Beyond overcapacity: Chinese-style modernization and the clash of economic models

Key findings

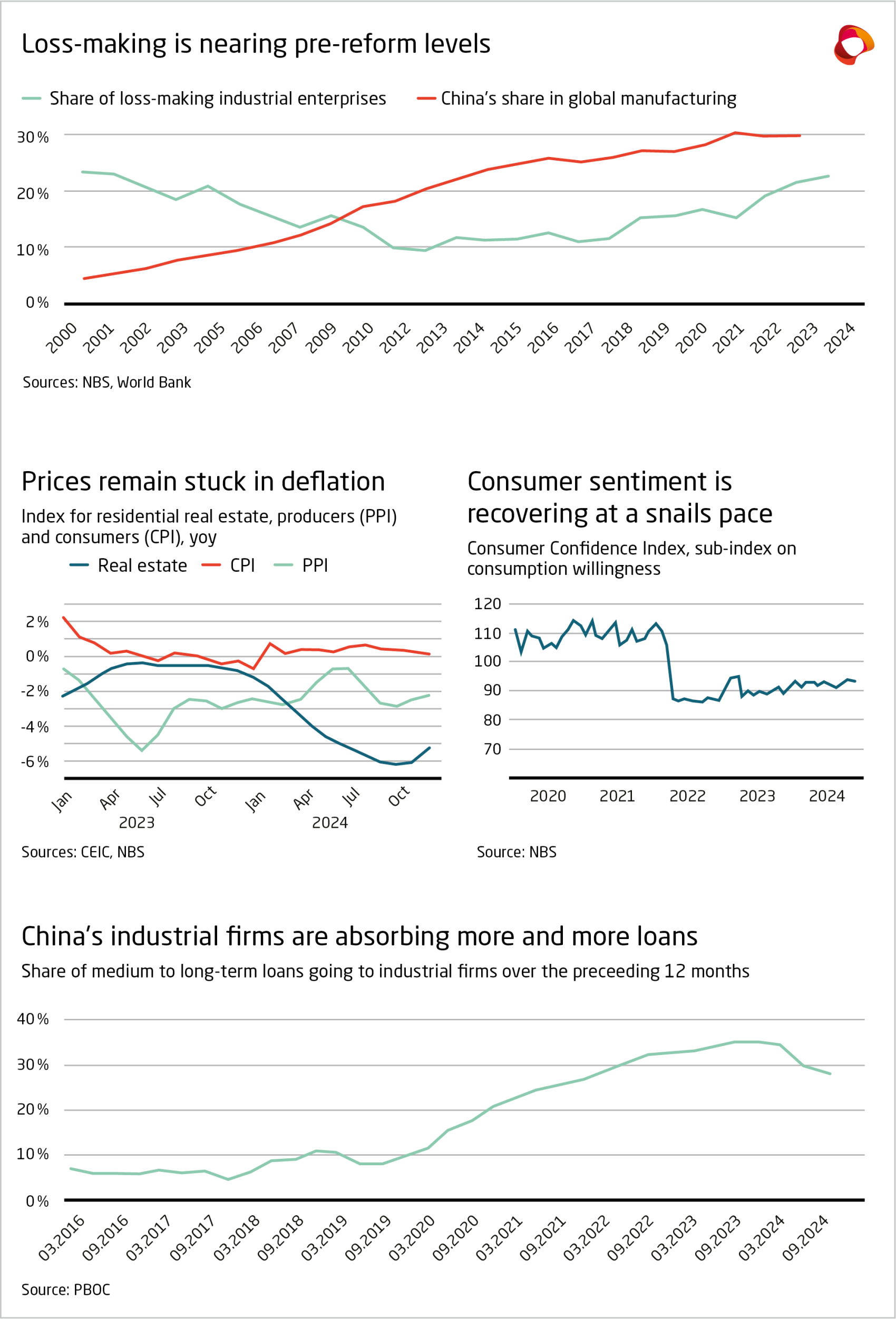

- President Xi Jinping has remolded China’s economic model in ways which establish the conditions for overinvestment, overcapacity, and overproduction.

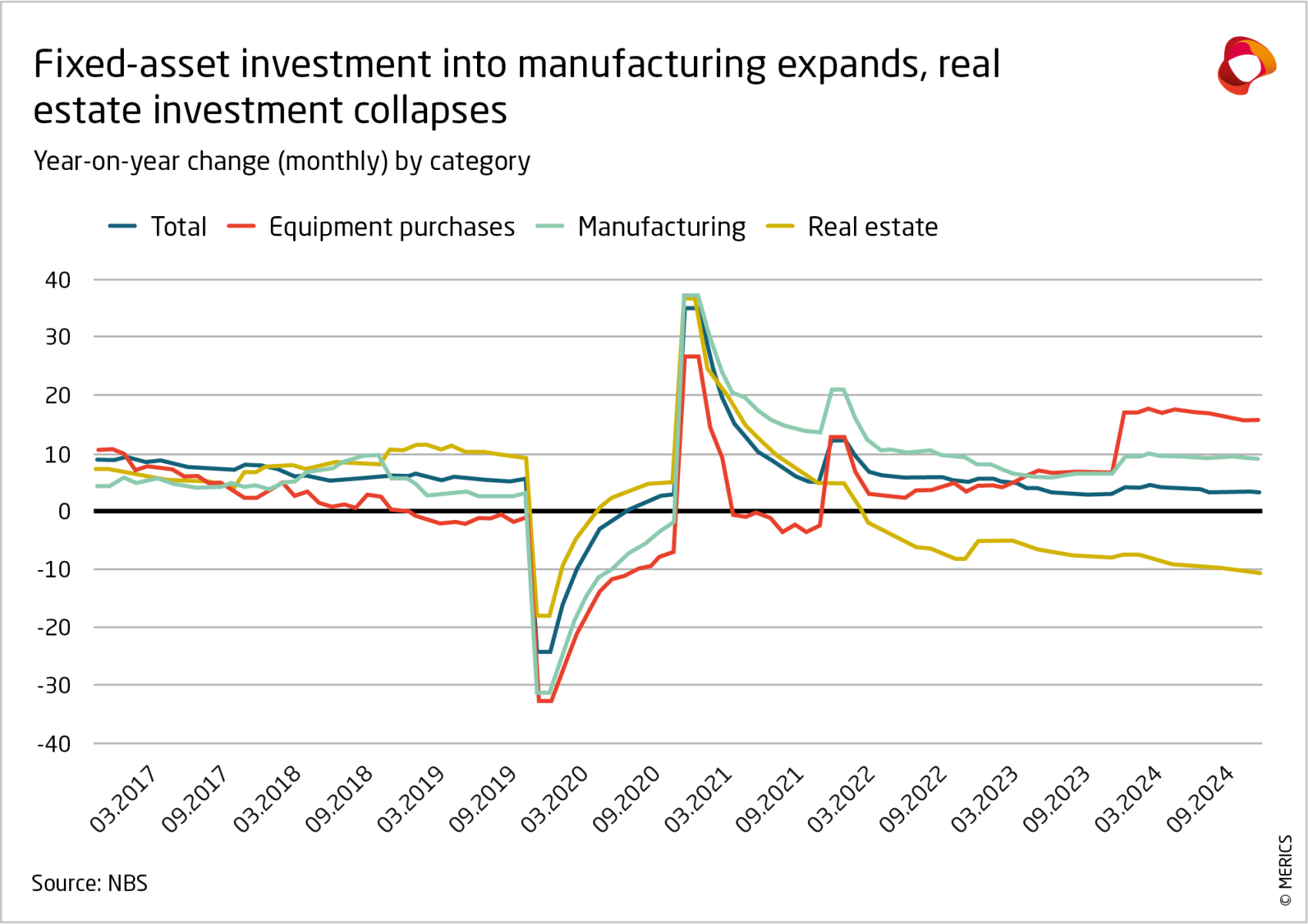

- China’s economic actors continue to invest heavily into more production with investment in manufacturing showing steady double digit growth year-over-year despite weak consumption growth. The resulting spillover via exports threatens global markets and healthy profitability.

- Global prices and healthy profitability are at risk from the level of state support, subsidies, cheap financing, and the industrial policy toolkit at Beijing’s disposal.

