Chasing the ghost of transatlantic cooperation to level the playing field with China: time for action

Key findings

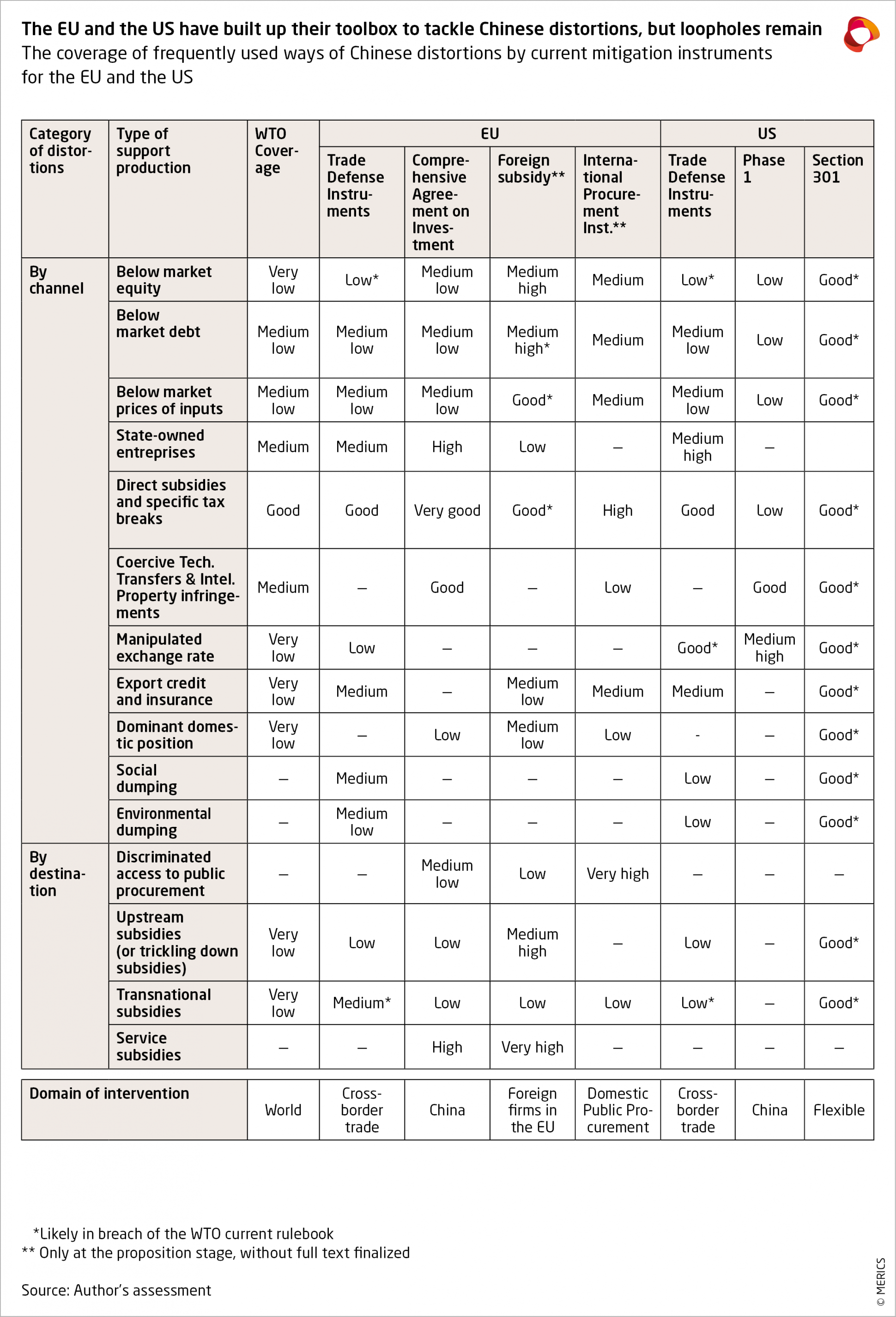

- In recent years, the EU has beefed up its awareness, toolbox, and administrative ability to deal with Chinese economic competition distortions. Tough actions, and costly Chinese retaliation, are still ahead.

- There is a growing bipartisan consensus in the United States on the need for more assertive reactions to Chinese economic distortions. The Biden administration has done away with the more controversial rhetoric and positions of the Trump administration, without repudiating the vast majority of the latter’s economic measures. A clear position and approach on how to handle Chinese distortions is still pending.

- China aims for a new development model focused on innovation and technological independence, under the overarching strong guidance of the party state. This is likely to worsen its economic distortions, especially in relation to more innovation-intensive advanced economies.

- With an increasingly distortive China and the transatlantic alignment of views in this regard, a unique window of opportunity to act to fix the liberal economic order has opened. Especially as the EU-China Comprehensive Agreement on Investment and the US-China Phase 1 Agreement appear unlikely to become functional.

- An update of the multilateral rulebook would need EU resoluteness against retaliation by Beijing and accepting the possibility of pursuing a complementary plurilateral system if negotiations stall. The United States would need to clarify its position regarding enforceable multilateral rules. However, geopolitical and technical complexities make concrete outcomes a long-term game.

