Semiconductors

Semiconductors are crucial to many of China’s strategic goals: digitalizing the economy, boosting high-tech exports such as electric vehicles (EVs) and solar panels, and developing modern weapons. With its state-led “Big Fund,” China has invested more than CNY 686 billion (EUR 87.5 billion) into the industry since 2014, in addition to local government support and private investment.

Indigenizing the semiconductor industry has gained urgency, as US sanctions and export controls have cut off access to advanced semiconductors critical for development in AI, military and other fields.

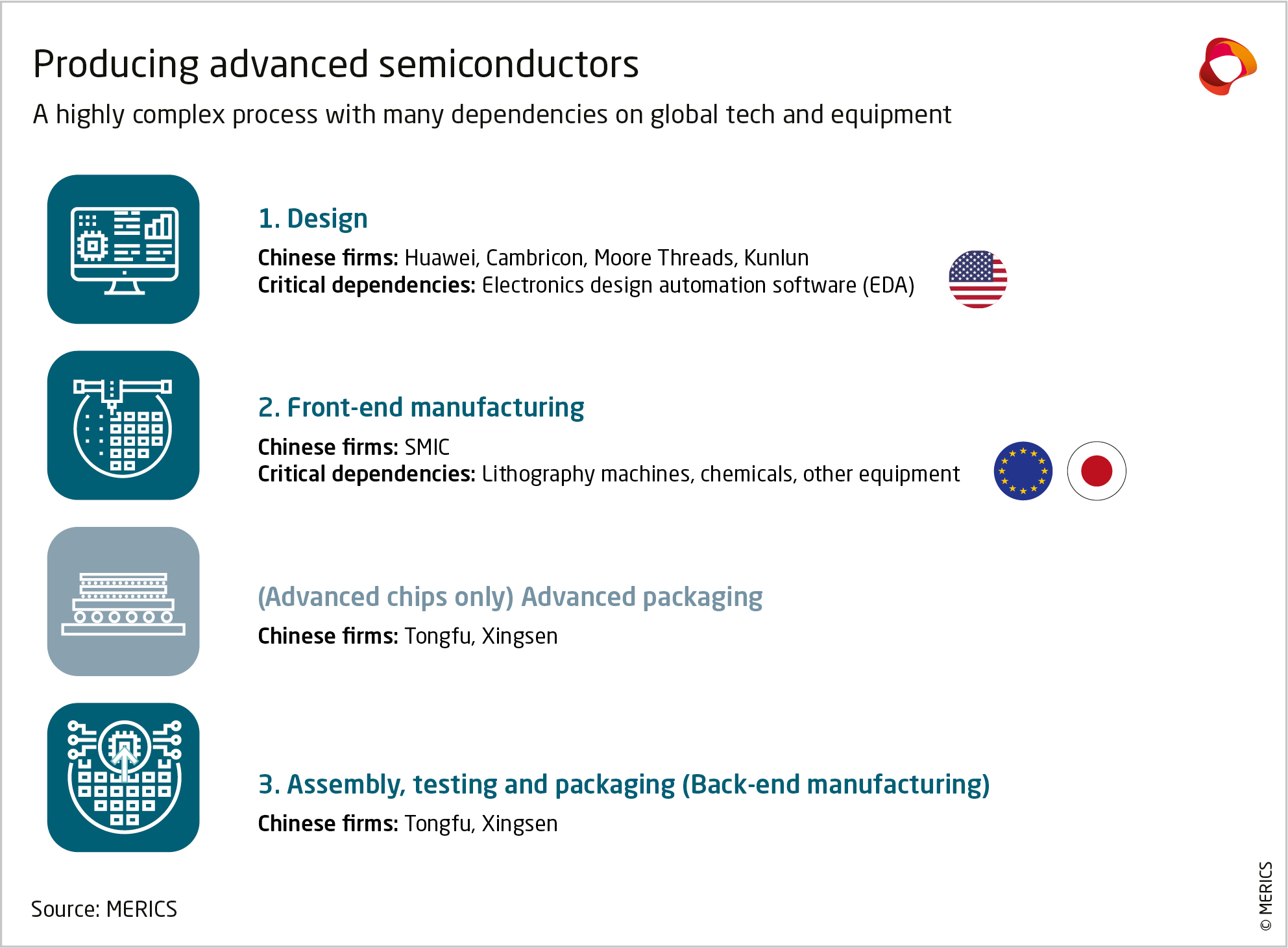

Since the US sanctioned the telecoms giant Huawei in 2019, Huawei has quietly become the central force in the state’s effort to develop homegrown chips, alongside other companies. China is a major producer of semiconductors using older manufacturing technology and is a leader in backend processes – chip assembling, testing, and packaging. But it lags in making advanced semiconductors and lacks the tools to manufacture them. US export controls have cut off access to critical foreign-made equipment.

