MERICS China Essentials Special Issue: The US-China trade war

Top story

US-China trade breakdown may herald leap into decoupling abyss, with global fallout

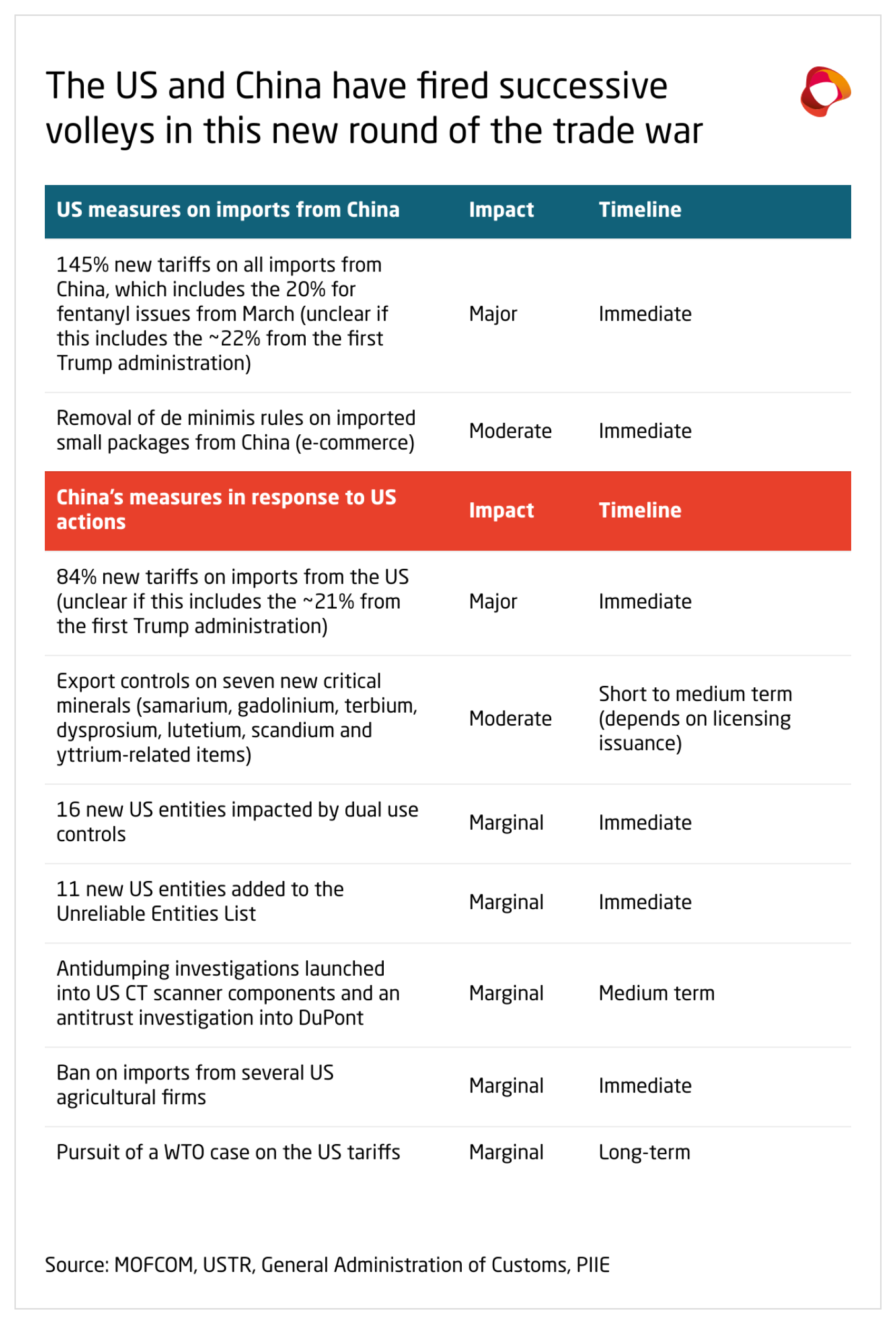

US-China trade looks set to collapse after the last week’s rapid tariff escalation, leaving the world on the brink of an abyss in which US-China decoupling could proceed quickly and at scale. Even if both sides say they might come to the table, the current economic, technological, security, and geopolitical fundamentals between the US and China would make any negotiated solution highly precarious.

Bilaterally, China faces a functionally lost export market as a result of the 145% new tariffs, possibly in addition to another roughly 22% from the first Trump Administration, which will weigh heavily as the country struggles with its own downturn.

Only days before, China could at least find common cause with other countries also saddled with US tariffs. However, now that all but the 10% baseline tariff have been frozen for others, there will be less pressure for third markets to look to Beijing as an alternative to the US. The unpredictability of the US tariffs will still drive some engagement, but for partners looking for a major export market, the promise of the US, which accounts for around 30% of global final consumption, simply cannot be matched by China with only around 12%.

