China's GDP expands in Q4 but new growth drivers are needed in 2025

MERICS Economic Indicators Q4/2024

MERICS Q4 analysis: China hits its growth target and Beijing braces for turbulence as risks loom in 2025

China’s economy ended the year stronger-than-expected, as GDP expanded by 5.4 percent in the final quarter of 2024, taking full year growth to five percent. Government stabilization efforts launched at the end of September appear to have paid off, so the official annual growth target was hit, spot on at five percent. The momentum gained positions the leadership to face the uncertainties of 2025, but significant challenges remain.

The improvement in Q4 was driven by a robust manufacturing sector and booming exports, which align closely with the leadership’s industrial policy objectives. Exports’ contribution to GDP growth hit its highest level since 1997, producing a record trade surplus of nearly USD 1 trillion. This peak highlights Beijing’s success in achieving its policy objectives, namely improving the industrial sector’s competitiveness. However, it risks triggering pushback from global partners, such as the United States and EU. Under the new Trump administration, frictions are likely to intensify.

By contrast, consumption remains a glaring weak spot, reflecting the downsides of China’s two-speed economy. The government has pledged additional support measures to bolster consumption, but there are no signs of structural reforms that could boost domestic demand in more secure, long-term ways. Household sentiment may take encouragement from signs the real estate sector’s struggles are bottoming out, but improvements remain tentative, and the sector’s recovery is still uncertain.

For China’s leadership, their prioritization of manufacturing and technology is about geopolitical resilience, even more than economic stability. Build-up capacity requires substantial financial resources, which comes at the expense of profitability. The leadership views the matter through the lens of geopolitical rivalry rather than economic development and is ready to bear the costs.

However, the middle class that is bearing the brunt of this strategy, with weak consumption and real estate woes destroying their asset values and dampening their economic prospects. Deteriorating US-China ties under President Trump may paradoxically aid Beijing’s narrative. A harder external environment might enable the leadership to justify further sacrifices from the middle class and pressure companies to align with strategic goals focused on economic security and self-reliance.

China’s leaders are preparing for more challenges. So far, they are holding course and seem ready for more volatility in 2025. But navigating complexities requires a clear view of the economic challenges – which the leadership seems less keen to hearing. Instructions to “promote a positive narrative about the bright spots” may get economists to parrot the official line but risks ignorance of brewing challenges and can get in the way of making the best policy choices. Concerns about the reliability of Chinese data which overstate growth are already growing.

The MERICS China Confidence Index measures household and business confidence in future income and revenues. The index is weighted between household and business indicators. It includes the following indicators: stock market turnover, future income confidence, international air travel, new manufacturing orders, new business in the service sector, urban households’ house purchase plans, venture capital investments, private fixed asset investments and disposable income as a share of household consumption. All components have been tested for trends and seasonality.

The MCCI was first developed in Q1 2017.

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 1

Macroeconomics: Stronger industrial sector helps lift Q4 growth to meet annual target

Exhibit 2

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 3

- China's GDP growth accelerated to 5.4 percent in Q4, which was the strongest quarterly expansion in 2024. It enabled the government to meet its annual growth target of “around 5 percent”; full year GDP came in at 5.0 percent. All the major components of GDP improved in Q4, with the aid of expanded stimulus measures (see exhibit 2). However, the divergence between a booming industrial sector and weak domestic consumption highlights China’s ongoing structural challenges. Trade tensions are expected to intensify in 2025 under Donald Trump’s presidency, which could add further complexity and require yet more support.

- Stronger manufacturing activity was key to better GDP growth in Q4. Manufacturing growth rose by 6.2 percent in Q4, year-on-year, up from 5 percent in Q3. Full year manufacturing growth was up by 6 percent, compared to a paltry 3.9 percent in 2023.

- Industrial output benefited from strong exports, contributing to China’s record trade surplus. Net exports contributed 30.3 percent to GDP growth in 2024, their highest share since 1997. Sustained foreign demand is underpinning China’s industrial activity, providing a buffer against weak domestic consumption.

- The service sector also gained traction, growing 5.8 percent in Q4, year-on-year, compared to 4.8 percent in Q3. Growth was lifted by stronger financial services (6.5 percent) and persistently strong IT services (9.6 percent) during Q4.

