MERICS Global China Inc. Tracker

No. 3, September 2021

What you need to know

EU launches Global Gateway

The EU has settled on a moniker for its new connectivity strategy: “Global Gateway.” The strategy was unveiled by EU President Ursula von der Leyen on September 15 in her “State of the Union” speech.1

Next day, the European Commission published the EU’s Indo-Pacific Strategy, which also gave a central role to connectivity in strategic engagement.2 Neither von der Leyen’s speech nor the Indo-Pacific document provided any details about Global Gateway’s financing or institutional structure. What is clear, however, is that green and digital development are high on the agenda and EU interests in Africa will be important for both initiatives.

Von der Leyen did not shy away from mentioning China in her speech. “It does not make sense for Europe to build a perfect road between a Chinese-owned copper mine and a Chinese-owned harbor,” she said, arguing the EU should “get smarter” about its investments.

The EU perceives the Belt and Road Initiative (BRI) as an astute attempt to leverage China’s economic heft, and is now attempting to counterbalance the BRI by making better use of its own significant contributions toward global development. It is redesigning its programs to suit what von der Leyen calls a “new era of hyper-competitiveness.”3

She stressed that the EU would build “links and not dependencies,” a thinly veiled criticism of what the US calls China’s “predatory lending.” The “new” connectivity strategy does not involve any qualitative change in the EU’s approach; it doubles down on what it already presented as a characteristically “sustainable”, “comprehensive,” and “rules-based” offering, stressing human rights and social equality.

Whether the EU’s redesign will go beyond a rebranding exercise remains to be seen. However, it may struggle even to launch a successful rebrand. Collectively, the EU does much more for global development than China, but to advertise this fact it will need to coordinate between member states and convince them to brand their activities under the “Team Europe” flag.

In this edition of Global China Inc, the “Key player” section looks at COSCO Shipping Ports Limited, and considers how the EU might need to counter the BRI on home ground. On September 21, it was announced that COSCO will take a 35 percent stake in a terminal within the port of Hamburg. The stake itself might not be a direct threat to EU interests, but it is part of a trend towards Chinese firms gaining increasing control of European shipping that could be leveraged by Beijing.

The “Regional spotlight” section also has a European focus as we explore China’s engagement with EU priority partner Ukraine. Over the summer, Ukraine withdrew its signature from an international statement on China’s human rights abuses in Xinjiang and signed an agreement with Beijing on infrastructure cooperation. Given Ukraine’s ongoing war with Russia, Chinese influence in Ukraine is a second-order consideration. However, if the China policies of Ukraine and the EU diverge it may complicate future discussions, especially on human rights.

Finally, in “Global China Inc. Updates,” we provide succinct updates on the overseas activity of Chinese companies these past three months.

Key Player: COSCO Shipping Ports Limited (中远海运港口有限公司)

COSCO takes stake in Hamburg Port terminal

Chinese state-owned firm, COSCO Shipping Corporation Limited (COSCO) has gained a foothold in Hamburg, Germany’s largest seaport.

On Sep 21 it was confirmed that COSCO subsidiary, COSCO Shipping Ports Limited (CSPL), will take a 35 percent stake in Container Terminal Tollerort GmbH (CTT). Antitrust authorities have yet to approve the deal.4,5,6

HHLA, which saw volumes at its Hamburg terminals fall 7.2 percent in the first three months of 2021,7 announced in June that negotiations were underway with COSCO. HHLA hopes that additional traffic and infrastructure investment will flow from a strategic partnership with COSCO, while COSCO seek linkage effects for shipping services through the operation of its own global terminal network.8

A state champion aligned with Beijing’s maritime ambitions

COSCO is the world’s third largest container carrier measured by capacity, and the fifth largest port terminal operator in terms of throughput.9,10 It was born in its current form, through the complicated merger, in 2015-2016, of COSCO with its rival, China Shipping Group (CSG), emerging as a formidable national champion.11

COSCO’s ownership structure is a hybrid of state owned and public company. The firm’s global expansion is in line with Beijing’s interests, and its growth has been facilitated by access to state capital,12 though it can be difficult to disentangle COSCO’s political and commercial drivers.

Beijing’s declared ambition of becoming a global “maritime power”13 includes the development of China’s maritime industries and merchant navy – a strategy that is clearly in line with the interests of COSCO’s executives and shareholders.

