China bets on a low-cost reset with Europe + EU-China trade tensions

Analysis

In the Trump 2.0 era, China bets on a low-cost reset with Europe

By Grzegorz Stec

China increasingly sees Europe as a politically divided and geopolitically challenged actor that can be leveraged for its market and used to gradually bring about a multipolar international order. A gradual process would give China time to further strengthen its geopolitical position. Beijing is betting that pressure from Washington will send Europe into the arms of China to counterbalance transatlantic tensions.

In this view, robust, coordinated European de-risking efforts, which Beijing views as destabilizing the relationship, are set to subside, bringing improvement in relations at little cost to Beijing. It may be enough to offer ambiguous rhetorical support, targeted economic benefits and cooperation in salvaging some of the multilateral status quo that China deems useful for its agenda.

Despite such views from Beijing, the lacking trust and persisting fundamental divergences of interests between China and Europe, even with Trump in the picture, mean there is a limit to any potential rapprochement.

China is yet to make an offer to Europe…

Several signals suggest Beijing is not eager to extend a major offer to Europe soon despite a diplomatic outreach.

First, unlike the proactive steps China took ahead of Biden’s inauguration, most notably, a breakthrough in the Comprehensive Agreement on Investment, no similar offers have been made to the EU. Although China has had the opportunity to make a gesture, such as in consultations on EV price commitments launched in the context of the EU imposed tariffs on Chinese EVs, Beijing felt no urgency to offer Europe concessions ahead of Trump’s arrival to the White House.

Second, the appointment of Lu Shaye as Special Envoy for Relations with Europe does not signal a conciliatory or cooperative tone or even care how the appointment is perceived in European capitals. Known for his controversial “wolf-warrior” style as China’s ambassador to France, Lu is likely to be used to communicate China’s demands and red lines in order to manage European positions.

Finally, China’s diplomatic outreach to Europe in the first weeks of Trump’s return did not signal major new proposals.

Wang Yi’s vocal support for Europe’s involvement in peace negotiations for Ukraine at the Munich Security Conference was just a reiteration of China’s established stance that all relevant parties should be involved in the negotiations, although it stood in stark contrast with the disruptive comments of US Vice President JD Vance and Ukraine War envoy General Keith Kellogg. It is highly unlikely, however, that Beijing will back up its rhetoric by actively responding to Europe’s concerns, halting its support for Russia and lobbying for Ukraine’s position beyond rhetorics. Still, by leveraging the optics, Beijing may hope to limit Europe’s assertiveness toward China. The other parts of Wang Yi’s speech focused on the need for multipolarity and “true multilateralism,” also a long-held Chinese position now deployed to present Beijing as a responsible power.

Wang's talks with European counterparts and diplomatic outreach (see the Diplomatic Tracker below for more details), the invitation Beijing reportedly extended to EU Trade and Economic Security Commissioner Maroš Šefčovič to visit China, and preparations for the upcoming EU-China summit following the Xi-Costa call indicate Beijing's clear intent to capitalize on Trump-era disruptions. But as Beijing sees itself as having the upper hand, Europe should not bet on a major offer or shift in China’s approach.

