GDP growth slows and finds solid footing

MERICS Economic Indicators Q2/2021

China’s economy performed well in Q2 though slower growth triggered policy responses

China’s strong economic rebound continued in the second quarter, as the impact of 2020’s Covid-19 shutdowns receded. GDP expanded by 7.9 percent in Q2, supported by resilient external demand and improving domestic demand. The effects on GDP growth data stemming from comparison with the same periods of last year are becoming less pronounced. In the coming quarters, further growth moderation can be expected, as base effects wear off and give a more realistic picture.

The recovery remains unbalanced, as consumption – although improved – is still not strong enough to balance out any slowdown in investment or exports. Renewed, small scale regional Covid-19 outbreaks are hampering full normalization in retail, and especially services such as transport and tourism. Despite China’s success in containing the pandemic, Covid-19 is still impacting the economy. Future outbreaks and regional lockdowns continue to pose a risk to China’s economic performance.

The aftermath of the pandemic is also intensifying persistent domestic structural problems. Regional disparities in the recovery indicated a growing disconnect between coastal regions and China’s poorer western and northeastern provinces. Furthermore, a skills mismatch is hindering labor market recovery as the manufacturing sector struggles to find workers to meet strong demand, whereas recent graduates’ aspirations lean towards the weaker services sector.

External challenges came from soaring commodity prices for essential metals such as copper and iron ore; shortages in the supply chain, especially for semiconductors; skyrocketing shipping costs; and currency appreciation, which raises the price of Chinese exports. These issues did not derail external demand and seemed to have subsided by the end of the quarter. However, the impact of higher costs will lag and could affect exports in the coming months.

Overall, China’s economy weathered the challenges well. But the second quarter also marks the beginning of more challenging aspects as economic growth normalizes in the coming quarters. The government is not leaving things to chance. In anticipation of stronger economic headwinds supportive policies are already put in place. This also comes at a time of accelerated securitization of foreign economic relations and a tightening regulatory grip on the country’s economy.

Macroeconomics: More balanced recovery sets the scene for more targeted government support

- China’s second quarter GDP growth was up 7.9 percent on the same period of last year, but below Q1 levels by 10.4 percentage points. The drop is not as concerning as it seems, as the pandemic’s impact on the reference period persists: the 2020 Q2 numbers were higher than Q1, which explains most of the slowdown.

- Economic output across the first six months of 2021 was up 12.7 percent compared to the same period of 2020. China´s economic recovery has been substantial and is on track to hit the government’s GDP growth target of around 6 percent.

- Consumption was by far the largest contributor to GDP growth, supplying 77.1 percent of gains in Q2. Investment contributed 13.2 percent, and net exports.9.7 percent. This is a positive development as the Chinese economy was heavily reliant on investment and exports in the immediate post-pandemic period.

- The service sector outpaced GDP growth for the first time since the second quarter 2020, expanding 8.3 percent. Output in most service sectors has returned to pre-pandemic levels. The only exception is catering and accommodation, which is still 1 percent below the first six months of 2019.

- Government policy is clearly visible in a sectoral breakdown of the GDP. The government has sought to reduce overinvestment in real estate. As a result, both the construction and real estate sectors grew at a slower pace than overall GDP, with construction up 1.8 percent and real estate gaining 7.1 percent.

