Trade and Technology Council + Chinese debates on sanctions on Russia + EU-Japan summit

ANALYSIS

After Ukraine, what can China expect from the EU-US Trade and Technology Council?

By Rebecca Arcesati

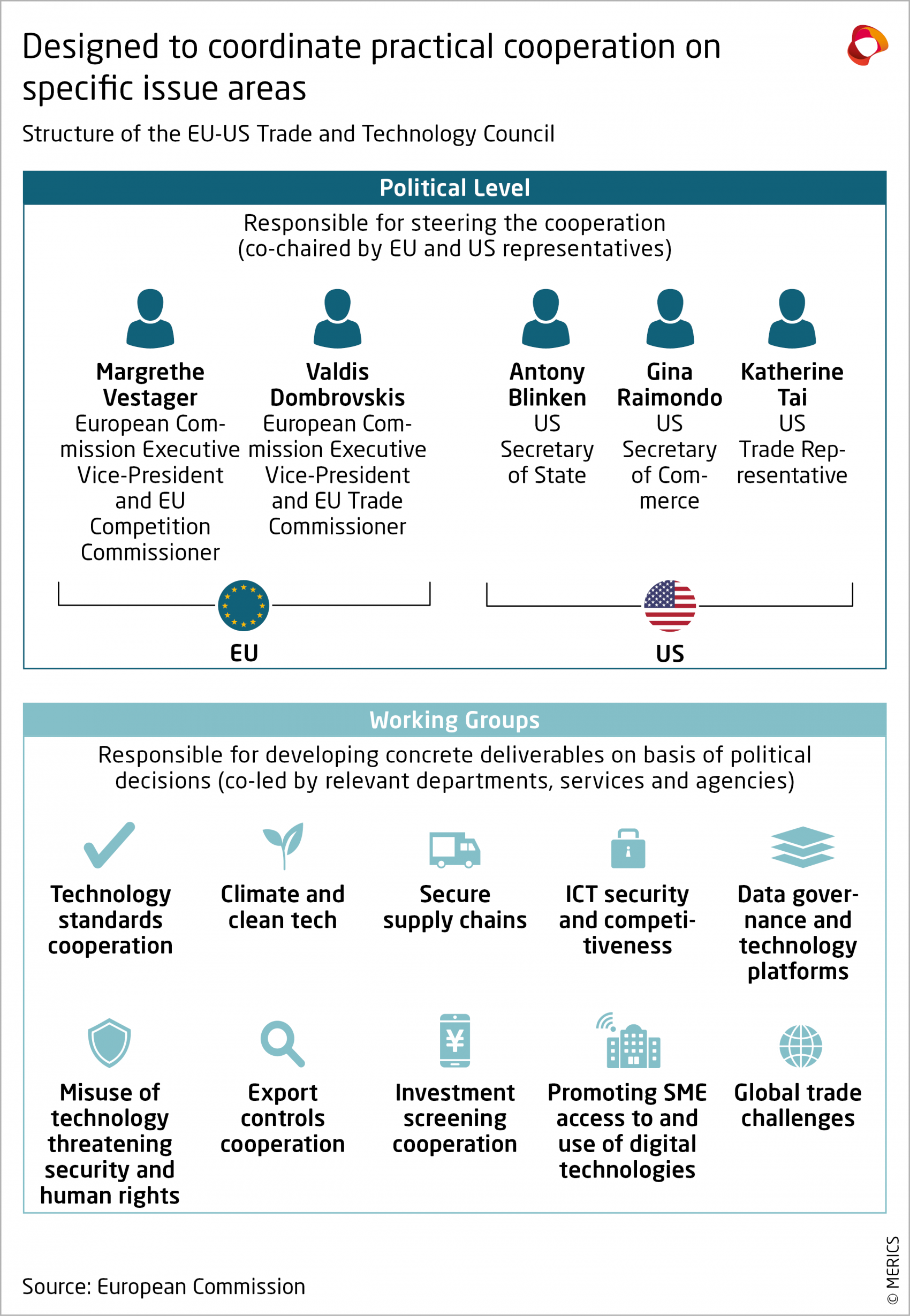

From 14–16 May, European Commission and US government officials gathered in Paris-Saclay for the second ministerial meeting of the Trade and Technology Council (TTC). The lack of groundbreaking outcomes should not come as a surprise given the forum’s limited mandate, nor should it lead observers to underestimate the progress made since the two sides first gathered in Pittsburgh eight months ago.