Instead, China’s need to find replacement markets for its lost export opportunities with the US will drastically magnify the problem already facing many markets – that China’s overcapacity issues are distorting prices in unsustainable ways. Many of China’s trade partners have already started raising barriers to its surging exports in recent years, and they are likely to respond to any new increase in exports, including those originally intended for the US.

Beijing will certainly seek engagement with as many other countries as possible. The party-state will also likely deepen its ongoing efforts for self-reliance and economic resilience. Economically, the leadership likely fears worst-case scenarios of coalitions leaving China increasingly isolated. At the same time, they likely feel vindicated in their choice to prioritize radical self-reliance in recent years. Beijing almost certainly wants to avoid decoupling with the US at this stage, especially on US terms, but this is also exactly what the party-state has planned for.

All eyes are on China to see if there will be another round of tit-for-tat measures now. While full-on capitulation is unlikely, President Xi Jinping and others are probably keen to find a negotiated solution, but only from a position of strength – and the current geopolitical and economic situation will weigh on any deal. Beijing still has a variety of levers to increase the pain on the US: it could target trade in services, where the US has a surplus that has been mostly unscathed so far; Beijing could also turn to the export controls it has expanded in recent years and block exports to the US and others; and it could turn the screws on US investors in China, though perhaps not too much since those companies provide much-needed growth, jobs, tax revenue, etc. for China.

Jacob Gunter, Lead Analyst, MERICS: "Both sides have rhetorically left the door open for negotiations, but the sustainability of any real dealmaking is questionable – the fundamentals of the economic, technological, security, and geopolitical relationships between the US and China are increasingly irreconcilable. We are not yet at the level of full decoupling, and in the coming weeks there will be pressure to make exceptions for critical technology imports on both sides. However, those supply chains are also the ones most exposed to export controls by the other side, and the possible slip into another round of escalation could send the world hurdling into an abyss of comprehensive decoupling and patchwork globalization.”

Media coverage and sources:

- AP: Trump hits back with a 125% tariff in escalating trade war with China

- Ministry of Finance: Announcement of the State Council Tariff Commission on Adjusting the Tariff Measures on Imports from the United States

- Nikkei: China's 84% tariffs on U.S. take effect as superpower clash intensifies

- Reuters: EU's von der Leyen urges China to ensure responsible tariff response

METRIX

76

This is the number of Chinese military aircraft detected near Taiwan on the first day of the People Liberation Army’s two-day “Strait Thunder – 2025A" exercise in early April – the largest show of force since October. Some 37 of the aircraft crossed the median line of the Taiwan Strait into the island's self-declared Air Defense Identification Zone. Long-range bombers were reportedly equipped with the new KD-21 ballistic missile, a weapon that for the first time gives China the ability to strike US bases and naval assets from Japan to South Korea. (Source: Ministry of National Defense, Taiwan)

Topics

Beijing projects stability to its citizens and stresses need for self-reliance

Beijing was adamant it would not bow to aggressive new US tariffs, projecting an image of strength and stability domestically and stressing the need for China’s economic and technological self-reliance. The ministries of commerce and foreign affairs vowed to “fight to the end if the US insists on its path,” but also said China would consider coming to the table if negotiations were “on equal footing” and “on the basis of mutual respect.” The quick and firm response shows Beijing is better prepared than during Donald Trump’s first term as US president.

Two articles published in the People’s Daily on Monday underlined the Chinese Communist Party’s determination to stick to its long-term development path and reassured the public that “the sky will not fall” despite the economic challenges. They said China would “turn pressure into motivation” and “focus on its own affairs.” The party also emphasized its readiness to cushion the impact of the trade war, including measures to boost domestic consumption, stabilize market confidence and support businesses.

As events unfold, China is attempting a rhetorical balancing act: demonstrating toughness and signaling a willingness to talk. In a white paper published on Wednesday with its position on economic and trade relations with the US, Beijing also emphasized the importance of the relations for both sides and called for dialogue.

Christina Sadeler, Senior Analyst at MERICS: "Beijing is carefully orchestrating the message of a stable and confident China, ready to face external pressure while reaffirming its own long-term development strategy for the country. The CCP is doubling down on its narrative that the leadership has full control over the situation even in highly volatile times.”

Media coverage and sources:

- People’s Daily (CN): Focus on doing our own things集中精力办好自己的事

- People’s Daily (CN): Unswervingly promote high-level opening up坚定不移推进高水平对外开放

- Xinhua: China will resolutely take countermeasures if U.S. escalates tariff measures: commerce ministry

- State Council Information Office: China's position on some issues concerning China-US economic and trade relations

- Ministry of Commerce (CN): Regular press conference 10 April 2025

Beijing struggles to find allies in the escalating tariff row with US

Donald Trump’s pause on reciprocal tariffs for 90 days, with the exception of China, further isolates Beijing and threatens to undermine its efforts to seek trade allies elsewhere. In a phone call this week, Chinese Premier Li Qiang told EU Commission President Ursula von der Leyen that Beijing was looking to “strengthen cooperation with countries around the world” to counter US “abuse of tariffs against all trading partners.” But the EU does not appear set to join forces with China right now.