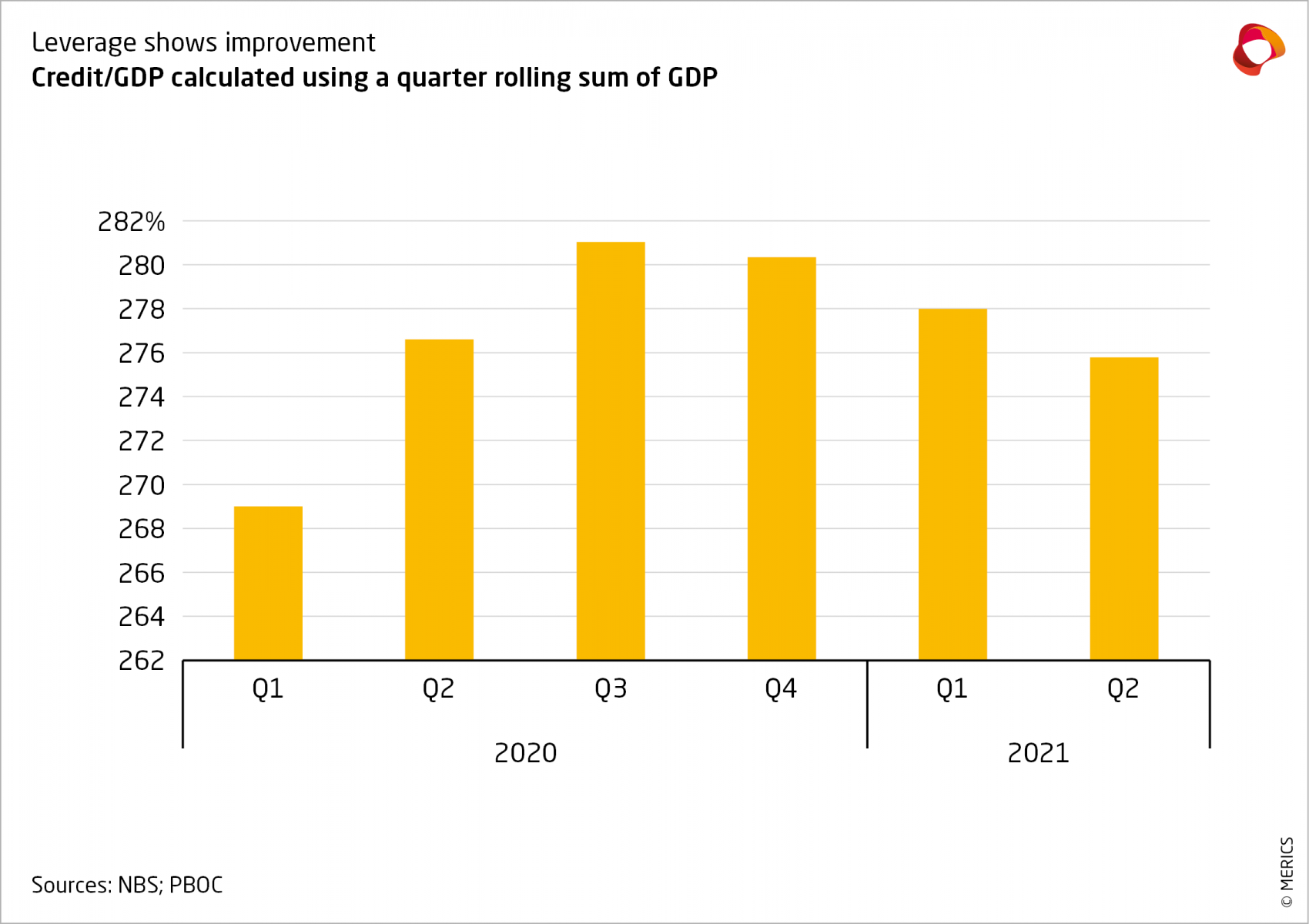

- Another welcome development was the marked improvement in the overall debt situation. Nominal GDP grew by 14 percent, higher than aggregate debt outstanding, which expanded at 11 percent. This caused the debt-to-GDP ratio to fall from 278 to 276 percent (calculated using a rolling sum of GDP).

What to watch: The government is likely to roll out more targeted stimulus as growth moderation sets in.

Business: Output is not hurt by supply shortages and rising commodity prices

- Manufacturing remains the main pillar of China’s economy, despite a gradual slowdown in the second quarter. The growth rate for value-added production eased to 8.3 percent in June, compared to year-earlier. However, it remained elevated when compared to average growth of around 6 percent in the last five years. Production growth was robust, up 15.9 percent compared to the second quarter of 2020.

