Rare-earths export controls + Nexperia + Fourth Plenum

Top Story

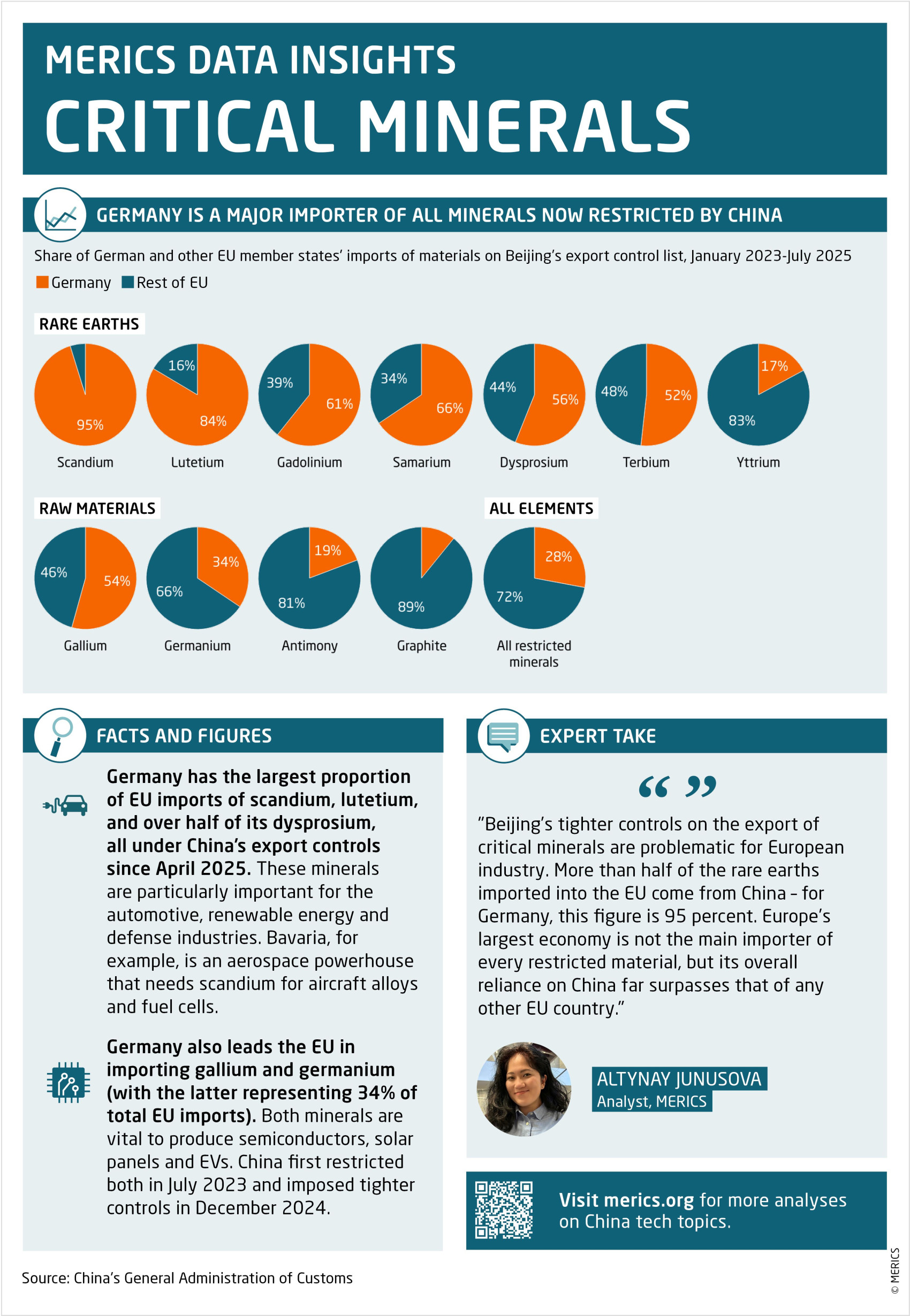

Beijing’s expanded export controls mirror US measures – on a much larger scale

China expanded its export controls last week in ways that are much like US controls, but on a radically larger scale. On October 9, China’s Ministry of Commerce and General Administration of Customs issued notices expanding the number of specific materials and industries included. They also added new mechanisms to exponentially increase the number of value chain links where Beijing could require licensing, even when those flows are between two other countries.

