China's economy continues path towards normality

MERICS Economic Indicators Q1/2021

China gains the advantage in the post-Covid era as its economic recovery broadens

China’s economy has benefited from throughgoing pandemic response measures that allowed the government to reopen the economy last Spring. China’s first quarter GDP surged by 18.3 percent in 2021, the highest quarterly growth on record. However, the jaw-dropping increase was largely due to the contrast with the economic shut-down in the first three months of 2020. On a quarter-by-quarter basis, China’s GDP grew by 0.6 percent, a less dramatic number that nonetheless confirms that recovery is continuing. Growth rates will begin to normalize to pre-crisis levels over the next quarters.

After a year marked by crisis-management during the Covid-19 pandemic, the focus in 2021 will be on smoothing out the economic aftershocks. Policy makers are already signaling moderate tightening of fiscal and monetary policy. The better-than-expected recovery has given China’s government the confidence to begin cautiously rolling back stimulus measures.

Although China’s government did not abandon the practice of setting a GDP growth target in 2021, it is seeking very conservative growth of “over 6 percent.” Given historically low GDP growth in 2020, it is really a non-target that underlines the government’s desire to return the economy to pre-pandemic normality.

Financial risk is still a major concern for policy makers as sustained defaults will continue to cause strain on the financial system. Despite this, policy makers remain determined to address financial risk and especially keen to curb speculative investments. They are eager to avoid repeating mistakes made in response to the 2008 global financial crisis, when credit-fueled growth contributed to the build-up of financial risk that China is still grappling with today.

The government is busily redirecting stimulus efforts to target high-tech industries and innovation, while withdrawing support for investment in real estate and infrastructure, two sectors that played a crucial part in economic stabilization during 2020. Most importantly however, consumption will need to pick up considerably despite the improvement in the first quarter in order to put the economy on a more solid footing.

Premier Li Keqiang has announced numerous tax cuts, reductions in red-tape for business, and other reforms to improve the business environment. Small and medium sized enterprises are a particular focus of the recent efforts to streamline the business environment and improve employment – another major policy concern.

China is coming out of the pandemic-induced crisis ahead of the curve, and the government is doubling down on strategies to meet future economic development challenges. For China, 2021 offers a strategic opportunity to improve its economic competitiveness while most of the rest of the world continues to be distracted by the immediate impact of the pandemic.

Macroeconomics: China’s economy is returning to its pre-pandemic state

- Real GDP expanded at the fastest rate ever recorded in the first quarter of 2021, growing at 18.3 percent. Nominal GDP also hit a record, growing at 21.2 percent. The record growth was mostly due to comparison with the massive contraction that took place in the Q1 2020 reference period. Year on year GDP growth peaked in Q1 due to these strong base effects and will fall back to lower levels over the coming quarters.

- In absolute terms, GDP was 24.9 trillion CNY in Q1, a fall from 29.6 trillion in Q4 2020. However, it is normal for Q1 GDP to be lower than in the following quarters. Overall, the economy looks like it is coming back to pre-pandemic levels of activity. As a sign of the recovery broadening, consumption was the largest growth driver in Q1.

- Household and government consumption contributed 11.6 percentage points to GDP growth, accounting for more than 60 percent of growth. Investment and net exports contributed 4.5 and 2.2 percentage points, respectively.

- The service sector rebounded at a slower pace than manufacturing as growth in secondary industry which contains manufacturing grew at 24.4 percent. Tertiary industry, which contains services, grew at a much lower 15.6 percent, which was a weak performance considering the low reference base of Q1 2020.

- But China’s recovery has come at a cost. The government unleashed huge stimulus in 2020 which led to debt-to-GDP growing by 25.6 percent and the government deficit growing. This has once again led to concerns about financial risks, particularly as defaults are rising. Keeping debt-to-GDP from rising will become difficult as growth slows in the coming quarters. Moving forward the government will forced to balance its policy between containing risk and maintaining growth.

What to watch: The government’s reduction in stimulus measures will depend on how well growth holds up in the coming quarters.

