Downward pressure on the economy rises amid growing uncertainty

MERICS Economic Indicators Q1/2022

MERICS Q1 analysis: Economic growth will depend upon stimulus as outlook worsens

China’s economy has faced a challenging start to 2022. Although GDP grew by 4.8 percent in the three months to March, up from 4 percent in the final quarter of 2021, there are considerable downside pressures ahead. After strong growth in the first two months, March was a turning point. The unfolding economic fallout of the Ukraine war has brought new levels of geopolitical complexity and dampened prospects for global economic growth. Meanwhile, China is experiencing the largest Covid-19 outbreaks and lockdowns since the pandemic began, as the government sticks to its strict pandemic management policy.

Clearly, March brought very unpleasant headaches for China’s leadership, requiring urgent policy changes. With the upcoming 20th Party Congress in the fall the government is looking for stronger stimulus measures to support economic growth.

China has been less affected than many other countries by the skyrocketing energy and food prices sparked by Russia’s war in Ukraine. It has a high degree of self-sufficiency in grain and benefits from the mitigating effects of state-owned enterprises in the energy sector. But the longer the war drags on, the more China’s economy will be affected. After rising prices for key commodity imports, the most immediate threat comes from falling exports. Soaring inflation is denting consumers’ purchasing power in key export destinations. China has enjoyed nearly two years of thriving exports propping up GDP growth, something that seems likely to end. If so, manufacturing activity will be negatively affected, and already struggling small and medium enterprises (SMEs) will suffer the most.

The government’s attempt to shift from the “zero Covid” policy to “dynamic zero Covid” has been far from smooth amid a record number of new cases. Rigorous pandemic management policies have hit China’s industrial heartland, with lockdowns in Shanghai, Shenzhen, and Jilin in the northeast. Manufacturing supply chains have been disrupted and prospects for a recovery in consumption look dismal. Consumption was already the weak spot during the economic recovery last year. Now, households are again increasing their savings to guard against uncertain times.

Nonetheless, China’s government has set its GDP growth target at “around” 5.5 percent. The target looks highly ambitious as exports and consumption will fail to support growth. However, the reason is straightforward: growth needs to reach this target to ensure labor market stability. In 2022, China’s labor market will need to absorb a record 10.8 million university graduates.

The government will accelerate stimulus measures in order to reach its GDP growth target. It is already easing up on regulatory tightening in the real estate and tech sectors. The shift towards more expansive fiscal and monetary policy is set to accelerate to shore up investment. But as private companies seem unlikely to invest, already highly leveraged local governments and state-owned enterprise are likely to do the heavy lifting, which will erode long term efforts to reduce debt levels and underlying financial risks.

The MCCI was first developed in Q1 2017.

Macroeconomics: Economic recovery looks fragile without more stimulus

Exhibit 1

Exhibit 2

- China’s GDP grew by 4.8 percent in the first quarter (see exhibit 1), up from 4 percent in Q4 2021, largely thanks to increased monetary and fiscal easing measures introduced at the end of last year. Difficulties in the economic environment such as rising Covid infections and the Ukraine war only started to show up in March. It will now be an uphill battle for the government to reach its annual GDP growth target of “around 5.5 percent.”

- The uptick in the first quarter was mainly due stronger industrial activity. After slowing for three quarters, manufacturing activity expanded by 6.1 percent, up from 3.1 percent in the last quarter of 2021. The construction sector returned to growth following two quarters of contraction, expanding by 1.4 percent year on year (see exhibit 1).

- Growth in all other sectors of the economy (services and agriculture) either slowed compared to the previous quarter, or contracted. Real estate services contracted (-2 percent), as did the accommodation and catering trade (-0.3 percent). Overall services sector growth lagged behind overall GDP growth, rising by 4 percent year on year.

- Gross capital formation’s share to GDP growth increased by 38.5 percentage points compared to the last quarter, accounting for 26.9 percent of overall growth. The share is likely to increase as more stimulus measures are rolled out and real estate construction begins to recover.