Chinese firms control 10 percent of European shipping

There are three Chinese companies involved in European ports: COSCO, China Merchants Port Holdings Company (CMP) (招商局港口控股), which is the world’s sixth largest terminal operator, and Hutchison Port Holdings Limited (Hutchison) – a private Hong Kong group that is the world’s number two operator. Of these, COSCO is the most relevant actor – it is the only operator that is also a shipping carrier, and it is the only state-owned Chinese actor with controlling shares in European terminals.

COSCO achieved its ambition of operating its own port in Europe in 2008 when, facilitated by the global economic crisis, it gained a 35-year lease to manage piers 2 and 3 at the Athens port of Piraeus. In 2016, the Greek government sold its majority stake in the Piraeus Port Authority (PPA) to COSCO, as Greece was under pressure to repay debt to the EU and International Monetary Fund.

Although the takeover has not been without controversies, Piraeus under COSCO’s leadership has become the busiest port in the Mediterranean and the fourth busiest in Europe, up from 17th place in 2007.14

EU concerns about Chinese firms’ expansion

In Europe, the boom in Chinese investments that followed the global economic crisis has given way to wariness and new regulations for screening foreign direct investments. As ports have “critical infrastructure” status, Chinese investors’ interest in them has received special scrutiny.

- The network effects of Chinese port acquisitions could be significant – The market conditions exist for China to expand its control over European terminals; some scenarios suggest Chinese port operators could gain shares that would give control over as much as half of European throughput. Although the expansion is commercially driven, there are inevitable political consequences to greater Chinese control over global shipping flows, as there are risks to the strategic autonomy of European policymakers and their ability to control supply chains.

- Ownership creates indirect influence – Beijing has recently used freight traffic as a coercive tool against Lithuania. However, diverting cargo away from Piraeus would be a dramatic act of self-harm.15 While it is not always obvious which levers Beijing would pull to translate its economic significance into influence over policymakers, Piraeus is Greece’s main seaport and an important piece of its economy.

- China-owned ports in Europe will not become dual-use facilities but can still pose security risks – Beijing is not beyond hiding strategic military intent behind commercial activities but transforming port interests into military facilities takes many years and is not possible without the explicit backing of the host country. Greece remains a sovereign state and COSCO’s concession rights to Piraeus would be irrelevant in a state of war. A more valid concern is that commercial port infrastructure fitted by Chinese companies could be used for intelligence gathering.

- Acquisitions may be detrimental to labor rights - The main complaint against COSCO in Piraeus was that it casualized employment, undermined the unions and intensified work without accompanying protections. In Germany, the Ver.di union has criticized negotiations with COSCO, saying the Hamburg acquisition would undermine social justice in the future development of the port. However, the shift towards a worker-hostile, just-in-time business model is an industry wide phenomenon. In their statement, Ver.di noted that employment conditions are being “increasingly determined by a small, global group of shipping companies.”

Chinese firms are in the market for European terminals. Many independent terminal operators see such deals and sales as making sense in order to guarantee cargo flows. Shipping industry consolidation has generated an oligopoly of three shipping alliances with significant sway over the fortunes of European ports. COSCO is a dominant member of the OCEAN alliance, the largest of these three groups.

The trend in shipping is toward greater vertical integration and consolidation. By turning to COSCO, ports like Hamburg are responding to inescapable market pressures. However, these decisions are likely being made with limited consciousness or concern for the wider strategic consequences. COSCO is competing on an uneven playing field with the backing of the Chinese state, and its market dominance is a potential geopolitical tool for Beijing.

This pattern of consolidation may need to be interrupted in order to protect the resilience of European companies. Any measures taken will need to be enacted Europe-wide, as ports will be reluctant to pass up partnership opportunities when they risk seeing the benefits go instead to competing ports in neighboring member states.

Regional Spotlight: China in Ukraine

China leverages vaccines and investment, demands silence on Xinjiang

In June, Kyiv withdrew its signature from an international statement on China’s human rights abuses in Xinjiang.16 The move was allegedly made in response to Chinese threats to withhold Covid-19 vaccine supplies.17 Six days later, Ukraine and China signed an agreement on infrastructure cooperation, paving the way for Ukraine to access roughly USD 1 billion worth of low-interest loans.18,19

Russian aggression towards Ukraine will always be the dominant geopolitical issue, but it is also important for Brussels to understand China’s engagement in Ukraine. Warmer Sino-Ukrainian relations and the potential for Ukrainian compromises on human rights issues complicate the already-fraught geopolitics surrounding this EU priority partner.