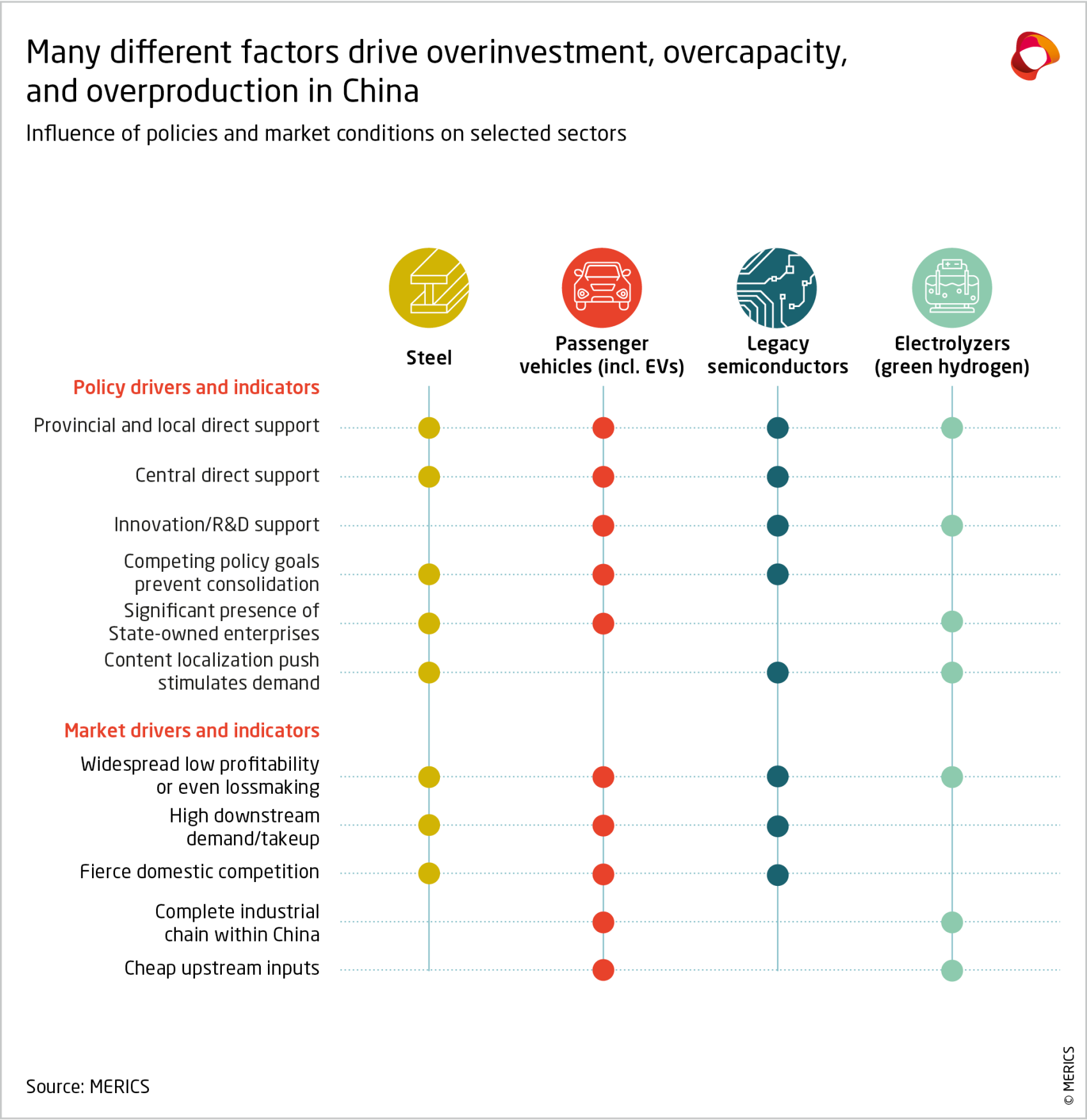

- Overcapacity risks in China are already apparent in traditional industries like steel and passenger vehicles and increasingly for high-tech technologies like legacy chips and electrolyzers for green hydrogen production (all of which are covered in case studies below).

- The most common policy drivers and indicators of overcapacities are: Provincial and local support (subsidies, cheap loans, etc.), central direct support (subsidies, cheap loans, etc.), innovation/R&D support, intervention is preventing consolidation, and a significant presence of SOEs.

- The most common market drivers and indicators are: High downstream demand/take-up, fierce domestic competition, widespread low profitability or even lossmaking, and falling prices.

- Based on the above drivers and indicators, the sectors most likely to see overcapacities emerge:

- In the short term: Legacy semiconductors, low to mid-range industrial machinery and components, IT equipment, low to mid-range medical devices, and pharmaceuticals.

- In the medium to long term: Electrolyzers, advanced medical devices, advanced industrial machinery and components, and new materials.

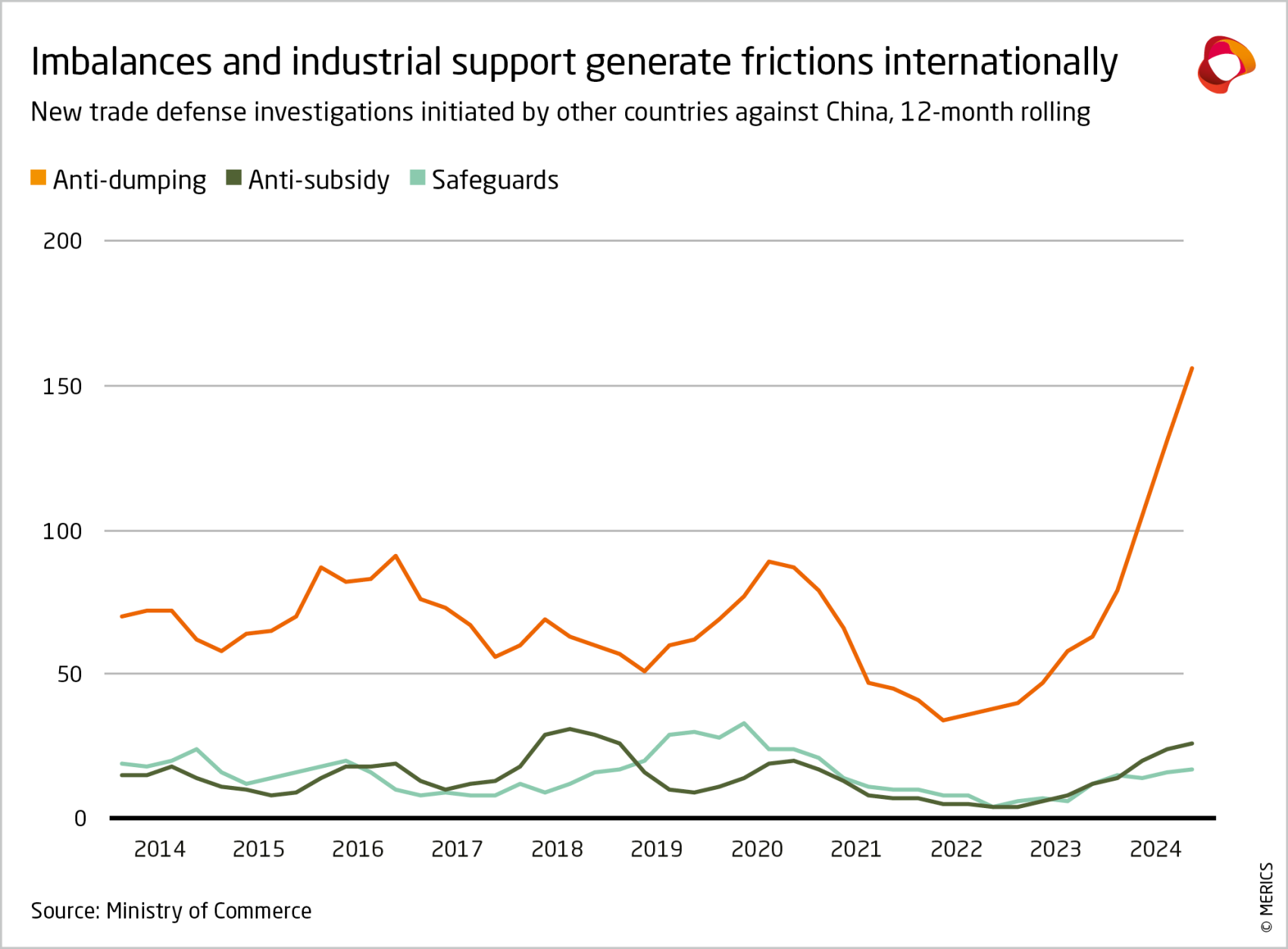

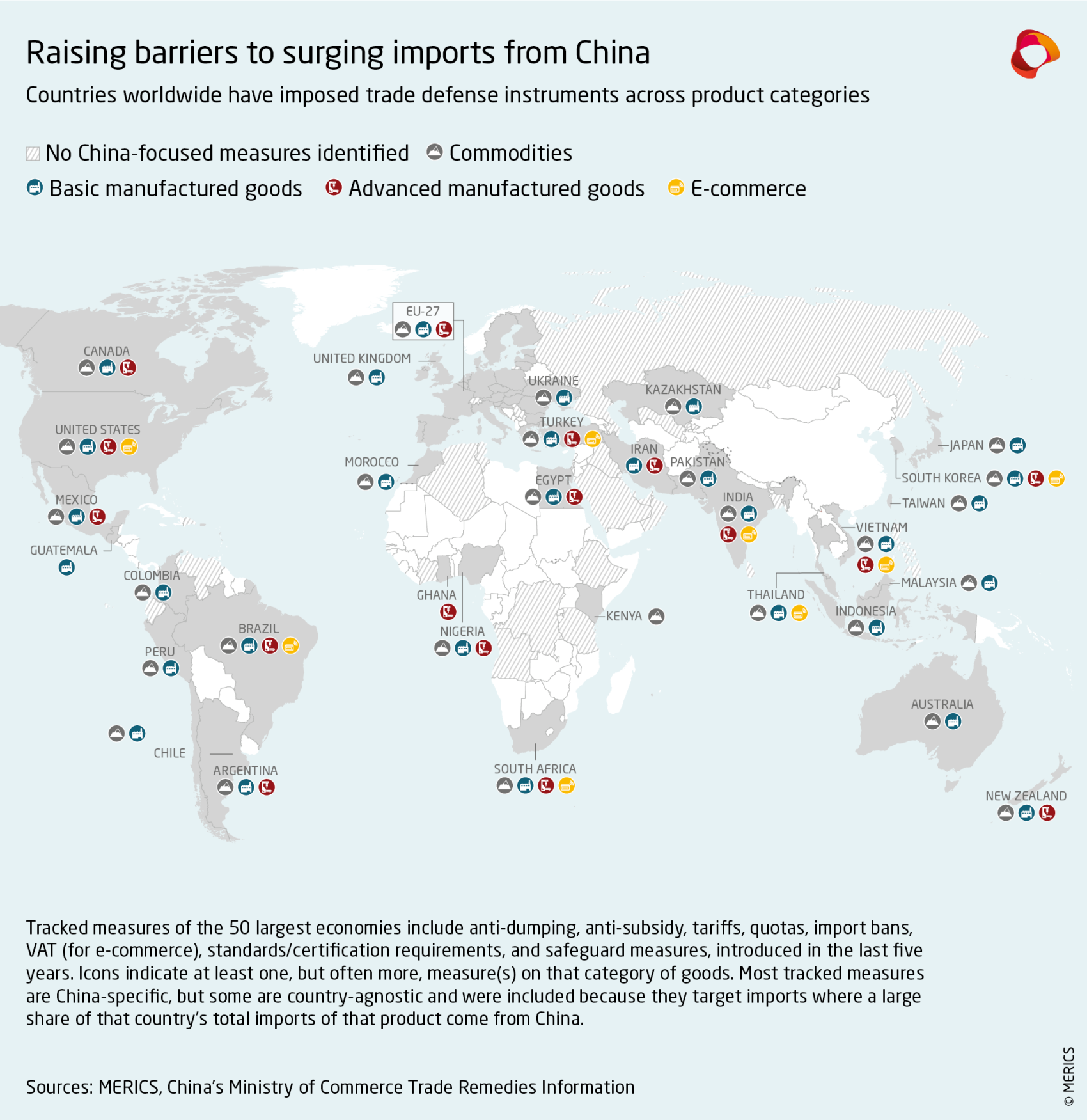

- In Europe, there is growing concern that China exporting its overcapacities could potentially undermine Europe’s industrial base, potentially creating a European China shock analogous to the one the US faced in previous decades.

- The best way for the EU to develop measures to deal with the challenges created by Chinese overcapacities would be to coordinate with partners, but autonomous action is warranted first, with coordination with friends following suit.