- The pandemic is leaving its mark on the structure of the economy. The first quarter usually sees the highest contribution from the services sector due to the Chinese New Year holiday, when most factories shut down and leisure spending is high. Since 2020, the service sector’s share of the economy has begun to fall back to levels last seen in 2015/16, while the industrial sector has increased its share (see exhibit 2).

What to watch: China’s economy will only be on a more solid footing when service sector growth recovers.

Business: Industrial output grows steadily but faces major headwinds

Exhibit 1

Exhibit 2

- Mining and high-tech industries propped up China’s industrial output in Q1, expanding by 10.7 percent and 14.2 percent respectively. Overall value-added industrial activity grew by 6.5 percent. However, in the coming months, adherence to the “zero-covid” strategy will weigh heavily on growth, despite government efforts to keep production and logistics running. (see exhibit 1).

- Manufacturing growth slowed to 4.4 percent in March after expanding by 7.3 percent in the first two months. Production shutdowns in key manufacturing hubs hit foreign companies concentrated in these are-as hard. Value-added year-on-year growth for foreign firms fell by 1.1 percent in March, compared to growth of 6 percent for private enterprises overall.

- The automotive sector had a strong first quarter with value-added growth of 4.0 percent year-on-year. However, the sector remains far below its 2017 production peak and its recovery is coming to a halt. In March, output shrank by 1 percent as lockdowns hit Jilin and Shanghai, two major car producing regions.

- For crude steel, value-added growth fell by 10.5 percent in Q1, while for cement it was down 12.1 percent. Central government directives limited steel production to reduce emissions during the Winter Olympics and the National People's Congress. Demand for building materials is likely to pick up as the government’s stimulus boosts construction.

- The Purchasing Managers’ Index (PMI), which captures business sentiment, dropped to 48.8 in March, its lowest level since the first lockdown in January 2020. Small enterprises were particularly pessimistic; their manufacturing PMI stood at 46.6 in March.

- Small and medium sized enterprises (SME) remain highly vulnerable to the challenging business environment. In response, the government has pledged to halve corporate income tax for small and micro-sized enterprises and announced that tech-focused SMEs can also deduct 100 percent of some R&D expenses from their taxable income.

What to watch: The fallout from lockdowns in China’s manufacturing hubs will only be fully apparent in Q2.

International trade and investment: Foreign trade faces rapidly shifting external and internal environment