- A surprising recovery in the real estate component of GDP added to Q4 performance. The blighted sector expanded by 2 percent year-on-year, its first growth since Q1 2023. (see exhibit 3). The improvement came despite related indicators, such as land and apartment sales, showing signs of bottoming out. However, recovery remains a long way off. The development has raised questions about the reliability of National Bureau of Statistics (NBS) data.

What to watch: Exports will likely face difficulties from changing global politics, stoking pressure on Beijing for alternative growth drivers to emerge.

Business: Rise in auto production carries strong quarter for industrial output

Exhibit 4

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 5

- China’s industrial sector finished the year strong, with value-added output rising by 6.2 percent year-on-year in December. The manufacturing sector led the way with 7.4 percent growth that month. Government support for high-tech manufacturing continues to deliver results in December: new energy vehicles (43.2 percent), industrial robots (36.7 percent) or solar cells (20.7 percent) were all higher.

- A rebound in domestic car sales prompted a surge in automotive production, which rose to 17.7 percent in December, finishing well above its 2024 annual growth rate of 9.1 percent (see exhibit 4). Measures to encourage car buyers, including a vehicle trade-in program, have stimulated sales of new energy vehicles (NEVs) which accounted for just over 50 percent of passenger car sales since August 2024.

- The machinery and transport sectors also did well, with December value-added output for general equipment rising 7.7 percent, electric machinery and equipment going up 9.2 percent and transport equipment up 10.6 percent. Production of civilian steel ships grew by a hefty 36.4 percent in November.

- Steel output rose on the back of a pick-up in manufacturing orders, state-backed construction activity and rising exports. Pig iron and crude steel production climbed out of negative territory to reach 9.4 percent and 11.8 percent respectively in December. But outputs of other construction inputs continued to contract, declines that suggest the fallout from the real estate crisis is not over.

- The National Bureau of Statistics composite purchasing managers’ index (PMI) reached its highest value since April, rising to 52.20 in December (values over 50 indicate expansion), revealing growing optimism in the service (52) and construction sectors (53.2) in December.

- Falling profitability is likely contributing to the lack of enthusiasm among China’s industrial firms, as deflationary pressure and fierce competition in many sectors is hurting the bottom line. Operating profits at industrial enterprises have progressively worsened over the course of 2024, falling to 4.5 percent year-on-year up till the end November (see exhibit 5).

What to watch: With trade barriers set to cause growing headaches for business in 2025, more effective demand side policies will be needed to support the industrial sector.

International trade and investment: Exports boost growth in Q4, but trade frictions look sure to increase in 2025

Exhibit 6

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 7

- Exports remain a crucial growth driver for China’s economy as overall growth accelerated in Q4, the strongest quarter of 2024. Year-on-year export growth in October was 12.7 percent, measured in USD, and 10.7 percent in December. Full year 2024 exports were worth USD 3.6 trillion, a 38 percent increase from 2019, a robust performance that shows China’s strength as a manufacturing superpower.

- A surge in US-bound exports, up 15.5 percent in December, likely reflects front-loading of orders to buffer against anticipated tariff changes in President Donald Trump’s second term. But exports to ASEAN outpaced all other regions with an 18.9 percent rise, highlighting the region’s reliance on Chinese goods. Meanwhile export growth to the EU, China’s second most important export partner after ASEAN, was up by 8.8 percent in December.

- China retained its position as the world’s top vehicle exporter for the second year in a row, exporting more than six million vehicles (including chassis), up by 22.8 percent. China’s auto makers continue to expand internationally, shaking up global markets. Tariffs have already been put in place in several countries, including in the EU, which are likely to slow, not stop, the expansion.

- Weak household demand, the real estate slowdown and China’s self-sufficiency drive continued to weaken imports in Q4. Contractions in October and November contributed to a year-on-year decline that made Q4 the year’s weakest quarter for imports (see exhibit 6).

- As a result, China’s 2024 trade surplus climbed to nearly USD 1 trillion, the highest on record. Over the past five years the surplus has nearly doubled, expanding by 89.9 percent as China dominates a growing number of industrial sectors, while weak consumption means China’s demand for imports is muted.

China’s trade surpluses expanded across most regions, with Africa being an exception as demand for raw materials from the continent has risen (see exhibit 7). The imbalance in trade flows is likely to bring more pushback, particularly in developing economies grappling with an influx of Chinese goods.