China is in no rush

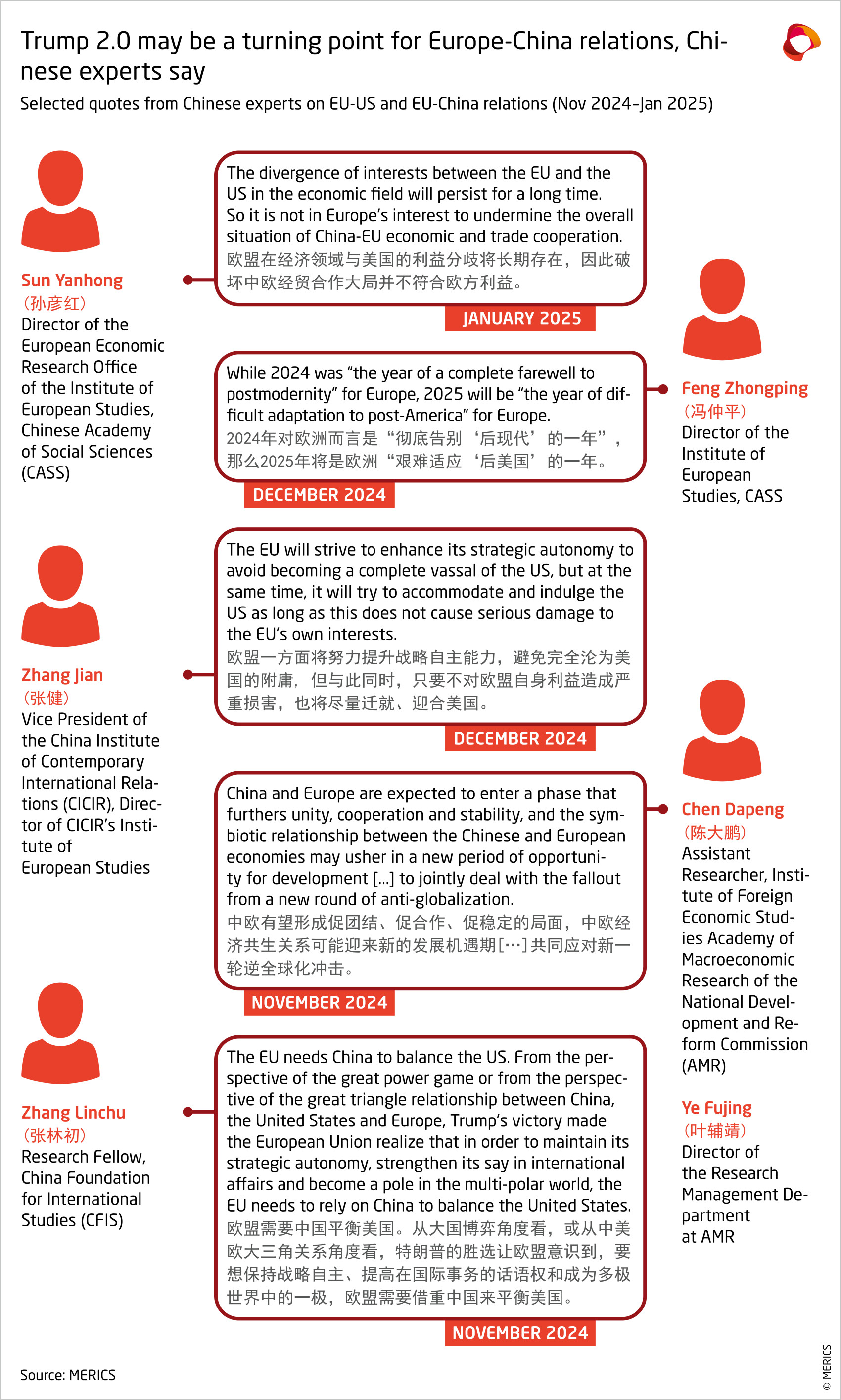

Recent assessments by Chinese think tanks offer a glimpse into the framing of European affairs within the Chinese system and help interpret Beijing’s outreach. Analysts emphasize a core contradiction in European foreign policy: the tension between a deepening dependence on the US with increasingly imbalanced transatlantic relations and Europe’s growing aspiration for strategic autonomy. Some, like Zhang Jian, Vice President of the China Institute of Contemporary International Studies (CICIR), describe Europe’s predicament as one of “vassalization” (附庸化), with the handling of the Russian invasion showing how the US leverages crises to strengthen Europe’s reliance on American security guarantees, arms supplies, and energy exports. Trump’s decision to negotiate directly with Putin over the heads of Europeans is likely to only support similar assessments in China.

Indeed, the return of Trump is seen as intensifying this contradiction. Chinese analysts expect Trump’s policies to heighten transatlantic tensions, forcing European capitals to confront the realities of “American imperialism” and, in the words of Feng Zhongping, Director of the Institute of European Studies at the Chinese Academy of Social Sciences (CASS), learn to navigate the world of “post-America” (后美国).

As Europe feels the pressure of Washington’s radical assertiveness, Beijing expects the logical response to be for European capitals to seek closer ties with China. Such a shift is envisioned not as a result of active Chinese investment in the relationship, but rather as an inevitable counterbalance to a US-dominated transatlantic relationship. Although Beijing may offer selective concessions or investments to ease this transition, the overall trajectory of EU–US relations remains the decisive factor. Hence, Trump’s pressure is expected to reduce European “protectionism” and de-risking measures, potentially heralding a turning point in EU–China relations.

Implications for Europe

- Beijing sees itself in a position of strength vis-à-vis Europe and is likely to assume Europe will re-engage China out of necessity. Europe should not expect major, concrete, favorable proposals from Beijing at this stage. Any such proposal – if it were to materialize – would likely come after Beijing feels Trump has created so much havoc in transatlantic relations that Beijing’s negotiating position with Europe is even more favorable.

