Shanghai auto show + Chinese ambassador on Ukraine + European tech firms in China

Top story

Chinese EV makers set the pace for stuttering foreign rivals at Shanghai car show

The Shanghai International Automobile Industry Exhibition in the latter half of April showed that Western car makers are increasingly looking to Chinese electric-vehicle (EV) makers for innovation and collaboration – the reverse of the dynamic in pre-Pandemic 2019, when foreigners were last able to attend the biennial trade fair in big numbers.

Reports indicate that attendees from overseas were surprised by the progress their Chinese competitors have made in the last four years, all at a time in which European companies feel a growing need to expand research and development in China to keep up with the high pace of innovation in the world’s largest EV market.

Stand-out Chinese-made products on display in Shanghai until April 27 pushed the envelope in terms of range, power and technology: the BYD Seagull, a full-sized sedan EV with a battery range of around 300 kilometers and a price tag of only USD 11,400; the luxury SUV EV U8 by Yangwang, a luxury brand developed by BYD, with independent motors allowing it to ‘tank turn’ and rotate on a dime; a sodium-ion EV battery by CATL, a cheaper alternative to lithium-ion, which is slated for use by EV maker Chery.

The success of China’s EV ecosystem has seen Chinese manufacturers take significant market share from foreign competitors. Chinese brands held only 35.7 percent of the domestic market in 2020, but had pushed their share to 49.7 percent in the first quarter of 2023.

Over the same timeframe, German brands saw their market share fall from 25.5 percent to 21.8 percent and Japanese brands from 24.1 percent to 16.8 percent. Some European automakers are already integrating Chinese firms into their value chains, for example contracting with CATL to supply EV batteries. And they and European suppliers are increasingly interested in local R&D footprints to better tap into China’s world-leading innovation ecosystem.

MERICS analysis: “European automakers faced a rude awakening at the Shanghai car show as China’s EV champions displayed cutting edge models, from budget to luxury, while Chinese suppliers unveiled breakthrough technologies in EV batteries and more,” said Jacob Gunter, MERICS Senior Analyst. “With sizeable investments in China and shrinking market share, European automakers are under pressure to find new ways to compete in China and, increasingly, in their home markets against Chinese competitors.”

More on the topic: China's innovation system and the localization dilemma, Report by MERICS and the European Union Chamber of Commerce in China

Media coverage and sources:

