MERICS China Forecast 2025: Economic stress increases risk of domestic instability

China's economic growth will slow for a second consecutive year in 2025, making economic stress and unemployment the most likely drivers of public dissent or protest, according to the annual MERICS China Forecast. Some 65 percent of the 843 China experts and observers we surveyed said the world's second-largest economy would grow “less than 5 percent”, while only 31 percent expected stable growth of “around 5 percent”, the same rate the Chinese government is forecasting for 2024 after reporting growth of 5.2 percent in 2023.

Weak consumption and debt remain most significant risks to Chinese economy

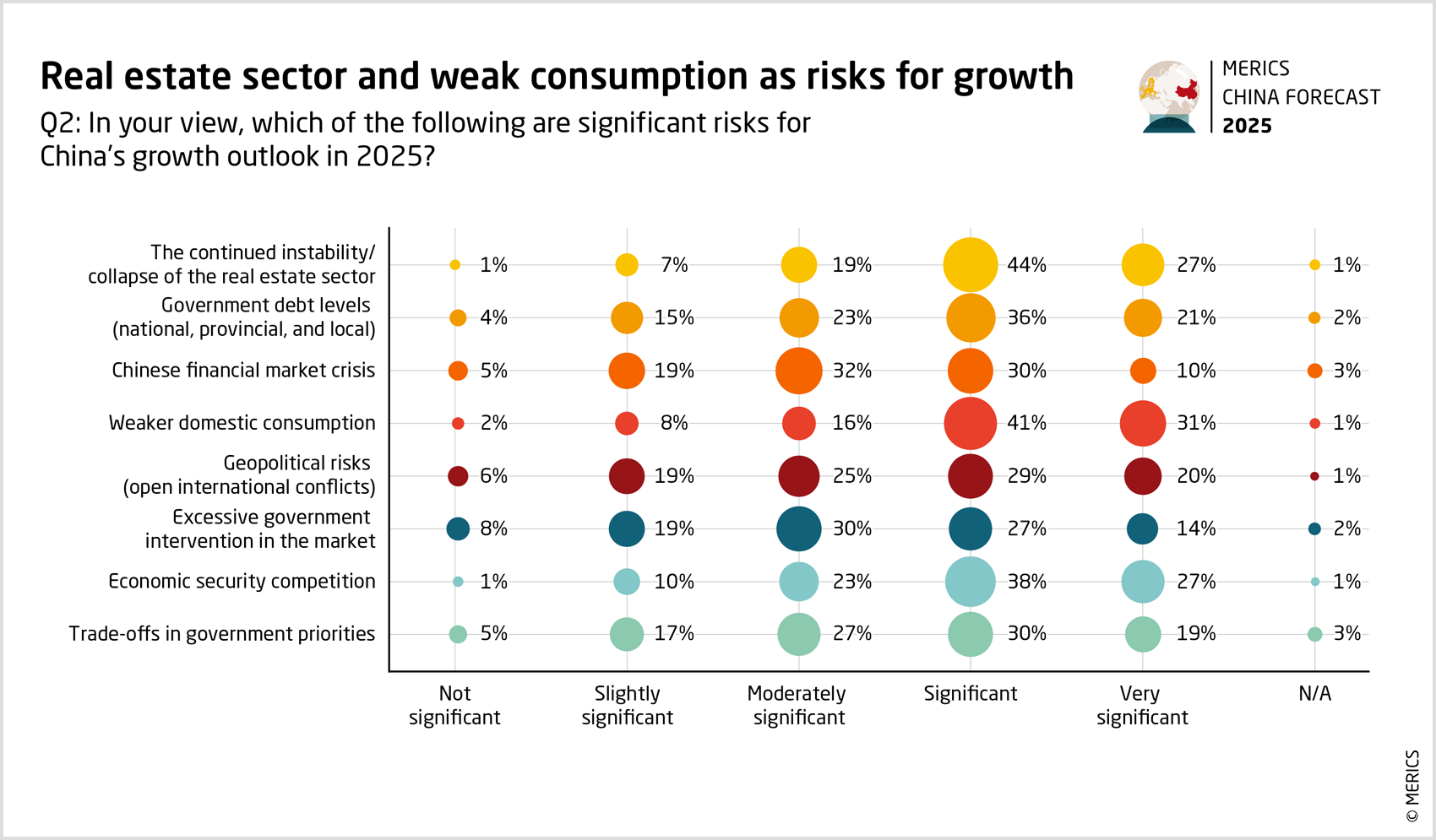

While Xi Jinping’s government last year took some steps to address the Chinese economy’s structural problems, a clear majority of the experts and observers MERICS polled still saw these as the key economic issues going into 2025: Some 73 percent said weak consumer demand posed “significant” or “very significant” risks to the economy, while 71 percent said the same of real-estate market problems, and 57 percent of excessive national, provincial and local government debt levels that have weakened public spending and financial stability.

Economic issues are also the most likely source of domestic instability – and the Chinese Communist Party is likely to place a focus on public order, according to these China watchers from 58 countries. Some 76 percent said falling real-estate prices and other forms of economic stress would make public dissent or protests “somewhat likely” or “very likely”. 63 percent said maintaining public order would be “very important” for the CCP in 2025, while only 12 to 26 percent attributed the same urgency to tackling the key economic problems.

But the experts and observers we surveyed were fairly evenly split on which issue Xi and other members of the Chinese leadership would make their top priority in 2025: 29 percent expected it to be building China's technological self-sufficiency, 28 percent improving social control, and 25 percent stabilizing the economy and boosting growth. Whatever Xi's eventual focus, 62 percent of China watchers expected the country's innovation capabilities – skills, processes, resources, organisation – to improve over the course of the year.

This view is all the more noteworthy given the perceived risks to Chinese research and development (R&D) from export controls and other forms of economic decoupling between China and the West. Some 59 percent of China watchers said decreasing access to Western technology would be a “significant” or “very significant” risk to the country’s R&D in 2025, while 56 percent said the same of decreasing international science co-operation – less collaborative research, fewer exchange programs, more circumspect resource-sharing.