- Output for the 34 of 41 major industries tracked by the National Bureau of Statistics (NBS) expanded in June. Falling automobile production dragged down data, as global semiconductor shortages forced car makers to cut down vehicle assembly. As a result, vehicle production began to contract in May, after 11 months of expansion. The impact increased in June: vehicle output fell by 13.1 percent.

- Government efforts to contain financial risk build-up in the real estate sector could be seen in the reduced output of construction related materials. For example, cement production growth fell by 2.9 percent in June, year on year.

- Production of key industrial inputs, including metals and chemicals, remained robust, reflecting the underlying strength of China’s manufacturing sector in supplying intermediary industrial goods. For example, ethylene output, a key component in the production of plastics, expanded throughout the second quarter. By the end of June production was up 31.1 percent year on year, the highest increase since 2010.

- Services are still struggling to bounce back to normality. In particular the transport, travel and tourism-related sectors remain weak. Hotel occupancy rates are well below their 55 percent average of the past five years, while average room prices are around 10 percent lower.

- The difficulties in the services sector were also reflected in the Purchasing Manager’s Index (PMI). The Caixin/Markit services PMI fell to 50.3 in June, a 14-month low. Although it remains above 50, indicating business is expected to grow, renewed Covid-19 outbreaks have muted the optimism in parts of the service sector.

What to watch: Automobile production could be dragged down if there is a sustained shortage of semi-conductors.

International trade and investment: Foreign trade affected by higher commodity prices

- Foreign trade is benefiting from a strengthening global recovery, accompanied by an insatiable appetite for China-made goods. Exports had grown for 13 consecutive months by the end of June. More importantly, the gains remained steady at higher levels, up more than 30 percent year-on-year in Q2 when measured in USD terms.

- Export growth picked up in June, indicating that exporters were passing on higher input costs to customers. For example, the volume of aluminum products rose 10.7 percent, but their value in USD terms increased by 32.5 percent in the first half of 2021. Higher costs fueled concerns that China could export inflation to its trading partners as the United States and Europe emerge from the pandemic.

- Surging container shipping costs on European and Pacific routes have not dampened export volumes. Rates for major European routes were five times higher than during the same period of 2020. Delays caused by the week-long closure of Shenzhen’s Yantian terminal in late June due to a Covid-19 outbreak did not impact Q2 data.

- Import growth continues to be driven by higher commodity prices, rather than stronger demand. For instance, timber imports rose 10.6 percent by volume, whereas their value rose 21.8 percent, and copper import volumes fell 1.6 percent, yet their value soared 48.1 percent.

- Although import growth has outpaced exports, China’s trade surplus continues to expand. In US dollar terms the trade balance increased from USD 115 billion in the first quarter to USD 251.5 billion in the first half of the year. So far, currency appreciation pressures have been offset by Chinese banks pursuit of large deposit build-ups, which have raised suspicions that a disguised build-up of foreign exchange is taking place.

- Foreign direct investment (FDI) into China exceeded USD 93.9 billion in the first six months 2021. This was an increase of 28.7 percent year-on-year.

What to watch: Export growth will eventually ease as overseas demand for Chinese-made consumer goods normalizes.

