How the BRI is shaping global trade and what to expect from the initiative in its second decade

No. 4, December 2023

Introduction

At the end of November, China’s Belt and Road Construction Leadership Group released a ten year plan for the next phase of the BRI. This comes a month after Beijing celebrated ten years of China’s Belt and Road Initiative by hosting the Third BRI Forum with attendees from 150 countries. This special edition of the Global China Competition Tracker looks at the BRI’s first decade of evolution, assesses its impact, and asks what the future of Xi Jinping’s signature foreign policy initiative might look like.

The BRI has had considerable influence on China, on BRI host countries and the world. It would be wrong to see it as a declining force simply because Beijing is allocating less finance to BRI projects: many of the BRI’s initial goals were achieved early on in its first decade. The BRI has evolved over time to suit Beijing’s strategic goals. This special edition of the tracker examines the BRI’s impact on trade flows through the ports sector - critical logistics nodes along the BRI. We look at the ports built, bought, operated and used by China’s state-owned national champions.

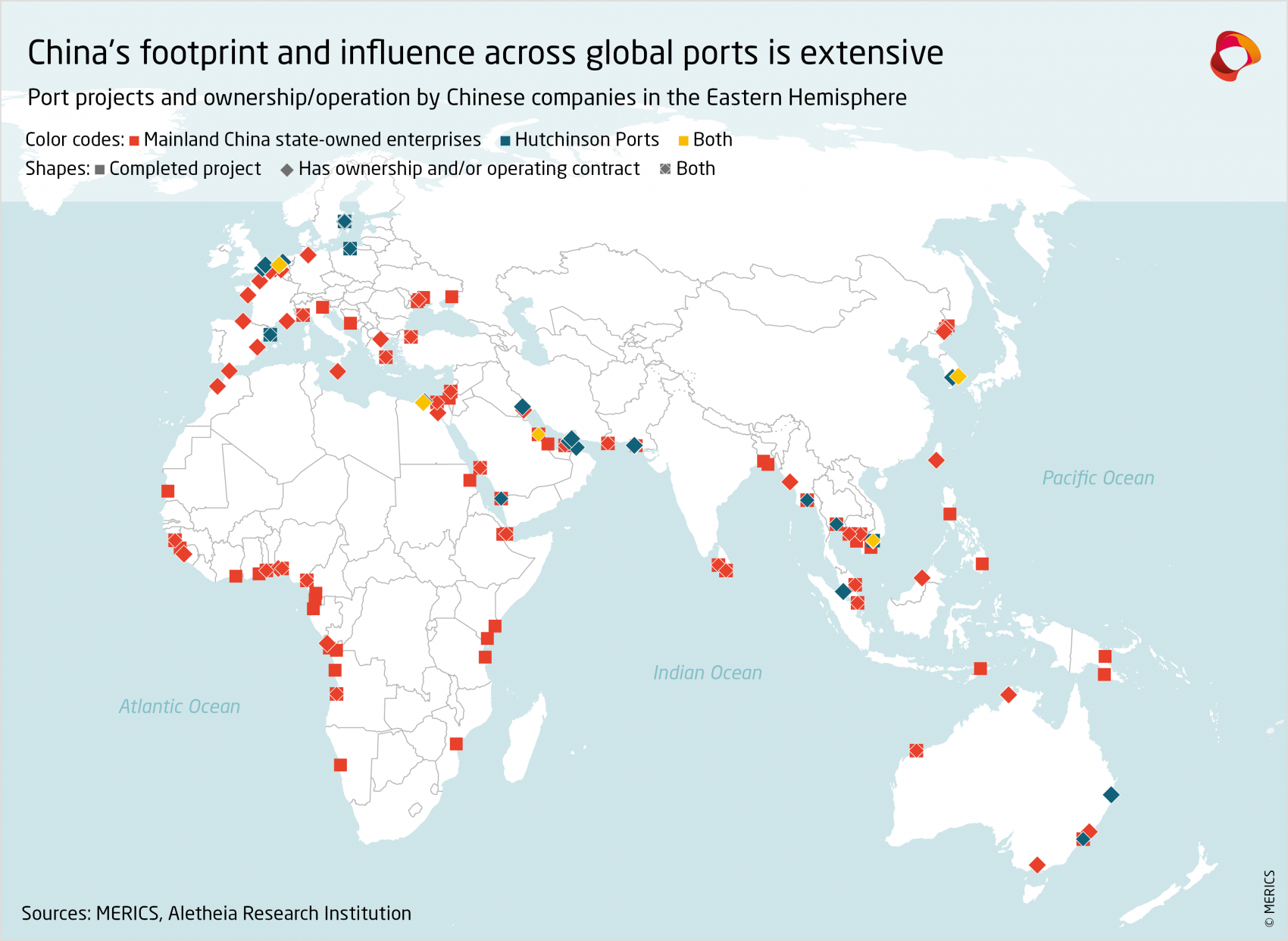

First, Clark Banach maps out China’s footprint across global port ecosystems in a detailed map. Banach, who is MERICS Futures Fellow, explains the more deeply Chinese SOE’s are entrenched in a port, the more strongly it is pulled into China’s orbit at the expense of trade with other partners.

Second, MERICS Lead Analyst Jacob Gunter builds on Banach’s quantitative analysis with a qualitative look at how China’s involvement in ports develops. Gunter details China’s presence in Mediterranean and Northern European shipping ecosystems and how ports can spread distortions emanating from China’s own economic model. He examines how port networks create potential dependency and influence risks.

Banach and Gunter then take a closer look at four Mediterranean ports with Chinese participation. In each case study, they assess Chinese SOEs’ strategic and commercial success or failure. The case studies look at port holdings or operations in Greece, Spain, Algeria, and Israel and offer a way to benchmark Beijing’s desired outcomes and how far they are being achieved.

