Economic recovery picks up over last quarter

MERICS Economic Indicators Q4/2020

The envy of the world: China’s economic growth avoids major disruptions in a challenging year

During 2020, China’s economy passed its first real stress test since the start of the reform era with flying colors. The turbulence of the Covid-19 pandemic and China’s deteriorating relations with the United States presented unprecedented challenges to economic growth and economic management. However, despite recording the slowest GDP growth since 1976, China’s economy ended 2020 in a strong position compared to much of the rest of the world, which continues to struggle with the pandemic and its economic impact.

China’s economy continued its steady recovery from the abrupt slowdown in early 2020 during the height of the pandemic. Over the fourth quarter, GDP growth accelerated to 6.5 percent, the highest quarterly growth since Q4 2018. As a result the world’s second largest economy grew by 2.3 percent despite all the challenges.

Economic stimulus proved effective in China

The urgent economic stresses precipitated by the pandemic forced China’s government to ramp up spending and tolerate increasing financial leverage. But China’s leadership showed it was not willing to sacrifice progress on controlling financial risks since 2017, and has learned lessons from the giddy stimulus package deployed in the 2008 global financial crisis. Most importantly, as 2020 closed the stimulus deployed had proved effective at supporting a swift rebound in economic growth.

China’s economic rebound may be enviable when viewed from elsewhere, but it continues to be unbalanced. Investments, especially in real estate and industrial production are the recovery’s main drivers. China’s recovery has benefited from strong global demand. External demand is likely to slow in 2021, but in 2020 exports stayed strong and the trade surplus has soared, giving an additional boost to GDP growth.

Domestic consumption provides a stark contrast. Although demand for retail and services improved over the final quarter of 2020, they have yet to return to pre-pandemic levels. Looser monetary and fiscal policies are being scaled back, but only slowly. Stimulus measure are likely to stay in place until the rebound is on a more solid footing.

Covid-19 remains a challenge for recovery of consumption

Renewed outbreaks of Covid-19 in Hebei province, and elsewhere, also serve as a reminder that the pandemic is still a major challenge in China. A return to nationwide lockdown is unlikely, given the government’s rigorous response. However, the persistent uncertainty is likely to hinder the recovery of consumption. Spending on travel, restaurant visits and other leisure activities which are typically in high demand over the Chinese New Year holiday is likely to be weak.

China’s economy is on track for a good start in 2021, despite its vulnerabilities, and is likely to shine in compari-son to much of Europe or the United States. Barring the risks of a major Covid-19 outbreak, GDP growth seems set to bounce back to pre-crisis levels or better.

Macroeconomics: Economic growth returns to pre-crisis levels

- Strong government support for the economy and China’s successful containment of the Covid-19 outbreak helped its economic recovery in Q4. The final quarter’s real GDP rose 6.5 percent year on year, the fastest rate of expansion since the end of 2018. Total GDP growth for 2020 was 2.3 percent. China’s output far outpaced most of the developed world, which is in recession.

- Consumption as a share of GDP recovered strongly in the fourth quarter of 2020, contributing 2.6 percentage points to overall growth. However, the recovery of consumption remains below pre-crisis levels and dragged down full year growth by half a percentage point. China’s leadership is concerned and has announced plans to boost domestic demand in 2021. In Q4, investment contributed 2.6 percentage points to growth, and a record trade surplus ensured net exports contributed 1.4 percentage points.

- Expansion in secondary industry grew by 6.8 percent, outpacing tertiary industry which grew by 6.7 percent for the first time since 2014. The fastest growing sub-industry was the IT industry which expanded by 19.7 percent.

- Nominal GDP grew at 6.6 percent in Q4, almost the same rate as real GDP, indicating that inflation is very low. Nominal GDP also expanded at a significantly slower pace than total outstanding credit, meaning aggregate debt levels have increased. In 2020, one unit of GDP growth cost almost 12 units of credit.

- If things continue along the current trajectory, growth could well be even higher next year, possibly reaching 8 percent or more. However, there are several risk factors that could derail China’s strong economic performance. These include a second wave of Covid-19, a drop in external demand, and serious problems within the financial system.