- The EU and United States would need to make concessions on bilateral divergences, such as how to have serious negotiations on a WTO reform and how to get developing economies on board for more disciplines on industrial policies.

- Parallel actions through their respective unilateral tools to level the playing field with China could be quick wins for the EU and the United States and contribute to transatlantic cooperation. Sectors prioritized in China’s industrial plans are good targets, being of strategic importance and subject to Chinese innovative distortive channels improperly covered in the current rulebook.

- The working group on global trade challenges of the EU-US Trade and Technology Council offers a good venue to kick-start serious discussions on common actions against Chinese distortions as well as multilateral disciplines.

- Considering the magnitude of the joint effort needed to fight back against Chinese distortions, the EU and the United States should set aside, at least temporarily, the irritants in their trade relationship and the areas where their views do not converge.

1. Introduction: Transatlantic cooperation is needed to deal with economic challenges posed by China’s new development model

Fighting for a level playing field with China has been an increasingly common priority for Europe and the United States. The Biden administration has put China and alliance building at the heart of its foreign policy narrative. The analytical framework it has laid out for its relations with Beijing as simultaneously a partner, a competitor, and a systemic rival, is very similar to the EU’s.

The EU met the new US administration with an ambitious cooperation proposition for a renewed rules-based liberal order.1 This led to the creation of the EU-US Trade and Technology Council intended to “coordinate approaches to key global trade, economic, and technology issues” in order to “better protect our businesses and workers from unfair trade practices.” A working group of the council is dedicated to “global trade challenges,” largely to tackle Chinese distortions.

Fighting distortions is a top priority of EU and US trade policy plans.2 According to a definition of the World Trade Organization (WTO), the term ‘distortion’ describes a situation when “prices and production are higher or lower than levels that would usually exist in a competitive market.”

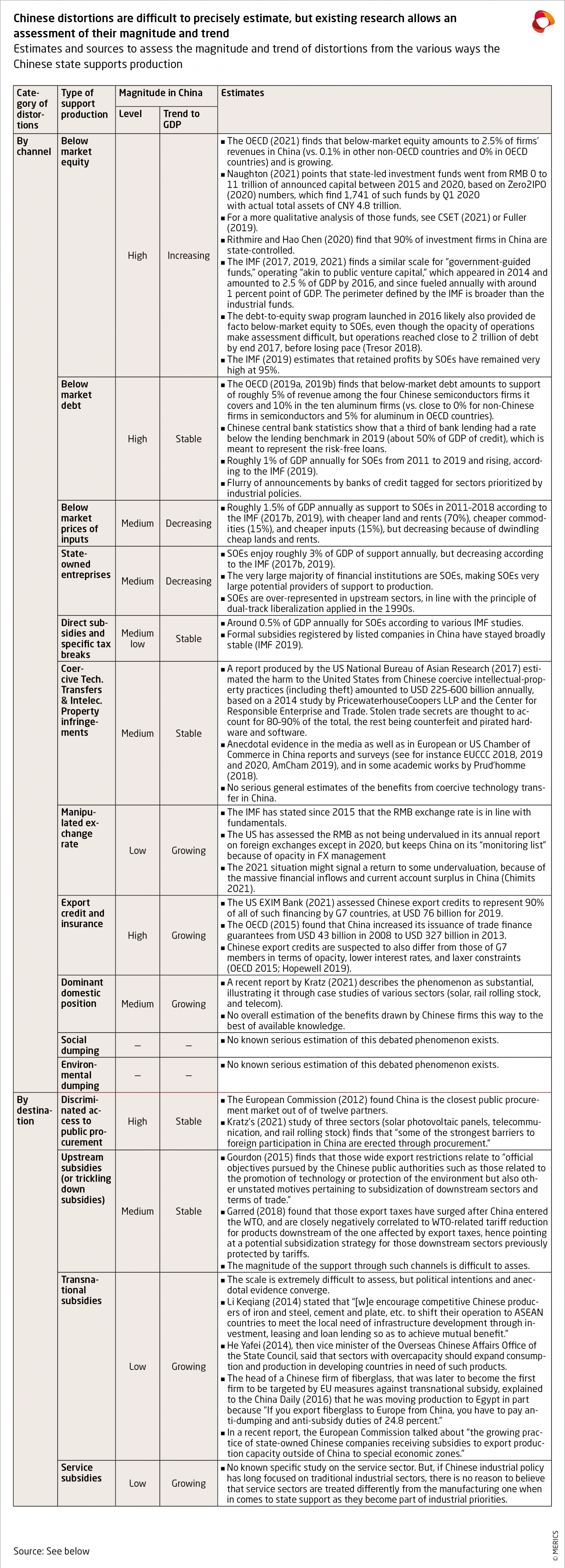

Transatlantic cooperation is even more pressing as China develops an economic system aiming for state-led technological leadership and grows more assertive in redesigning the rules of globalization.3 This “new development model” intends to innovatively use market forces for the allocation of resources under the strong guiding hand of the party-state, incorporating new types of distortions channels (see Exhibit 2).4 This has led to an often- misread mix of improving China’s legal and regulatory framework, circumscribed liberalization and targeted opening-up, and tech-centered industrial policies.

