitical and strategic gains from economic interactions, are causes for concern.

However, weaponizing one’s advantage risks weakening one’s leverage by encouraging others to speed up diversification. In fact, Beijing appears aware that restricting technology-related outflows is a double-edged sword and entails a careful balancing act. While remaining mindful of these limitations and avoiding overreactions, the PRC’s trading partners should take seriously China’s long game to shore up and leverage its technological dominance.10

Beijing’s flexible adoption of dual-use export controls: national security meets industrial policy

China’s export control regime11 serves disparate goals, spanning retaliation and technology dominance as well as more consensual national security interests and international non-proliferation aims. The State Council’s 2021 White Paper on export controls directly reflects this broader focus, referencing Xi’s “comprehensive national security concept” (总体国家安全观) as a core guiding principle.12 For Xi, national security also encompasses S&T self-reliance and competitiveness.

The notoriously opaque way in which China’s government handles licenses for exporters of controlled items diverges from international standards, particularly as it gives the authorities wide scope for discretion. For instance, from 2020 to 2023, Swedish battery startup Northvolt was suddenly unable to get artificial graphite from China, whereas Chinese battery makers building plants in Hungary had no such problems.13 China’s unofficial rare earth export embargo against Japan in 2011 was, officially, to address environmental concerns, though the coercive intent was apparent.14

Although China’s government has sought to make the system more transparent and predictable, the outcome has been a mixed bag. Before the 2020 Export Control Law (ECL) was passed, export controls were spread over multiple lists and bureaucracies. Most have been consolidated into two lists.15 However, no available list is complete, nor is China’s end-user blacklist public.

Recent cases offer useful lessons about China’s flexible and untransparent use of export controls.

Export controls for non-proliferation – and to bolster domestic industries

Beijing carefully uses export controls to present itself as a responsible stakeholder that strives to prevent arms proliferation, without hurting its industry’s interests. For instance, it first included drones under export controls in 2002 on the Export Control List for Missiles and Related Items and Technologies. It also included autopilots for unmanned aerial vehicles (UAVs), precise gyroscopes, and UAVs able to carry a payload of more than 500 kilograms for at least 300 kilometers.16

The narrow parameters (a Mavic-3, a common Chinese drone, only has a flight range of 50 km) meant China could still permit many drone exports. Domestic commenters have argued that these controls served China’s core competitiveness, and their expansion in 2015 was “conducive to the healthy development of China’s drone industry”.17

Russia’s invasion of Ukraine has put Beijing’s opportunistic stance in the spotlight. In 2023, as Chinese drones popped up among Russian armaments on Ukrainian battlefields, Beijing imposed extra controls to signal its constructive stance.18 However, these were designed in a way that most Chinese commercial exports were not affected. More recently, Beijing has included certain aerospace and aviation sector equipment, software and technologies, as well as bulletproof vest components in its control list.19 It remains to be seen whether and how this will be enforced, considering that China remains Russia’s top supplier of dual-use components used in Moscow’s war of aggression against Ukraine.20

Leveraging critical minerals to rebuff Western export controls and hinder de-risking