Nevertheless, leading manufacturer SMIC has produced an advanced 7nm smartphone chip and a line of AI chips, both for Huawei. Taiwan’s TSMC, the world’s leading semiconductor contract manufacturer, first pioneered a 7nm process in 2018 (has since produced several rounds of further innovations), suggesting SMIC lags by roughly five years. However, China’s lack of access to Extreme Ultraviolet Lithography (EUV) machines, essential for making advanced semiconductors and exclusively produced by the Netherlands’ ASML, may hamper further progress.

Graphics dashboard

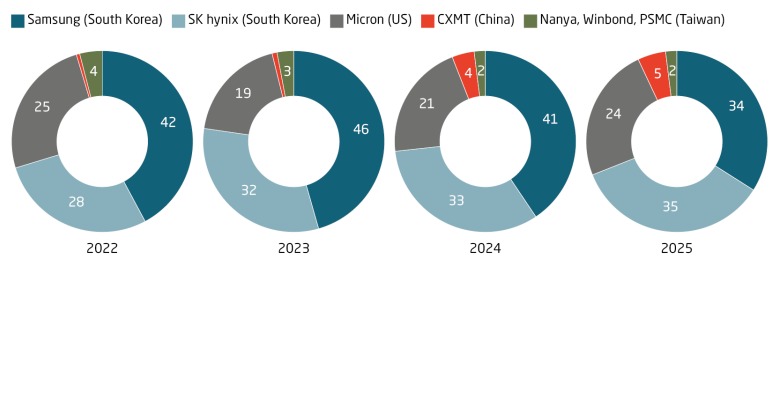

China gains ground in DRAM global market, competing with Samsung, SK hynix, and Micron. Its share of the global memory chip market has climbed from 0.6 percent to 5 percent in just four years, driven largely by ChangXin Memory Technologies (CXMT), now the world’s fourth-largest DRAM maker by capacity. CXMT mainly produces mature products like DDR4 and LPDDR4 chips but is signaling ambition toward DDR5 and HBM which are important for AI chips. In the last two years, CXMT has expanded to three 12-inch wafer fabs in Beijing and Hefei and is planning new plants in Shanghai with two to three times the Hefei capacity. CXMT’s gain in the memory market is a milestone for China in challenging the dominance of South Korean and US memory chip makers, but it still has a long way to go to compete at scale.

China faces the daunting task of trying to own the entire manufacturing process for semiconductors, which is highly complex with many steps. This is even more so with advanced semiconductors, which requires specialized equipment from other countries.