Finally, they suggest what the future of the BRI might look like, drawing on President Xi Jinping’s speech to Third BRI Forum and their own research. The future BRI can be expected to leverage its extensive built infrastructure further, while shifting focus towards green energy and telecoms equipment. China’s green transition industries suffer from overcapacity, so they need export outlets, while telecoms giants like Huawei and ZTE must secure and expand their footprints in more neutral markets to compensate for restrictions on their activities in liberal democratic markets.

Chinese port holdings and projects impact trade beyond the BRI

The BRI was officially introduced in 2013 as part of Xi Jinping’s agenda to expand China’s global influence. However, the initiative had been gathering speed since 1999, first as the “Go Out Policy” (which encouraged Chinese businesses to find partners in international markets), then as the “Going Global Strategy.” By the time Xi Jinping officially baptized the BRI as “One Belt One Road,” Chinese firms had secured terminal operating contracts at ports in 14 countries (in order of agreement: United Kingdom, Argentina, Pakistan, Belgium, Malta, Poland, Spain, Egypt, Angola, United States, Greece, Sweden, Nigeria, Sri Lanka and Togo). In the last 10 years, the network of global influence has expanded to over 75 countries.

To better understand how this network of Chinese owned, operated or built port terminals affects world trade, we identified changes in exports, imports, and total trade flows after signing a contract. Our findings suggest China’s port network has played a significant role in reshaping international competition. The results indicate that terminal operating contracts have a significant impact on bilateral trade with China, while a completed port project will temporarily increase trade with the rest of the world (RoW).

Where Chinese firms operate ports, they appear to modify the host countries’ trade toward China and away from former trade partners. By contrast, infrastructure projects appear to bring temporary economic benefits to host economies that fade away about four years after completion. For the BRI’s trade network to function as a new development model, it would need to bring substantial benefits to host countries. While the BRI has generated extensive discussion and geopolitical debate, detailed analysis of its economic effects has been limited. At present, it remains uncertain whether the benefits of these relationships outweigh the risks, or if the new model of interconnectivity benefits host countries as much as they benefit China.

These are not abstract matters, as Germany recently allowed Chinese state-owned shipping giant COSCO to take a significant stake in the port of Hamburg. An expansive presence in Mediterranean ports has also garnered substantial attention, as it could offer strategic advantages for China among growing tensions between Europe and Asia.

The Maritime Silk Road stretches further than its official footprint

China's reach extends far beyond the BRI’s official membership boundaries and is fortified by its prolific investment in overseas ports. This ambitious expansion fits within China’s broader global economic strategy. Although the official Maritime Silk Road (MSR) serves as a primary channel for international flows, additional port contracts with Chinese firms can be considered tributaries along a wider network of influence. Countries along this extended MSR can transact relatively easily with Chinese firms due to shared standards and practices along the supply chain.

The BRI’s stated objectives include policy coordination, facilities connectivity, unimpeded trade, financial integration, and people-to-people bonds. This reduces uncertainty as well as the transaction costs of trade between partners, which can manifest as fees, commissions, insurances and legal expenses, along with the time required to procure these services. In a world increasingly interconnected by trade, transaction costs play a pivotal role in shaping economic relationships.

China’s port activities influence Global Trade Networks

Our estimates suggest that this growing constellation of Chinese port activities has had a significant impact on total trade with China over the past 20 years. Typically, we see a trend towards more exports to China as control over terminal operation increases. This means that Chinese firms are buying a greater share of their goods from these countries than ever before. Furthermore, these results are not affected by a country's development status. Regardless of GDP per capita, the changes are significant and consistent.

All participation is not created equal. Investment projects, property acquisitions and operating agreements for port terminals by Chinese SAEs are not equivalent events. As the level of control at the port increases, total trade also increases with China. Port construction projects show a different pattern. As Chinese investment increases, so does trade with the rest of the world, at least temporarily. The statistically significant increases to total trade flows begin six years prior to completion and, on average, turn negative four years after completion. This suggests that trade increases may come from the surge in materials, equipment and project requirements to actually develop the terminal rather than a reduction in trade costs.

Unless a Chinese SAE is involved in port operations, there are no measurable long-term changes to trade flows after a port development project. This is surprising, as gains from trade are often the main motivation for large maritime infrastructure projects. However, there is evidence that the short-term increases to total trade during the time of construction do generate temporary economic benefits for host economies.

Key findings from empirical analysis of Chinese port activities

A port contract with a Chinese firm does not predict an increase in trade between other members of the extended MSR. This implies that there is no significant reduction in costs between these trade partners and that cost savings are a result of a reduction in transaction barriers between host economies and Chinese markets. Pricing data would be needed to confirm whether host countries have shifted business away from low-cost providers, but trade flows indicate that trade is being diverted away from their former trade partners in favor of trade with Chinese firms.

- Total trade with China is expected to increase about 21 percent after a terminal operating contract is signed and exports to China usually increase more than imports.

- Expected increases are magnified if Chinese firms have a controlling interest in all terminals, in at least one port in the country. In these cases, over a 12-year period, exports to China would be expected to increase by 76 percent, whereas imports from China would be expected to increase by 36 percent.

- Host countries that allow Chinese firms to operate all terminals in at least one port saw a 19 percent reduction in exports to the rest of the world (RoW) during the analysis period.

- Chinese firms buy more goods than they sell to the host countries after operating agreements are signed and much of the cost savings go to the Chinese.

- There is no measurable effect on overall trade between other members of the trade network, regardless of whether China is included in the estimation.