China is effectively using its chokehold over rare earth value chains and technology the same way the US has done to China with other traded goods. It clearly mirrors Washington’s measures, including lowering de minimis thresholds to functionally capture any good containing China-made rare earths, similar to the US Foreign Direct Product Rule (FDPR). It also added a “Chinese persons” rule – like the “US persons” rule – to stop legal persons, such as citizens, residents or entities, from doing work related to rare earths outside of China.

Where this differs is the sheer scale captured in the new process. The US has used export controls in quite narrow categories – advanced chips, lithography machines, and US persons restrictions on helping China in AI development. China’s new export controls on such basic materials found across much of the modern economy, rather than on inputs further downstream in value chains, is a colossally larger scale of application.

Even on a purely logistical level, it is unclear how Beijing will manage to expand the licensing system and the personnel needed to actually implement rules of this scope. When previous export controls on materials like gallium and germanium were introduced, it took a few months of administrative work until export levels resumed to pre-controlled levels.

“Policymakers and companies should not expect the new export control measures to be negotiated away. China may strike deals to ensure speedy licensing for cooperative partners, but Beijing is likely to benefit from keeping the rules in place and hanging the licenses like a Sword of Damocles over their heads while they (re)consider their derisking ambitions. Meanwhile, these export controls could have a material impact on European rearmament efforts and on the battlefield in Ukraine by undermining key defense value chains.“

Jacob Gunter, Head of Program for Economy and Industry, MERICS

More on the topic: Read our series on China’s rare-earths export controls. Rebecca Arcesati, Jacob Gunter, Niklas Hintermayer, Antonia Hmaidi and Altynay Junusova explain how China’s export controls raise pressure on Europe to derisk, how European importers have struggled with intricate approval processes, and what the rules mean for European defense industry.

METRIX

77

This is the number of times the word jiating (家庭) – meaning family or household – is mentioned in a white paper on China’s achievements in gender equality recently published by the Chinese government. Beijing has taken an increasingly traditionalist stance on women’s roles in society, promoting marriage and having children even as gender inequality and workplace discrimination persist. Nevertheless, Beijing continues to present the country as a global leader in women’s development. It hosted a global leaders' meeting October 13-14 to commemorate the 1995 Beijing declaration, a landmark for women’s rights globally. Domestically, state media emphasized women’s family roles, while touting the “historic” participation of women in government – even though there are no women in the Politburo and only 11 in the Central Committee. (Sources: Chinese government website, People’s Daily)

More on the topic: When giving birth is a national duty: Beijing’s struggle to reverse demographic decline – MERICS Report by Daria Impiombato and Nis Grünberg

Topics

Critical tech as a strategic asset: Netherlands seizes China’s Nexperia

The Dutch takeover of Chinese semiconductor maker Nexperia shows that states increasingly see critical technology as a strategic national asset. This week, news hit that the Dutch government had quietly put Nexperia under temporary management via the Goods Availability Act, a never-before-used law harking back to the Cold War, and that Beijing had responded with export controls on Nexperia’s Chinese unit – all at the start of October. This came as China’s rare earth export controls threaten to block Europe’s supply of technology – such as chips used for AI, critical for securing its economy and defense.

Chinese investors bought Nexperia from Dutch NXP in 2017. But Nexperia had hoped to shed its Chinese control since the US put its owner, Wingtech, on its Entity List in 2024. Now, new US trade restrictions blocking Nexperia’s use of US technology appear to have triggered the takeover by the Dutch government, which feared a loss of access to the critical chips. In addition, Wingtech’s owner was preparing to move more front-end production to China.

Sparked by the chip shortage during Covid and the global race for AI technology, semiconductors have taken on new strategic significance – and may mark a new trend in state intervention. Nexperia is not the first time government worries have sparked such action. In June, local Swedish investors took majority control of Silex Microsystems from Chinese Sai Microelectronics after the government blocked Silex’s expansion plans over national security concerns.

“In previous years, several European countries approved Chinese investments in areas they now regard as critical to national economic security. Now they are exploring ways to control the damage. The Nexperia case signals to Beijing that majority ownership no longer guarantees control and to Europe the need for concrete action to protect its critical technology and defend its interests from the US-China rivalry.”

