Guardians of the Belt and Road

The internationalization of China's private security companies

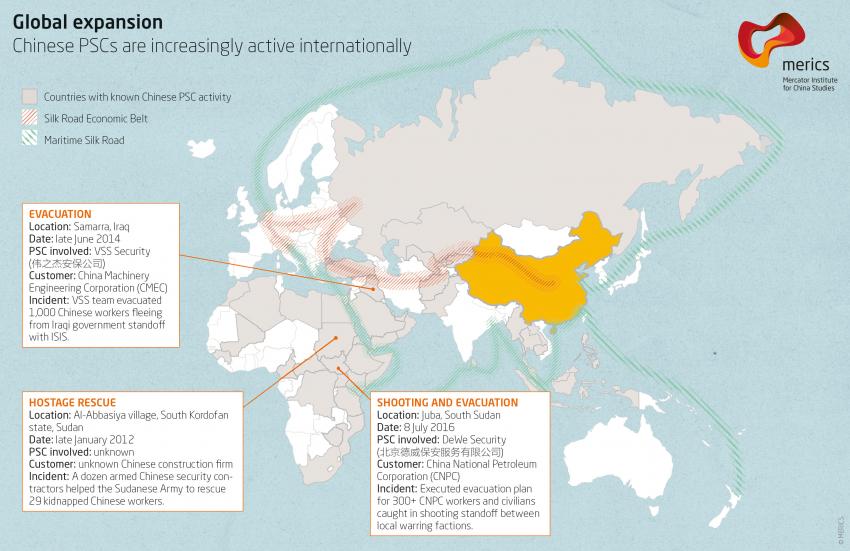

Following the build-up of infrastructure and investment projects along China’s extensive Belt and Road Initiative (BRI), private security companies from China are also increasingly going global – to protect Chinese assets and the growing number of Chinese nationals living and working in countries along the BRI, in sometimes unstable regions. Out of the 5,000 registered Chinese private security companies, 20 provide international services, employing 3,200 security personnel in countries like Iraq, Sudan and Pakistan.

The impact of this newly developing Chinese activity abroad is analyzed in this MERICS China Monitor. Chinese private security companies’ international activities pose a challenge to European interests as they are often largely unregulated and their security staff are often inexperienced in dealing with serious conflict situations and combat. EU policymakers, thus, are called upon to encourage and assist Beijing to pass laws regulating Chinese private security companies’ activities overseas.

Main findings and conclusions

- Chinese private security companies (PSCs) are going global, encouraged by the saturation of the domestic market, the Belt and Road Initiative (BRI) and Beijing’s preference for using homegrown companies to protect its interests abroad.

- Projects related to the BRI have become a prime market for Chinese private security companies, as Chinese investment expands into countries that are either experiencing or emerging from conflict.

- Chinese private security companies operate overseas in a legal grey zone: Chinese domestic law does not apply to their international activities, and international law lacks regulation, so they only have to abide by local host country laws, where those exist.

- The behavior and operations of Chinese PSCs abroad vary widely from country to country, depending on their contracts and local legislation, or lack thereof.

- Beijing’s use of private security companies to protect its overseas interests is risky. Due to their relative inexperience, there is high potential for mistakes that could create political backlash for Beijing.

- European Union member states’ interests will be affected by Chinese PSCs’ international expansion. The companies might contribute to an increase of instability in regions that are strategically important for Europe. At the same time, they could help Beijing increase its influence over host country governments.

- More thorough regulation of Chinese private security companies’ international activities is urgently needed. Through their own national experience in regulating PSCs, European policymakers are in a unique position to help and encourage Beijing to pass relevant laws and at the same time assist host countries of Chinese PSC activity to strengthen their national legislation regulating foreign private security company activities.

Introduction

A military base in Djibouti, an expanding Shanghai Cooperation Organization under Beijing’s leadership, and rapidly growing arms exports to countries around the world: China has left no doubt that it plans to become a global security actor.

The rapid expansion of China’s commercial and political activities around the globe is exposing Chinese citizens and assets to the threats of transnational terrorism, civil unrest, and anti-Chinese sentiment. And domestic expectations that Beijing will protect these interests, together with the Chinese government’s ambitions to shape global norms, are pushing China to embrace force projection abroad. For the time being, Beijing is neither willing nor able to deploy the People’s Liberation Army (PLA) overseas to protect Chinese companies and citizens. As a result, Chinese private security companies (PSCs) are stepping in to fill this security vacuum.

The globalization of China’s security policy presents challenges for countries around the world, but Beijing’s use of private actors to defend its international interests carries with it its own unique set of issues. The presence of private security actors abroad – regardless of their country of origin – is a complicated issue for host governments, due to the impact that these companies can have on the interests and stability of the host country, as well as the difficulty in controlling their activities. In the Chinese case, however, this issue is even more pronounced due to the blurry line between public and private entities. Despite their nominally private status, Chinese private security companies tend to operate with the tacit support and encouragement of the Chinese government and are often staffed by former PLA officers with close, if indirect, ties to the Chinese authorities. This makes them complex, quasi-governmental international actors whose behavior is unregulated, since existing legal frameworks – both at the domestic and international level – do not clearly specify who is responsible for policing their operations.

The potentially negative consequences of this are clear. For Beijing, there is the risk of these unregulated, relatively inexperienced private security companies making mistakes on the international arena that could have political consequences. If such mistakes accumulate, this could erode China’s international reputation, which is of utmost concern now that party and state leader Xi Jinping has committed to turning China into a global power by 2049. And from the perspective of European countries, Chinese PSCs’ international expansion can have an impact on their interests in regions around the world, by potentially causing tension and instability in host countries and by helping Beijing increase its influence in some of those countries. If current trends continue, Chinese private security actors will continue to expand their activities in strategically important areas along the Belt and Road Initiative, coming ever closer to the wider European neighborhood.

It is, therefore, important to pay close attention to this issue and to encourage the regulation of Chinese PSCs’ behavior and operations overseas. A better understanding of the current state of the Chinese private security sector, its overseas activities and the legal conditions is essential as it enables European governments to assess and deal with the impact that Chinese PSCs’ activities may have on their interests and priorities.

1. Going global: the internationalization of China’s private security sector

Chinese private security companies are rapidly expanding their international presence, driven by the saturation of the domestic market, developments linked to the Belt and Road Initiative and Beijing’s encouragement. But to this day, they still hold a small share of the international private security market.

1.1. Internal drivers for internationalization

While China does not have or allow private military companies, the country does permit private security companies to operate. These companies, however, do not have to follow the same rules and principles as their equivalents in other countries, and their activities are shaped by the special conditions of the Chinese market and regulatory framework.

Beijing keeps the People’s Liberation Army (PLA) and paramilitary groups such as the People’s Armed Police (PAP) under the tight and exclusive control of the Chinese Communist Party (CCP). However, a booming domestic private security sector has developed since the legalization of PSCs in September 2009. Prior to this, the private security industry operated in legal limbo. Although some PSCs did exist since the mid-1990s, they were small in size, and their activities were very limited. By 2013, however, there were already 4,000 registered PSCs in China, employing more than 4.3 million security personnel.1 By 2017, this number had risen to 5,000.2 Like their Western counterparts, most Chinese PSCs employ former soldiers or former police officers, a fact that blurs the line between China’s security forces and private security providers.