Exhibit 2

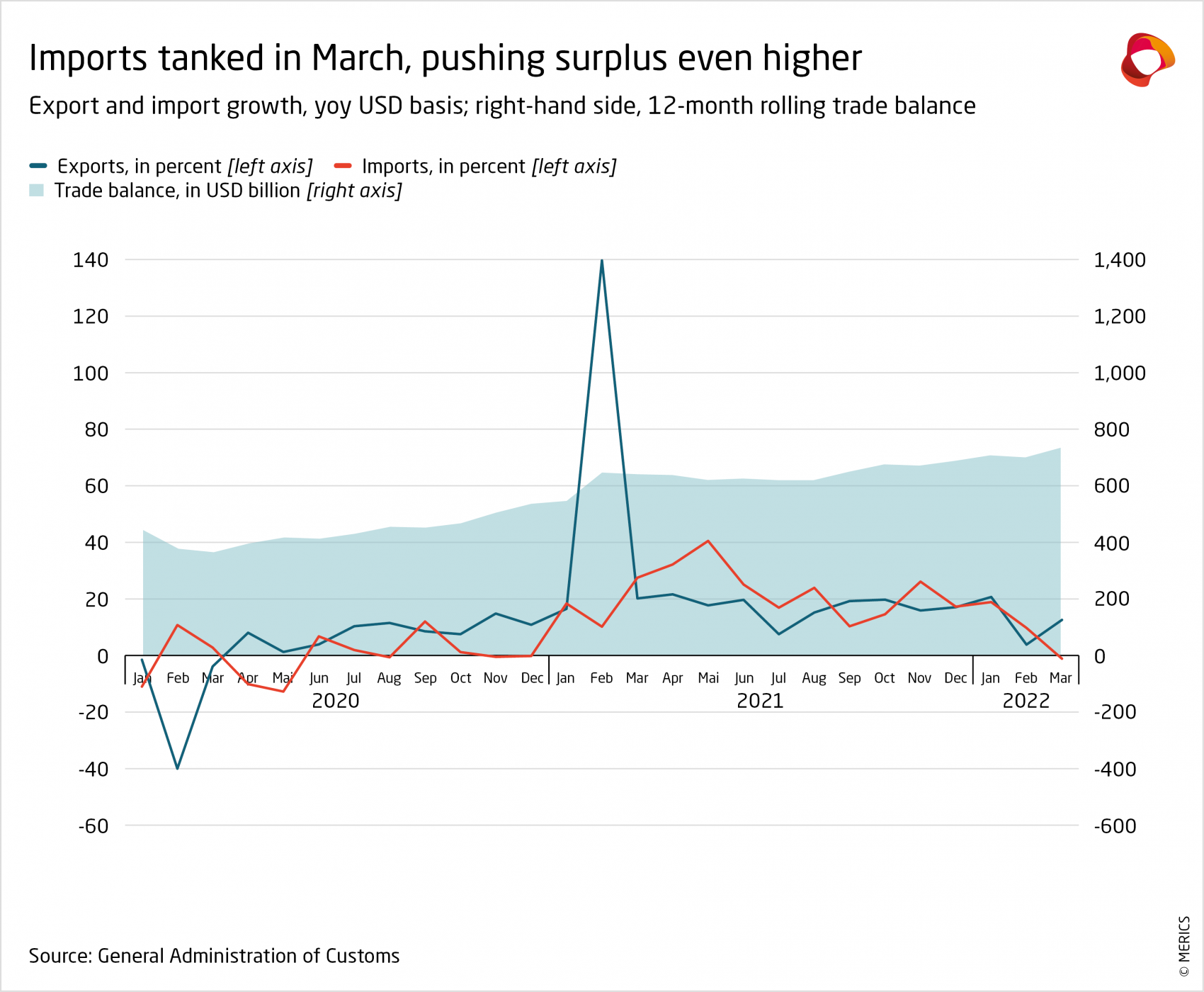

- Robust global demand for China’s exports continues to be a lifeline for the economy and GDP growth. In the first quarter exports expanded by 15.8 percent in USD terms despite strong base effects in the reference period. In 2021 exports grew by a record 49 percent in Q1. Despite increasing headwinds domestically and internationally, export growth managed to accelerate in March (see exhibit 1).

- Exports to the EU and the US have remained robust so far; those to the EU rose 21.1 percent while exports to the US were up 16.5 percent. But China’s exports will begin to slow as higher inflation impacts key markets. New export orders within the Purchasing Managers Index (PMI) have already slipped to 47.2 (values below 50 indicate contraction). Shanghai’s prolonged lockdown will also impact exports in the second quarter.

- However, booming electric vehicle exports also highlight a gradual shift in China’s export structure. Total exports of EVs reached USD 11.8 billion in the first quarter, up from USD 6.3 billion in the previous year.

- In contrast, imports fell sharply over the first quarter. After 19.8 percent growth in January, imports showed a contraction of 0.1 percent in March. But the deteriorating picture in March reflected logistical issues rather than weaker demand. The lockdown in Shanghai has caused a massive backlog of cargo ships waiting to offload their goods.

- Amid Russia’s war in Ukraine, China’s bilateral trade with Russia is worth a closer look (see exhibit 2). Chinese exports grew by 26 percent year on year in Q1. But exports plummeted in March to a two-year low, from an all-time high in December. The 35 percent increase in China’s imports from Russia is entirely explained by energy commodity prices, which started to pick up in Q2 2021. Volumes of coal, gas and oil stayed broadly stable, with even a slight decline at the end of the quarter.

What to watch: A rapid slowdown in exports would increase downward pressure on the economy.