Altynay Junusova, Analyst, MERICS

Media coverage and sources:

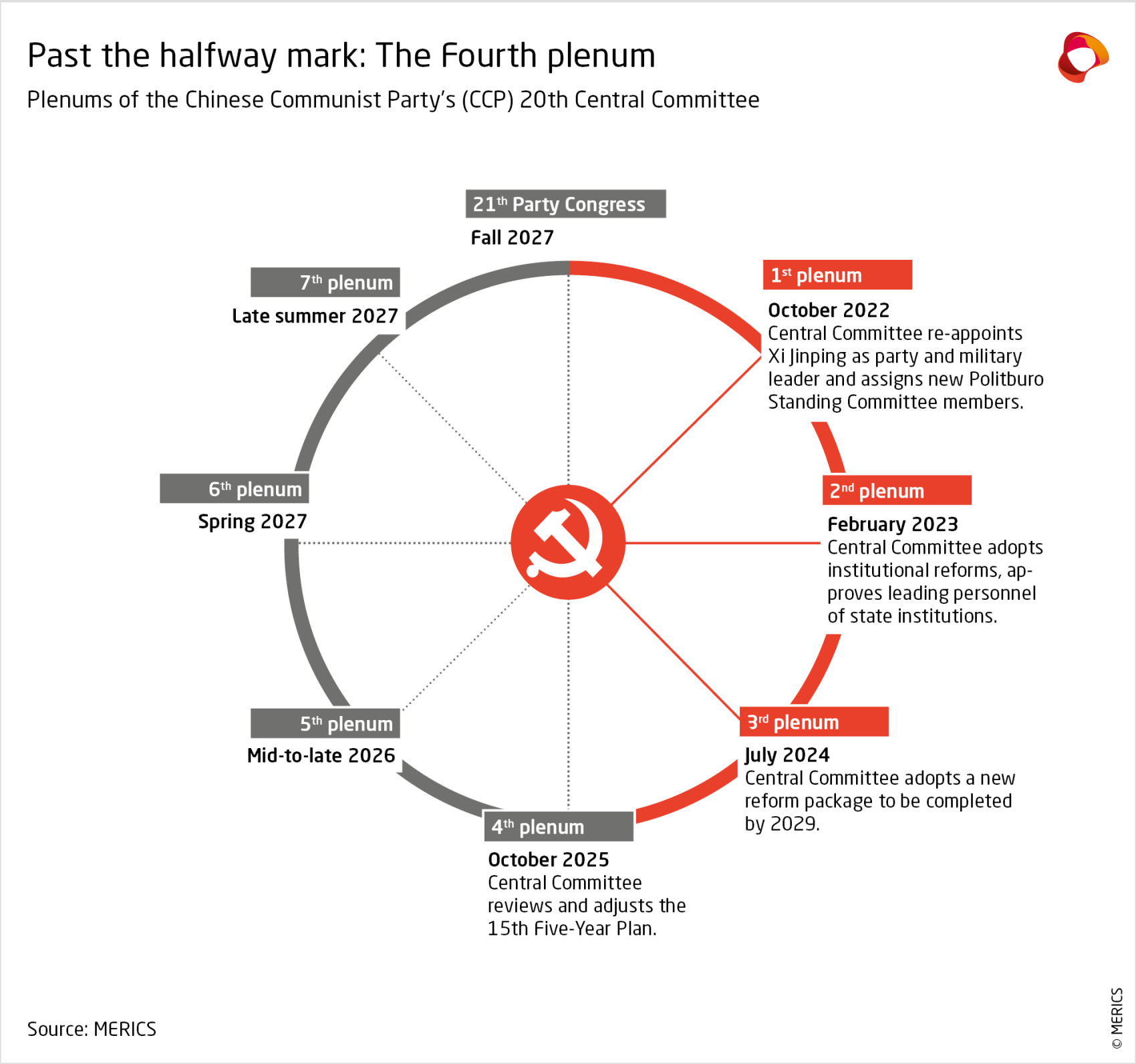

As pressure rises, China’s leaders meet to chart economic path for the years ahead

Geoeconomic clouds are hanging over a top-level political meeting on China's next Five-Year Plan. The roughly 370 members of the Chinese Communist Party’s (CCP) current Central Committee will next week gather in Beijing for the fourth so-called plenary session of their 2022-2027 term. This non-public event will focus on finetuning the CCP’s economic and social development blueprint for the coming years, an opening for targeted adjustments to China’s 15th Five Year Plan, which has long been in preparation, but won’t be finally adopted by China’s legislature until March 2026.

