Nigeria sees China as a steady partner and its largest lender

You are reading chapter 6 of the MERICS Paper on China "Beyond blocs: global views on China and US-China relations". Click here to go to the table of contents.

You are reading chapter 6 of the MERICS Paper on China "Beyond blocs: global views on China and US-China relations". Click here to go to the table of contents.

Nigeria has the largest population and biggest economy in Africa, yet, it is confronted with serious challenges.1 About 80 million of Nigeria’s 200+ million people live in poverty. There is insufficient infrastructure, weak and ineffective institutions, transparency and governance issues, and an oil-dependent rent-seeking economy. Meanwhile, insurgency in the northeast is now being compounded by separatist Indigenous People of Biafra (IPOB) attacks in the southeast.2 Within that context, Nigeria-China relations are dominated by economic considerations. China is a major investor and an alternative to other sources of development finance like the International Monetary Fund (IMF), World Bank and other bilateral lenders; it has become Nigeria’s largest bilateral lender.

Status quo: Economic relations are at the core

China is one of Nigeria’s top trading partners. According to the World Bank, Nigeria-China trade in products increased from about USD 1.2 billion in 2003 to USD 13.7 billion in 2019. Nigeria’s trade with the United States in the same period declined from USD 11.5 billion to USD 7.5 billion. Within the same period, Chinese investment in Nigeria increased from USD 24.4 million to 123.27 million. Nigeria became one of the top five Chinese investment destinations in Africa – after Kenya, The Democratic Republic of Congo, South Africa, and Ethiopia in 2020.3

