Economy improves in Q3 but faces mounting risks

MERICS Economic Indicators Q3/2022

Q3 analysis: China’s economy is under massive stress as Xi seals his third term in power

Gloomy economic data for the third quarter was sure to dampen the mood as Xi Jinping secured his third term as the CCP’s General Secretary at the 20th Party Congress, so officials took a clumsy last minute decision to postpone the bad news until the Congress was over. China’s economy expanded by 3.9 percent in the third quarter, and by a lackluster 3 percent in the first nine months. Growth has faltered all year after the economy expanded by 4.3 percent in Q1. Sentiment remains at rock bottom as China’s economy is suffering from a combination of domestic and external challenges not seen in decades.

Much of the slowdown is self-inflicted: growth was hindered by the government’s inability to shift away from its zero-Covid policy which has caused recurring lockdowns. Stimulus measures are led by more fiscal spending and investments by state-owned enterprise are contributing to stabilize the economy. But the lack of an exit strategy of its Covid policy is causing severe exhaustion for business and consumers alike. The resulting pessimism has depressed retail spending and business investment. But China’s economy is also being held back by multiple politically-driven corrections, for instance, the tech and real estate crackdown, measures to reduce emissions and curb financial risks. Each on its own might have merits but prescribing too much medicine at once is causing unpredictable side effects for the economy and worsening the investment climate for private companies.

The global economy’s deteriorating outlook is adding to the domestic pressures. Russia’s war in Ukraine has produced skyrocketing inflation worldwide and reduced purchasing power in China’s key export markets. Exports have been a lifesaver for China during the pandemic so falling demand adds to risks. Central banks, notably the US Federal Reserve, have responded with rapid interest rate rises. This in turn fuels capital outflow as investors seek safe havens and causes downward pressure on China’s currency as the People’s Bank of China (PBOC) has not raised interest rates.

So far, China’s policy makers have geared their stimulus measures towards the supply side to strengthen high-tech manufacturing, boost innovation and increase infrastructure spending. The current stimulus prioritizes the CCP’s long-term strategic goals - to upgrade the economy and reduce technological dependency on the West. But consumption and private investment will not improve without a major policy shift. Faced with ever greater economic insecurity, households and private companies are holding back on spending.

Xi’s economic policies could become more contested after the 20th Party Congress as the middle class grows increasingly frustrated. However, any significant improvement in sentiment will require a return to a far more pragmatic economic policy. There is little indication of that. Instead, expect further ideologically driven measures and an expansion of state capitalism. This will worsen the efficiency of capital allocation and risks reducing China’s long-term growth prospects. But the CCP leadership seems willing to allow the middle class to suffer economic insecurity for Xi’s grander ambitions.

Macroeconomics: Economic recovery remains on a weak footing

Exhibit 1

Exhibit 2

- Q3 GDP growth was a modest 3.9 percent once the data was finally released – it was postponed at the last minute during the 20th Party Congress, an unprecedented move. Compared to growth of 0.4 percent in the previous quarter, there has been a significant rebound. Growth was helped by lockdowns becoming less widespread and stimulus measures starting to make an impact.

- China’s economy is set to disappoint in 2022 and to perform far below the now abandoned growth target of around 5.5 percent. During the first three quarters, China’s economy has expanded by 3 percent so far, prompting major banks to cut their full-year growth forecasts and 2023 forecasts.

- Construction activity made the strongest recovery, up by 7.8 percent in Q3 year on year. Manufacturing grew by 4 percent and services by 3.2 percent (see exhibit 1). However, much of this improvement is due to comparison with a low baseline year-earlier, as construction activity contracted by 1.8 percent in Q3 2021. So far, stimulus measures have not produced a substantial uptick in either infrastructure or real estate construction (see section on investment).

- Services sector growth continues to be the economy’s weak spot and showed only minor improvements in Q3. For example, IT related services, a long-standing key growth driver for services, grew by 7.9 percent, up from 7.6 percent in Q2 year on year. But the sector lags far behind the 21.7 percent growth recorded in 2019 prior to the pandemic and the government’s crackdown on China’s tech sector.