Due to the special conditions under which they emerged and operate, the services provided by Chinese PSCs are still substantially different from those provided by large international companies. Chinese PSCs are relatively young and inexperienced in operating in combat scenarios. Though some are staffed with PLA veterans, it should be noted that the PLA has not experienced active combat since the war with Vietnam in 1979. While operating abroad, for example, Chinese PSCs normally do not carry or use arms. As a result, most Chinese PSCs working overseas tend to provide services focused on security consulting, although they occasionally carry out armed missions via contracted local teams.

As China’s commercial and political activities around the globe expand, some of the largest and most successful domestic private security firms have started to follow Chinese firms’ international expansion and now provide international security services as well. However, the vast majority of these companies still operate exclusively in China, providing security services for public or private facilities or offering bodyguard services to China’s wealthy and powerful. According to Chinese state media, 20 Chinese PSCs had entered the international market by 20163 and had deployed about 3,200 security professionals overseas.4 Yet, their market share is small compared to Western PMCs: in 2008, an estimated 50 foreign private security companies were operating in Iraq alone.5 The large UK and US-based private security and military companies are still the preferred choice for many private firms operating overseas.6

This, however, is rapidly changing, as Chinese state-owned enterprises (SOEs) and other domestic firms operating overseas shift their preferences towards employing Chinese PSCs. There are various reasons for this shift, including language and cultural barriers faced when working with non-Chinese staff, as well as financial incentives, since international PSCs tend to be more expensive.7 Contractors estimate that a team of 12 Chinese guards might cost the same as a single British or US guard.8 Reportedly, there is also government pressure to hire domestic PSCs.

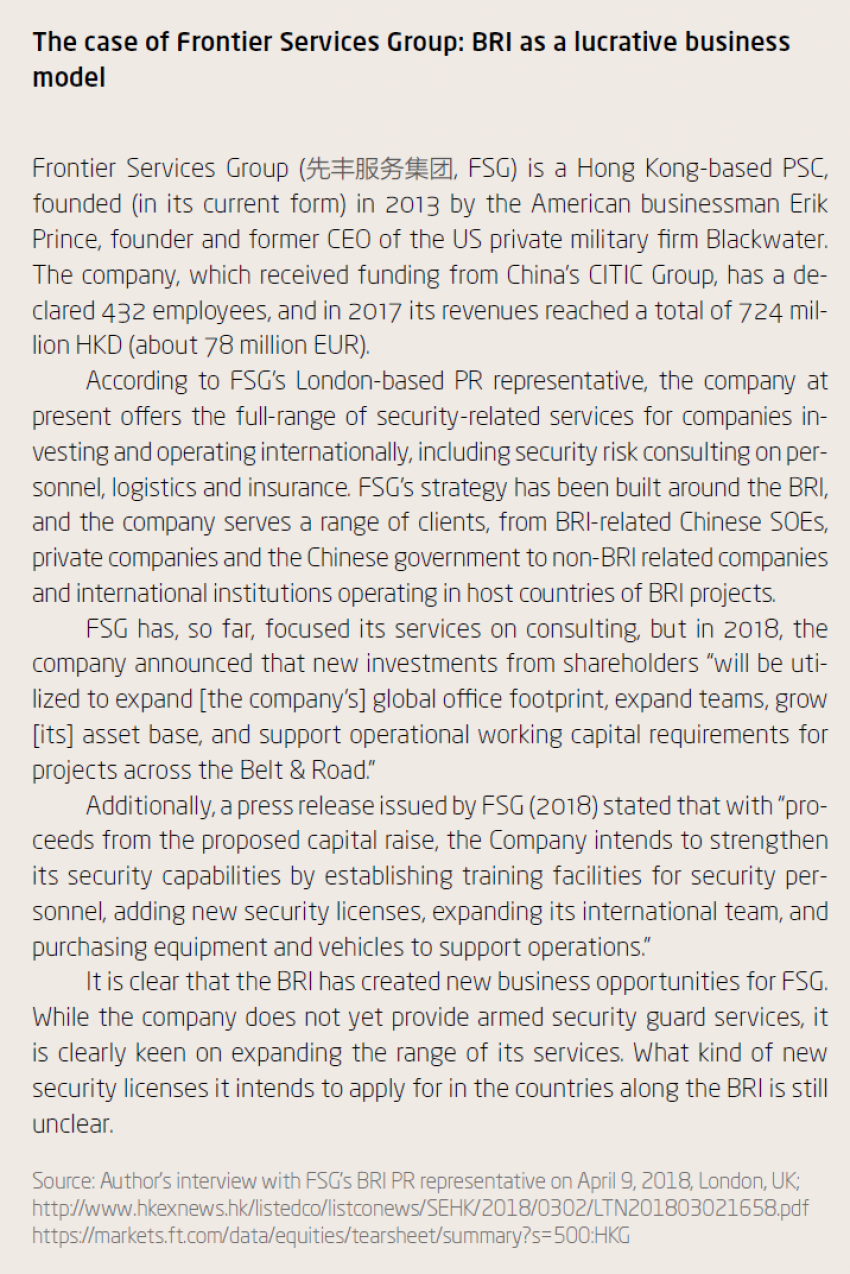

So far, a publicly-available, comprehensive list of all Chinese PSCs with overseas operations does not exist, but some of the most active firms are easily identifiable. Phoenix International Think Tank – part of China’s Phoenix Media Group – identified important PSCs active abroad in a 2016 ranking.9 The top two companies in this ranking are the (presumably China branches of) UKbased security giants G4S and Control Risks. They are followed by eight entirely Chinese-owned PSCs.10 G4S and Control Risks are just two examples of international PSCs setting up Chinese branches. The former head of the private US military company Blackwater, Erik Prince, has also set up a PSC in Hong Kong called Frontier Services Group (先丰服务集团).

China’s private security sector is thus rapidly expanding its market share, piggybacking on Chinese companies’ expanding international presence. Spurred by Beijing’s push for Chinese state-owned enterprises to hire domestic private security companies, as well as a general preference for their methods of operation, Chinese PSCs are present in growing numbers of countries around the world.

1.2. The BRI as a catalyst for further internationalization

Involving 65 countries and an estimated 900 billion USD (about 765 billion EUR) of planned investments around the globe, the Belt and Road Initiative (BRI) has substantially expanded China’s overseas economic presence.11 According to data from the Beijing-based Center for China and Globalization, by 2016 a total of 847,000 Chinese nationals worked in more than 16,000 companies worldwide.12 The BRI, therefore, acts as a catalyst for the further internationalization of Chinese PSCs: as the BRI pushes Chinese SOEs and other firms to expand internationally, often into risky environments, Chinese PSCs can fill the security gap by providing global services.

Chinese companies and nationals working abroad face vulnerabilities and security concerns, which has spurred demand for private security services. Many companies operate in countries where security is a long-standing problem. The BRI runs through several highly unstable countries, from South Asia and the Middle East all the way to East Africa, where operational and safety risks are high for Chinese companies and citizens. Examples of such risky operations include the maintenance of power plants in Iraq, infrastructure development in Pakistan or oil drilling in Sudan.

