China is securing battery metals on the global stage

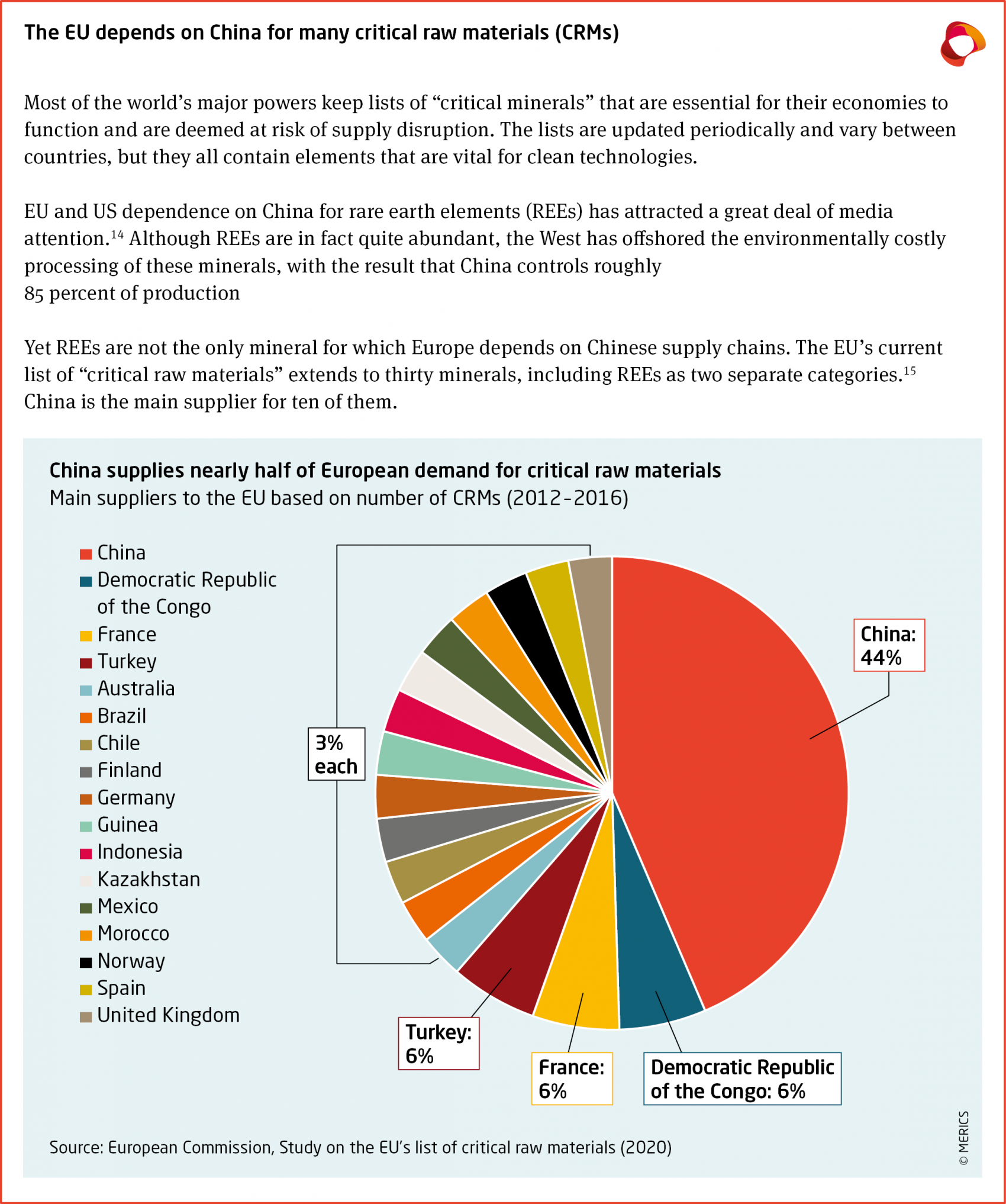

China is either the largest market or largest producer for all seven of the main minerals needed to build a typical electric car. These minerals are graphite, copper, nickel, manganese, cobalt, lithium, and rare earth elements (REEs) - a grouping of 17 separate, but similar metals, that are needed in small quantities for a huge range of modern manufactured goods.

Despite requiring hundreds of times more material during operation than a system based on renewable energy, clean energy technologies are much more material intensive to produce. According to a report from the International Energy Agency (IEA), production of an electric car requires six times more mineral inputs than its fossil-fueled counterpart, and an onshore wind plant nine times more minerals than a gas-fired power plant.