Business: Industrial production stays strong amid stimulus and exports

- Manufacturing output growth remained strong in the first quarter, expanding by 24.5 percent year-on-year. Output expanded by 35.1 percent in the first two months, but improvements slowed to 14.1 percent in March. Industrial production was one of the least affected parts of the economy at the height of the pandemic in early 2020. As a result, growth in industrial production is likely to taper in the coming quarters, becoming less dramatic in comparison with the year-earlier reference period.

- Output for construction-related materials remained strong, reflecting brisk activity in the construction sector. In the first quarter, output of steel and cement expanded by 22.5 and 47.3 percent respectively. Output of steel used in real estate and railway construction remained particularly strong in Q1, especially when set against a March 2020 contraction of only 0.1 percent.

- The automotive industry was among the best performing industries amid roll outs new e-mobility vehicles, which has also been one of the reasons for the recent shortage of semiconductors. The automobile industry expanded by 55.1 percent in the first quarter, as output of e-vehicles surged by 312 percent.

- China’s improving economy was also reflected in the Purchasing Managers’ Index (PMI), which captures business sentiment. The PMI improved to 51.9, indicating expansion. Both the sub-indices for new orders and new export orders also improved to 53.6 and 51.2 in March respectively.

- The service sector remains a trouble spot for the economy as transport and tourism-related services are still lagging behind the overall recovery. However, March data gave an indication of renewed activity and helped improve expectations. As a result, the service sector PMI jumped from 48.9 in February to 55.9 in March.

What to watch: If stimulus measures are rolled back in earnest, a sharp slowdown in output of construction materials is likely.

International trade and investment: Foreign trade surges as exports stay strong and domestic demand improved

- Growth in exports and imports continued to improve over the first quarter, signaling China’s ongoing domestic recovery and the uptick in other key markets. Foreign trade expanded by 29.9 percent in the first three months of 2021, measured in US dollars. However, high growth in the first quarter owed much to the comparison with the same period of 2020, when China’s foreign trade was dampened by the outbreak of the Covid-19 pandemic.

- Exports benefited from persistent global demand, expanding 49 percent in the first quarter in USD terms. Demand for Chinese-made goods was particularly high in the EU and US, with Q1 imports expanding 56.7 percent and 74.1 percent respectively on year-earlier. The low reference base from the same period of 2020 was particularly evident noticeable in February, when exports surged by 154.9 percent. Such volatility in growth will fade in the coming months amid a higher reference base.

- Import growth accelerated in the quarter, expanding by 28 percent in USD terms. Overall imports grew far less than exports. March proved an exception, as imports outpaced exports that month, rising 38.1 percent versus export growth of 30.6 percent. As a result, China’s trade balance narrowed to 13.8 billion USD, the lowest since February 2020.

- The rebound in commodity prices contributed to stronger import growth, especially as prices for copper and iron ore have surged amid a widening global recovery. In addition to price effects, import growth continued to be driven by industrial inputs, including electronics, and construction-related products. However, signs of stronger domestic demand could be seen in imports of cars, up 30.2 percent, and of cosmetics, which jumped 62.6 percent.

- By February, the currency appreciation of the Chinese yuan against the US dollar that had been a factor since mid-2020 subsided, after reaching 6.43 CNY/USD. By end of March, China’s currency depreciated moderately, to 6.54 CNY/USD. The depreciation is expected to continue as the US economy picks up and interest rates rise.

What to watch: Import growth outpacing exports would indicate the strength of China’s domestic recovery.

Financial markets: Credit tightening is being felt across the financial market

- China’s central bank has not yet raised repo rates. Strong economic results are pushing inflation upwards so the People’s Bank of China (PBOC) would like to see lower credit growth as China’s credit-to-GDP expanded enormously in 2020. However, it is constrained by the fact that many companies have weak financials and depend on cheap credit to sustain their balance sheets. Additionally, an interest rate increase could impact asset prices, causing destabilizing selloffs.

