Increasing economic pressure on Taiwan is risky business for China

Beijing has threatened economic pain if the pro-China KMT loses. But Max J. Zenglein says any substantial penalties after a DPP victory would also hit China’s economy hard. This article is part 2 of our series on Taiwan’s 2024 presidential election.

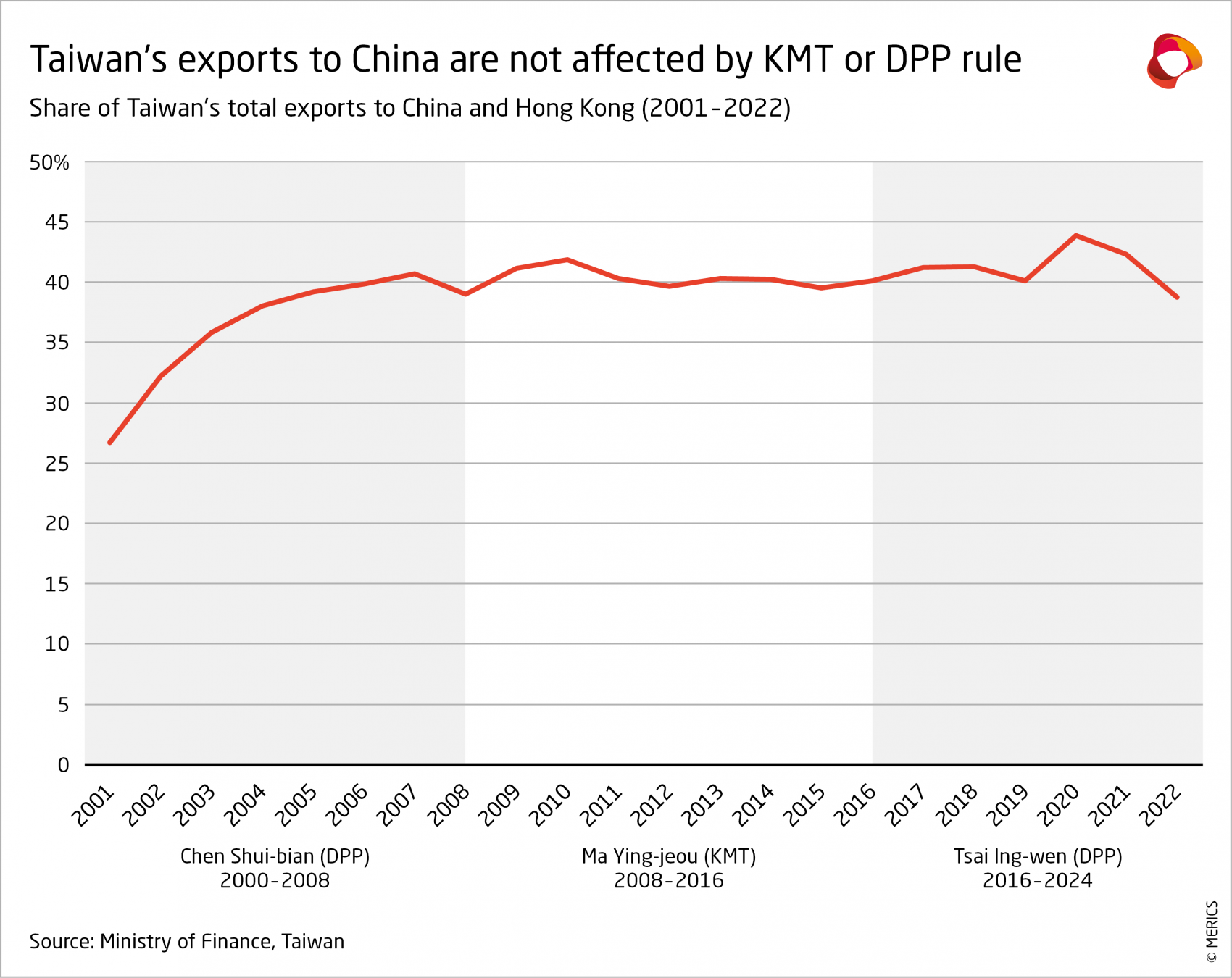

Polling ahead of Taiwan’s general election on January 13 shows the independence-inclined Democratic Progressive Party (DPP) might secure a third term in power, raising fears of more Chinese military aggression. But its moves in the economic sphere could be more revealing. Business ties between Taiwan and China have continued to flourish, even with the more China-friendly Kuomintang (KMT) in opposition. Since the DPP’s Tsai Ing-wen became president in 2016, China has practiced broad economic cooperation and only selective coercion. Any shift to real economic pain would be a step-change – although unlikely for now.