This monitor assesses the feasibility and specific modalities of cooperation between the EU and the United States to level the economic playing field with China.5 It does not cover challenges related to the Chinese economy but less directly to the issue of a level playing field e.g., economic competition, security and trust (for instance, on industrial standards, export control, investment screening, supply dependencies, or data transfers), or values and politics (forced labor, dual-use technologies, industrial standards, or economic coercion). Nor does it touch upon the discussion on the virtues and flaws of industrial policy and distortions in general.

The first section reviews the possibility of cooperation towards an update of the international rulebook, especially at the WTO, with consideration for a second-best option of a liberal and rule-based plurilateral order. The second section looks at EU and US unilateral tools that could be used in parallel. The analysis describes recent evolutions of domestic stances, as well as efforts to cooperate, before assessing the prospects for greater cooperation (see Exhibit 3).

3. Selective EU-US coordination on their unilateral actions could pave the way for multilateral efforts

While US actions on China during the Trump administration have attracted attention, the EU has for some years strengthened its unilateral toolbox to shield its market from distortions. Those efforts have in many respects put the EU ahead of the United States (see Annex 1).

3.1 Joint sanctions on sectors most subsidized by China would help build trust

The EU has beefed up its legal and administrative ability to put tariffs on distorted imports, with China in mind. The 2013 - 2017 modernization of its trade-defense instruments (TDIs)46 was in response to both failure to act on some Chinese goods and to end the NME status of China.47 The first EU report to provide sector- and country- NME categorizations mentioned China. The reform facilitated and amplified TDI tariffs, in a WTO-compliant way.

In addition to its legal capacities, the EU strengthened its administrative ability by creating the position of a Chief Trade Enforcer Officer in 2020, with a mandate to enforce international trade rules and dedicated human resources.

The European Commission has recently displayed a willingness to act forcefully and innovatively on Chinese distortions. Since 2018, EU TDIs have targeted new distortions, such as the lack of labor-union diversity, political influence through CCP cells in firms, subsidized inputs, restrictions on exports of raw materials, and subsidies provided abroad under the BRI.48 The use of TDIs has risen from 13 investigations per year between 2013 and 2017 to 18 in 2019 and in 2020. The share of China-related cases rose to two-thirds of initiated procedures in 2020.49

The United States has also used its TDIs more but without any similar efforts to fix loopholes. The number of anti-dumping and countervailing duties under implementation against China rose from 131 in 2014 to 208 in January 2021, amounting to a third of all cases.50 But, in spite of the momentum against Chinese distortions, US trade remedies do not cover transnational subsidies and do not attempt to tackle labor-market distortions.51 In her recent presentation of the Biden administration’s approach to China, US Trade Representative Katherine Tai acknowledged the need for new tools against “massive subsidies” from China, as well as the perspective of cooperating with allies on that matter. One minor innovation was the strengthening in 2020 of the possibility to counter the undervaluation of foreign currencies, which led to the tariffs in the aforementioned case.

Cooperation between the EU and the United States on their respective tools has been limited to jointly pushing the OECD to inform on support for production brought by public authorities worldwide. This has led to reports which have found China to be the provider of 80 percent of the world’s subsidies in sectors such as aluminum and semiconductors.52 A recent report scoping below-market financing through main companies in 13 industrial sectors also finds China standing out, with an average of support through below-market equity price of two percent of firms’ revenues from 2005 to 2019, versus zero percent in OECD countries.53

Common actions on key topics and sectors could set new standards to tackle Chinese distortions, while building trust and clarifying the need for the WTO reform.54 The EU’s innovative use of trade remedies against Chinese distortions often tests the current WTO framework on the very points where an update is deemed needed. The strong priority given by the Biden administration to labor rights creates cooperation potential on this often- overlooked topic, as pointed to in the communiqué of the first TTC meeting in September.55

China’s reaction is likely to be fierce in this eventuality as this touches a core characteristic of the CCP regime. A less sensitive option would be to build on the work of the OECD on the channels and sectors for Chinese distortions, such as semiconductors, rail stock vehicles, steel, aluminum, or telecommunications cables.56

Such common action on that front could possibly be shared with other G7 partners, that clearly signaled interest to better confront Chinese distortions.57 At the same time, efforts to better understand and assess distortive practices through the OECD could be amplified.