What to watch: China’s policymakers will have to balance risk and growth to ensure their goals are met

Business: Solid growth in industrial output boosts economic recovery

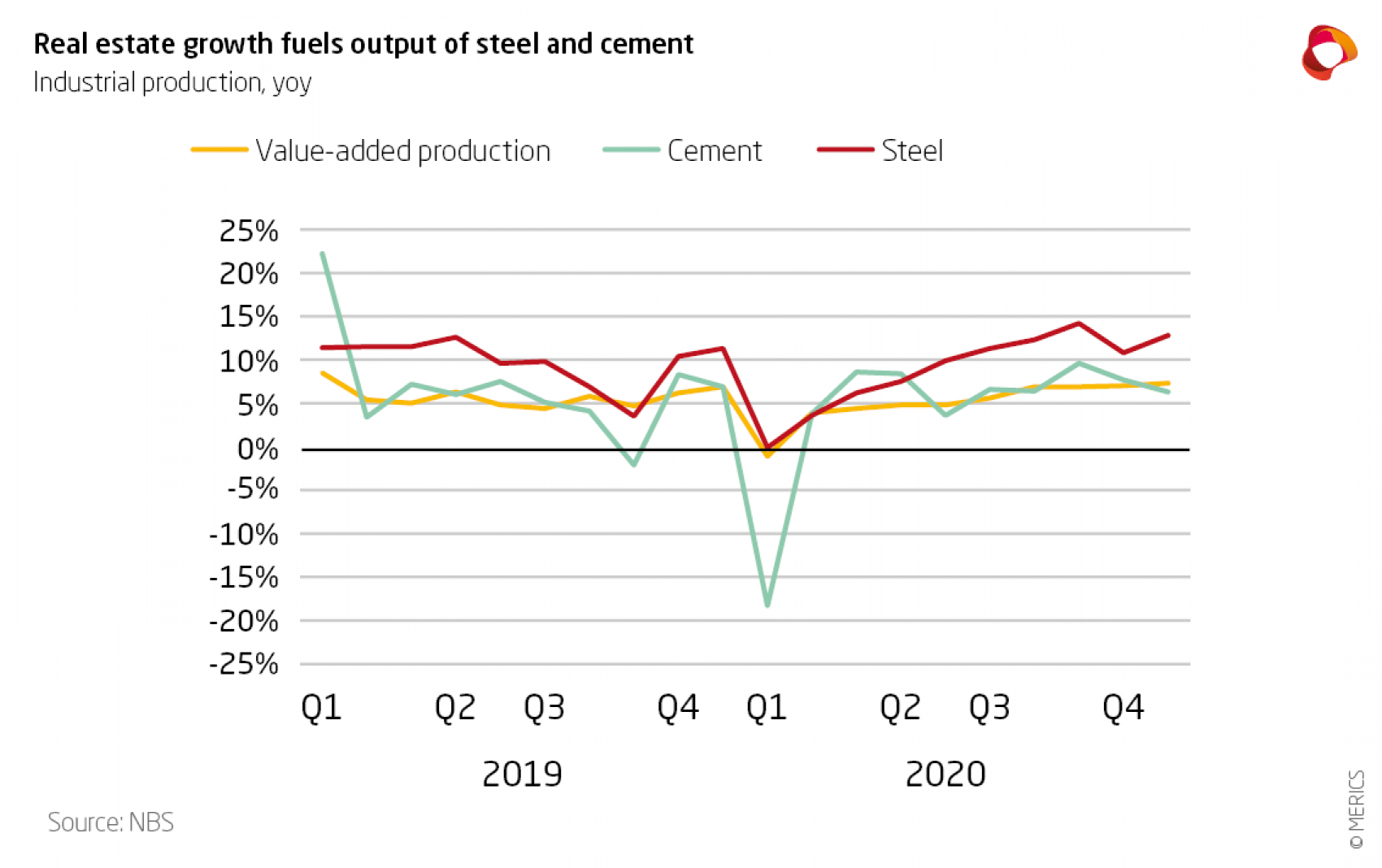

- China’s manufacturing recovery was driven by strong export demand, and by construction related output growth bolstered by government stimulus. Manufacturing output expanded by 7.3 percent in December year on year, the highest level since early 2019. Industrial production steadily improved during the year, after the first quarter’s massive contraction, and expanded 2.8 percent in 2020 overall.

- The value-added of all major industries tracked by the National Bureau of Statistics (NBS) returned to growth by the end of 2020, with the exception of food processing and transportation equipment (including rail, ships and aircraft). Robust industrial output was evident in increased demand for machinery. Electric machinery and equipment was the fastest growing sector; in November, it recorded its highest level of growth since February 2012, with output up 18 percent.

