Chinese FDI in the EU declines in 2018 amid growing caution and new regulatory hurdles

New Report by Rhodium Group and MERICS

Chinese foreign direct investment (FDI) in the European Union continued to decline in 2018, mirroring the decline in Chinese investments globally. This was due mainly to continuing capital controls and lower liquidity in China’s financial system. Another contributing factor, however, is the growing political and regulatory backlash against Chinese commercial presence in advanced economies, including new and updated investment screening mechanisms in various EU member states. These are the findings of the joint report “Chinese FDI in Europe: 2018 Trends and impact of new screening policies” by Thilo Hanemann, Agatha Kratz (Rhodium Group) and Mikko Huotari (MERICS).

Fall in Chinese FDI in Europe

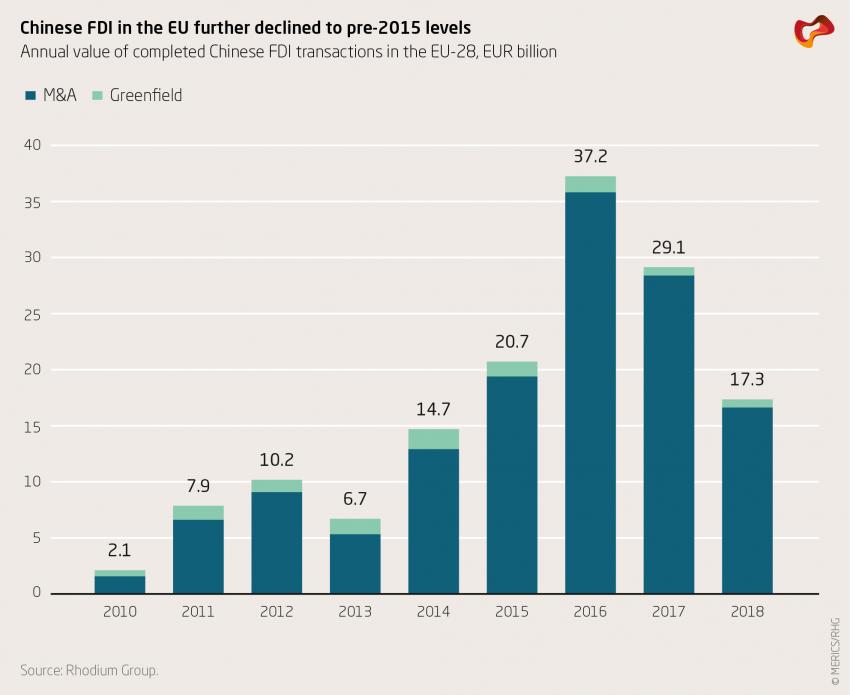

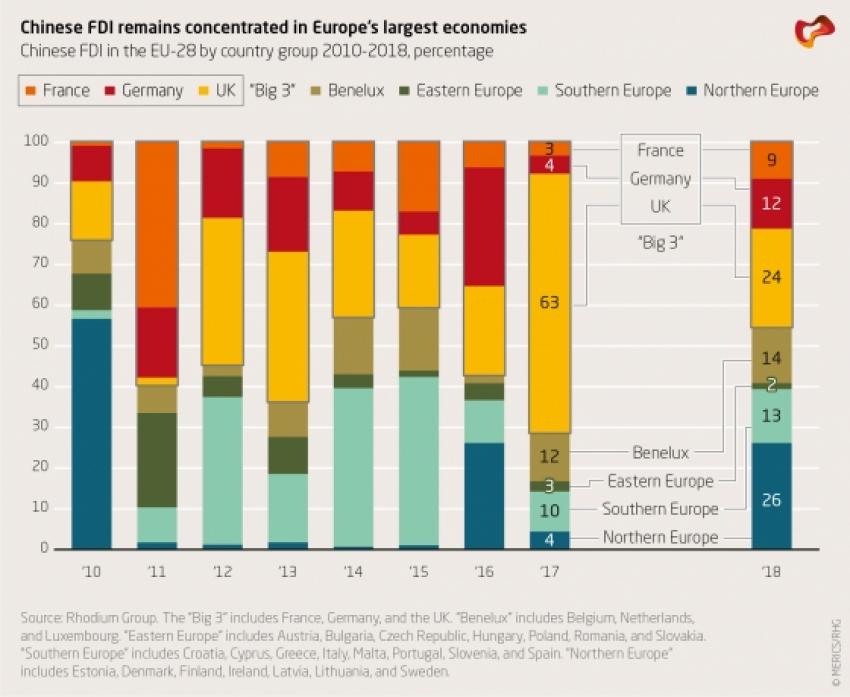

In 2018, Chinese firms completed FDI transactions worth EUR 17.3 billion, a decline of 40 percent from 2017 levels and over 50 percent from the 2016 peak of EUR 37 billion. The lion’s share of the investment continued to go to the three biggest economies in Europe: the UK (EUR 4.2 billion), Germany (EUR 2.1 billion) and France (EUR 1.6 billion) received 45 percent of Chinese investment in Europe – down, however, from 71 percent in 2017. All three nations have updated their screening regimes in the last two years. Significant investment in Sweden (EUR 3.4 billion) and Luxemburg (EUR 1.6 billion) contributed to an increase in Northern Europe and the Benelux’ respective weight, to 26 percent and 13 percent respectively, thereby cutting into the share of the “big three”.