Russia’s invasion of Ukraine has provided an important test case for this young forum. Preexisting working dialogues within the TTC laid the groundwork for the swift imposition of technology export controls on Russia and Belarus. Now the challenge will be to maintain the momentum to tackle longer-term issues such as “China’s state-centric approach to the economy”, US trade chief Katherine Tai told stakeholders on Monday citing trade distortions.

The war has cemented a consensus that was already emerging following the coronavirus pandemic and geopolitical tensions with China: be it in critical value chains or in the digital and information spaces, deep interdependence with authoritarian powers is a source of risk which must be addressed.

Securing the digital and green transition

Supply chain resilience was the buzzword of this TTC. Following pandemic-induced disruptions and shortages, semiconductors have been a focus of the forum’s work. But the urgency to realize the twin digital and green transition, coupled with past policy mistakes, is also creating new dependencies on China in other areas which both sides need to contend with.

In their joint statement, the EU and the US affirmed their intention to diversify supply chains for rare earth magnets — essential products for meeting decarbonization targets — and solar supply chains. For the former, all stages of production are heavily concentrated in China. The country is also the leading exporter of solar photovoltaic (PV) products, an industry tied to Uyghur forced labor. The statement stresses the commitment to “eradicate forced labor” and reduce reliance on “unreliable sources of strategic supply”.

China’s centrality in Information and Communication Technology (ICT) supply chains was also in focus. One of the most concrete outcomes of the TTC has been the creation of a taskforce on joint public financing for secure digital infrastructure in third countries to provide alternatives to “high-risk vendors” — a nod to China’s Digital Silk Road. This would be the connective tissue between the EU’s Global Gateway and US efforts in this area, but the two are far from identifying joint projects to pursue.

Competing with China on future technologies

Transatlantic competitiveness in future technologies is a related priority in which China is forging ahead, particularly 6G and Artificial Intelligence (AI). In addition to cooperating on research and development and technology governance, the EU and the US have established a Strategic Standardization Information mechanism to “promote and defend our common interests in international standards activities”. This is largely aimed at China’s strategic approach to technical standardization and will initially focus on electric vehicle chargers.

Much of the TTC’s work is devoted to technology protection through coordination on investment screening and export controls, where more work is needed to tackle China’s state-led strategy to appropriate foreign technology, particularly in dual-use fields. Through the TTC, there is now “a structured and systematic forum for the US and the EU for further work on export restrictions and sanctions” which would have been unthinkable a year ago.

In sum, China will have to contend with a transatlantic trade and tech forum whose work agenda has become clearer and more ambitious since its inception, when many feared that the TTC would turn into a talking shop or get bogged down with frictions on trade and digital governance. Policy priorities have now been set. The next meeting, scheduled before year-end, will tell whether concrete action will follow.

Read more:

- EU-US Joint Statement of the TTC [EN]

- Joint Statement by President Von der Leyen and President Biden [EN]

- White House Fact Sheet [EN]: U.S.-EU Trade and Technology Council Establishes Economic and Technology Policies & Initiatives

- South China Morning Post [EN]: At Paris Summit, US and EU vow coordinated tech standards to counter China

- Tweet by Wang Lutong (王鲁彤), Director-General of the European Affairs Department at China’s Foreign Ministry, reacting to the Paris meeting [EN]