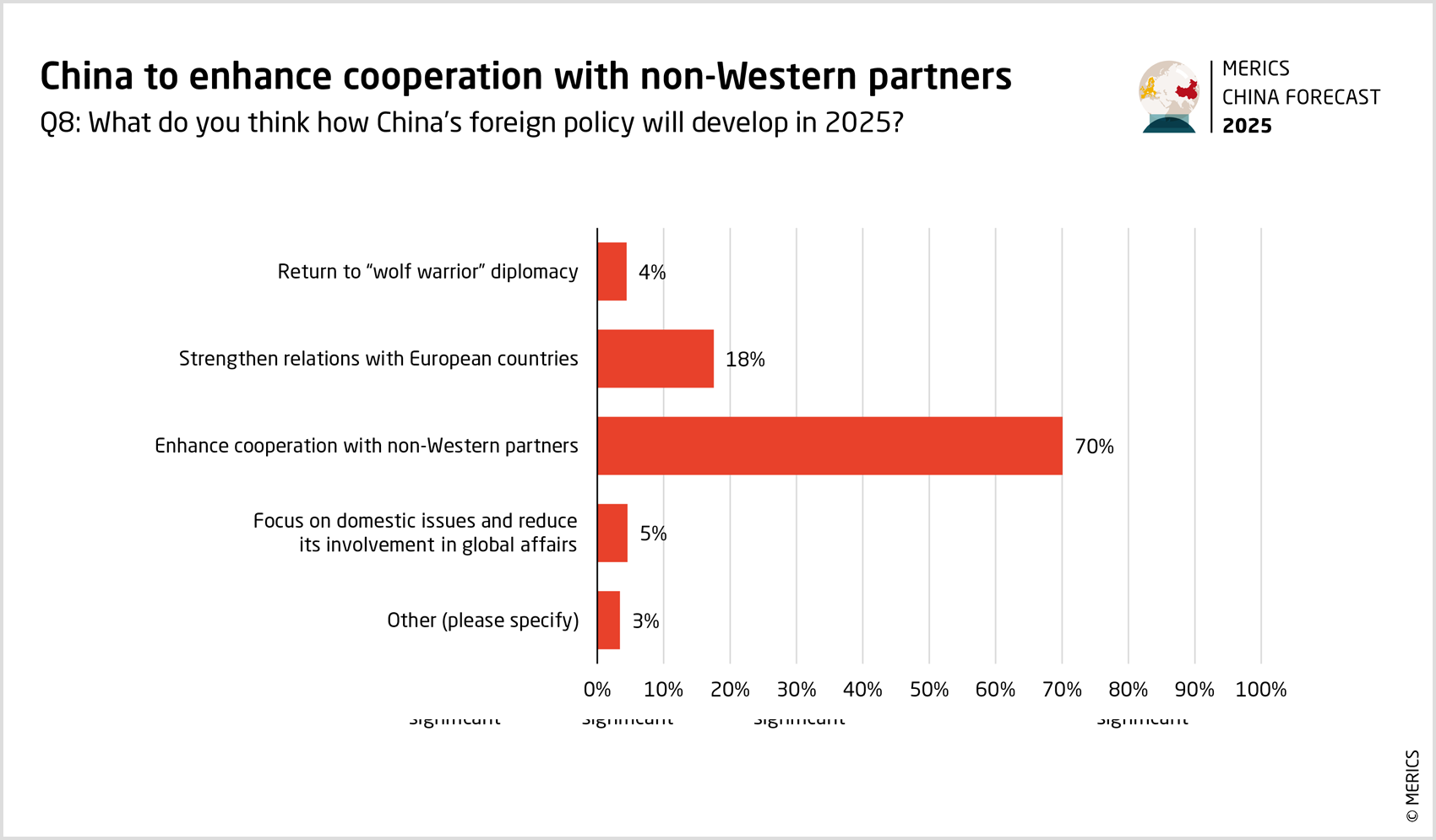

Beijing engages more with non-Western countries to break US-led containment

In the light of increasingly fraught economic and geopolitical competition between China and the US and EU, 70 percent of the experts and observers with whom we were in contact expected Beijing to enhance co-operation with non-Western partners. Some 38 percent said China’s backing for Russia would be as strong in 2025 as it was in 2024, while 23 percent said Beijing would expand its political and economic support. Only 13 percent expected it to take a more active role in mediating between Moscow and Kiev in Russia’s war on Ukraine.