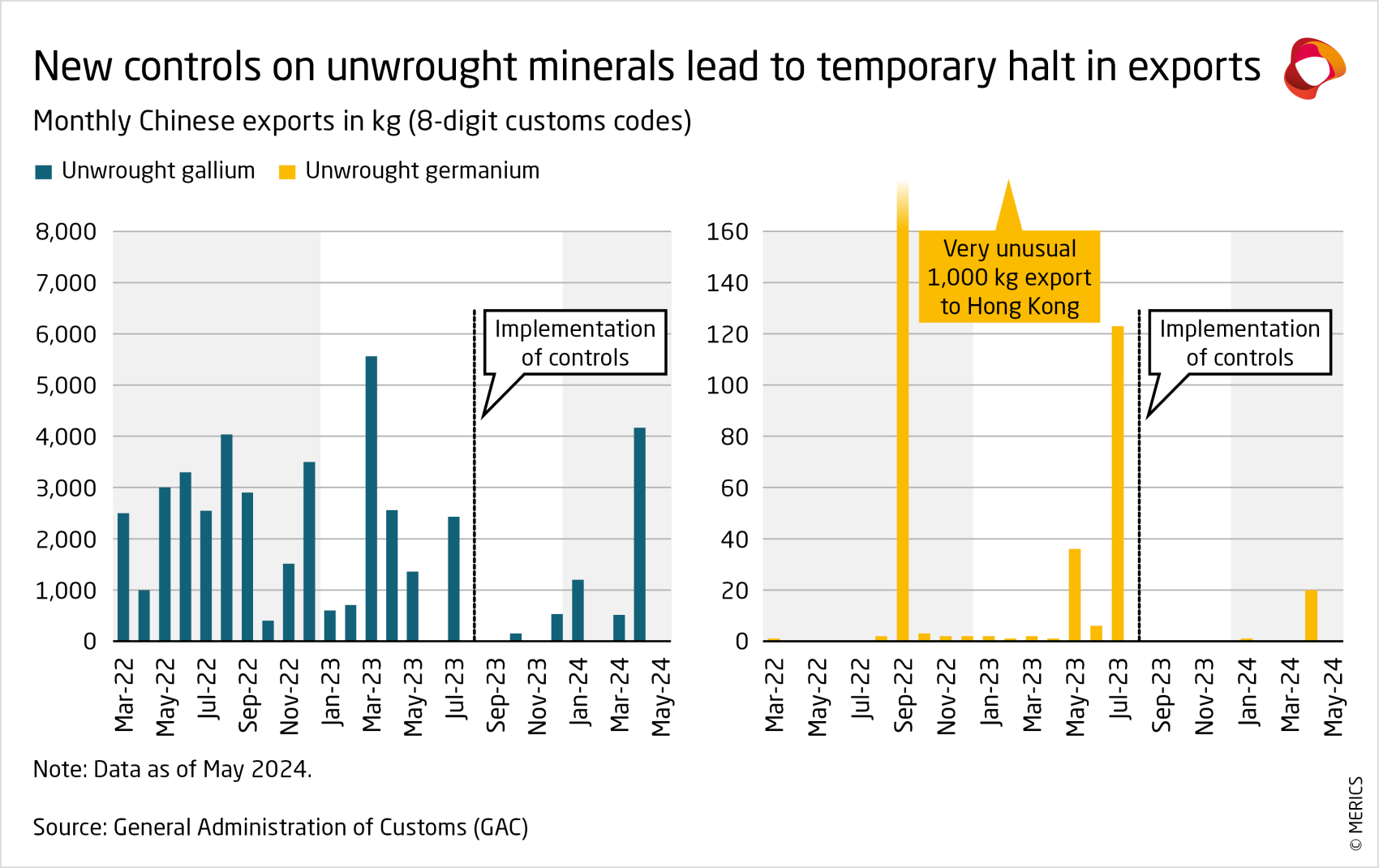

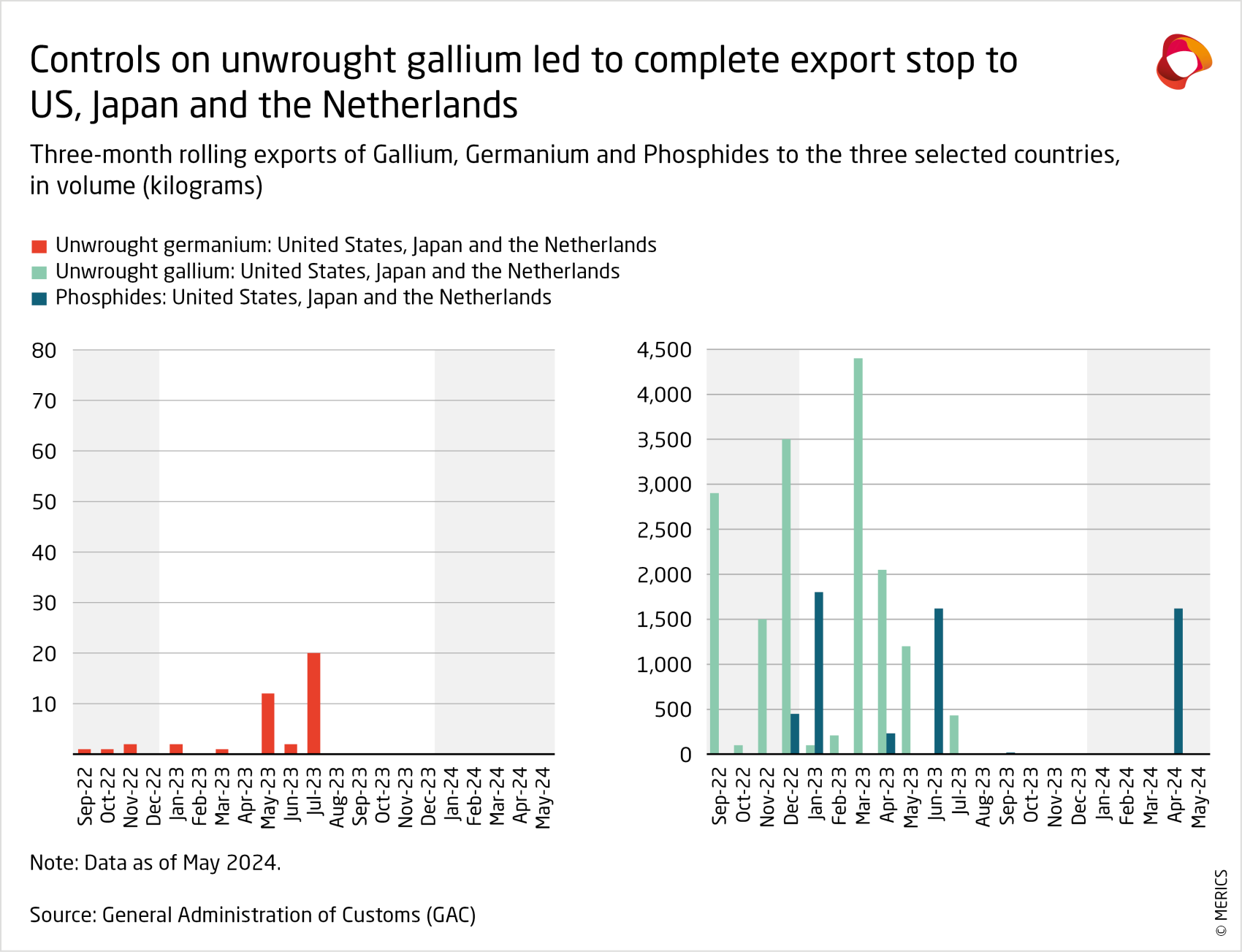

Trade data suggests that some worries regarding Beijing’s weaponization of strategic inputs are legitimate, even though fears of a trade blockade were overblown. On the one hand, China’s mineral export controls mostly covered a handful of minerals and their importers. Export volumes for the vast majority of the 22 custom lines for gallium, germanium and graphite products on China’s 2023 control lists were unaffected. On the other hand, regional disparities in trade patterns following the controls fuel legitimate fears among partners of a geopolitical bias to licensing decisions (see details below), with clear retaliatory intent in some cases.

China announced export controls on gallium and germanium in July 2023, months after the United States, alongside Japan and the Netherlands, barred Chinese firms from buying advanced computing chips and related tools. Both metals are used across important electronics supply chains, including semiconductors. Around 90 percent of global production of both metals is in China.21 Gallium and germanium are also crucial for US and NATO defense-industrial bases. They fall under the multilateral Wassenaar Arrangement,22 which allows China to justify the export controls on national security grounds.

The controls seem to have been used to retaliate against what China views as the abuse of export controls by other partners. Exports of unwrought gallium and germanium as well as phosphide from China to the US, Japan and the Netherlands disappeared completely once the new controls were enforced. The brief uptick before the implementation suggests importers were stockpiling. Exports to OECD countries have since rebounded to slightly below pre-control levels, but not for the United States, Japan and the Netherlands.

Again, these controls allow China to show its capacity to hurt the United States and partners without affecting domestic industries. Only the exports of unwrought metals, which need extensive processing to make usable materials, and phosphides, vital in LED manufacturing, have been affected among the many customs categories included in the export controls. Exporting final products rather than raw materials is in the interest of China’s industries.

In fact, China selects its targets carefully. Beijing could have chosen silicon carbide (SiC), a semiconductor material showing promise for specific, economically important chips for which China makes 44 percent of the world exports.23 No other country supplied more than 10 percent of exports, while the United States, Japan and the Netherlands are key importers. China seeks to dominate both the production of SiC-based chips (often called compound semiconductors) and the growth of SiC crystals (also called ingots) which these chips are cut from.24

However, SiC is not a raw material. Silicon and carbon are both relatively abundant materials with wide applications; this and China’s large imports of both make them poor targets for export controls. China could restrict the export of finished SiC ingots or wafers, but doing so would jeopardize an emerging strategic industry by disincentivizing foreign companies from sourcing there. China does not have a decisive technological lead, and its nascent SiC industry must compete with others.