- As economic growth has picked up, the PBOC has shifted its focus to containing financial risk. It has been stepping back from its stimulus measures by injecting less liquidity into markets. The first quarter of 2021 saw a big reduction in liquidity: 2.1 trillion CNY was injected in Q1 this year, down sharply from the 3.5 trillion CNY injected in Q4 2020.

- With less liquidity in the markets, the slowdown of outstanding aggregate credit growth continued in the first quarter. In March, credit growth fell to 12.3 percent, compared to 13.3 in December. Official credit channels such as bank lending and bond issuance also slowed with bank lending growing 13.3 percent and bond issuances at 11.7 percent. Shadow banking aggregates contracted, falling by 2.6 percent year on year.

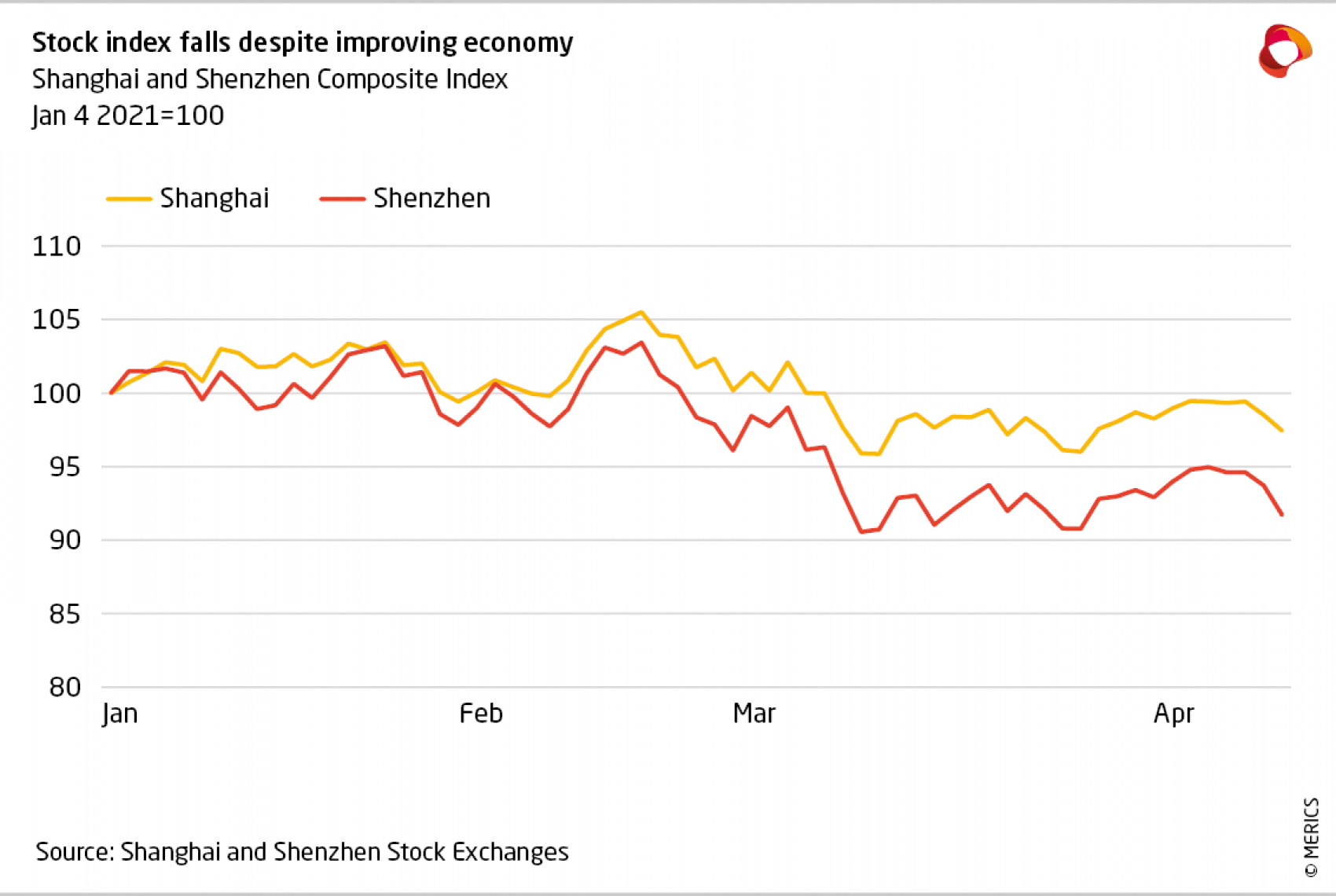

- The stock market had a very strong year in 2020, but indices have struggled in 2021 thus far. Less injections have meant less money flowing to stock markets. As of mid-April, the Shanghai index was down 2.6 percent and the Shenzhen index down 8.3 percent since the start of the year.

- Wide-ranging reforms of financial markets are picking up pace. Overall, the reforms seek to modernize financial markets to become better at allocating financing towards government priorities. Crackdowns on fraud and speculation are underway; digitalization and fintech are being promoted; lending to SMEs and green projects is being incentivized; and monetary policy is to be more focused on interest rate stability instead of the quantity of money in the system.

What to watch: If monetary policy continues to tighten, credit growth will fall further.

Investment: Investment rebounds strongly, but rises are unlikely to persis

- Investment expanded robustly in the first quarter, growing at 25.6 percent from a low base. The double-digit expansion increase represented a return to normal rather than a huge jump, as the data took Q1 2020 as the reference point. Moderate slowing of overall investment growth was apparent at the end of the quarter, as year to date investment growth fell from 35 percent in February to 25.6 in March. The slowdown is likely to persist into Q2, especially as credit growth is being curtailed by the government.

- Real estate investment was a crucial growth pillar at the height of the pandemic, fueled by ample liquidity. This has led to growing concerns over speculative investment. Recently, China’s government has begun limiting lending for real estate, prompting a slowdown in March. However, the impact was not yet seen in Q1 when real estate investment expanded by 25.6 percent.