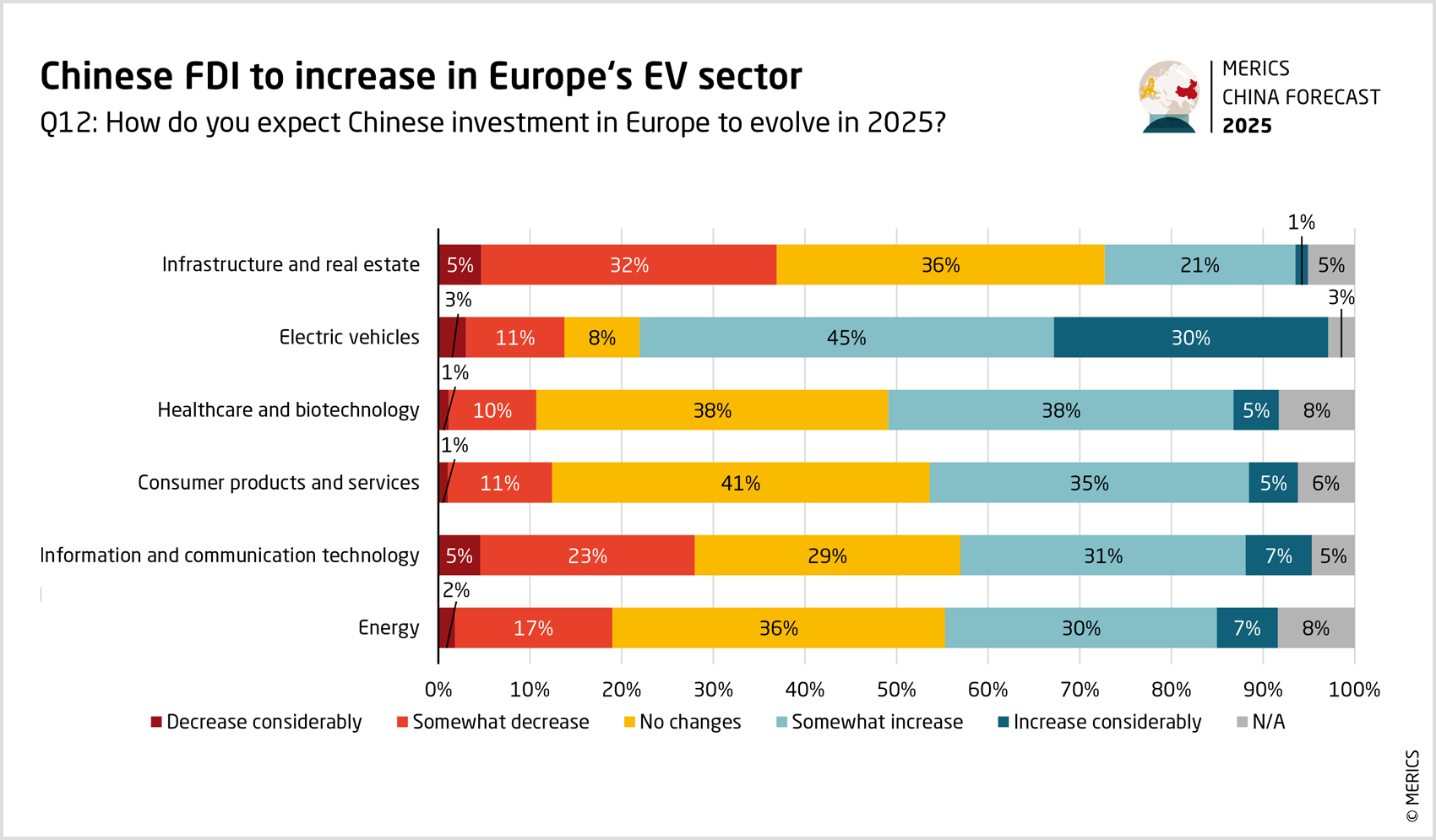

This appears to be one reason why 56 percent of our survey participants expect political relations between the EU and China to worsen “somewhat” or “considerably”. On the other hand, 52 percent expect economic relations to remain stable or even improve. Despite recently raising tariffs on Chinese-made electric vehicles (EVs), the EU, unlike the US, is keen to continue trading with China – for example, 75 percent of our experts expect Chinese foreign direct investment in Europe’s EV sector to increase “somewhat” or “significantly”.

Even then, only 24 percent of our respondents expected any significant political progress on trade, investment and market access rules – the only policy area in which a majority saw any chance of meaningful EU-China collaboration was climate and environment. Despite this, only 15 percent recommended that the EU align itself more with the US under a second Trump administration – some 35 percent said it should balance between the US and China, a further 34 percent said that it should diversify its partnerships beyond the two countries.

US-China relations are expected to deteriorate significantly, but military conflict remains unlikely