Transnational terrorist groups also operate in several of these countries along the BRI. While domestic terrorism has long been high on the list of Beijing’s security priorities, especially when related to Uighur separatism, transnational terrorism has only come to the forefront since the BRI was unveiled in late 2013. A number of threats and attacks against Chinese citizens and assets along the BRI in the last few years have underlined this concern: in 2017, terrorist groups linked to the Salafist jihadist organization of Jabhat al-Nusra bombed the Chinese embassy in Bishkek.13 And in Pakistan, attacks have already cost the lives of at least three Chinese nationals: two teachers were kidnapped and killed by ISIS in June 2017, and an employee of a shipping company was killed in a shooting in Karachi in February 2018.

The BRI itself also has the potential to exacerbate security issues in the countries and regions it passes through. Big-ticket Chinese projects can lead to substantial debt burdens for host governments, and can also create opportunities for graft and rent-seeking behavior by predatory elites, especially in countries where corruption is widespread and transparency is lacking. This, along with potentially low social and environmental standards, can also fuel tensions and lead to social instability and anti-Chinese sentiment, as it has done in the past in Sri Lanka, Pakistan and Vietnam, among other places. The BRI also has a broader geopolitical impact. Relations with India, for example, are strained due to ambitious BRI projects in Pakistan (through the China-Pakistan Economic Corridor (CPEC)) and in the Maldives, a long-standing Indian ally.

The Chinese government knows that it must protect its citizens and assets from overseas risks. But Beijing, as well as host countries, are reluctant to have the PLA deployed for protection. This is due to several factors, including China’s long-standing policy of non-interference, the fear of damaging its diplomatic relations with neighboring countries and potential allies, the PLA’s lack of combat experience, and the lack of the necessary infrastructure and logistics. As of now, the Chinese government mostly relies on host countries’ security forces to provide protection for BRI projects. In some countries along the BRI, however, Chinese firms feel inadequately protected by local security companies and armed forces, mostly due to a lack of trust in their abilities and reliability, and have thus turned to private security providers.14

2. Chinese private security companies operating overseas are largely unregulated

The international activities of China’s private security companies are largely unregulated by either international or domestic laws. Chinese laws regulating the security sector only cover activities on domestic soil. And international law remains vague about PSCs, even though it does cover activities of private security firms in times of conflict. Therefore, constrained only by the laws of the country in which they operate, Chinese PSCs with a global presence find themselves with substantial leeway to operate with little to no legal consequences for them at home.

As a result of this lack of regulation, Chinese PSCs carry out widely different activities with varying levels of engagement in countries around the world. For example, the lack of regulation means that for their overseas operations, Chinese PSCs are not required to obtain a license in China (though they may need one from the host country). This carries the risk that small, unqualified companies may exaggerate their experience and set up overseas units that are incapable of providing the services they advertise. Furthermore, in countries with lax gun controls, Chinese PSCs could easily get access to weapons. In countries with stricter regulations on arms control and the activities of foreign PSCs, however, Chinese security companies still mostly limit their services to consulting. In these cases, PSCs that want to offer broader security services have to enter into partnerships with local security companies, like they have done in Russia or Pakistan already.

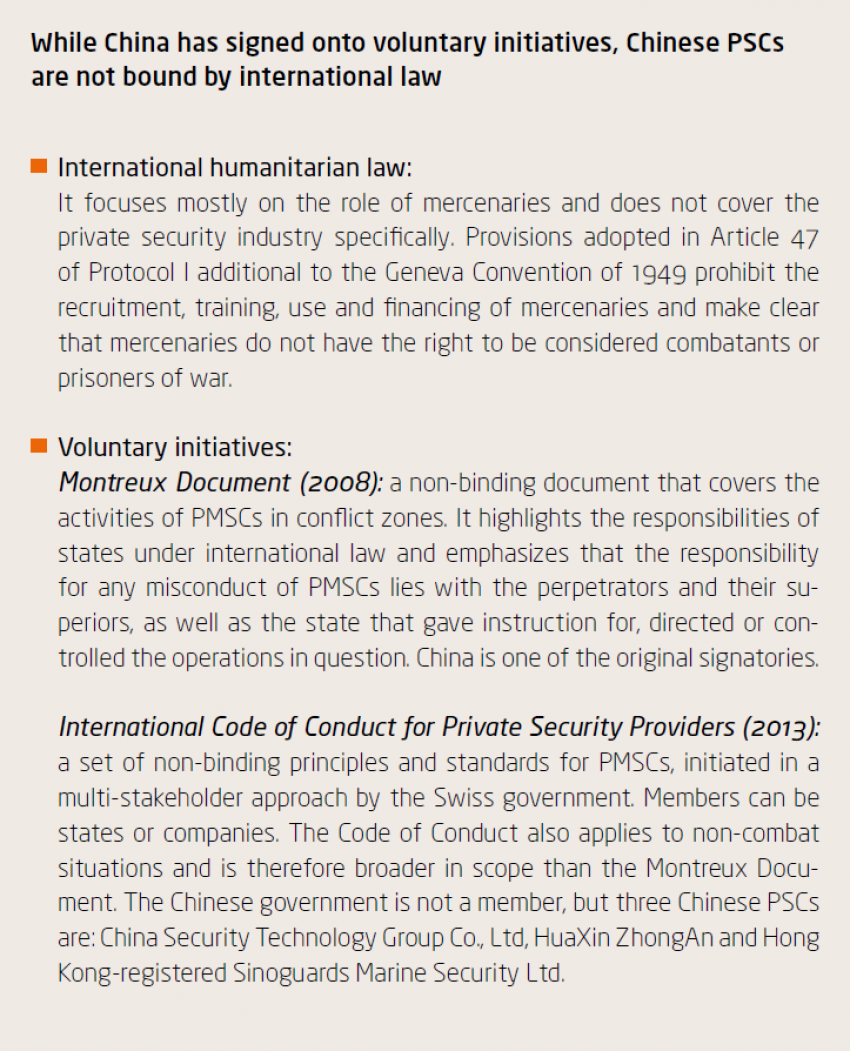

2.1. International law fails to regulate private military and security companies

International humanitarian law clearly defines the responsibility of the state and who is a civilian and who a combatant during times of conflict. But there is no single, binding international law or human rights treaty that specifically regulates private military or security contractors (PMSCs). Initiatives covering the private security sector are all voluntary and non-binding.

A central question when it comes to private security actors is: are they accountable to the state in which they are registered (home country), to the state in which they operate (territorial or host country), or to the state by which they were contracted (contracting states)? Ultimately, according to Article 3 of the Fourth Hague Convention and Article 91 of Protocol I, states are directly responsible for violations of international humanitarian law attributable to them.12 This includes acts attributed to private contractors or other parastatal entities that were empowered to exercise elements of governmental authority (even if they remain outside of the official structure of the state) 16 Thus, in theory, Beijing, just like any other government, could be held responsible for misconduct on the part of PSCs contracted to operate overseas on its behalf. However, considering the general difficulty in enforcing international law, it is very unlikely that the two articles mentioned will be applied.

International law is even more unclear on relevant issues such as gun use. Current international humanitarian law does not prohibit PMSCs from carrying guns, nor does carrying arms affect a PMSC employee’s status as civilian or combatant. Unless directly hired by a government in an armed conflict scenario, or unless armed and guarding a government or public facility, a private military contractor is considered a civilian by international law.