What to watch: Growing trade frictions are likely to be the theme of the year, as President Trump has signaled plans to raise tariffs and take other protectionist measures.

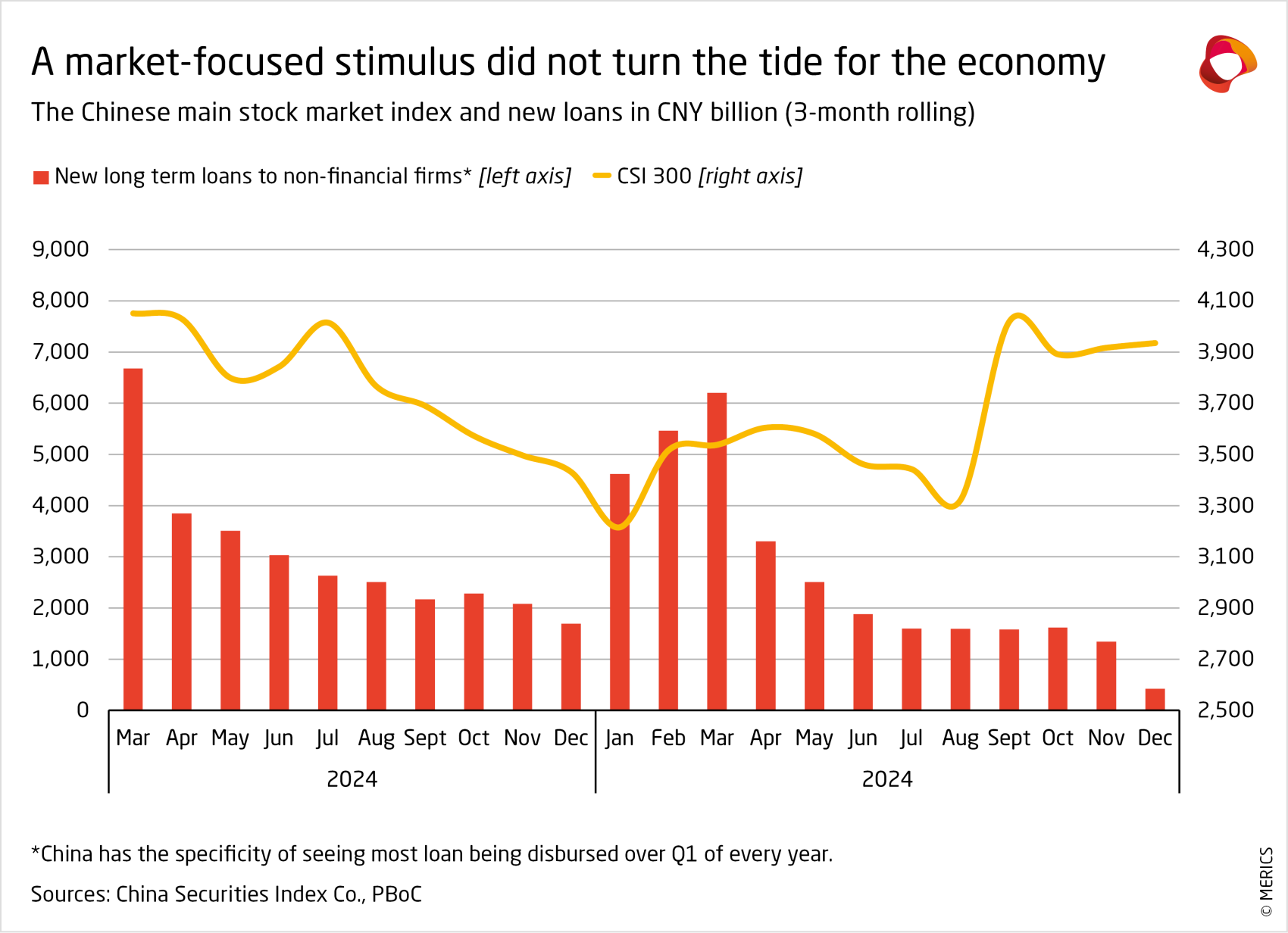

Financial Markets: Massive support stabilized markets, but failed to revive confidence

- Monetary policy expansion in Q4 failed to shift entrenched market and household pessimism. The People’s Bank of China (PBOC) responded by signaling stronger monetary support for 2025, dropping the “prudent” label for the first time since 2011. The monetary policy stance was shifted to a “moderately loose” policy, with interest and reserve rate cuts to ensure ample liquidity.