- The weak economy is adding stress to government finances. Expenses are rising for health services related to enforcing the strict Covid measures and for growing costs to alleviate labor market pressure (see exhibit 2). Meanwhile key revenue sources are faltering. Enterprise income tax grew by 2.1 percent, the lowest rate in almost two years, while tax from land sales contracted by 8.9 percent in Q3 year on year.

What to watch: Service sector growth will need to increase for the recovery to be more balanced.

Business: Manufacturing activity shows steady recovery boosted by automotive

Exhibit 1

Exhibit 2

- Industrial activity remained an important driver of overall GDP growth. In Q3, value-added industrial out-put grew 4.8 percent year-on-year. Manufacturing growth averaged 4.1 percent, the strongest quarterly performance since Q2 2021, aided by a jump in September that saw 6.4 percent growth. The government's focus on supply-side stimulus and measures to minimize supply chain disruptions appears to be paying off for now.

- Aided by temporary tax measures and base effects, the value-added production of motor vehicles in Q3 grew strongly by 25.6 percent. New energy vehicles (NEVs) again stole the show: NEV production in Q3 was up 118 percent on Q3 2021. But headwinds loom large: deliveries increasingly head to dealers rather than customers and NEV subsidies will be phased out in December.

- Demand for building materials was stagnant, as stimulus for infrastructure investment and the suppressed real estate market has been deliberately limited. Output growth for construction materials such as cement and plate glass remained negative in July and August. Double-digit growth of crude steel output of 17.6 per-cent in September was mainly due to weak data in the year-earlier baseline period.

- High-tech industries continue to be a bright spot and did particularly well in September. Value-added out-put in September was up 9.3 percent on the same month of 2021, though growth was no longer in double digits. In Q3, the average output growth for transportation equipment was up 7 percent, electrical and ma-chinery equipment up 14.4 percent, and electronical products 7.8 percent higher compared with the same period of last year (see exhibit 1).

- Confidence among producers and service providers fell at the end of Q3 (see exhibit 2). Caixin’s manufactur-ing purchasing managers index (PMI) came in at 48.1 in September and services PMI has dropped from a strong 55.5 in July to 49.3 in September. With no end in sight to rolling lockdowns, service providers expect consumption to remain weak.

What to watch: More stimulus measures can be expected in Q4 to prop up production output.

International trade and investment: China’s trade surplus hits new records as its car exports overtake Germany’s