Financial markets: Monetary easing helps credit expansion get underway

Exhibit 2

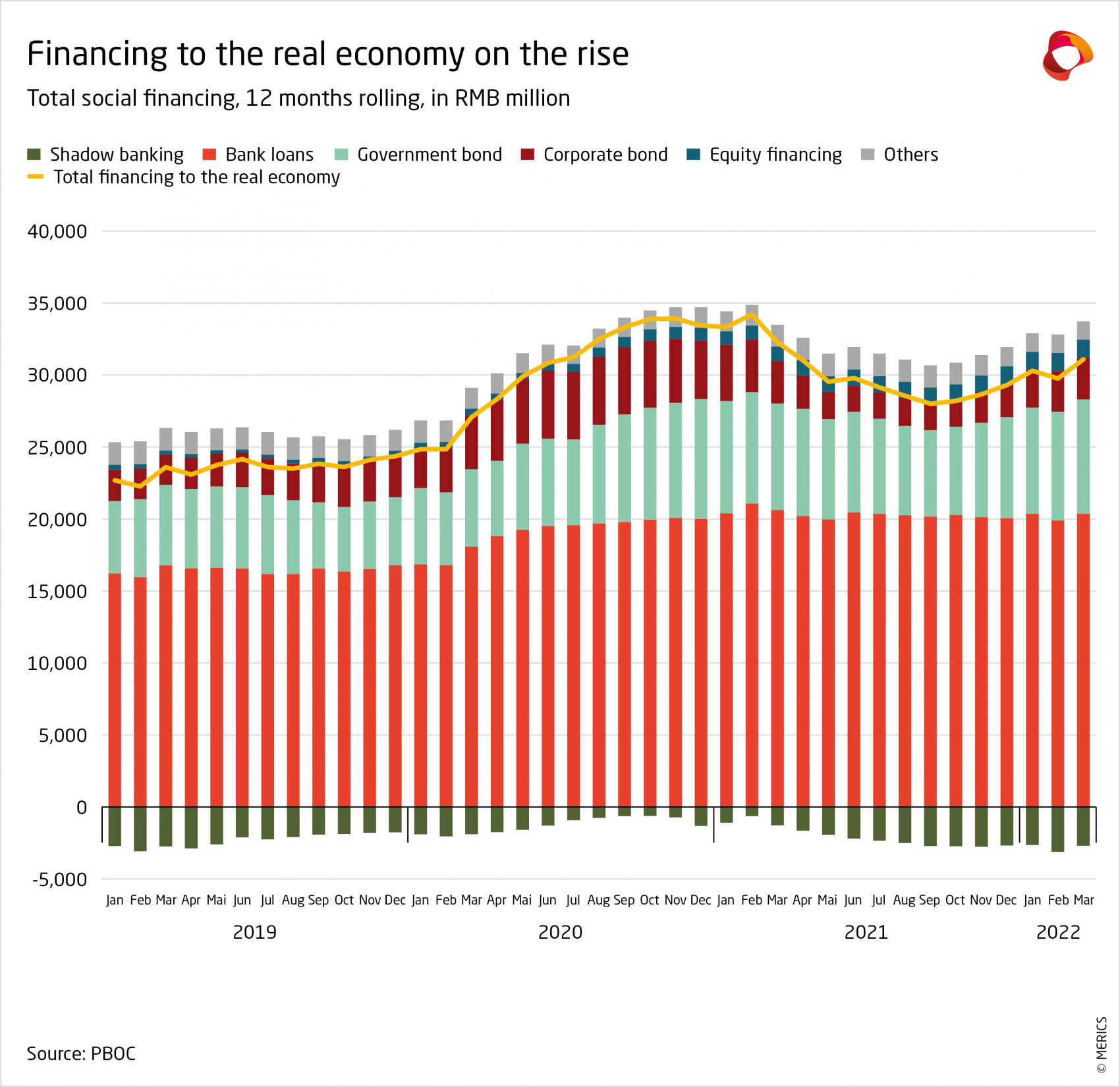

- Total social financing, a broad credit measure which includes banks and shadow banking, picked up over the first quarter, growing 10.6 percent year on year (see exhibit 1). Credit growth has been accelerating since November in response to monetary easing. To support the economy, the Peoples Bank of China (PBOC) cut reserve requirement ratios (RRR) and policy interest rates in late 2021.