Encouraged by this absence of clear oversight and monitoring mechanisms, private military and security companies are increasingly taking on the functions that had until recently been inherent to the sovereignty of states. Recognizing this problem, the UN, through its Commission on Human Rights’ “Working Group on the use of mercenaries”17 is encouraging thorough regulatory efforts: at the industry level through self-regulation, at the national level through specific legislation and at the international level through efforts of the Working Group itself, which has announced a draft convention for the oversight and monitoring of PMSCs.18

However, despite these recommendations and some other non-binding international rules (see box 3), PMSCs are still mostly regulated only at the state level. Once they work in non-combat situations abroad, they continue to operate in a legal grey zone.

2.2. Domestic Chinese law only regulates private security companies' activities within China

China’s existing legislation only covers PSCs’ operations inside China. Some of these existing laws, however, have had the (possibly unintended) effect of encouraging the rapid international expansion of Chinese PSCs.

The most important of these laws regulating domestic Chinese private security companies is the September 2009 “Regulation on the Administration of Security and Guarding Services” (保安服务管理条例), which legalized PSCs and marked China’s first attempt to establish a regulatory framework for the sector.

This regulation makes clear that Chinese PSCs are entirely under the control of the state, through the Ministry of Public Security (MPS). This shows that the line between public and private in this sector is blurry. PSCs that wish to provide armed security services inside China are effectively required to give up their private status, since they must either be a wholly state-owned company or have state-owned capital accounting for at least 51 percent of all their registered capital.19 On the other hand, those providing armed services overseas, since they are not covered by this regulation, could in theory remain fully private.

In 2010, China’s Ministry of Commerce issued a follow-up set of rules and regulations for firms operating abroad, creating very strict security requirements for them, and thus indirectly encouraging Chinese PSCs to go international, even though they are not directly mentioned. The “Regulation on the Safety Management of Overseas Chinese-Funded Companies, Institutions and Personnel” (境外 中资企业机构和人员安全管理规定) stipulates, under the principle of “whoever sends them is responsible”,20 that Chinese firms must provide security training to their employees before sending them abroad. Firms operating in high-risk areas must also set up overseas security management systems and mechanisms for security emergencies.21 This effectively created a niche: by offering such training programs and security management systems to Chinese firms overseas, especially along the BRI, the Chinese PSCs could enter the international private security market.

The lack of oversight of security companies’ activities abroad also extends to gun control. While the use of arms by private security actors on Chinese soil is strictly regulated by several laws, including the “Law of the PRC on Control of Guns” of 1996 (中华人民共和国枪支管理法) and the “Regulation on the Administration of the Use of Guns by Full-Time Guards and Escorts” of 2002 (专职守护押运人员枪支使用管理条例), there are no provisions regarding the use of arms overseas. As mentioned above, Chinese PSCs often set themselves apart from international counterparts by arguing that their employees are unarmed. Some Chinese PSCs claim that the government discourages their use of guns abroad, lest they engage in activities that could cause political backlash for Beijing. Others stress that the contracts signed with their clients often include a clause prohibiting the use of guns. The ultimate reason for their reluctance to use guns is unclear, but it is not explicitly prohibited by Chinese law. And since international law also allows for PSC gun use, restrictions can only come from political considerations imposed by Beijing, or from host country laws. Therefore, theoretically, Chinese PSCs could at any moment start using guns in countries where local laws permit this if they were willing to ignore Beijing’s political pressure.

This absence of clear regulation of PSCs’ overseas activities at a domestic level has turned China into an outlier among those countries with an active private security sector. Countries such as Canada, Sweden, the UK and the United States - all of them, unlike China, members of the International Code of Conduct for Private Security Providers of 2013 - have taken substantial measures to regulate their respective PMSC industries and their international operations. The UK, the US and Sweden, for example, have national neutrality laws designed to control mercenary involvement overseas by prohibiting activity that could drag a country into a war that it is otherwise not a party to.22 There are also laws prohibiting mercenary activities and recruitment, for instance in Belgium. Lastly, several countries, like the United States, have laws on military export controls that also contain provisions on military services and require private military companies (PMCs) to register at home before they can engage in activities abroad.23 While most of these laws deal with PMCs and only to some extent PSCs, the fact that national legislation covering the private security sector’s overseas activities does exist in many countries makes China’s lack of sufficient regulation even more poignant.

There are indications though that the Chinese authorities have woken up to the problems caused by the lack of regulatory oversight. Media reports say that the Ministry of Public Security, which has supervisory authority over the private security sector, may issue regulations on PSCs’ overseas operations in the future. The magazine Caijing reported in 2017 that the China Security Association (中国保安协会),24 which is under the jurisdiction of the MPS, was evaluating Chinese PSCs to draw-up a “white list” of firms deemed suitable for overseas work.25 For now, however, and barring the passing of a new law or regulation, Chinese PSCs’ overseas activities remain largely unregulated by either international or domestic law.

3. Case Studies: Chinese private security companies’ activities on foreign soil

Due to the lack of a regulatory framework at the international level or at home, Chinese PSCs’ activities overseas are mainly determined by the host country’s regulations and by the contracts signed with the firms employing them. Countries like Pakistan, Sudan and South Sudan represent the two ends of the spectrum: Pakistan has strict regulations on foreign PSCs on its soil, while Sudan and South Sudan lack any meaningful regulation of this kind.26

3.1. Case study 1: Pakistan

The China-Pakistan Economic Corridor (CPEC) is the flagship project of the Belt and Road Initiative: by 2018, the value of CPEC projects was worth 62 billion USD (about 53 billion EUR).27 The aim of the CPEC is to connect the BRI’s Maritime Silk Road with the land-based Silk Road Economic Belt through a 3,000-km network of roads, railways and pipelines to transport oil and gas from Gwadar on the Arabian Sea to the Chinese city of Kashgar in north-western Xinjiang. More importantly, over 30,000 Chinese nationals are reported to be employed through different CPEC projects in Pakistan.28

The CPEC runs through notoriously unstable and insecure parts of Pakistan. Security concerns are therefore significant, particularly in those parts of Pakistan where Chinese nationals have been targeted by extremists, such as in Quetta and Karachi. In December 2017, Beijing even warned Chinese nationals in Pakistan that more attacks on Chinese targets could be imminent.29

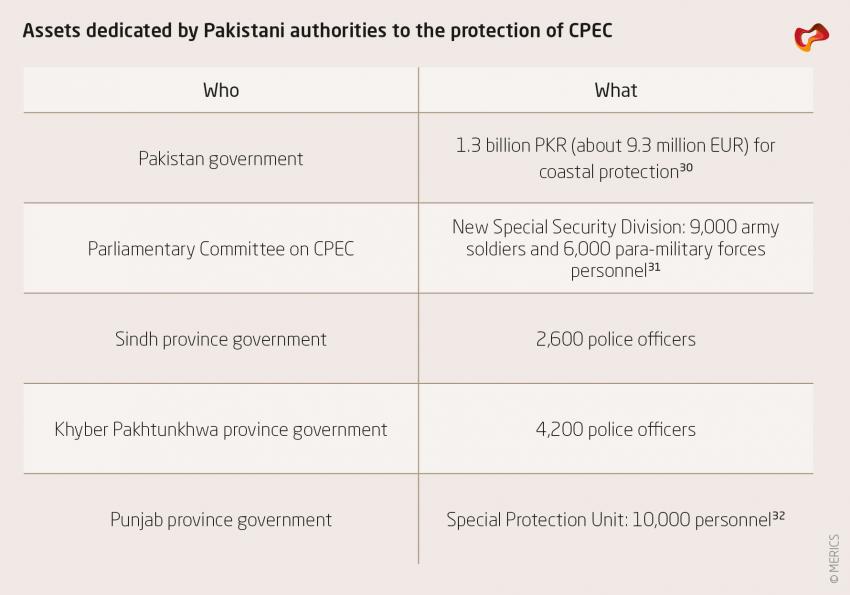

Pakistani authorities have taken several measures to guarantee the safety of Chinese workers involved in CPEC projects. Both the central government, various provincial governments as well as the Pakistani Parliamentary Committee on CPEC have committed considerable resources to the protection of the CPEC initiative (see table 2).

