G20 + Real estate market + Zero-Covid

Top story

Xi signals willingness to reengage with the West, with limits

The G20 Summit in Bali was the setting for a momentous meeting between US President Joe Biden and Chinese President Xi Jinping – the first in person since Biden took office and just after the Chinese Communist Party’s 20th Congress at which Xi secured a norm-breaking third term as party head. The meeting delivered one positive outcome: reopening the lines of communication between the two countries. The hope is that renewed communication will stop deterioration of US-China relations and prevent an unintended escalation of tensions. But it won’t resolve any longstanding friction points.

This summit could set the tone for China’s foreign policy over the next few years. Confident in his renewed power and authority and without fear of looking weak, Xi is signaling some willingness to engage with the US and other powers in a more constructive fashion, albeit with clear limits. Noticeably, Xi did not meet with Indian PM Narendra Modi during the summit, likely due to an unwillingness to compromise on their border dispute. China’s relatively low-key participation in the simultaneous COP27 in Sharm el-Sheikh, with Special Envoy Xie Zhenhua leading the delegation and Xi skipping the conference, also indicates that geopolitical competition and China’s relations with the US will remain a top priority. As a result, there is a risk that cooperation on global issues like climate change could be sidelined.

Absent any real common ground, the meeting between Xi and Biden was largely a platform to deliver messages to the international community and a restatement of well-known positions. Likely a message for Russian President Vladimir Putin, the US government highlighted in its briefing that both presidents confirmed their opposition to the threat or use of nuclear weapons in Ukraine. But this point, which also arose during Xi’s recent meeting with German Chancellor Olaf Scholz, was not mentioned in the Chinese readout, a further indication that it was meant for an international audience and does not signify a shift in Beijing’s position. While it is notable that Xi mentioned this in the talks, rejecting the threat or use of nuclear weapons is part of China’s longstanding nuclear doctrine. The comment was likely seen by Beijing as a low-cost way to appear constructive in the international arena.

Media coverage and sources:

- Chinese MFA: (CN): China’s readout of Xi-Biden meeting

- White House: US readout of Xi-Biden meeting

- The Guardian: Xi-Scholz meeting and nuclear weapons comments

- SCMP: Xie Zhenhua at COP27

- Chinese MFA: 2005 arms control white paper

Metrix

150.000

This is the estimated daily shortfall in iPhone production at the world’s biggest Apple contract factory, run by Foxconn in Zhengzhou. Tight Covid-19 restrictions have analysts forecasting a 30 percent drop in iPhone output in the near term. In late October, Foxconn confined 300,000 workers to its Zhengzhou campus to contain a Covid outbreak, causing droves of panicked workers to flee for fear of food shortages and medical-care problems. Video clips showing workers hiking out of the city went viral on social media. As a result, Foxconn offered bonuses to encourage workers to return to work. (Sources: Reuters, Business Insider, CNN)

Topics

Beijing gives stressed real-estate sector some breathing space

The facts: China’s property sector has been on the brink of crisis for over a year following new rules about the debt developers can take on. The People's Bank of China and the China Banking and Insurance Regulatory Commission on November 14 issued a 16-point plan to address some of these problems. Key initiatives include:

- permitting banks to extend developers' maturing loans;

- encouraging real-estate sales by lowering mortgage rates and down-payments;

- promoting new funding avenues including bond issuance;

- guaranteeing the completion of properties that have been presold.

What to watch: Xi Jinping is committed to his pledge of not bailing out the property sector. He aims to rebuild confidence in the market by giving lenders and developers with liquidity issues the scope to overcome looming crises through new rounds of financing. In the short run, this will bring some stability to the property market by ensuring that companies remain solvent and repay their loans on time. But by not addressing the fundamental debt problem, it is effectively kicking the can down the road. As a result, regulators and party-state media could be prone to overstating any bounce back in the market in coming weeks to further spur investor. Shares in Chinese real-estate companies have soared on stock markets since the measures were announced.

MERICS analysis: “For now, there is no indication that Xi will back off of his principle that ‘housing is for living in, not for speculation’ – though recent plans do indicate a respite. However, the measures lack a meaningful strategy to resolve the property market’s core problems: overleveraged firms, supply outstripping demand, bad practices by developers, and so on” says Jacob Gunter, MERICS Senior Analyst. “Additionally, protecting homebuyers’ creditworthiness will have little effect on already underconfident consumers. They are holding back from property investment, not because of financing shortfalls, but because of the broader economic outlook under zero-Covid.”