3.2 Where EU and US approaches and priorities diverge, transatlantic cooperation could still foster information sharing

The European Commission has innovatively proposed to mobilize competition rules to tackle the effect of foreign subsidies within the single market, including for public procurement, services, and foreign acquisition. The proposed foreign subsidy regulation of May 2021 would apply to distortions not covered by the WTO (first services, but potentially also transnational subsidies or below-market financing), distorted foreign investment, and subsidized foreign firms in public procurement. The proposal is then simultaneously a lever for, a complementary tool to, and a backup for WTO reform.58

The European Commission is optimistic that the adoption process will be fast, thanks to wide support, and hopes for its implementation as soon as 2022.59 The only official Chinese reaction so far has pointed at the weakness of the proposal regarding EU law and WTO rules, and called for a carve-out for investments at the invitation of an EU member state.60

The EU has been working on an International Procurement Instrument (IPI) for almost a decade with the potential to make it a reality by 2022. The IPI was approved by the Council and passed to the European Parliament in June. It aims “to strengthen the position of the EU when negotiating access for EU businesses” to foreign public procurement.61

In practice, the IPI facilitates excluded bidders from countries without a commitment on a sufficient openness of their own in public procurement for EU firms. It would be thus defensive and offensive. Divergent views among member states hampered progress at the level of the EU Council; for instance, on the level of penalties for bidders from closed countries.62

While China has not officially reacted, the EU plan likely contributed to a fresh proposal by Beijing to join the WTO agreement on the topic in late 2020. It was followed shortly by a draft domestic regulation to clarify, standardize, and make public all domestic public procurement. Both do not appear to meet EU demands, which has a veto on China joining this plurilateral WTO agreement. The Government Procurement Agreement at the WTO (GPA) among the EU and 20 others members (including the United States) is a commitment on agreeing to a certain degree of public procurement access to other members of that deal, made by each participant.

The United States has extensively used national-security tools to block Chinese firms from its market, sometimes with level-playing-field motivations, reducing needs for tools akin of the ones the EU is proposing. The screening of foreign investment has been strengthened in recent years, especially with regard to Chinese firms, contributing to the quasi- disappearance of Chinese investments. Many Chinese firms have been banned because of alleged connections to the Chinese military. Public procurement, already only marginally open, has been de facto closed to Chinese firms.

EU-US cooperation perspectives in the near term appear limited to information sharing and damage control. The insistence of the Biden administration on international rules and proportionality suggests a narrower use of national-security tools by the United States. However, its first measures indicate that any narrowing will be marginal. The rather closed nature of US public procurement and the ambition to close it further to support domestic production limit the prospects for cooperation in the medium term.63

The recent announcement of cooperation on China between the EU commissioner for competition and the US trade representative indicates some prospects for cooperation on the new EU competition tools. Still, given the strong emphasis by the United States on national security when talking about China as well as the ongoing domestic discussions regarding a reform of competition rules for better tackling domestic growing clout of large companies, any perspective for cooperation in the medium term seems limited to information sharing.

4. Conclusion

The divergence between the views of the EU and the United States on Chinese distortions during the Trump administration was largely exaggerated and the extent of transatlantic cooperation overlooked. Since the start of the Biden administration, broader commonalities feed into an already narrowing – but certainly remaining – gap.

However, a clear view on divergences is needed to make the most of the current window of opportunity to respond to this challenge for the international economic order. Parallel actions against China’s most pervasive distortions offer a way to deepen transatlantic commonalities and build up trust. These are necessary preconditions for the more ambitious overhaul of the multilateral rules-based order.

The creation of the EU-US Trade and Technology Council, with its specific working group on global trade challenges, could help a lot in that respect. So could the separate working group on aircraft, which has a mandate to tackle the issue of distortion by non-market economies.

Sticking to a more demanding rules-based approach rather than ad hoc pushbacks would help demonstrate that, on level-playing-field issues, the EU and the United States are only standing up to safeguard rules-based principles they believe to be optimally efficient and not repressing any country’s development. This would also be necessary to establish a complementary, more plurilateral, order in the likely enduring vacuum between the crippled old multilateral order and a new one that could only be agreed after a struggle with China.

- Endnotes

-

1 | It intends to “be the linchpin of a new global alliance of like-minded partners”, based on “common values of fairness, openness and competition” and “centered on areas where our interests converge, our collective leverage can best be used”. European Commission (2020). EU-US: A new transatlantic agenda for global change. European Commission. Accessed: September 2021.

2 | The “US Trade policy agenda” (United States Trade Representative, March 2021, hereafter USTR (2021)) lists “China’s Coercive and Unfair Economic Trade Practices Through a Comprehensive Strategy” and “Partnering with Friends and Allies” among priorities. The “Trade Policy Review” (European Commission, February 2021) identifies “the rapid rise of China, demonstrating global ambitions and pursuing a distinct state-capitalist model” among the main factors for the early review.

3 | Brown, Alexander & Gunter, Jacob & Zenglein, M. J. (2021). “Course Correction: China’s Shifting Approach to Economic Globalization“. MERICS. Berlin (Germany): MERICS.

4 | Blanchette, Jude (2021). “From “China Inc.” to “CCP Inc.”: A New Paradigm for Chinese State Capitalism”. China Leadership Monitor. Stanford (US): The Hoover Institution.

5 | A level playing field is a situation in which market participants “compete on an equal footing” (OECD). Discriminative state interventions such as specific subsidies, regulatory discrimination, and national preference are the usual culprit for tilting the playing field.

6 | Organisation for Economic Co-operation and Development (2019a). "Measuring distortions in international markets: the aluminium value chain". OECD Trade Policy Papers. No. 218. Paris: OECD Publishing. Organisation for Economic Co-operation and Development (2019b). "Measuring distortions in international markets: The semiconductor value chain", OECD Trade Policy Papers, No. 234. Paris: OECD Publishing.