- This was necessary because financial support rolled out in September and October failed to change course of the economy, despite reductions in key policy rates and two relending facilities for financial institutions. These measures helped stabilize the economy but did not produce a turnaround to revive credit demand.

- Outstanding loan growth fell to a record low of 7.6 percent in December year-on-year, down from 8.1 percent at the end of September. The slowdown was partially due to record low long-term loans to firms over Q4 (see exhibit 8). However, thanks to dynamic government bonds and stronger shadow banking, growth of aggregate financing recovered after falling for a year, expanding by 8 percent year-on-year in Q4.

- Uncertainty about growth, outlook and deflation meant the yields of government bonds continued to fall. Rates on ten-year government bonds plummeted to 1.5 percent at the end of December, compared to 2.6 percent at the end of 2023. The trend indicates limited appetite for investments and underscores how policy support has failed to lift sentiment.

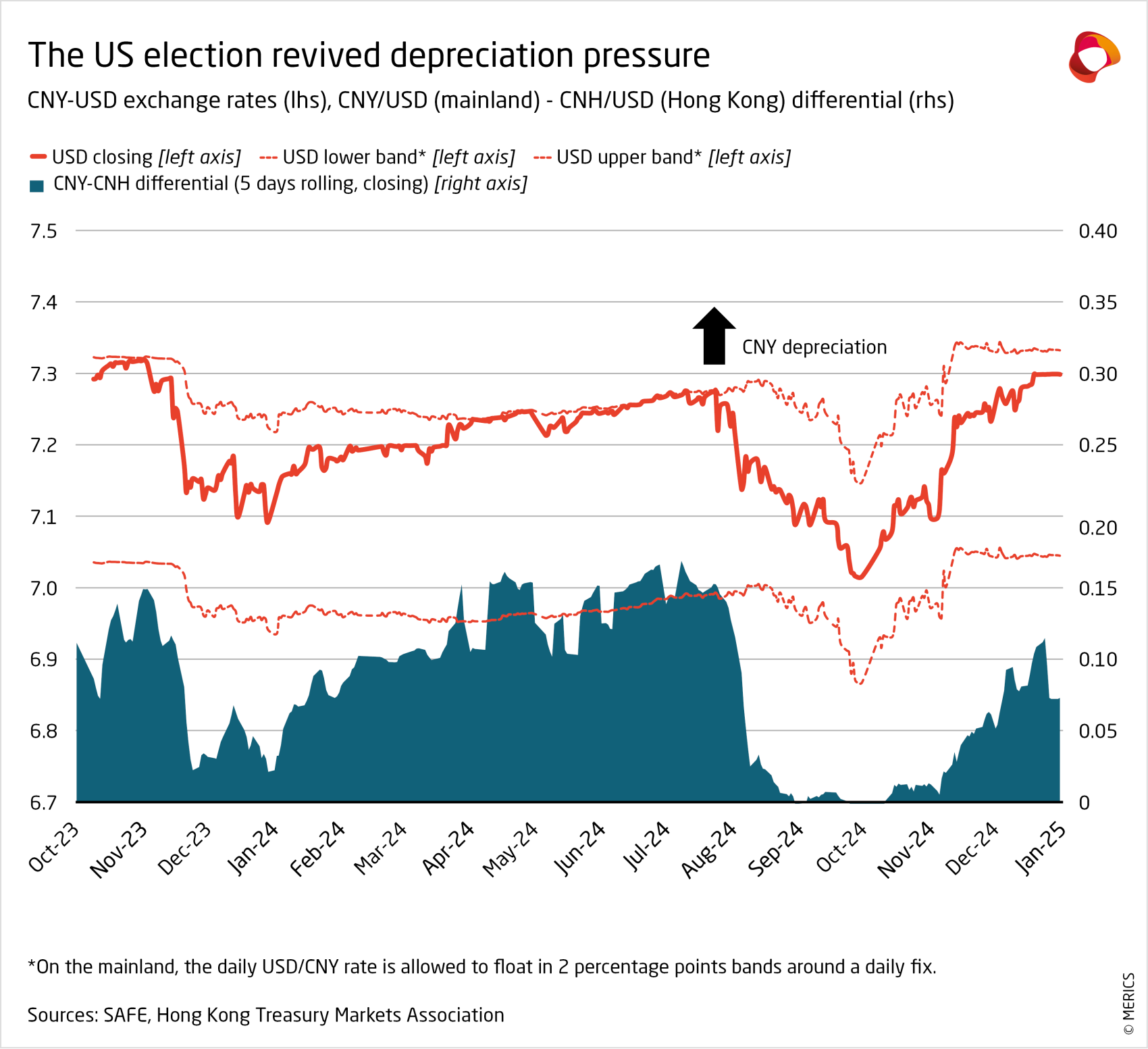

- Anticipating fresh trade frictions from the new Trump administration, Beijing has let the CNY depreciate significantly. Since early November and the result of the US election, the CNY has lost 3 percent of its value against the USD (see exhibit 9). But prospects of a weaker currency have increased capital outflow pressures. In Q4, the exit from the mainland financial market amounted to CNY 496 billion.

What to watch: The scale and nature of additional monetary and fiscal measures will be crucial in shaping investor sentiment on China’s economic trajectory.

Investment: Manufacturing remains a core driver but shows signs of easing

Exhibit 10

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 11

- Fixed asset investment (FAI) in China slowed in Q4, despite support from monetary easing and reduced interest rates. FAI growth fell to 3.2 percent year-on-year in December, the lowest rate in 202, but slightly better than 3 percent in December 2024. Excluding real estate, FAI grew by 7.2 percent, reflecting a stark divergence between strategic sectors, such as technology, and struggling non-strategic areas like real estate.

- Investment is closely aligned with industrial policy objectives focused on modernization and capacity expansion. Manufacturing investment grew steadily at 9.2 percent for the year, making it a key driver. High-tech investment, though still high, showed signs of a slowdown in December, raising concerns about sustaining momentum in advanced sectors (see exhibit 10).