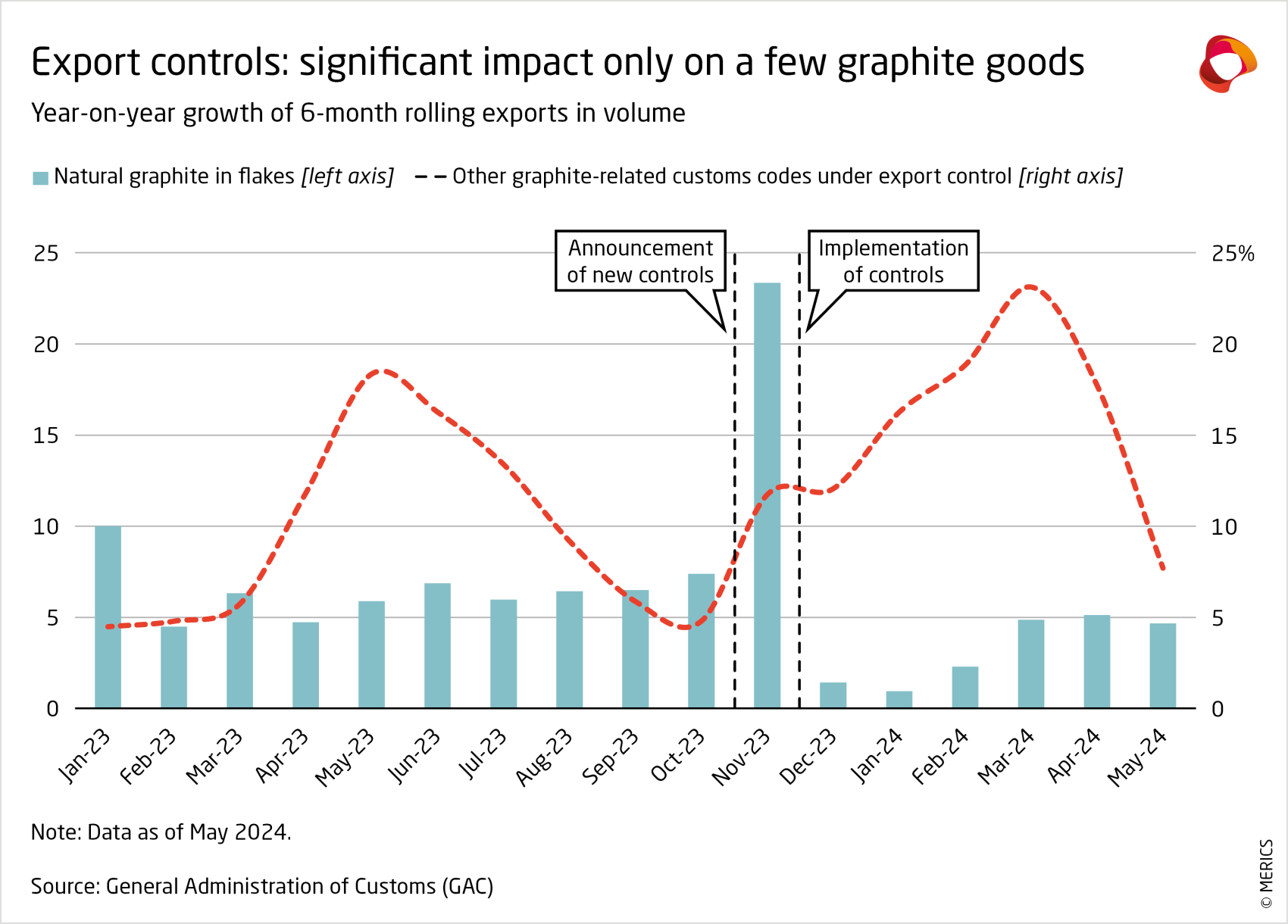

China’s controls on graphite seem to follow the logic of industrial and technological competition, even though graphite, too, has military applications and features in Wassenaar. The sudden and unannounced halting of artificial graphite exports to Sweden in early 2020 conveniently coincided with the expansion of Chinese EV battery makers in the EU. Politically motivated economic coercion cannot be ruled out as bilateral relations became fraught in 2019. It is worth noting, however, that exports briefly resumed in January 2023, shortly before Chinese company Putailai announced plans to make battery anodes from synthetic graphite in Sweden.25 Chinese supplies to Sweden suddenly resumed in 2024, without any public announcement or explanation.

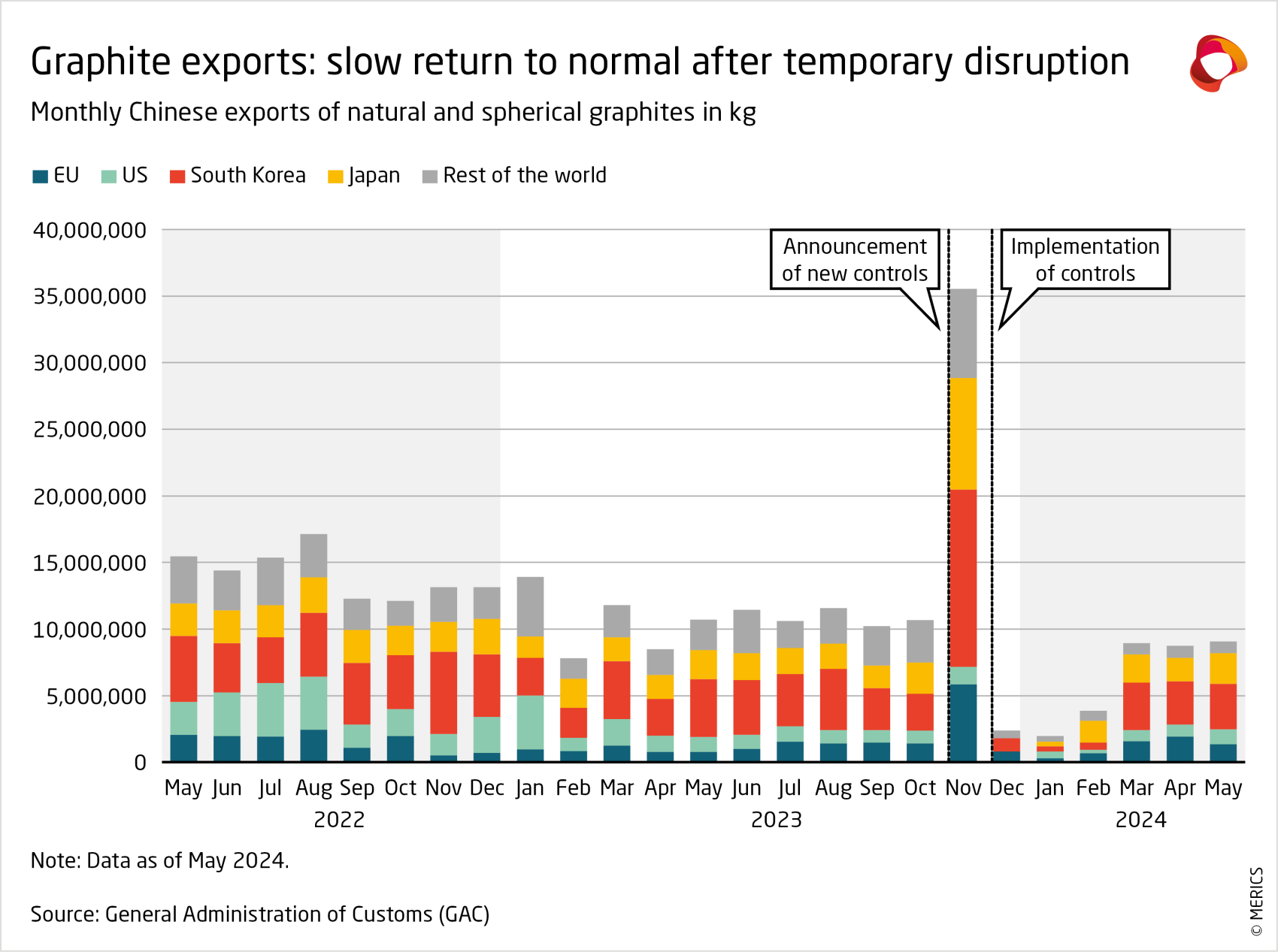

Against this backdrop, it is hardly surprising that the announcement of the new measures in October 2023 led to massive orders by OECD countries, especially those that are striving to shift battery and EV value chains away from China. G7 countries and South Korea saw the biggest frontloading and subsequent drop in Chinese sales of both spherical and natural graphite. The United States and Japan even had an unprecedented month of zero imports in December, possibly indicating that the authorities were delaying licenses for imports to those countries.