7 | A simple quantity definition would define international unilateralism as the action of one party, bilateralism of two, and multilateralism of three of more. A more quality-based approach would define multilateralism as a combination of indivisibility, generalized organizing principles, and diffuse reciprocity. Bilateralism would be based on preferentialism and changes its goals and priorities on a case-by-case basis. Unilateralism describes a situation where a state acts autonomously with tools under its sole responsibility. Tago, A. (2017). “Multilateralism, Bilateralism, and Unilateralism in Foreign Policy”. Oxford Research Encyclopedia of Politics.

8 | Predatory behavior, also referred to as mercantilist, is when the creation of wealth for the acting party is realized by the punction of someone else’s welfare, rather than a net value-added in terms of overall utility.

9 | The United States jointly proposed with Brazil in July 2020 that “market-oriented conditions are fundamental to a free, fair, and mutually advantageous world trading system.” They were joined later by Japan, but opposed by the EU in exchanges at the WTO.

10 | Trade Talks (2021). “The EU’s new trade policy, with S. Weyand of DG Trade”. Trade Talks 148. Peterson Institute for International Economics.

11 | The “Trade Policy Review” of the European Commission (published in February 2021) recognizes that “the US has raised a number of valid concerns” about the role of the Appellate Body, including the need for “judicial economy”, for new rules on SOEs, and for stricter timelines. The question of the leverage to get serious WTO reform regarding China’s state-led economy was the first asked to S. Weyand during her interview at one of the most famous American podcasts on trade matters (Trade Talks (2021)).

12 | In two articles in Foreign Affairs in 2020, US Trade Representative Robert Lighthizer justified the unilateral approach by referring to a lack of determination in Europe to confront China for its distortive actions. Scholar and former Obama official M. Bown shared similar concerns (Trade Talks (2021)).

13 | White House (2021). US-EU summit statement. Accessed: September 2021. Washington DC: White House.

14 | Office of the United States Representative (2017). Joint Statement by the United States, European Union and Japan at MC11. Accessed: October 2021.

15 | World Trade Organization (2019). Procedures To Enhance Transparency and Strengthen Notification Requirements Under WTO Agreements. JOB/CTG/14/Rev.2.

16 | Office of the United States Representative (2020). Joint Statement of the Trilateral Meeting of the Trade Ministers of Japan, the United States and the European Union. Accessed: July 2021.

17 | Office of the United States Representative (May 2018). Joint Statement of the Trilateral Meeting of the Trade Ministers of Japan, the United States and the European Union. Accessed: July 2021. Office of the United States Representative (September 2018). Joint Statement of the Trilateral Meeting of the Trade Ministers of Japan, the United States and the European Union. Accessed: July 2021.

18 | Under the CAI, SOEs – defined as all firms with a certain respect of state influence, including local SOEs – have an obligation to act according to commercial considerations and not discriminate against EU firms, as well as extra transparency obligations. Any subsidy to an SOE is considered ”specific”, hence eligible for trade sanctions.

19 | S. Weyand, DG of the DG Trade at the webinar “The EU-China CAI: will it be a game changer?” organized by the Peterson Institute for International Economics (2021).

20 | At her various confirmation hearings this year, the incoming USTR K. Tai refrained from singling out SOEs when talking about the challenges relating to the “state-directed economics.” Besides, the US Trade Policy Agenda for 2021 only refers to subsidies and transparency under the objective of addressing China’s “unfair economic trade practices.”

21 | The Ottawa group is Australia, Brazil, Canada, Chile, EU, Japan, Kenya, South Korea, Mexico, New Zealand, Norway, Singapore, and Switzerland. European Commission (2021). “Joint Communiqué of the Ottawa Ministerial on WTO Reform”.

22 | In line with long-standing positions, the propositions of China on WTO reform (State Council of the People’s Republic of China (2018). China and the WTO. Accessed: February 2021) focuses on market access in agriculture, fewer subsidies by developed economies in that sector, and more policy space for developing countries. China as the “champion of the developing world” is constitutive of the CCP narrative, explained by Wang Yi when detailing Xi Jinping’s thought on diplomacy (Qiushi (2021). 深入学习贯彻习近平外交思想, 不断开创中国特色大国外交新局).

23 | World Tarde Organization (2019). Communication from the USA. WT/GC/W/757. EU supported a proposition formally made by Norway (WT/GC/W/770). The United States got Brazil, Singapore, and Mexico to let go of the developing status for future negotiations.

24 | Both propositions have shied away from stripping China of that status, but only of the related benefits.

25 | The long proponent of extra industrial policy space for developing countries D. Rodrik (an idea expressed clearly as soon as 1997 in Has globalization gone too far?) has been joined by other respected scholars such as J. Bhagwati and P. Krugman. The IMF in 2018 acknowledged that no country had successfully caught up with advanced economies without strong industrial policies (Cherif, R. and Hasanov F., “The return of the policy that shall not be named”, IMF Working paper 19/74. Washington: International Monetary Fund).