- Completed infrastructure projects bring no significant long-term effects. Agreeing to and completing an infrastructure development project predicts a temporary increase in trade with all partners during the duration of a project, but these effects do not last.

These results indicate that hypothetically, a country could maximize the economic benefits of cooperation by allowing Chinese SAEs to operate one or two port terminals, while also negotiating regular maritime infrastructure development projects that diversify import and export partner during construction. However, this constellation omits the serious financial and geopolitical risks of unintended lock-in effects and challenges that can arise during long-term operating contracts.

Geopolitical risks need consideration

It would be too ambitious to claim that China is indeed giving the world a new model of international development, although it appears their maritime activities have certainly modified conditions in global markets. China’s network of SAEs acts as a quasi-supranational organization seeking to establish a global footprint. Host economies may gain from greater trade, increased commerce and cheaper goods but the price tag includes institutional lock-in and loss of diversity in trade partners.

For policymakers, the challenge is to find a balance between benefiting from economic interdependence and mitigating the hazards in a geopolitically unstable world. In the best-case scenario, any trade diversion would benefit network members by reducing total trade costs; however, in real terms, an undiversified supply chain is a national security risk. The more a country becomes economically dependent on another, the less agency it will have in making economic decisions. Caution is advisable.

China’s privileged SOEs are well entrenched in European ports and shipping

Host countries face risks and opportunities to their overall economy from Chinese SOEs owning or operating ports. MERICS and the Vienna Institute for International Economic Studies conducted a risk assessment of Chinese investments in European maritime infrastructure for the European Parliament. We found some cyber and data risks, and minor potential for more traditional ‘hard’ security concerns. Bringing in a foreign company can add a lot of value if the host country is unable to run ports efficiently and profitably because it lacks capable firms or government capacity. However, the shipping companies plying the port should feature in any proper risk assessment. In other words, you can’t talk about ports without also talking about shipping companies.

We have reviewed the impact on regional markets of China’s global shipping giant COSCO and two of its major port companies - China Merchants Group (CMG) and COSCO Ports. We describe their activities in the Mediterranean and Northern European shipping markets below. CMG, COSCO Ports, and COSCO ownership and funding carry distinctive risks, which should be understood to appreciate their impact on regional networks. This section excludes Hong Kong-based port operator Hutchinsons (which is covered elsewhere in this report) because of its status as a private firm and its limited integration into the protected home market in Mainland China as well as the SOE vertically integrated value chain issues discussed below.

CMG, COSCO Ports, and COSCO can build market share in unfair ways

One of the chief risks that can emerge in a shipping network is dependency on a key external player. In a simplified example:

- If Country-A depends on port operators and shipping companies from Country-B to handle the bulk of its trade, then Country-A is dependent on Country-B for its prosperity, and maybe even for critical supply chains of goods it cannot produce.

- If Country-A can also turn to Country-C for those services, it has less dependency risk. Dependency risks fall further if Country-A can also turn to D, E, and F.

- However, if Country-B’s shipping companies hold 50 percent of regional shipping market share, while countries C, D, E, F, and G’s companies hold 10 percent each, then Country-B has considerable power as Country-A has little chance of replacing B’s shipping services in a crisis.

Market share is a good metric to measure the risk of dependency, where an actor’s dominant share could not be readily replaced by others. In the competition for market share, China’s SOEs benefit from three critical advantages over their European counterparts.

First, COSCO, CMG, and COSCO Ports are all owned (directly or through a parent company) by a body that is directly under China’s State Council, namely the State-owned Assets Supervision and Administration Commission (SASAC). They do not have a fiduciary responsibility to shareholders and their sole stakeholder can and does assign them strategic roles on a regular basis. Beijing also directs a wide range of state aid to SASAC-owned SOEs to support them in achieving national goals. This does not mean that firms like COSCO never act on commercial terms. In fact, the bulk of COSCO’s operations may well be driven by market forces. But at any moment, Beijing may mandate non-commercial goals.

If Beijing sought to make a country’s trade more dependent on COSCO, it could mandate shipping rates at lower margins, or even below profitability, to build market share, which could be weaponized at a later date. If Berlin tried to do this through Hapag-Lloyd, the company could ignore the government: it would need shareholder approval to abandon profitability to build market share at a loss.