- The larger the coalition, the bigger the scale of the collective undistorted market for companies to operate in, the smaller the chances of economies of scale for advantaged Chinese firms in third markets, and the higher the collective political cover against Beijing’s retaliation.

- Finally, Europe should not plan on Beijing fighting China’s overcapacity, even for its own reasons. The phenomenon is a feature, not a bug, of Xi’s new economic policymaking and ideology as the party state prioritizes self-reliance and economic security at all costs, even at the erosion of profitability, return on investment, and efficiency.

The systemic nature of China’s overcapacity problem

In the past, overcapacity issues in China arose mainly around State-owned Enterprises (SOEs) as they enjoy extensive state support. In the mid-2010s, this generated massive overinvestment in SOE-dominated sectors like steel, aluminum, cement and glass.1 Beijing decreased the number of players in those markets but did little to write off excess production capacity.2

Overcapacity in these traditional commodities was a concern in Europe, but only a small number of jobs were at risk in high-pollution industries. The cost benefit of cheap commodities kept prices in Europe low, making many European products more cost-competitive. The current wave of overcapacity is different:

- It is no longer only an SOE phenomenon but involves a mix of state-owned and private firms alike.

- It is emerging in high-tech industries like electric vehicles, batteries, semiconductors, and green energy.

- After China’s tech rectification campaigns and real estate crackdown, household investors have fewer good investment options, so they tend to invest where Beijing sends positive signals, most commonly in manufacturing.3

Overcapacity in China - definition and observations: Overcapacity is commonly defined as a company, country or market having higher production capacity than can be utilized profitably, leaving some of that capacity unused. This is mainly driven by overinvestment and subsequent overproduction, and/or underconsumption. In a functioning market economy, this is a normal part of the business cycle as excessive supply drives down prices and only the strongest survive as weaker companies close shop. This normal pattern can be disrupted by extensive market interventions, as is the case with China. According to the European Union Chamber of Commerce in China Business Confidence Survey 2024, conducted among 529 companies in China, 36 percent of respondents already see overcapacity, and 10 percent see it on the horizon. Within sectors, 51 percent see overcapacities looming for chemicals, 55 percent for industrial machinery, 56 percent for pharmaceuticals, and 62 percent for automotive.

Imbalanced industrial policy: Beijing prioritizes production, investment and tech

Beijing generally prioritizes "supply-side" measures (which support the production/investment side of the economy) rather than "demand side" measures (which boost household incomes and consumption). This model’s imbalances are driving a surge of production that cannot be met by demand. Furthermore, Beijing’s industrial policy is focused on economic upgrading and catching up in key technologies at any cost. The outcome is that Beijing’s economic model has diverged even further from liberal market economies.

China is in a league of its own when it comes to excess saving, which also drives investment. China’s savings rate (34 percent) is significantly higher than in middle or high-income countries (24 percent). Since the pandemic, growing economic insecurity has only worsened the problem. High saving rates mean more capital sitting in banks, which need to find returns by financing something – in this case, the “real economy” investments that President Xi Jinping calls for.

Large campaigns promoting self-reliance and supply-side reforms are common under President Xi and have driven capital into industrial production, often regardless of the return on investment. Several prominent economic policy slogans suggest the unbalanced allocation of resources to the supply-side will grow.

- "New Quality Productive Forces’ (新质生产力): – With this term, the CCP calls for “revolutionary breakthroughs” in technology, allocation of factors of production, and industrial transformation.4 In material terms, this is largely more of the same - investing even more heavily on the supply-side, in innovation and R&D, higher productivity and more advanced industry.

- “Developing new quality productive forces does not mean abandoning traditional industries” (发展新质生产力不是要忽视、放弃传统产业”): President Xi has explicitly signaled that these new forces will empower traditional industries and ensure their competitiveness, though there will be a period of transformation.

- “First establish, then dismantle” (先立后破): initially used by President Xi to explain China’s decarbonization strategy, the term is now applied to general industrial policy making by state-planners. It can cause delays as new production is built up first, before the consolidation and shuttering of old production.5

These concepts are frequently invoked, and were central to a major cover story in People’s Daily in early 2024.6 It highlighted the rise of China’s advanced manufacturing, as well as cases like Shaoxing, a small city in Zhejiang province whose textile dyeing and printing industry has 30 percent of the national market. Under these slogans, officials invested heavily, moved all producers to one industrial zone, then consolidated firms. This year, the city expects to have 40 percent national market share. Shaoxing is touted as a model to emulate, proof that consolidation need not bring a decrease in output. Instead, it could generate an increase, even in low-end manufacturing that would normally migrate overseas as a country develops. Hence, these industries can and should remain in China.

Further investment in already overinvested industrial sectors will eventually produce overcapacities and overproduction, and generate yet more Chinese exports to other markets. Import substitution is another likely factor contributing to growing trade imbalances with other countries – investments are being made to produce inputs and finished goods that would ordinarily be imported.

The result is significant exacerbation of China’s wildly unbalanced trade. For the EU, it means that, as the United States and other markets are raising more barriers to imports from China, European markets are likely to bear the brunt of China exporting more and importing less.

The clash between economic models is on

Beijing has pushed back against accusations of overcapacity in a variety of ways. It has said, for example, that exports are “just the manifestation of competitive advantages” or that those equating “supply-demand relationship fluctuations with 'overcapacity'” are fundamentally misunderstanding market mechanisms. Nevertheless, comments from top-ranking officials have clearly articulated the issue. In March 2024, Premier Li Qiang raised concerns about it in his Government Work Report. More recently, Zheng Zhajie, the director of the National Development and Reform Commission (NDRC), noted a core feature of the trend at a press conference, saying: “There are firms that are producing more but not increasing revenue or profit.”8

One of Beijing’s blunter responses to accusations of overcapacity is that the western liberal market economic model simply cannot compete with Chinese-style modernization – most explicitly stated in a Xi Jinping speech published at the end of 2024 which doubled down on the current model and direction of policy.9 There is some truth in this. Companies that emerged from the PRC-style state-capitalist system enjoy benefits not available to those that emerged in the OECD-style market system, and so cannot compete equally. China’s firms, especially SOEs, enjoy old and new forms of support from industrial policy. Many were able to grow in a protected home market before facing off against foreign competition.10

The messaging from Beijing is partly true. China’s system has deviated so far from market-economy norms that significant features of its model have reached a point of incompatibility with those in Europe, North America, the Pacific Rim, and elsewhere. At this stage, the idea of merely trying to tackle an overcapacity issue coming out of China fails to meet the challenge. Instead, the problem should be tackled as a systemic competition between economic models which, while still compatible in many areas, are throwing up new points of friction. These frictions are increasingly difficult to reconcile using the existing toolkit available to European policymakers and corporate leaders.

Although the broad trends already discussed have emerged across a range of industries, it is also important to zoom in on specific sectors to understand the nuances of how overcapacity and overproduction materialize (or not) in different cases. The following case studies will analyze four sectors: steel, passenger vehicles, semiconductors and electrolyzers.

Case study: Steel – a traditional sector rife with overcapacity

Key takeaways

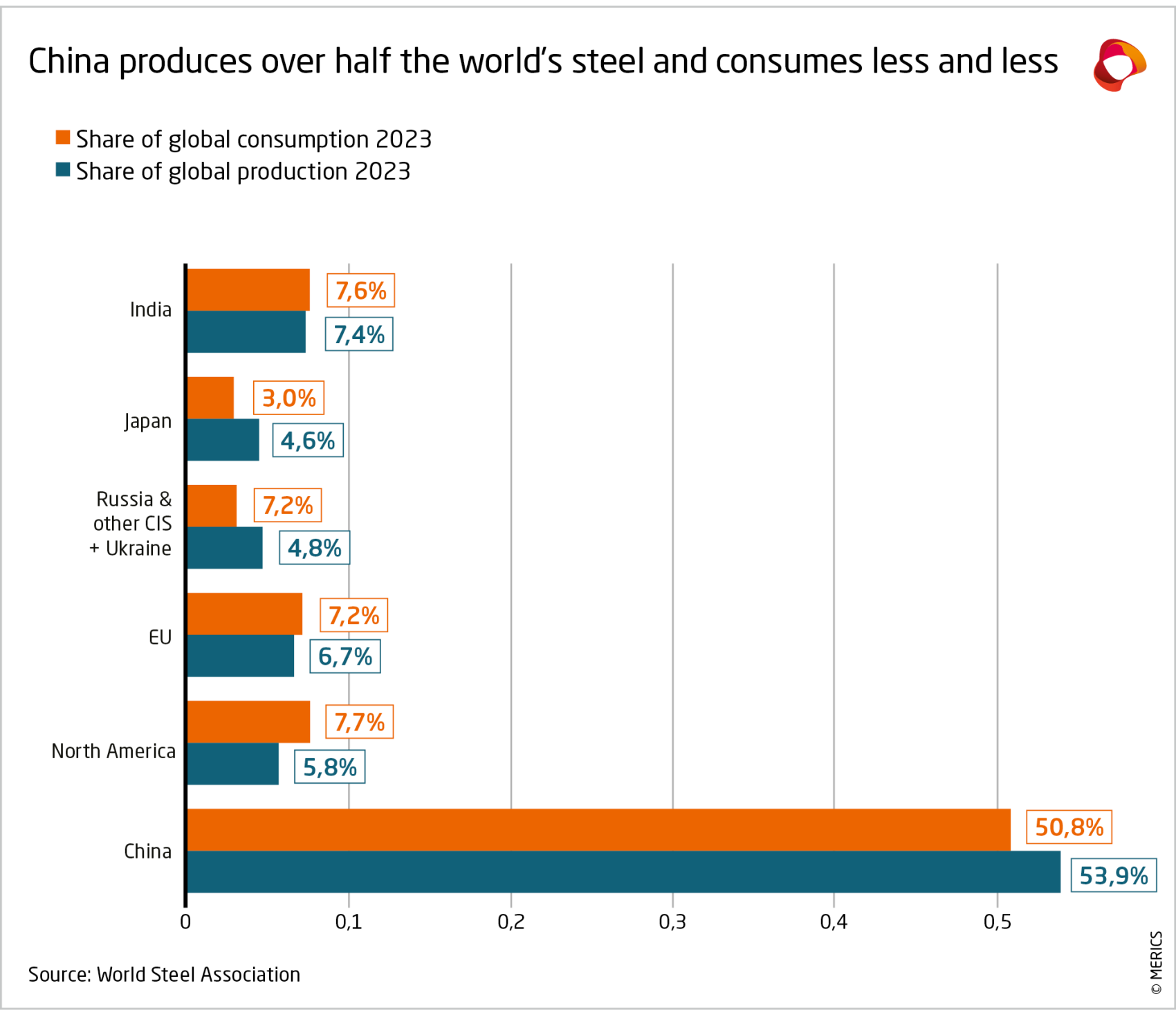

- China’s steel overcapacity is well documented. Efforts to resolve overcapacity have not meaningfully reduced total output or underutilization. Europe’s own steel sector was undermined as China offered cheap steel at scale in global markets.