It must be noted that exports of those two graphite products seem to have returned to normal since March 2024, at slightly lower levels than before but rather homogeneously for all trading partners.

In summary, China uses dual-use export controls flexibly. It seeks to portray itself as a responsible stakeholder yet seems to carefully design controls to develop and support domestic industries in key dual-use areas. Within the global technology rivalry, export controls signal not only China’s ability to hit back at similar measures taken by other countries, but also an intent to keep them dependent on China.

China’s civilian technology export control regime prioritizes economic security

While China’s dual-use export controls are partially consistent with multilateral regimes and international practices, Beijing’s parallel export control regime for civilian technologies is more unique. It centers on innovation and industrial policy motives and is anchored by the “Catalogue of Technologies Prohibited or Restricted from Export”, last amended by MOFCOM in December 2023. The catalogue sits under the Foreign Trade Law and related regulations, chiefly the Technology Import-Export Regulations (TIER).26 The regulations explicitly allow China’s government to protect economic security, so they are even more versatile than control lists under the ECL, whose main policy objectives are safeguarding national security and contributing to non-proliferation.

The economic security logic was underscored by a move to preserve “China’s indigenous development and controllability of key and core technologies.”27 Since 2018, a security assessment has been needed for transfers to foreign parties of Intellectual Property Rights (IPR) tied to technologies marked as restricted in the catalogue. This includes patents, exclusive rights to integrated circuit layout designs, computer software copyrights or new plant varieties.

Importantly, the rule applies to any transfer of IP to a foreign entity, including if they are based in China or if the transfer results from the purchase of Chinese firms.28 For example, China applied export controls on TikTok’s content recommendation algorithm in 2020 after the US government tried to force mother company ByteDance to divest from the live-streaming app.29

Limiting technology exports to keep industrial chains in China

One sector Beijing has moved to protect is rare earth manufacturing technology, by banning the export of technology to make rare earth-based magnets. These can be seen to complement the controls on the exports of the minerals themselves. China’s controls do not limit the export of finished magnets: the goal is to retain China’s dominance of rare earth processing and to prevent production capacity being built outside of China with Chinese technology.30 A ban on the export of rare earth extraction and separation technology was already in place.

Rare earths are key value chains where the PRC has a massive footprint. Despite only producing 60 percent of the world’s rare earths, the country processes nearly 90 percent.31 Chinese firms have amassed IP and technical expertise so restricting the export of processing technology protects domestic industry.32 Permanent magnets (especially neodymium-iron-boron NdFeB magnets), for instance, are used in EV engines and wind turbine generators, and are therefore vital for the green transition. At the end of 2021, China controlled 87 percent of the global market for these magnets, which amounts to a strategic sourcing dependency for the EU.33

However, it appears that China’s restrictions cannot effectively impede the viability of alternative value chains. The Chinese footprint in some areas of the value chain largely stems from massive domestic demand and obscures foreign firms’ advantage in some high-end segments.34 For example, South Korean group POSCO International claims to have developed a China-free NdFedB magnet supply chain jointly with Star Group.35 E-Vac Magnetics, a subsidiary of German magnet manufacturer Vacuumschmelze, is building a US plant in South Carolina with Pentagon funds, while Canadian Neo Performance Materials is constructing one in Estonia.36

The double-edged sword of weaponization

Ultimately, banning technology exports – or tightly restricting licenses – could backfire for China. Where foreign firms hold relevant technical expertise and IP, imposing export controls can erode rather than protect a country’s advantage by further incentivizing de-risking efforts elsewhere. China’s policymakers seem aware of the pitfalls of weaponizing ‘choke points’37 along highly complex and global value chains. They are testing different ideas, likely to see where China can exploit dependencies without scoring an own goal.38

Domestic technologists and industry insiders are debating such tradeoffs. For example, MOFCOM imposed export restrictions on 3D laser scanning technology (also called LiDAR), which has applications ranging from drones to self-driving cars. Chinese companies like Hesai mainly compete on price, so there is uncertainty whether controls would strengthen their competitive position or rather hamper overseas expansion and cooperation.39 Going forward, the TIER-based controls could make it harder for Chinese firms to license their technology to European partners.

These kinds of discussions have influenced export control decisions in some cases, leading to more restraint on the part of the authorities. In an earlier draft of the catalogue, MOFCOM proposed banning exports of certain core technologies for making solar panels but dropped the idea from the final version. Chinese companies and experts had raised concerns, pointing out some European and US competitors had already responded by restarting their own production.40

Nevertheless, the advantages Chinese authorities can gain from improving their ability to monitor technology-related outflows should not be discounted. This benefit is strong when the catalogue introduces a licensing requirement rather than a blanket ban. Through processing the license applications of Chinese and foreign companies the government could be gathering useful supply chain data for industrial policy purposes.41

Outlook: Information and cross-cutting coordination are key to dealing with China’s actions

China’s newly proactive adoption of export controls should not merely be seen as tit-for-tat retaliation against US measures. It is part of a wider trend for Beijing to protect industrial and innovation interests more forcefully. After decades of chasing foreign technology, the Chinese government is now intent on managing technology-related outflows and limit foreign access to favor domestic champions while hindering Western de-risking.

Many of the instruments we have discussed are still being developed and tested. There are not many technologies where China has a sufficiently unassailable lead to give its toolbox similar firepower to US export controls on semiconductor technology. Even in segments where China has a strong leverage, such as strategic minerals, the government has arguably shown restraint in restricting exports. Moreover, China is careful not to hurt domestic industries and strategically picks its targets, which makes it difficult for foreign companies and governments to predict the impact of its measures. This sometimes leads to overreaction by China’s trading partners.

Nevertheless, China’s toolbox plays a valuable role in providing the government with intelligence about industrial and technological developments and progress. It can enable the government to identify frontrunners and their technological lead early, monitor their international partnerships and protect them where necessary.

Intelligence about China’s progress along key technology value chains

While China’s success is no foregone conclusion, EU governments should invest more in tracking China’s progress in technology value chains, especially in areas where it is already a frontrunner such as the so-called “new three industries” (EVs, solar panels and lithium-ion batteries), third-generation semiconductors and quantum communications. After all, clear-cut dominance in such value chains is a precondition for credibly restricting foreign access. Combined with continued monitoring of European dependencies on China, this could serve as an early warning system against future Chinese attempts at exploiting technological advantages.

Coordination with the private sector to track Chinese actions

European governments should improve coordination and communication with industry in a confidential and effective manner. Companies who source from or do business in China could share information about their on-the-ground experiences with governments – for example, regarding China’s licensing practices. It could help countries monitor and respond to instances where Beijing uses discriminatory licensing to orchestrate Chinese supply chains overseas. Governments should first build up the necessary expertise in critical sectors and technologies, so they can understand the insights they receive. Each industry’s specific vulnerabilities that Beijing might, at some point, exploit, need to be considered.