CHINA DEBATES

Western sanctions on Russia: challenges and opportunities for China

By Thomas des Garets Geddes

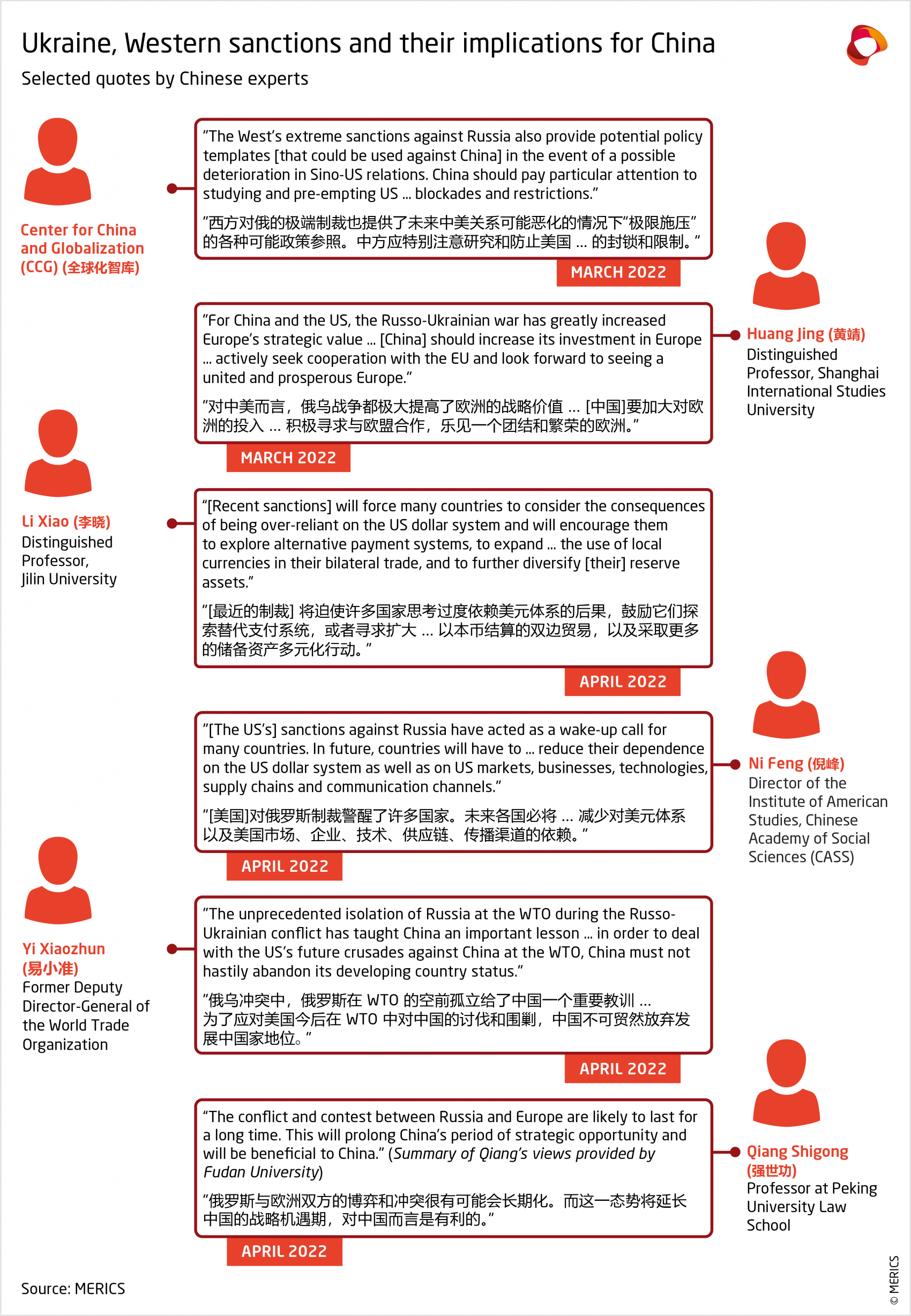

In China, the war in Ukraine is often described as marking a key turning point in international relations. Cui Hongjian, an influential analyst at the China Institute of International Studies (CIIS), describes it as accelerating the shift from “an era of globalization characterized by geo-economic cooperation to an era of post-globalization defined by geopolitical competition”. The war and the wide-ranging sanctions imposed on Russia seem to have acted as a wake-up call in China — a call both to protect but also to advance China’s interests at a time of international unrest.