- Capacity additions in the electronics sector, combined with the trend for companies to upgrade their manufacturing during the crisis, have boosted demand for industrial robots. Production increased throughout the fourth quarter, expanding 32.4 percent in December and 19.1 percent in 2020.

- Output growth in the automotive sector slowed over the fourth quarter, due partly to higher base effects in the reference period in 2019. Growth eased to 9.7 percent in December, after hitting more than 20 percent during the second quarter. Output of new energy vehicles continue to boom the government announced cuts to subsidies in 2021. Growth was 55.6 percent in December and 17.3 percent for the year.

- Manufacturing companies remained upbeat about business sentiment despite the NBS’ Purchasing Managers’ Index (PMI) falling to 51.9 in December from 52.2 in November (values above 50 indicate expansion). The outlook for new orders was particularly optimistic, with the PMI subindex ending the year at 53.1. This may be partly explained by seasonal heavy orders ahead of the Chinese New Year holidays.

What to watch: Regional lockdowns in response to renewed Covid-19 outbreaks could disrupt output, and possibly domestic supply chains.

International trade and investment: Exports surge amid strong global demand

- China’s export growth accelerated in the final quarter of 2020. Exports expanded 17 percent year-on-year in Q4, measured in US dollar terms, to their highest level of quarterly growth on record for the mainland. China’s exports continued to benefit from strong demand, particularly from advanced economies. Amid strong external demand over the last quarter, annual exports expanded by 3.6 percent in 2020.

- Demand for consumer goods surged, driven by a combination of Christmas orders and extended (or renewed) lockdown measures across the world. Exports of high-tech products (mainly electronics) rose 17 percent year on year in Q4, while export of toys and furniture grew more than 30 percent. Strong sales of health care goods also contributed, with Q4 exports expanding by over 50 percent year on year.

- The recovery in imports stalled in Q4, resulting in a full-year contraction of 1.1 percent in 2020 as the final quarter failed to offset the Covid-induced slump of the first quarter. The dip was partly explained by lower commodity prices. Demand for tech inputs, metals and agricultural products was strong. As a result, China imported record volumes of copper, iron ore and pork in 2020.

- China’s trade surplus hit a quarterly record of 212 billion USD, while the full-year 2020 trade surplus was 534 billion, the second highest surplus on record. Efforts by the United States to narrow trade imbalances have failed: China’s trade surplus with the United States increased to 317 billion USD, an increase of 7.1 percent compared to 2019.

- The CNY appreciated over the second half of the year; up 7.1 percent against the USD, and 3 percent against the reference basket, CFETS in H2. The CNY’s strength should eventually weigh on export growth, though a four-to-six-month delay is typical.

What to watch: Global demand, especially for electronics and medical products should moderate over 2021.

Financial markets: Monetary policy is slowly tightening as the economy performs better

- As China’s economy continued to improve over the fourth quarter, the PBOC signaled a gradual shift in monetary policy in response to growing concerns over increased leverage. Credit growth has surged amid looser monetary policy to support the economic recovery, resulting in China’s credit-to-GDP ratio climbing 35 percentage points to over 280 percent in 2020.

- The central bank is now shifting its policy focus from economic recovery to controlling financial risks. A total of 3.54 trillion CNY of open market operations was conducted in Q4, 32 percent lower than in in Q3. But rates and reserve requirements remained unchanged, indicating caution in shifting towards tighter monetary policy.

- Credit growth started slowing in Q3, and the trend became more pronounced in Q4. Outstanding aggregate credit growth fell 0.3 percentage points to 13.3 percent. Contractions in shadow banking (-4.3 percent) and bonds (-17.2 percent) were the biggest sources of the decrease.

- Trimming lending to the real estate sector is a major focus of risk control policies. The government has long feared the consequences of a bubble in the sector. However, curtailing lending to real estate is difficult as banks depend heavily on the sector; almost 30 percent of all lending in 2020 went to the real estate sector.

- China’s efforts to internationalize its financial markets were aided by resilient GDP growth, higher yields and a flurry of IPOs. New investment channels are being introduced for foreigners. The latest addition was the November trading debut of a new copper futures contract open to foreign buyers on the Shanghai Interna-tional Energy Exchange.

What to watch: The PBOC may raise interest rates if demand continues to recover.