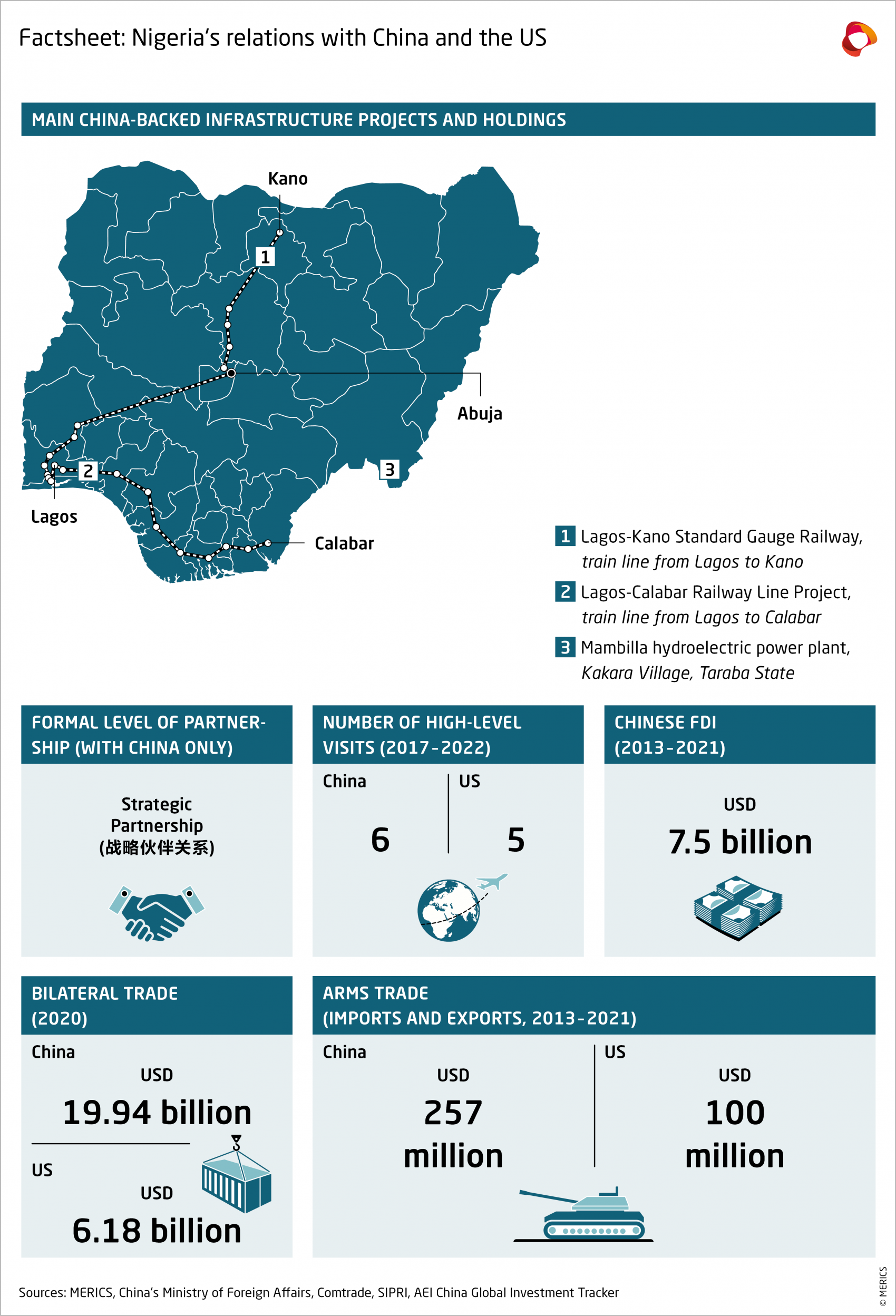

Beyond trade and investment, China is financing large projects and its companies are contracted to deliver their construction – including railways, road projects and the rehabilitation of Nigeria’s main four airports in Abuja, Lagos, Kano and Port Harcourt. All this makes China fundamental to Nigeria’s development finance. In addition to these projects, China has sold millions of USD worth of tanks and artillery to the Nigerian military.4

China’s rising influence in Nigeria, nonetheless, raises three main concerns worth stressing:

The first revolves around the opacity of China’s loans and infrastructure contracts, something that can encourage corruption and other illiberal activities. This opacity led Nigeria’s House of Representatives (i.e., the Lower House of the National Assembly) in May 2020 to decide unanimously to probe Chinese loans.5 They voted for the probe despite a plea from the Minister of Transportation, Rotimi Amaechi, that the inquiry might frustrate future Chinese loans.6 However, by late June 2021, there were media reports that the House probe was not proceeding.7

China’s response to the House’s probe was to emphasize that loans to Nigeria were mutually beneficial.8 Some months later, in February 2022, a two-man Chinese delegation, Wu Baocai and Li Ineijian, visited the national secretariat of the main opposition party, PDP, whose members in the House had moved and supported the motion for the probe, at its headquarters.9 Less than a month later, Wu led another Chinese delegation to the Inter-Party Advisory Council (IPAC), an umbrella body for all the registered political parties in Nigeria. These visits appear to have been successful as positive statements about China’s activities in the country were made by Iyorchia Ayu, the chairperson of the PDP, and by his IPAC counterpart, Yabagi Sani.10 By showing willingness to reach out to the main opposition party, the Chinese initiative may have laid a useful foundation if the 2023 general election brings a change of government.

Second, there are concerns that imports of Chinese products, especially textiles, are contributing to the demise of local industries. There have been protests amid reports linking Chinese textiles to the unemployment of thousands of Nigerians in the textile industry.

The third concern centers on Nigeria’s growing dependence on China. There have been situations where Nigeria has had to jostle to find alternative sources of finance when China – or Chinese banks – declined to fund projects they had initially committed to. Recently, the China Exim Bank declined to proceed with the funding of projects. The Nigerian government was forced to approach Standard Chartered to bridge the gap after China Exim Bank disbursed only USD 1.3 billion of an estimated total loan of USD 8.3 billion for the Lagos-Kano railway – a major infrastructure project to link Nigeria’s former capital and commercial center to its largest northern city.11

Geopolitics, China, and the United States: Nigeria searches for the best pragmatic deals

Like China, the United States occupies an important position in Nigeria’s economic, political and security relations. So far, US-China rivalry has had only a minimal impact on Nigeria. However, there could be a drastic impact if the rivalry persists and deepens. For instance, Nigeria’s telecommunications industry is increasingly dominated by Chinese technology firms led by Huawei, a multinational equipment and service provider with credit lines from state-owned Chinese banks.12