Financial markets: Credit tightening is being felt across the financial market

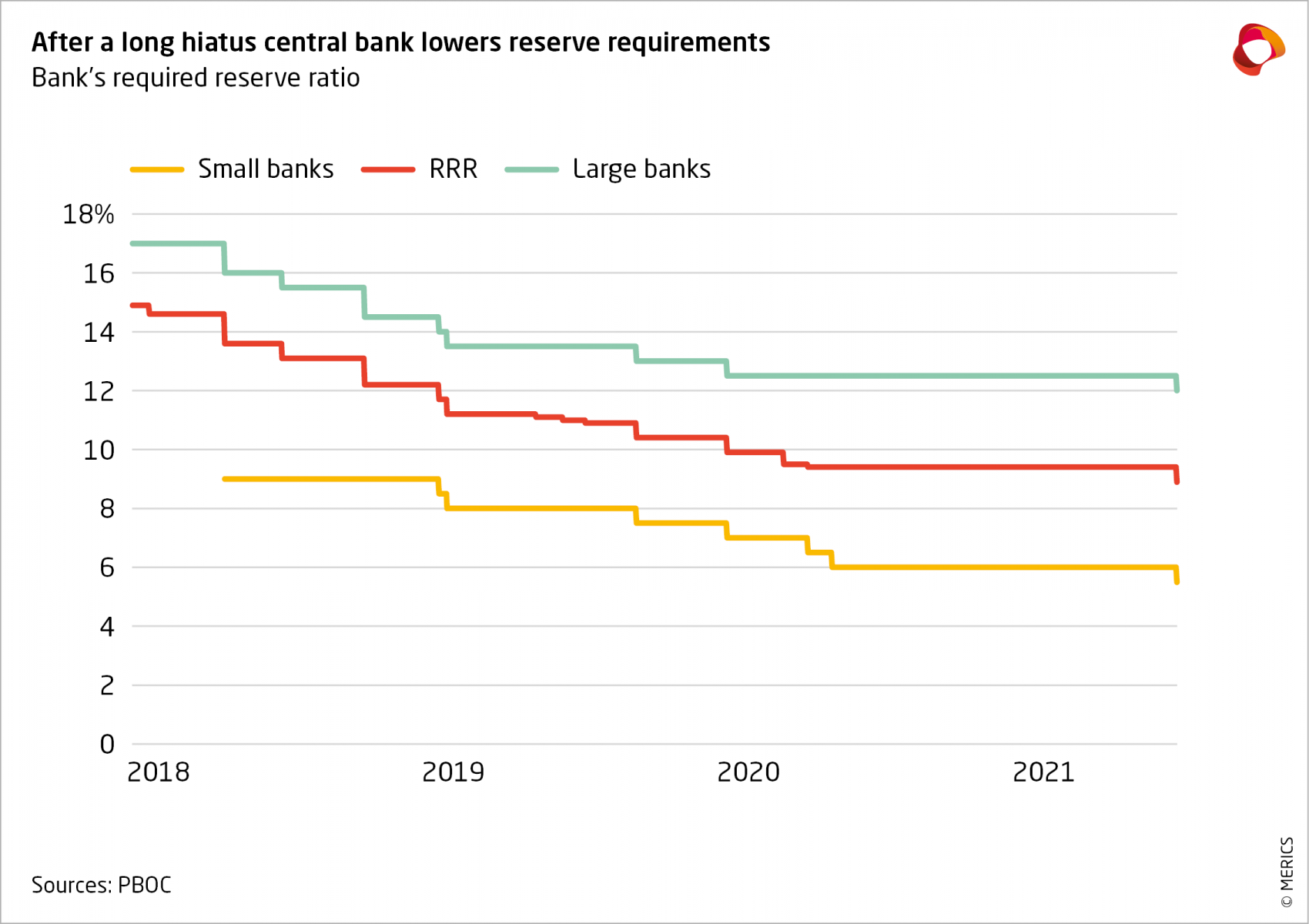

- The economic recovery has reduced the need for emergency lending, leading to lower aggregate credit growth. However, the People’s Bank of China (PBOC) is concerned about the recovery losing momentum and the strong yuan. The central bank has responded by signaling looser monetary policy, without lowering interest rates. Instead, it further reduced the banking sector’s required reserve ratio (RRR), a move that should free up additional liquidity. The measure was targeted to improve support small and medium sized companies (SMEs).

- The slowing growth of outstanding credit aggregates was visible across the board. Aggregate financing growth fell to 10.1 percent in the second quarter, from 12.3 percent in Q1; bank lending fell to 12.6 percent from 13 percent; bond financing fell to 6.7 percent from 11.7 percent; and shadow banking from -10.5 percent to from -2.6 percent.