Information sharing among like-minded partners to bolster resilience

Like-minded OECD partners should coordinate to counter Chinese export restrictions and other actions that limit technology-related flows, especially those of critical inputs. Beijing has demonstrated its readiness to apply such measures in a discriminatory, opaque and at times overtly coercive way.60 Countries should share information to counteract China’s habit of trying to drive wedges. Within the EU, information sharing obligations could be made more stringent to make sure member states are not played off against one another.

The EU-US Trade and Technology Council created a first early warning mechanism after China announced controls on gallium and germanium. It could become more structured and extended to manage disruptions beyond the semiconductor supply chain. Whether such coordination would even be possible in the event of a reelection of Donald Trump as US president, though, is a big question mark.

- Endnotes

1 | Ministry of Commerce of the PRC (2023). “商务部 海关总署公告2023年第23号 关于对镓、锗相关物项实施出口管制的公告 (Announcement No. 23 of 2023 of The Ministry of Commerce and The General Administration of Customs on The Implementation of Export Controls on Gallium and Germanium Related Items.” July 3. https://archive.is/bNZpf. Accessed: July 23, 2024; Seaman, John (2023). “China’s Weaponization of Gallium and Germanium: The Pitfalls of Leveraging Chokepoints.” French institute of international relations. July 27. https://www.ifri.org/en/publications/briefings-de-lifri/chinas-weaponization-gallium-and-germanium-pitfalls-leveraging. Accessed: July 23, 2024.

2 | Ministry of Commerce of the PRC (2023). “商务部 海关总署公告2023年第39号 关于优化调整石墨物项临时出口管制措施的公告 (Announcement No. 39 of 2023 of The Ministry of Commerce and The General Administration of Customs on Improving and Adjusting Temporary Export Controls on Graphite Items.” October 20. https://archive.is/GjtCP. Accessed: July 23, 2024; Ministry of Commerce of the PRC (2023). “商务部 科技部公告2023年第57号 关于公布《中国禁止出口限制出口技术目录》的公告 (Announcement no. 57 of 2023 of The Ministry of Commerce and The Ministry of Science and Technology on Publishing the ‘Catalogue of Technologies Prohibited or Restricted from Export’.” December 21. https://archive.is/irrFc. Accessed: July 23, 2024.

3 | Xi, Jinping 习近平 (2020). “国家中长期经济社会发展战略若干重大问题 (Certain Major Issues for Our National Medium- to Long-Term Economic and Social Development Strategy).” Speech at the seventh meeting of the Central Financial and Economic Affairs Commission on April 10, 2020. Qiushi. Translated by Center for Security and Emerging Technology. https://cset.georgetown.edu/wp-content/uploads/t0235_Qiushi_Xi_economy_EN-1.pdf. Accessed: July 23, 2024.

4 | Naughton, Berry, Xiao, Siwen and Xu, Yaosheng (2023). “The Trajectory of China’s Industrial Policies.” University of California, San Diego and UC Institute on Global Conflict and Cooperation Working Paper. June. https://ucigcc.org/wp-content/uploads/2023/06/Naugton-et-al-working-paper-1-jun-2023.pdf. Accessed: July 23, 2024..

5 | CPC News 中国共产党新闻网 (2016). “习近平论科技赶超战略:应该有非对称性 “杀手锏” (Xi Jinping discusses the catching up strategy in science and technology: we must have asymmetric “assassin’s mace” technologies).” March 22. https://archive.is/5QVW7. Accessed: July 23, 2024.

6 | The White House (2023). “G7 Hiroshima Leaders’ Communiqué.” Briefing Room. Statements and Releases. May 20. https://www.whitehouse.gov/briefing-room/statements-releases/2023/05/20/g7-hiroshima-leaders-communique/. Accessed: July 23, 2024.

7 | CCP Central Committee (2024). “中共中央关于进一步全面深化改革 推进 中国式现代化的决定 (Resolution of the Central Committee of the Chinese Communist Party on Further Deepening Reform Comprehensively to Advance Chinese-style Modernization.” July 18. https://www.gov.cn/zhengce/202407/content_6963770.htm. Accessed: July 24, 2024.

8| In this report we deliberately take a broad definition of technology inputs and outputs, encompassing data, patents, technical information, personnel, hardware, software, equipment and upstream inputs.

9 | Drinhausen, Katja and Legarda, Helena (2022). “Comprehensive National Security" unleashed: How Xi's approach shapes China's policies at home and abroad.” MERICS. September 15. https://www.merics.org/en/report/comprehensive-national-security-unleashed-how-xis-approach-shapes-chinas-policies-home-and. Accessed: July 23, 2024.

10 | Arcesati, Rebecca (2023). “Export Controls: China’s Long Game to Defend Its Tech Chokepoints.” China Observers in Central and Eastern Europe. December 14. https://chinaobservers.eu/export-controls-chinas-long-game-to-defend-its-tech-chokepoints/. Accessed: July 23, 2024.

11 | Export controls are the regulations that govern the export, re-export and transfer of commodities, software, technology and sometimes services (e.g., technical assistance) to specific end uses, end users or destinations, in order to accomplish a country’s national security or foreign policy objectives. The focus of the four multilateral export control regimes that were created after the end of the Cold War is chiefly to prevent the proliferation of items, either military or dual-use items, that may enable the development, production or use of conventional weapons and weapons of mass destruction. Of these four, China is only a member of the Nuclear Suppliers Group. However, it maintains national control lists for military goods, nuclear goods, and dual-use items and technologies.

12 | The State Council of the PRC (2021). “Full Text: China's Export Controls.” December. Official English translation. https://english.www.gov.cn/archive/whitepaper/202112/29/content_WS61cc01b8c6d09c94e48a2df0.html. Accessed: July 23, 2024.

13 | European Commission (2023). Export restrictions for artificial graphite products by China. Trade Barriers. Last update February 28, 2024. https://trade.ec.europa.eu/access-to-markets/en/barriers/details?barrier_id=17542&sps=false. Accessed: July 23, 2024; China introduced temporary controls on the relevant graphite items in 2006, officially due to their possible applications in the development of nuclear weapons. However, there was no official explanation for the sudden change in licensing policy towards Sweden. Ministry of Commerce of the PRC (2006). Ministry of Commerce, Commission for Science, Technology and Industry for National Defense and General Administration of Customs (2006). “关于决定对石墨类相关制品实施临时出口管制措施的公告 (Announcement on The Decision to Implement Temporary Export Control Measures for Graphite-Related Items.” July 27. https://archive.is/arMfj#selection-721.4-721.10. Accessed: July 23, 2024.

14 | Adachi, Aya, Brown, Alexander, Ghiretti, Francesca et al. (2021). “Dealing with China’s economic coercion – The case of Lithuania and insights from East Asia and Australia.” MERICS Executive Memo. December 20. https://merics.org/en/executive-memo/dealing-chinas-economic-coercion-case-lithuania-and-insights-east-asia-and-australia. Accessed: July 23, 2024.

15 | These are: the Catalogue of Goods subject to Export License Administration (for general goods) and the Catalogue of Import and Export Licenses for Dual-Use Items and Technologies (for dual-use goods and technologies). Both are issued by MOFCOM and GAC. China is also known to maintain a non-public list of restricted end-users.