- Beijing will be happy to pursue re-engagement that comes at little cost. Europe will need to strictly distinguish Beijing’s rhetoric, symbolic moves and offers with very limited scope from concrete actions as Beijing will seek to present itself as a major player and stabilizing force in contrast to the Trump administration. The recent re-engagement between China and the UK, for instance, illustrates how Beijing may approach other European capitals with a relaunch of high-level dialogues and targeted benefits.

- Beijing will seek to hinder Europe’s de-risking agenda by capitalizing on Trump-induced reflex of Europeans to reengage with China. While targeted re-engagement – such as in climate policies or supporting multilateral institutions as in Trump’s first administration (keeping the Paris Agreement afloat or resuscitating the WTO dispute settlement system) – may be desirable, these efforts will not alter China’s strategic objectives towards Europe.

- European capitals must exercise caution if they choose to re-engage Beijing. While the lure of closer ties with China might appear attractive to counter US pressure, it is important to remember that Beijing’s strategic priorities remain unchanged even if they may seem less radical than the actions of the Trump administration. The fundamental divergences of interests will remain – whether China’s relationship with Russia, divergences of the EU’s and China’s economic models or perspectives on the rules-based international order. The potential benefits of any re-engagement with China should be weighed against the risk of deepening ties with a party-state that has limited overlaps in strategic objectives with Europe.

Read more:

Update

EU-China trade tensions gearing for escalation

As the new Trump administration wreaks geopolitical havoc trade tensions between China and the EU that started in mid-2023 continue to escalate. Trade and digital investigations in Brussels are piling up after an unprecedently active year in 2024. The first forceful de-risking obligations are creating a new front of tension. Meanwhile, Beijing has been gradually advancing retaliatory measures against the tariffs on China-made EVs that the EU put in place in November, but it has not taken any action.

What you need to know:

- Traditional trade tensions are building: The Commission imposed tariffs on Chinese biodiesel, sweeteners, mobile access equipment or titanium, among others since November. Additional investigations have been opened against Chinese-made candle, chemicals, sweet corn, steel cylinder and carbonates. In January, the first-ever investigation under its new dedicated instrument on public procurement found systematic discriminations against European firms in the China’s medical sector. Member states must now decide restrictions on Chinese firms’ access to such European procurements. Finally, Brussels requested a new WTO consultation about Chinese courts setting unfairly low worldwide royalty rates for some European patents, mostly in the telecom industry.

- Digital regulations are kicking in: Chinese digital champions are getting in the crosshairs of European efforts to regulate the digital world. After an investigation into the Chinese online marketplace Temu in November, the EU opened a probe into online retailer Shein in February for breach of consumer protection under the Digital Services Act. In the meantime, the Commission has formally proposed increasing customs constraints and legal liabilities attached to the quality of products for e-commerce platforms. The Commission also opened a formal investigation into TikTok in December for the alleged interference of social media posts in the now-annulled Romanian presidential election. On the data management front, an Austrian NGO has filed a complaint regarding illegal data transfers to China by online retailers Shein, Temu, and AliExpress, social media outlets TikTok and WeChat, and tech company Xiaomi.

- So is de-risking: The EU conducted its first-ever auctions with formal conditions to diversify supply away from China in the electrolyzer and battery sectors in Q4 last year. Limited in scope and depth so far, the Commission proposed in January to standardize such diversification incentives in all the green industries supported by the EU Net Zero Industry Act of May 2024.

- More Beijing retaliation on the table: In January, China’s Ministry of Commerce concluded its investigation into the EU Foreign Subsidy Regulation, establishing it as an unfair "trade and investment barrier." Beijing can now take any "appropriate measures” to redress any harms. This new venue for retaliation comes on top of ongoing investigations into European brandy, pork and dairy products. In the meantime, Chinese firms impacted by the European tariffs have lodged a new legal challenge in the EU against its EV tariffs, alongside their European and US peers.

Quick take: The flagship October 2024 EU tariffs against EVs made in China was just another cog in the wheel of Sino-European trade tensions. Facing an uncertain US geopolitical agenda, Beijing and Brussels continue to build capacities so they can quickly take action if necessary, while delaying any meaningful cost, be it concessions or sanctions. The guns are on the table. Whether they are used for a trade war or for a trade negotiation is up to the two sides to decide. The ball is in Beijing’s court, as Europeans feel – largely legitimately so – they are simply enforcing WTO-abiding measures to preserve their domestic market from distortions and abuse.