Thus, if the so-called ‘splinternet’ emerges – with Chinese and US technologies supporting different digital and internet ecosystems – it could have a disruptive impact and could force Nigeria(ns) to take sides. Not only have Chinese companies (e.g., Huawei and ZTE) dominated the telecommunications market by supplying the main service providers like MTN but also, like many African countries, Chinese-made smart phones have become popular in Nigeria.13 Meanwhile, the enormity of the internet split could have unintended implications and disruptions for the emerging fintechs in the West African country. It is important to mention that of the five fintech unicorns (i.e., start-ups worth over USD 1 billion) in Africa, three – “Interswitch, Flutterwave and Paystack – are Nigerian companies”.14

Thus far, Nigerian governments have managed their relationships with the US and China in a strongly pragmatic way. As Foreign Minister Geoffrey Onyeama put it during US Secretary of State Antony Blinken’s 2021 Africa trip, “It’s not a question of one country or the other per se; it’s really a question of the best deal that we can strike.”15

Nigeria had a democratic transition of power in 2015, after the ruling Peoples Democratic Party (PDP) lost to the All Progressive Congress (APC). The next general election is due in early 2023 and will take place at a critical moment in the country’s history because, aside from the many security challenges, the country is confronted with socio-economic challenges. For instance, the outbreak of Covid-19 compounds the afore-mentioned pre-Covid poverty situation. Public universities have been on strike and their students have been at home for months. Given the level of frustration with the current government, there is a real chance for the opposition to return to power – although the current President, Muhammadu Buhari, will not be on the ballot. Instead, a former Governor of Lagos, Bola Ahmed Tinubu of the APC will be contesting against PDP’s Atiku Abubakar, a former Vice President, for the top job.

Although its relationship with China is important and strong, Nigeria’s political system and political affinities are more in tune with that of the US and Western Europe. Local media, civil society and successive governments offer a space where US and EU interests have operated without Chinese interference.

Perceptions: China is seen as a partner despite ups and downs

Public perceptions of China in Nigeria are generally positive.16 Afrobarometer polls in 2020 reported that 62 percent of Nigerians viewed China as a positive influence on their country – the same percentage as rated the United States positively.17 The trend continued in 2021, when 63 percent of Nigerians considered China’s political and economic influence as positive and gave the United States the same 63 percent score.18 At the elite level, China is considered a partner and seen as an alternative to traditional sources of development finance.

Top level political office holders in Nigeria and China have periodically exchanged visits. For instance, President Jiang Zemin and President Hu Jintao visited Nigeria in 2002 and 2006, respectively, after President Olusegun Obasanjo visited China in 1999 and 2005. President Umaru Yar’ Adua (in 2008), President Goodluck Jonathan (in 2013), and the sitting President, Buhari (in 2016) visited China.19 In addition to China’s Premier Li Keqiang’s visit to Nigeria in 2014, Chinese foreign ministers like Yang Jiechi (in 2010, and as President Xi Jinping’s special envoy in 2019), and Wang Yi (in 2017 and 2021) have visited Nigeria.

Anti-Chinese sentiment has occasionally flared up after, triggered by the maltreatment of Nigerians in Guangzhou in 2020 during the Covid-19 pandemic or the periodic maltreatment of locals by some Chinese companies in Nigeria.20 But these episodes have gradually faded, and the usual friendly relations returned. Of the 34 African countries, Nigerian ranked seventh highest in rating the Chinese development model best for their country in the 2019/2021 Afrobarometer survey. It was favored by 29 percent of respondents, though 36 percent favored the US model.21

However, there are controversial issues amid these broadly positive views of China. The decimation of the local textile industry is a focus of anti-China feelings, although government policies on textiles and other local factors have contributed to that industry’s decline as well. Thousands have protested against Chinese textile imports.22

The Nigeria-China relationship has gone through occasional sharp swings and instabilities over economic matters. When the government of President Olusegun Obasanjo initiated the short-lived oil-for-infrastructure policy with China in 2006, seeking to pay for Chinese infrastructure with oil, it was cancelled after only a few months by his hand-picked successor who was also from the PDP. Another example of instability in the economic relationship was China Exim Bank’s reluctance to proceed with funding the Lagos-Kano railway project.23 Although Nigeria’s ruling elites generally consider China a reliable alternative source of development finance, this perception, too, is susceptible to oscillations.