The Fourth Plenum is happening at a time of high external volatility and internal pressures, requiring Xi Jinping and other member of the Central Committee to forge a safe and sustainable path toward adjusting China’s economic model. The trade war with the US, growing international concerns over industrial overcapacity and dependencies, and rising trade barriers are a threat to the country’s ambitions for economic growth. But domestic issues like low consumption and weak private-sector growth, the real estate slump and youth unemployment are also key issues.

These challenges suggest that the focus of the meeting and any policy plan agreed by the Central Committee will continue to be on economic and technological self-reliance and leadership. Innovation, manufacturing and supply chain security in strategic sectors will continue to occupy the attention and resources of the party state even more than boosting citizens’ disposable incomes and reducing their social woes to promote consumption. The Plenum can also usher in high-level personnel changes that can carry important signals about the internal dynamics and power balance at the top of the CCP.

“Xi Jinping promised China a path to modernization, rejuvenation and common prosperity. Three fifths of the way through his third term, he faces an uphill battle to make his ‘China Dream’ come true. The Fourth Plenum will provide key signals on how the CCP leadership plans to tackle the challenges ahead.”

Katja Drinhausen, Head of Program for Politics and Society, MERICS

Media coverage and sources:

- Brookings: Purges, personnel, and policy: a primer on China’s Fourth Plenum

- The Diplomat: What Is China’s Fourth Plenum (and why should you care)?

- Reuters: China to review five-year plan at October Communist Party conclave

- SCMP: China’s fourth plenum poised for highest Central Committee turnover in 8 years

Li Qiang visit signals shift in China’s North Korea policy

Beijing has for the past year publicly distanced itself from the growing military cooperation between North Korea and Russia but now seems to be shifting its stance: China’s Premier Li Qiang recently visited Pyongyang to attend the 80th anniversary of the founding of the Workers' Party of Korea, signaling a warming of relations. Li’s was the highest-level trip since 2019, when Xi Jinping met Kim Jong Un, and followed the visit of the North Korean leader to Beijing for September’s 80th commemoration of World War II “Victory Day”. Images of Xi presiding over a military parade with Kim and Russian President Vladimir Putin went around the world.

China’s renewed embrace of North Korea may have been driven by fears of being cut out by – and so losing influence over – Pyongyang and Moscow at a time when Beijing is under increasing international pressure. North Korea’s dispatch of soldiers and weapons in support of Russia’s war against Ukraine, the potential of a quid-quo-pro transfer of technology from Russia to North Korea and the signing of a mutual defense treaty between the two countries challenged Beijing’s position as the main protector of the North Korean regime. A flurry of exchanges in 2025 was likely designed in part to counterbalance Russia’s growing influence on Pyongyang.

After most recent bilateral meetings, including Xi and Li’s respective meetings with Kim, Beijing and Pyongyang emphasized close relations “no matter how the international situation changes,” and agreed to deepen cooperation. It’s even possible that Kim took a small step towards realizing North Korea’s long-standing goal of having Beijing at least tacitly recognize it as a nuclear power and back its regional posture. Chinese readouts after Li’s trip and Kim’s visit to Beijing no longer carried standard references to the denuclearization of the Korean peninsula or to the political settlement of the Korean peninsula issue. This omission is not conclusive proof of any shift in China’s strategy, but it is a troubling signal.

“Beijing’s – and Moscow’s – tighter embrace of their often-problematic neighbor is helping North Korea exit its international isolation. Though we are yet to see formal cooperation between the three, China’s reengagement and the deepening Russia-North Korea relationship signals the hardening of a trilateral partnership with some overlapping geopolitical interests.”