26 | Demands from most developing countries, under the informal G90 group, has been trimmed down from 87 demands in 2002 to 10 propositions in 2017 (see WTO documents: JOB/DEV/48; JOB/TNC/60).

27 | In line with the long-standing position of the Democrats, the US Trade Policy Agenda for 2021 has “Promoting Equitable Economic Growth Around the World” among its ten priorities. The piece disregards mere market opening as a satisfying condition for common prosperity and poverty alleviation in third countries.

28 | Other subjects of international rules, such as sector-specific disciplines on overcapacities, development financing, corruption, economic coercion, and external debt could also benefit from extra disciplines against Chinese practices. Being less directly related to the level-playing-field issue, they are left out from this report.

29 | World Trade Organization (2000). Brazil - Export Financing Programme for Aircraft Recourse by Canada to Article 21.5 of the DSU - AB-2000-3 - Report of the Appellate Body. WT/DS46/AB/RW.

30 | Hopewell, Kristen (2019). “Power transitions and global trade governance: The impact of a rising China on the export credit regime". Regulation & Governance 15 (3), 634-652.

31 | Export-Import Bank of the United States (2021). "EXIM 2020 Competitiveness Report". Washington DC: Export-Import Bank of the United States. Multiple Chinese ministries published encourage in September 2020 the use of export credit to support “core enterprises” supply chain 中国人民银行 工业和信息化部 司法部 商务部 国资委 市场监管总局 银保监会 外汇局关于规范发展供应链金融 支持供应链产业链稳定循环和优化升级的意见). In March 2021, the ”Notice of the China Export Credit Insurance Corporation of the MofCom on Further Utilizing the Role of Export Credit Insurance” was issued by the Chinese ministry of Commerce, 商务部中国出口信用保险公司关于进一步发挥出口信用保险作用加快商务高质量发展的通知).

32 | The EU, the United States, Australia, Brazil, Canada, Japan, Korea, New Zealand, Norway, Switzerland and Turkey jointly announced the suspension of their participation because of the lack of meaningful progress. China, India, and Russia are among the few participants missing from the statement.

33 | United States Trade Representative (2021). US Trade policy agenda. Accessed: July 2021.

34 | European Commission (2020). 38th Annual Report from the Commission to the Council and the European Parliament on the EU's Anti-Dumping, Anti-Subsidy and Safeguard activities and the Use of TDIs by Third Countries targeting the EU in 2019. 2020/776. See p.13 for electric bicycles.

35 | Hackenbroich, J. & Oertel, J. & Sandner, P. & Zerka, P. (2020). Defending Europe’s economic sovereignty: new ways to resist economic coercion. European Council on Foreign Relations. Ruhlig, T. (2020). Towards a more principle European China policy. Institut français des relations internationals. Huotari, M. & Weidenfeld, J. & Arcesati, R. (2020). Managing economic cooperation and competition with China - Towards a More Integrated European Trade Policy Approach. MERICS.

36 | Office of the United States Representative (May 2018). Joint Statement of the Trilateral Meeting of the Trade Ministers of Japan, the United States and the European Union. Accessed: July 2021. For the concrete outcomes of the non-market-economy status and the unilateral approach used by the US and the EU: Sandkamp, & Yalcin, K. (2020). Different Antidumping Legislations within the WTO. CESifo Working Paper No. 8398. CESifo GmbH.

37 | Since then, China has dropped the case it brought, most probably to prevent the decision and the explanatory report from being published. As acknowledge by Chinese scholar Tu Xinquan in an interview with CSIS in July 2019.

38 | Zhiguo Yu (2020). The US is now a “Non-Market Economy” – Anti-Dumping Ruling by China. International Economic Law and Policy Blog.

39 | Coercive technological transfer here refers to public actions coercing foreign firms to a technological transfer that would not have happened under a free competing market (OECD). Technological theft is not per se a level-playing-field issue as it is outside the realm of economic exchanges.

40 | Office of the United States Representative (2018). “Findings of the investigation into China’s acts, policies, and practices related to technology transfer, intellectual property, and innovation under section 301 of the trade act of 1974”. p.19.

41 | Wei, L. & Davies, B. (2020). “Negotiating a Truce, December 2019-January 2020 ”. In: Superpower showdown – How the battle between Trump and Xi threatens a new cold war. P359-386. New York, NY : Harper Business. Blustein, P. (2019) “Might Unmakes Right”. In: Schism – China, America and the fracturing of the global trading system. P253. Waterloo, ON, Canada : Centre for International Governance Innovation.

42 | Lester, S. (2021). Forced Technology Transfer Provisions in the CAI and the US-China Phase 1 Deal. International Economic Law and Policy Blog. Following the EU’s sanctions on local officials responsible of human rights violation towards the Uighur minority, China retaliated by sanctioning European officials and civil society institutions. With some of its members being targeted, the European Parliament put the ratification process of the CAI on hold on April 2021.