- Beijing’s decision to hold on to so much inefficient steel production creates opportunities in China that Europe will struggle with, such as the ample supply of steel for advanced shipbuilding and offshore wind, or the additional demand for green hydrogen from China’s steelmakers as they decarbonize.

Status

The OECD expects global steel overcapacity to reach 644 million tons by 2025, which is more than the total steel output of OECD countries combined.11 In 2023, China produced just over one billion metric tons of steel and exported around 90 million tons.

China’s steel overcapacity, a boon for downstream steel users in European industry, significantly undermined the European steel sector, which gravitated towards more advanced and niche applications. This has been good for overall productivity and profitability but has undermined Europe’s broader industrial ecosystem generally but also including for emerging industries and economic security alike.

Meanwhile, China occupying so much of global steel production creates additional opportunities for its industrial policy ambitions in steel-intensive sectors in ways that benefit both established and emerging technologies. In 2010, 20 percent of China’s steel usage went into machinery; by 2023 this had risen to 30 percent.12

Drivers and indicators of overcapacity risks

China’s steel overcapacity can be explored in more detail through the reporting by the OECD in particular. Rather than replicate that work, below summarizes core factors and indicators, while the outlook section focuses on the negative impacts on the world and the positive impacts on China’s industrial ecosystem.

Central direct support – The OECD Steel Committee reported in 2024 that China’s subsidies for its steel sector was five times that of the average non-OECD country, and ten times that of the average OECD country.15 Provincial and local support is also significant.

Competing policy goals prevent consolidation – Provincial and local SOEs producing steel are commonplace in China, and local procurement for property development and infrastructure uses are commonly known to hand bids to local steelmakers or even bar steel products from neighboring provinces. This is one of many cases where Beijing is attempting, and failing, to ‘unify the national market’.16 This prevents consolidation and drives up overcapacity

Market drivers – China consumes roughly half of the world’s steel due to its property development, infrastructure projects, and massive industrial base ensuring widespread, though falling, demand.17 Fierce domestic competition drives down profits, but most steelmakers are SOEs who can survive weak profits and still produce.

Market indicators – Falling steel prices and a surge in exports suggests supply isn’t being taken offline or consolidated, and profitability is weak for some and many are enduring loss-making.18

Outlook

China’s steel overcapacity is here to stay and is likely to increase. In 2024, China is set to consume less than half the world’s total steel production, while producing more than the rest of the world combined. At the end of Q3 2024, China’s steel exports by volume had increased by 21 percent but were down in value by 5 percent year to date.19

Upstream from steel, China’s nascent green hydrogen sector is likely to benefit considerably from the size of its steel sector as hydrogen is one path to decarbonization of the sector. The scale of China’s steel sector means the bulk of demand for green hydrogen for smelting will be in China, giving China’s hydrogen producers higher early-adopter demand. Considering China produces over eight times as much steel as the EU’s, it will be hard for European players to keep pace.

Downstream from steel, other beneficiaries are to be found, like machinery, the automotive sector, and shipbuilding.20 China’s steel overcapacity, which undercut steel in Europe, fed into the rise of its shipbuilding sector and the decline of shipbuilding in Europe. Steel-hungry shipbuilders benefit from close proximity to producers, so it is no surprise that China, South Korea, and Japan account for so much of the world’s shipbuilding sector when the region also produces a large part of the world’s steel.

Emerging sectors that need abundant steel and shipbuilding capacity also benefit from China’s overproduction. For example, floating wind turbines for mobile offshore wind farms need abundant cheap steel and shipbuilding and maritime construction capacity. The erosion of Europe’s steel and shipbuilding sectors makes it harder for European producers to scale up quickly enough to compete with Chinese counterparts.

Beijing’s crackdown on the bloated real estate sector has driven down domestic demand, and other sectors are not filling the gap. China will turn to export markets, but many undergoing their own development miracles are raising barriers against Chinese steel, such as Brazil, Mexico, Turkey and Indonesia. The outcome could be fresh pressure to sell to Europe, with the EU becoming a market of last resort if too many destination markets put in tariffs and other restrictions.21

Case study: Passenger vehicles – a new area of overcapacity

Key takeaways

- Massive industrial policy and market intervention supported the rise of China’s passenger vehicle industry, and this trend was most acute in EVs where years of extensive industrial policy created a huge wave of market entrants.

- However, consolidation has slowed as the survivors became regional vested interests and local protectionism keeps them in the game. Price wars have emerged, driving pressure to export to more profitable markets.

- Forcing consolidation would come with the trade-off of job losses at a time of economic downturn. Although this may happen, China’s state planners are likely to prefer letting exports become the silver bullet to overcapacity for now.

Status

China’s passenger vehicle sector is the world’s largest, both in units produced and consumed; traditionally the bulk of those were internal-combustion engine (ICE) vehicles. This established base was beneficial when Beijing launched an industrial policy push to promote development of an electric vehicle (EV) industry. Hundreds of companies entered the market. Many were squeezed out as the sector matured and consolidation began when industrial policy support decreased and technical standards were raised. However, consolidation has slowed, and investment continues to pour into production despite a vicious price war.

The China Association of Automobile Manufacturers predicted total passenger vehicle sales by volume to be around 26.8 million, but automakers have established their own targets of around 30 million.20 Companies are investing heavily in unprecedented numbers of new car-carrier ships – a clear indication they plan to export their way out of trouble. China became a net exporter of cars in 2023, and the world’s largest car exporter overall.

Drivers and indicators of overcapacity risks

Several factors contribute to China’s passenger vehicle overcapacity. The US think tank Center for Strategic and International Studies (CSIS) estimates the combination of favoritism for local firms in public procurement, innovation/R&D support, infrastructure support, sales tax exemptions, and subsidy/price rebates amounts to more than USD 230 billion between 2009 and 2023.21

The European Commission has completed investigations into Chinese EV subsidies creating distortions in China’s EV exports to the EU. The findings echoed the prevalence of state support that CSIS and others have found, especially on subsidies and rebates, but also below-market financing, free or cheap land, and distortions up the value chain in batteries, battery components, and raw and refined materials, all of which are passed down to the final EV. This section focuses on additional layers of the problem, beyond the above-mentioned issues.

Tax exemptions – EV purchases are exempt from vehicle purchase tax till the end of 2027. The State Council confirmed the exemption had totaled CNY 315 billion by 2024, and projected further exemptions would be worth CNY 520 billion between 2024 and 2027.22

Central direct support – Central government subsidies were mostly wound down by 2022. Nevertheless, their massive size has fueled economies of scale that European EV makers must now compete with.

Provincial and local support – Regional governments played their own role in fostering local champions through subsidies, cheap financing, cheap land, procurement favoritism, and other forms of aid. They are at a crossroads, where they must choose between ongoing support for local champions that would otherwise exit the market, or letting them fail at the risk of local job losses.

Rebates – In 2024, rebates became a new focus at the central and local levels, incentivizing car owners to surrender their old models with up to CNY 30,000 towards the purchase a new EV.23

Protection period from foreign competition – Foreign passenger vehicle makers were compelled into joint ventures until 2018, for EVs, and 2022 for internal combustion engines (ICE). The biggest subsidies and other supports were available during the early stages of the industry’s rise, meaning Chinese EV makers were able to gain scale before wholly foreign-owned players were able to enter the market.

Other factors – The zero-wait-time in China’s biggest cities to get a license plate for an EV compared to typical waits of months or years for an ICE pushed up demand for EVs. National security concerns also prevent some vehicle brands from being driven through certain sensitive areas, incentivizing consumers to choose local brands that face no such restrictions.

Market factors – China’s EV industrial chain is complete, making it considerably easier for the flood of market entrants that contributed to overcapacity as suppliers and cheap inputs were readily available. Chinese consumers are also highly welcoming to EV adoption, enlarging the potential market and drawing in new entrants. High numbers of entrants from the above factors have led to fierce domestic competition, falling prices, and widespread low profitability or even lossmaking.

Outlook

Beijing has set market consolidation as a clear goal, seen in the fact that only four new brands have received approval since early 2018.24 Much will depend on how willing officials are to incur localized costs (especially to employment) to drive consolidation. It is also easy to imagine some automakers keeping some ICE production lines working for export while EV production expands – in line with President Xi’s “first establish, then dismantle” mantra - delaying consolidation even further.