Ukraine views China as a partner not a threat

Ukraine’s general Western orientation is not in question –20 NATO and EU membership are written into the constitution – but Kyiv does appreciate Beijing’s potential role in a more independent Ukrainian foreign policy.21

With Ukrainians still dying in the ongoing conflict with Russia,22 US attempts to portray China and Russia as equally valid threats hold little water in Ukraine. From Kyiv’s perspective, Beijing just wants to do business, whereas Moscow is invested in Ukraine’s failure as an independent state.23

Trade drives China-Ukraine relations

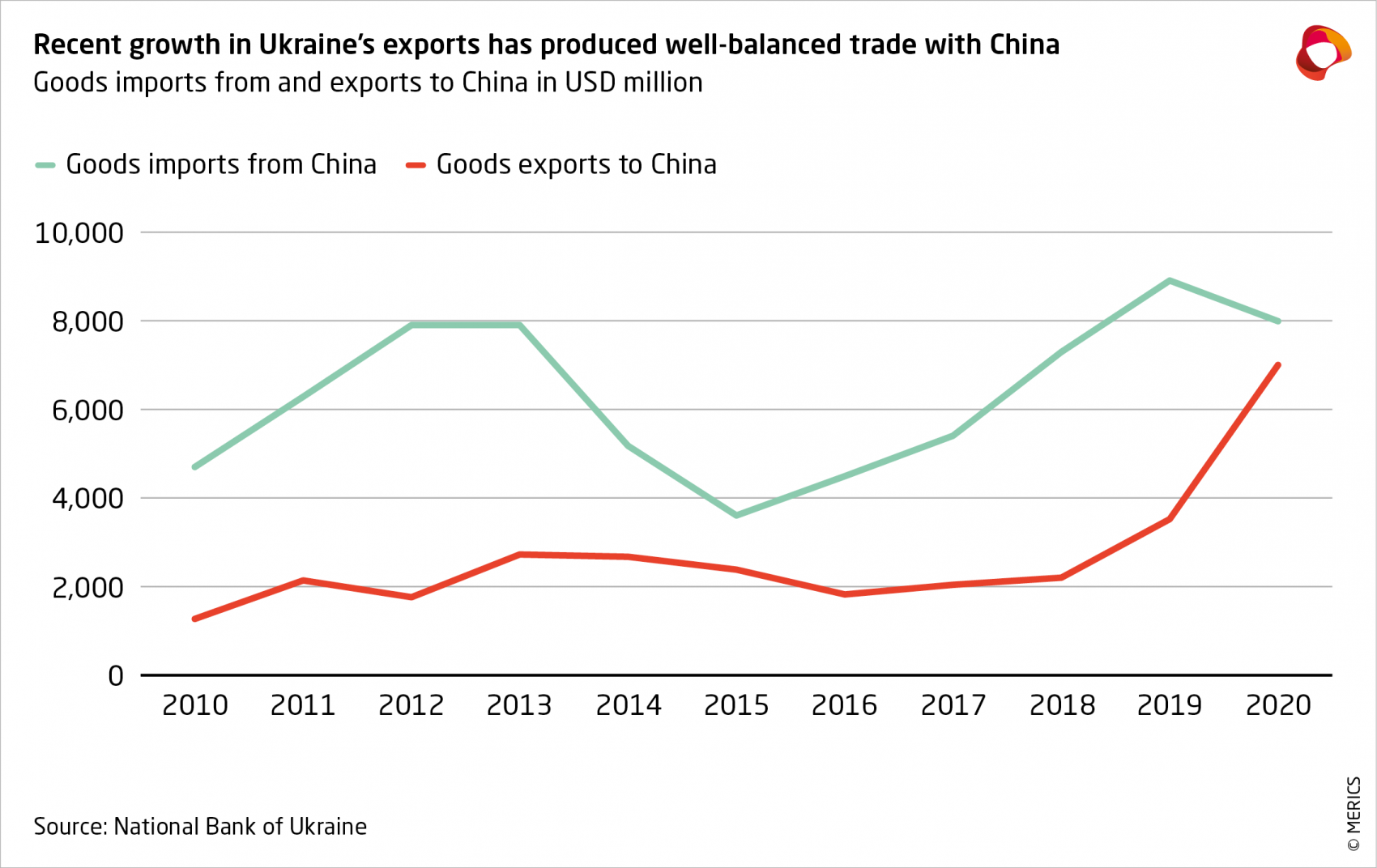

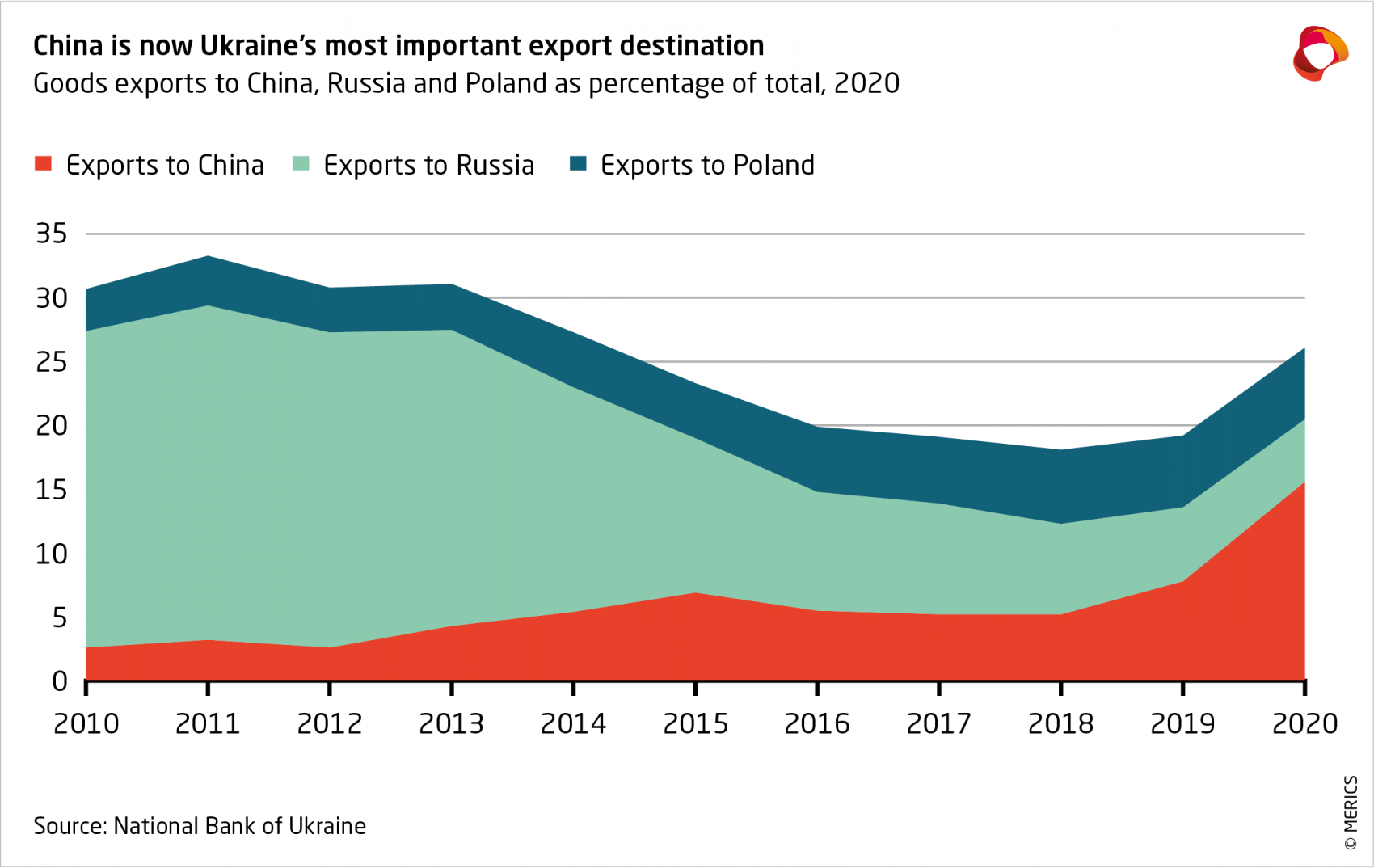

While the infrastructure and investment aspects of the BRI have had a limited impact on Ukraine (see map below), China became Ukraine’s most important trade partner in 2019. Beijing’s hunger for grains25 and its efforts to diversify supply chains have driven this trend, with food products accounting for 53.1 percent of exports to China in the first months of this year.26

However, agricultural cooperation with China has had its downsides. Ukraine was badly burnt by a loan-for-grain deal signed with China Exim Bank in 201227 that now threatens to bankrupt the Ukraine State and Food Grain Corporation (DPZKU).28

Infrastructure cooperation has been unsuccessful, but Ukraine wants to try again

Despite past frustrations, the new transport infrastructure agreements signal some degree of optimism, or perhaps necessity, on the Ukrainian side.29 The long-awaited Kyiv bypass road is of special concern, and in June the government passed legislation that scraps requirements for competitive bidding on the project.