Exhibit 2

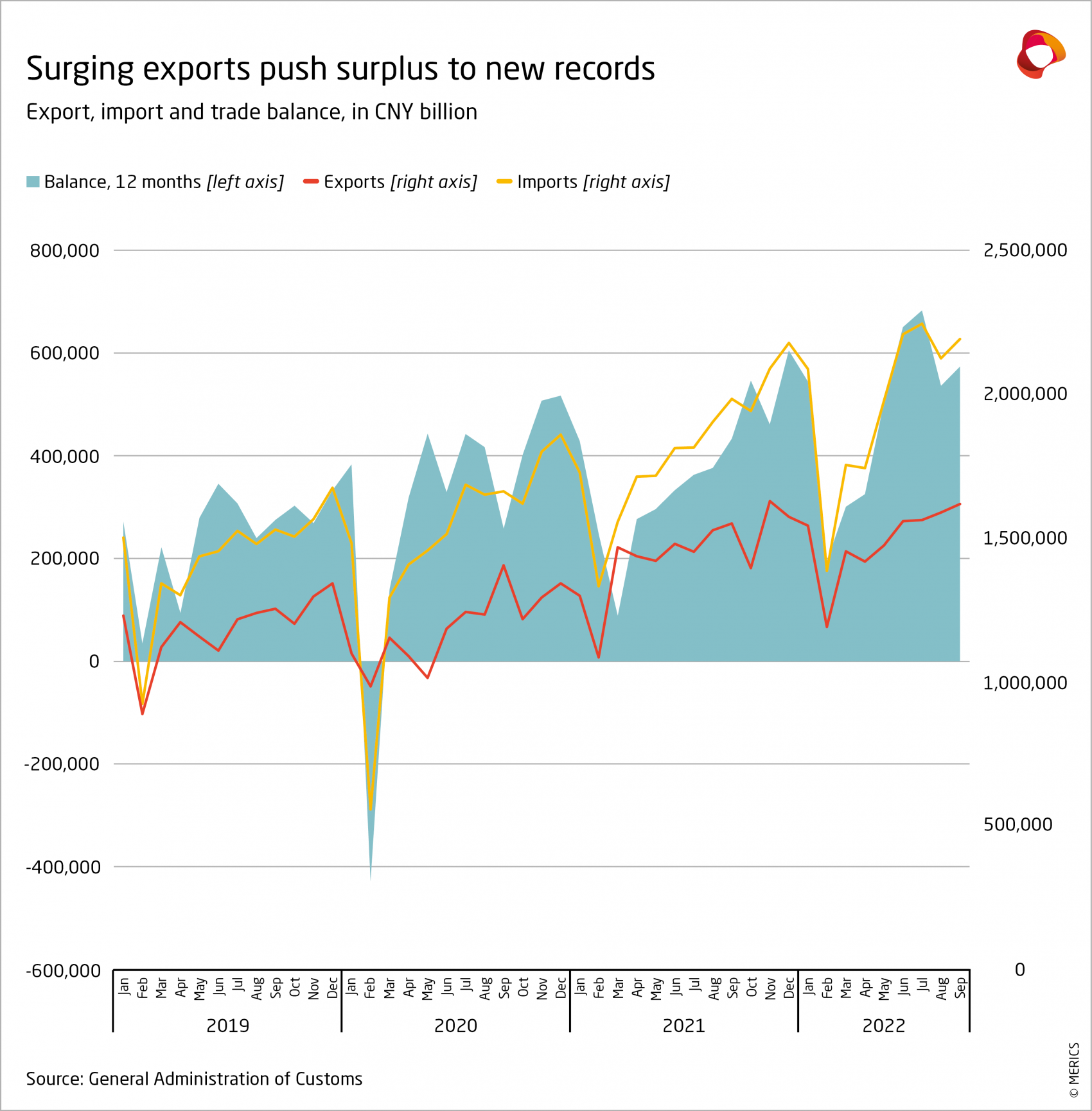

- Exports continue to provide a key support for the economy though export growth slowed down over Q3 (see exhibit 1). Export growth in USD terms fell from 17.9 percent at the end of Q2 year on year, to 5.7 percent in September. Despite slower growth China still exported USD 322 billion-worth of goods in September, not far below the all-time record of USD 340 billion in December 2021 and well above the pre-pandemic level of USD 218 billion in September 2019.

- Rising inflation and lower growth prospects in key markets have not yet dented demand for Chinese goods in a significant way. Exports to the EU expanded by 16.9 percent in the first nine months of 2022, while exports to the United States and ASEAN area grew by 8.9 percent and 20.6 percent in the same period.

- Vehicle exports have surged to new heights as Chinese companies push for global expansion, especially in electric vehicles (EVs). Auto exports rose 64.6 percent in the first nine months of 2022, hitting record levels (see exhibit 2). China has now overtaken Germany to become the world’s second biggest car exporter after Japan.

- Import barely grew, up by a mere 0.3 percent in September year on year and up 4.1 percent during the first nine months. Apart from commodities, China’s demand for foreign made goods is lackluster. Car imports dropped by 0.6 percent and machine tool imports contracted by 12.3 percent.

- The discrepancy between exports and imports has resulted in an ever-widening trade gap. China’s trade surplus hit a record monthly high of USD 101.3 billion in July. It eased slightly over to the quarter, to USD 84.6 billion in September, but remains at record levels.

What to watch: China’s car exports could soon become a new area of economic conflict with the EU.

Financial markets: PBOC expands stimulus in a complex policy environment

Exhibit 1

Exhibit 2

- The People’s Bank of China (PBOC) faces a challenging policy environment as it seeks to support the domestic economy and tackle weak investor sentiment. Significant interest hikes from the European Central Bank and US Federal Reserve during Q3 have complicated China’s monetary policy as the CNY has depreciated against the USD. For now, the PBOC is prioritizing support for the economy. Consequently, it has had to accept greater exchange rate depreciation than it previously tolerated.

