The trade-offs of innovating in China in times of global technology rivalry

By Jeroen Groenewegen-Lau and Jacob Gunter

Please note that this report is embargoed until June 24, 2025, 10 a.m. CEST.

This report is part of a series of projects supported and funded by the German Ministry of Research, Technology and Space (as part of the grant under funding reference number 01DO21014B).

Key findings

- European firms and policy makers have been too slow to understand the impact of China’s shift to an innovation and technology industrial powerhouse.

- Many European companies rely on China’s innovation ecosystem in their global R&D strategies, which over time can jeopardize their technology, often followed by their market share in China, and eventually globally.

- China’s policy approach is tailored to further its national interests so foreign firms are met with different environments and incentives based on what they have to offer.

- Those with strategic technology like the semiconductor value chain are courted to pull in technology, though they may then lose market share once Chinese competitors have caught up enough.

- Firms in less strategic sectors like automotive or consumer goods receive fewer incentives but are more likely to be accepted longer-term as providers of jobs and investment.

- Many foreign firms adjust for China risks with a mix of localization, partial decoupling of China operations from global ones, offshoring some R&D and operations while tailoring other operations more deeply to the China market. Such localization and siloing of their China operations is protective but also brings disadvantages and costs.

- China’s industrial policy playbook leads to overcapacity and shrinking profit margins for everyone, which eats into foreign firm’s ability to finance R&D investment and maintain their technology leads while also eroding their revenue base.

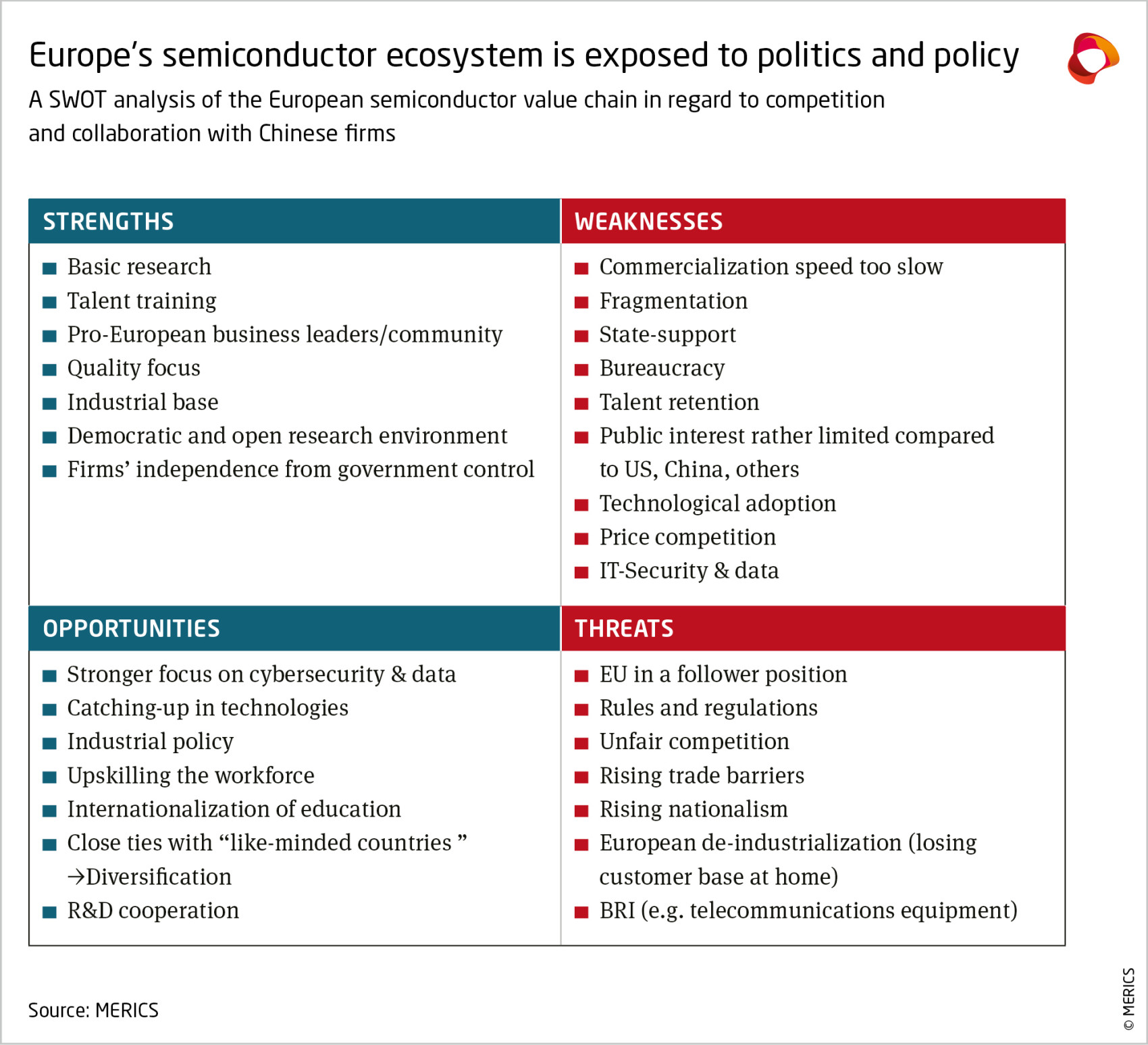

- European technology and innovation policies are based on openness to globalized technology and investment and slow to adjust to technology challenges emanating from China – specifically that European openness is taken advantage of while Beijing strategically incentivizes foreign technology providers to enter China while limiting technology outflows where China is on the cutting edge.