Private security companies, albeit mostly non-Chinese ones, also used to be active in Pakistan to complement the government’s efforts. However, following the arrest of a private contractor for the US Central Intelligence Agency, who shot and killed two reportedly armed men in Lahore in January 2011,33 Pakistan’s Minister of Interior, Rehman Malik, made a statement in 2012 barring foreign security companies from operating in Pakistan. This made certain leading international PSCs, such as G4S, withdraw their services from Pakistan.34 The Islamabad government thus made a political decision to secure investment, including CPEC projects, using only Pakistani security providers. Pakistan’s domestic private security industry has, as a consequence, boomed to meet the country’s security challenges. According to estimates, at least 600 security companies exist, though many of them are non-functional.35

A solid regulatory framework governs PSC activities across Pakistan. Under Pakistani law private military companies are forbidden from operating in the country, and domestic private security companies must adhere to strict provincial legislation.36 PSCs are allowed to carry arms in Pakistan, if appropriately licensed, trained and registered with the national regulatory body.

However, the Islamabad Capital Territory (ICT) and Provincial Ordinances, by which PSCs must abide, are limited in scope to the national sphere and do not address the import or export of PSC activities. The ordinances also do not specify the issue of foreign ownership or joint ventures, while the Companies Ordinance of 1984 allows for foreign investment and joint ventures in general but makes no specific mention of private security companies.37 This, and the fact that the ban on foreign-owned security companies operating in Pakistan was a political decision, has resulted in a legal grey-zone for joint ventures between Pakistani and foreign private security firms.38

It is difficult to obtain reliable information on the real scope of Chinese PSCs’ activities in Pakistan. Some PSCs such as Frontier Services Group and China Overseas Security Group (COSG), among several others, claim to operate in Pakistan. And it is likely that these companies work with local partners in-country. FSG, for example, states that its northwest regional division comprises services in Pakistan, Afghanistan, Kazakhstan and Uzbekistan.39 COSG states on its website that it has a Pakistan branch, but a recent news report mentions that COSG cooperates with a local security company.40

Though certain PSCs only offer consulting services, COSG in Pakistan went a step further towards offering more hands-on services in 2018. The company reported that its Pakistan branch, called the Pan-Asia Group, took part in a livefire training of management personnel and first-line security guards, with the aim of providing security for overseas Chinese in light of the deteriorating security environment. These overseas Chinese included the diplomatic mission in Pakistan and Chinese-funded enterprises and individuals, according to Pan-Asia Group’s regional manager Yang Lulei.41

Additionally, HuaXin ZhongAn claims to have operated in Pakistan at least once before, using retired local special forces as armed guards when providing services to Chinese TV crews covering the kidnappings in Quetta in 2017. HuaXin ZhongAn was able to operate in Pakistan, but it had to cooperate with a local entity.42

It is apparent that Chinese PSCs are increasingly active in Pakistan, in direct relation to the growth of Chinese CPEC-related investments in the country. However, there is no publicly-available evidence that any of the Chinese PSCs active in Pakistan have been involved in a conflict scenario, most likely because their activities are constrained by strict national and regional laws.

Whilst foreign PSCs are barred from working in Pakistan, companies such as COSG, FSG and HuaXin ZhongAn have evidently found loopholes around this and continue to offer consulting and hands-on security services in Pakistan. In doing so, they have filled the gap created in the market by the departure of Western PSCs in 2012. They now compete with local private security providers to protect CPEC projects. Considering the continued instability and the growing Chinese investment in Pakistan, it is likely that Chinese PSCs will increase their business in the country, taking advantage of Chinese SOEs’ preference for hiring Chinese PSCs.

3.2. Case study 2: Sudan and South Sudan

The case of Sudan and South Sudan provides another example of the achievements and limitations of Chinese PSCs’ work overseas. We look at both countries together because Chinese involvement in the region, which focuses mostly on the oil sector, dates back to the late 1990s, when oil-rich South Sudan was not yet independent. Chinese projects, infrastructure and operations in the region thus often span modern Sudan and South Sudan, from the oil producing fields straddling both countries to Port Sudan in Sudan. While neither Sudan nor South Sudan are officially part of the BRI, both governments are trying to make use of their strategic location near the Maritime Silk Road to attract Chinese investment. The Sudanese government in Khartoum, for example, has announced that it aims to turn Port Sudan into a free trade zone to support BRI.43

China-Sudan bilateral ties have become increasingly close in the past decades. Because of the massive exports of oil, China is now the largest trading partner of both Sudan and South Sudan. The Greater Nile Petroleum Operating Company, a joint venture between several oil companies established in 1997, with the China National Petroleum Corporation (CNPC) taking a 40 percent stake, marked the first large Chinese investment in Sudan. Today, China reportedly controls about 75 percent of the Sudanese oil industry.44

Security in the region has long been a problem. In October 2008, nine Chinese workers of the China National Petroleum Corporation (CNPC) were kidnapped in Sudan’s oil-producing state of South Kordofan; four of them were killed. And in late January 2012, rebels from the Sudan People’s Liberation Movement (SPLM)-North group kidnapped 29 Chinese workers from the state-owned China Power Construction Corporation in the same region.45 As a result, the number of Chinese nationals in the region has been declining. In 2012, just before the unveiling of the BRI and following South Sudan’s 2011 independence, there were over 12,000 Chinese workers in Sudan and South Sudan. By 2016, the number had dropped to under 7,000.46

While the security of oil installations was for a few years largely in the hands of South Sudan’s military, Chinese firms operating in the region, such as CNPC, have long used PSCs for further protection.

Neither Sudan nor South Sudan have clear laws or regulations restricting the operations of foreign PSCs in their territories. And arms control legislation in the region either does not mention PSCs, in the case of Sudan,47 or openly allows private security contractors to carry and use firearms as long as they have a license, in the case of South Sudan.48 According to a 2014 study, in South Sudan only one local PSC, Veterans Security Services (VSS), which is comprised mostly of former military regiments, had the legal right to hold arms, while other companies were required to contact local authorities if armed protection was needed.49 Whether this is still the case is unclear.

