The National People's Congress + Sustainable development + State-owned enterprises

"Two Sessions": National pride, innovation, self-sufficiency - and a tough line on Hong Kong

The Spring Festival is over and the most important event in China’s political calendar is coming into view. The "Two Sessions" – the plenary session of the National People's Congress (NPC) and the Chinese People's Political Consultative Conference – will begin on March 4. At a time when many nations are still in Covid-19 lockdown, more than 5,000 delegates will travel to Beijing to take part.

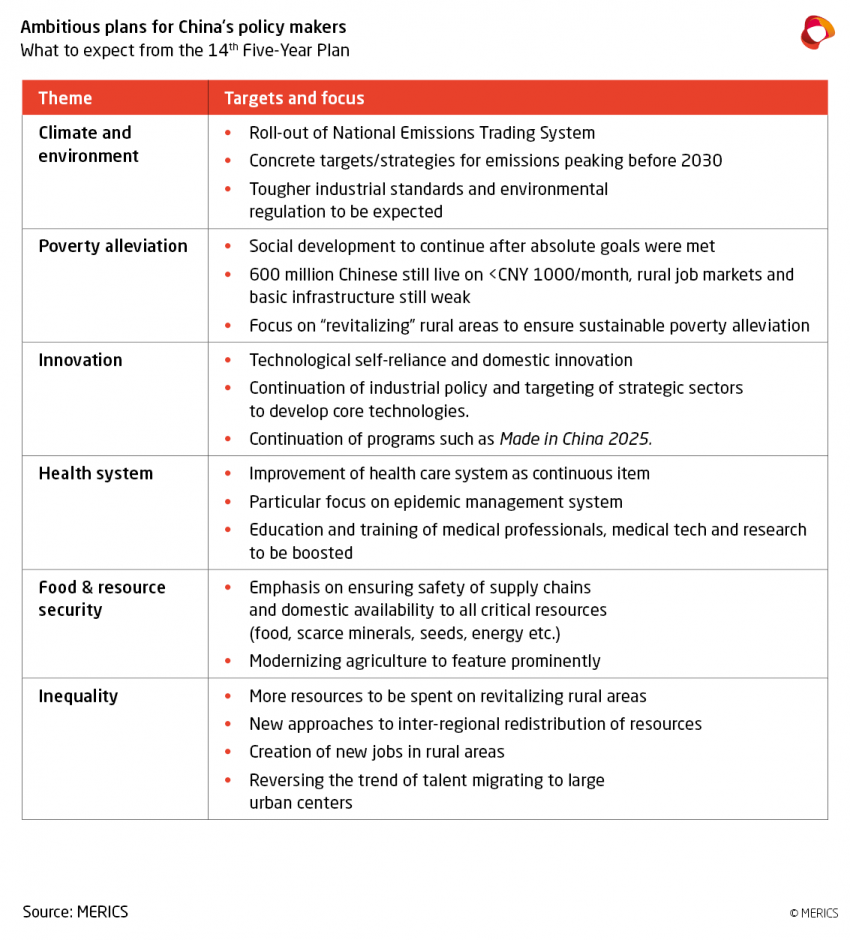

This year's NPC will be a special for several reasons. A year after the start of the pandemic – which even China has not yet fully overcome – the country’s leadership under State and Party leader Xi Jinping will try to use it to demonstrate self-confidence and strength at the start of a year that marks the centenary of the founding of the Chinese Communist Party (CCP). Premier Li Keqiang will present a work report that will give insights into the priorities for Chinese politics this year. But the focus of attention will be on the 14th Five-Year Plan, which will be officially passed by the delegates.