China's innovation ecosystem remains attractive to European firms, but risks are growing

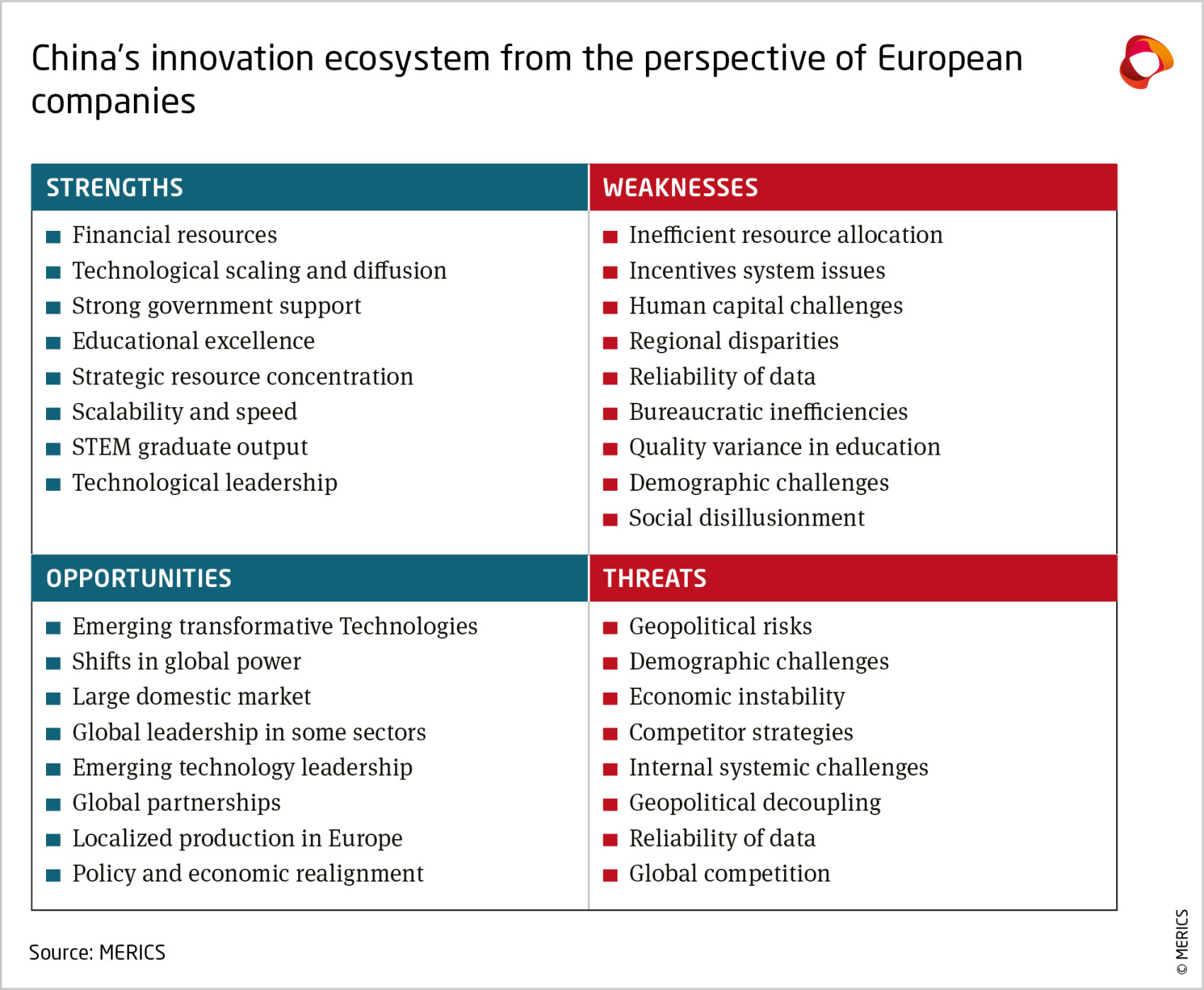

European companies remain highly interested in engagement with China’s technology and innovation ecosystems. However, compared to the recent past they are increasingly skeptical and concerned about the risks of that engagement, both in terms of China’s own techno-industrial agenda but also because of fears of escalation of the technology war with the US. As a result, a range of opportunities, risks, and dilemmas face European companies when considering how to approach China’s innovation ecosystem.

Opportunities

European companies continue to view China’s innovation ecosystem as increasingly central to many of their global R&D strategies – a trend that has advanced steadily over recent years. China’s market offers innovation strengths that are often complementary to European industrial strong points, especially where Chinese green technology and digitalization complement European core industries in fields like machinery, chemistry and medical devices. In some areas, China’s advanced position offers opportunities for European industry to catch up, especially in the automotive and auto component sectors where China’s electrification, digitalization, and infotainment success are eagerly embraced by EU firms. These opportunities are appealing, even if in some sectors China has implemented controls that limit technology outflow, especially in digital and green technology.

Risks

However, not all European companies are equally engaged with the innovation ecosystem in China, nor do they want to be. IP concerns remain especially pressing for companies in strategically oriented sectors where Beijing is keen to capture technology capacities and the United States and others are imposing export restrictions. This is most notable in the semiconductor value chain and telecoms equipment, as well as emerging technologies like AI and quantum. European SMEs are more conservative about conducting technology collaboration in China, as the loss of one or two core pieces of IP could doom their firm. Finally, some companies are being squeezed out of the China market, either by policies or competition, yet continue to maintain sizeable R&D positions there, despite plummeting market share, in the hope of finding and developing technology to take global.

Dilemmas

The interests of European companies pursuing innovation opportunities in China are increasingly caught between China’s national innovation strategies and European national innovation interests. And that’s without getting into the United States’ expanding measures limiting technology flows to China and innovation partnerships there. Because China aims to draw in as much technology, capital, and data as possible it welcomes companies that bring them in, while simultaneously making it harder for firms to move technology, capital and data out of the country. Meanwhile, the EU remains overwhelmingly open because of its historical commitment to open innovation and globalized technology and innovation. Europe is only slowly realizing the structural nature of China’s lack of reciprocity, prompting it to scrutinize European outflows, apply more investment screening and now possibly technology-based export controls.

China's national interest-based policies pull in foreign technology and innovation, then skew benefits

Chinese policymakers are eager to draw in European technologies and innovation capacity in the right areas. Beijing is making some of the right noises in response to European investors’ concerns, though it does not always respond with actual policies. The European Union Chamber of Commerce in China has repeatedly raised concerns that responses do not materialize. It welcomed positive signals like the State Council’s Opinions of the State Council on Further Optimising the Foreign Investment Environment and Increasing Efforts to Attract Foreign Investment, but criticized the failure to implement it, a year later. The Chamber’s response to the CCP’s 3rd Plenum was also tepid.1