There is no open-source evidence of any Chinese private security presence in the country at the time of the first kidnapping incident of a Chinese national in Sudan in 2008. But by the time of the second kidnapping in 2012, the activity in the region of one of these companies was publicly recorded, although the specific company remained unidentified. According to media reports, armed contractors from this unnamed Chinese PSC – presumably hired by the China Power Construction Corporation – participated in the Sudanese army’s mission that resulted in the successful rescue of all 29 kidnapped workers.50

In July 2016, another Chinese PSC made headlines after getting involved in a skirmish in the South Sudanese capital of Juba. More details were publicly revealed in this case, showing that although Chinese PSCs in the region still tend to focus on security consulting, they can sometimes be dragged into combat scenarios for which they are unprepared. In this particular case, the PSC Beijing DeWe Security Services (DeWe) was called in to protect the employees of CNPC (its main client in the country) and to help evacuate 330 civilians to Nairobi, Kenya, after a shooting started between warring local factions. Reports of the incident show that DeWe employees were unarmed at the time and largely unprepared for this scenario. According to media reports, DeWe employees discovered in the middle of the firefight that the building they were based in “could not stop bullets”, and the evacuation of workers had to wait until the government forces had expelled the rebels out of the city.51 There were, however, no reported injuries or casualties and all civilians were eventually safely evacuated to Nairobi.

While it is not immediately obvious how many Chinese PSCs maintain a regular presence in Sudan or South Sudan, some of the largest Chinese PSCs are relatively open in admitting that they provide services in the region. In most cases, their clients are Chinese SOEs that remain involved in the two countries despite the political instability. The main player in the region is DeWe, which claims to have established a regional office in South Sudan52 and has also announced plans to build a permanent “security camp” in the country, in what appears to be the first overseas private security facility of its kind established by a Chinese company.

Other Chinese PSCs, such as VSS Security Group (伟之杰安保集团)53 or China Security and Protection Group also claim to provide services in the region.54 VSS, for example, whose main overseas client is PetroChina, reportedly had personnel on the ground in South Sudan in 2016.55 These companies, however, are substantially more opaque than DeWe so there is little publicly available evidence to substantiate these claims.

The examples of PSC activity in Sudan and South Sudan show that Chinese PSCs are very active in the region, and occasionally get involved in combat scenarios. Chinese PSCs, however, are not the only private security contractors operating in the region. International competitors, such as G4S and Control Risks, as well as private military firms like DynCorp or Academi (formerly Blackwater), also run missions in the area, mostly in South Sudan. Given the instability of both countries, competition for the private security market in Sudan and South Sudan is likely to increase in the future. The outcome of this competition, however, will most likely not depend on which PSCs are more effective or better prepared. Instead, it will depend on which international firms are willing to continue to invest in the region, despite the risk. As Beijing encourages Chinese SOEs to hire Chinese PSCs, and is also pushing for greater investment in the region through BRI, if Chinese firms expand their operations in Sudan or South Sudan, we can expect that Chinese PSCs will use the momentum of the growing Chinese involvement in the region to gradually increase their market share.

This is, of course, not a guaranteed outcome, as political conditions in the countries may change or non-Chinese oil companies may decide to invest in the region again, among several other factors. If current trends continue, however, we can expect to see a growing Chinese PSC presence in both Sudan and South Sudan.

4. Conclusion: Beijing needs to regulate its private security companies’ overseas activities

China has entered the largely unregulated international private security market. The saturation of the domestic market and opportunities provided by the BRI has encouraged Chinese PSCs to diversify their target clients and go global. Indeed, for some Chinese PSCs, the BRI is the basis of their entire market strategy.

Private security companies have turned into a good alternative to secure Chinese investments abroad. Beijing must guarantee the security of Chinese citizens abroad, as well as the success of BRI related projects, particularly as the initiative expands into more unstable and insecure countries. However, sending in PLA troops is an unrealistic option for the moment. It goes against China’s self-proclaimed non-interference principle, as well as against the benign image that China would like to portray through the BRI. PSCs’ relative “private” nature would be useful to Beijing – allowing it plausible deniability in worst-case scenarios whilst reaping the PR benefits of successful missions in the best-case scenarios. China is not the first country to come to this conclusion, as other international examples of PMC and PSC use in armed conflict or post-conflict reconstruction have shown.

The difference is, however, that Chinese PSCs are (indirectly) linked to the CCP, through their recruitment of almost exclusively PLA veterans. They also remain new to the game and relatively inexperienced in managing conflict situations they might be faced with in unstable countries like Sudan and South Sudan. Any incident in which Chinese PSCs handled armed conflict unprofessionally could turn into a political and PR disaster for Beijing. Furthermore, according to international law, it is the responsibility of the state to oversee and monitor PSCs based in their country. In the event of any dispute involving PSCs operating abroad, responsibility lies with the state by which the company is contracted. China could therefore be liable for Chinese PSCs’ actions should such companies become embroiled in a confrontation abroad.

It is therefore clear that regulation of Chinese PSCs’ overseas activities has upsides both for Beijing and for the international community. The question that remains is whether Beijing will choose to go down this path, and if so, whether it will manage to regulate these companies, either on an international or national level.

China has so far not taken any steps to improve the existing international legal framework or to create new regulations to control PSC behavior. Beijing still has not signed onto mechanisms like the International Code of Conduct. While this could be seen as a conscious choice not to be bound by legal requirements China had no hand in drafting, the voluntary and non-binding nature of these documents means that this should be no obstacle, as Beijing’s signature would be seen simply as a signal of goodwill. As a way to ensure greater quality control of its PSC presence abroad and create goodwill among host countries, Beijing should become a member of the International Code of Conduct and should require all Chinese PSCs that intend to operate internationally to do the same.

And at the national level, Beijing should push the Ministry of Public Security (MPS) to finalize existing plans to issue a new regulation specifically covering Chinese PSCs’ overseas operations. Models for such a regulation abound in the international arena, including in several European countries. Beijing should also encourage the MPS to issue a “white list” of PSCs that are actually qualified to provide overseas security services. This would reduce the risk of small, inexperienced companies making mistakes during their operations.

European countries - such as the UK, Belgium or Sweden - with domestic private security sectors that are more strictly regulated and that have signed onto voluntary international mechanisms could play a key role in encouraging Beijing to take these steps. They could provide examples of best practices. Another role that these countries could play would be to help host countries along the BRI to strengthen their national legislation regulation of foreign PSC activities in their countries, taking advantage of their own experiences with this issue. The aim here would be for host countries to build a strong framework of legislation, through which Chinese and other PSCs could operate in-country but under strict conditions with clear indications of liability. The European Union, through the European External Action Service (EEAS) and the European Commission’s Directorate General for International Cooperation and Development (DG DEVCO), could also use their experience and expertise in post-conflict reconstruction and security sector reform to help host countries build such a framework.

This is especially pressing because it is very likely that, as Chinese PSCs continue to pursue opportunities in security for BRI-related projects, Beijing will try to negotiate conditions for Chinese PSC operations on a bilateral basis with host governments in countries where Chinese PSCs operate. This way, Beijing could adjust these discussions based on each individual country’s national regulatory system of PSCs, giving greater clarity to liabilities should mishaps occur. From Beijing’s perspective, this would be a practical solution, since it would allow China to use its political and economic influence over host country governments to create favorable conditions for Chinese PSCs.