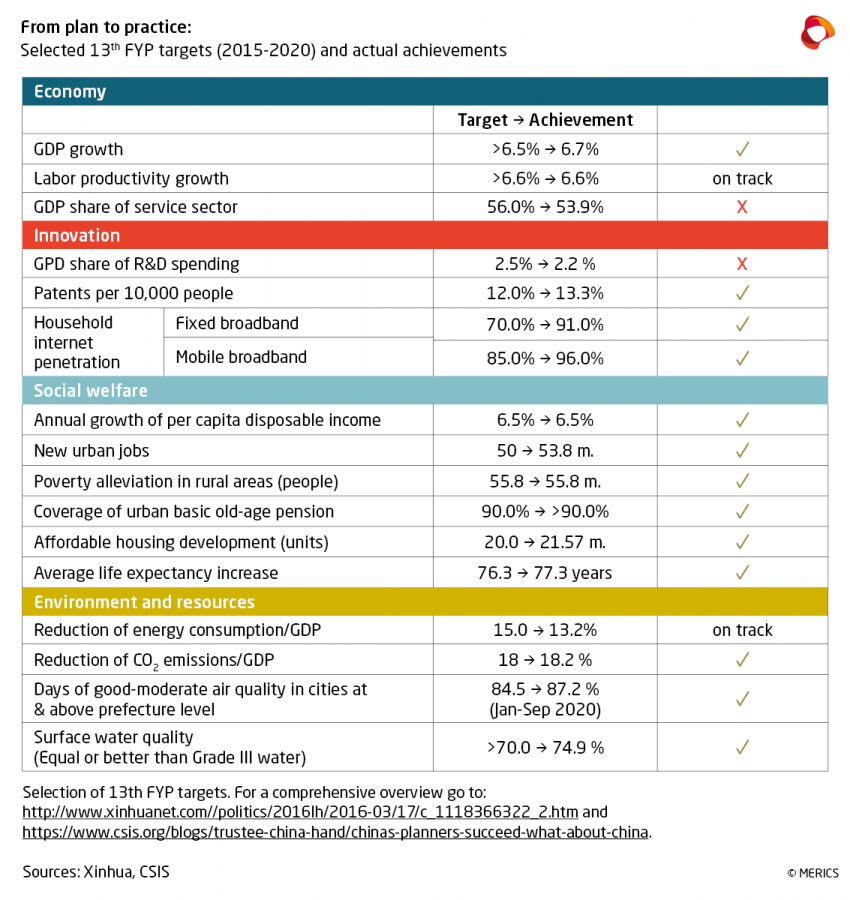

Celebrating the targets achieved – and setting ambitious new ones

In the draft Five-Year Plan, the Chinese leadership celebrated its recent successes. Despite the pan-demic, it reached its goal of achieving a “moderately prosperous” China by 2021. Now "socialist mod-ernization" is scheduled to be completed over the next 15 years – and the leadership is expected to present the NPC its "visions for 2035." For example, China’s leaders expect the country's economic output to double in this time – and they are likely to give the People's Congress more details about which investments and economic policy decisions they expect will bring China closer to this goal.

Worrying about domestic demand – and striving for high-quality growth

China’s current economic growth is solid in international comparison. But worried about internal de-mand, China leaders are expected to introduce several measures to boost domestic consumption.

But the NPC is not expected to adopt concrete growth targets. The Chinese leadership is all too aware of how unpredictable the Covid-19 crisis has made domestic and global developments. In-creased volatility makes setting growth targets more risky. But the complexity of restructuring of the economy is probably the main reason why China’s leaders have backed off setting clear growth tar-gets. There has been an ongoing debate on whether China will (finally) drop GDP growth targets in an effort to focus more on quality growth. The 2021-2025 Five-Year Plan names renewing the county’s industrial base, catching up with industrialized economies and technological renewal as central pro-jects.

Focusing on high tech and climate – and clamping down on Hong Kong

To achieve these goals, China’s leadership is focusing on technological and scientific innovation, and implementing its climate targets. By 2060, for example, carbon dioxide emissions are meant to fall to zero – a huge challenge for a country that today still meets most of its energy demand by burning coal and other fossil fuels. Also, having endured a trade war with the US, China now wants to become less dependent on international suppliers of technology and expertise – not least in the semiconductor sector so essential for digitalization. Developing the high-tech sector, "qualitative growth" and self-sufficiency are the order of the day – as should become very clear at the People's Congress.