- China’s central bank continued its shift towards looser monetary policy – but gradually. Over Q3, most key policy rates were lowered by 10 basis points (see exhibit 1) to stop economic growth stalling further. To support real estate investment, steps were taken to lower mortgages rates.

- In addition to lowering interest rates, the PBoC has deployed other policy tools to support the economy and maintain stability. For real estate developers, it announced loans totaling up to CNY 1 trillion to revive stalled projects, and contributed to many targeted funds for corporates and real estate developers. Furthermore, more than CNY 100 billion in additional liquidity was provided to policy banks, including China Development Bank and the Export-Import Bank.

- Even so, low confidence remains entrenched. Households and private companies are reluctant to investment. Deposits are overtaking credit and corporate bond issuance is slowing. Still, credit has grown overall, due to some easing in the real estate sector and significant efforts from the public sector. At the end of Q3, total social financing to the real economy had slowed only slightly to 10.6 percent year on year, versus 10.9 percent at the end of Q2.

- Capital flight has grown, given China’s weak domestic economy and US interest hikes. Outflows appear to have been substantial enough for authorities to stop publishing multiple series. Despite one of the largest trade surpluses of all time, this put substantial pressure on the exchange rate (see exhibit 2). The PBOC has used a complex set of instruments that include raising the reserve requirement for foreign deposits and using foreign exchange reserves to stop the currency from depreciating too fast.

What to watch: The PBOC will be under pressure to shift to a more expansive monetary policy if household and business sentiment does not improve over the next quarter.

Investment: Weak economic outlook dampens private investment

Exhibit 1

Exhibit 2

- The slowdown in fixed-asset investment (FAI) came to an end the third quarter. After the lowest expansion this year, of 5.7 percent in July, investment picked up to 5.8 percent in August and 5.9 percent in September year on year.

- Government stimulus measures, including cheaper credit, are driving investment by state-owned enterprises (SOE). SOEs’ investments accelerated over Q3, and had risen 10.6 percent by the end of Q3, compared to a rise of 9.2 percent at the end of Q2.

- In contrast, growth in private sector investment fell to just 2 percent, the lowest level in nearly two years. Although investment measured by absolute value picked up slightly in the first nine months, private sector investment amounted only to CNY 23.2 billion, a similar level as 2014 (see exhibit 1).

- Infrastructure investment gradually quickened pace after the government announced a CNY 6.8 trillion infrastructure plan in July. Infrastructure investments rose by 8.6 percent in the first nine months of the year, to 2022’s highest level so far. But the impact of more infrastructure spending cannot counter stalling real estate investment (see exhibit 2).

- Manufacturing remains a vital growth driver for investments; it grew by 10.1 percent in the first nine months year on year. On average, manufacturing investment has increased by 12.5 percent in 2022, well above the pre-pandemic five-year average of 5.6 percent. Strong Q3 investment activity in automotive (12.7 percent) and in electrical machinery (up 39.5 percent) boosted overall investment.

What to watch: A recovery in private sector investment will be essential for a more sustainable economic rebound.

Prices: Inflationary pressure remains low despite CPI peak in September

Exhibit 1

Exhibit 2

- Consumer inflation accelerated in Q3, reaching 2.8 percent in September year on year - the biggest monthly increase since April 2020. But inflation was only marginally up against the 5-year average of 2 percent. Annual inflation remains below the annual target of 3 percent. Rising prices will not be a key concern for policy makers as they roll out more stimulus measures.

- China’s inflation is minor compared to surging inflation in the euro zone or the United States where September price increases were 10 percent and 8.2 percent respectively. European and US inflation triggered tighter monetary policy. Although China is also experiencing higher energy and food prices, the impact has been less severe, largely due to weak overall economic activity.

- China has not been isolated from higher energy prices since the start of Russia’s war in Ukraine. But prices peaked during Q2 and have continued to ease in Q3. Monthly vehicle fuel price rises eased from 32.8 percent in June to 19 percent in September, year on year, and industrial energy cost rises dropped from 29.4 percent in June to 14.3 percent in September year on year.