16 | The State Council of the PRC (2002). “中华人民共和国导弹及相关物项和技术出口管制条例 (Regulations of The People’s Republic of China on Export Controls for Missiles and Related Items and Technologies.” https://web.archive.org/web/2/https:/www.gov.cn/gongbao/content/2002/content_61742.htm. Accessed: July 23, 2024.

17 | Economic Daily 经济日报 (2015). “我国为何限制部分无人机出口 (Why our country restricts some drone exports)” August 5. https://archive.is/2MxB3#selection-431.3-435.0. Accessed: July 23, 2024.

18 | Ministry of Commerce of the PRC (2023). “商务部 海关总署 国家国防科工局 中央军委装备发展部公告2023年第27号 关于对无人机相关物项实施出口管制的公告 (Announcement no. 27 of 2023 of the Ministry of Commerce, the General Administration of Customs, the State Administration of Science, Technology and Industry for National Defense and the Equipment Development Division of the Central Military Commission on Implementing Export Controls on Drone-Related Items.” July 31. https://web.archive.org/web/20240510090803/http:/www.mofcom.gov.cn/article/zwgk/gkzcfb/202307/20230703424598.shtml. Accessed: July 23, 2024.

19 | Ministry of Commerce of the PRC (2024). “商务部 海关总署 中央军委装备发展部公告2024年第21号 关于对有关物项实施出口管制的公告 (Announcement no. 21 of 2024 of the Ministry of Commerce, the National Administration of Customs and the Equipment Development Department of the Central Military Commission on The Implementation of Export Controls on Relevant Items).” May 30. https://archive.is/C9ttg. Accessed: July 23, 2024.

20 | Bilousova, Olena, Hilgenstock, Benjamin, Ribakova, Elina et al. (2024). “Challenges of Export Controls Enforcement: How Russia Continues to Import Components for Its Military Production.” Yermak-McFaul International Working Group on Russian Sanctions and Kyiv School of Economics. January. https://kse.ua/about-the-school/news/challenges-of-export-controls-enforcement-how-russia-continues-to-import-components-for-its-military-production/. Accessed: July 23, 2024; Office of The Director of National Intelligence (2023). “Support Provided by the People’s Republic of China to Russia.” Unclassified report. July. https://democrats-intelligence.house.gov/uploadedfiles/odni_report_on_chinese_support_to_russia.pdf. Accessed: July 23, 2024.

21 | Funayole, Matthew P., Hart, Brian and Riggs-Powers, Aidan (2023). “De-risking Gallium Supply Chains: The National Security Case for Eroding China’s Critical Mineral Dominance.” August 3. De-risking Gallium Supply Chains: The National Security Case for Eroding China’s Critical Mineral Dominance (csis.org). Accessed: July 23, 2024; Carrara, S., Bobba, S., Blagoeva, D. et al. (2023). “Supply chain analysis and material demand forecast in strategic technologies and sectors in the EU – A foresight study.” Publications Office of the European Union. Luxembourg, 2023, JRC132889. doi:10.2760/334074.

22 | The Wassenaar Arrangement is the multilateral regime that governs transfers of conventional weapons as well as dual-use items and technologies. The Wassenaar Arrangement. About us. https://www.wassenaar.org/about-us/#faq. Accessed: July 23, 2024.

23 | This was confirmed by industry insiders.

24 | The Observatory of Economic Complexity. Silicon Carbide. https://oec.world/en/profile/hs/silicon-carbide. Accessed: July 23, 2024.

25 | Financial Times (2023). “Chinese group Putailai to build Europe's largest anode factory in Sweden.” May 4. https://www.ft.com/content/80d34254-3e12-4fa7-8f02-fdceb1c2fa2e. Accessed: July 23, 2024.

26 | Ministry of Commerce of the PRC (2021). “中华人民共和国技术进出口管理条例(2020年修订)(Regulations of the People’s Republic of China on The Administration of Import and Export of Technologies (2020 Revision).” November 29. https://www.pkulaw.cn/fulltext_form.aspx?Db=chl&Gid=348783. Accessed: July 23, 2024.

27 | People’s Daily 人民日报 (2018). “维护国家安全和创新发展能力 建立完善知识产权对外转让审查机制 (Protecting national security and innovative development capacity, building a complete review system for the outbound transfer of intellectual property rights.” April 4. https://archive.is/wGfFv. Accessed: July 23, 2024.

28 | The State Council of the PRC (2018). “国务院办公厅关于印发《知识产权对外转让有关工作办法(试行)》的通知 (Notice of the General Office of the State Council on Printing and Distributing the Working Measures for the Transfer of Intellectual Property Rights to Foreign Countries (for Trial Implementation).” March 18. Accessed: July 23, 2024.

29 | The New York Times (2020). “TikTok Deal Is Complicated by New Rules from China Over Tech Exports.” August 29. https://www.nytimes.com/2020/08/29/technology/china-tiktok-export-controls.html. Accessed: July 22, 2024.

30 | Bloomberg (2023). “China Turns Up Heat on Trade with Rare Earths Tech Curbs.” December 21. https://www.bloomberg.com/news/articles/2023-12-21/china-bans-exports-of-some-rare-earth-processing-technologies-lqf1pzw8. Accessed: July 23, 2024; Yang Men’s Insights杨门灼见 (2023). “中国强化稀土管理,商务部公布目录:出口需要报告 (China strengthens rare earth regulation, MOFCOM releases catalogue: exports must be reported).” November 10. https://archive.is/JL96W; The Paper 澎湃新闻 (2023). “"中国限制出口稀土技术,美西方在供应竞争中受阻” (“China restricts exports of rare earth technology, U.S. and West hindered in supply chain competition”).” December 22. https://archive.is/3KC2Z.

31 | Baskaran, Gracelin (2024). „What China’s Ban on Rare Earths Processing Technology Exports Means.” Center for Strategic and International Studies. January 8. https://www.csis.org/analysis/what-chinas-ban-rare-earths-processing-technology-exports-means. Accessed: July 23, 2024.

32 | China has been trying to climb up the value chain by moving away from less value-add steps like mining, where the highest environmental and social costs lie, towards more advanced steps. Che, Chang (2021). “The Rare Earth Myth.” The China Project. September 2. https://thechinaproject.com/2021/09/02/the-rare-earth-myth/. Accessed: July 23, 2024.

33 | Ma, Damien and Anderson, Joshua (2021). “The Impermanence of Permanent Magnets: A Case Study on Industry, Chinese Production, and Supply Constraints.” Macro Polo. November 16. https://macropolo.org/analysis/permanent-magnets-case-study-industry-chinese-production-supply/. Accessed: July 23, 2022. European Commission (2022). “EU strategic dependencies and capacities: second stage of in-depth reviews.” February 21. https://ec.europa.eu/docsroom/documents/48878. Accessed: July 23, 2024.

34 | Ma, Damien and Anderson, Joshua (2021). “The Impermanence of Permanent Magnets: A Case Study on Industry, Chinese Production, and Supply Constraints.” Macro Polo. November 16. https://macropolo.org/analysis/permanent-magnets-case-study-industry-chinese-production-supply/. Accessed: July 23, 2024; Hmaidi, Antonia and Gunter, Jacob (2023). “China faces an uphill climb while the West needs to make unpopular choices.” MERICS. August 15. China faces an uphill climb while the West needs to make unpopular choices | Merics. Accessed: July 23, 2024.