Delegates are also expected to again take up the issue of Hong Kong – deliberations that will be watched very closely by Western governments. Beijing is reportedly planning to tighten election rules in the special administrative region. Last year’s NPC ushered in the National Security Law as a prel-ude to the political clampdown in the special administrative region.

Media coverage and sources:

NPC looks ready to help ensure that “Hong Kong is governed by patriots”

The facts: This year’s two back-to-back sessions of the NPC and the CPPCC will again have Hong Kong on their agenda, according to state media. Last year’s NPC ushered in the National Security Law as a prelude to a clampdown in the then protest-ridden special administrative region. In a widely reported speech, Xia Baolong, director of Hong Kong and Macao Affairs Office of the State Council, recently reminded his listeners that Hong Kong had to be governed by “patriots.” In other words, every member of Hong Kong’s legislature, judiciary and administration must love the Chinese motherland and support its Communist Party.

Indeed, measures to enforce this principle were tightened this month: New draft legislation introduced in Hong Kong will require all members of the city’s legislature and district councilors to swear an oath of loyalty. Political representatives who break their pledge will be banned from office for five years. EU officials met on Monday to contemplate measures in response to the diminished political freedoms and rule of law in the city, such as terminating extradition treaties.

What to watch: Party-state media have recently lamented “loopholes” in Hong Kong’s electoral system that allow “non-patriots” into office and endanger national security. They have explicitly called for an overhaul of Hong Kong’s election rules. China's leadership is reportedly planning to table a bill to the NPC that would oust opposition groups from the election committee that decides the head of government in the special administrative region. Nearly a year after the NPC passed the National Security Law, delegates look set to overwhelmingly approve even tighter controls over Hong Kong.

MERICS analysis: “Far-reaching as it is, last year’s National Security Law was never supposed to rein in dissent and ensure centralized rule over Hong Kong on its own. Supporting measures have long been in the works. The EU needs to be prepared for the fact that the NPC will continue to use its legislative power to change the constitutional and political order of Hong Kong.” Katja Drinhausen, MERICS Senior Analyst.

Media coverage and sources:

- Global Times: Top policymakers detail standards, fundamentals for HK political reforms

- WSJ: Beijing wants to shake up membership of Hong Kong’s election committee

- SCMP: Five-year election ban for Hong Kong lawmakers, district councillors disqualified over improper oaths Xinhua:夏宝龙出席并讲话(Xia Baolong speech on Hong Kong cited by Xinhua)

- Politico: EU mulls action amid Hong Kong crackdown

Sustainable development will be a priority at the NPC and in the coming Five-Year-Plan

The facts: Since Xi Jinping’s pledge of carbon neutrality by 2060, carbon-reduction policy appears to be gaining momentum in China. This week the State Council released a circular which stresses the importance of green development, including the promotion of a circular economy and low-carbon economy. Over the last weeks several state-owned enterprises, among them large polluters in energy and heavy industries, have announced timelines for carbon reduction. In December, China announced it will aim to peak carbon emissions before 2030, and in January released the ground rules for its National Emission Trade System.

What to watch: At the eve of the NPC and the release of the 14th Five-Year-Plan, recent efforts show Beijing’s commitment to sustainable growth. China’s track-record on implementing green policies is mixed. Being by far the world leader on new installations of renewable energy, China is also still developing massive amounts of coal power capacity. The new Five-Year-Plan will have to initiate a shift to more forceful green policy and implementation at local levels to make sure ambitious climate targets can be met.

MERICS analysis: The main issue for Beijing has not been its willingness to emphasize the importance of sustainability but implementation, especially in the heavy polluting sectors of energy, steel and cement. These industries are the drivers of supply-side reform, which Beijing has been pushing to counteract economic downturns. Moreover, the national climate and environmental policy has not been equipped with the necessary resources and authority to enforce ambitions at local level.