If properly regulated, operations of Chinese private security companies abroad could offer a win-win solution to security concerns in countries along the Belt and Road. If PSCs succeed in improving security conditions, Chinese (and other countries’) investments into third countries could potentially flourish, offering much needed infrastructure and development to under-developed areas. Simultaneously, by securing Chinese investments and citizens abroad, PSCs would help Beijing address the growing concerns of Chinese nationals working in volatile host countries without needing to deploy the PLA abroad, a move that might tarnish China’s self-crafted image as a non-interventionist and benign power and also cause tensions with countries concerned about China’s global military expansion.

Until the afore-mentioned measures are taken and progress is made in regulating Chinese PSCs, however, China’s use of private security companies to secure its overseas interests has the serious potential to undermine China’s credibility and do little to allay concerns over Beijing’s international investments and its self-proclaimed intentions to become a responsible global security actor.

- Endnotes

-

1 | Chongqing Shibao (2013). “国内保镖行业揭秘:超半数富豪雇保镖撑门面.” October 20.

http://new.qq.com/cmsn/20131020/20131020000223. Accessed: July 23, 2018.

2 | Arduino, Alessandro (2018). “China’s Private Army: Protecting the New Silk Road”, Singapore; Palgrave Pivot.

3 | Xie, Wenting (2016). “Chinese security companies in great demand as overseas investment surges.” Global Times. June 23. http://www.globaltimes.cn/content/990161.shtml. Accessed: June 14, 2018.

4 | Zhong, Nan (2016). “Overseas security to get upgrade.” China Daily. April 22.

https://www.chinadailyasia.com/nation/2016-04/22/content_15420820.html. Accessed: June 16, 2018.

5 | Elsea, Jennifer et al. (2008). “CRS Report for Congress. Private security contractors in Iraq: Background, Legal Status, and Other Issues.” August 25. https://fas.org/sgp/crs/natsec/RL32419.pdf. Accessed: May 25, 2018.

6 | Xinhua (2016). “海外安保市场总额达百亿美元 中国企业试水“淘钻”.” May 27.

http://www.xinhuanet.com/world/2016-05/27/c_129019763_3.htm. Accessed: May 30, 2018.

7 | Arduino, Alessandro (2018). “China’s Private Army: Protecting the New Silk Road”, Singapore; Palgrave Pivot, p. 103; Clover, Charles (2017). “Chinese private security companies go global.” Financial Times. February 26. https://www.ft.com/content/2a1ce1c8-fa7c-11e6-9516-2d969e0d3b65. Accessed: July 2, 2018.

8 | Ibid.; For reference, at the height of the Iraq war in 2003-04, an American PMC officer with a military or law enforcement background could earn over 750 USD (about 635 EUR) per day, but salaries had dropped to 500 USD (about 425 EUR) a day in 2011 due to oversupply. (Kelly, Suzanne. (2011). “Confessions of a private security contractor.” CNN. December 27. http://security.blogs.cnn.com/2011/12/27/confessions-of-a-private-security-contractor/. Accessed: July 23, 2018.)

9 | Phoenix International Think Tank (2016). “凤凰国际智库, “2016年中国企业海外安保公司排榜”.” March 30. http://pit.ifeng.com/event/special/haiwaianquanguanlibaogao/chapter3.shtml. Accessed: May 29, 2018.

10 | These are: Beijing DeWe Security Services (北京德威保安服务有限公司), China Security and Protection Group (中安保实业有限公司), HuaXin ZhongAn (华信中安(北京)保安服务有限公司), Shanghai’s China Cityguard Security Group (上海中城卫保安服务集团有限公司), Beijing Ding Tai An Yuan Security Technology Institute (北京鼎泰安元安全防范技术研究院), Shenzhen Zhongzhou Special Security Consulting Company (深圳中州特卫安全顾问有限公司), Beijing Guanan Security & Technology Company (北京冠安安防技术有限公司) and Shandong Huawei Security Group (山东华威保安集团股份有限公司). Not listed by Phoenix but also notable is China Overseas Security Group (中国海外保安集团).

11 | Hancock, Tom (2017). “China encircles the world with one Belt, One Road strategy.” Financial Times. May 4. https://www.ft.com/content/0714074a-0334-11e7-aa5b-6bb07f5c8e12. Accessed: July 22, 2018.

12 | Zhong, Nan (2016). “Overseas security to get upgrade.” China Daily. April 22. https://www.chinadailyasia.com/nation/2016-04/22/content_15420820.html. Accessed: June 16, 2018.

13 | Putz, Catherine (2017). “3 convicted for Chinese embassy attack in Bishkek.” The Diplomat. June 30. https://thediplomat.com/2017/06/3-convicted-for-chinese-embassy-attack-in-bishkek/.

Accessed: July 10, 2018.

14 | Erickson, Andrew and Collins, Gabe (2012). “Enter China’s Security Firms.” The Diplomat. February 21. https://thediplomat.com/2012/02/enter-chinas-security-firms/. Accessed: July 3, 2018.

15 | International Committee of the Red Cross (1907). “Convention (IV) respecting the Laws and Customs of War on Land and its annex: Regulations concerning the Laws and Customs of War on Land.” 18 October. https://ihl-databases.icrc.org/ihl/INTRO/195. Accessed: June 13, 2018.

16 | There are additional draft articles that go further in specifically addressing the responsibility of the state in various circumstances, but they have not yet been adopted as a UN convention, following their submission to the UN General Assembly at its 53rd session in 2001. (UN (2001). “Draft articles on Responsibility of States for Internationally Wrongful Acts, with commentaries.”

http://legal.un.org/ilc/texts/instruments/english/commentaries/9_6_2001.pdf. Accessed: July 23, 2018.)

17 | Full name: “Working Group on the use of mercenaries as a means of violating human rights and impeding the exercise of the rights of peoples to self-determination.”

18 | UN Working Group on the use of mercenaries (2010). “Report of the Working Group on the use of mercenaries as a means of violating human rights and impeding the exercise of the right of peoples to self-determination.” April 1. https://documents-dds-ny.un.org/doc/UNDOC/GEN/G10/125/90/PDF/G1012590.pdf?OpenElement. Accessed: July 23, 2018.

19 | State Council of the People’s Republic of China (2009). “保安服务管理条例.” October 13.

http://www.gov.cn/zwgk/2009-10/19/content_1443395.htm. Accessed: May 28, 2018.

20 | In the original Chinese: 谁派出,谁负责

21 | Ministry of Commerce of the People’s Republic of China (2010). “境外中资企业机构和人员安全管理规定.” August 13. http://www.mofcom.gov.cn/aarticle/b/bf/201008/20100807087099.html.

Accessed: May 29, 2018.

22 | These include the United States’ Neutrality Act 1974 and Neutrality Act 1939, the UK’s Foreign Enlistment Act 1870, Article 85 of the French Penal Code and Chapter 19 of the Swedish Penal Code.

23 | Beyani, Chaloka and Lilly, Damian (2001). “Regulating Private Military Companies: options for the UK Government.” International Alert. August. http://www.international-alert.org/sites/default/files/Regulating%20private%20military%20companies_UK_EN_2001.PDF. Accessed: June 27, 2018.

24 | Official website of the Chinese Security Association: http://www.zgba.org/zgbaxh. Accessed: July 23, 2018.

25 | Caijing Magazine (2017). “”海外中国”的隐秘侍卫.” July 24. http://www.caijingmobile.com/article/detail/334033?source_id=40. Accessed: July 23, 2018.