According to the World Bank, the current global production capacity of key minerals like copper, cobalt, and lithium will need to increase 500 percent by 2050 to meet the demands of the clean energy transition. Improved recycling can help soften this demand. Nonetheless, much of the 3 billion tons of material the World Bank estimates will be needed to keep global warming below 2 degrees centigrade comes from the earth’s crust.

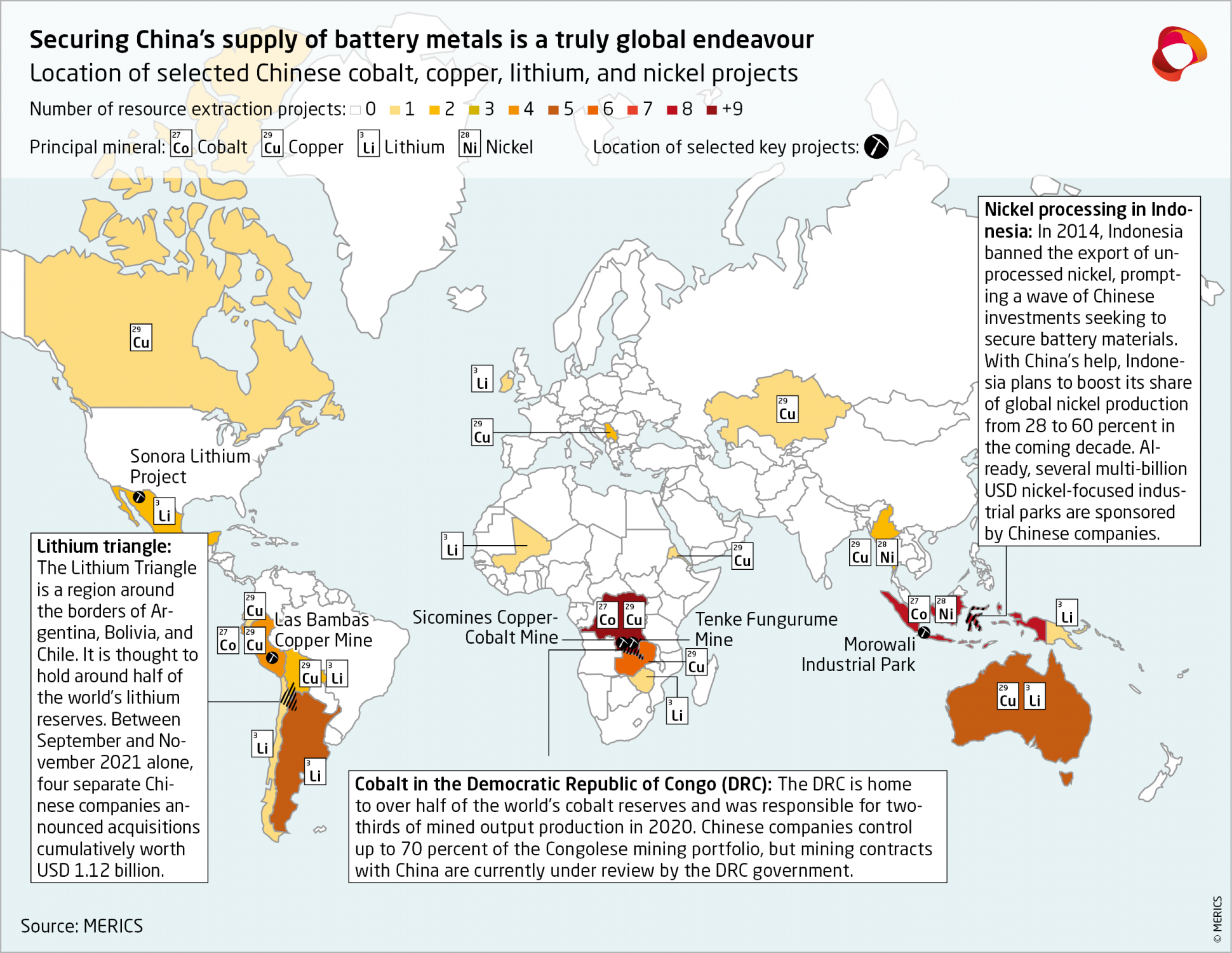

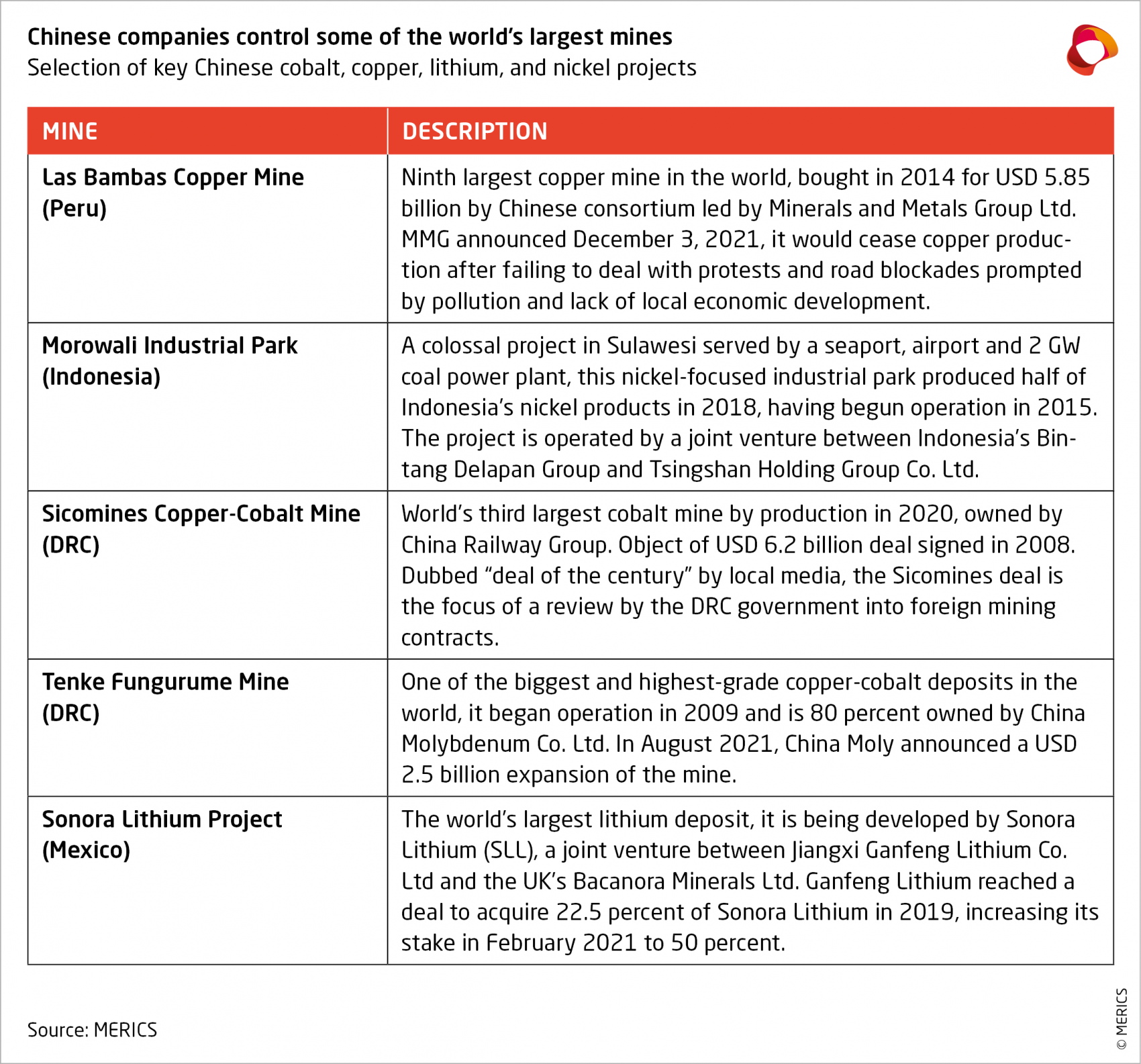

China already consumes as many battery minerals as the rest of the world combined, and as demand grows it has been forced overseas to secure its domination of battery supply chains. China has domestic manganese and graphite resources, but for copper, nickel, cobalt, and lithium, it has been imperative to look overseas.

Despite being poorly endowed with minerals like cobalt and lithium, China has nonetheless come to dominate global processing capacity. Taking its cue from the central role of oil in 20th century geopolitics, Beijing has made a concerted push to secure its supply of new energy minerals.

China’s overseas footprint in these four mineral markets is the result of efforts to address its own strategic vulnerabilities, and a forward-looking agenda that anticipated clean energy demand several years before it became topical in the US or Europe.

You are reading an excerpt of our latest

MERICS Global China Inc Tracker.

If you want to learn more about our membership model for institutions and businesses, please click here.

If you are a MERICS member, you can access the full publication here.