Media coverage and sources:

- Business Times: China issues 16-point plan to rescue ailing property sector, Global Enterprise

- People's Bank of China (CN): Notice on doing a good job to financially support the stable and healthy development of the real estate market

- Reuters: Factbox: Key regulatory measures to stabilise China's embattled property sector

- FT: China extends bank deadline for capping property sector loans

China relaxes zero Covid – investors applaud, but citizens are torn

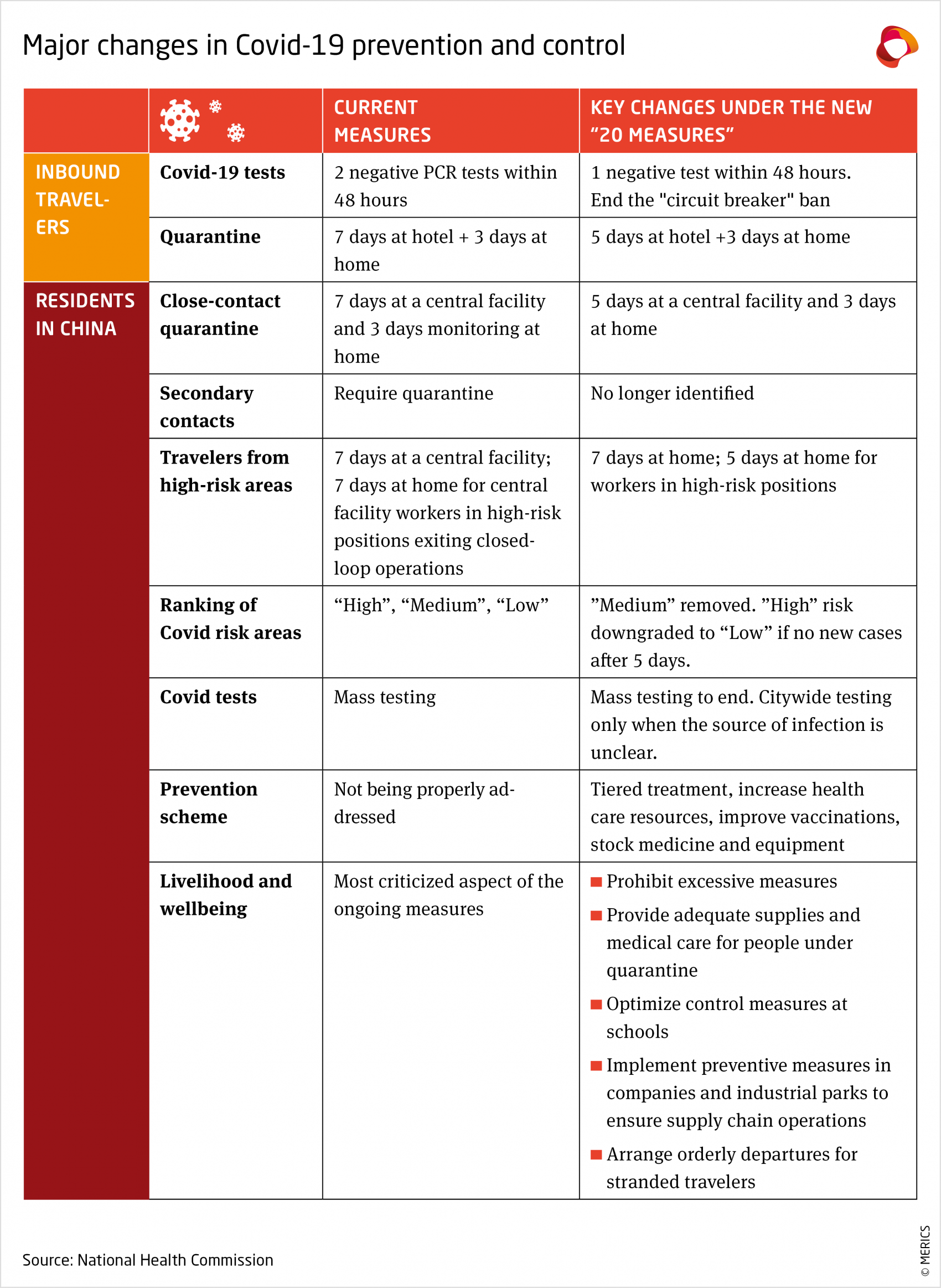

The facts: China’s National Health Commission (NHC) on November 11 issued 20 changes to its Covid-19 prevention and control rules (see table). It shortened quarantine times, restricted the need to quarantine the contacts of contacts of potentially infected people, and laid out preventive steps to strengthen vaccination rates and healthcare. This reflects the recognition that the burden on the economy and personal incomes was not sustainable – from Monday onto Tuesday, residents in the southern city of Guangzhou clashed with police over being locked down and unable to work.