- The level of risk in the financial system remains a challenge, despite the slowdown in credit growth. China’s bond defaults hit a record USD 18 billion in the first six months, and similar results can be expected in the second half of the year, as the proportion of bad debt in the financial system seems to be high. A report by ratings firm S&P found that only a small fraction of rated firms can meet the debt guidelines issued by the PBOC.

- Demand for China’s currency is being boosted by the economic rebound, current account surplus, and capital inflows into China’s financial markets. The PBOC has acted to stem currency appreciation pressures by increasing the level of US dollar reserves banks are required to hold. It has also launched new outbound investment schemes, including the Wealth Management Connect in Hong Kong.

- Financial markets wobbled and investors were thrown into anxiety when China’s regulators blocked ride hailing company Didi Chuxing from China’s app stores two days after Didi’s USD 4.4 billion listing in New York. The Cyberspace Administration of China (CAC) claimed the US listing would force Didi to share customer data with US officials, a breach of national security, and opened an investigation.

What to watch: Further monetary easing can be expected should economic growth slow too quickly.

Investment: Government policies constrain real estate investment

- Fixed asset investment remains a key driver for the economy, but year to date growth has slowed. In the first half of the year, growth dropped back to 12.6 percent, from 15.4 in the first five months. The boost to growth rate data stemming from comparison with the lockdown period has faded, and FAI data now reflects government efforts to curtail risks in the financial system.

- Investment in China’s more developed coastal provinces showed the weakest increases. However, investment in China’s eastern, northeastern and western provinces all increased at a similar pace: 11.2 percent, 11.8 percent and 11.4 percent. Growth in the central provinces, a region that includes Hubei, the focus of the longest pandemic lockdowns, has outpaced other regions, increasing by 22.3. percent.

- Private sector investment growth has outpaced the state sector so far this year. China’s post lockdown stimulus is being rolled back so state enterprises (SOEs) are losing their easier access to stimulus funds. Private sector investment was up 18.1 percent in the year to date, while investment in SOEs rose 9.6 percent.

- Partly due to government efforts to curb credit growth, real estate investment has slowed since the start of the year; it rose 25.6 percent in the first quarter but only 15 percent in Q2. Nonetheless, the real estate sector remains a major contributor to total fixed asset investment, with 28 percent of the total. Month on month land sales increased sharply between May and June, soaring by 258 percent, indicating that developers are preparing for more investment.

- Investment growth in secondary industry continued to outpace investment in the tertiary (services) sector for the fourth consecutive month. Within secondary industries, the manufacturing industry was the main beneficiary, with investment up 19.2 percent, whilst mining investment grew at 11.5 percent. Year to date investment in the tertiary sector expanded by 10.8 percent in the second quarter, down from 24.1 percent at end-March.

What to watch: Real estate may pick up significantly in the second half of the year, following the large land sales.

Prices: Inflation pressures started to ease in June

- After peaking in May, growth in both consumer and producer prices eased off in June. The consumer price index (CPI) growth fell from an 8-month high of 1.3 percent in May to 1.1 percent in June, while producer prices (PPI) saw growth ease to 8.8 percent after racking up a 9 percent rise in May, the highest increase in 13 years.

- However, producer prices remain elevated as the global recovery is causing supply shortages and pushing up commodity prices. Prices for industrial inputs remain high despite the slight improvement in June: prices for processed ferrous metals rose by 34.4 percent year-on-year in June, dipping back from a 38.1 percent increase in May.

- China’s government stepped up its attempts to control rising commodity prices in the second quarter, reflecting concerns about the impact on small and medium sized companies (SMEs). In May, the National Reform and Development Commission (NDRC) signaled a “zero tolerance” policy for market speculators who drive up prices.

- To increase supply and curb soaring commodities prices, national stockpiles of copper, aluminum and zinc will be auctioned by the National Food and Strategic Reserves Administration (NFSA) in early July. It is the first release from national stockpiles since 2005 for copper, and the first since 2010 for aluminum and zinc.