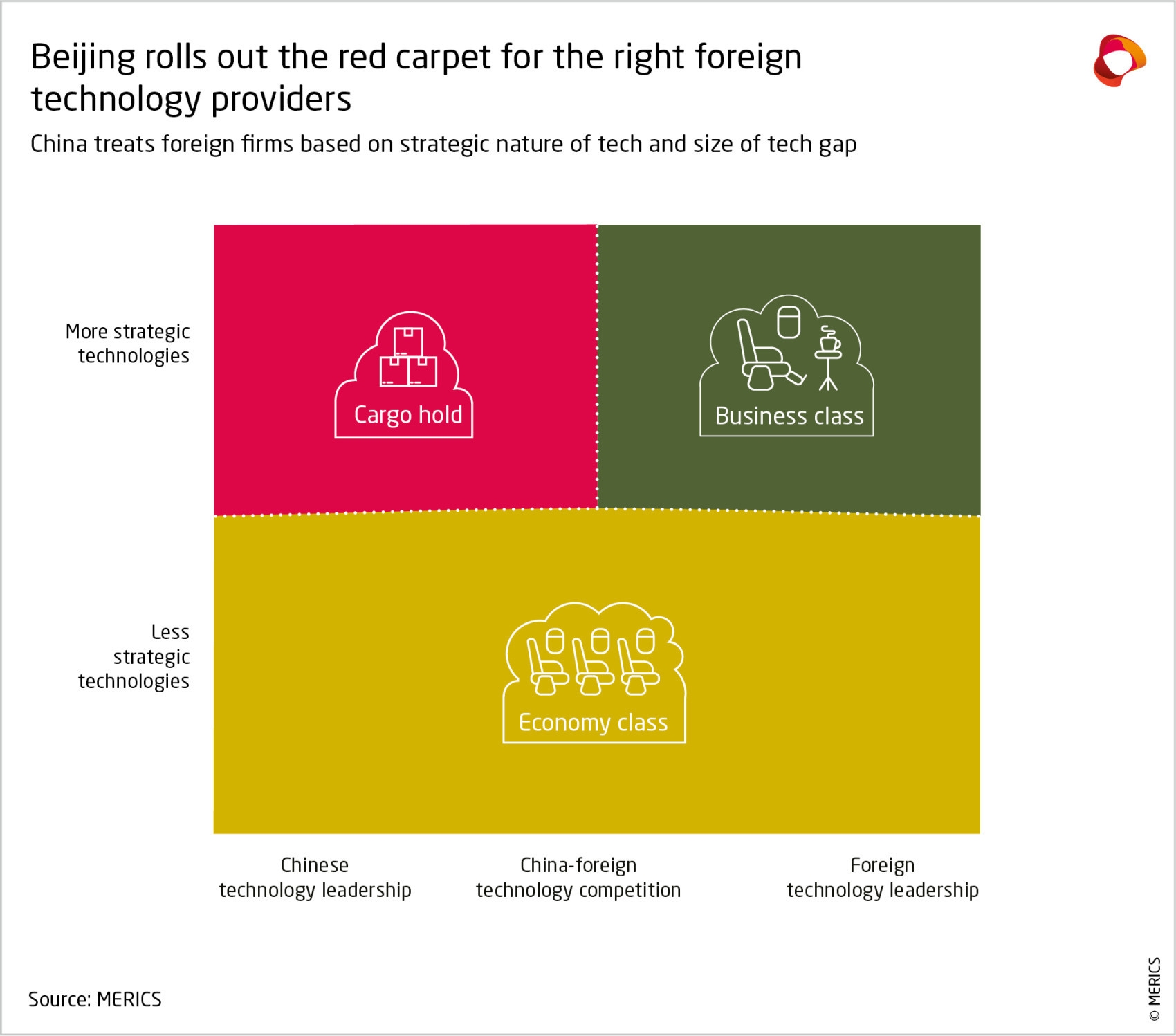

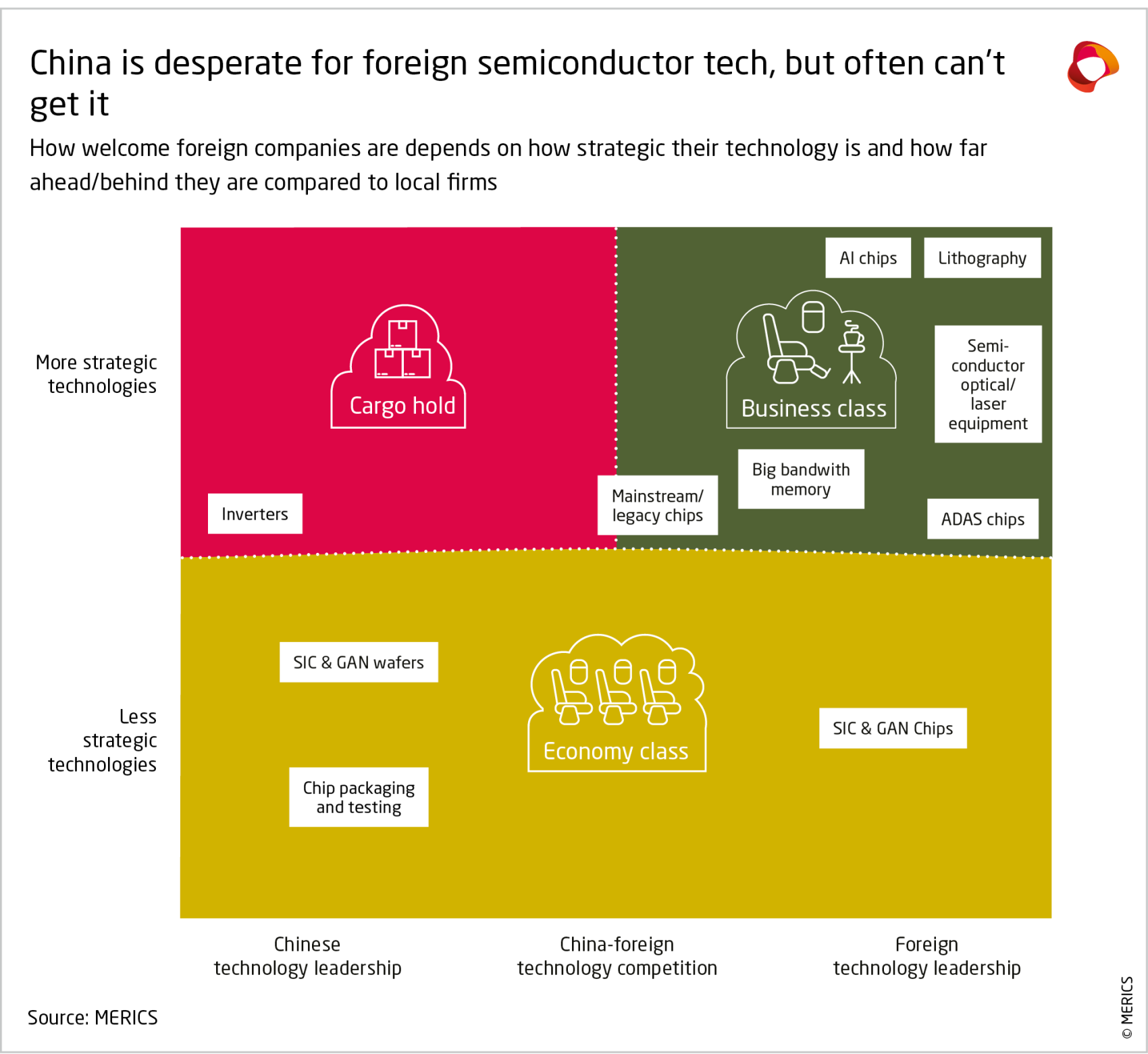

Beijing makes strong efforts to attract the technology needed for China’s strategic goals. Beijing tends to view less strategically relevant technologies more neutrally, although, in principle, all investment is welcome to support the struggling economy. A foreign company’s position in Beijing’s eyes depends on the size of the technology gap compared to Chinese firms – the larger the gap, the more Beijing will do to induce investment and technology localization.