- Underscoring the importance of construction in the recovery, infrastructure investment grew by 29.7 percent in the first quarter. Investment in air transport and railways grew at particularly rapidly, expanding by 84.5 and 66.6 percent, respectively.

- The government is shifting its focus towards boosting investment in more productive parts of the economy, and away from construction, particularly real estate. The success of this drive is visible from the data: investment in manufacturing grew at 29.8 percent, higher than overall fixed asset investment. Services grew at a considerably slower pace, expanding 24.1 percent.

- Investment within the manufacturing sector was uneven. Investment in ferrous metal smelting jumped 64 percent. Another strong sector was transportation equipment, which grew by 41.8 percent. Strikingly, investment in automobile production contracted, falling by 3.3 percent.

What to watch: China’s policymakers will have to balance risk and growth to ensure their goals are met.

Prices: Rising inflation paves the way for moderate policy tightening

- Price levels have picked up over the first quarter as China’s economic recovery broadened. March was the first month since January 2020 in which both consumer and producer prices rose. The Financial Stability and Development Commission responded by warning about rising inflation, issuing a statement that provides an early signal of more policy tightening should prices pick up further.

- In the first quarter of this year, producer price increases continued to outpace consumer price increases, suggesting China’s recovery continues to be mainly driven by industrial demand and rising prices for industrial inputs.

- But year-on-year changes to both consumer and producer price indices also reflect the effects of comparison with the same, exceptional period of 2020, when CPI eased off a 10-year high and PPI was plunged into deflation.

- Consumer prices only slowly inching upwards, as household demand remains slack despite recent improvements. Core inflation increased in February and March, expanding 0.3 percent in the first quarter. This marked the first uptick since March 2020, indicating the slow increase in consumption demand.

- All main consumer price sub-indices (including food, clothing, and rents) returned to rising prices in March. However, measured over the whole quarter overall CPI was 0 percent, well below the target of 3 percent for the year. CPI recovery was most pronounced in transportation and communication services, which increased by 2.7 percent in March.