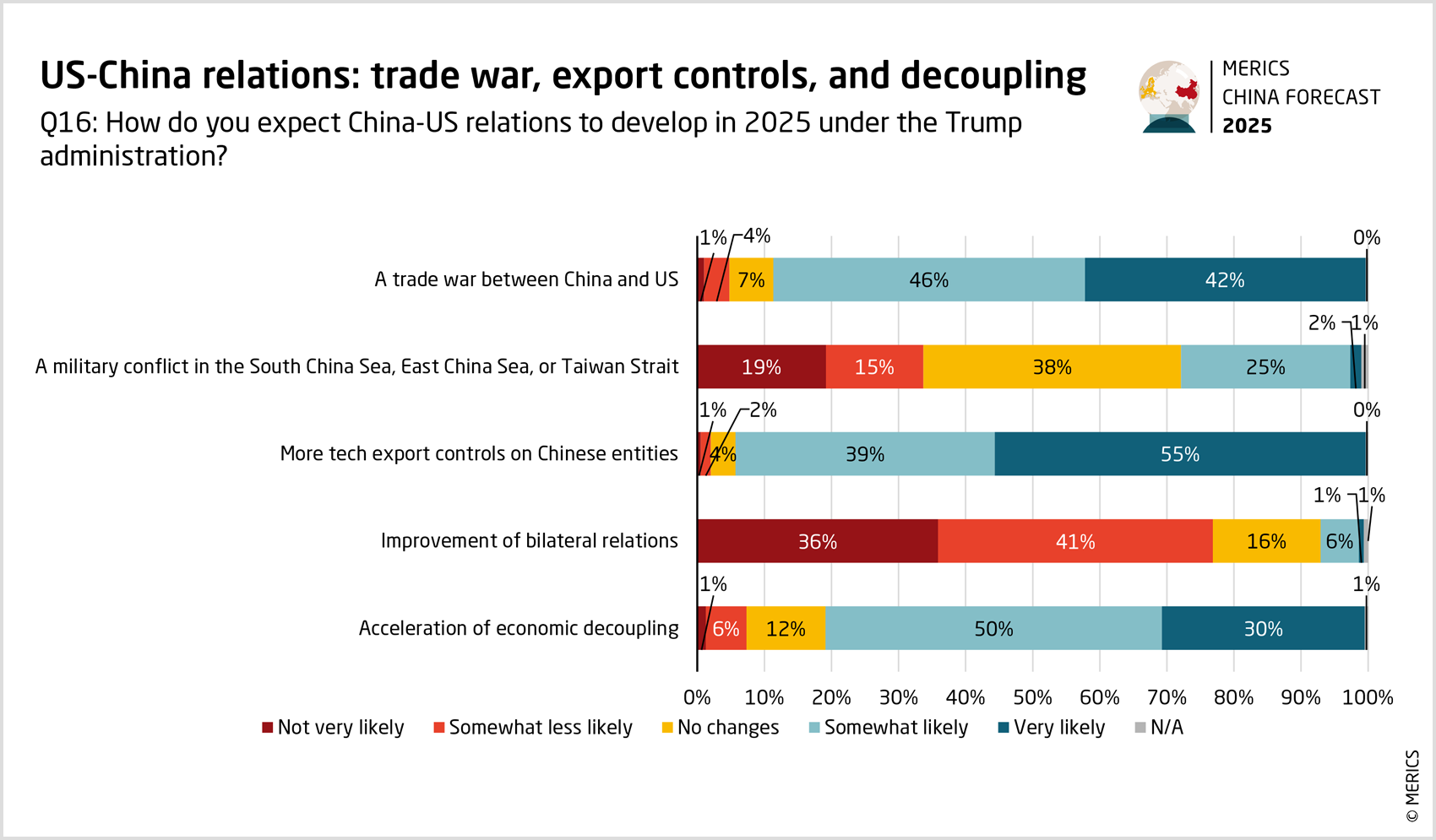

One reason for this seems to be a fear of the EU being drawn into the turmoil of worsening US-China ties. Some 77 of the experts and observers see an improvement in the bilateral relations between Washington and Beijing as being “not very likely” or “somewhat less likely” after Donald Trump assumes the US presidency from Joe Biden on 20 January. But with only 27 percent of observers seeing a military conflict over flashpoints like Taiwan as in any way likely, the battle between the two is widely expected to be an economic one.

More US export controls on high-tech products bound for China are seen as “very likely” or “somewhat likely” by 94 percent of respondents, with a clear majority stating the former. With an all-out trade war between the US and China seen as “very likely” or “somewhat likely” by 88 percent of our poll, some 80 percent said the economic decoupling would likely accelerate in 2025. While Joe Biden sought to lower economic interdependence on national-security grounds, Trump also wants to address trade imbalances and protect US jobs.

Economic interests are also expected to play a major role in Trump’s approach to Taiwan. Some 89 percent of the China watchers said it was “somewhat likely” or “very likely” that the new US government would urge Taiwanese chip makers to invest more in the US, while 64 percent saw Washington selling more arms to Taiwan as similarly likely. Only a small minority expect Trump to make big geopolitical shifts, such as changing the US’s One China policy or its “strategic ambiguity” about its response to a Chinese military attack on Taiwan.

The results of the MERICS China Forecast 2025 will be presented at a conference on January 15. To get all the results of the survey, download the PDF:

The MERICS China Forecast 2025 is part of the “Dealing with a Resurgent China” (DWARC) project, which has received funding from the European Union’s Horizon Europe research and innovation programme under grant agreement number 101061700.

Views and opinions expressed do not necessarily reflect those of the European Union. Neither the European Union nor the granting authority can be held responsible for them.