However, it is not just cooperation with China that has encouraged Kyiv away from competitive tenders. A recent EUR 900 million agreement with France hands a contract to Alstom with no tender at all.30,31

Ukraine rethinks defense cooperation with China

Kyiv has a history of military-technical cooperation with Beijing, including the 1998 sale of the Varyag – a Soviet ship that was surreptitiously refitted to becomes China’s first aircraft carrier.32,33 According to the Stockholm International Peace Research Institute (SIPRI), Ukraine has exported USD 80-90 million worth of weapons to China annually be-tween 2016 and 2020.34

However, this partnership has not been without scrutiny or risks. There appears to be little prospect of defense ties with Beijing deepening in the future.

In March 2021, a Ukrainian court seized the assets of Motor Sich, a Ukrainian firm that is among the world’s largest manufacturers of advanced aircraft engines, including those used in the Chinese L-15 combat training aircraft. Chinese company Beijing Skyrizon Aviation Industry Investment sought to acquire the Ukrainian firm in 2016, but the deal was frozen in 2017, where it remained in limbo until the United States blacklisted Skyrizon.

US pressure doubtless factored into the decision, but so too did genuine domestic concerns, ranging from technology transfer to Russia, Ukraine’s own defense capabilities, and the threat to projects with EU and NATO partners.

China is not a realistic choice of partner for Ukraine

Speaking in July, adviser to the Ukrainian president's office, Oleksiy Arestovych, was quoted as saying, “If the West keeps surrendering Ukraine's interests for a friendship with Russia, Ukraine may turn to the East.”

Serbia’s China policy proves that warm relations with Beijing can help win concessions from the West. However, Ukraine is in a more geopolitically vulnerable position than Serbia.

Beijing sees advantages in weakening European solidarity on human rights issues, but this is not enough to make it a reliable strategic partner for Kyiv. China pays lip-service to the idea of Ukraine’s territorial integrity, but it respects Russia’s sphere of influence. It seems likely that Beijing’s Ukraine policy has received Moscow’s blessing.

After the Russian annexation of Crimea in 2014, China’s attentions shifted north to Belarus. The current crisis in Belarus and its international isolation have provided the backdrop to China’s renewed interest in investment in Ukraine. However, Beijing’s role in Ukraine’s prosperity will be limited by respect for Russian interests.36

Ukraine’s China policy is problematic but falls short of threatening EU interests

Ukraine’s cooperation with China remains limited and its concessions to Beijing are more indicative of its vulnerability than of any allegiance. Just as Kyiv must make concessions to Washington and Brussels, it must respect the demands of its most important trade partner.

China’s footprint in Ukraine does not yet pose a serious threat to EU interests, but it does come with risks. Ukraine’s apparent vulnerability to Chinese demands might prove problematic for its eventual alignment with the EU on values. However much Ukraine might want to compartmentalize, the EU’s own relations with China have demonstrated there can be no neat division between economics and politics.

However, there is a genuine appetite for liberal democratic principles and values-based politics in Ukraine. Compared to domestic problems, China does not score highly in terms of public interest. There is a lack of China expertise in Ukraine at the same time as there is a growing China lobby among academics and politicians.37,38

In order to encourage alignment on values, Brussels should harness existing public sympathies for democratic values. A useful first step would be to cultivate local China expertise and help raise awareness on issues like Xinjiang.

Global China Inc. Updates

ENERGY

Towards a Greener Belt and Road?

On September 22, President Xi Jinping told the United Nations in a prerecorded address that China “will not build new coal-fired power projects abroad."39 Chinese institutions have become last resort lenders for many international coal projects, so Xi’s pledge could be a significant step forward in the battle to phase out coal.