- Soaring global commodity prices contributed to lifting the producer prices index (PPI) out of deflation for the first time since January 2020. In March, PPI grew at the fastest pace in three years, expanding 4.4 percent in the month, while growth for the quarter was 2.1 percent. Higher prices for metals, chemicals and fuel all contributed to the surge, as the global growth recovery impacted prices.

What to watch: Consumer prices should pick up over the next quarter as household demand picks up steam as well as due to base effects.

Labor market: Employment pressure persists despite economic recovery

- Labor market stability remains a key concern for the government despite the economic rebound. The Government Work Report Premier that Li Keqiang presented to the National People’s Congress in March included an emphasis on measures to support the labor market. These included tax cuts and fiscal support for businesses that either hire workers or refrain from downsizing their labor force, as well as steps to expand of vocational training.

- In 2021, the annual target for new urban jobs has reverted to the pre-pandemic level of 11 million. Due to the pandemic, the target was reduced to 9 million, though the target was easily met. The government expects there will be 15 million new entrants to the labor market this year. Despite the improving economy, the skills mismatch between applicants and job vacancies will pose a challenge.

- 2021 will bring yet another record cohort of university graduates. It is expected that 9.1 million students will enter the labor force this year. In 2020, China produced 8.7 million university graduates, many of whom struggled to find jobs.

- The government has announced a five-year plan to gradually increase the retirement age. Details of the specific adjustment have to be published. The current retirement age for white collar men is 60 and 55 for women, and 50 for blue collar workers. The plans were first proposed in 2020 but have been delayed due to the public backlash.

- Four provinces (Jiangxi, Heilongjiang, Shaanxi, Xinjiang) introduced minimum wage adjustments by April 1. Three additional provinces or municipalities have since announced adjustments (Jilin, Tianjin, Chengdu). These mark the first pre-crisis adjustments. The low adjustments indicate that wage growth in 2021 will remain weak.

- Disposable income growth expanded by 13.7 percent in the first quarter. The recovery is less pronounced than overall GDP growth indicating that household income growth as yet to return to pre-crisis levels.

What to watch: Wage growth is likely to remain subdued for the coming quarters weighing down on consumption.

Retail: Consumption finally bounces back as recovery spreads

- Retail spending came back to life in the first quarter, soaring by 33.9 percent when set against the dismal data from same period of 2020. But consumption is still far from normal. Compared to the first three months in 2019, retail sales were up 7.9 percent, an improvement from the 5.5 percent growth in the first two months. Until now, China’s retail recovery has trailed behind the revival in manufacturing and investments, but it seems finally to be underway.

- Restaurant revenue surged by 91.6 percent in March and 75.8 percent over the quarter, compared to the same period in 2020. This suggests growing consumer confidence as China leaves pandemic re-strictions behind. However, service sectors related to travel and tourism have yet to recover from the massive hit.

- The transportation sector continued to struggle as consumers preferred to stay close to home in the first quarter, a period that included the Chinese New Year holiday, usually the sector’s annual peak. Although rail passenger numbers increased by 41.9 percent in the first quarter compared to the same period in 2020, they remain substantially below pre-pandemic times. There were only 544.1 million railway passenger journeys in Q1 2021, significantly down on 853.1 million in Q1 2019.

- Another sign that consumers are returning to pre-pandemic behavior was the drop in online shopping over the first quarter. As shoppers returned to malls, the online share of total retail spending for mer-chandise goods (excluding services) fell from an all-time high of 23.6 percent in Q1 2020, to 21.9 per-cent in the same period of 2021.

- Consumption of durable goods bounced back strongly in Q1, a change that signaled consumers’ will-ingness to spend on big ticket items and greater economic confidence. Sales of automobiles increased by 65.6 percent, while household appliances increased by 41.4 percent in the quarter year on year.

What to watch: Retail growth will need to maintain strong gains to support a sustainable economic recovery over the coming quarters.