Outlook: A cautious China remains an attractive alternative

China has become a reliable major player in Nigeria’s infrastructure development over the last 20 years. However, the future relationship will need to weather increasing regional instability and push back against Chinese debt. Nigeria’s oil-rich economy is rent-seeking and has relied on exports of raw crude for years, though China is not a major market for Nigeria’s oil. More seriously, the impending global shift to renewable energy could devastate the economy.

Meanwhile, Nigeria is moving into an election period that will culminate in general elections in early 2023. The elections will likely take place amid escalating regional frictions. There is ongoing conflict in the northeast; simmering tensions in the southeast where there is a secessionist group and a call for an Ibo presidency; and persistent frictions in the southwest, where herdsmen attacks on local communities have generated fresh local nationalism that led to the first region-based security outfit, Amotekun, by the southwest governments in 2020 and attacks on a Fulani community in Oyo, a southwest state, by a pro-Yoruba Nation secessionist group led by Sunday “Igboho” Adeyemo in 2021. China appears to be pulling the breaks on some projects.24 Although this hesitancy could be tied to uncertainty in an election year, the question of Chinese loans to Nigeria becoming unsustainable is an issue.

Chinese development finance has led to a rise in debt. According to the Nigerian Debt Management Office, Chinese loans to Nigeria stood at about 10 percent (USD 3.3 billion) of the total external debt (USD 33.3 billion) at end-December 2020.25 While this appears manageable in terms of the total external debt portfolio, China is Nigeria’s top bilateral lender with 80 percent of the bilateral loans – which includes loans from France (USD 494 million), Germany (USD 184 million), Japan (USD 80 million), and India (USD 37 million). Thus, the narrative of a Chinese debt trap used by Western diplomats may soon find its way into national discourse. In 2020, questions about Chinese loans affecting Nigeria’s sovereignty became a major issue in the National Assembly and in the news.26

Although China has not become an election issue in Nigeria (as it did in Zambia’s 2006 national election), political elites have a tendency to criticize its conduct, especially when in opposition. The most frequent criticisms focus on growing Chinese loans to the government; the lack of transparency in such loan agreements; and the number of Chinese citizens working on China-funded construction projects. A cautious China may therefore be responding to local realities so as to reposition itself for all possible election outcomes.

In conclusion, Nigeria-China trade has increased in the last 20 years but in China’s favor. Although the voices of local stakeholders will become louder, the trade imbalance in favor of China will continue – at least until Nigeria’s government creates the necessary environment for local manufacturing to reverse the current situation. However, non-state actors like the media and civil society groups will remain critical elements in Nigeria-China relations. They are able to push back at the illiberal influence of Beijing and of Chinese companies where the Nigerian state fails.

- Endnotes

-

1 | Olurounbi, Ruth. Al Jazeera (2022a). “Africa’s largest economy, Nigeria, tops growth forecasts,” February, 17. https://www.aljazeera.com/economy/2022/2/17/africas-largest-economy-nigeria-tops-growth-forecasts. Accessed: March 22, 2022.

2 | Lain, Jonathan, Schoch, Marta & Vishwanath, Tara. World Bank Blog (2022). “Picking up the pace of poverty reduction in Nigeria.” March 22. https://blogs.worldbank.org/africacan/afw-picking-pace-poverty-reduction-nigeria. Accessed: April 2, 2022.

3 | SAIS-CARI (2020). “Data: Chinese investment in Africa.” http://www.sais-cari.org/chinese-investment-in-africa. Accessed: February 10, 2022.

4 | Defenceweb. (2020). “Nigerian military receives tanks, artillery from China.” April 9. https://www.defenceweb.co.za/featured/nigerian-military-receives-tanks-artillery-from-china/. Accessed: April 10, 2022.

5 | Abuh, Adamu. The Guardian (2020). “Why House of Representatives resolved to probe Chinese loans.” May 25. https://guardian.ng/politics/why-house-of-representatives-resolved-to-probe-chinese-loans/. Accessed: February 10, 2022.