To assess the available strategies, it helps to distinguish between ‘Business class’, ‘Economy class’, and ‘Cargo hold’ positions, as outlined in the above chart. Those in business class, with strategic technologies that are much more advanced than local options, tend to get generous inducements to invest, from 100 percent foreign ownership deals to easier access to land, subsidies, tax incentives, plus measures more directly linked to innovation support. Such measures include better support in IP disputes, positive signals to help attract local and international talent, including soft infrastructure like housing support, access to international schools and more.

Foreign technology firms face ‘up or out’ competition to stay ahead of local companies

These positions are not static. For instance, foreign companies who lose their technological edge over local ones risk sliding into the ‘cargo hold’ class, where they may struggle for market share. Once there, an uncaring Beijing leaves them to wither or, worse, may even actively push them out. The trip from ‘business class’ to ‘cargo hold’ is a direct one, there is no connecting flight through ‘economy class’, because the strategic nature of a technology rarely changes, even if the technology gap does.

Importantly, there is no single line of demarcation between these two categories. Rather, there is a grey zone where Beijing may decide that, though a technology gap remains, a local firm has ‘good enough’ technology to tilt the playing field in their favor. Once that threshold is crossed, Beijing seeks to push foreign players out, so market share can shift to domestic firms, which thereby gain the scale and momentum to become efficient and globally competitive. This basic playbook has proved successful with high-speed rail, telecoms equipment (5G), and electric vehicles. Some types of industrial machinery, industrial software, medical devices and legacy semiconductors are also on this trajectory.

Firms in ‘economy class’ tend to have less uncertain fates. Beijing is largely ambivalent about foreign investment in their sectors – typically downstream in value chains and consumer-oriented goods – as the investment bolsters employment, tax revenue, HR development, etc. without taking market share from local firms that could be used to fund R&D in a strategic technology.

Market share saturation is a policy-driven path to closing China’s technology gap

China’s industrial policy seeks to close technology gaps with incentives to expand production capacity. Beijing sees this as indirectly boosting innovation because production scale leads to lower prices, larger global market share, faster product iteration and increased R&D budgets, which in turn lead to better products and production processes.

First, the more China can expand its production and global market share, the more that it will capture revenue bases and profits that can be funneled back into optimizing and innovating products and production processes.

Second, the concentration of manufacturing in China generates all kinds of clustering and spillover effects that hugely speed up innovation. China’s complete industrial clusters have repeatedly come up in interviews during our three-year study as strengths that facilitate innovation there. The ability to work at so-called “China speed” is largely due to shorter, more direct links between different actors in the industrial ecosystem, including upstream and downstream suppliers - from startups to multinational corporations (MNCs) - and a range of service providers in contract research, digital modeling and talent development. The World Intellectual Property Organization ranks the top 100 global science and technology clusters; in 2024, China had 26, the most of any country, and the global top ten included the Shenzhen-Hong Kong-Guangzhou corridor (2), Beijing (3), Shanghai-Suzhou (5) and Nanjing (9).2

Third, growth in production scale also leads to faster product iteration cycles. Innovation is not confined to researchers in labs doing basic research: it frequently happens on factory production lines with technical engineers and process managers experimenting to finetune their work, sometimes even leading to breakthroughs. The Asia Growth Partners Innovation in China Survey found the most common sources for innovation ideas in China were sales team input (76 percent), competitor benchmarking (71 percent), customer/user interviews (55 percent) and only then R&D centers (55 percent).3

Foreign firms squeezed out in China will eventually suffer globally

Foreign competitors are also likely to get crowded out. China’s playbook leads to overcapacity and shrinking profit margins for everyone, which eat into foreign firm’s ability to finance R&D investment and maintain their technological lead.

China’s growing market share across lower and mid-tier value chains creates an underappreciated risk: European companies left to occupy only the upper end of value chains are unlikely to generate enough revenue to maintain this lead. Deindustrialization can slow down innovation, especially if EU firms lose access to economic value and deep production knowledge within the production segment in the supply chain. In the AGP survey, when asked where companies were experiencing pressure from local competitors, 95 percent said they felt high pressure on price and 66 percent said they felt high pressure on sales and service speed – pressure on quality was the lowest, with only 11 percent saying pressure was high, 42 percent saying it was medium, and 47 percent saying it was low.4

This of course does not suggest that there are no paths for foreign companies in China to remain competitive and profitable. Beijing is happy to have foreign companies with the right technologies as they grow the global market share of ‘made in China’ products and enrich China’s industrial clusters. Many firms surveyed and interviewed for this study engage extensively with local innovation partners, which helps the overall ecosystem. The efforts made by European firms to help their Chinese suppliers achieve global quality standards are a disregarded form of technology transfer encouraged by Chinese policies on promoting local content.

China’s central government, which ultimately sets many of the rules, focuses on national interest. It shuns open innovation and the free flow of technology in favor of mechanisms to ensure more technology flows in than out. The innovation model that the Chinese state has rolled out is based on intense pragmatism and realpolitik that prioritizes geopolitical goals above all and frames foreign companies’ options accordingly. China’s most successful innovation clusters display open, inclusive and cosmopolitan business environments that are equally created and constrained by this framework.

For European firms in China, localization and partial decoupling are widespread and complex

As globalization is under pressure, European corporates are rebalancing their R&D footprints and wider positions in China vis à vis global operations. European companies face a ‘localization dilemma’.5 Chinese incentivizes makes it attractive to do more R&D in the country, but this simultaneously increases the risk of knowledge transfer to Chinese competitors. Because the Chinese state structurally supports domestic firms, localizing in China increasingly resembles a high-stakes game that is not for everyone. The AGP Innovating in China survey found that 61 percent of respondents were investing more in innovation programs in China, while 24 percent were investing less.6

- Some firms have assessed that China is a losing proposition in the long run. They intend to keep their current operations and R&D in China as long as possible but will invest resources (including R&D) in other markets to beat their Chinese competitors there.