Several cities swiftly abolished broad Covid testing, with Shijiazhuang, capital of Hebei province, forging ahead. Its municipal government published a letter to residents, urging them to take responsibility for their own health and announcing that negative Covid test results would no longer be required to use public transport and access most public places.

What to watch: The loosening was welcomed by financial markets and could focus China’s resources on a more targeted response. But it also comes as infections are rising again and citizens remain insufficiently protected through up-to-date vaccinations. After three years of authorities enforcing strict controls, emphasizing the deadliness of the virus and pointing out Western policy failures, the Chinese public is torn. The new measures were a hot topic on social media, with some people cheering the relaxation, others expressing confusion and shock.

MERICS analysis: “Abroad, China’s zero-Covid policy is often seen as driven by ideology – and relaxation touted as a return to pragmatism. But considerable risks for the country and its leadership remain,” says Katja Drinhausen, Head of Politics and Society, MERICS. “Beijing now needs to contain outbreaks and focus sufficient resources on vaccination campaigns to prevent major loss of life. To avoid the erosion of trust at a critical time, authorities need to reassure citizens and communicate practical steps.”

More on the topic: China bows to reality by relaxing Covid restrictions – but ushers in new risks. Short analysis by Vincent Brussee and Katja Drinhausen

Media coverage and sources:

- Yicai: “20条”出台后,多地取消区域全员核酸检测 (A summary of the changes in policy in different cities following the introduction of the 20 new measures)

- Reuters: New China COVID rules spur concern as some cities halt routine tests

- What's on Weibo: All Eyes on Shijiazhuang: Capital City of Hebei Among First To See a Shift in Covid Measures

- Bloomberg: These Are China’s 20 New Guidelines for Easing Covid Zero

Allies in Europe and East Asia lukewarm about US chip restrictions on China

The facts: US hopes that allies in Europe and Japan will back curbs on exports of chipmaking equipment and technology to China look premature. US officials are scheduled to visit the Netherlands this month for another round of talks about the restrictions announced October 7, but the chances for an agreement do not appear high. Recent reports about exchanges between Washington, Tokyo and The Hague suggest Dutch and Japanese officials are frustrated with US President Joe Biden’s expectation that their governments fall in line with his unilateral move against China. Economic impact is also a concern for the Netherlands, home to global lithography leader ASML, and Japan, home to Tokyo Electron and Nikon.

What to watch: Unless allies and partners adopt corresponding measures, US export restrictions will become less effective in the long run and likely hurt US companies. As the extra-territorial provisions of the October controls do not cover chip-making equipment, there is little that the US can do if the Netherlands and Japan continue to hold out. All three countries want to block exports that enable Chinese military advances. But the Netherlands and Japan are less keen to slow down innovation across the board in China. According to the Financial Times, both capitals had agreed to stop the export of tools capable of producing relatively advanced chips but baulked when the US pushed to include equipment for less advanced integrated circuits.

MERICS analysis: “It is unclear whether US allies and partners are on board with Biden’s containment strategy in technology competition with China,” said Rebecca Arcesati, Analyst, MERICS. “It’s fast-growing semiconductor market gives China leverage. There is little incentive for European and East Asian countries to pursue broad-based decoupling – and little incentive for Beijing to directly retaliate against firms headquartered there as a next move in its tech war with the US.”

Medienberichte und Quellen:

- Financial Times: US tries to enlist allies in assault on China’s chip industry

- Bloomberg: Biden’s Chip Curbs Outdo Trump in Forcing World to Align on China

- Center for Security and Emerging Technology (CNAS): A Conversation with Undersecretary of Commerce Alan F. Estevez

- MERICS: Industry, allies and partners face tough choices as US-China tech war escalates

Review

The Cashless Revolution: China's Reinvention of Money and the End of America's Domination of Finance and Technology, by Martin Chorzempa (PublicAffairs, 2022)

China has reinvented money. So few citizens nowadays carry cash that even street beggars have printed-out QR codes to enable money to be wired to them. In The Cashless Revolution, Martin Chorzempa provides a ground-breaking, nuanced chronicle of how China became a world-leader in technology to enable banking and financial services, so-called fintech. It shows how a decades-long state monopoly on finance led consumers and businesses starved of convenient finance to seek new ways.