35 | POSCO (2024). “POSCO INTERNATIONAL Establishes ‘China Excluded’ Supply Chain for Rare Earth Magnets.” March 18. https://newsroom.posco.com/en/posco-international-establishes-china-excluded-supply-chain-for-rare-earth-magnets/. Accessed: July 23, 2024; Global Times 环球时报 (2024). “韩国永磁体大单“试图摆脱中国”,专家:背后离不开美西方支持 (Korea’s large order of permanent magnets “attempting to get rid of China”, expert: background is US and Western support).” March 13. https://archive.is/kbrod. Accessed: July 23, 2024.

36 | U.S. Department of Defense (2024). “DOD Looks to Establish 'Mine-to-Magnet' Supply Chain for Rare Earth Materials.” March 11. https://www.defense.gov/News/News-Stories/Article/Article/3700059/dod-looks-to-establish-mine-to-magnet-supply-chain-for-rare-earth-materials/. Accessed: July 23, 2024; NEO’s former CEO downplayed the controls, stating that China already restricted the technology from being exported. Reuters (2023). “China bans export of rare earths processing tech over national security.” December 22. https://www.reuters.com/markets/commodities/china-bans-export-rare-earths-processing-technologies-2023-12-21/. Accessed July 23, 2024. Vacuumschmelze has a plant in Shenyang which makes magnetic cores, among other products, but we could not verify whether this has any implications for the company’s ability to undertake the US project without needing to obtain a Chinese government license.

37 | Choke points are points of failure along global supply chains and within economic networks. In recent years, scholars have demonstrated how governments can leverage such choke points to achieve geopolitical and strategic gains, for example by denying access to adversaries. This was recommended as a strategy the US government should adopt to cut China off certain technology value chains through leveraging the dominance of US and allied countries’ firms over key production steps. Washington effectively tested this in October 2022 when it restricted semiconductor technology exports to China.

38 | The US government is facing a similar tradeoff. Crosignani, Matteo, Han, Lina, Macchiavelli, Marco and Silva, André F. (2024). “Geopolitical Risk and Decoupling: Evidence from U.S. Export Controls.” Federal Reserve Bank of New York Staff Reports, no. 1096, April. https://doi.org/10.59576/sr.1096https://www.newyorkfed.org/research/staff_reports/sr1096. Accessed: July 23, 2024; Baums, Ansgar (2024). “The “Chokepoint” Fallacy of Tech Export Controls.” Policy Memo. The Stimson Center. February 6. https://www.stimson.org/2024/the-chokepoint-fallacy-of-tech-export-controls/. Accessed: July 23, 2024; Hmaidi, Antonia and Chang, Wendy (2024). “Tech “choke-points” – the long-term side-effects for China and the US.” MERICS. February 1. https://merics.org/en/comment/tech-choke-points-long-term-side-effects-china-and-us. Accessed: July 23, 2024.

39 | 21st Century Economic Herald 21 世纪经济报道 (2023). “激光雷达技术限制出口影响有限,真正壁垒是成本与量产 (The impact of export controls on LiDAR technology is limited; real barriers are cost and mass production).” January 31. https://archive.is/7gY6z. Accessed: July 22, 2024; National Business Daily 每日经济新闻 (2023). “商务部拟禁止激光雷达技术出口 为摊平成本各方加速“上车” (The Ministry of Commerce plans to ban the export of LiDAR technology, everyone is speeding up the autonomous driving game to spread costs).” February 8. https://archive.is/KdIwM. Accessed: July 22, 2024; AlixPartners (2023). “China’s Proposed Export Ban on LiDAR Technology: What Impact Will It Have on the Automotive Industry?” April 5. https://www.alixpartners.com/insights/102ic0t/chinas-proposed-export-ban-on-lidar-technology-what-impact-will-it-have-on-the/. Accessed: July 22, 2024.

40 | China Economic Net 中国经济网 (2023). “白重恩委员:建议不限制光伏硅片制备技术出口 (Delegate Bai Chongen: It is proposed not to restrict the export of photovoltaic silicon wafer preparation technology).” March 10. https://archive.is/CXzKy. Accessed: July 23, 2024.

41 | This was confirmed in conversations with multiple foreign government officials.

42 | US House of Representatives. “United States Code – Title 50 – Chapter 58 – Export control reform.” https://uscode.house.gov/view.xhtml?path=/prelim%40title50/chapter58&edition=prelim. Accessed: July 17, 2024; Sullivan, James (2022). “Remarks by National Security Advisor Jake Sullivan at the Special Competitive Studies Project Global Emerging Technologies Summit.” The White House. September 16. https://www.whitehouse.gov/briefing-room/speeches-remarks/2022/09/16/remarks-by-national-security-advisor-jake-sullivan-at-the-special-competitive-studies-project-global-emerging-technologies-summit/. Accessed: July 17, 2024.

43 | Drinhausen, Katja and Legarda, Helena (2021). “China’s Anti-Foreign Sanctions Law: A warning to the world.” June 24. https://www.merics.org/en/comment/chinas-anti-foreign-sanctions-law-warning-world. MERICS. Accessed: July 22, 2024.

44 | Groenewegen-Lau, Jeroen and Laha, Michael (2023). “Controlling the innovation chain: China’s strategy to become a science & technology superpower.” February 2. https://merics.org/en/report/controlling-innovation-chain. Accessed: July 22, 2024; Laha, Michael (2022). “How China plans to engineer its way out of technology ‘strangleholds’.” September 16. https://www.aspistrategist.org.au/how-china-plans-to-engineer-its-way-out-of-technology-strangleholds/. Accessed: July 22, 2024.

45 | SASAC announced in May 2023 the formation of the Leading Small Group for the Accelerated Development of Strategic Emerging Industries in Central Enterprises. Party Committee of the State-owned Assets Supervision and Administration Commission 国务院国资委党委 (2023). “深学细悟笃行 为强国建设贡献国资央企力量 (Deeply study and practice the power of state-owned central enterprises in contributing to the construction of a strong nation).” Qiushi. May 1. https://archive.is/FJ2hB. Accessed: July 22, 2024; People’s Daily 人民日报 (2023). “全面推进美丽中国建设 健全自然垄断环节监管体制机制 (Comprehensively promote the construction of a beautiful China and improve supervision systems and mechanisms in natural monopoly sectors).” November 2023. https://archive.is/GRD9J. Accessed: July 22, 2024.

46 | Brown, Alexander, Chimits, Francois and Sebastian, Gregor (2023). “Accelerator State: How China fosters “Little Giant” companies.” MERICS. August 3. https://www.merics.org/sites/default/files/2023-07/MERICS%20Report%20Accelerator%20State_final.pdf. Accessed: July 22, 2024; Li, Jinlin (2022). “Government as an Equity Investor: Evidence from Chinese Government Venture Capital through Cycles”. Available at SSRN: https://ssrn.com/abstract=4221937 or http://dx.doi.org/10.2139/ssrn.4221937. Colonnelli, Emanuele, Li, Bo and Liu, Ernest (2024). “Investing with the government: A field experiment in China”. Journal of Political Economy 132(1): 248-294; Xinhua 新华 (2024). “国务院国资委确定首批启航企业 加快发展新质生产力 (State-owned Assets Supervision and Administration Commission of the State Council identified the first batch of Set Sail Enterprises to accelerate the development of new quality productive forces).” March 29. https://archive.is/OffPQ. Accessed: July 22, 2024.