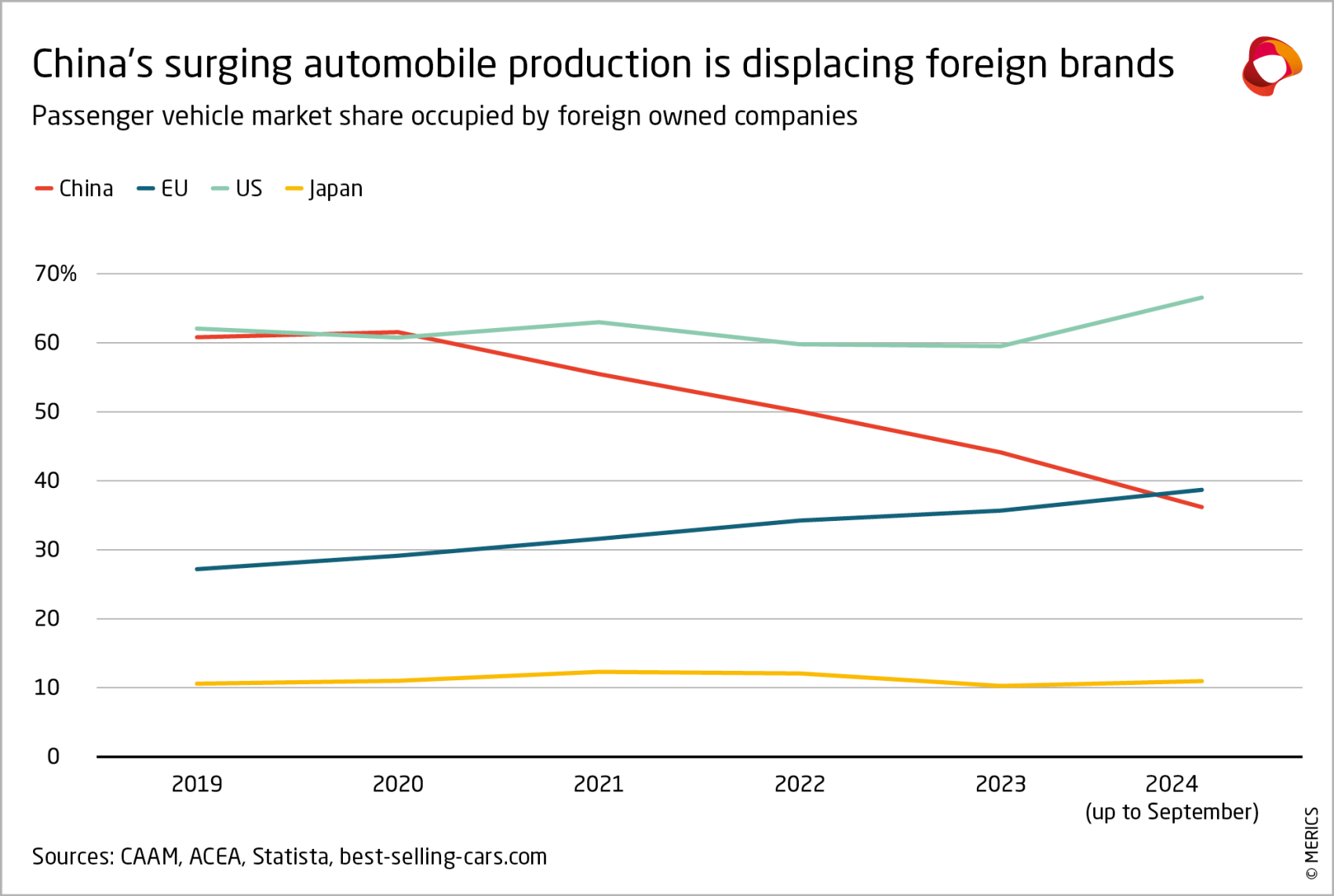

Meanwhile, foreign companies’ market share has nearly halved in the last four years, despite their near complete shift away from exports to China and towards localized production for some brands. Their heavy investment in China-based production will only worsen trade imbalances by reducing the flow of EU-made cars shipped to China.

Case Study: Legacy semiconductors - an emerging area of overproduction

Key takeaways

- Europe will feel China’s overproduction of chips, not through semiconductor imports directly, but through the goods chips are embedded in and the potential global market price impacts.

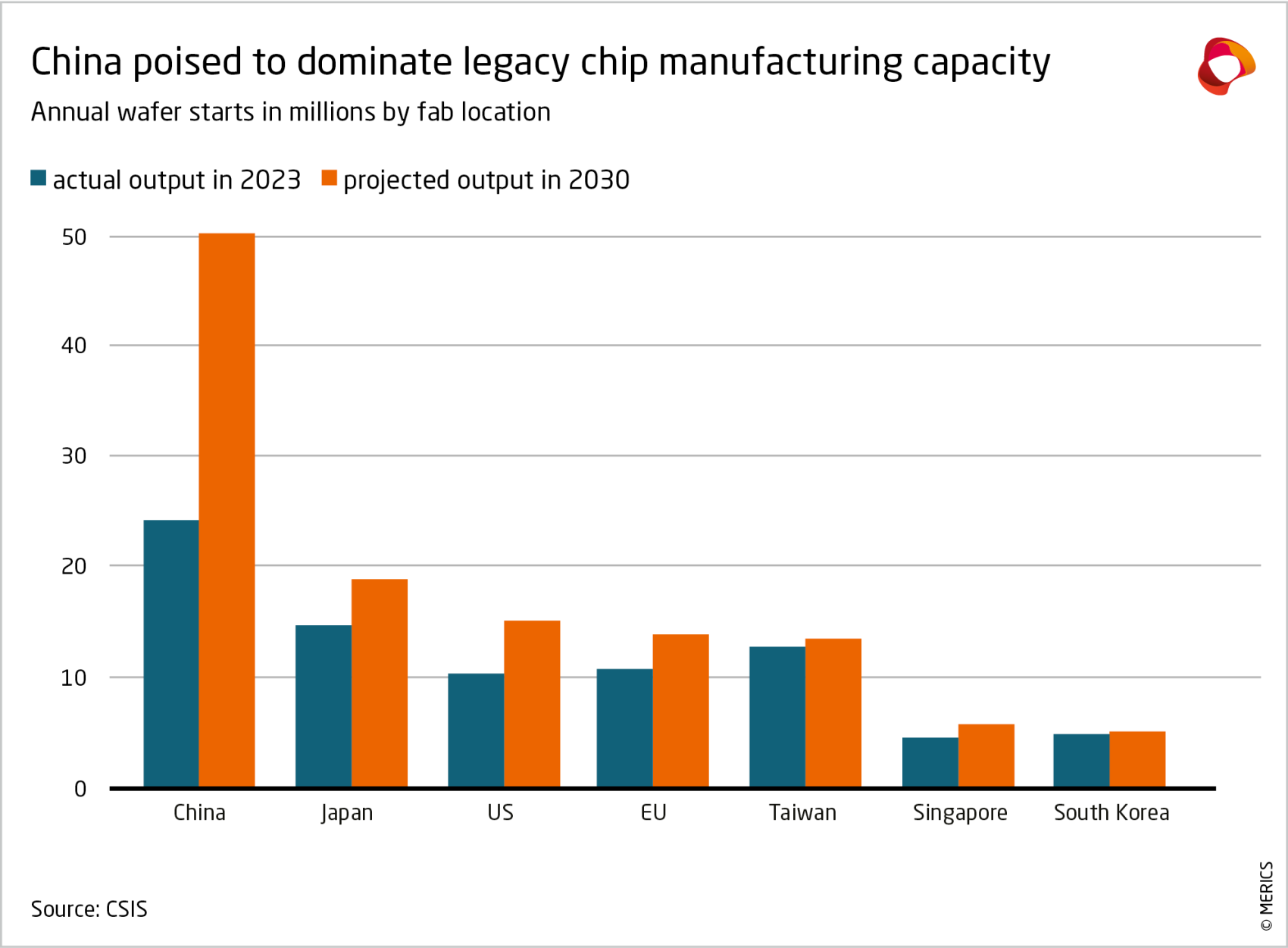

- China is in the process of building up massive capacity, especially in legacy semiconductors (chips of older design that are found in household appliances, for instance). The resulting supply will far exceed domestic demand at current projections.

- These expansions are supported internally by central and local policies, funds and coordination that all incentivize supply chain indigenization. External factors like growing restrictions on Chinese firms’ access to US and allies’ technology has driven Chinese chip users to invest in and source from domestic suppliers.

Status

Semiconductors are a heterogeneous market, and it is not easy to replace one chip with another. The global semiconductor industry is also very decentralized, and companies have developed niches in a sophisticated and multi-layered value chain.

China is the only country aiming for a complete semiconductor industrial chain. Beijing has made this technology class the core of its technological ambitions. Furthermore, newer external factors like the US-China trade and tech wars motivated Chinese firms to invest massively as they fear losing access to semiconductors needed for their production.

So far, China has established a base in foundational semiconductors, also called legacy semiconductors or mainstream chips - the workhorses of current industry, in contrast to the cutting-edge chips used in smartphones and AI applications. Vast numbers of firms have entered this space and are producing foundational chips at scale. China might face shortages in advanced chips it cannot yet make, while also overproducing the types it can make.

Drivers and indicators of overcapacity risks

Projections from the market research institute TrendForce suggest China will account for 39 percent of mature node capacity by 2027, with further expansion after that.25 These expansions are set to continue despite the 2023 global industry downturn which even delayed the expansion plans of Taiwanese semiconductor giant TSMC.26 While many chip design firms are going bankrupt, investment in manufacturing capacity remains massive.27 China’s build-up of capacity in legacy semiconductors is influenced significantly through policy, which is driving a growing gap between supply and demand.28

Widespread low profitability or even lossmaking – Short-term profitability is not as important for many Chinese companies as for their international counterparts. Given Beijing views catching up in chips as a national security issue, it will give support where needed. Hua Hong, a Chinese foundry focused on mature processes, for instance, was able to avoid bankruptcy due to subsidies provided between 2018 and 2020.29

Public capital availability – At the national level, the government set up one big investment vehicle, the “Big Fund”, which deployed roughly USD 40 billion in two waves between 2014 and 2023, with a third wave in progress.30 This, plus local government support, has led to a huge increase of market entrants.

Private capital availability – Private money is also still pouring into the sector, despite its current troubles. As Yuanchuan investment review noted: “In the long term, domestic substitution still supports the development of the semiconductor industry.”31 Expectations of an escalation of the fierce tech conflict with the United States will incentivize more private investment.

New support measures and signals – Government and private money also intersect to support China’s chip-making ambitions. New-generation IT and new materials are key domains within the “Little Giants” investment program which supports SMEs.32 For investors, it is attractive to raise funds for firms supported by the Beijing government.

Content localization push stimulates demand – Following Huawei’s placement on the US entity list of companies subject to trade restrictions, Chinese companies are trying to indigenize.33 They are willing to accept additional costs to preserve and build up supply chain security.34 Even unsanctioned firms like Xiaomi, a consumer electronics giant that has launched a USD 1.45 billion35 chip fund, have taken such measures.

Limitations of the tech war – US export controls since 2022 have further strengthened China’s ascendancy in legacy chips (those at or above 28 nanometers), as they only affect high-end types (16/14nm and below).36

Competing policy goals prevent consolidation – While some consolidation is happening in China, especially in chip design, local governments are keen to keep a “complete supply chain” and support struggling chip companies instead of allowing consolidation.

Case study: Electrolyzers – core tech for green hydrogen production is on the path towards overinvestment

Key findings

- Beijing plans to use hydrogen for decarbonization and is driving significant investment in the production of electrolyzers, the key equipment for green hydrogen production.