- Credit growth was led by strong bonds issuance. Government bonds reached RMB 1.6 trillion in the first quarter, more than twice the level in 2021. The spike indicates local governments are preparing to roll out new projects. Net corporate bonds increased by 44 percent year on year, shaking off market fears of defaults by struggling real estate developers.

- The war in Ukraine and China’s worsening Covid outbreaks have prompted a more supportive monetary stance towards lower borrowing costs. The PBOC will try to prevent capital flowing into speculative investment and steer credit into the real economy. But in an uncertain business environment, credit is likely to flow to state-owned enterprises and local-government infrastructure projects. This may spur economic growth but risks losing the progress made in the deleveraging campaign since 2017.

- China’s financial markets were in turmoil after Russia’s invasion of Ukraine compounded the anxieties created by regulatory crackdowns in tech and real estate, sparking a selloff and massive capital outflow (see exhibit 2). To calm the markets, Vice-Premier Liu He promised to review regulatory campaigns and accelerate efforts to boost the economy.

- Outflow pressures were exacerbated by rising interest rates in the United States. For the first time in 10 years, US Treasury 10-year bond yields exceeded similar Chinese government bonds. Despite this the USD/RMB exchange rate stayed flat throughout the quarter, at 6.35, signaling the return to a de facto peg in a period of high uncertainty.

What to watch: Interest cuts by the PBOC are likely in order to boost growth but will increase outflow pressure

Investment: Government stimulus gains momentum, drives investment growth

Exhibit 1

Exhibit 2

- Investment activity grew by 9.8 percent in the first quarter of 2022 compared to last year. January and February saw a rapid acceleration, as fixed asset investment surged by 12.2 percent, up from 4.9 percent at the end of 2021, despite the highest growth in 20 years in the reference period, Q1 2021.

- The government has pressed ahead with front loading investment as it is concerned about economic growth (see exhibit 1). As a result, year on year growth in infrastructure investments jumped from 0.4 percent at the end of 2021 to 8.5 percent in Q1 2022. Looser fiscal policy is likely to result in more infrastructure spending especially in the first half of the year.

- Investments by state-owned enterprises (SOEs), which tend to be less concerned about economic risks, outpaced the private sector for the first time since December 2020. SOE investment accelerated by 11.7 percent year on year, while private investment grew by 8.4 percent.

- Investment in manufacturing remains a key growth driver, with high-end manufacturing growth continuing to be the main factor. Machinery and electronics have maintained strong growth rates of over 20 percent since last year. New investments in new energy vehicles production capacity brought a recovery in the automobile sector; after 10 months of contraction, investment expanded by 12.4 percent at the end of Q1.

- Foreign companies rushed to expand investments in China as part of localization efforts and to exploit new market opportunities. Foreign direct investment surged to USD 59.1 billion in Q1, which was by far the highest quarterly value on record (see exhibit 2). Of this, 34.8 percent of investments were in high-tech manufacturing.

- The real estate sector is still grappling with the government’s 2021 crackdown on developers. Investment growth continued to fall during over Q1, dropping to 0.7 percent year on year at the end of March. But declines have likely bottomed out as the government relaxes policies.

What to watch: The Ukraine war and increasing economic uncertainty is likely to impact foreign direct investment.

Prices: Low inflation leaves room for more monetary easing

Exhibit 1

Exhibit 2

- Energy costs have remained at elevated levels since May 2021 amid rising global energy prices. Short-lived price easing in late 2021 faded amid the economic fallout from the Ukraine war. Vehicle fuel prices rose by 24.1 percent year on year in March, up from 20.2 percent at the beginning of the year. Energy costs for producers rose by 30.9 percent in March, ending four months of declines from the November peak, when prices jumped by 43.8 percent.

- Consumer inflation (CPI) picked up slightly over the first quarter of 2022, rising 1.5 percent in March, up from 0.9 percent in January and February year on year. But inflation remains well below the government’s 3 percent target.

- A notable exception was rising vegetable prices, which tend to be highly volatile and see spikes in the winter months. Prices increased throughout the quarter, reaching 17.2 percent in March. However, overall food prices fell by 0.3 percent mainly due to falling meat prices as supply is normalizing after the swine flu outbreak in 2020 (see exhibit 1).