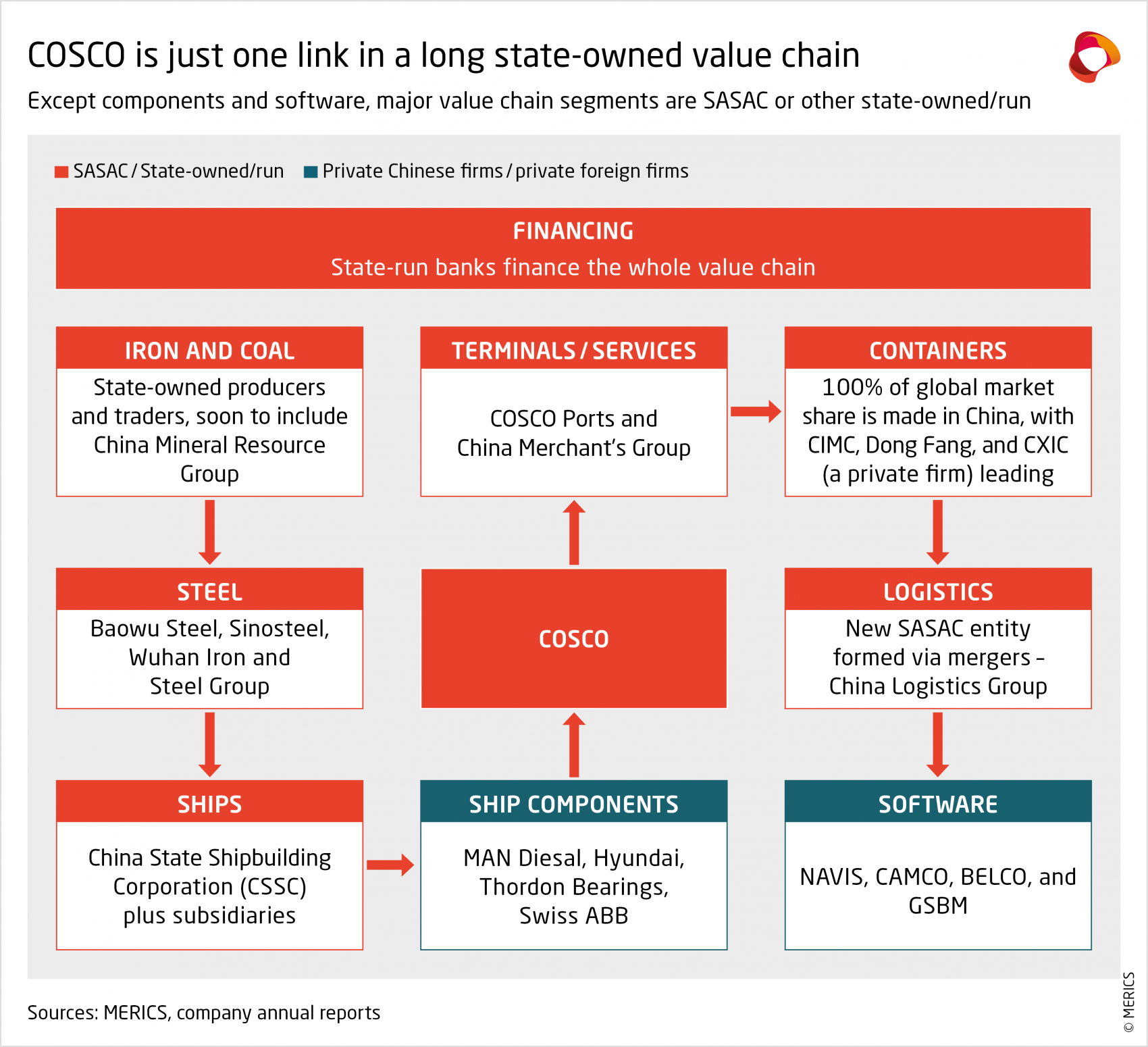

Second, SASAC-owned firms’ value chains include many similar SOEs, which can empower them to undercut market prices. CMG and COSCO Ports get state aid, while benefitting from state aid given to other Chinese SOEs in their value chain. If Beijing pushes CMG to build or expand a given port, it can do so with many friendly suppliers passing along state aid in favorable prices. For instance, CMG can depend on SOE construction giants like China Communications Construction Company (CCCC) or its subsidiary China Harbour Engineering Company who can source materials from SOE steelmakers like Baosteel, or harbor cranes from CCCC subsidiary Shanghai Zhenhua Heavy Industries Company Limited. Project finance would almost certainly come from China’s state-run banks along the whole supply chain.

COSCO occupies a similar position in a heavily-state-run value chain (see chart below), which creates competitive advantages for China’s port operators and shipping companies – they bring their own massive scale and much of China Inc’s too. Market economies with robust anti-trust laws would not allow SASAC’s vertically-integrated value chains to develop in their own jurisdictions: EU and Danish anti-trust and competition law would dismantle MAERSK promptly if it were one entity owned by a holding company that also owned many of its suppliers and customers. But European rules that rightly hold back local firms do nothing to hold back Chinese ones, either because regulators fail to see SASAC for what it is, or only interact with limited parts of a given value chain (e.g., like having market contact with COSCO, but not its suppliers).