6 | Yakubu, Dirisu. Vanguard (2020). “NASS probe may frustrate Chinese loan for rail projects – Amaechi.” July, 30. https://www.vanguardngr.com/2020/07/nass-probe-may-frustrate-chinese-loan-for-rail-projects-amaechi/. Accessed: February 11, 2022.

7 | Baiyewu, Leke. The Punch. (2021). “Reps panel chair silent on Chinese loans’ probe discontinuation.” July 5. https://punchng.com/reps-panel-chair-silent-on-chinese-loans-probe-discontinuation/. Accessed: April 3, 2022. ThisDay. 2021. “Ninth House and Her Fruitless Probes.” June 27. https://www.thisdaylive.com/index.php/2021/06/27/ninth-house-and-her-fruitless-probes/. Accessed: April 3, 2022.

8 | Vanguard. (2021). “Chinese envoy says loans to Nigeria mutually beneficial.” July 22. https://www.vanguardngr.com/2021/07/chinese-envoy-says-loans-to-nigeria-mutually-beneficial/. Accessed: April 3, 2022.

9 | Daily Post. (2022). “Nigeria, China cooperation will be strengthened when PDP returns to power – Iyorchia Ayu.” February 4. https://dailypost.ng/2022/02/04/nigeria-china-cooperation-will-be-strengthened-when-pdp-returns-to-power-iyorchia-ayu/. Accessed: April 3, 2022.

10 | Agbakwuru, Johnbosco. Vanguard. (2022). “2023: Chinese Communist Party meets with IPAC in Abuja.” March 17. https://www.vanguardngr.com/2022/03/2023-chinese-communist-party-meets-with-ipac-in-abuja/. Accessed: April 3, 2022.

Daily Post. (2022). “Nigeria, China cooperation will be strengthened when PDP returns to power – Iyorchia Ayu.” February 4. https://dailypost.ng/2022/02/04/nigeria-china-cooperation-will-be-strengthened-when-pdp-returns-to-power-iyorchia-ayu/. Accessed: April 3, 2022.11 | Olurounbi, Ruth & Clowes, William. BNN Bloomberg (2022). “Nigeria gives up waiting for China Exim loan for railway project.” February, 2. https://www.bnnbloomberg.ca/nigeria-gives-up-waiting-for-china-exim-loan-for-railway-project-1.1717326. Accessed: February 11, 2022. Olurounbi, Ruth. The African Report. (2022b). “Nigeria turns to Europe for rail loans as China talks hit dead end.” February, 14. https://www.theafricareport.com/176583/nigeria-turns-to-europe-for-rail-loans-as-china-talks-hit-dead-end/. Accessed: February 11, 2022.

12 | Tugendhat, Henry (2020). “How Huawei succeeds in Africa: training and knowledge transfers in Kenya and Nigeria,” SAIS China Africa Research Initiative (CARI) Working Paper, No. 34, pp. 1-30. Washington, D.C.: SAIS-CARI.

13 | Tugendhat, Henry (2020). “How Huawei succeeds in Africa: training and knowledge transfers in Kenya and Nigeria,” SAIS China Africa Research Initiative (CARI) Working Paper, No. 34, pp. 1-30. Washington, D.C.: SAIS-CARI.

14 | PEVCA (2022). “The Rise of FinTech in Nigeria.” February 3. https://pevcang.org/the-rise-of-fintech-in-nigeria/. Accessed: February 4, 2022.

15 | Lee, Matthew. AP News (2021). “In Africa, Blinken sees limits of US influence abroad.” November, 22. https://apnews.com/article/coronavirus-pandemic-health-china-antony-blinken-nigeria-ae944eaf8e5ecfbb3661651fce69784e. Accessed: February 11, 2022.

16 | Seteolu, Folabi & Oshodi, Abdul-Gafar T. (2018). “Oscillation of two Giants: Sino-Nigeria Relations and the Global South.” Journal of Chinese Political Science 23(2): 257-285. Springer.