Chinese experts have been taken aback by the sheer scale of Western sanctions targeting Russia. Many argue that similar measures could not be imposed on China because the cost for the West would simply be too high. Nevertheless, anxiety over such a prospect remains perceptible. Regardless of their scope, anti-China sanctions “will be one of the greatest challenges to be faced by our country” in the coming years, warns Wu Baiyi, a researcher at the Chinese Academy of Social Sciences (CASS).

Discussions in China have therefore increasingly turned towards how Beijing should protect itself from such measures. The freezing of USD 300-billion-worth of Russian reserves in the US and Europe and the eviction of Russia from the SWIFT bank-messaging system appear to have had a chilling effect on China. For a country that stores a large share of its USD 3.25 trillion reserves in the West, this is perhaps understandable. Chinese experts readily acknowledge that reducing and further diversifying China’s foreign exchange reserves cannot be done overnight, but the war in Ukraine seems to have made such aims more pressing.

Worries about the West’s influence over the global economic governance system also seem to have increased. Xu Boling, another researcher from CASS, denounces the “involvement” of the system’s three main pillars — the World Trade Organisation (WTO), the International Monetary Fund (IMF) and the World Bank — in helping the US and its allies sideline Russia. Yi Xiaozhun, a former deputy director-general of the WTO, echoes such concerns and has called on his country to continue to increase its “circle of friends” to counter Washington’s influence. He, like many others in China, still believes that “the European Union is the key to breaking the US’s containment of China at the multilateral level”. That is, China must work towards securing “a certain degree of neutrality” (一定程度的中立) from the EU.

Beyond these concerns, however, expert discussions in China tend to emphasize the great opportunities unlocked by the war in Ukraine. Like many analysts in China, Zhang Xiaonan, a researcher at the China Center for International Economic Exchanges, believes that the recent “weaponization” of SWIFT and the freezing of Russia’s assets have “cast a shadow on the stability and reliability of the [US-led] international monetary and financial system”. He, like others, predicts that the neutrality of such a system will increasingly become a major concern for developing countries (most of whom have refused to impose sanctions on Russia). Clearly implicit in these discussions is the leading role China could play in helping buttress such a new and supposedly “depoliticized” system. For Guo Dong, a senior manager at China Development Bank, the current international turmoil presents his country with a "window of opportunity" to reshape the current financial and monetary order, further promote the internationalization of the RMB and encourage the dedollarization of the world’s economy. None of these objectives are particularly new, but the war and subsequent sanctions against Russia appear to have added a new sense of urgency to them in this current state of flux.

Read more:

- Report by CCG [CN]: The impact of the Ukraine crisis on global supply chains and the Chinese economy (Quote 1)

- Analysis by Huang Jing [CN]: China's opportunities, challenges and options following the Russo-Ukrainian war (Quote 2)

- Analysis by Li Xiao [CN]: The structural impact of the Russo-Ukrainian conflict on the international financial system (Quote 3)

- Analysis by Ni Feng [CN]: US policy changes and adjustments in the context of the Russo-Ukrainian conflict (Quote 4)

- Analysis by Yi Xiaozhun [CN]: The Impact of the Russo-Ukrainian conflict on the multilateral trading system (Quote 5)

- Seminar with Qiang Shigong [CN]: The Russo-Ukrainian conflict, the changing international landscape and China's strategic security (Quote 6)

BUZZWORD OF THE WEEK

NATO

In what can only be described as a historical development, Finland and Sweden have officially decided to apply for NATO membership. Beijing views any enlargement of NATO as a negative outcome, and it has made its position crystal clear in numerous statements in which it depicts the North Atlantic Alliance as the US’s long-arm in Europe. More on this in the next edition of MERICS’ Security and Risk Tracker to be published on May 25, 2022.

Read more:

REVIEW

A timely EU-Japan Summit

On May 12, the EU and Japan held their annual summit. Whether directly or indirectly, China occupied a central role in the discussion as the EU and Japan work towards further aligning their relationship.