- Surging pork prices are once again a major government concern due to surging animal food prices (in 2019, African swine flu deaths triggered massive price increases in the country’s favorite meat). In September, pork prices were up 36 percent on the same month last year (see exhibit 1). However, prices for the first nine months of this year were down 18 percent.

- The producer price index (PPI) has fallen for 11 consecutive months, reaching 0.9 percent in September year on year. The drop comes amid falling global commodity and energy prices, but also reflects persistent weak demand in the economy. So far, stimulus measures have not driven up construction-related prices.

- Real estate prices continue to falter as the entire sector is affected by the crackdown on property developers and weak household sentiment. Prices are now falling in 50 of the 70 cities tracked by the National Bureau of Statistics (NBS), the highest number since 2015 (see exhibit 2).

What to watch: The government will try to stop real estate prices from dropping much further by encouraging more investment.

Labor market: Social pressure is rising as employment conditions remain bleak

Exhibit 1

Exhibit 2

- The labor market is seeing the impact of persistent weak consumption on service and retail jobs, combined with the real estate and tech sector slowdowns. In manufacturing, the picture is more mixed. The automotive, machinery and electronics sectors are bright spots; combined, they have added over one million jobs in 2022.

- New urban employment is likely to reach the annual target of 11 million, as it had hit 10 million by the end of the third quarter (see exhibit 1). Even so, it looks set to be the worst year for new employment since the pandemic began in 2020.

- Urban unemployment remained stable, reaching 5.5 percent by the end of September, after falling to slightly lower level in August (5.3 percent). However, youth unemployment hit a new record level in August, reaching 19.9 percent in August. By the end of Q3 the rate eased to 17.5 percent but remains at high levels due to record number of new graduates entering the labor market.

- Provincial governments have rolled out countless support measures, including reduced social insurance premiums and training subsidies. These measures helped to prevent steeper deterioration but failed to improve hiring conditions in Q3 as sentiment remained depressed.

- In response to greater insecurity, the outlook on employment and income further slipped over Q3 (see exhibit 2). It will be an uphill battle for the government to turn the situation around as the ‘zero-Covid’ policy remains in place and the global economic outlook is deteriorating.

What to watch: A key priority for the government will be to reduce youth unemployment.

Retail: Faltering consumer sentiment is suppressing spending

Exhibit 1

Exhibit 2

- Lockdowns became more localized during the third quarter, but MERICS estimates still show that between 30-40million people had been in some kind of lockdown by the end of September. The unpredictability of lockdowns and the lack of an exit strategy are holding back any meaningful improvement in retail spending. Sentiment is at record lows as consumers hold back on spending in favor of more savings (see exhibit 1).

- Retail spending did continue to expand over Q3 but remains fragile. Growth peaked at 5.4 percent in August, its highest level since January, then fell to just 2.5 percent in September (see exhibit 2). Consumers’ fear of being caught up in a lockdown is hurting restaurant spending particularly hard. After rebounding to 8.4 percent growth in August year on year, restaurant spending again contracted by 1.7 percent in September.

- Local governments are handing out vouchers and subsidies in a bid to boost consumption. But consumption is not a key priority of the government’s stimulus which continues to favor manufacturing and investment.

- A recovery in automobile sales was one of the few bright spots, driven by government incentives including subsidies for electric vehicles (EVs). Auto sales expanded by 13.2 percent in Q3 compared to the same period last year. But the change does not mark a substantial rebound in households’ willingness to spend. The improvement in auto sales is likely to be short-lived once subsidies are rolled back unless overall consumer sentiment improves sharply.

- Spending during the National Day holiday early October offered yet more evidence of how the zero-Covid policy is suppressing consumption. Holiday tourism-related revenue was down by 26.2 percent during the week-long holiday this year, compared to the same holiday period in 2021. Revenue was only 44 percent of spending during the same holiday week in 2019.

What to watch: Household sentiment will need to recover before any substantial recovery in retail spending can take place.