- Others have bolder assessments and are betting on the China market for R&D to maximize opportunities there, out-compete local rivals and advance the best technology and attract the best talent. They hope to suppress market share and economies of scale for their local competitors before these can become global competitors.

Protective localization does not always go smoothly. The 2024 European Union Chamber of Commerce in China Position Paper identifies “a growing tendency towards siloing China operations and supply chains” through such steps as onshoring or offshoring parts of supply chains, the heavy localization of staffing, data and information technology (IT) systems, and sometimes R&D activities. The strategy has produced “instances of miscommunication and misunderstanding between companies” China operations and headquarters (HQs) resulting in a slowdown of existing operations; the reduced ability to capitalize on new projects or investment plans; the need to adapt product or service offerings; and even the need to downsize or close operations.

Moving deeper, the findings of the China Innovation Conference unearthed further levels of nuance. There was a considerable divergence between ‘less strategic’ and ‘more strategic’ industries – represented respectively by the automotive and auto components sectors and semiconductor value chain. Below, we take a closer look at the dynamics in these sectors and in the more or less strategic areas they represent to explore the conditions that could be imposed on European actors and the responses available to them.

EU firms in less strategic industries are more optimistic about localization

Many less strategic MNCs find there is a case to be made for both pursuing diversification overseas and onshoring/localizing into China’s innovation ecosystem. This typically leads to a relatively siloed China branch so both it and the global operations could continue under any geopolitical circumstances with minimal disruptions, at least in the short term.

The logic here is that China is too important a market to leave simply due to geopolitical risks, hence the route to resilience is heavy localization and onshoring of China operations and supply chains. This will allow China operations to continue if decoupling pressure intensifies in China, the United States and Europe. 41 per cent of respondents to the European Chamber’s Business Confidence Survey 2024 reported some form of decoupling between their China operations and their HQs in the past two years.7 Many of the firms adopting this resilience strategy are also diversifying their global operations away from China to various extents.

In R&D activities, for many larger companies the fortification of their China operations has led to further integration into China’s innovation ecosystem. These firms calculate that technology and IP flows across borders can effectively be ‘locked in’ in ways that supply chains cannot – if a company suddenly finds they cannot export a certain component to China, this could shut down entire production lines; whereas if a company suddenly finds they cannot transfer newer IP and know-how into or out of China, they can still rely on whatever has already been transferred, then use the already expanded R&D footprint in China for local operations.

Companies building up their R&D operations in China are doing so because they need to remain competitive in the Chinese market and/or are scouting for Chinese suppliers with advanced products, in the hope it could lead to innovation implemented globally – something that is becoming increasingly problematic as China continues to expand its restrictions on outbound technology. These firms are simultaneously building up internal R&D infrastructure in China so they will have resilience to prioritize localized innovation within the China bubble if technology flows become more restricted.

EU firms in more strategic industries are bound by geopolitics

European companies with strategic technology are more averse to localizing production in China, let alone bringing their core technology to the market. That is in part due to IP theft and competition fears, and in part current or anticipated restrictions imposed by the US and others. This is notable in defense-related sectors like aerospace and aviation, as well as the semiconductor value chain.

Many of these firms are already affected by US and/or EU controls, which have always existed on traditional dual use technology like many types of avionic systems that may be sold to Chinese commercial aircraft makers, but which must only be produced in trusted countries for export and cannot be localized as Beijing would like. The same is true for a growing swatch of the semiconductor value chain, where certain technology can only be exported and not localized or in some cases cutting-edge chips and equipment needs approval based on end-users.

However, some firms in more strategic sectors are also hedging their bets in anticipation of future developments. For some, that could mean escalation of the US-China technology war to cover more of their products. These firms are preparing for a possible decoupling. Others have assessed that they should strategically resist localization and only focus on exports to avoid technology leakage that would risk their current leadership and accelerate state-supported Chinese competitors.

Finally, some companies exist in strategic technology classes where Chinese firms have already overtaken them and Beijing has found ways to effectively push them out of the market, as happened in high-speed rail and 5G and telecoms equipment. Some firms in this situation still leave R&D resources in China to scout for technology and partners, keep track of trends in China’s technology, and do R&D to take to their global offerings.

Case Studies: Not all sectors are treated equally

The China Innovation Conference underlying this report included concentrations of industry representatives and experts covering two technology groupings chosen to compare how different technologies were viewed in China, how they fall into the US-China trade and technology wars, and how broader decoupling in China and derisking in the EU are affecting them. The findings that emerged clearly indicated that:

- The automotive sector is a less strategic technology class that can mostly avoid the geopolitics of the moment – but with emerging technology like EV batteries, hydrogen cell systems, and connected vehicle technologies, the strategic relevance of the sector is likely to increase.

- The technologies that make up the semiconductor value chain are overwhelmingly on the more strategic side of things. That puts them at the center of the technology war and China’s self-reliance campaign and complicates European corporate engagement in that space.