Compared to previous years, Chinese investment was spread more evenly across a greater variety of sectors. The absence of mega deals led to a more balanced distribution of capital, with no single sector accounting for more than 20 percent of overall Chinese investment. Investment by state-owned enterprises fell to a five year low of EUR 7.1 billion, while state-owned enterprises’ share of total Chinese investment fell to 41 percent from 71 percent in 2017, the second lowest level on record.

Impact of Europe’s new investment screening framework

For the time being, the EU remains an attractive region for Chinese investors. At the start of 2019, more than EUR 15 billion worth of proposed transactions were pending. The expansion of the US’ investment screening regime, and the deterioration of US-China relations might at least temporarily boost Chinese investment in Europe.

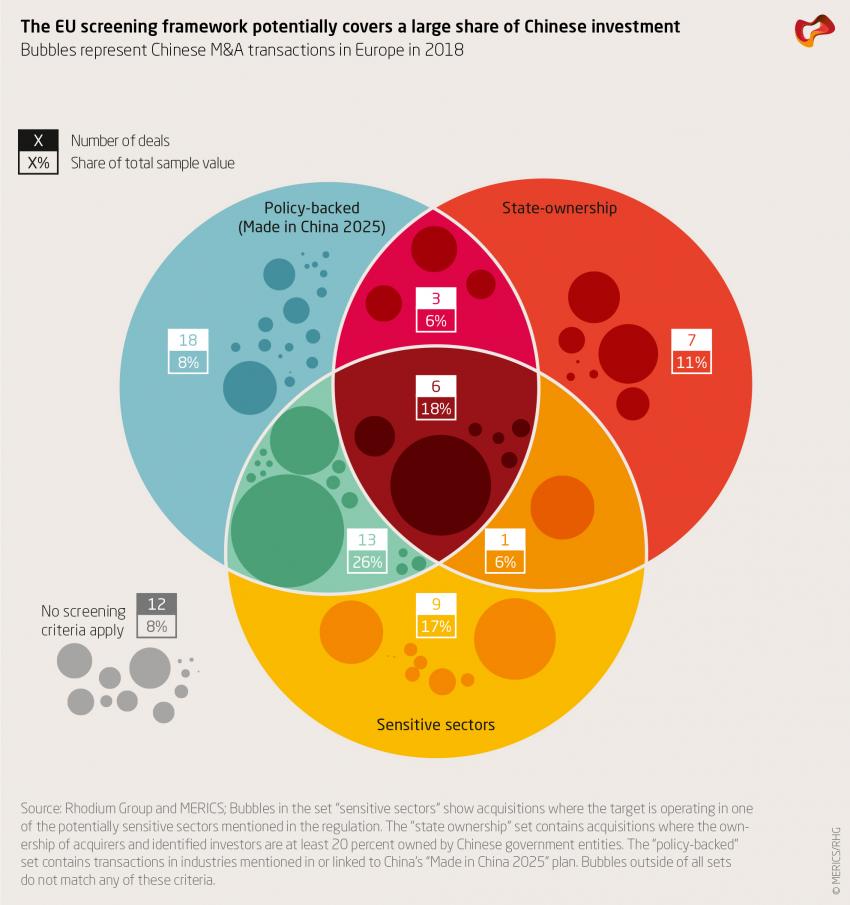

The Berlin based think tank MERICS and Rhodium Group however expect that the new European investment screening framework, which was presented in November 2018 and passed the European Parliament in February 2019, will reinforce the current trend of falling Chinese investment in Europe. The new EU regulation encourages member states to specifically review investment in sensitive sectors including critical technologies and infrastructures, as well as transactions by state-controlled entities or those backed by “state-led programs” (such as the “Made in China 2025” strategy). The authors estimate that 83 percent of Chinese mergers and acquisitions in 2018 would have fallen into at least one of these three categories.

As current debates in Europe about the risk of economic engagement with China progressively extend beyond FDI reviews, additional policy action in areas like export controls for dual use and critical technologies, data security and privacy rules, procurement rules, and competition policy is becoming more likely.