47 | Largely in response to the PRC’s talent poaching and S&T espionage, Taiwan and South Korea have moved to monitor the activities of certain scientific and engineering personnel to protect IP and trade secrets related to critical technologies. Executive Yuan (2022). “Executive Yuan guards core technologies with draft amendments to national security and mainland relations laws.” Department of Information Services, Executive Yuan. February 17. Accessed: July 17, 2024. https://english.ey.gov.tw/Page/61BF20C3E89B856/7e320e20-2216-4142-91de-7e8ab921f6d3; Nikkei Asia (2022). “South Korea to track travel by chip engineers as tech leaks grow.” February 5. South Korea to track travel by chip engineers as tech leaks grow - Nikkei Asia. Accessed: July 22, 2024.

48 | CCP Central Committee and State Council (2016). “关于加强和改进教学科研人员因公临时出国管理工作的指导意见 (Guiding Opinions on Strengthening and Improving the Management of Teaching and Scientific Research Personnel Temporarily Going Abroad for Official Purposes).” Available at: https://archive.is/ygLYm. Accessed: July 24, 2024; South China Morning Post. “‘Two sessions’ 2024: China urged to ease overseas travel and media rules for academics.” March 8. https://www.scmp.com/news/china/diplomacy/article/3254641/two-sessions-2024-china-urged-ease-overseas-travel-and-media-rules-academics. Accessed: July 22, 2024. One legal expert told us that in the context of a patent litigation case they were involved in, it was found that a Chinese university professor needed around a dozen different permits to file a patent abroad, involving the university and at least five government agencies.

49 | “Strategic scientists” (战略科学家), a category in China’s talent program for top talents, are included in the restrictions for overseas travel that we know exist for Chinese officials and employees of SOEs. South China Morning Post (2024). “China’s expanding travel curbs are cutting off more state workers from the rest of the world.” June 6. https://www.scmp.com/news/article/3265503/chinas-expanding-travel-curbs-are-cutting-more-state-workers-rest-world. Accessed: July 22, 2024.

50 | Ministry of Science and Technology of the PRC (2021). “中华人民共和国科学技术进步法(2021年修订) (People’s Republic of China Science and Technology Progress Act (Revised in 2021).” December 2024; European Chamber of Commerce in China (2021). “European Business in China Position Paper 2021/2022”. October. https://sgc.frankfurt-school.de/wp-content/uploads/2021/10/European_Business_in_China_Position_Paper_2021_2022964.pdf. Accessed: July 17, 2024.

51 | National People’s Congress of the PRC (2020). “中华人民共和国专利法(2020年修正) (National Patent Law of the People’s Republic of China (Revised in 2020).” November 23.

52 | Taiwan and South Korea stand out for having limited outbound investment screening legislation, while the United States is on course to introducing one specific to transactions involving Chinese companies in designated technology sectors. Ghiretti, Francesca (2023). “From opportunity to risk: The changing economic security policies vis-à-vis China”. MERICS. February 22. https://merics.org/de/studie/opportunity-risk-changing-economic-security-policies-vis-vis-china. Accessed: July 17, 2024; US Department of the Treasury. Outbound Investment Security Program. https://home.treasury.gov/policy-issues/international/outbound-investment-program. Accessed: July 17, 2024.

53 | Huotari, Mikko, Gunter, Jacob, Hayward, Carl et al. (2021). “Decoupling - Severed Ties and Patchwork Globalisation.” European Chamber of Commerce in China in partnership with MERICS. January 14. https://merics.org/en/report/decoupling-severed-ties-and-patchwork-globalisation. Accessed: July 17, 2024.

54 | Ministry of Science and Technology of the PRC and National Bureau for the Protection of State Secrets (2015). “Regulations on the Protection of Science and Technology Secrets.” Translated by China Law Translate. December 1. https://www.chinalawtranslate.com/en/Regulations-on-the-Protection-of-Science-and-Technology-Secrets/. Accessed: July 22, 2024; Chinese Communist Party Members Network 共产党员网 (2024). “请对照自查!科技保密管理一定要了解的知识 (Please check yourselves! The knowledge that must be understood in the management of scientific and technological confidentiality).” January 4. https://archive.is/sYXuL. Accessed: July 22, 2024.

55 | National People’s Congress (2024). “中华人民共和国保守国家秘密法 (Law of the People's Republic of China on Guarding State Secrets.” Revised on February 27, 2024.

56 | Von Carnap, Kai (2023). “Amended anti-espionage law aims to curate China’s own narrative.” MERICS. May 25. https://merics.org/en/comment/amended-anti-espionage-law-aims-curate-chinas-own-narrative. Accessed: July 22, 2024; Reuters (2023). “China detains staff, raids office of US due diligence firm Mintz Group.” March 24. https://www.reuters.com/world/us-due-diligence-firm-mintz-groups-beijing-office-raided-five-staff-detained-2023-03-24/. Accessed: July 22, 2024; The Guardian (2023). “China targets foreign consulting companies in anti-spying raids.” May 9. https://www.theguardian.com/world/2023/may/09/china-targets-foreign-consulting-companies-in-anti-spying-raids. Accessed: July 22, 2024.

57 | Von Carnap, Kai (2023). “The increasing challenge of obtaining information from Xi’s China.” MERICS. February 15. https://merics.org/de/report/increasing-challenge-obtaining-information-xis-china. Accessed: July 22, 2024; The Wall Street Journal (2023). “U.S. Think Tank Reports Prompted Beijing to Put a Lid on Chinese Data.” May 7. https://www.wsj.com/articles/u-s-think-tank-reports-prompted-beijing-to-put-a-lid-on-chinese-data-5f249d5e. Accessed: July 22, 2024.

58 | Garred, Jason (2019). “The persistence of trade policy beyond import tariffs.” Center for Economic Policy Research. July 9. https://cepr.org/voxeu/columns/persistence-trade-policy-beyond-import-tariffs. Accessed: July 22, 2024; European Commission (2009). WT/DS395 - China - Measures Related to the Exportation of Various Raw Materials. https://policy.trade.ec.europa.eu/enforcement-and-protection/dispute-settlement/wto-dispute-settlement/wto-disputes-cases-involving-eu/wtds395-china-measures-related-exportation-various-raw-materials_en. Accessed: July 23, 2024; Bown, Chad P. Wang Yilin (2022). “China's recent trade moves create outsize problems for everyone else”. Peterson Institute for International Economics. https://www.piie.com/blogs/realtime-economic-issues-watch/chinas-recent-trade-moves-create-outsize-problems-everyone April 25. Accessed: July 22, 2024.

59 | Global Times (2023). “China to strengthen regulations governing rare-earth exports: MOFCOM.” November 7. https://www.globaltimes.cn/page/202311/1301346.shtml. Accessed: July 22, 2024.

60 | The New York Times (2021). “Lithuania vs. China: A Baltic Minnow Defies a Rising Superpower.” September 30. https://www.nytimes.com/2021/09/30/world/europe/lithuania-china-disputes.html. Accessed: July 22, 2024.