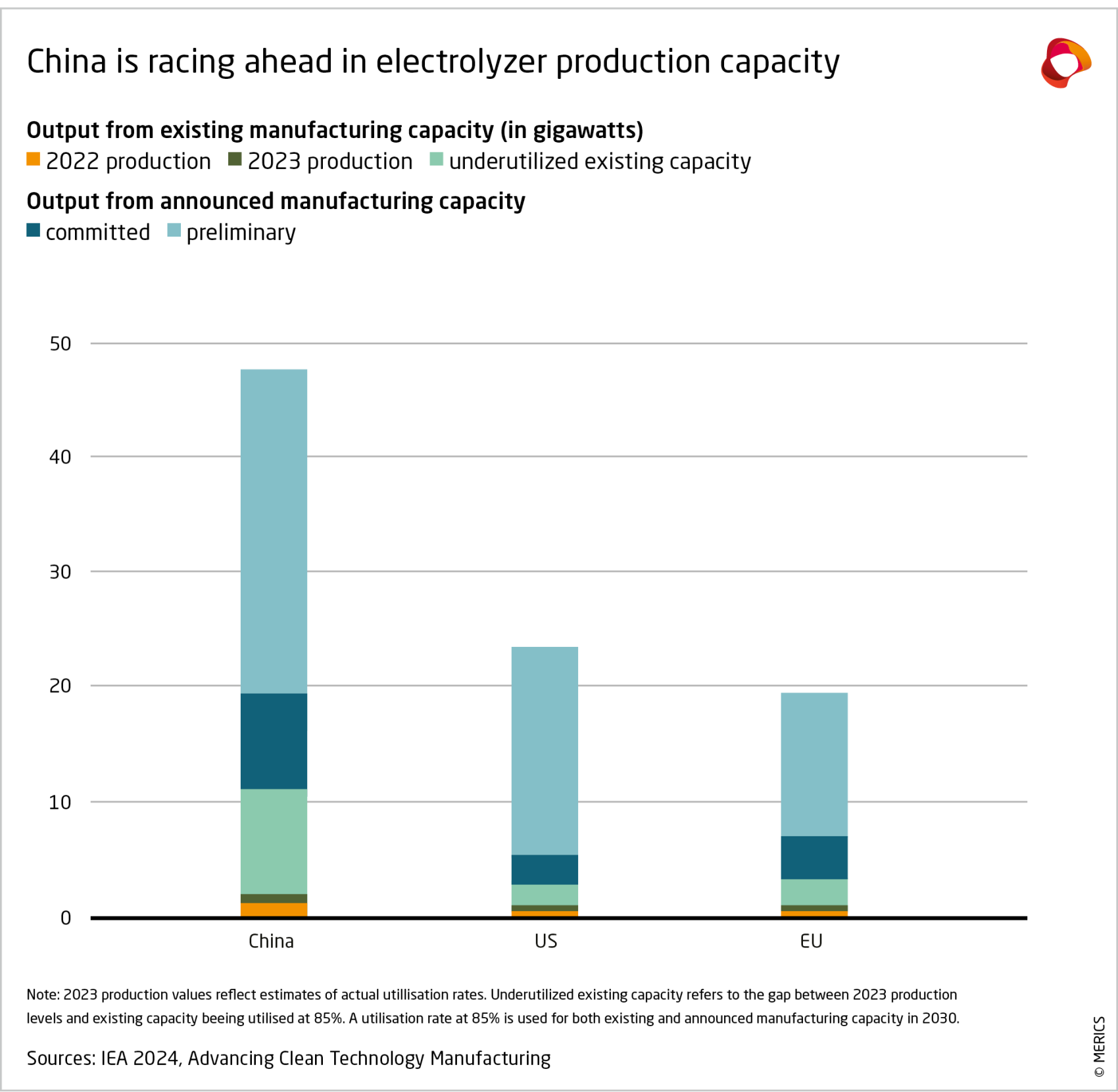

- China’s electrolyzer manufacturing capacity accounts for 60 percent of global capacity and is growing rapidly. Private firms are jostling to secure early market share, and state-owned enterprises are following government directives to develop the sector. Yet green hydrogen’s high production costs and technical barriers mean demand is lagging.

- For now, most of China’s capacity lies idle (approximately 86 percent). Whether the supply-demand mismatch persists will depend on if China’s energy intensive industries fast track green hydrogen uptake or if other measures stimulate demand.

Status

The green hydrogen sector shows how China’s economic system can generate huge levels of investment, even during the earliest development stages for emerging technologies. Electrolyzers – machines that use electricity to split water into hydrogen and oxygen – are vital for producing green hydrogen. China’s leaders have signaled that hydrogen will play a key role in decarbonization, leading production capacity for electrolyzers to surge and outpace demand.37

Hydrogen’s applications across industry, transport and energy are vast. Demand in the short- to mid-term will likely come from ammonia, methanol and steel production. By 2030, China’s domestic electrolyzer market is expected to reach CNY 37 billion, creating a market 26 times bigger than it was in 2022.38

As it stands, green hydrogen only accounts for about one percent of total hydrogen production in China, with the rest being "grey hydrogen" made using electricity from fossil fuels.39 So far no major subsidies have been rolled out at the national level to spur growth in green hydrogen or electrolyzers, but there have been a few at the provincial or local level.40 State-owned enterprises are the primary investors in this emerging tech.41

Although the market remains small, manufacturing capacity is rising rapidly. According to the International Energy Agency (IEA), in 2023, production capacity in China reached 13 Gigawatts (GW), or about 60 percent of global capacity, compared to 1.8 GW in electrolyzer output in China - a utilization rate of around 14 percent. 42 That’s about the same underutilization rate as in the United States and Europe, the other two main production bases for electrolyzers. Yet the ramp up in China is happening on a much larger scale.43

Drivers and indicators of overcapacity risks

Demand for green hydrogen in China is weak due to its price. Compared to grey hydrogen, green hydrogen can be three to five times more expensive.44 The main electrolyzer technology – alkaline electrolyzers – operates less effectively with intermittent power, like solar and wind.45 Other challenges include hydrogen leakage, storage and pipeline infrastructure for distribution, and safety standards.46

Despite relatively weak demand, hydrogen’s central role in China’s greening agenda is leading many to bet on future demand. Firms are ramping up electrolyzer production now rather than waiting because of:

First-mover advantage – securing market share early, even if it means losses now, may be worth it. Large solar and new electric vehicle (NEV) firms such as LONGi, Sungrow and BYD are expanding into the electrolyzer business and can afford short-term losses.

Complete industrial chain in China – Solar PV firms such as LONGi and Sungrow can leverage cheap electricity from their own panels to produce green hydrogen with their electrolyzers. Wind turbine manufacturers, such as Envison and Mingyang, are planning the same.47 Cheap steel, a major input, also helps drive market entry.

Momentum from state-owned enterprises (SOEs) – China’s SOEs are crucial players in kick starting the government's vision for the green hydrogen sector. Several SOEs are developing electrolyzers, such as PERIC (China’s current market leader), Huadian Heavy Industries, SPIC and Sinopec.48

Outlook

According to the International Energy Agency (IEA), China’s existing manufacturing capacity for electrolyzers is already twice the level needed to meet Beijing’s 2030 climate pledges (6 GW).49 China’s government tends to under-promise and over-deliver on official targets, so it is likely that China could utilize significantly more capacity than currently assumed.

The gap between planned supply and current demand suggests unless installation rates grow fast and soon, much of the production capacity will sit idle or be exported, as some firms have begun to do. Some have gained European CE and US ASME certifications to enter those markets.50 Europe is among the key targets given strong growth forecasts for green hydrogen production there.51

The growth of China’s home market for green hydrogen will be key, and that process is still developing. It is too early to determine whether overinvestment in electrolyzers is already occurring in China. However, the following developments may indicate the direction of travel:

The pace of SOE take-up – Large scale adoption of green hydrogen as an input/fuel in high energy-intensity sectors, like steel, refining, chemicals, and others, would significantly increase electrolyzer demand in China. These industries are dominated by SOEs, which the government can effectively compel to accelerate green hydrogen adoption at a loss.

The expansion of carrots and sticks – Subsidies and favorable loans could facilitate green hydrogen at the point of production or sale, lowering costs so take-up becomes more feasible (some local governments already do this).52 Quota systems could boost adoption by relevant industries, as could the accelerated expansion of China’s emissions trading system.

The limits of China’s green-tech investment frenzy – Central and local governments promoting investment in, and financing for, green tech companies have driven excess production capacity in EVs and solar. Chinese executives in these fields have called for an end to “blind investment” as it has produced rapidly falling prices and profits.53 A moderation in such policy support would likely dampen investment in electrolyzer capacity as well.

Early establishment of clear market leaders – The market for electrolyzers is already quite consolidated, with PERIC, Sungrow and LONGi together accounting for 50.4 percent of public tenders won in 2023.54 If they can significantly outpace competitors by scaling up rapidly, the hurdles facing new players may become too high.

Many electrolyzer manufacturers in China have other business segments, so they could afford to abandon electrolyzer production if it became unprofitable. The situation is different for EV-makers, for example, as most of them are solely in that business and cannot afford a market exit.

Responding to China’s overcapacity requires sector-specific strategies

The distortions and risks from China’s overcapacity entering the EU are diverse and will require different tools and strategies to address them; these include, but go beyond, preventing market disorder. Such distortions can be categorized by the kind of impacts they bring:

Benign impacts – Even though many of China’s exports carry distortions, if they are in sectors without European competition or ambition, and present limited to no economic or national security risks, then they should be treated as lower priority concerns than other categories. The bulk of China’s exports to the EU fit this category, with most consumer goods and electronics meeting these criteria.

Competition distortions – Price distortions are increasingly appearing in sectors that overlap with European industrial core strengths and threaten to undermine prices in ways local firms cannot compete with profitably. A modest but important minority of China’s exports are in this category, particularly products like EVs, chemicals and certain medical devices.

Economic and national security threats – Firms that benefit from China’s strongly-interventionist economic model can crowd out local production of essentials needed for economic and national security. A small but critical and growing minority of China’s exports fit this category, such as green energy equipment, steel and aluminum.

To illustrate how these diverse impacts might be handled using the EU’s current and potential tools, we look at the same sectors covered in the case studies.

Steel – Steel embodies the risks of long-term, insufficient action to mitigate issues stemming from China’s overcapacity. Below-market priced steel was often viewed as benign because of benefits downstream, before it came to be seen as a competition distortion. It is now also a security threat as, since Russia’s invasion, defense value chains have struggled to supply Ukraine.

Despite safeguards in place since 2018 following Chinese overcapacities and US tariffs measures, Europe’s steel industry has eroded so much that trade defense instruments alone will not ensure the future of the sector. Countervailing tariffs and quotas should be forcefully applied to China’s steel exports to the EU. Moreover, the economic and national security risks of a weakened steel sector cannot be tolerated, and promotion measures are urgently needed to rebuild, decarbonize and upgrade.