- Investment in transportation, including rail, aerospace, and shipping, surged by 34.9 percent year-on-year in December. Strong exports and domestic demand for ships likely contributed to this growth. The crucial auto sector also gained traction over Q4, achieving its highest growth rate of 2024 at 7.5 percent in December.

- However, low-tech sectors also supported overall manufacturing investment growth in 2024. For example, furniture (9.8 percent), paper (19.6 percent), and textiles (15.6 percent) all expanded strongly. Their growth may be driven by automation upgrades. Investment in new equipment rose 15.7 percent in 2024, compared to just 6.6 percent in 2023, suggesting the official drive to modernize traditional industries is succeeding.

- Real estate investment showed its sharpest decline since early 2020, contracting by 10.6 percent in Q4. Government stabilization measures have yet to reverse the downward trend, as building starts and land purchases continue to struggle, reflecting the sector’s ongoing challenges which have ripple effects on wider economic sentiment.

What to watch: The high level of manufacturing investment is likely to ease in 2025, adding to pressure on the government to find new growth drivers.

Prices: China’s economy continues to grapple with deflationary pressures

Exhibit 12

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 13

- China’s economy continues to suffer deflationary pressure as key price indicators slipped during the final quarter of 2024 (see exhibit 12). The government’s greater focus on supply-side measures, rather than boosting household demand, limited the effectiveness of its fiscal and monetary stimulus to boost prices.

- The consumer price index (CPI) narrowly avoided deflation in December, rising by just 0.1 percent year-on-year, the slowest pace since March. Annual CPI growth of 0.2 percent remains well below the government’s 3 percent target, reflecting persistently weak domestic demand.

- Service price rises provided a slight cushion to the overall CPI, inching up from 0.4 percent in September to 0.5 percent in December. However, consumer goods prices fell back into deflation, contracting by 0.2 percent in December, underscoring the fragile nature of household consumption and low sentiment.

- After the strongest contraction of 2024 in October (-2.9 percent), price contractions had improved slightly by December, when prices only fell by 2.3 percent. The producer price index (PPI) has now been falling for 27 consecutive months. There is no end in sight as the government’s policy priority remains to support the expansion of China’s industrial capacity.

- The automotive sector has been particularly hard hit. Prices contracted by a record 3.8 percent in December, a symptom of the intense price competition and overcapacity in an industry that received a strong growth push from government-backed capacity expansion policies.