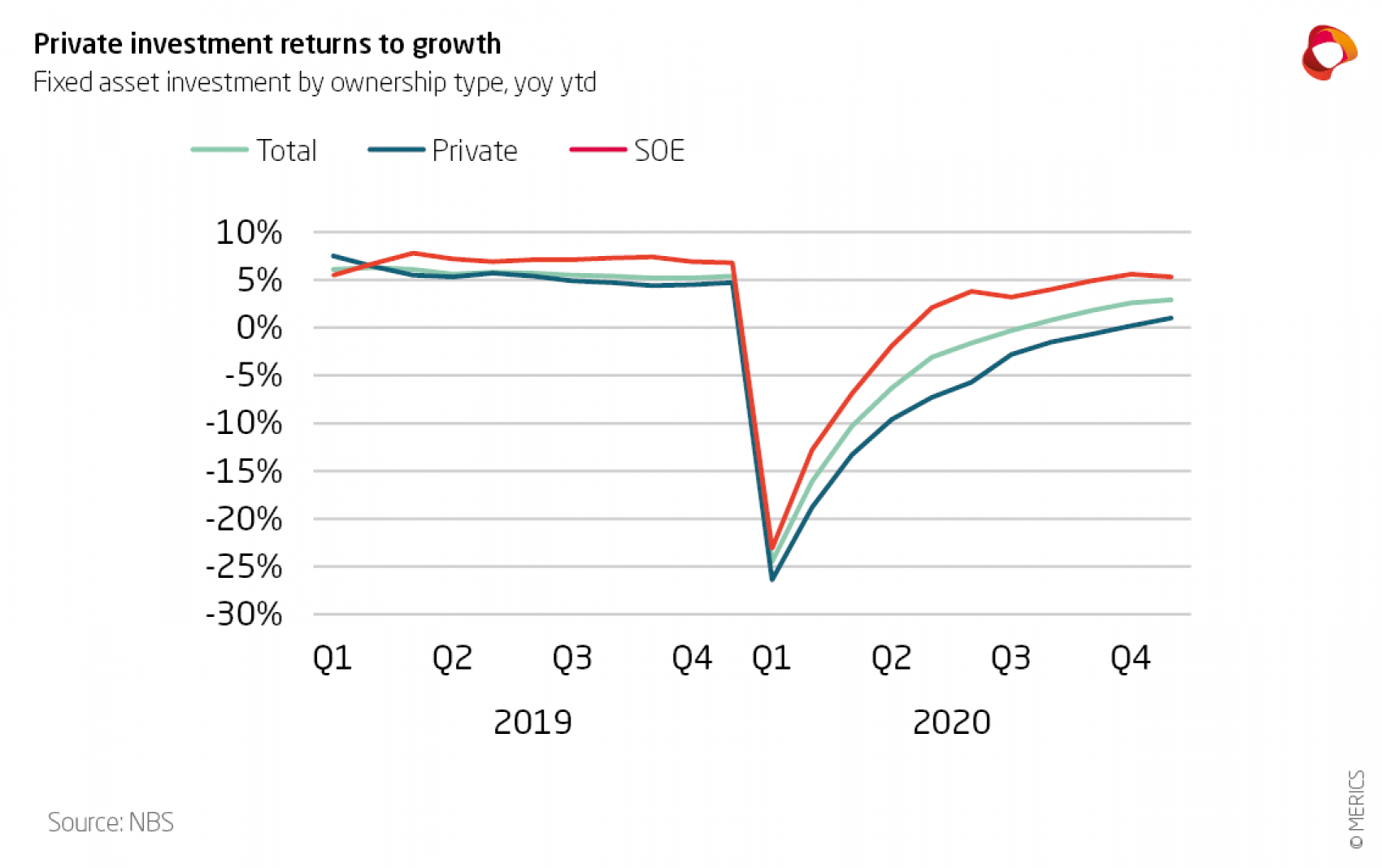

Investment: Real estate leads recovery in investment

- Fixed asset investment (FAI) growth improved to 2.9 percent in the final quarter of 2020 as the economic recovery strengthened. While growth accelerated by 2.4 percentage points over Q3, it only improved 1.1 percentage points in the last three months. FAI growth for 2020 as a whole was well below 2019, when it increased by 5.4 percent.

- Growth in real estate investment had accelerated to 7 percent at the end of the year, up from 5.6 percent during the last quarter. Given the significance of real estate investment in China’s economy, the rapid expansion played a strong role in lifting overall investments. The government responded by unveiling measures to curb property loans in December as it is concerned about rising financial leverage and property market speculation.

- Expansion in China’s IT infrastructure was more than able to compensate for other weak spots. Investments in IT grew by more than 20 percent. However, investments related to retail, restaurants and accommodation failed to recover in Q4 as demand has remained sluggish.