26 | Though Sudan and South Sudan are not officially party to the BRI, China has significant investments in both countries, and their respective governments have indicated a willingness to participate in the Initiative to garner further investment.

27 | The News (2018). “Chinese firms ink 41 CPEC-linked accords in 2018.” March 16.

https://www.thenews.com.pk/print/292807-chinese-firms-ink-41-cpec-linked-accords-in-2018.

Accessed: July 23, 2018.

28 | The Nation (2017). “CPEC, other projects being supported by 30,000 Chinese workers: Ambassador Khalid.” August 24. https://nation.com.pk/24-Aug-2017/cpec-and-other-projects-being-supported-by-30000-chinese-workers-ambassador-khalid. Accessed: July 11, 2018.

29 | Hassan, Syed Raza (2018). “Senior Chinese shipping executive shot dead in Pakistan.” Reuters. February 5. https://www.reuters.com/article/us-pakistan-china-shooting/senior-chinese-shipping-executive-shot-dead-in-pakistan-idUSKBN1FP1UK. Accessed: July 23, 2018.

30 | Khan, Raza (2016). “15,000 troops of Special Security Division to protect CPEC projects, Chinese nationals.” Sawn. August12. https://www.dawn.com/news/1277182. Accessed: July 23, 2018.

31 | AFP (2017). “Pakistan deploys force of 15,000 to protect Chinese nationals.” South China Morning Post. June 25. http://www.scmp.com/news/china/diplomacy-defence/article/2099922/pakistan-deploys-force-15000-protect-chinese-nationals. Accessed: July 20, 2018.

32 | First Post (2017). “Pakistan scrambles to protect OBOR projects after Islamic State kill two Chinese teachers in Balochistan.” June 11. https://www.firstpost.com/world/pakistan-scrambles-to-protect-obor-projects-after-islamic-state-kill-two-chinese-teachers-in-balochistan-3542253.html. Accessed: July 3, 2018.

33 | Mazzetti, Mark (2013). “How a Single Spy Helped Turn Pakistan Against the United States.” New York Times. April 9. https://www.nytimes.com/2013/04/14/magazine/raymond-davis-pakistan.html. Accessed” July 23, 2018.

34 | Reuters (2012). “G4S to pullout from Pakistan: FT.” August 20. https://www.reuters.com/article/us-g4s-pakistan/g4s-to-pullout-from-pakistan-ft-idUSBRE87J00520120820. Accessed: July 19, 2018.

35 | Imtiaz, Saba (2011). “Private security guards: on the safe side.” The Express Tribune. July 10. https://tribune.com.pk/story/203775/private-security-guards-on-the-safe-side/. Accessed: July 23, 2018.

36 | Ministry of the Interior of Pakistan (2014). “Private Security Companies.” February 10.

https://www.interior.gov.pk/index.php/2012-08-08-03-01-35. Accessed: July 16, 2018. See also Provincial Government of Sindh (2001). “The Sindh Private Security Agencies (Regulation and Control) Ordinance, 2001.” http://sindhlaws.gov.pk/setup/publications_SindhCode/PUB-16-000059.pdf. Accessed: July 16, 2018; Provincial Government of Punjab (2002). “The Punjab Private Security Companies (Regulation and Control) Ordinance, 2002.” http://punjablaws.gov.pk/laws/453.html. Accessed: July 16, 2018.

37 | Government of Pakistan (1984). “The Companies Ordinance, 1984.” https://www.secp.gov.pk/document/companies-ordinance-1984-3/?wpdmdl=22579. Accessed: July 19, 2018.

38 | Leng, Sidney et al. (2017). “A peek into China’s top bodyguard factories.” South China Morning Post. July 23. http://www.scmp.com/news/china/society/article/2102703/peek-chinas-swashbuckling-bodyguard-factories-and-their. Accessed: July 23, 2018.

39 | The company’s website, however, does not directly claim to work on securing CPEC in Pakistan.

40 | Guancha (2017). “外媒称中资公司易遭风险 中外保安公司争抢商机.” April 25.

http://www.guancha.cn/global-news/2017_04_25_405230.shtml. Accessed: July 17, 2018. Note: COSG employs more than 20,000 people in security services across ten provinces and cities in China and has reported an operating income of 500 million RMB.

41 | China Overseas Security Group (2018). “中国海外保安集团巴基斯坦分公司举行实弹射击训练.” March 21. http://www.cosg-ss.com.cn/2018/jtxw_0321/139.html. Accessed: July 4, 2018.

42 | Sohu (2017). “把安全带出国门,把放心留给祖国——记华信中安在巴基斯坦武装随卫.” June 22. http://www.sohu.com/a/151199778_465554. Accessed: July 3, 2018.

43 | Hammond, Joseph (2017). “Sudan: China’s Original Foothold in Africa.” The Diplomat. June 14. https://thediplomat.com/2017/06/sudan-chinas-original-foothold-in-africa/. Accessed: July 20, 2018.

44 | Ibid.

45 | Laessing, Ulf and Wee, Sui-Lee (2012). “Kidnapped Chinese workers freed in Sudan oil state.” Reuters. February 7. https://www.reuters.com/article/us-china-sudan-workers/kidnapped-chinese-workers-freed-in-sudan-oilstate-idUSTRE8160UU20120207. Accessed: May 17, 2018.

46 | Johns Hopkins SAIS, China-Africa Research Initiative. “Data: Chinese Workers in Africa.”

http://www.sais-cari.org/data-chinese-workers-in-africa. Accessed: May 14, 2018.

47 | Flew, Catherine and Urquhart, Angus (2004). “Strengthening small arms controls: An audit of small arms control legislation in the Great Lakes region and the Horn of Africa.” Sudan; Saferworld.

48 | South Sudan (2016). “Firearms Bill.” https://www.gunpolicy.org/documents/6446-south-sudan-firearms-bill-2016/file. Accessed: June 6, 2018.

49 | Anthony, Ross and Jiang, Hengkun (2014). “Security and engagement: the case of China and South Sudan.” The China Monitor, African East-Asian Affairs. Issue 4. December 2014. http://aeaa.journals.ac.za/pub/article/viewFile/147/103. Accessed: June 25, 2018.

50 | Spegele, Brian et al. (2012). ”China’s Workers are Targeted as its Overseas Reach Grows.” Wall Street Journal. February 1. https://www.wsj.com/articles/SB10001424052970204652904577194171294491572. Accessed: July 18, 2018.

51 | Clover, Charles (2017). “Chinese private security companies go global.” Financial Times. February 26. https://www.ft.com/content/2a1ce1c8-fa7c-11e6-9516-2d969e0d3b65. Accessed: July 2, 2018.

52 | Caijing Magazine (2017). “”海外中国”的隐秘侍卫.” July 24. http://www.caijingmobile.com/article/detail/334033?source_id=40. Accessed: July 23, 2018.

53 | Not to be confused with South Sudan’s Veterans Security Services (VSS).[54 | China Security and Protection Group (2018). “中安保国际公司南苏丹安保团队凯旋归来.” February 12. http://www.cspbj.com/News/Detail/522. Accessed: July 11, 2018.

55 | VSS Security Group (2016). “南苏丹内战.” July. http://www.vss911.cn/Solution.aspx?Id=346. Accessed: July 11, 2018.