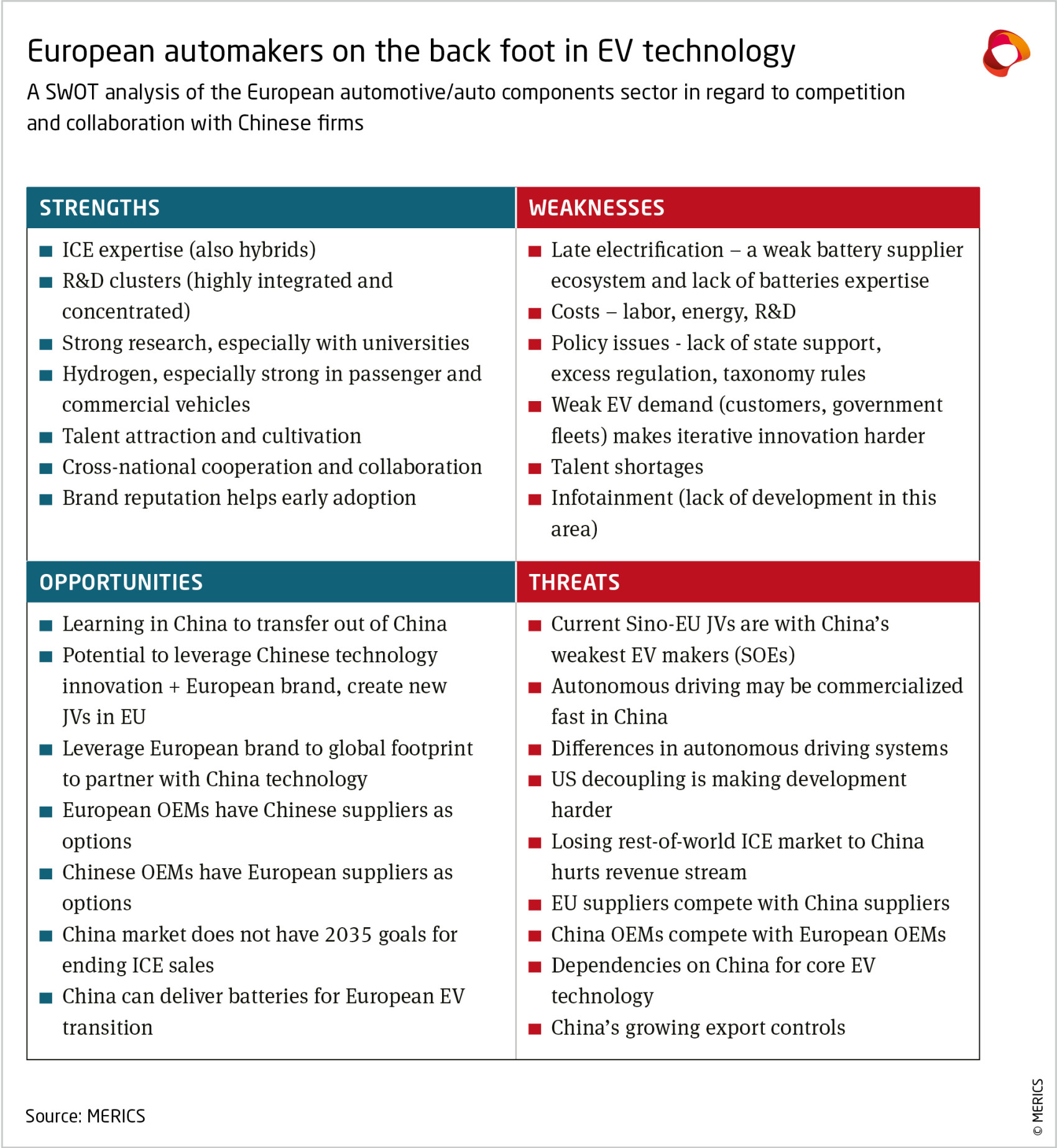

Cars themselves are treated as ‘less strategic’ by Beijing, but many component technologies are critical to China’s ambitions

The automotive and auto components sectors are representative of the situation for industries with less strategic and politically sensitive technologies, mostly avoiding Beijing’s lists of target technologies of the future other than EV-specific technology. For decades, European firms in this sector have used their technological superiority to reap large profits from the Chinese market. The requirement to have a Chinese joint venture partner did not challenge the market dominance of European carmakers. However, the dynamic changed with the rise of electric vehicles (EVs) bolstered by China’s innovators and intense industrial policy.

European automotive firms intend to use their size and global experience to remain relevant. They also seek to leverage Chinese JV partners and business partners and are generally confident about opportunities to collaborate on technology globally. The comparatively high flexibility of these firms stems from an abundance of component suppliers for the OEMs and abundance of OEMs for the component suppliers. As a result, they tend to view China as critical for overcoming their weaknesses in electrification, digitalization, and infotainment.

European firms across this value chain often argue that these goals demand deeper engagement in the China market and increased investments there, including R&D. Nevertheless, they do recognize their considerable risks from existing and potential Chinese restrictions on technology outflows in the green and digital spaces. They are especially worried about self-driving or connected vehicles, due to the potential for securitization. Automakers’ success is built on deeply globalized value chains and economies of scale but growing restrictions on connected vehicles in the United States and China, and possibly elsewhere, may balkanize the global industry.

Perhaps most importantly, many of the core technologies within the sector still rank lower on the scale of strategic significance. So, for now companies can probably count on the continuity of current operations and strategies. However, divergence in connected vehicle systems and infrastructure plus the looming prospect of EVs and EV core technology becoming more embroiled in trade and technology wars does worry OEMs and component makers alike.