- Producer price (PPI) growth continued to slow, falling for five consecutive months to 8.3 percent in March. Overall producer prices were 8.7 percent higher in the first quarter of 2022 compared to Q1 2021. Despite moderate easing over recent months, PPI remains at some of the highest levels in 20 years, mainly due to higher energy costs.

- Prices for industrial inputs, excluding energy, eased in the first quarter. Even energy-intensive sectors such as chemicals and ferrous metals saw prices falls, despite higher energy costs (see exhibit 2). Weak demand seems to be having a bigger impact on prices than rising energy costs.

- Real estate prices continued to drift downwards but have avoided major disruptions following the regulatory crackdown last year. Prices in first tier cities started to pick up over the second quarter, rising by 8.1 percent by the end of March compared to the 70-city average of 3.4 percent.

What to watch: Supply chain disruptions due to regional lockdowns could translate into more inflation.

Labor market: Employment hit by lockdowns and tech crackdown

Exhibit 1

Exhibit 2

- Altogether, 2.8 million new urban jobs were created in the first quarter. The government remains concerned about employment levels: economic growth is sluggish and recurring lockdowns will hurt the service sector. China’s labor market will need to absorb a record of 10.8 million graduates this year. Stimulus measures will be needed to reach the government’s annual target of 11 million new jobs this year (see exhibit 1).

- Surveyed urban unemployment has been creeping upwards since October. In March, the unemployment rate reached 5.8 percent, the highest level since May 2020 and above the annual target of 5.5 percent. Scant employment opportunities for 16-24 year-olds are of particular concern: unemployment for this age group was 16 percent in March.

- Services and retail businesses are reluctant to hire new staff due to lockdowns and persistent weak consumption. Reports of layoffs in the nation’s tech and education sectors are a further worry in the wake of the government's crackdown last year, which has diminished growth prospects in these sectors.

- The government is taking measures to encourage corporate hiring. The Ministry of Human Resources and Social Security (MHRSS) announced a plan to create one million internships. Other steps include subsidies, tax incentives and corporate tax deductions for hiring new staff. The ministry further aims to provide RMB 100 billion to support training programs and to stabilize wages at businesses.

- Challenging labor market conditions are likely to increase the appeal of positions in government institutions and state-owned enterprises as job seekers may favor stability over higher wages.

- Real disposable income growth slowed to 5.1 percent in the first quarter, mainly due to higher income growth in rural areas. Adjusted for inflation rural residents’ income expanded by 6.3 percent, outpacing GDP growth of 4.8 percent. This is in contrast to urban areas, where disposable income only grew by 4.2 percent.

What to watch: New labor market initiatives, including to support entrepreneurs, suggest that stimulus measure alone will not be enough to ensure employment stability.

Retail: Lockdowns suppress consumption, again

Exhibit 1

Exhibit 2

- China’s strict Covid policy continues to disrupt any fragile recovery of consumer spending. Repeated lockdowns paired with slower wage growth will continue to subdue consumption and prevent it from returning to pre-pandemic normality. Without recovery in consumption, the government will need to lean more heavily on investment driven stimulus.

- Retail spending started strongly in January and February, up 6.7 percent on the first two months of 2021, registering the highest growth in five months. But in March regional lockdowns in response to renewed Covid outbreaks wiped out most gains. March retail spending contracted by 3.5 percent, reaching its the lowest level since April 2020.

- Consumers cut back on discretionary spending in response to growing economic uncertainty. Garment sales plummeted by 12.7 percent in March year on year, while car sales contracted by 7.5 percent (see exhibit 1).

- The service sector is the most vulnerable to lockdowns. Restaurant spending grew by 10.1 percent in the first two months of 2022, year on year then slumped in March, contracting 16.4 percent. The economic rollercoaster will continue for as long as there are no changes in Covid policy.

- China remains largely isolated internationally, with international air travel down by 90 percent on pre-pandemic levels. Mobility within China also remains heavily affected. Highway traffic across the nation is only at about 30 percent of 2019 levels (see exhibit 2).

What to watch: Tax breaks and vouchers would represent a broadening of the government’s stimulus package.