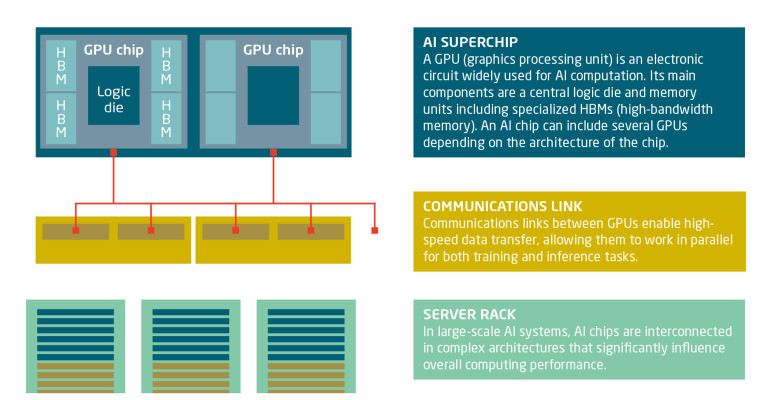

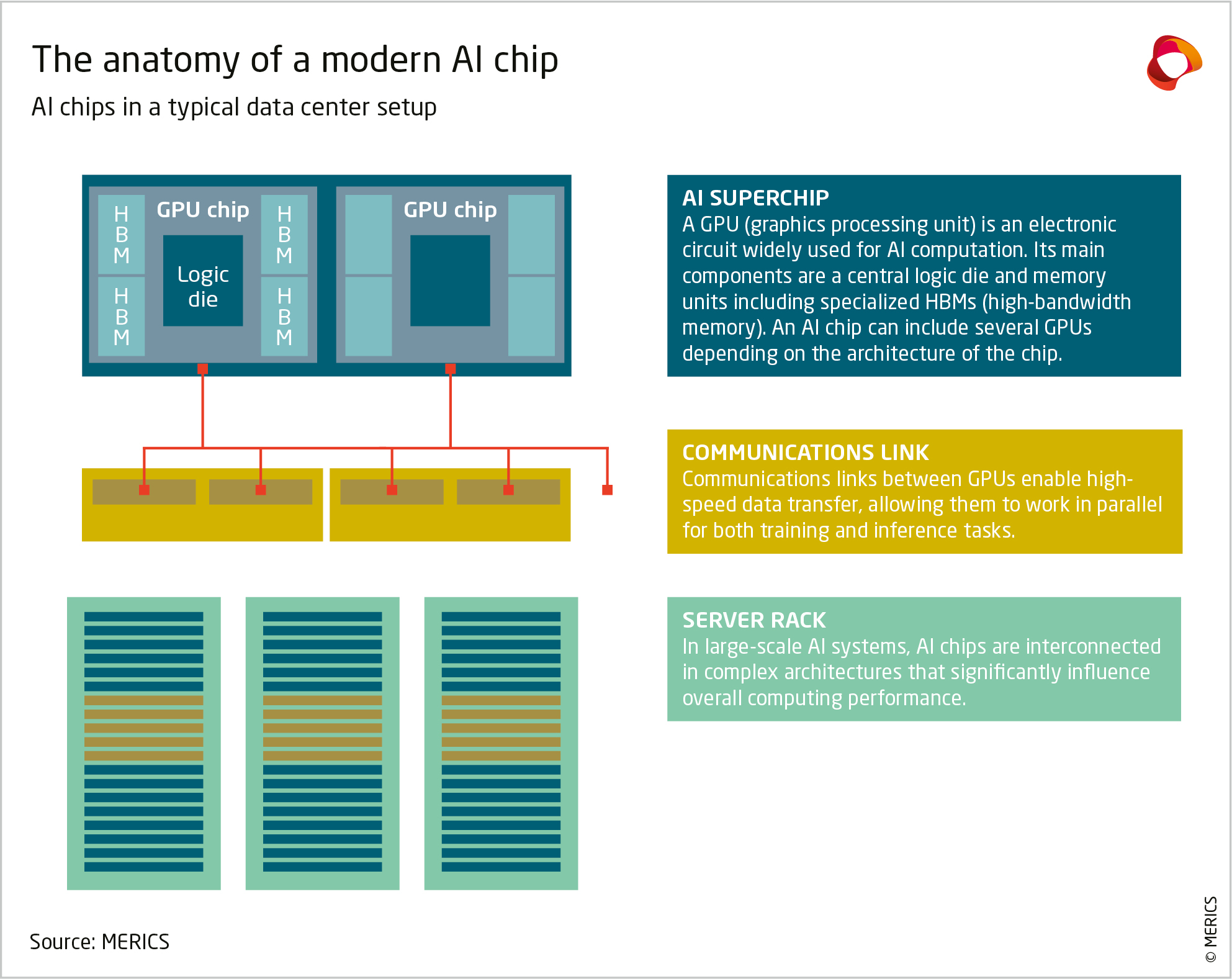

Modern AI chips contain GPUs, powerful processing units capable of parallel processing computing tasks, and high-bandwidth memory (HBM) units storing computation results. The chips are then connected with specially designed communications links in massive clusters. The engineering architecture of a data center, as well as the chips themselves, can affect its overall computational performance.

Semiconductors in China: Timeline of crucial events

The US adds Huawei and its subsidiaries to the Entity List, restricting exports to them. This impacts Huawei's supply chain, with 33 of its 92 core suppliers based in the US.

US applies Foreign Direct Product Rule to Huawei, blocking its technology access globally. Companies are barred from using US technology (mainly semiconductors) to supply Huawei.

Top Chinese scientist suggests China use open-source RISC-V chip design architecture to overcome Western sanctions, and create an ecosystem around “RISC-X” in Belt and Road countries.