What you need to know:

- World order: European Commission President Ursula von der Leyen labelled Russia “the most direct threat to world order”, but China’s role in threatening that same order was evident throughout the summit, beyond the official mention in the final joint statement. Both von der Leyen and Council President Charles Michel have denounced China’s perceived closeness with Russia.

- Collaborations: Energy was at the forefront of future collaborations, especially LNG and helping Europe to decrease its dependency on Russian gas. But other notable areas of collaborations included climate, cybersecurity, disinformation, maritime security, connectivity, crisis management and a new EU-Japan Digital Partnership. There were also talks of Japan’s potential involvement with the EU’s Horizon program.

- Disputed islands: Beijing did not wait long to signal its displeasure with the section of the EU-Japan summit joint statement that directly mentions the territorial dispute regarding “the Senkaku Islands” (Diaoyu Islands for China). An issue that China regards as internal.

Quick take:

The summit has revealed new areas of collaborations and confirmed others. A closer relationship between the EU and Japan is something hardly welcomed in Beijing for several reasons. One of these is the facilitation of a greater European presence in what China regards as its neighborhood: the Asia-Pacific. But also, a more powerful and internationally supported Japan.

Read more:

- MERICS: A Japanese solution to the EU’s economic security struggle

- Euractive: Russia ‘most direct threat to world order’, von der Leyen says at EU-Japan summit.

- European Council Council of the European Union: Joint Statement EU-Japan Summit 2022

- European Council Council of the European Union: EU-Japan summit, 12 May 2022

- Reuters: China voices discontent with EU-Japan position on Senkaku islands

SHORT TAKES

In a May 14 joint statement, G7 foreign ministers called on China to uphold its commitments within the rules-based international order, not to circumvent sanctions on Russia and to “urge Russia to stop its military aggression against Ukraine.”

- German Ministry of Foreign Affairs: G7 Germany 2022 - Foreign Ministers’ Communiqué

A survey conducted on May 6–8 by the German Chamber of Commerce in China revealed that of the 73 percent of respondents’ businesses operating in areas of full or partial lockdown, only 19 percent of those German businesses have permits to continue production in areas disrupted by lockdowns. The survey also found that 28 percent have foreign employees wanting to leave China over Covid-19-restrictions.

On May 8, EU High Representative Josep Borrell criticized the Hong Kong Chief Executive election process, which saw John Lee Ka-chiu, leading force behind the National Security Law, stand as the only candidate. The move preceded a joint G7 statement on the matter.

- Council of the European Union: Hong Kong: Declaration by the High Representative on behalf of the European Union on the Chief Executive election held on 8 May

- EEAS: Hong Kong: G7 Foreign Ministers’ Statement on the Chief Executive Selection

Italian Parliament extended the scope of the government’s anti-takeover regulations, known as “golden powers”, which Mario Draghi’s administration has used to curb selected takeovers by Chinese companies. The regulations will now also impact the hydroelectric sector and new companies operating in strategic sectors.

The European Commission is planning to upgrade its trade dialogue mechanism with Taiwan during a meeting set for June 2. The move seems to be a return to a policy project that was disrupted by the China-Lithuania fallout (see our past piece).

- SCMP: EU to upgrade trade ties with Taiwan as China warns Brussels ‘not to gamble on this issue’

- MERICS: EU-Taiwan ties: Between expectations and reality

During a May 16–18 visit to Taiwan, a Polish delegation, including Vice-Minister of Development and Technology, participated in the Poland Investment Opportunities Forum in Taipei and signed new MOUs pertaining to semiconductors, electric vehicles, laboratory practice standards, and environmental protection.

- FocusTaiwan: Polish government welcomes Taiwan investment

On May 18, The Hungarian Constitutional Court blocked the attempt of holding a referendum over a planned campus of China’s Fudan University in Budapest. The request for the referendum came from the city’s mayor and opposition leaders. The construction plans sparked public protests.

Inquiries from China and Hong Kong for the Greek “Golden Visa” scheme increased by 40 percent in the first quarter of 2022. The increase may be attributed to domestic Covid-19 restrictions and tightening of similar schemes by other EU members.