Passenger vehicles and EVs – China’s EV exports are already subject to countervailing tariffs. However, it remains to be seen if these will be sufficient to capture the full extent of China’s industrial policy agenda and economic model. First, there is the scale of distortions and, as a knock-on effect there are additional risks which could emerge if the tariffs drive up China’s EV investments in and around the EU – especially if they turn into final assembly plants with all of the tech and components coming from China and bringing their distortions with them. Expanding reactively trans-national subsidies mechanisms would be an important next step for the latter.

The EU also needs a framework to make sure Chinese EV companies’ greenfield investments in Europe effectively contribute to the reduction of dependencies on China. For instance, investment deals could be made conditional on supplier-localization criteria, especially for critical elements of the value-chain to foster the development of domestic know-how and reduce the dependency on China. Finally, the security concerns arising from connected vehicles need to be assessed. If they can be regulated, the conditions for doing so will need to be assessed.

Legacy semiconductors – European companies are leaders in legacy semiconductors. Thus, Chinese chipmakers’ non-market production directly challenges their business models, especially as many European producers sell a significant share of their chips to China. The pandemic exposed the economic security risks of disruptions in the supply of legacy chips. As with steel, Russia’s invasion of Ukraine has underscored the critical role of legacy chips for traditional and emerging defense technologies and value chains. Thus, keeping production in Europe is important both for downstream industries and for national security. The response to distorted competition from China may thus need to combine promoting local firms while protecting them against imported distortions.

As chips are intermediate goods crucial to many future industries, this response should not be limited exclusively to the chip industry but also look at possible distortive effects on other downstream industries. For instance, Chinese electric vehicles might benefit from heavily subsidized Chinese chips that further drives down prices. It will be key to ensure that European chip consumers, many of them industrial companies themselves, are not pushed to using subsidized Chinese chips to compete with Chinese companies active in their industries. Thus, protection against imported distortions should apply not only to chips directly, but also to the goods containing chips which carry those distortions.

Green hydrogen electrolyzers – The initial impacts are likely to begin as competition distortions but could erode local players to a degree that creates security threats. The EU has already lost existing and emerging green tech sectors to China (solar panels, EVs and EV batteries) and the same could happen with wind power.

In these early stages, measures to promote local firms could help. So too could restrictions on China’s exports to prevent market distortions crowding out local players. One novel approach could be the use of quotas, which would allow entry to the benefits of cheap China-made green tech, while requiring a minority of total demand to be met by local production. This might include Chinese firms producing locally, so long as sufficient supply chain localization also happens to prevent dependencies. It would keep green transition costs low, yet ensure security, with sufficient local production for energy security and green transition autonomy.

The EU must act, and it must pre-empt the next areas of overcapacity

Ideally, the EU can coordinate these measures with partners. This would unlock considerable advantages as the larger the coalition:

- The greater the size of the undistorted market for companies to operate in

- The smaller the economies of scale for advantaged Chinese firms in third markets

- The higher the collective political cover against Beijing’s retaliation

Despite the significant theoretical advantages, such cooperation is difficult and rare, and China will resist the emergence of any coordinated efforts. However, a growing number of countries outside the OECD are raising barriers to China’s disruptive exports, making coordination more feasible though not easy.

The priority should be to put autonomous instruments in place. They would build up trust among partners and facilitate technical discussions, paving the way for partnerships down the road. Besides, they could empower more risk-averse countries to act. The EU, with its deeply rooted rules-based and country-agnostic preferences, could lead a fact-based regulatory approach against Chinese distortions.

Finally, efforts to coordinate should not allow “the perfect to be the enemy of the good”. Perfect coordination with as many partners as possible could take too long to materialize to be effective. Multiple, partially overlapping coalitions would be a more efficient route to moving in the right direction quickly.

While responding to sectors already suffering from China’s overproduction and distortion, it is also important to develop a response for industries where future distortions can be anticipated, especially in emerging technologies.

A strategic approach might involve significant restrictions on Chinese participation in EU R&D programs – for instance in basic research in emerging technologies – and outbound tech flow/FDI restrictions on critical technologies. The aim is to prevent key tech outflows to China where it will be commercialized, scaled up and lead to market crowding and spillovers.

Looking at the most consistent factors driving overcapacity in the four case studies are likely indicators of future sectors where these issues could be replicated:

- Most common policy drivers and indicators: Provincial and local support (subsidies, cheap loans, etc.), central direct support (subsidies, cheap loans, etc.), innovation/R&D support, intervention is preventing consolidation, and a significant presence of SOEs

- Most common market drivers and indicators: High downstream demand/take-up, fierce domestic competition, widespread low profitability or even lossmaking, and falling prices

Many of these are widespread throughout the “real economy”, but they are especially acute in the most strategically relevant and prioritized sectors, many of which were mapped out in Beijing’s Made in China 2025 strategy. Our internal projections find that these common market drivers and indicators are widely present in the following sectors where the conditions are right for overcapacity to emerge in the near future.

- Sectors most likely to see overcapacity emerge in the short term: Legacy semiconductors, low to mid-range industrial machinery and components, IT equipment, low to mid-range medical devices, and pharmaceuticals.

- Sectors most likely to see overcapacity in the medium to long term: Electrolyzers, advanced medical devices, advanced industrial machinery and components, and new materials.

In other words, much of European core industry, a fact that makes greater urgency from European policymakers all the more critical.

- Endnotes

1 | European Chamber of Commerce in China and Roland Berger, “Overcapacity in China: An Impediment to the Party’s Reform Agenda,” 2016, https://www.europeanchamber.com.cn/en/publications-overcapacity-in-china; Lu Lanqing 陆澜清, “2016年钢铁行业如何去产能 (How to Reduce the Capacity of the Steel Industry in 2016),” 2016, https://www.qianzhan.com/analyst/detail/329/160225-2671dc64.html; Chinabgao 中国报告大厅, “我国钢铁行业2016年现状:亏损惨重产能过剩 (The Status Quo of China’s Steel Industry in 2016: Heavy Losses and Overcapacity),” 2016, https://www.chinabgao.com/freereport/71999.html; Wang Ming 王明, “去产能与增产量——钢铁去产能困境何解? (De-Capacity and Production Increase - What Is the Solution to the Dilemma of Steel Capacity de-Capacity?),” 2016, https://news.mysteel.com/16/1220/10/FC04C105D8E47F20.html.

2 | Watanabe Shin and Ochiai Shuhei, “China Steel Industry Faces Growing Pressure to Consolidate,” Nikkei Asia, 2023, https://asia.nikkei.com/Business/Business-deals/China-steel-industry-faces-growing-pressure-to-consolidate.

3 | Elaine Kurtenbach, “China Rolls out New Measures to Fix Its Property Crisis, Spur Growth,” AP News, 2024, sec. Business, https://apnews.com/article/china-economy-property-housing-1d650edc0b4f8f580bc20570e9a27519; Amanda Wang, “China Unveils Dramatic Steps to Rescue Property Market,” Australian Financial Review, May 17, 2024, sec. asia, https://www.afr.com/world/asia/china-unveils-dramatic-steps-to-rescue-property-market-20240517-p5jel2; Gao Liangping and Clare Jim, “China Unveils ‘historic’ Steps to Stabilise Crisis-Hit Property Sector,” Reuters, May 17, 2024, https://www.reuters.com/markets/asia/china-new-home-prices-fall-fastest-pace-over-9-years-2024-05-17/.

4 | Qiushi, “Understanding New Quality Productive Forces and Accelerating Their Development,” 2024, http://en.qstheory.cn/2024-05/11/c_985265.htm.

5 | Wang Huirong 王蕙蓉, “习近平:发展新质生产力不是要忽视、放弃传统产业 (Xi Jinping: Developing New Quality Productivity Is Not about Neglecting or Abandoning Traditional Industries),” 2024, https://www.thepaper.cn/newsDetail_forward_26602068.

6 | People’s daily 人民日報, “坚持稳中求进、以进促稳、先立后破 (Insisting on Seeking Progress While Maintaining Stability, Promoting Stability through Progress, and Establishing before Breaking Down),” 2024, http://paper.people.com.cn/rmrb/images/2024-02/28/01/rmrb2024022801.pdf, http://paper.people.com.cn/rmrb/images/2024-02/28/01/rmrb2024022801.pdf, https://www.gov.cn/yaowen/liebiao/202402/content_6934644.htm

7 | Author’s note: Premier Li Qiang said during his speech that “The foundation for China’s sustained economic recovery and growth is not solid enough, as evidenced by a lack of effective demand, overcapacity in some industries, weak public expectations, and many lingering risks and hidden dangers”. Li Qiang, “REPORT ON THE WORK OF THE GOVERNMENT: Delivered at the Second Session of the 14th National People’s Congress of the People’s Republic of China on March 5, 2024,” 2024.

8 | State Council Information Office, “国新办举行新闻发布会 介绍‘系统落实一揽子增量政策扎实推动经济向上结构向优、发展态势持续向好’有关情况图文实录 (The State Council Information Office Held a Press Conference to Introduce the “systematic Implementation of a Package of Incremental Policies to Solidly Promote the Upward Structural Optimization of the Economy, the Development Trend Continues to Improve),” 2024, http://www.scio.gov.cn/live/2024/34923/tw/.

9 | Xi Jinping, “Comprehensively advance the construction of a strong country and the great cause of national rejuvenation with Chinese-style modernization” (Qiushi, 2024) http://www.qstheory.cn/20241231/d21bd57c012d4d29824219effd18ca35/c.html?utm_source=substack&utm_medium=email

10 | Max Zenglein and Jacob Gunter, “The party knows best: Aligning economic actors with China’s strategic goals” (Merics, 2023), https://merics.org/de/report/party-knows-best-aligning-economic-actors-chinas-strategic-goals.

11 | OECD, “Steel,” 2025, https://www.oecd.org/en/topics/steel.html.

12 | Julia Wendling, “China’s Steel Demand Through Time,” Visual Capitalist, 2024, https://www.visualcapitalist.com/sp/bhp01-chinas-steel-demand-through-time/.

17 | https://worldsteel.org/wp-content/uploads/World-Steel-in-Figures-2024.pdf

18 | https://www.visualcapitalist.com/sp/bhp01-chinas-steel-demand-through-time/

19 | https://merics.org/en/merics-briefs/chinas-new-space-science-plan-brics-summit-steel-exports

20 | Cheng Jia 程佳, “国产新能源车进入惨烈‘淘汰赛’ (Domestic New Energy Vehicles Enter Grueling “Elimination Race),” 2024, https://m.thepaper.cn/newsDetail_forward_26761490.