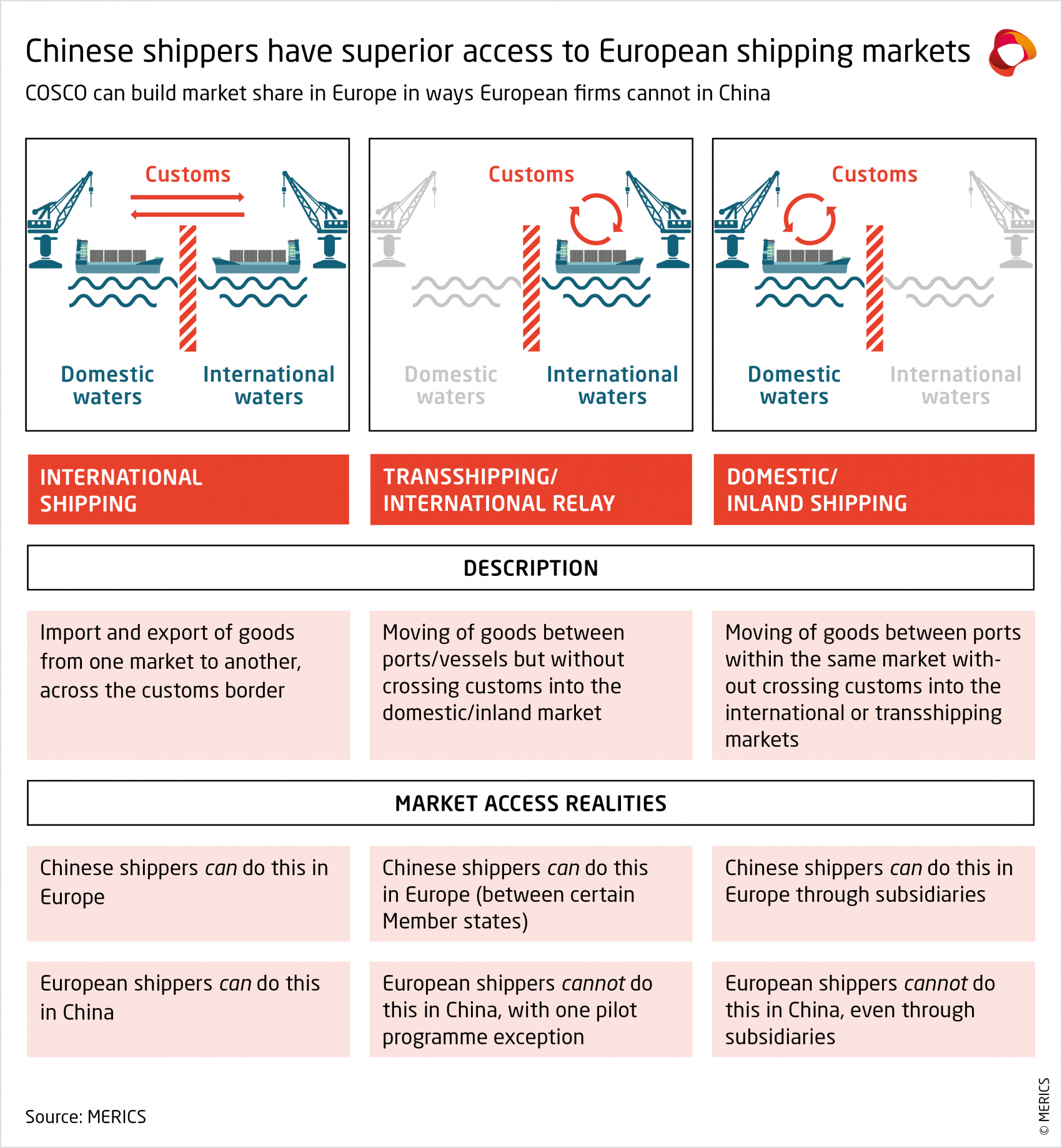

Third, Chinese shipping companies enjoy a protected home market, yet open access to European networks. Chinese firms can do more in European ports than European firms can do in China, which changes the value-proposition of port-ownership and operation. European shipping companies can only perform direct international shipping services in China (see chart below). They are excluded from transshipping or domestic/inland shipping services in China, even through local subsidiaries. Meanwhile, COSCO can provide all kinds of shipping services in Europe. For transshipping, COSCO must route between different EU members states - not a big challenge given the close proximity of such major ports as Hamburg, Rotterdam, and Antwerp, all in different countries. COSCO does need a local subsidiary to do domestic/inland shipping, which it has in COSCO (Europe) and another unit called The Diamond Line.

These three advantages skew the pitch in favor of China’s port operators and shipping companies seeking market share. As a result, they have penetrated European shipping networks deeply and are expanding their reach.

Piraeus and Rotterdam: China Inc’s port networks in southern and northern Europe

The Port of Piraeus serves as COSCO’s major transshipping hub in the Mediterranean and Black Sea markets. Majority owned and operated by COSCO, which has expanded it over the years, the port’s ‘hub and spoke’ operations transfer cargo from COSCO’s huge long-haul container ships onto smaller ‘feeder’ vessels sailing to many smaller ports. Feeders also bring China-bound containers to Piraeus for vessels returning to China.

The scale of transshipping through Piraeus creates dependencies across the region but most acutely in Greece itself because the port supports so many jobs, directly and indirectly. If COSCO were to shift its trade flows elsewhere, there would be no market demand for other shipping companies to fill – the port is effectively an artificial miracle purely because COSCO determined to make it its own hub. Beijing also aspires to use Piraeus to send goods inland by rail through the Western Balkans into Central Europe, though these ‘intermodal’ ambitions have yet to fully materialize.

The Port of Rotterdam, where COSCO owns 35 percent of one terminal and CMG owns 14.7 percent of another, gives is a more direct access point to European customers through intermodal connections with barges on the Rhine, plus railways and highways. COSCO (Europe) and Diamond Line have some of this intermodal market, though it is unclear how successful their efforts have been – COSCO’s investment in the inland Port of Duisburg seems to have failed as it divested in late 2022.

Chinese players hold stakes in the broader English Channel/North Sea region that amplify their Rhine Delta foothold: COSCO owns 85 percent of a terminal in Zeebrugge, Belgium, and 24.9 percent of an Antwerp terminal jointly with CMG. The latter also has minority stakes in three terminals in Northern France: Terminal des Flandres (44.6 percent), Terminal De France and Terminal Nord (24.5 percent), and Terminal Du Grande Ouest (24.5 percent).

While CMG and COSCO have significant leverage in Northern Europe, it is more diffuse than in Piraeus. Nor do they have the same leverage. The immense natural demand for the Rhine Delta and English Channel as gateways to the EU market means many rivals would willingly take over COSCO’s capacity if it were to cease services there.

COSCO and CMG’s unfair advantages and hidden support to capture market share and build dependencies apply to China’s expansion everywhere within global maritime infrastructure and shipping networks. However, the differing regional networks radiating from Piraeus and Rotterdam suggest how circumstances should be factored into mitigating risks and distortions on the common market stemming from the issues outlined above. The next chapter develops this theme with a deeper look at the specifics and dynamics of several ports, their surrounding networks, China’s aspirations for each port and whether those wishes have succeeded.

Beijing gains and loses traction along the Maritime Silk Road

In Europe, large contracts with Chinese firms provide a network of influence, although formal BRI affiliations at the national level are few and its influence is quickly declining in countries that signed MOUs. Not every Chinese port presence is officially part of the MSR. Nonetheless they link into a wider network that appears to reshape trade flows. Therefore, market penetration by Chinese firms is still a win for Beijing, even if the contract is only Belt and Road adjacent, as favorable conditions for investment returns still benefit the broader objectives of the CCP.