- Investments in agriculture grew by 19.5 percent by the end of year as meat suppliers expanded capacity in order to ramp up pork production again in the wake of the swine flu outbreak that began in 2019. Investment in animal husbandry grew by more than 90 percent in 2020 as pig farming recovered.

- Manufacturing-related investments remained weakest, failing to return to growth by the end of 2020. Although investments continued to improve during the last quarter, investment fell 2.2 percent by end of December. New capacity was added in high-demand sectors, notably pharmaceutical and medical (28.4 percent) and IT (12.5 percent).

What to watch: Government efforts to curb excessive credit expansion, especially in real estate, should gradually moderate the pace of investment growth.

Prices: China is leaving deflation behind

- After four consecutive months of falling consumer prices, the CPI recovered at the end of the year. After falling briefly into deflation in November, prices recovered in December; the CPI rose 0.7 percentage points to 0.2 percent. In 2020, consumer prices increased by 2.5 percent.

- The December data reflected falling food prices, as previously surging pork prices have begun to normalize. However, core consumer inflation, which does not include more volatile food or fuel prices, fell by 0.1 percent, indicating deflation. This indicates that consumption demand still remains weak.

- Producer price recovery was pronounced across most industrial categories. Prices continued to contract but improved sharply. The PPI rose sharply from -1.5 in November to -0.4 percent in December, the highest monthly increase since 2015. Producer prices are still negative but have almost returned to 2019 levels.

- Investment related to construction and the production of electronics has been a major contributing factor to the economic rebound this year. As a result, prices for metals have been trending upward. Prices for ferrous metals (including steel) grew for eight consecutive months, rising by 5 percent in December. Non-ferrous metals prices (including copper) have risen for nine months; prices jumped by 4.2 percentage points in December to 8.3, the biggest monthly increase in four years.

- Real estate prices have been trending down since 2019 and continued to do so in the fourth quarter. Even property prices in Shenzhen, which had previously opposite to price developments elsewhere began trend-ing downwards. The fall is largely driven by policy, as the government has been engineering a soft landing of the property market.

What to watch: Stimulus measures will be kept in place unless increased demand drives up core inflation.

Labor market: Labor market improves as economic growth accelerates

- China’s labor market rebounded amid stronger demand from manufacturers, especially exporters, and in construction-related sectors. As economic growth accelerated over the last quarter of the year, hiring easily exceeded the government’s pre-crisis target of 11 million new urban jobs in 2020. During the crisis, the tar-get was revised to 9 million.

- Surveyed unemployment fell to 5.2 percent in the fourth quarter of 2020, after peaking at 6.2 percent in the quarter. According to official data, unemployment has therefore returned to pre-crisis level and China has avoided major job losses during the pandemic.

- Disposable income improved in the fourth quarter, expanding by 2.1 percent in real terms. Income growth will be crucial to help lift consumption. Future income expectations surveyed by the National Bureau of Statistics (NBS) have improved during Q4 but remain below 2019 levels.

- During the Central Economic Work Conference in December, the government emphasized that the labor market will remain high on its agenda. In an effort to expand consumption, it declared its intention to focus on optimizing income distribution and reducing inequality.

What to watch: An announcement of fresh increases to provincial minimum wage adjustments early this year should act as a good indicator of how solid the recovery is, as they were nearly all halted in 2020.