US expands export controls on advanced semiconductors and manufacturing equipment, restricting tech specs of chips and including arms-embargoed countries.

Huawei and SMIC release Kirin 9000S, a 7nm 5G chip for Huawei's latest high-end smart phone – even after US export controls blocked equipment considered necessary to make such chips.

Ant Group says it has used domestic semiconductors, including from Alibaba and Huawei, to develop ways to train AI models that would cut costs by 20% compared to Nvidia’s.

SMIC intends to acquire the outstanding shares of Semiconductor Manufacturing North China (Beijing) Corporation (SMNC), currently 51% owned by SMIC.

SMIC tests a domestically produced immersion deep ultraviolet (DUV) photolithography machine that uses multiple patterning to produce 7nm chips without extreme ultraviolet (EUV) tools.

A Dutch court rules there are "well-founded reasons to doubt" that the Chinese semiconductor company Wingtech is being managed correctly and, suspends Zhang Xuezheng as its CEO.

Chinese AI startup Zhonghao Xinying launches Chana, a tensor processing unit (TPU), as a domestic alternative to Google’s TPU chips.

Second tranche of Big Fund raises CNY 2 trillion (EUR 25.6 billion) to support Chinese semiconductor industry – beyond just fabs – to create an ecosystem for making semiconductors in China.

COVID-19 severely disrupts supply chains for automotive chips. Car companies must cut output due to the shortage. Chinese chip companies evolve to meet the demand of its auto industry.

US institutes country-wide semiconductor export controls, a major policy shift that restricts all of China’s access to "chokepoint" technologies, not just certain entities.

Third phase of China Integrated Circuit Industry Investment Fund (Big Fund III) raises CNY 3.4 trillion (EUR 44.3 billion) from state-owned investors for semiconductor industry, the largest to date.

China’s chip exports exceed CNY 1trn for the first time in 2024, reflecting growing production prowess. But imports are still twice as high as exports and are rising again after a dip in 2023.

A subsidiary of Ant Group acquires a stake in memory chip developer InnoStar Semiconductor, as part of China’s efforts to support domestic suppliers. InnoStar raises its capital to CNY 50 m.

The Dutch government seizes control of Dutch semiconductor manufacturer Nexperia, a subsidiary of China’s Wingtech, following concerns that it was transferring operations and IP to China.

Shenzhen launches a CNY 5-bn fund to support semiconductor startups and strengthen local chip supply chains. The fund is part of Shenzhen's "20+8" industrial policy and has a 10-year duration.

As China announces a one-year suspension of export controls on critical minerals, the US cuts tariffs on Chinese imports by 10% and delay certain restrictions on Chinese subsidiaries.

The US approves exports of Nvidia’s H200 chip series to China under strict conditions. The chips could relieve China’s short-term compute shortages and accelerate domestic chip innovation.

- Dutch Nexperia, a unit of China’s Wingtech, has obtained a USD 60-million loan from Dutch state-owned Invest International. The loan will support investments in back-end production sites to replace its China-based sites blocked since October when a court put Nexperia under Dutch government control due to alleged mismanagement. (Source (EN): Reuters, February 16, 2026)

- Chinese AI startup Zhonghao Xinying has launched a tensor processing unit (TPU) called Chana as a domestic alternative to Google’s increasingly popular TPU chips. TPUs are specialized chips for AI development that can do quick calculations with tensors, or multi-dimensional matrices. (Source (CN): EEF, December 1, 2025)

- Shenzhen launched a CNY 5-billion fund to support semiconductor startups and strengthen local chip supply chains. The 10-year fund is part of Shenzhen's "20+8" industrial policy. (Source (CN): STdaily, October 17, 2025)

- Japanese carmaker Honda said persistent automotive semiconductor shortages will force multiple vehicle plants in China and Japan to suspend or reduce production from late December 2025 to early January 2026. (Source (CN): EET, December 18, 2025)

- China-based semiconductor foundry SMIC started testing a domestically produced immersion deep ultraviolet (DUV) photolithography machine, developed by Shanghai-based startup Yuliangsheng (宇量昇). If successful, this would be an important step toward self-sufficiency in semiconductor manufacturing tools. But testing and volume production can often be years apart for semiconductor manufacturing. (Sources (CN): ESM China, September 17, 2025)

Semiconductors in China: Profiling the actors

Publications