Metrix

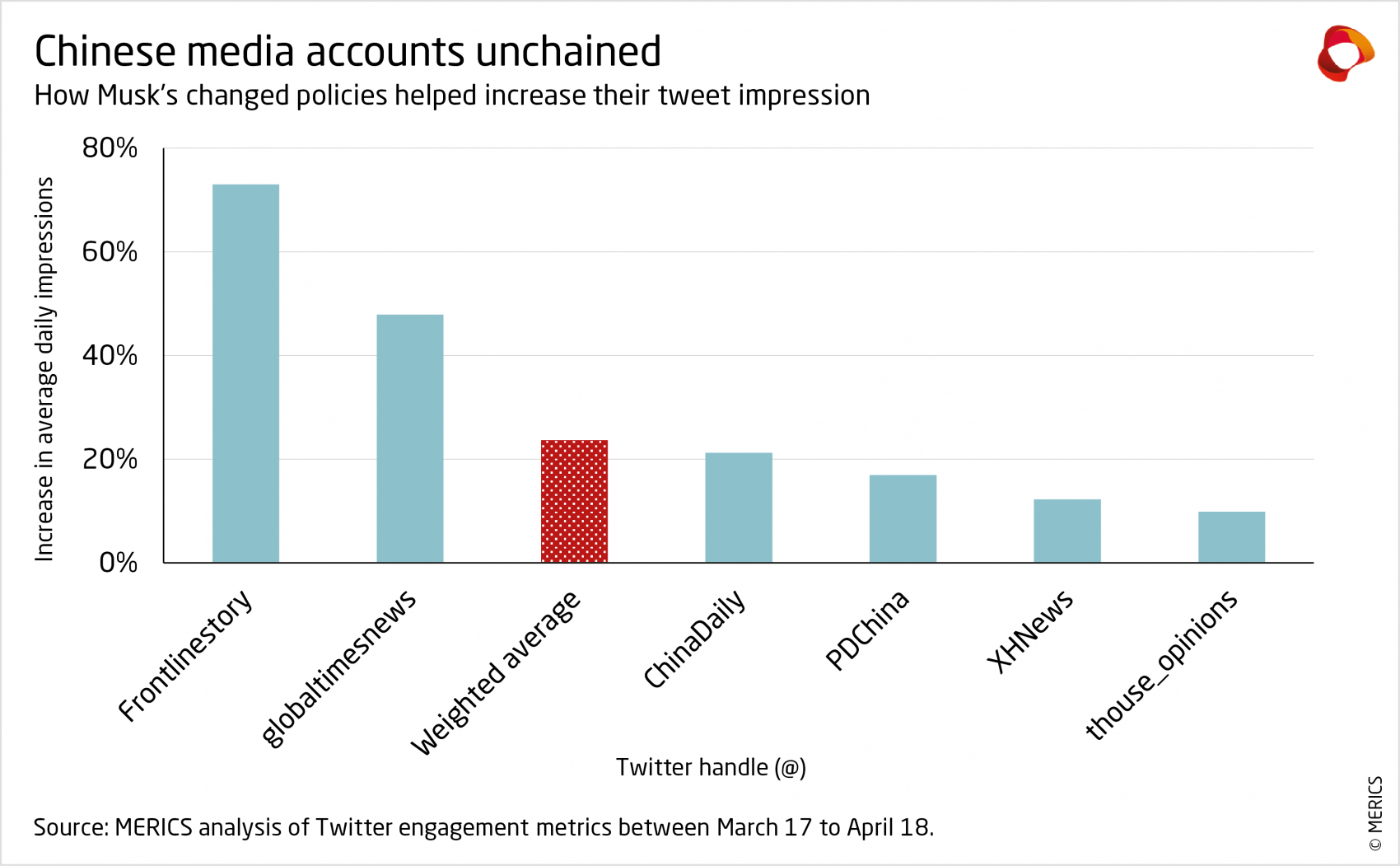

23.7%

This is the rise in average Tweet impressions – tweets served to users in their timeline or search results – recorded by six Chinese state-media outlets since Twitter stopped labelling and filtering content by state-affiliated accounts. Before starting to make changes on March 29, the company alerted users when they were browsing state-media tweets and used its algorithm to make such content less visible. Elon Musk’s decision to end this policy has increased the risk of Chinese state media influencing of Western public opinion and has again highlighted the need for regulation. (Sources: MERICS analysis of Twitter engagement metrics between March 17 to April 18, DFRLab)

Topics

In questioning Ukrainian sovereignty, Beijing’s Ambassador to France tests waters on Taiwan

The facts: In an interview with French news channel LCI, China’s Ambassador to France Lu Shaye indirectly questioned the sovereignty of Ukraine, wracked by war after the Russian invasion in February 2022. Countries that belonged to the former Soviet Union “have no effective status because there is no international agreement to concretize their status as sovereign countries,” he asserted. Ambassador Lu’s statement is just the latest in a series of controversial remarks that have earned him a reputation as the last of China’s “wolf-warriors” in Europe, a group of diplomats known for their assertive, often undiplomatic behavior, defending Beijing aggressively even at the cost of relations with the countries where they are posted. Recently, China appeared to be backing away from this style of diplomacy.

What to watch: In fact, Beijing has officially distanced itself from Ambassador Lu’s most recent remarks, stating that they were just the expression of a personal viewpoint and did not reflect China’s official stance. Yet, the Ambassador has not received any form of public reprimand. It remains to be seen whether the remarks remain an isolated incident or if other arguments emerge to suggest China may be more strongly throwing its weight behind Russia. Until now, it has remained relatively reserved on the subject. Yesterday President Xi had a much-awaited first phone call with President Zelensky since the beginning of the war.

MERICS analysis: “The Ambassador’s statement can be viewed as a test of an extreme argument. To avoid a diplomatic strain in its relationship with Europe, Beijing has rejected the comments. However, it creates a basis for drawing parallels between the Russia-Ukraine and China-Taiwan conflicts in the future, in which both Taiwan and Ukraine are not recognized as full states, legitimizing Russia’s war of aggression and any future moves by China to take Taiwan,” says Francesca Ghiretti, Analyst at MERICS in Brussels.

Media coverage and sources:

- LCI interview on YouTube: L'interview polémique de Lu Shaye, ambassadeur de Chine en France

- Chinese Ministry of Foreign Affairs: Press statement on Lu Shaye’s statement

- Le Monde: Parliamentarians call on French FM to expulse Lu Shaye

- Politico: European reactions on Lu Shaye’s statement

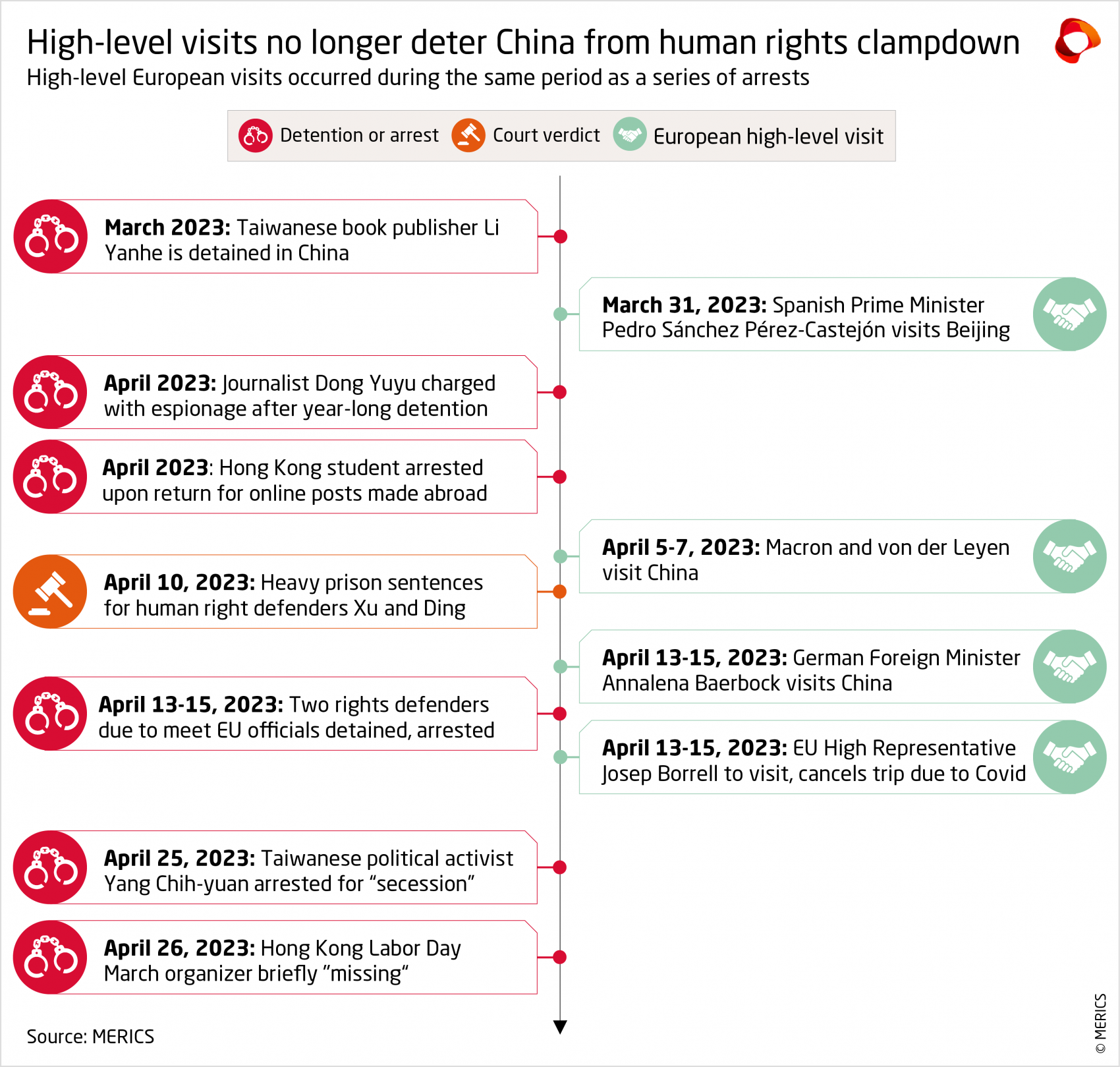

High-level EU-visits fail to deter Beijing’s human rights clampdown

The facts: Recent weeks saw a flurry of high-level visits by European leaders to Beijing to reset relations and seek space for common ground with China. All appealed to the Beijing leadership to adhere to international human rights standards. But the reengagement was overshadowed by detainments, arrests and sentencings of human rights activists, journalists and regular citizens, including in Hong Kong (see table). The wave of cases adds to concerns about the fate of people detained after protests broke out across the country at the end of last year.

What to watch: This marks a qualitative change compared to just three or four years ago, when such cases were handled more quietly when international visitors were around. Now, Beijing has dropped any pretense of restraint in its pursuit of public and political order. This goes even beyond the mainland. Arrests and sentencing continue in Hong Kong, including the arrest of a returning student for online posts made while abroad. Where previous leaders were deterred by reputational risk, China under Xi seems to trust in the country’s global clout and coercive power to burnish its global image.

MERICS analysis: “When engaging with China, foreign leaders must understand that Beijing has a very different vision of human rights in mind, even if it pays lip-service to it,” says Katja Drinhausen, Head of Program Politics and Society at MERICS. “Instead, Beijing argues that maintaining stability and collective security by any means is necessary to protect human rights – no matter the cost to the individual,” says MERICS Analyst Alexander Davey.

Media coverage and sources:

Tough times for European tech firms in China

The facts: In early April, Chinese tech unicorns (Galaxy Space, Hyper Strong, and Horizon Robotics) met with new premier Li Qiang, accompanied by industry and science ministers. The meeting received considerable media attention in China. It is yet another signal that China’s regulatory crackdown on the tech industry (dubbed “rectification”) has ended, and that for industries strategically important in Xi’s “New Era”, such as green energy, semiconductors, software and AI, and biotech, there is a new status quo. Two weeks later, the Central Committee for Comprehensively Deepening Reform – a supra-ministerial party-body led by Xi Jinping – announced a new strengthening of China’s private industry in developing home-grown technology.

What to watch: In its attempt to achieve technological self-reliance and leadership, China’s tech stars in strategic sectors will receive increasing support. At the same time, European companies in these fields recently received mixed signals. While Dutch semiconductor machinery maker ASML and German chemicals company BASF have been given preferential treatment, Nokia was put under pressure to maintain an IoT joint venture with Huawei. SAP, on the other hand, is about to face new competition in its core business from Huawei, which unveiled new in-house industrial software.

MERICS analysis: “The latest events show how fragile business relations in strategic sectors are,” says MERICS Analyst Kai von Carnap. “With one hand, Beijing seeks to ensure access to strategic and irreplaceable production lines, while replacing foreign companies with domestic ones wherever possible. The current trajectory implies that foreign tech companies that are not irreplaceable will face an increasingly unfavorable environment. Those that still have useful technology or know-how may find it harder than expected to disentangle themselves."

More on the topic: Decoupling - Severed ties and patchwork globalization, report by MERICS and the European Chamber of Commerce in China

Media coverage and sources:

- Xinhua (CN): 习近平主持召开二十届中央全面深化改革委员会第一次会议强调 守正创新真抓实干 在新征程上谱写改革开放新篇章 李强王沪宁蔡奇出席. (Xi Jinping presided over the first meeting of the 20th Central Commission for Comprehensively Deepening Reform, emphasizing the importance of innovating, and writing a new chapter of reform and opening up on the new journey. Li Qiang, Wang Huning and Cai Qi attended.)

- Xinhua: Chinese premier stresses boosting high-quality development with confidence, innovation

- The Economist: How to make it big in Xi Jinping’s China

Review

The Twilight Struggle by Hal Brands (Yale University Press, 2022)

Xi Jinping recently opined about the “all-round containment” of China by the West, to which the author of this detailed thematic history of the Cold War might reply, “If only!” A political scientist at Washington’s Johns Hopkins School of Advanced International Studies (SAIS), Hal Brands wants his book to “sharpen the judgment” of those in charge because “the United States particularly needs such sharpening right now.” Like the US elite at the start of the Cold War with the Soviet Union, Brands worries the US is ill prepared for today’s rivalries with China and Russia, “probably” already cold wars.

The author subtitled his book, “What the Cold War teaches us about Great-Power rivalry today,” and delivers a twelve-point extrapolation in his final chapter. To get there, Brands wades through the highs and lows of US post-World War II history – the realization it shouldn’t fight against Stalin, the birth of containment under a then-unique nuclear shield, the invention of “the free world”, the nuclear stand-off, many proxy wars, including the disaster of Vietnam, Soviet strength in the 1970s, Nixon in China, détente, US economic, technical (and military) edge, victory thanks to Reagan, Gorbachev, Bush.

The Cold War was exhausting and expensive, but Brands says it was better than a hot war and better than “appeasement”. For him, great-power rivalry is innate and zero sum, and the first lesson in the book’s conclusion is that “long-term competition requires navigating between […] disastrous escalation as well as disastrous retreat.” His tool of choice to engineer such a “twilight struggle” with China and Russia is containment – which does not mean tolerable co-existence (in his view, détente was always bound to fail), but a step towards one side winning. “Losers can fall into decline, even disaster”, he warns, apparently confident that fear will sharpen his countrypeople’s judgement.

Reviewed by Gerrit Wiesmann, freelance editor

MERICS China Digest

China’s Xi calls Zelenskyy, in first contact since Putin launched war on Ukraine (Politico)

Chinese president Xi Jinping spoke to Ukraine’s president Volodymyr Zelenskyy on the phone this Wednesday. It was the first time Xi has spoken to Zelenskyy since Russia launched its war on Ukraine more than a year ago. Zelenskyy said it was “long and meaningful” in a Twitter post. (23/04/26)

G7 top diplomats spotlight unity on China and Russia amid talk of rift (The Japan Times)

The joint communique following the G7 foreign ministers meeting in Japan this week emphasizes the group’s unity in tackling geopolitical challenges with regards to China and Taiwan. (23/04/18)

China's planned changes to espionage law alarm foreign businesses (Nikkei Asia)

An update to China’s counterespionage will expand the scope of the law – so far limited to state secrets – to cover transfers of any information related to national security. A greater focus will also be put on cybersecurity. The law does not provide details on what includes national security and interests and has raised concerns among foreign individuals and companies in the country. (23/04/25)

China releases rules for generative AI like ChatGPT after Alibaba launch (CNBC)

Chinese regulators released draft rules for generative artificial intelligence products like ChatGPT earlier this month. The measures lay out the basic rules that these services have to follow, including the type of content they are allowed to generate. According to the rules, content generated by AI needs to reflect the core values of socialism and should not subvert state power. (23/04/11)