Ambitious tech entrepreneurs like Alibaba’s Jack Ma and Tencent’s Pony Ma seized the opportunity, making use of the government’s wait-and-see approach in the 2000s and early 2010s to build multiple-service apps brimming with innovative fintech. In the process, they overcame competition with foreign enterprises like privately-owned eBay from the USA and Chinese state-owned financial-services monopolies like UnionPay.

Chorzempa shows how these developments caused new forms of financial risk, created monopolies and so-called super-apps that inspired US entrepreneurs like Meta’s Mark Zuckerberg, exploited tech workers – but also led to an economic boom and more inclusive finance. He provides one of the most thorough accounts of China’s “tech rectification,” Beijing’s campaign to make big tech work for the country. These are crucial themes as governments worldwide struggle to regulate tech and fintech.

The book’s subtitle, “The End of America's Domination of Finance and Technology” hints at a tired narrative of China-US competition. But Chorzempa avoids easy explanations, instead describing how coincidences and path dependencies shaped Chinese fintech – and why they did not take place in the US. He does see security and economic threats as China’s fintech internationalizes, but also warns against alarmism.

The book’s one weakness is its forced discussion of the Social Credit System. Chorzempa is aware of the myths surrounding it, but he nevertheless cuts a few corners to incorporate a discussion that adds little to his grander narrative. Nevertheless, The Cashless Revolution is a masterpiece and should be read by anyone with an interest in fintech and the platform economy. Its insights and implications reach far beyond China.

Reviewed by Vincent Brussee, MERICS Analyst

MERICS China Digest

Draft of German China Strategy leaked to Spiegel magazine (Reuters)

The 59-page draft strategy document, which Spiegel said the Foreign Ministry had distributed to the other ministries for approval a few days ago, refers to "massive human rights violations" in the Xinjiang region and in Tibet, among others. (2022/11/17)

ASEAN talks lay bare deep divisions on South China Sea, Ukraine (Nikkei Asia)

This year’s annual summit of the 10-member Association of Southeast Asian Nations highlighted deep divisions among members on critical security issues, ranging from the crisis in Myanmar to the Ukraine war and tensions in the South China Sea. (2022/11/13)

China Starts COP27 With Call for Climate Aid to Poorer Nations (Bloomberg)

China’s top envoy for climate change, Xie Zhenhua, called for more aid to developing nations at the COP27 conference that is currently taking place in Egypt. (2022/11/06)

Semiconductor Market: Germany Blocks Elmos Chip Facility Sale to China Investor (Bloomberg)

Germany blocked the sale of chip makers Elmos and ERS Electronic to Chinese investors. The move is a sign of growing concerns over national security and strategically important technologies. (2022/11/09)

Binance founder Changpeng 'CZ' Zhao wants to 'rebuild' crypto post FTX collapse (CNN Business)

Canadian billionaire, founder and CEO of Binance, Changpeng Zhao, has made headlines this week for announcing the establishment of “an industry recovery fund” to mitigate any further damage from the collapse of the crypto firm FTX. (2022/11/15)

FBI director says TikTok poses national security concerns (Reuters)

FBI Director Chris Wray said that the Chinese-owned video-sharing app TikTok raises national security concerns, flagging the risk that Beijing could harness TikTok to influence users or control their devices. (2022/11/15)

Chinese authorities are planning to simplify employment registration and create more jobs in support of the additional 820,000 university graduates expected in 2023. (2022/11/16)

WeChat Users are Handwriting Apologies to Get their Banned Accounts Back (Rest of the World)

As was the case in October, when users shared images of a protest against Xi, WeChat increasingly shuts users out for their ‘transgressions’. WeChat accounts are so vitally essential to Chinese people’s social and professional lives that users are willing to go to great lengths retrieving them. (2022/11/08)

Big Four Auditors Shut Down Legal Operations in China (Law Society)

According to an investigation by Law.com International, the big four auditing giants PwC, Deloitte, KPMG and EY have shut down their legal affiliations in China after being raided by local regulators. (2022/11/16)