Over the past 20 years, three main strategies have been favored to expand China’s influence in foreign ports. The first is ‘project-then-operate,’ Chinese SOEs come in with a project, then leverage it into a bigger concession that has greater control of the terminal. The second is ‘operate-then-project’ where a Chinese firm wins a port operating concession or buys into a consortium. From here, it builds up the port by developing the terminal(s) to increase throughput. The third strategy is ‘under-new-management,’ as seen in the CCP’s growing influence over the vast assets of Hong Kong-based CK Hutchison Holdings. Although Hutchison remains a private enterprise operating out of Hong Kong, growing influence from Beijing and the eroding autonomy of the HKSAR makes it increasingly difficult to determine the degree of independence that HK-based firms have when their operations overlap with Beijing's strategic goals.

The Mediterranean is a unique waypoint on the extended MSR in that agreements are predominantly acquisitions, or operating contracts rather than development deals. Chinese SAEs have signed significant contracts at 18 ports in 11 countries with varying degrees of success; however, only 4 of them could be classified as ‘project-then-operate’ and 1 of them (El Hamdania Port in Cherchell, Algeria) is indefinitely suspended. Of the other 3, only 1 turned into an operating contract and that project has not panned out as expected (SIPG Bayport Terminal in Haifa, Israel). Although the BRI has been losing ground in some regions, Chinese SAEs can still be positioned for favorable investment returns. Even in the cases where large projects did not transform into operating contracts (Bulk Cargo Terminal in Port of Ploče, Croatia and Main Terminal in the Port of Ashdod, Israel), Chinese SAEs make millions of dollars on the construction.

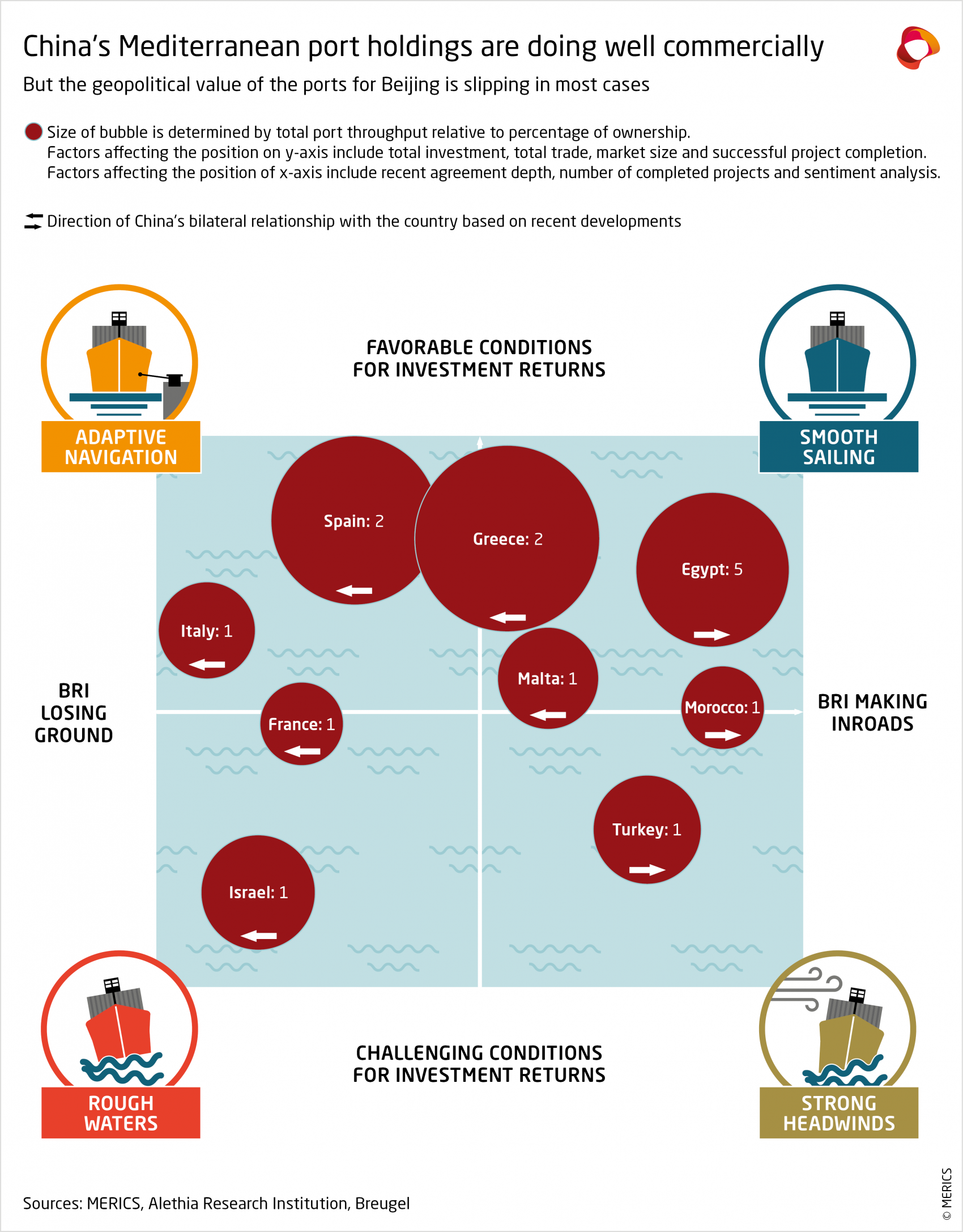

Mapping the waypoints on the Belt and Road

The situational matrix below illustrates our assessment of successful efforts to penetrate Mediterranean port markets using two measures of effectiveness for Chinese maritime holdings. The first is a measure of commercial potential in the market; the second measure weighs up strategic success. A market is considered favorable if Chinese firms serve large markets, own larger percentages of operating companies, operate larger terminals, manage more containers, execute profitable projects and require less development investment. If these conditions are coupled with support for the BRI, it is smooth sailing for Chinese firms.