China’s strategy reflects an at least notionally comprehensive approach to asserting its influence over Taiwan. Military exercises around Taiwan are meant to apply constant pressure and serve as a reminder of China’s goal of unification. Economic coercion is also a frequently used tool to express Beijing’s displeasure – but bans on imports of Taiwanese goods like pineapples, in 2021, and a type of seabass, in 2022, are little more than symbolic. China’s moves on this front have noticeably steered clear of Taiwan’s economic backbone, its world-beating high-tech industry, which exports vast amounts to and invests heavily in China.

Taiwanese companies provide vital components for Chinese exports

With almost 40 percent of the island’s exports going to China in 2022 (see exhibit), Taiwanese companies provide vital components for Chinese exports to the world and capital for the manufacturing facilities that make them. This latter fact appears to have stopped their export dependency becoming a fully-fledged vulnerability, as any sanctions would also harm China. This, in turn, has led Taiwanese companies to show little interest in the DDP’s New Southbound Policy, designed to diversify Taiwan across the Indo-Pacific and away from China.

A DPP government makes relations with China noisier and a further formalization of economic ties – as with the 2010 Economic Cooperation Framework Agreement (ECFA) under KMT rule – hard to imagine. But the DPP has challenged China’s assumption that only the KMT can ensure stable economic ties. Nevertheless, as during every race since Taiwan’s first direct presidential election in 1996, Beijing has clearly signaled that it favors the KMT and its more conciliatory approach – and that China could inflict substantial damage on Taiwan’s economic interests in the event of voters awarding the DPP another four years in power.

Inconveniently for Beijing, the KMT and the up-and-coming Taiwan People’s Party (TPP) recently failed to turn co-operation into agreement on a joint presidential candidate, leaving the DPP’s Lai Ching-te, Taiwan’s vice president, slightly ahead of the KMT’s Hou You-yi in a late-November poll. With Tsai barred from running again by Taiwan’s presidential term limits, Beijing now faces the possibility of having to deal with a second DPP president in succession – despite in past months engaging in some not-so-subtle behind-the-scenes maneuvering to boost support for the KMT and render an outcome it considers more favorable for China.

Beijing, in late October, announced an investigation into Foxconn’s operations in China after the electronics contract manufacturer’s owner, Terry Gou, announced a presidential bid likely to take votes from KMT and TPP. Trailing in polls, the billionaire pulled out in late November, although Beijing’s stance was likely a factor, too. Six months before that, China launched an investigation into purported Taiwanese ECFA-related trade barriers. After slating its findings for October 12, Beijing moved publication to January 12, 2024, the eve of the election. In what looks to be a tight race, this will allow Beijing to influence the election in its favor by threatening potentially painful countermeasures should the DPP still be top in polls.

Beijing relies on the goodwill of Taiwan’s business community

Both instances show how Beijing relies on the goodwill – or compliance – of Taiwan’s business community. The annual Cross-Strait CEO Summit remains one of the last channels of communication between Chinese and Taiwanese elites – and a steadfast promoter of cross-straits integration. The tenth meeting mid-November in Nanjing ran under a theme out of the playbook of the Chinese Communist Party: “Integrated development and high-quality development under the new pattern”. Xi Jinping addressed delegates by video – and Taiwanese representatives called for broadening the existing free trade agreement with China.

But Beijing seems to realize that such support does not guarantee servility. The reason it has refrained from anything-but-symbolic economic sanctions is not only the simple export-investment nexus described above. Crucially, most Taiwanese exports to China aren’t destined for the latter’s home market, they are intermediate products for Chinese finished goods mainly destined for export. Should Beijing hinder this flow, Taiwanese companies could move final assemblies to other Asian countries. By moving from symbolic to real economic sanctions, Beijing would alienate a vital constituency in Taiwan and endanger its investments in China.

This suggests China would signal its discontent in the event of a DPP victory but think twice about a response that would seriously impact economic ties. Applying more severe economic pressure – by limiting trade and targeting Taiwanese investments in China – would be unprecedented. Such substantial economic pressure would mark a break from past responses and a major escalation by China. But, as this would risk severely damaging relations with the Taiwanese business community and threaten major consequences for a China already struggling with a number of economic challenges, this seems unlikely to happen in 2024.