Helena Legarda, Head of Program for Foreign Relations, MERICS

Media coverage and sources:

- Chinese MFA: Li Qiang Meets Kim Jong Un, General Secretary of the Workers' Party of Korea and Chairman of the State Affairs Commission (李强会见朝鲜劳动党总书记、国务委员长金正恩)

- Chinese MFA: Xi Jinping held talks with Kim Jong Un, General Secretary of the Workers' Party of Korea and Chairman of the State Affairs Commission (李强会见朝鲜劳动党总书记、国务委员长金正恩)

- CSIS: Dataset: China-North Korea High Level Visits Since 1953

Graphic of the week

China accounts for roughly 70 percent of global iron ore imports. One important supplier is the Australian miner BHP, accounting for approximately 13 percent of China’s imports. Previously, BHP was able to negotiate with Chinese steelmakers individually, but this changed in 2022, when the China Mineral Resources Group (CMRG) was formed. It handles all iron ore imports and resells them to the domestic steelmakers.

Currently, negotiations between BHG and CMRG are stalled, as the Chinese Group wants to bring prices down. It first flexed its muscles by pausing purchases of BHP's Jimblebar fines product, a type of iron ore, before temporarily pausing purchases of all new BHP cargoes.

More on the topic: In 2022, MERICS Expert Jacob Gunter already warned that CMRG “could have a significant impact on global prices or even lead to lower iron ore prices for the China market than for others.” Read his analysis in the MERICS China Global Competition Tracker from December 2022.

MERICS China Digest

Chinese freighter halves EU delivery time on maiden Arctic voyage to UK (Reuters)

A Chinese container ship has completed a pioneering journey from Zhoushan, China, through the Arctic to the port of Felixstowe in the UK in 20 days, state-run news agency Xinhua reported, cutting in half the usual transit time of 40 to 50 days through the Suez Canal or around the Cape of Good Hope. The new Northern Sea Route, running entirely through Arctic waters and within Russia's exclusive economic zone, can now be navigated by ships due to global warming. But weather and sailing conditions along the Arctic passage can be unpredictable. (25/10/14)

US and China begin charging port fees on each other’s ships (BBC)

China says its levies, which took effect on Tuesday, aim to safeguard the country's shipping industry from "discriminatory" measures and apply to US-owned, operated, built, or flagged vessels but not Chinese-built ships. It comes in retaliation to similar US fees on Chinese ships, which Washington says are designed to support American shipping companies. (25/10/14)

German Foreign Minister accuses China of undermining the international order (Die Zeit)

German Foreign Minister Johann Wadephul has criticized China's behavior toward its neighbors and its support for Russia in the war in Ukraine. At an event at the Japanese-German Center in Berlin, Wadephul accused Beijing and Moscow of “rewriting the international order based on international law.” (25/10/14)

Taiwan unveils “T-Dome” air defence system (Deutsche Welle)

Taiwanese President Lai Ching-te has vowed to speed up the construction of a multi-layered air defense system — dubbed "T-Dome" — as part of efforts to counter rising threats from China. "We will […] establish a rigorous air defense system in Taiwan with multi-layered defense, high-level detection, and effective interception, and weave a safety net for Taiwan to protect the lives and property of citizens," Lai said in an address during Taiwan's National Day celebrations on October 10. (25/10/10)

Germany investigating Temu on price-fixing suspicions (Deutsche Welle)

Germany's Federal Cartel Office on October 8 announced an investigation into Chinese e-commerce giant Temu, saying it wanted to examine conditions for traders and the company's treatment of the suppliers it relies upon to sell products. “We are pursuing the suspicion that Temu could be setting unacceptable conditions for pricing for traders on the German marketplace,” Andreas Mundt, the president of the competition watchdog, said in a statement. (25/10/08)

China replaces head of CCP’s international department (Channel News Asia)

The CCP unexpectedly appointed a new head of its influential international department, which manages relations with foreign political parties, replacing Liu Jianchao, who is reportedly under disciplinary investigations and has vanished from the public eye over the last two months with his whereabouts unknown. He is replaced by Liu Haixing who previously served as a senior director of a powerful party commission overseeing national security. (25/10/01)

China introduces new talent visa as US hikes visa fees (Reuters)

The new K visa, announced in August, targets young foreign science, technology, engineering and mathematics graduates and promises to allow entry, residence and employment without a job offer. In early September, the Trump administration said it would ask companies to pay 100,000 USD per year for H-1B worker visas, widely used by tech companies to hire skilled foreign workers. (25/09/29)