17 | Appiah-Nyamekye Sanny, Josephine & Selormey, Edem. Afrobarometer (2020). “Africans regard China’s influence as significant and positive but slipping.” No. 407, November, 17. https://afrobarometer.org/sites/default/files/publications/Dispatches/ad407-chinas_perceived_influence_in_africa_decreases-afrobarometer_dispatch-14nov20.pdf. Accessed: February 11, 2022.

18 | Appiah-Nyamekye Sanny, Josephine & Selormey, Edem. Afrobarometer. (2021). “Africans welcome China’s influence but maintain democratic aspirations.” No. 4891, November, 15. https://afrobarometer.org/sites/default/files/publications/Dispatches/ad489-pap3-africans_welcome_chinas_ influence_maintain_democratic_aspirations-afrobarometer_dispatch-15nov21.pdf. Accessed: February 11, 2022.

19 | Seteolu, Folabi & Oshodi, Abdul-Gafar T. (2018). “Oscillation of two Giants: Sino-Nigeria Relations and the Global South.” Journal of Chinese Political Science 23(2): 257-285. Springer.

20 | Oshodi, Abdul-Gafar T. The Conversation (2020). “Why Maltreatment of Nigerians in China may not End Soon.” May 28. https://theconversation.com/why-maltreatment-of-nigerians-in-china-may-not-end-soon-137828. Accessed: February 11, 2022.

Oshodi, Abdul-Gafar T. (2015). “Between the Dragon’s Gift and its Claws: China in Africa and the (Un) Civil fostering of ILO’s Decent Work Agenda.” In: Axel Marx, Jan Wouters, Glenn Rayp & Laura Beke (eds.). Global Governance of Labor Rights: Assessing the Effectiveness of Transnational Public and Private Policy Initiatives, 190-208. Massachusetts, US: Edward Elgar.21 | Appiah-Nyamekye Sanny, Josephine & Selormey, Edem. Afrobarometer. (2021). “Africans welcome China’s influence but maintain democratic aspirations.” No. 4891, November, 15. https://afrobarometer.org/sites/default/files/publications/Dispatches/ad489-pap3-africans_welcome_chinas_influence_maintain_democratic_aspirations-afrobarometer_dispatch-15nov21.pdf. Accessed: February 11, 2022.

22 | Muhammed, Murtala. The Guardian (2015). “Kano residents protest presence of Chinese textiles in their market.” May 14. https://guardian.ng/news/kano-residents-protest-presence-of-chinese-textiles-in-their-market/. Accessed: February 11, 2022. Ewepu, Gabriel. Vanguard (2018). “Cotton farmers accuse China over collapse of textile industries.” March 19. https://www.vanguardngr.com/2018/03/cotton-farmers-accuse-china-collapse-textile-industries/. Accessed: February 11, 2022.

23 | Seteolu, Folabi & Oshodi, Abdul-Gafar T. (2018). “Oscillation of two Giants: Sino-Nigeria Relations and the Global South.” Journal of Chinese Political Science 23(2): 257-285. Springer.

24 | Ajobaju, Jeph. The Niche. (2021). “Abuja sourcing $1b for AKK pipeline as China delays funding.” August 9. https://www.thenicheng.com/abuja-sourcing-1b-for-akk-pipeline-as-china-delaysfunding/. Accessed: February 10, 2022.

Olumhense, Sonala. The Punch (2021). “Lessons of Nigeria’s coastal rail.” September 19. https://punchng.com/lessons-of-nigerias-coastal-rail/. Accessed: February 11, 2022.25 | DMO (2020). “Nigeria's External Debt Stock as of December 31, 2020, in Millions of USD.” December, 31. https://www.dmo.gov.ng/debt-profile/external-debts/external-debt-stock/3489-nigeria-s-external-debt-stock-as-at-december-31-2020/file. Accessed: February 10, 2022.

26 | Onoja, Adagbo. The Diplomat (2020). “How China lost Nigeria.” August 25. https://thediplomat.com/2020/08/how-china-lost-nigeria/. Accessed: February 11, 2022.

You were reading chapter 6 of the MERICS Paper on China "Beyond blocs: global views on China and US-China relations". Click here to go to the table of contents.

You were reading chapter 6 of the MERICS Paper on China "Beyond blocs: global views on China and US-China relations". Click here to go to the table of contents.