In practice, much will depend on the interpretation of “build” and “new.” A total ban on Chinese participation in coal projects would inflict heavy damage on major state-owned enterprises (SOEs). Between June and September, Chinese companies signed contracts to build a 300 MW coal plant in Mozambique;40 two separate 1320 MW coal plants in Vietnam;41 and a 700MW coal plant in Bosnia and Herzegovina (BiH).42 Chinese companies are also intent on pursuing Tuzla B, a Chinese funded coal plant that the EU is trying to put a stop to.43

The end of China’s financial involvement in coal has been predicted for some time. Host country demand for coal projects in countries like Pakistan44 and Bangladesh has waned, so BRI-related coal investments have declined. In June, the Industrial and Commercial Bank of China (ICBC) announced it would begin to phase out funding for coal.45 Two weeks later, it told Go Clean ICBC, a coalition of 32 environmental NGOs, that it was dropping plans to fund Sengwa coal-fired power plant, a 2.8 GW project contracted to China Gezhouba Group.46

On July 16, China’s Ministry of Commerce (MOFCOM) and Ministry of Ecology and Environment (MEE) also issued new guidelines for greening foreign investment.47

Chinese companies sign oil and gas contracts in Iraq and Kazakhstan

In the past quarter, Chinese companies have signed 27 agreements overseas linked to oil and gas extraction and processing. Oil and gas will likely become the next frontier for emissions cuts campaigners as coal funding is phased out.

On June 30, China Petroleum Engineering and Construction Corporation (CPECC) signed a contract, along with Italy’s Eni Oil Company, for the expansion of Iraq’s Zubair oil field. The contract is valued at approximately USD 690 million. Also in June, China CAMC Engineering Co., Ltd. (CAMCE) signed a USD 1.2 billion contract with Sozak Oil & Gas JSC to develop a gas field in southern Kazakhstan’s Sozak region. In September, CITIC Construction signed a USD 905 million contract for the Kirkuk oil refinery project in Iraq.48

TRANSPORT & LOGISTICS

Israel opens Chinese operated port

On Sep 1, Israel inaugurated a new port terminal in Haifa Bay. The USD 1.7 billion Haifa Port will be operated by Shanghai International Port Group (SIPG).49 SIPG won the tender to operate the port in 2015, prompting security concerns within Israel and abroad, especially from the United States. Israel is selling state-owned ports and building private docks in an effort to cut costs and improve efficiency.

Controversial Chinese built bridge completed in Croatia

On July 28, the final steel segment of Pelješac Bridge was installed, connecting the Dubrovnik peninsula to the rest of Croatia. European companies protested when the tender for the EU funded project went to China Road and Bridge Corporation (CRBC) in April 2018. The unsuccessful bidders accused CRBC of price-gouging.50 The bridge cost EUR 550 million, of which EUR 357 million came from the EU.

DIGITAL AND HEALTH

China’s vaccine makers expand local production

On September 9, Serbia’s president held a groundbreaking ceremony for a factory to produce Sinopharm’s COVID-19 vaccine. He said the factory is expected to ramp up production to a capacity of 30 million doses a year in its first six months, far more than is needed for Serbia’s population of 7 million. In the past quarter, Chinese vaccine makers have struck deals or are in talks to produce Covid-19 vaccines locally in multiple countries, including Algeria,51 Bangladesh,52 Belarus,53 Chile,54 Morocco,55 Russia,56 and Uzbekistan.57 In July it was reported that Egypt had manufactured its first one million doses of Sinovac’s Covid-19 vaccine.58 In other Covid-19 vaccine news, Chinese firm Everest Medicines has bought an mRNA vaccine license from Canada’s Providence Therapeutics Holdings, continuing China’s pivot toward mRNA technology.59

Senegal aims for digital sovereignty with Huawei data centre

On June 22, President Macky Sall announced that Senegal will move all government data from foreign servers to a new national data center to guarantee “Senegalese digital sovereignty.”60 The new data center is being built with Huawei equipment and a loan from the Export-Import Bank of China.