Retail: Weak consumption is the biggest threat to economic recovery

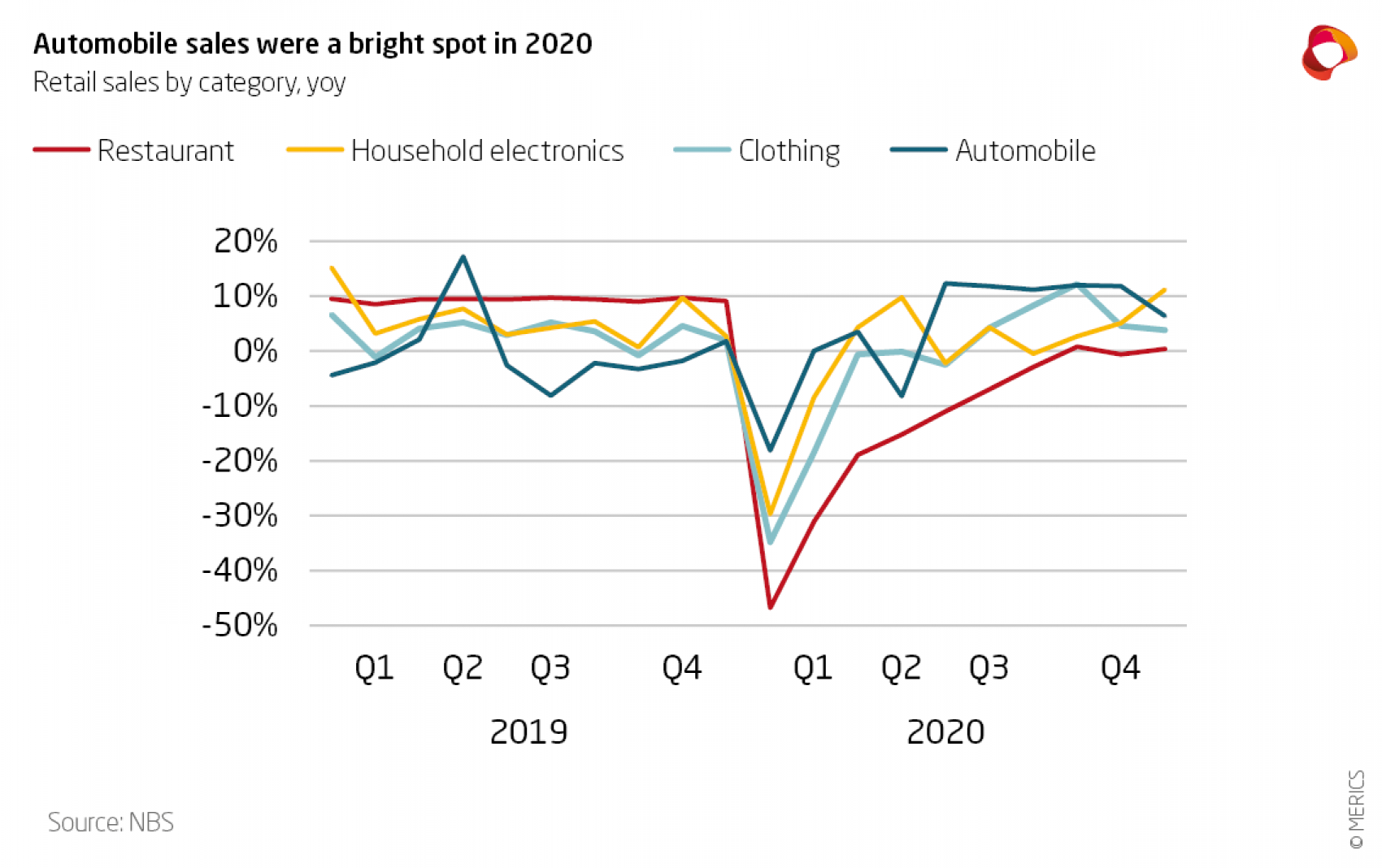

- Retail spending slackened in December after improving steadily since March. The decline highlights the persistent weakness in consumption; retail spending rose 5 percent in November, but growth eased to 4.6 percent in December year on year. Lower wage growth has impacted consumers’ willingness to spend, despite the strong rebound in China’s GDP growth in the final quarter of 2020. Retail growth has failed to recover from its first quarter crash and contracted by 3.9 percent in 2020.

- Spending on restaurants returned to growth in October, increasing 0.8 percent year on year. But the recovery has hit a wall amid news of renewed virus outbreaks cases. Growth stagnated in the last two months, while spending was down 16.6 percent for the year. A swift improvement in the first quarter of 2021 looks unlikely as regional lockdowns have spread in January. There are currently 19 in place.

- Automobile sales growth eased to 6.4 percent year on year in December, after double digit growth over the previous five months. Government subsidies aimed at boosting e-vehicles to 20 percent market share by 2025 were a key driver of demand. According to data from the National Bureau of Statistics (NBS), annual sales fell by 1.8 percent, while data from the China Passenger Car Association vehicle shows a drop of 6.8 percent in units sold.

- Although travel demand for rail, air, and highway use has gradually improved since the first quarter, the recovery it failed to keep up the growth trajectory in the final quarter. For example, rail passenger volume contracted 21.1 percent in December, following a fall of 14.8 in October. As long as concerns related to Covid-19 persist, the appetite for tourism and business travel will remain subdued.

What to watch: Travel and tourism spending during Chinese New Year which starts in mid-February; it will need to pick significantly for consumption to recover.