- Real estate prices show tentative signs of stabilization. After contracting 8.8 percent in April, price falls moderated to 2.4 percent by December, supported by marginal improvements in residential apartment prices (see exhibit 13). However, the sector’s recovery remains fragile, and an improvement will be central to improving sentiment and lifting demand.

What to watch: The government may need to step up policy support to avoid a deflationary spiral if the stimulus package it announced at the end of Q3 2024 fails to help lift prices.

Labor Market: Employment conditions fail to improve over the final quarter of 2024

Exhibit 14

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 15

- China's unemployment rate was 5.1 percent in December after falling to 5 percent in the two months before. There were 12.6 million new urban jobs created in 2024, exceeding the government’s 12-million target. But challenging labor market conditions persist, prompting various government agencies to once again expand measures such as tax cuts for employers and initiatives for entrepreneurship.

- Nonetheless, companies continue to announce job cuts in a difficult economic environment. Employment at foreign companies fell by 15 percent in 2024, going below 10 million for the first time since 2009. Record numbers of young Chinese sought safety in public sector jobs: 3.4 million took the civil service exam in 2024, triple the number who applied a decade ago in 2014.

- Youth unemployment eased to 15.7 percent in December, down from August's peak of 18.8 percent. With a record number of university graduates entering the labor market in 2025, the Ministry of Education is pushing universities to align programs with national priorities and technological progress (see exhibit 14). To streamline university offerings, programs with low employment rates will get “red or yellow card” warnings.

- Public confidence in future employment and income prospects remains near three-year lows, as tracked by household surveys. Despite government efforts, labor market sentiment continues to soften, highlighting persistent uncertainty among households.

- Wage increases for new positions tracked by recruitment platform Zhaopin worsened in the second half of 2024, contracting by 0.6 percent in Q3. Wage rises had expanded by 0.5 percent in Q2 year-on-year. The number of provinces announcing minimum wage increases fell in 2024, and the wage increases were the lowest in five years (see exhibit 15). In January, reports emerged that civil servants could expect wage increases in 2025 as part of measures to boost consumption, despite local government budget constraints.

What to watch: As yet another record cohort of university graduates enters a weak labor market, the government will face greater pressure to reconsider the effectiveness of its support measures.

Retail: Stimulus helps lift Q4 consumption, but recovery remains fragile

Exhibit 16

![]() Hover over/tap the charts to see more details.

Hover over/tap the charts to see more details.

Exhibit 17

- The consumption year beat market expectations in 2024, up by 3.7 percent year-on-year and better than the forecasted 3.5 percent. The stimulus push announced in September helped raise retail growth to 4.8 percent. Overall consumption growth in Q4 was 3.8 percent, outpacing Q3’s gains of 2.6 percent.

- Services stayed robust though it showed signs of cooling in Q4 (see exhibit 16). By December, spending on services and restaurant sales hit their lowest levels in 2024, partly due to high base effects from 2023. Despite the slowdown, growth in service demand remains stronger than for goods consumption.

- Retail sales of goods improved modestly, up 3.2 percent year-on-year in December. Retail sales for house-hold electronics and appliance surged to their highest levels since early 2010, lifted by government trade-in programs in the stimulus package. Sales expanded by 39.3 percent in December, year-on-year, and by 12.3 percent annually.

- The government aims to boost consumption in 2025, despite headwinds from a likely slowdown in export and investment growth. Stronger domestic demand will be crucial to maintain economic momentum and offsetting China’s external and structural challenges.

- The government stressed the importance of supporting stronger consumption during its direction-setting Central Economic Work Conference in December. New measures were swiftly introduced in January. The Ministry of Commerce made four more types of home appliances eligible for subsides, lifting the total to 12 by including microwaves, water purifiers, dishwashers and rice cookers.

- Consumer sentiment remains a challenge, and consumer confidence indicators bump along at persistently low levels (see exhibit 17). Weak sentiment could dampen any further recovery in consumption, highlighting the importance of ongoing government interventions to stimulate demand. But lifting sentiment in a more sustainable way will need stronger wage growth and a focus on structural challenges such as household registration reforms and social welfare.

What to watch: The scope and speed of new consumer support measures will be key to lifting retail growth in 2025.