MANUFACTURING, CONSTRUCTION, AND RESOURCES

Indonesia opts for Japanese not Chinese developers

In July, a USD 2.7 billion contract was awarded to Japan-based Chiyoda Corporation for a copper smelter in Gresik, Indonesia. The Indonesian developer originally held talks with China’s Tsingshan Holding Group to build the new smelter – a reminder of the fierce competition between Chinese and Japanese engineering firms in Southeast Asia.61 In other news, Chinese company Huayou Cobalt Co., Ltd announced in late May that it will jointly carry out a USD 2.08 billion nickel-cobalt project in Indonesia's WedaBay Industrial Park.62

Democratic Republic of Congo reviews mining deals with China

On August 27, the Democratic Republic of Congo (DRC) finance minister announced the country was reviewing its USD 6 billion “infrastructure-for-minerals” deal with China, amid concerns that current mining deals to not bring sufficient benefit to the DRC. Chinese firms control around 70 percent of the DRC’s mining portfolio.63

- Endnotes

-

1 https://ec.europa.eu/commission/presscorner/detail/ov/SPEECH_21_4701

2 https://eeas.europa.eu/headquarters/headquarters-homepage/104126/joint-communication-indo-pacific_en

3 https://ec.europa.eu/info/strategy/strategic-planning/state-union-addresses/state-union-2021_en

4 https://www.welt.de/wirtschaft/article233222169/Hamburger-Hafen-Die-Hansestadt-wagt-den-heiklen-China-Deal.html

5 https://hhla.de/unternehmen/news/detailansicht/hhla-verhandelt-mit-cosco-shipping-ports-ltd-ueber-strategische-minderheitsbeteiligung-am-terminal-tollerort

6 https://www.ndr.de/nachrichten/hamburg/Chinesische-Reederei-steigt-bei-Hamburger-Hafenterminal-ein,hhla402.html

7 https://shippingwatch.com/Ports/article13041470.ece

8 https://ports.coscoshipping.com/en/#financial-highlights

9 https://www.ship-technology.com/features/the-ten-biggest-shipping-companies-in-2020/

10 https://www.marineinsight.com/know-more/11-major-container-terminal-operators-in-the-world/

11 https://www.seatrade-maritime.com/asia/cosco-shipping-guide-merger-cosco-and-china-shipping

12 https://jamestown.org/program/shipping-finance-chinas-new-tool-becoming-global-maritime-power/

13 https://www.scmp.com/news/china/article/1077858/china-should-become-maritime-power-hu-jintao-says

14 https://www.railfreight.com/intermodal/2020/02/24/gdansk-and-piraeus-most-dynamic-container-ports-in-europe/

15 https://www.scmp.com/news/china/diplomacy/article/3145520/china-halts-rail-freight-lithuania-feud-deepens-over-taiwan

16 https://www.radiosvoboda.org/a/kytay-torgivlya-tysk-vaktsyny/31380145.html

17 https://apnews.com/article/united-nations-china-europe-ukraine-health-a0a5ae8f735b92e39c623e453529cbb9

18 https://mp.weixin.qq.com/s/IbGFYNgl35CvyiEj-KzxVQ

19 https://www.kyivpost.com/ukraine-politics/dangerous-debt-china-lends-money-to-ukraine-with-strings-attached.html

20 https://www.voanews.com/europe/ukraine-amends-constitution-cement-eu-nato-course

21 https://blogs.pravda.com.ua/authors/kuleba/5e8adfffa2521/

22 https://en.interfax.com.ua/news/general/762117.html

23 https://www.axios.com/ukraine-zelensky-china-coronavirus-vaccines-e6a45253-1448-43a0-a846-b8d0f448eaa1.html

24 https://ubn.news/ukraines-trade-in-goods-with-china-surged-during-the-first-half-of-this-year-nearly-hitting-9-billion/

25 https://www.hellenicshippingnews.com/chinas-grain-hunting-to-continue-amid-growing-uncertainty-analysts/

26 https://www.ukrinform.net/rubric-economy/3237580-ukraine-interested-in-expanding-access-of-agricultural-products-to-chinese-market.html

27 https://www.ft.com/content/79bc2174-0276-11e2-8cf8-00144feabdc0

28 https://www.rwradvisory.com/substantial-debt-to-china-by-ukraines-largest-state-owned-grain-exporter-creates-strategic-vulnerability-complicating-companys-privatization-plan/

29 https://www.reuters.com/article/ukraine-parliament-idUSL2N2OC0IQ

30 https://en.interfax.com.ua/news/investments/743653.html

31 https://www.kmu.gov.ua/news/ekspres-do-borispolya-buduyetsya-z-viperedzhennyam-grafika-ekonomiya-koshtiv-po-robotah-sklala-vzhe-120-mln-grn-premyer-ministr