In places where the BRI has become less popular, the same conditions require some adaptive navigation to be successful. As the amount of investment increases, or the amount of throughput decreases the ability to earn returns will experience some headwinds, even in favorable pro-BRI terrain. If the BRI has fallen out of favor, or Chinese firms were unable to get a foothold in the market, those same headwinds will lead to rough waters for Chinese investments and geopolitical ties with Beijing.

Smooth sailing in Egypt

Egypt is a great example of favorable investment conditions under favorable conditions for the BRI. In 2007, China Shipping Group invested USD 40 million for a 20 percent share in Port Damietta, which can handle 2.5 million 20-foot-equivalent [container] units (TEUS) per year. About 70 kilometers up the coast is Port Said, where COSCO invested USD 186 million in 2005 to acquire 20 percent of the Suez Canal Container Terminal, which can handle about 3.5 million TEUS per year. This is as a result of China Harbour Engineering Company (CHEC) investing USD 219 million to construct a new quay. In this constellation, Chinese SAEs exert 20 percent control over some 6 million TEUS a year, creating an impact score of 1.2 TIPS (TEU Influence at Ports). TIPS are calculated by multiplying the capacity of the terminal in millions (6 TEUS) by the percentage of ownership or ownership of an operating consortium (20 percent).

In 2016, Hutchison purchased a 30 percent share in Alexandria International Container Terminals Company for an undisclosed amount. The consortium owns terminals at Port Alexandria and Port El Dekheila that have been wholly operated by Hutchison since 2005, with combined annual TEUS of 1.5 million. As Hutchison is the sole operator, all TEUS are added to the impact score bringing the total influence in Egypt to 2.7 TIPS.

In 2020, Hutchison signed a USD 700 million deal to build additional capacity at Alexandria and new cargo terminal at Abu Qir Naval Base. In total, Chinese firms have invested over USD 1.5 billion to grow their presence in Egyptian ports, with little international attention. Media reports tend to focus on failed projects, or China’s pervasive network in Greece. Egypt is an enthusiastic supporter of the BRI, and its armed forces appear to be embracing Hutchison as a partner. If these trends continue uninterrupted, Egypt may eventually surpass Greece as China’s Mediterranean gem.

Adaptive navigation in Italy

Even when the BRI is losing traction, strategic investments in maritime holdings will hold their ground. Earlier this year, Italy signaled plans to leave the BRI, not long after officially joining in 2019. The about turn is generally ascribed to EU and US “de-risking” campaigns to curb dependence on China. Italy’s plans had already suffered setbacks but pulling out of the BRI meant losing millions in earmarked port upgrades and infrastructure development. Rome’s decision was bad geopolitical news for Beijing, but it does not affect the good investments already made by Chinese SAEs.

With some adaptive navigation, COSCO and Qingdao Port International can still flourish at Port Vado Ligure. In 2016 APM Terminals sold them a 40 percent and 9.9 percent share of Reefer and Deepwater Container Terminals respectively. The terminals at Vado Ligure contain the largest refrigerated cargo facility on the Mediterranean Sea and now have the ability to accommodate Ultra-Large Container Ships (ULCS) of up to 19,000 TEUS capacity. This strategic advantage will be left unaffected by the changing tides of support for the official BRI and Chinese firms are still positioned to see a return on their investments.

The Vado Ligure acquisition cost only USD 53 million, but the consortium has spent around USD 500 million developing a new deepwater terminal that increased annual TEUS to 1.3 million. This means that despite losing ground in the geopolitical arena, Chinese firms will still have an impact score of 0.6 TIPS. As a result, there is still plenty of room for commercial success.

Strong headwinds in Turkey

This is a project that has a lot of support from the BRI but where returns are constrained by large investments and smaller throughputs. In 2015, COSCO, China Merchants and China Investment Corporation formed Consortium SPV and paid USD 920 million for a 64.5 percent share of Kumport Terminal. The project’s geopolitical significance was underscored when Presidents Recep Erdogan and Xi Jinping both attended the signing.

Although this was a big win for Beijing, the project will face strong headwinds as can be seen when comparing the conditions to Egypt. Chinese firms have invested around USD 1.5 billion for access to terminals in both the Mediterranean and in the Suez Canal and in return are involved in the handling of over 10 million TEUS. In Turkey, there has been about USD 1 billion in investment, but Kumport Terminal only manages about 1.3 million TEUS and offers an impact score of 0.8 TIPS.

Kumport Terminal’s reported capacity was 1.4 million TEUS in 2014 and even after a number of completed upgrades is still operating below those levels. The terminal is currently running at about 60 percent of total capacity with high investment costs. For Beijing, the inflated costs of moving into the neighborhood are outweighed by a strategic position between Europe and the Middle East. The project undoubtedly has the potential to create stable financial returns in the long run.

Rough waters in Israel

This is a good example of the best laid plans going awry. In 2015, Shanghai International Port Group signed a contract to develop a deepwater terminal in Port Haifa. This was one of the few times that Chinese firms attempted to use the ‘project-then-operate' model to enter a Mediterranean market. Although it was clear from the beginning that this USD 1.7 billion investment was intended to be a tip on the spear of broader involvement, significant pressure from the US and EU led stakeholders to explore other options.