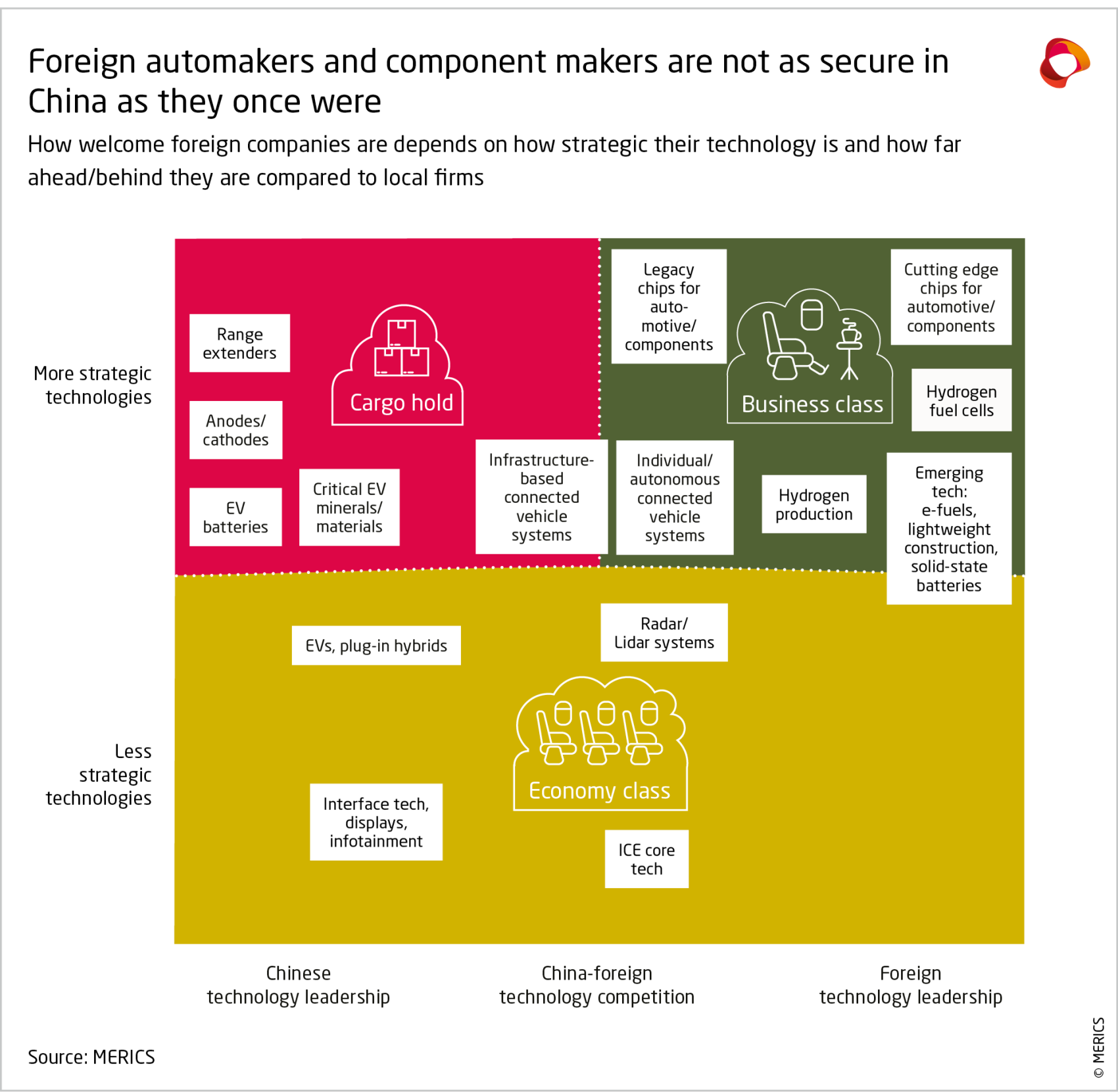

Semiconductor value chain technologies are more strategically relevant and face a complex political environment

The semiconductor value chain demonstrates the situation for more strategic industries vividly. Covering most of the hardware and software underpinning semiconductor production (machinery, inputs, chips, back-end processes, integrated software, etc.).

European players in this arena have either benefited from past technology gaps with Chinese competitors or still do. But they are also at risk from policy-supported Chinese competitors arising while Europe deliberates about how to promote and protect itself. Furthermore, threats of escalation in the US-China trade war may well find European players caught in the middle. Finally, threats from China’s overcapacity could accelerate deindustrialization in Europe and other markets. By undermining firms’ customer bases, Chinese overcapacity deprives them of revenue to fund their own R&D and remain competitive.

The strategic nature of the sectors is apparent in the second chart below, with almost all brainstormed subcategories ending in the upper portions. The contrast between the left and the right is also quite striking, showing the transition can be rapid in areas where China’s firms have generally caught up. Foreign alternatives are pushed out to preserve market share (and revenue) for local brands to fully catch up with, or even overtake, foreign providers. However, many of the technologies in this grouping retain sizeable gaps over Chinese counterparts for now, giving a sense of space to act to preserve that edge, though not without urgency.

Firms will struggle without a strategic perspective from home

The return of geopolitics is fracturing the previous period of globalization in ways that bring much more uncertainty than companies would like. As ideals of frictionless trade and technology flows are being replaced by issues of supply-chain resilience and strategic races in innovation and technologies, stakeholders are building in redundancies and hedged bets.

This approach and the reassertion of national interests more generally require firms that are active in multiple countries to re-assess and sometimes re-arrange their internal structures and regional priorities which, as outlined above, bring along other challenges. Companies in more strategic technology classes are likely the most affected and will need to change their relationship with globalization and their home market and policymakers the most. While also negatively impacted, firms in less strategic sectors will have more options available and where they can generally stay out of the geopolitical points of friction can likely do so without as much of a rethink of their relationship with home governments.

European national innovation interests are no longer fully aligned with corporate ones

European policymakers are increasingly struggling to balance protecting their national interests, promoting the success and competitiveness of their companies, and derisking problematic aspects of their relations with China. At its most basic, that means:

- Minimizing the amount of technology and innovation flowing to China that could undermine European core industries (especially those in more strategic technology classes) while also allowing enough of it to flow to China for European companies and exports to remain competitive there (especially in less strategic technologies).

- Maximizing the amount of technology and innovation flowing from China to Europe, especially where it empowers goals like the green and digital transitions while also minimizing dependency risks (i.e., it is better to have EV battery technology transferred and/or localized in Europe than merely to import it)

In the past, there was tighter alignment between European national interests and corporate interests in China. The decades-long shift from exporting to China to localizing some production to localizing most production and supply chains to full on localizing even R&D and IP has changed how corporate interests align with national ones. During those decades of transition, corporates convincingly argued this was good for Europe – more of the higher value work (R&D, HQ roles, high-end engineering, etc.) would remain and even expand in Europe because global economies of scale would grow by doing more in China.

But extensive or even comprehensive siloing is changing that, as the entire point of it is not to be reliant on globalized supply chains with high-value-added components and technology and R&D flows from Europe to China. Throughout this project, a significant number of conversations with government stakeholders included this dilemma – if they localize and silo so much, what good is that for European citizens? Add to this the efforts of the EU and many member states to derisk ties with China and the divergence grows wider.

European national innovation interests vary from sector to sector

The European automotive sector is in a precarious competitive position, specifically in electrification, digitalization, and infotainment. Real opportunities for collaboration exist to help the industry make up for its weaknesses, and could bring more Chinese investment and technology to Europe. Doing so could help European players catch up, while increasing the risks of being undermined by China’s EV makers. Cooperation would boost dependencies on Chinese technology and supply chains and can inhibit European players from pushing for indigenous innovation and capacity.

Very different dynamics exist in the semiconductor value chain. Key lessons should be learned from the areas where European champions are already being pushed out, such as telecoms/network equipment. They tended to have more localized technology and R&D footprints in China. In the many areas where European players across the value chain remain far enough ahead, companies are increasingly resisting Beijing’s localization pressures and incentives, so as to maintain their own competitiveness and in anticipation of technology war escalation.

However, these firms are insufficiently supported and protected by European policymakers, even while contributing to European economic security by limiting their footprint in China, often with significant loss of opportunities in the short term. As China’s industrial policy agenda aims at the heart of these value chains, China’s progress in some technologies may outpace European firms, who, with less government support and protection in their home countries, are at risk of being crowded out, first in China, then in third markets and even at home.

More than ever, these companies must think strategically and geopolitically and are in greater need of policymakers to think about their future through those lenses as well.