MERICS Senior Analyst Nis Grünberg: “The key to a successful green transition will not only be national targets but making sure all the key players in the system are compelled to comply. Recently, a high-level inspection team issued a report critical of the energy administration’s reluctance to control coal power, a hopeful sign that the implementation gap between national policy ambition and local realities will finally be addressed.”

More on the topic: “Greening” China: An analysis of Beijing’s sustainable development strategies" MERICS China Monitor by Anna Holzmann and Nis Grünberg.

Media coverage and sources:

State-owned enterprises to raise R&D to support Five-Year Plan’s innovation goals

The facts: China's 96 big state-owned enterprises (SOEs) will invest more in research and development and focus on high-quality development over the coming years, the State-owned Assets Supervision and Administration Commission (SASAC) said last week. "Our centrally administered SOEs and enterprises […] are preparing for the 14th Five-Year Plan,“ SASAC head Hao Peng said at a press conference with a view to the National People’s Congress that is expected to formally adopt China’s economic plan for 2021 - 2025.

The 14th Five-Year Plan will focus on building China’s domestic innovation capacity in key industries. In October 2020, the Chinese Communist Party’s Fifth Plenum Proposal declared innovation a “strategic support” for national development and ascribed it “the core position” in China’s overall modernization. The country’s industrial and technology policy is increasingly geared toward achieving greater self-reliance, for example, by supporting Chinese companies to upgrade their capabilities and move up the global semiconductor value chain.

What to watch: One of the most important short-term factors that will affect Chinese progress in many strategic technologies – especially semiconductors – will be US President Joe Biden’s stance on technology transfers after his predecessor presided over various measures that targeted technology transfers to China. Despite the new Five-Year Plan’s ambitions, China has a mixed record in promoting domestic progress in complex sectors such as semiconductors.

While China probably already has self-contained innovation and production capacity in many areas, catching up to the global technological frontier is much more challenging. Beijing’s goal is not to mimic other national innovation systems, but to build an effective system that is compatible with “socialism with Chinese characteristics.” Examples of features distinctive to China are the emphasis on national “top-level design” and the leadership of the Chinese Communist Party.

MERICS analysis: “While China has many great strides in many areas, it still lags significantly in many others. In the semiconductor sector especially, much depends on the US government’s ability to enforce these and coordinate them with allied governments. Even with progress in domestic innovation capacities, Chinese firms are unlikely to close the gap with global industry leaders without continued access to foreign technologies.” MERICS analyst John Lee.

More on the topic: ”The rise of geoeconomics and the need for a resilient European semiconductor industry”. Short analysis by Brigitte Dekker and Anna-Lena Rhiem, participants of the MERICS European China Talent Program 2020.

Media coverage and sources:

• SCMP: Xi: Achieving greater self-reliance is at the heart of China’s economic plans

• CNBC: China unveils plans to boost chipmakers – analysts are sceptical

• 中国共产党第十九届中央委员会第五次全体会议公报 (CCP Fifth Plenum Communique)

• WSJ: China’s SMIC Says It’s Missing Out on the Chip Boom Due to U.S. Restrictions

NPC set to discuss key economic challenge of boosting domestic consumption

The facts: Amid travel restrictions, Chinese consumers spent around CNY 821 billion (~EUR 105 billion) on shopping and dining during this year’s Lunar New Year holiday week. This is an increase of 28.7 percent over last year. However, it marks an uptick of only 4.9 percent from 2019, far below pre-pandemic yearly growth rates of around 10 percent. In 2020, retail recovery was the weak spot in China’s economic recovery, falling 3.9 percent from the previous year.

What to watch: Boosting domestic consumption will be one of the key economic priorities discussed during the upcoming Two Sessions. Policy meetings and announcements in recent months have made clear that China’s leadership is intent on strengthening demand-driven economic growth over the next five years - a key part of its “dual circulation strategy.” Rural consumption is receiving special policy attention within the context of the government’s broader initiative to vitalize China’s comparatively underdeveloped countryside. Other focus areas for boosting consumption are the automotive sector, home appliances and food and beverage.