Beijing hopes that dismay about Trump’s attacks on the global trading system will drive countries to seek closer ties to China. Xi Jinping chaired a key conference emphasizing relations with its neighbors on April 9, strengthening ties, for example, in Southeast Asia. The read out of the conference states that China aimed to further “build strategic trust, enhance cooperation, and deepen the integration of regional supply chains."

But so far, no country is openly siding with China in defiance of the US. Instead of imposing retaliatory tariffs like China, Asian countries such as Vietnam, Cambodia and India quickly showed their willingness to placate the US, and Japan and South Korea sent officials for talks.

After Trump’s reversal Wednesday, the EU also paused tariffs it had planned in retaliation for US levies on steel and aluminum. It also proposed a transatlantic free trade agreement, although the idea may get little traction in Trump’s Washington. In her conversation with Li, von der Leyen suggested "a mechanism to track possible trade diversion," a sign the EU worries China will flood other markets with goods that have been priced out of the US.

Claus Soong, MERICS Analyst: "Despite its strong rhetoric, Beijing appears to have only limited leverage in persuading other countries to join it in countering the US efforts to reshape the global trading system. China is willing to challenge the US, its largest export market, but other countries are more reluctant, denying any coalition against Washington the support it would need.”

Media coverage and sources:

- Wall Street Journal: China wanted to negotiate with Trump. Now it’s arming for another trade war

- United Daily: Chinese Expert: China’s countermeasures against US tariffs are a last resort — with no room left to retreat, it has no choice but to go all in. (聯合報: 陸專家:大陸反制美國對等關稅 是因退無可退、只能放手一搏)

- Reuters: Southeast Asian nations, among hardest-hit by Trump tariffs, seek talks

- Xinhua: The Central Conference on Work Relating to Foreign Affairs with Neighboring Countries was held in Beijing. . (新华社:中央周边工作会议在北京举行)

- Xinhua: Li Qiang had a phone conversation with European Commission President Ursula von der Leyen. (新华社:李强同欧盟委员会主席冯德莱恩通电话)

- EU Commission: Read-out of the phone call between President von der Leyen and Chinese Premier Li Qiang

Trump’s fear of upsetting US TikTok users gives Beijing leverage in trade war

Donald Trump’s reluctance to ban TikTok in the US could give China some high-profile leverage in the trade war with Washington. Trump said Beijing had pulled its support for a nearly finalized sale of TikTok’s US assets after he imposed new “reciprocal tariffs” on China, prompting him to grant TikTok US another 75 days to sever ties with its Chinese parent company, Bytedance, or face a ban. China has expanded its retaliatory toolkit for trade disputes in recent years, and only this week flanked a traditional tit-for-tat tariff hike with more politically targeted export controls, sanctions and anti-trust probes.

Trump’s eagerness to avoid shutting down TikTok US reflects the popularity of the social-media platform. It has 170 million active monthly users, many of them young adults with whom Trump has sought to connect. According to a survey conducted by the Pew Research Center in February and March, only 34% of US adults currently favor a ban, down from 50% in March 2023.

Citing national security concerns about the Chinese government’s potential access to US user data, the first Trump administration tried to force a sale in 2020. This led China to add recommendation algorithms – like the one that powers TikTok – to its export control list, meaning that Bytedance cannot sell the company without Chinese government approval.

Antonia Hmaidi, Senior Analyst at MERICS: "The new delay in complying with a US law enacted by congress to sell or ban TikTok increases China's leverage in the US-China trade war. The risk of negative public sentiment and of upsetting TikTok’s 170 million US users are possibly weighing on Trump’s decision."

Media coverage and sources:

- Bloomberg: TikTok Deal Stalled by China’s Objections to Tariffs, Trump Says

- Reuters: TikTok deal put on hold after China objects over tariffs, sources say

- SCMP: Trump says China could get tariff relief if it approves TikTok deal

- Pew Research Center: Support for TikTok ban in 2025 is down from 2 years ago

MERICS China Digest

Spain’s PM heads east to build bridges in China, Vietnam amid US tariff fallout (The Strait Times)

Spain's Prime Minister Pedro Sanchez started his trip in Vietnam on Wednesday, before travelling on to Beijing on Friday for a day's visit. The trip to China is Sanchez's third in as many years as he seeks to position Spain as an interlocutor between China and the 27-member European Union. (25/04/09)

Chinese nationals captured fighting for Russia in Ukraine, Zelenskiy says (Reuters)

President Volodymyr Zelenskiy said that Ukrainian forces had captured two Chinese men fighting for Russia in eastern Ukraine and that Kyiv had "information suggesting that there are many more Chinese citizens" fighting. China's Foreign Ministry objected to Zelenskiy's remarks that more Chinese citizens were at the frontline alongside Russians, calling them "groundless". (25/04/09)