European nations and firms urgently need better collaboration on China risks

The relationship between European governments and firms is changing profoundly, due to geopolitical competition. The dilemma on both sides is to balance openness/market liberalism and security, an emerging priority which conflicts with a core EU tenet. In less sensitive or strategic sectors, open market liberalism will probably continue to make sense, but security concerns must prompt the consideration of specific export controls and fundamental thinking about industrial policy in strategic technologies.

The tensions around openness are particularly salient around reciprocity. European firms have taken IP and R&D to China that was developed with European support, yet this is rarely reciprocated by Chinese firms bringing their core IP and R&D to the EU. China’s technology leaders mostly stick to an export model, sometimes with final steps and assembly overseas in plants in Hungary or nearby the EU in Morroco or Turkey, as is happening in EVs and EV batteries. This pattern exists because of:

- Official controls from Beijing, such as the existing or mooted controls on critical EV technology, from mineral refining to graphite to cathodes, or export controls on minerals like germanium, gallium, antimony, and others.8

- Informal window guidance from the party and/or state – Guidance has already been issued to EV firms not to invest in EU members states that voted for countervailing tariffs on subsidized EVs from China.9

- China’s companies follow signaling from the party, state, and/or industry associations10 – For instance, in early December 2024, after new US export controls were announced, four major Chinese industry associations called US semiconductors “unsafe and unreliable” and urged member companies to be careful about selecting US semiconductor technology suppliers.11 It is easy to see how signals and reading the political tea leaves in China might lead Chinese industry to be equally cautious about taking technology abroad or about how they protect it when investing overseas.

European policymakers and corporates are insufficiently responsive to changing realities

Only recently have national governments in Europe woken up to China’s status as both a systemic rival and a technology and innovation powerhouse. Policymakers in Brussels and European capitals should realize that, faced with this urgent challenge, it is better to seek ‘good enough’ solutions than wait for perfect ones. The conversation among policymakers tends to divide between pro-market liberalization and pro-industrial policy arguments, when the actions so urgently needed are likely to demand a mix of both. Regulatory simplification and addressing the energy cost situation is essential. There are also key European industries already being eroded, or soon to be at risk from fierce, state-backed Chinese competitors – identifying the industries strategically most important to European interests, and which ones can and should be reinforced, will be difficult but essential.

Meanwhile, European corporate leaders are moving too slow to address the challenges presented by China’s emergence as an increasingly innovative and fast-moving industrial giant. The extent of siloing of decision-making and information flow between global HQ and China operations creates significant risks. Many firms interviewed for this project and in other capacities have heavily outsourced their China expertise to their local operations. Local staff may therefore make decisions that do not best serve the technology and innovation interests of the wider global company. Siloing can also mean lost opportunities for collaboration and positive impacts in global markets as links between China teams and the global HQ are not strong or relevant enough.

European companies should embrace more circulation of junior and senior personnel from HQ to China operations. They should also break the ‘bamboo ceiling’ so promising Chinese nationals are able to circulate through HQ and other global operations to share their experiences – this would also solve a common problem among interviewed companies, who complained their best talent often quits to join competitors, to which we would ask how many of their senior China team had ever been promoted to HQ.

Finally, the possibility of a ‘grand bargain’ should not be completely written off. For policymakers, the ideal would be positive corporate responses to guidance on national interests. The corporate ideal would be to benefit from deregulation, cheaper energy and supportive industrial policy. Some sort of deal combining these might be sensible – a quid pro quo of deregulation in general and targeted industrial policy for strategic sectors, in exchange for European companies thinking less as multinational and more as European companies in regard to China.

- Endnotes

1 | EUCCC, “Statement on State Council’s Opinions on Attracting and Optimising Foreign Investment,”

2023, https://www.europeanchamber.com.cn/en/press-releases/3549/statement_on_state_council_s_

opinions_on_attracting_and_optimising_foreign_investment; EUCCC, “European Chamber Calls for

More Action, Not More Action Plans,” European Business in China Position Paper 2024/2025 (Position

Paper 2024/2025), 2024, https://www.europeanchamber.com.cn/en/press-releases/3649/european_

chamber_calls_for_more_action_not_more_action_plans; EUCCC, “Stance on 2024 Annual Central

Economic Work Conference,” 2024, https://www.europeanchamber.com.cn/en/press-releases/3680/

stance_on_2024_annual_central_economic_work_conference.2 | WIPO, “GII Science and Technology Clusters 2024: Tokyo-Yokohama and Shenzhen-Hong Kong-Guangzhou

Top the Ranking; Emerging Economies Make Their Move,” 2024, https://www.wipo.int/pressroom/

en/articles/2024/article_0012.html.3 | Asia Growth Partners, “Innovating in China. 2024 Strategic Landscape for Multinationals,” 2024,

https://asiagrowthpartners.com/insight/innovating-in-china.-2024-strategic-landscape-for-multinationals/

a60.4 | Asia Growth Partners.

5 | Jacob Gunter and Jeroen Groenewegen-Lau, “China’s Innovation System and the Localization Dilemma”

(Merics, April 21, 2023), https://merics.org/en/report/chinas-innovation-system-and-localization-dilemma.6 | Asia Growth Partners, “Innovating in China. 2024 Strategic Landscape for Multinationals.”

7 | EUCCC and Roland Berger, “Business Confidence Survey 2024,” 2024, https://www.europeanchamber.

com.cn/en/publications-business-confidence-survey.8 | MOF, “关于《中国禁止出口限制出口技术目录》调整公开征求意见的通知 (Notice of Public Consultation on

Adjustments to China’s Catalog of Prohibited and Restricted Export Technologies),” 2025, https://fms.

mofcom.gov.cn/xxfb/art/2025/art_4717648e8ef94faba7564800b90ea3cc.html.9 | Daniel Ren, “Beijing to Chinese EV Makers: Think Twice about Investing in Tariff-Backing EU Countries,”

South China Morning Post, October 31, 2024, sec. Business, https://www.scmp.com/business/

china-business/article/3284591/beijing-chinese-ev-makers-think-twice-about-investing-tariff-backingeu-

countries.10 | Jacob Gunter and Max J. Zenglein, “The Party Knows Best: Aligning Economic Actors with China’s Strategic

Goals” (Merics, October 12, 2023), https://merics.org/en/report/party-knows-best-aligning-economic-

actors-chinas-strategic-goals.11 | Wu Yuli 吴遇利, “不再安全可靠!四大行业协会呼吁审慎选择美国芯片,多家企业回应业务影响 (No Longer Safe

and Reliable! Four Major Industry Associations Call for Prudent Choice of U.S. Chips, Many Companies

Respond to Business Impacts),” Pengpai, 2024, https://m.thepaper.cn/newsDetail_forward_29533508.