MERICS analysis: While domestic consumption has recovered significantly since the Covid-19 outbreak, it remains a longer-term challenge for economic growth as China enters its 14th Five-Year Plan phase. Even after the pandemic, the government will struggle to bolster demand-driven growth, as this requires a significant rebalancing of income distribution to raise households’ purchasing power. Boosting sustainable domestic demand has long been a top policy priority that has featured in previous five-year plans but China’s lack of significant progress so far shows how challenging it will be for the government to achieve this goal."

Media coverage and sources:

• Bloomberg: China’s holiday consumption withstands travel restrictions

• MOFCOM: Original announcement on boosting rural consumption

• Xinhua: China to fully advance rural vitalization, facilitate modernization of agriculture, rural areas

VIS-À-VIS: Plamen Tonchev: “The thrill is gone from the China-CEE cooperation format”

Plamen Tonchev, Head of Asia Unit at the Institute of International Economic Relations (IIER), Greece, discusses the past, present and future of the 17+1 format. Tonchev is currently a European China Policy Fellow at MERICS and is studying China’s Belt and Road Initiative (BRI) and the infrastructure scheme’s impact on climate change.

Questions by MERICS analyst Grzegorz Stec

Why were the results of the February 17+1 summit between China and CEE countries so thin?

The rationale behind the summit related primarily to optics rather than substance, as China wanted to score a political point. The mere fact that the summit took place could be seen by Beijing as a positive development. However, what came out of it did not quite match China’s expectations. Six CEE countries downgraded their level of participation, despite the presence of President Xi Jinping, who had to put on a brave face. It’s clear that China’s supreme leader overplayed his hand as a result of overestimating his personal weight. In terms of outputs, Beijing’s initial draft guidelines were much longer, but the meeting only yielded a rather short list of “activities” without the usual lofty manifesto presented at other China-CEE summits. Infrastructure development is no longer the focus of cooperation. Instead, China emphasized trade, (Chinese) vaccines and culture. This could be attributed to Beijing’s failure to deliver on its earlier pledges for investment in infrastructure, as well as to concerns voiced by CEE countries about their growing trade deficits with China. Notably, Beijing inserted a reference to the simplification of customs procedures for Chinese goods shipped from Piraeus through the Western Balkans corridor. Vaccines are the new tool in Beijing’s diplomacy amid the pandemic, while culture is seen as a relatively easy and painless area of cooperation.

Did the CEE countries get any of the concessions they wanted at this meeting?

The only substantive concession made by Beijing was the promise to import CEE agricultural products worth up to USD 170 billion over the next five years – although it remains to be seen to what extent this will be honored. Cultural cooperation is not viewed a priority by CEE countries. And the promotion of Chinese vaccines is not a concession, but increasingly part of China’s foreign policy. Hungary and Serbia have already agreed to import Chinese vaccines, and other CEE countries may also join them.

Does the outcome of the summit tell us anything about the future of the 17+1 format?

Looking at the pros and cons of the summit, the balance looks rather negative for China. It is no longer embraced by many CEE countries – I would say that the thrill is gone from this cooperation format, which was based on some flawed assumptions anyway. Clearly, there is a north-south divide. Countries in the northern part of CEE, in particular the Baltic republics and Poland, are becoming more cautious about – in some cases even hostile towards -– the format. At the same time, in the southern part of CEE, China’s image is more positive and the level of acceptance of its initiatives is higher. And it’s not just Serbia, there are other countries in Southeast Europe still willing to work with China and pinning some hopes on it. Some opt-outs – in the Baltic region, for example – cannot be ruled out. But the scenario that the China-CEE format will dissolve altogether remains far-fetched – that would be a huge loss of face for Beijing.