43 | “The Biden Administration will examine how Treasury, Commerce and USTR can work together to put effective pressure on countries intervening in the FX market to gain a trade advantage” (Office of the United States Representative, US Trade policy agenda, 2021). United States Department of the Treasury (2021). Report on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States. Washington DC: United States Department of the Treasury.

44 | The latest annual report on China by the IMF still criticizes the opaqueness around the renminbi exchange rate.

45 | World Trade organization (2020). Advancing Sustainability Goals Through Trade Rules To Level The Playing Field. WT/GC/W/814.

46 | TDIs, as recognized by the WTO, are tools crafted to put some extra barriers to products entering the domestic market. They are anti-dumping, countervailing duties (in the case of subsidies) or safeguard.

47 | A point made by then EU Trade Commissioner M. De Gucht in a speech at the High-Level Conference: Modernisation of TDIs in 2012. Gstöhl, S. & De Bievre, D. (2018). Actors and Processes in EU Trade Policy. In: The trade policy of the European Union. P69—77. London: Palghrave. Pepermans, A. (2016). The Huawei case and what it reveals about Europe’s trade policy. European Foreign Affairs Review. Pepermans, A. (2017). The Sino-European solar panel dispute. Journal of Contemporary European Research.

48 | See EU legal document: 2020/776; 2020/C 51/12; 2020/C 351/08; 2020/C 352 I/01; 2019 C 192/30, 2019/C 342/09 and 2020/776. Crochet, V. & Hedge, V. (2020). China’s ‘Going Global’ Policy: Transnational Subsidies under the ASCM. Leuven Centre for Global Governance.

49 | Chimits, Francois (2021). The EU targets distortions in the Chinese aluminum value chain. MERICS, EU-China briefing. MERICS

50 | US Congressional Research Service (2021). Trade Remedies: Antidumping and Countervailing Duties.

51 | See the 1998 amendment incorporated Section 351.527 in the US Code of Federal Regulations (§ 351.527).

52 | OECD (2019a), "Measuring distortions in international markets: the aluminium value chain", OECD Trade Policy Papers, No. 218, OECD Publishing, Paris. OECD (2019b), "Measuring distortions in international markets: The semiconductor value chain", OECD Trade Policy Papers, No. 234

53 | The covered sectors are aerospace and defense; aluminum, automobiles, cement, chemicals, glass and ceramics, rolling stock, semiconductors, shipbuilding, solar photovoltaic panels, steel, telecom network equipment, and wind turbines. The sample cover in almost every sector more than two-thirds of the world production, along with a balanced geographical coverage. OECD (2021).

54 | Such key sectors could be derived from the sectors prioritized by Chinese industrial policies. To have an idea of such sectors, see “Evolving Made in China 2025: China’s industrial policy in the quest for global tech leadership” by A. Holzmann and M. J. Zenglein (2019, MERICS).

55 | As part of its second priority of its trade policy agenda, called “Putting workers at the Center”, the USTR stated that “Trading partners will not be allowed to gain a competitive advantage by violating workers’ rights.” The current USTR has long been a proponent of actions against labor-rights infringement abroad.

56 | The last three are referred to as likely Chinese distortions by both the USTR 2021 Trade policy agenda and recent EU TDIs investigations.

57 | The June 2021 G7 Communique mentions “the need for the world’s leading democratic nations to unite behind a shared vision to ensure the multilateral trading system is reformed, with a modernised rulebook and a reformed WTO at its centre”, with the following points to be advanced: modernization of the rulebook and protect against unfair practices (such as forced tech transfers, IP theft, lowering green and social standards to gain competitive advantages, market-distorting actions of SOEs and harmful subsidies).

58 | The WTO has an exclusivity clause barring domestic rules on distortions already effectively covered (Art 32.1).

59 | France and Germany reiterated in February 2021 their strong support to the mechanism as part of a joint proposal on reducing European dependencies.

60 | China Chamber of Commerce to the European Union (2020). CCCEU responds to EC white paper. Brussels: China Chamber of Commerce to the European Union.

61 | European Parliament (2020). EU international procurement instrument. Brussels: European Parliament.

62 | Federation of German Industries (BDI) (2020). International Public Procurement: New Opportunities for the EU?.

63 | In April 2021, the EU, the United Kingdom, Canada, Japan, Australia, Israel, and South Korea lodged a request for arbitration regarding a US effort to lower its opening commitments made under the WTO Government Procurement Agreement, initiated under Trump and confirmed under Biden (see: GPA/ARB/USA/1 - GPA/ARB/USA/1/Add. 7).

Annex

- Annex Sources

-

American Chamber of Commerce in China (2019), 2018 China business climate survey report. Beijing (China):

American Chamber of Commerce in China.Chimits, Francois (2021). China’s 2020 external surplus - a wake-up call. Berlin (Germany): MERICS.

China Daily (2016), “Chinese companies boost operations in Egypt”. China Daily.China Development Bank (2021) announced in March to have earmarked 400 Bl RMB of annual loans to

support strategic emerging industries and advanced manufacturing.Arnold, Z., Ngor Luong, B. Murphy (2021). Understanding Chinese Government Guidance Funds: An Analysis

of Chinese-Language Sources. Washington (United States): Center for Security and Emerging Technology.Chimits, Francois (2018). Le programme d’échange de dettes contre actions (DES) semble pour le moment

principalement assainir les bilans des entreprises d’Etat et des grandes banques. Paris (France): Direction

Générale du Trésor (DG Trésor).EU Chamber of Commerce in China (2018). European business in China: Business confidence survey 2018.