Read more:

- European Commission: Discrimination in China's medical device procurement market

- Le Monde: EU launches probe into TikTok over 'interference' in Romania's presidential election

- European Commission: Commission launches calls for feedback on Net-Zero Industry Act secondary legislation - European Commission

- Rhodium: Why Isn’t Europe Diversifying from China?

- China Trade Monitor: Beijing Finds EU Subsidies Investigations To Be Trade Barrier

Europe China Diplomatic Tracker

- Beijing’s diplomatic readouts and speeches by Wang Yi and Ding Xuexiang at the MSC and Davos drew on the usual playbook, voicing support for economic globalization, “true multilateralism,” digital and green cooperation, and well-known stance on the Ukraine war. Beijing seems to be betting that the disruptive actions of the Trump administration will enhance its appeal as a more predictable partner. In line with this, Wang emphasized opposition to “a return of the law of the jungle” in international relations – also in exchanges with European counterparts and in his speech at the UN.

- The date of the EU-China summit, mentioned during the Xi-Costa call, remains uncertain as preparations continue without a confirmed timeline.

- China's outreach to the UK may a blueprint for re-engaging other European capitals through a flurry of dialogues that offer targeted benefits but avert a more assertive China policy. Caveat being that UK-China engagement may be at the higher end of what European capitals can expect, as the British and Chinese economies are more complementary than those of most continental European countries.

- In January, the UK-China Economic & Financial Dialogue featured agreements amounting to GBP 600 million over the next five years, including new agreements on vaccine approvals, fertilizer, whisky labelling, legal services, automotives, and accountancy. Practical implementation of some agreements should be treated with caution as per past similar Chinese announcements.

- During the high-level strategic dialogue, both sides agreed on follow ups through the China-UK Energy Dialogue, the UK-China Joint Committee on Science, Technology and Innovation Cooperation, consultations between education ministers, and preparations for institutional dialogues like the China-UK Joint Economic and Trade Commission, health and industrial cooperation. Notably, the UK Labour government is still conducting its China policy audit, aiming for more risk-conscious engagement – something Beijing may be eager to prevent through the re-opening of dialogues.

Short takes

The EU has imposed a first set of full-fledged sanctions on seven Chinese entities for helping the Russian war effort

In December, EU member states approved the 15th package of sanctions protesting the war on Ukraine that, for the first time, sanctioned six Chinese firms and one individual for supporting the Russia war effort. Their interactions with European entities have been prohibited, and any assets in the EU frozen. Previous sanction packages saw a dozen of Chinese entities added to a less stringent blacklist for helping circumvent sanctions, banning them from buying goods from the EU. As part of its 16th package, slated for approval on February 24, another Chinese entity is expected to be fully sanctioned and 25 others added to the blacklist.

- South China Morning Post: Chinese names added to EU sanctions list over Russia’s war in Ukraine

- South China Morning Post: EU to blacklist 25 more Chinese entities for flouting Russia sanctions

Kyiv calls for Beijing’s involvement in peace negotiations process

In a strong statement following Ukraine’s Foreign Minister Andrii Sybiha’s and Head of President Zelensky’s office Andriy Yermak’s meeting with Wang Yi on the sidelines of the Munich Security Conference, Kyiv officials stated that “China has a crucial role to play in achieving peace.”

- Office of the President of Ukraine: Andriy Yermak and Andrii Sybiha Met with Foreign Minister of the People's Republic of China Wang Yi

- X of Andriy Yermak: 15 February 2025

The EU asks member states to work on an outward investment screening as reform toward a more stringent regime on inward flows continues

On January 15, the Commission released its much-delayed recommendation to EU member states regarding a new oversight mechanism for outbound investments in critical technologies – namely, AI, quantum, and semiconductors. Countries must evaluate outbound investments made since 2021 and set up an “adequate control system” by July 2026. As for the inward investment regime, the European Parliament published its draft proposal for a review of the 2019 oversight mechanism on January 17, exactly a year after the Commission introduced its own contribution to the review process. Beyond its support for the EU to have greater say on member state decisions to accept investment, the idea would be to now make technology transfer or import dependency reduction a potential condition for a greenlight.

- European Commission: Recommendation on outbound investments

- European Parliament: Draft Report on foreign investment screening in the Union

AfD leader reportedly cultivated unofficial exchanges with Chinese Ambassador

According to Germany’s Bild tabloid, referring to internal sources within the AfD, the right-wing party’s leader Alice Weidel met with Wu Ken, former Ambassador to Germany, with monthly regularity in appointments kept outside her official calendar. Weidel’s office denies the frequency of the meetings but has not challenged the fact that they took place.