32 https://www.scmp.com/news/china/military/article/3139603/how-china-grew-buyer-major-arms-trade-player

33 https://chinaobservers.eu/why-ukraine-is-reassessing-its-defense-cooperation-with-china/

34 https://www.scmp.com/news/china/military/article/3139603/how-china-grew-buyer-major-arms-trade-player

35 https://www.dw.com/en/germany-us-strike-nord-stream-2-compromise-deal/a-58575935

36 http://iep-berlin.de/en/new-berlinperspectives-one-year-after-the-presidential-election-in-belarus-germanys-role-and-policy-recommendations-for-the-political-crisis-in-belarus/

37 https://iwpr.net/global-voices/could-turn-towards-china-disrupt-ukraines-western-direction

38 https://ukranews.com/en/news/787147-servant-of-the-people-political-party-has-common-principles-with-the-communist-party-of-china

39 https://www.reuters.com/world/china/xi-says-china-aims-provide-2-bln-vaccine-doses-by-year-end-2021-09-21/

40 https://www.marketwatch.com/story/ncondezi-energy-signs-contract-with-china-machinery-engineering-271631172368

41 https://www.seetao.com/details/94486.html

42 https://balkangreenenergynews.com/firms-from-china-poland-ink-deal-for-ugljevik-3-coal-plant-in-bih/

43 https://www.euractiv.com/section/politics/short_news/china-not-giving-up-on-building-a-coal-fired-power-plant-in-bih/

44 https://asia.nikkei.com/Politics/International-relations/Bangladesh-scraps-plans-for-10-coal-fired-power-plants

45 https://chinaafricaproject.com/2021/06/15/chinas-largest-commercial-bank-says-it-plans-to-phase-out-financing-coal-projects/

46 https://www.climatechangenews.com/2021/07/01/chinas-biggest-bank-ditching-zimbabwe-coal-plant-campaigners-say/

47 https://green-bri.org/interpretation-of-the-green-development-guidelines-for-foreign-investment-and-cooperation/

48 https://www.seetao.com/details/109961.html

49 https://www.reuters.com/world/middle-east/israel-opens-chinese-operated-port-haifa-boost-regional-trade-links-2021-09-02/

50 https://balkaninsight.com/2021/07/29/croatia-celebrates-joining-of-peljesac-bridge/

51 https://www.trtworld.com/africa/algeria-gets-green-light-to-produce-sinovac-covid-19-vaccines-48650

52 http://www.xinhuanet.com/english/2021-08/17/c_1310132683.htm

53 https://www.macaubusiness.com/belarus-china-in-talks-on-joint-covid-19-vaccine-production-media/

54 https://www.reuters.com/article/health-coronavirus-chile-sinovac-biotech/chinas-sinovac-to-invest-60-mln-in-vaccine-facility-in-chile-idUSL1N2PB1PW

55 https://whbl.com/2021/07/05/moroccos-sothema-to-produce-chinas-sinopharm-vaccine/

56 https://balkaninsight.com/2021/07/13/serbia-signs-agreement-to-produce-chinese-sinopharm-vaccine/

57 https://www.urdupoint.com/en/health/china-uzbekistan-strike-deal-on-production-o-1324781.html

58 https://www.egyptindependent.com/egypt-locally-produces-one-million-doses-of-sinovac-vacsera/

59 https://www.bloomberg.com/news/articles/2021-09-13/chinese-firm-buys-canada-mrna-vaccine-tech-in-500-million-deal

60 https://www.datacenterdynamics.com/en/news/senegal-to-migrate-all-government-data-and-applications-to-new-government-data-center/

61 https://asia.nikkei.com/Business/Markets/Commodities/Chiyoda-seals-2.7bn-deal-for-Indonesian-copper-smelting-plant

62 https://mp.weixin.qq.com/s?__biz=MzI4ODQ3MTE2NQ==&mid=2247532376&idx=2&sn=0e0126cd45889f65bc81357e25e3fe89&chksm=ec3fde4adb48575c55bfa8667b3d83c1dd0aab13eec4fdf111b59ad9fd9aea156b84dbe1f6c3&scene=178&cur_album_id=1589008440012668929#rd

63 https://www.reuters.com/world/africa/exclusive-congo-reviewing-6-bln-mining-deal-with-chinese-investors-finmin-2021-08-27/