- CPI picked up over the second quarter, driven by rising commodity prices rather than stronger demand. In the first half, prices accelerated by 0.5 percent, well below the government’s full year target of 3 percent for 2021. All major sub-categories including food, daily necessities, and health care were hovering just above zero, with the exception of transportation costs. Fuel costs soared by 23.6 percent in June, giving a rise of 8.2 percent in the first half of the year.

What to watch: Inflation easing would permit the government more policy flexibility to support economic growth in the second half of the year.

Labor market: Employment pressure persists despite economic recovery

- The pandemic continues to leave its mark on the labor market, which remains a persistent concern for China’s government, despite the economic rebound. In total, 6.98 million new urban jobs were added in the first half of the year, an improvement on 5.6 million in the first six months of 2020, but still below the 7.4 million gained in H1 2019.

- Weaker job creation was due to the service sector’s lagging recovery; demand for tourism, restaurant or transport related jobs remains depressed. Meanwhile, structural problems in the labor market have left companies struggling to fill manufacturing vacancies, as young graduates are unwilling to work on production lines and also lack the necessary skills.

- Migrant workers have been slow to seek employment outside of their home province following the Covid-19 lockdowns around Chinese New Year 2019. By the end of the second quarter numbers are just approaching pre-pandemic levels, but are still 150,000 below the same time period in 2019.

- Eight provinces and municipalities had announced or implemented minimum wages increases by the end of June. However, the nominal increases barely match rising living costs. Furthermore, the major manufacturing centers in Jiangsu and Guangdong provinces have not increased minimum wages since 2018.

- Survey data by online recruitment platform Zhaopin.com suggests regional pay disparities are growing. Salary growth for white collar positions in China’s first tier cities was unaffected by the pandemic. Meanwhile, China’s northeastern rustbelt provinces account for four of the country’s five worst-performing cities in terms of wage growth.

- Disposable income growth improved over the second quarter, increasing by 12 percent in real terms. Over the past two years disposable income growth grew by 5.2 percent in real terms, slightly lower than GDP growth during the same period. However, in the first half of 2021 growth is catching up and outpacing economic growth.

What to watch: The service sector will need to improve further to boost new jobs.

Retail: Consumer spending gains strength, but services sector trails behind

- Retail growth eased in the second quarter, as was predicted after the sharp rise in Q1 caused by base effects from comparison with the pandemic-impacted reference period in 2020. Those distorting impacts are fading. Crucially, the rebound in consumption over the second quarter was strong enough to contribute to a more balanced economic recovery.

- Household spending has lagged behind the overall recovery, but June data gave reasons for optimism. Retail spending beat market expectations as growth in June expanded 12.1 percent year on year. Overall growth over the second quarter held steady, dipping only slightly in June from 12.4 percent in May. Retail spending grew by 23 percent in the first half of 2021.

- Automobile sales contracted by 3 percent in May after 13 consecutive months of growth. The slow-down accelerated in June when unit sales dropped by 12.4 percent, according to the China Association of Automobile Manufacturers. However, the slowdown was largely due to a shortage of semiconductors needed by manufacturers. Across the first half of the year, sales improved by 25.6 percent to total 12.9 million units.

- Growth in restaurant spending has outpaced total retail spending, thereby contributing to the recovery. Restaurant spending has returned to pre-pandemic levels, indicating consumers feel confident about dining out, despite some small local outbreaks: in the first half of the year restaurant spending was 2.6 percent above pre-pandemic levels from H1 2019.

- However, services as a whole are still feeling the impact of the pandemic. For example, travel volumes for rail and air transport in the first half of the year was down roughly 25 percent compared to the same period of 2019, suggesting that people are still hesitant to travel.

What to watch: As vaccination rates rise, travel volumes could pick up, provided there are no significant regional outbreaks in key destinations.