Beijing (China): European Chamber of Commerce in China.EU Chamber of Commerce in China (2019). European business in China: Business confidence survey 2019.

Beijing (China): European Chamber of Commerce in China.European Commission (2012). Impact assessment working document (IAWD) of the Regulation establishing

rules on the access of third countries’ goods and services to the EU internal market in public procurement.

Accessed: September 2021. See Annex 3 entitled “Problem analysis”.European Commission (2021). 39th Annual report on EU’s Trade Defence activity. Accessed: September 2021.

Fuller, D. B. (2019). Paper Tigers, hidden dragons. Oxford (United Kingdom): Oxford University Press.Garred, Jason (2018). “The Persistence of Trade Policy in China After WTO Accession”, Journal of International

Economics, (114): 130-142.Gourdon, Julien, Hering Laura, Monjon Stéphanie, Poncet Sandra (2019). “Trade policy repercussions: the

role of local product space - Evidence from China”. Paris: Université Paris1 Panthéon-Sorbonne.He Yafei (2014). China's overcapacity crisis can spur growth through overseas expansion. Hong-Kong:

South China Morning Post.Hopewell, Kristen (2019). “Power transitions and global trade governance: The impact of a rising China on

the export credit regime”. Regulation & Governance 15 (3), 634-652.IMF (2017a). Mano, R., Stokoe P. “Reassessing the Perimeter of Government Accounts in China”. IMF Working

Paper No. 17/272. Washington, DC: International Monetary Fund.IMF (2017b). Lam, W. R., Schipke, A. “Chapter 11. State-Owned Enterprise Reform”. In: Modernizing China.

Washington, DC: International Monetary Fund. See Figure 11.5.IMF (2019). “People’s Republic of China: Selected issues”. IMF Country Reports, No. 19/274. Washington, DC:

International Monetary Fund. See graph on page 43.IMF (2021). “External sector report: Divergence recoveries and global imbalances”. Washington, DC:

International Monetary Fund.IMF (2021), “People’s Republic of China: 2020 Article IV Staff Report”, see Government-guided funds in

Table 5 p59, under the hypothesis of a similar split between construction and government-guided funds

identified in IMF (2017).Kratz, Agatha, J. Oertel (2021). Home advantage: How China’s protected market threatens Europe’s economic

power. European Council on Foreign Relations and Rhodium Group.Li Keqiang (2014). “Remarks by H.E. Li Keqiang Premier of the State Council of the People’s Republic of

China At the 17th ASEAN-China Summit”. Ministry of Foreign Affairs of the People’s Republic of China.

Accessed: September 2021.Naugthon, Barry (2021). “The rise of China’s industrial policy”. In: The rise of China’s industrial policy, 1978

to 2020. Buena Onda, S.A. de C.V. Mexico: Universidad Nacional Autonoma de Mexico; Organisation for Economic Co-operation and Development (2015). Skarp, Lennart. “Chinese Export Credit Policies and Programmes”. Trade Committee Working document. Paris: OECD Publishing.Organisation for Economic Co-operation and Development (2019a). “Measuring distortions in international

markets: the aluminium value chain”. OECD Trade Policy Papers. No. 218. Paris: OECD Publishing.Organisation for Economic Co-operation and Development (2019b). “Measuring distortions in international

markets: The semiconductor value chain”, OECD Trade Policy Papers, No. 234. Paris: OECD Publishing.Organisation for Economic Co-operation and Development (2021). “Measuring distortions in international markets:

Below-market finance”. OECD Trade Policy Papers, No. 247. OECD Publishing. Paris: OECD Publishing.Prud'homme, Dan & von Zedtwitz, Max & Thraen, Joachim Jan & Bader, Martin, 2018. “Forced technology

transfer’ policies: Workings in China and strategic implications”. Technological Forecasting and Social

Change, Elsevier, vol. 134(C), pages 150-168.The National Bureau of Asian Research (2017) “Update to the Intellectual Property Commission report – The

theft of American intellectual property”. Washington DC: The National Bureau of Asian Research.Export-Import Bank of the United States (2021). “EXIM 2020 Competitiveness Report”. Washington DC:

Export-Import Bank of the United States.United States Department of the Treasury (2021). “Report on Macroeconomic and Foreign Exchange Policies

of Major Trading Partners of the United States“. Washington DC: United States Department of the Treasury.Zero2IPO (2020). “Report on Performance Evaluation of Chinese Government Guidance Funds 2020”

[年中国政府引导基金绩效评价研究报告, 情科研究中心]. Beijing (China): Zero2IPO.

Acknowledgements

This study was supported by a Ford Foundation grant and is licensed to the public subject to the Creative Commons Attribution 4.0 International License. The authors are thankful for the contribution of the participants of an academic workshop conducted in preparation for this report.