This summit will probably lead to soul searching in China’s top echelons and some heads may roll. I think China will try to ingratiate itself to CEE countries and make improved offers to address some grievances. There is a range of possible options beyond that. For example, the China-CEE platform could be reduced to the ministerial level, various ad hoc co-operation modalities and sub-regional mechanisms, for example, Western Balkans+1, or summits thinned out or participation deemed voluntary. These face-saving arrangements would allow China and its remaining supporters in CEE to keep the format afloat, even though it is losing traction.

This interview is an excerpt of a recent episode of the MERICS podcast. Listen to the full interview here:

METRIX

6,8%

As China’s government will probably not announce a growth target for 2021 during the NPC, MERICS has done some calculations of its own. We took GDP data reported by provincial statistics bureaus and the 2021 targets mentioned in provincial work reports and then weighted these to take into account the economic power of each region. The resulting average annual national growth rate was 6.8 percent. Provincial figures are not always representative of nationally-reported growth, but this nevertheless suggests that provinces appear to be taking a relatively conservative view towards economic recovery.

PROFILE: Sun Chunlan – China’s vice premier for health and only woman in the Politburo

With the annual session of the National People’s Congress expected to formally approve China’s fourteenth Five-Year Plan at the start of March, Chinese Vice Premier Sun Chunlan recently reminded officials they had to keep the coronavirus in check to ensure the country’s 2021 - 2025 policy roadmap got off to a good start. As vice premier in charge of culture, education and public health, 70-year-old Sun is one of China’s highest-profile politicians in the fight against the Sars-CoV-2 pathogen and the Covid-19 disease. She oversaw China’s emergency response in Wuhan in early 2020, coordinating Beijing’s massive deployment of doctors and resources to the hard-hit city over several long weeks.

The only female member of the ruling Communist Party’s 25-member Politburo, Sun shows that Mao Zedong’s famous conviction that “women hold up half of the sky” still does not apply in the lofty halls of Zhongnanhai. As Chinese officials over 68 normally do not start new term in office, Sun is expected to retire in 2022 – and there are few women in her cohort likely to move up to make China’s top ranks any less male-dominated any time soon. There are currently only two other women in China’s central political leadership: Shen Yueyue, the 64-year-old President of the All-China Women's Federation and a Vice-Chairwoman of the National People's Congress Standing Committee, and Li Bin, who is 66 years old and a secretary general of the China People's Political Consultative Conference (CPPCC).

Sun has a varied background. She served large social organizations, such as the All China Federation of Trade Unions, and also filled leading political positions in Fujian, Tianjin, and Liaoning Province (where she worked alongside Premier Li Keqiang). She also served as Director of the Chinese Communist Party’s United Front Department, coordinating the party’s relations with non-state organizations and groups. Sun was born in May 1950 in Raoyong County, Hebei province, and has a degree in mechanics from Anshan Industrial Technology Academy, Liaoning province. She started her career in a factory in Anshan and joined the CCP in 1973, towards the end of the Cultural Revolution.

Media coverage and sources:

• Global Times: Chinese Vice Premier calls for anti-epidemic loopholes in villages to be plugged

• SCMP: The women in China’s war on the coronavirus

• US China Business Council: Profile State Council Vice Premier Sun Chunlan

• CGTN: Sun Chunlan hails the medical teams from other provinces

• The Diplomat: H.I. Sutton on the Future of Underwater Warfare in the Indo-Pacific Region

MERICS China Digest

TOP 3:

- Xinhua: Xi declares "complete victory" in eradicating absolute poverty in China

- SCMP: China shares video of deadly 2020 border clash with Indian troops in Galwan Valley

- Nikkei Asia: US and allies to build 'China-free' tech supply chain

Politics, society and media:

- AP: China steps up online controls with new rule for bloggers

- Caixin: China may ease controls on citizens’ offshore investments

Economy, finance and technology:

- Nikkei Asia: China boosts rare-earth output amid growing tech war with US

- China Banking News: Chinese STAR market stocks make their debut on global benchmarks

- Reuters: SWIFT sets up JV with China's central bank

- Bloomberg: Moutai’s USD 80 billion rout sends signal for China’s stock market

International relations: