Software industry + Labor gap + Big data

MERICS' TOP 5

1. Software industry plan to reduce reliance on foreign technology

At a glance: The Ministry of Industry and Information Technology (MIIT) released a 14th Five-Year Plan (FYP) for the software industry. The document underlines the importance of the software sector for China’s pursuit of an innovation-driven economy. Key targets for 2025 listed in the policy include:

- Raise the software industry’s total annual revenue to CNY 14 trillion, up from CNY 8.16 trillion in 2020; support 15 enterprises to reach revenue of over CNY 100 billion

- Achieve breakthroughs in the supply of software kernels (a core element of an operating system), development frameworks and other basic components

- Increase the number of indigenous industrial apps to over one million and promote their application in sectors such as shipbuilding, electronics, machinery and finance

MERICS comment: China’s self-reliance push increasingly prioritizes closing the technology gap in software, adopting a similar approach to semiconductors. Officials are mobilizing human and financial resources to accelerate local capabilities. For example, on December 6, 2021, the Ministry of Education released a list of specialized software colleges to be established at China’s top universities, as has been done for integrated circuits. In August 2020, the State Council released supportive measures granting tax concessions and other benefits to both industries. By the end of this year, it is reported China will have removed all foreign hardware and software from the IT systems of government offices and public institutions.

Leaders aspire to integrate software into all aspects of industry, to create a data-driven, high value-added manufacturing system. Yet as it stands, China’s capabilities in industrial software are weak and concentrated in low value-added segments. For instance, Germany’s SAP and the US’ Oracle account for over 90 percent of the high-end market of production management industrial software, thanks largely to their experience, brand recognition and full suite of service offerings. Foreign enterprises also dominated in R&D and design software. Even though Chinese software providers lag well behind established foreign players, they are likely to win more public as well as private customers as supporting local providers becomes an increasingly important political mission.

Article: 14th Five-Year Plan for Software and Information Technology Services (工业和信息化部关于印发“十四五”软件和信息技术服务业发展规划的通知) (Link)

Issuing body: MIIT

Date: November 30, 2021

2. Crisis management: Industry overhaul to boost productivity and tackle labor gap

At a glance: The MIIT released another FYP that aims to advance China’s industry through comprehensive informatization of the economy. Specifically, the document outlines several key missions for 2025:

- Boost the adoption of digital services and tools across the economy, including digital business management, R&D and design tools, numerical control (automated machine production) of essential processes, etc.

- Transform manufacturing by upgrading industrial supply chains, interlinking equipment, building informatization and industrialization into standards development, etc.

- Prioritize industries like steel, petrochemicals, coal, aviation, shipping, automotive, raw materials, equipment manufacturing, and green manufacturing

MERICS comment: Moving up the value chain and boosting productivity is critical to achieving two top priorities set by China’s leaders: escaping the middle-income trap and mitigating demographic challenges.

For decades, China enjoyed the advantages of cheap low-skilled labor. Recently, wages have risen considerably, which has resulted in the offshoring of low-skilled production to other markets. Nevertheless, China’s industry lags behind in terms of total factor productivity and value-added production. In fact, productivity growth has slowed in recent years. Boosting productivity per worker through automation and enhancing product quality through smart manufacturing is viewed as essential to escaping the middle-income trap.

Higher productivity, widespread uptake of automation and smart manufacturing as promoted in this plan are viewed as key tools in addressing China’s quickly emerging demographic crisis. Unlike countries such as Japan and Germany which became rich before becoming old, China is aging in the middle of its development trajectory. China’s workforce is expected to decline by 35 million over the next five years. As the workforce shrinks and higher burdens are placed on the social security system, China’s economy will have to do more with less.

Leading European companies in these sectors may see abundant new opportunities. However, if China’s companies succeed in boosting productivity, European manufacturers will have to compete with much stronger companies in China, third markets and even at home.

Article: 14th FYP for the Integration and Development of Informatization and Industrialization (工业和信息化部关于印发“十四五”信息化和工业化深度融合发展规划的通知) (Link)

Issuing body: MIIT

Date: November 30, 2021

3. China intends to triple its big data industry size by 2025

At a glance: The MIIT issued a FYP to promote the big data industry. The plan aims to fast-track big data applications across the economy and singles out priority sectors, including manufacturing (e.g., equipment manufacturing and consumer goods), finance and healthcare. Goals for 2025 include:

- Triple the size of the big data industry to CNY 3 trillion (annual growth rate of 25 percent)

- Form a high value-added, autonomous and controllable big data industry system

- Establish an initial market-based system to assess the value of data elements (for instance information on an individual’s consumer preferences) via several mature trading platforms

MERICS comment: The FYP clarifies that the government regards data as a national strategic resource, not long after the Chinese Communist Party (CCP) classified data as a factor of production in 2019. Data governance measures introduced in 2017 have, however, imposed additional burdens on data handling. The Data Security and Personal Information Protection laws have targeted data collection and processing and made cross-border transfers cumbersome. This plan firmly reestablishes the role of data in fostering development, at least within the bounds set by the new data governance framework.

On the industrial side, China continues to promote data as a general-purpose technology to raise productivity and become a “manufacturing superpower.” Support for data-driven economic applications and related infrastructure further increases the attractiveness of China for businesses. China also wants to capture the innovation potential imbued in its big e-commerce market by creating a data market. That could create new business models and promote household consumption – a long-held goal of the government.

The plan particularly affects foreign suppliers of data-related hardware and software. In the short-term, suppliers could benefit from increased demand as manufacturers upgrade their production. But in the long-term, localization demands could hurt foreign companies in China and abroad as political demands encourage adopting indigenous alternatives. Over time, Chinese suppliers may be able to leverage an increasingly protected home market and growing government support, to compete more aggressively in third markets, as was the case in high-speed rail and the ICT sector.

Article: 14th Five-Year Plan for the Development of the Big Data Industry (“十四五”大数据产业发展规划的通知) (Link)

Issuing body: MIIT

Date: November 30, 2021

4. R&D on maglev and vactrains to fast-track China’s rail technology upgrades

At a glance: The National Railway Administration (NRA) released China’s first-ever FYP for railway science and technology innovation. The government wants to develop highly advanced rail and construction equipment and boost China’s rail innovation system by improving coordination and resource use efficiency. Targets for 2025 include:

- Advance the level of China’s railway equipment – for rolling stock, this means developing passenger trains that can run at 400km/h

- Develop maglev systems with 600km/h speeds and vacuum tube trains which travel in reduced air resistance tubes to reach high speeds

- Establish a technology ecosystem that stretches across the entire value chain, from basic materials and core technologies to patents and standards

- Deploy digital technologies (including China’s Beidou satellite system, AI and cloud computing) across rail manufacturing, operation, maintenance and services

MERICS comment: Rail is a key industry for China’s manufacturing sector and crucial for China’s ambition to become a “Transportation Superpower.” In line with the national 14th FYP, this sectoral plan encourages companies to spend more on R&D and outlines priority technologies. Notably, China is looking to leap ahead of the competition by advancing cutting-edge technologies like vacuum tube trains that have not yet been mastered abroad.

The NRA proposes only a few new policy measures, which might reflect that policymakers are content with the current innovation system. 2021 saw several technological breakthroughs in the sector. In June, China launched its first self-developed maglev transport system and in October the International Organization for Standardization (ISO) published the first China-led rail standard.

The plan also calls for the creation of an independent technology system. After acquiring advanced technology from foreign companies, China has favored Chinese firms in public procurement and aims to develop autonomous and controllable technology supply chains to replace imported inputs. Foreign companies face the choice of retreating from the Chinese market or to further localize to maintain some access and retain their ties to China’s rail companies. Not an easy choice, given that China’s high-speed rail network is by far the world’s largest: 35,740km or 68 percent of the world’s total.

Article: 14th Five-Year Plan for Rail Science and Technology Innovation (“十四五”铁路科技创新规划) (Link)

Issuing body: NRA

Date: December 23, 2021

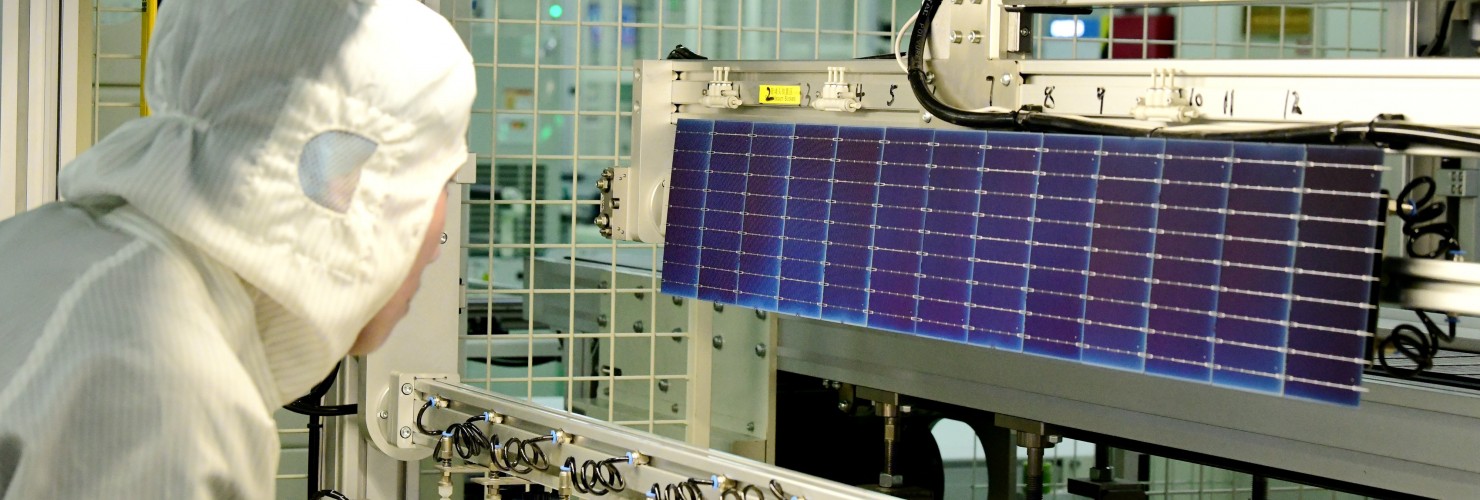

5. Industrial green development plan promotes clean tech manufacturing

At a glance: The MIIT released a FYP for industrial green development. The policy proposes the widespread adoption of environmentally friendly and low-carbon production methods. The document’s major targets for 2025 are:

- Reduce CO2 emissions per unit of value-added industrial output by 18 percent and gradually curb total carbon emissions of key industries such as steel, non-ferrous metals and building materials

- Increase the energy efficiency of key industrial input producers such as crude steel, cement and ethylene to globally advanced levels, as determined by the National Development and Reform Commission (NDRC)

- Support local production of green products and new energy equipment, including NEVs, high-power offshore wind power equipment and hydrogen technologies

MERICS comment: This plan underpins China’s decarbonization ambitions, as the industrial sector accounts for approximately half of the country’s total energy consumption and 80 percent of coal consumption. The document provides detailed guidance on required changes to production processes across diverse sectors. For instance, officials will promote clean casting, precision forging and green heat treatment in the machinery industry. Production capacity will be strictly controlled in high-emitting industries such as steel, plate glass and chemicals.

Many European companies already adopt their own strict environmental protection rules which may put them at a disadvantage compared to unbound competitors in China. As such, in areas where European firms compete directly with Chinese manufacturers, raising environmental standards in China will help to level the playing field. It will, to some extent, have a similar outcome as the proposed EU carbon border adjustment mechanism. At the same time, buyers of Chinese commodities can expect prices to increase due to the additional cost of investment in green production methods.

A need for more environmentally friendly products could stimulate higher demand for European suppliers of green equipment and services. Yet China’s policymakers are eager to cement their own companies’ positions as suppliers of green inputs. Increased support for the local development and adoption of green technologies, ranging from carbon and pollution reduction to efficient resource use solutions, will mean more competition for foreign suppliers.

Article: 14th Five-Year Plan for the Green Development of Industry (工业和信息化部关于印发《“十四五”工业绿色发展规划》的通知) (Link)

Issuing body: MIIT

Date: December 3, 2021

NOTEWORTHY

Policy news

- December 6: Ten government agencies, led by the Standardization Administration of China, issue the 14th FYP for the high-quality development of the national standardization system, outlining goals for standards in different sectors, including high-end manufacturing (SAC notice (CN))

- December 8: The NDRC releases guidelines for the green development of new infrastructure, aiming to reduce the dependence of data centers and 5G networks on coal-fired power plants (NDRC notice (CN); Reuters article (EN))

- December 13: The MIIT, along with four other departments, announces the catalog of major technical equipment which is exempt from import taxes, including components for nuclear reactors and semiconductor inputs (MIIT notice (CN))

- December 17: Numerous government agencies jointly release the 14th FYP on SME promotion, aiming for 100,000 specialized and new SMEs and 10,000 Little Giants by 2025 (MIIT notice (CN))

- December 20: The NDRC issues 14th FYP on the resource efficiency and environmental friendliness of industrial parks (NDRC notice (CN))

- December 22: The MIIT releases draft instructions for public institutions in industrial sectors to carry out risk information reporting regarding instances of data security risks, such as data leakage and data tampering (MIIT notice (CN))

- December 22: The Ministry of Transport (MOT) publishes the 14th FYP for digital transportation, seeking to boost the digital perception of transport facilities and develop smart transport services (MOT notice (CN))

- December 27: The Cyberspace Administration of China issues the 14th FYP for national informatization, outlining measures to upgrade the country’s digital infrastructure, innovation capacity, industrial structure and government services (CAC notice (CN))

- December 27: The NDRC releases the updated versions of the national and pilot free trade zone foreign investment negative lists, effective January 1 2022, which remove restrictions in the automotive and research service sectors (NDRC announcement (CN); NDRC announcement (CN); State Council article (EN))

Corporate news

- November 30: Sinopec announces it is building a hydrogen factory powered by renewable energy with an annual output of 20,000 tons in Xinjiang, making it the world’s largest under construction (The Paper article (CN); Yicai article (EN))

- December 17: German automotive supplier Continental is pressured by the Chinese government to stop using components made in Lithuania (Sohu article (CN); Reuters article (EN))

- December 20: Sinyang Semiconductor Materials cooperates with German Heraeus to accelerate the development of key components used in the production of advanced semiconductors (Yicai article (EN))

- December 23: Intel apologizes to suppliers in China that US legislation requires it to not source products or labor from Xinjiang (Reuters article (EN))

- December 23: China establishes the China Rare Earth Group through the merger of the rare earth units of five state-owned minerals enterprises (Yicai article (EN))

- December 27: China’s State Grid puts the world’s first 35-kilovolt superconducting power cable into operation in Shanghai (OpenGov Asia article (EN))