21 | Scott Kennedy, “The Chinese EV Dilemma: Subsidized Yet Striking,” CSIS, 2024, https://www.csis.org/blogs/trustee-china-hand/chinese-ev-dilemma-subsidized-yet-striking.

22 | Central Government of China, “发展新能源汽车是汽车产业转型的主要方向 (The Development of New Energy Vehicles Is the Main Direction of the Transformation of the Automobile Industry),” 2023, https://www.gov.cn/xinwen/jdzc/202306/content_6887675.htm.

23 | Central Government of China, “换设备 换车 换家电……12个领域更新换新细则全面出台! (Replacement of Equipment Replacement of Cars Replacement of Home Appliances ......12 The Rules for Renewal and Replacement in 12 Areas Are in Full Swing!),” 2024, https://www.gov.cn/zhengce/202409/content_6976813.htm.

24 | Julie Zhu, “Exclusive: China’s Xiaomi Wins State Planner Nod to Make EVs amid Glut in Autos,” Reuters, August 23, 2023, https://www.reuters.com/business/autos-transportation/chinas-xiaomi-wins-state-planner-nod-make-evs-amid-glut-autos-2023-08-23/.

25 | Trendforce, “Rumors Regarding Price Reductions in Mature Process for Foundries Emerge, Signaling a Further Decrease in Prices in Q2,” 2024, https://www.trendforce.com/news/news/2024/03/26/news-rumors-regarding-price-reductions-in-mature-process-for-foundries-emerge-signaling-a-further-decrease-in-prices-in-q2/.

26 | Deloitte, “2024 Semiconductor Industry Outlook,” 2024, https://www2.deloitte.com/us/en/pages/technology-media-and-telecommunications/articles/semiconductor-industry-outlook.html.

27 | Max J. Zenglein, Alexander Brown, and François Chimits, “China’s Economy Leaves a Mixed Picture in Q1,” Merics, April 24, 2024, https://merics.org/en/tracker/chinas-economy-leaves-mixed-picture-q1.

28 | Jimmy Zhang, “中国汽车制造商到2025年将采购25%国产芯片 (Chinese Automakers to Purchase 25% of Domestic Chips by 2025),” EE Times China, 2024, https://www.eet-china.com/news/202405178376.html.

29 | Yuanchuan Investment Review 远川投资评论, “华虹半导体上市,中国芯片代工的另类突围 (Hua Hong Semiconductor’s IPO, an Alternative Breakout for China’s Chip Foundries),” 36kr, 2023, https://36kr.com/p/2403301892219905.

30 | Author’s note: The first two phases of the Big Fund were heavily invested in chipmaking and wafer fabrication plants, driving front-end capacity expansion. Zhang Erchi et al., “Five Things to Know About China’s Scandal-Struck Chip Industry ‘Big Fund’ - Caixin Global,” Caixin Global, 2022, https://www.caixinglobal.com/2022-08-10/five-things-to-know-about-chinas-scandal-struck-chip-industry-big-fund-101924443.html.

31 | Yuanchuan Investment Review 远川投资评论, “半导体的乌云下,他们为什么加码芯片ETF?(Under the Dark Cloud of Semiconductors, Why Are They Adding to Chip ETFs?),” 36kr, 2023, https://36kr.com/p/2401816725807233.

32 | Alexander Brown, François Chimits, and Gregor Sebastian, “Accelerator State: How China Fosters ‘Little Giant’ Companies | Merics” (Merics, August 3, 2023), https://merics.org/en/report/accelerator-state-how-china-fosters-little-giant-companies.

33 | Yi Ouwang 亿欧网, “万亿车芯市场,迎来中国芯 (The Trillion-Dollar Core Market Ushered in China’s Core),” 36kr, January 23, 2025, https://36kr.com/p/2448576843683971.

34 | Paul Triolo, “Legacy Chip Overcapacity in China: Myth and Reality,” CSIS, 2024, https://www.csis.org/blogs/trustee-china-hand/legacy-chip-overcapacity-china-myth-and-reality.

35 | Ben Wodecki, “Xiaomi CEO Launches $1.45B Chinese Chip Fund,” AI Business, 2023, https://aibusiness.com/verticals/xiaomi-ceo-launches-1-45b-chinese-chip-fund.

36 | Jan-Peter Kleinhans et al., “Running on Ice: China’s Chipmakers in a Post-October 7 World,” Rhodium Group, April 4, 2023, https://rhg.com/research/running-on-ice/.

37 | National Development and Reform Commission of China, “氢能产业发展中长期规划(2021-2035 年) (Medium and Long-Term Plan for the Development of Hydrogen Energy Industry (2021-2035)),” 2022, https://www.ndrc.gov.cn/xxgk/zcfb/ghwb/202203/t20220323_1320038.html?code=&state=123https://www.ndrc.gov.cn/xxgk/zcfb/ghwb/202203/t20220323_1320038.html?code=&state=123.

38 | Quan Xiaojing 全小景, “万亿市场潜力的绿氢进入规模化验证阶段 规划、招标项目数量全面暴增 (Green Hydrogen with Trillion-Dollar Market Potential Has Entered the Stage of Large-Scale Verification, and the Number of Planning and Bidding Projects Has Skyrocketed),” Quanjing Caijin 全景财经, 2024, https://www.stcn.com/article/detail/1088547.html.

39 | Liu Canbang 刘灿邦, “万吨级绿色制氢项目大量启动 行业巨头挑大梁 (A Large Number of 10,000-Ton Green Hydrogen Projects Have Been Launched, with Industry Giants Picking up the Slack),” Zhengjuan Shibao 证券时报, June 13, 2024, https://archive.is/L7e4Q.

40 | Chinabaogao 观研报告网, “各地补贴政策频发 多家企业布局 绿氢行业或成我国氢能发展主方向 (Frequent Subsidy Policies in Various Places, and the Layout of Many Enterprises The Green Hydrogen Industry May Become the Main Direction of Hydrogen Energy Development in China),” 2024, https://www.chinabaogao.com/detail/696681.html.

41 | Alexander Brown and Nis Grünberg, “China’s Nascent Green Hydrogen Sector: How Policy, Research and Business Are Forging a New Industry” (Merics, June 28, 2022), https://merics.org/en/report/chinas-nascent-green-hydrogen-sector-how-policy-research-and-business-are-forging-new.

42 | Author’s note: The real utilization rate is likely to be lower. The figures for production capacity are based on company announcements, which may refer to the maximum production capacity of plants and not reflect current production capacity. IEA, “Advancing Clean Technology Manufacturing - An Energy Technology Perspectives Special Report,” May 6, 2024, https://www.iea.org/reports/advancing-clean-technology-manufacturing.

43 | ESCM 中国储能网新闻中心, “电解槽行业即将过剩? (Is There an Impending Surplus in the Electrolyzer Industry?),” 2024, https://www.escn.com.cn/20240411/b04df9822daf4297bd2703253cf0c247/c.html.

44 | Wang Haixia 王海霞, “光伏行业加速洗牌 (Photovoltaic Industry Accelerates Reshuffle),” China Energy News, 2024; Quan Xiaojing 全小景, “万亿市场潜力的绿氢进入规模化验证阶段 规划、招标项目数量全面暴增 (Green Hydrogen with Trillion-Dollar Market Potential Has Entered the Stage of Large-Scale Verification, and the Number of Planning and Bidding Projects Has Skyrocketed)”; Liu Canbang 刘灿邦, “万吨级绿色制氢项目大量启动 行业巨头挑大梁 (A Large Number of 10,000-Ton Green Hydrogen Projects Have Been Launched, with Industry Giants Picking up the Slack).”

45 | Wang Haixia 王海霞, “光伏行业加速洗牌 (Photovoltaic Industry Accelerates Reshuffle).”

46 | Citi, “HYDROGEN: A Reality Check on the Hydrogen Craze,” Citi GPS: Global Perspectives & Solutions, 2023.

47 | Polly Martin, “Envision to Build Gigawatt-Scale Green Hydrogen and Ammonia Project in China — with Exports to Europe, Japan and Korea in Mind,” Hydrogen Insight, 2023, https://www.hydrogeninsight.com/production/envision-to-build-gigawatt-scale-green-hydrogen-and-ammonia-project-in-china-with-exports-to-europe-japan-and-korea-in-mind/2-1-1533818?zephr_sso_ott=AppDmB; Sohu, “明阳集团绿氢‘妙手棋’ (Mingyang Group’s Green Hydrogen ‘Magic Chess’),” 2023, https://www.sohu.com/a/745211624_120717004.

48 | Xiangchenghui 香橙会, “30家上市公司跑步入场,谁能切分到电解槽市场大蛋糕?(30 Listed Companies Are Running to Enter the Market, Who Can Cut the Big Cake of the Electrolyzer Market?),” Of Week 维科网, June 13, 2024, https://archive.is/4PV9a.

49 | IEA, “Advancing Clean Technology Manufacturing - An Energy Technology Perspectives Special Report.”

50 | Zhong Rui 仲蕊, “电解槽企业忙‘出海’ (Electrolyzer Companies Are Busy ‘Going to Sea’),” People’s Daily 人民日報, 2023, http://paper.people.com.cn/zgnyb/html/2023-10/30/content_26025123.htm.

51 | GoalFore Advisory 国复咨询, “电解槽企业出海‘论剑’ (Electrolyzer Companies Go Overseas to ‘Debate’),” 2024, https://news.goalfore.cn/latest/detail/54082.html; Liu Jia 刘佳, “氢能产业步入发展快车道 (The Hydrogen Energy Industry Has Entered the Fast Lane of Development),” Xinhua 新华, 2024, http://www.news.cn/energy/20240325/0031fb515b8241f3bf388e80723aea7e/c.html.

52 | Chinabaogao 观研报告网, “各地补贴政策频发 多家企业布局 绿氢行业或成我国氢能发展主方向.(Frequent Subsidy Policies in Various Places, and the Layout of Many Enterprises The Green Hydrogen Industry May Become the Main Direction of Hydrogen Energy Development in China),” 2024, https://www.chinabaogao.com/detail/696681.html.

53 | Bloomberg News, “China Solar Leaders Urge Government Intervention to Cure Slump,” June 11, 2024, https://www.bloomberg.com/news/articles/2024-06-11/china-solar-leaders-urge-government-intervention-to-cure-slump.

54 | Xiangchenghui 香橙会, “30家上市公司跑步入场,谁能切分到电解槽市场大蛋糕?(30 Listed Companies Are Running to Enter the Market, Who Can Cut the Big Cake of the Electrolyzer Market?).”