Despite a significant investment in the new adjacent terminal, Chinese firms lost the bid to purchase and operate the entire port. A consortium led by India’s Adani group completed the purchase in early 2023 for about USD 1.2 million. Shanghai International Port Group found itself left with a 25-year management contract at a port it had funded and developed. Both the Chinese and Indian firms paid above market value, underscoring that not all wins are financial.

Given growing concerns over Chinas expanding network influence, enthusiasm for the BRI is losing ground in Israel; however, unlike in Italy, the premium paid for expansion may be difficult to service. The Haifa Bayport Terminal can only process around 1 million TEUS per year. Although there are rough waters ahead the project is not a total loss. Chinese firms completed the construction and have established a strategic foothold in the region. Despite the heavy price per TIP, its strategic position is still a win for China in the broader market for influence.

The BRI will evolve to become greener and tech focused

Xi’s keynote speech to the Third Belt and Road Forum in October 2023 signaled the BRI will continue to adapt. His sentiments were then echoed in the ten year plan for the future of the BRI the following month. Extensive language suggested projects would become smaller scale, more financially sustainable, and more focused on facilitating trade and greenfield investment. Furthermore, Xi emphasized the importance of softer dimensions of connectivity now that hard infrastructure is in place.

Xi’s speech may have contained a subtle admission that his signature foreign policy initiative has not always generated results that enhance Beijing’s interests and reputation. Some BRI projects were too large for the recipient country, the debt proved too great for others, or systems that could use finished projects efficiently were neglected. However, the BRI has advanced the party-state’s goals in ways that far exceed any defaults or criticism by foreign partners.

Port projects have done much to promote Beijing’s interests and enhance China’s economic security. Access to raw materials - from soybeans to iron, lithium and cobalt – is more certain, as are transport links to growth markets for China’s exports. COSCO has been able to grow its market share more readily alongside the global web of ports wholly or part-owned or operated by Chinese entities. Equally, the BRI has boosted Chinese rail companies, energy firms and oil and gas players. All have new footholds in emerging markets, and a bigger global footprint, making Beijing more influential and secure.

However, there is a limited viable demand for even more traditional infrastructure. In the future, priority will be given to sectors with more pent up demand and where China’s national champions urgently need new or expanded markets. The outcome may well fill in the gaps and shortcomings that continue to hold back projects built in the BRI’s first decade.

Traditional BRI infrastructure projects need better systems and skills

The first need is for more streamlined systems connecting projects across borders and smoothing customs checks. Physical infrastructure such as expanded mining operations, railways to ship out the ore and port facilities to load it are less valuable with poor linkages and administrative delays. Improving such intermodal connections is likely to become a core task for officials advancing the BRI.

This problem is evident along the “Middle Corridor” which runs from China through Central Asia then crosses either the Caucuses or Turkey to Europe. It requires at least one sea crossing of the Caspian and possibly a second at the Black Sea, depending on a given cargo’s destination. For smooth transitions between rail, road and water, the route needs efficient physical infrastructure as well as good alignment between customs, trade, tax, and safety authorities in China, Kazakhstan, Azerbaijan, Georgia, Turkey and the EU when goods finally enter its common market.

Xi’s speech suggested Beijing will work to fill vital skills gaps while simultaneously countering critics in host countries and extending its social influence. Maximizing the benefits of BRI infrastructure requires the right personnel. Beijing has taken a lot of flak for the abundance of imported Chinese workers on BRI projects and lack of local job-creation. Xi stressed stronger people-to-people ties, 100,000 new training opportunities for green development and ongoing support for the Silk Road Scholarship program.

A quick glance through the application pages of Chinese universities participating in the scholarship shows the program’s ambition: all types of mechanical and electrical engineering and computer science are offered, as are technical focuses on oil and natural gas extraction, mining and metallurgical engineering. The overwhelming emphasis is on STEM programs though there are also Chinese language programs with a focus on translation skills.

China pitches itself as the global south’s partner for the green and digital transitions

We can also expect the BRI will shift towards fields where China’s national champions hold strong positions and shield them from unwelcome new pressures.

Xi’s speech highlighted China’s quest for a green BRI. The BRI became notorious in its first decade for building coal-fired power plants. However, China’s own green energy story is likely to be replicated overseas, not least because of overcapacity. By the end of 2023, China is expected to producing twice as many PV panels as global demand can absorb. In EV batteries, China is on track to exceed current demand from vehicle makers by four times, and its output of finished EVs is similarly in need of buyers. As these are key growth industries that align with national ambitions, China’s local and provincial governments have been piling in with state aid to ensure their local player wins the long race. This has prevented market consolidation, a trend that is likely to persist as long as the national and local directives do. It brings pressure to export excess capacity in ways that undercuts prices. The BRI will likely be a platform to facilitate exports of that overcapacity, using green energy projects to stimulate demand overseas.

Meanwhile, telecoms infrastructure giants like Huawei and ZTE are likely to become increasingly reliant on the ‘Digital Silk Road’ as more developed economies impose restrictions on Chinese involvement in building their 5G networks. As China completes the bulk of its own 5G network, the pressure to find alternative revenue streams will grow. The outcome may be to accelerate upgrades or roll outs in the global south on favorable terms from China Inc. As Huawei and ZTE play central roles in Beijing’s tech self-reliance strategy, there are strong imperatives to secure markets so they have steady revenue streams to fund their R&D.

Competing with an evolving BRI and China Inc’s changing global footprint

Now the EU’s Global Gateway has technically launched its first projects, there is a need to do some serious strategizing about its relationship with the BRI. An essential consideration is the need for a framework to determine which BRI projects should be competed with, or collaborated on, and which should not. To that end, the forthcoming editions of this tracker will continue to map out China Inc’s global footprint, including in the BRI’s traditional and newly emerging spheres, and consider the questions facing Europe around competition with China in third markets.