Takeaways from the Xi-Putin meeting + Manufacturing overcapacity + Agrifood trade

Analysis

Xi meets Putin: Takeaways for Europe

By Eva Seiwert

The meeting of Chinese and Russian presidents Xi Jinping and Vladimir Putin on May 16 – 17 in Beijing was an important indicator not only of China-Russia relations but also of the EU’s relationship with China. Less than one week after Xi’s first trip to Europe in five years, the visit from Russia offered an opening for Xi to signal that China might adjust its position toward Russia’s war on Ukraine.

Instead, Xi used the 43rd meeting since 2013 with his “best friend” Putin to reassure the Russian President that Beijing would continue to stand by his side. The EU has repeatedly said that EU-China relations hinge on China’s approach to the war in Ukraine. But Europe needs to give teeth to that stance by taking more robust steps to show China it means business.

What did Xi tell European leaders and what does Europe want on China-Russia?

European Commission President Ursula von der Leyen used a trilateral meeting with Xi and French President Emmanuel Macron to remind China that Russia’s war on Ukraine is an “existential threat” to Europe, urging Beijing to “use all its influence” on Putin to end the war. She reiterated the EU’s demand that China curbs its delivery of goods with dual civilian and military use to Russia. This was already clearly and directly voiced at the EU-China summit in December 2023.

Xi, on the other hand, stressed that China was neither responsible nor party to the war in Ukraine. He signaled that he was ready to work with France and the EU to find a solution to the conflict. But what this means – beyond agreeing to Macron’s Olympic truce proposal and reiterating China’s commitment not to sell weapons to Russia – remains to be seen. Regarding dual-use exports, French sources reported that Xi agreed to “look into the issue of dual-use materials.” Even this vague statement was missing in official Chinese readouts, and there is arguably little hope that China will change course.

Putin’s visit to China: Any signs Xi will heed EU demands?

During their meeting last week, Xi and Putin agreed to deepen cooperation on multiple levels, including military, automobile manufacturing, civilian nuclear energy, media content cooperation, and in global institutions. Furthermore, Putin’s visit to the Harbin Institute of Technology (HIT) – one of the “Seven Sons of National Defense” (国防七子) research institutions and an institution sanctioned by the US for its military ties – signals that Russia’s access to Chinese defense technology is likely to expand. It will remain challenging for the EU and US to convince China to limit its support of Russia’s war.

The two also continue to stand side by side in promoting a new international order. In the 7000-word “China-Russia Joint Statement on Deepening the Comprehensive Strategic Partnership of Coordination for the New Era in the Context of the 75th Anniversary of China-Russia Diplomatic Relations” (中华人民共和国和俄罗斯联邦在两国建交75周年之际关于深化新时代全面战略协作伙伴关系的联合声明), Xi and Putin reiterated their view of the US as an unfair global hegemon whose actions “pose a direct security threat to China and Russia.” On Ukraine, the joint statement repeats Russia’s narrative that a fair security structure must take the “legitimate security interests and concerns of all countries into account.” Regarding China-Russia relations, it states clearly that the two countries will “strengthen coordination and cooperation to deal with the so-called ‘dual containment’ policy of the United States.” None of this indicates Xi took the EU’s demands seriously.

What should the EU do now?

Although hopes are muted, Europe should continue pushing to limit China’s support for Russia.

Diplomatically, the EU can crank up the pressure by coordinating on language to speak with one voice on China-Russia and the war in Ukraine in all upcoming exchanges with China. Ideally, going forward, Xi will hear the same words from all Europeans he meets. Italian Prime Minister Giorgia Meloni’s and Polish President Andrzej Duda’s upcoming visits to China will offer the EU a chance to showcase a stronger, more unified position.

As the EU works on its 14th package of sanctions, likely also targeting Chinese entities, it should consider tightening export controls of the most problematic dual-use goods found on the Ukrainian battlefield and imposing new sanctions on firms helping circumvent EU export controls. Given that the EU has no capacity to impose extraterritorial sanctions, this is still the best shot for influencing Chinese sales of dual-use goods to Russia’s war economy. Once the new export controls are imposed, EU Special Envoy on Sanctions David O’Sullivan should work on preventing individual countries from serving as proxies to deliver dual-use goods to Russia and China.

Finally, Europe should keep expectations realistic. While China may want to prevent tensions from spinning out of control – last week, Xi got Putin to sign a statement that “nuclear war cannot be won and cannot be fought” – China wants a resolution of the war that is ultimately favorable to Russia. While recent Chinese calls for a settlement of the war “at an early date” may indicate a more constructive role by Beijing, we should remember that China will always advocate for a solution in line with its own idea of a reshaped “fair and reasonable multipolar world” – which is a vision that Beijing, after all, shares with its close partner Russia.

Read more:

- European Commission: Press statement by the President following the trilateral meeting with French President Macron and President of the People's Republic of China Xi Jinping

- PRC State Council: 中华人民共和国和俄罗斯联邦在两国建交75周年之际关于深化新时代全面张略协作伙伴关系的联合声明

- Reuters: Putin and Xi pledge a new era and condemn the United States

- Le Monde: Macron and von der Leyen press China's Xi on Ukraine and fair trade at Paris summit

Expert debate

EU-China policy lessons from MEPs

Grzegorz Stec, Head of MERICS Brussels Office, invited MEPs of the five biggest European Parliament (EP) political groups to provide advice for the next mandate by answering the question:

What are the key lessons learned from the EP's work on China policy during the last mandate?

With contributions from:

- Iuliu Winkler – MEP (EPP), Vice-Chair of the Committee and Chair of the China Monitoring Group in the International Trade Committee

- Raphaël Glucksmann – MEP (S&D), Vice-Chair of the Subcommittee on Human Rights

- Hilde Vautmans – MEP (Renew), Rapporteur on the EP’s reports on a “new EU-China Strategy” (2021) and the EP’s “Recommendations concerning EU-China relations” (2023)

- Reinhard Bütikofer – MEP (Greens/EFA), Chair of the Delegation for relations with the PRC

- Charlie Weimers – MEP (ECR), Rapporteur on the EP report on EU-Taiwan political relations and cooperation (2021)

Read in full here.

NEW FEATURE: SOAPBOX-MERICS DATA HIGHLIGHT

Don’t target agrifood trade with China, says EU Commissioner

MERICS is pleased to offer a new, regular feature in our Europe China 360° brief: “Soapbox-MERICS Data Highlight.” In it, leading economists discuss a data visualization of issues in EU-China economic relations. We have teamed up with trade specialist Rafael Jimenez Buendía, Lecturer on International Trade at Taltech University in Talinn, Estonia, and co-founder of “Soapbox,” a free weekly newsletter focused on China trade. Rafael and MERICS economics analyst François Chimits will comment on timely data relevant to EU-China relations.

Rafael Jimenez Buendía:

In an interview in China, EU agriculture commissioner Janusz Wojciechowski last month openly acknowledged his concern that European agriculture exports could fall victim to rising Sino-European trade tensions: “My intention is to do everything which is possible to avoid the situation that agriculture is a victim of the problems in other sectors,” he said. Those concerns are understandable, as Beijing often targets the sector with retaliatory and coercive measures. When China imposed de facto sanctions on Lithuania for opening a representative office in Taiwan in late 2021, exports quickly plummeted to zero and have remained there since, including cereal exports that began at the end of 2020.

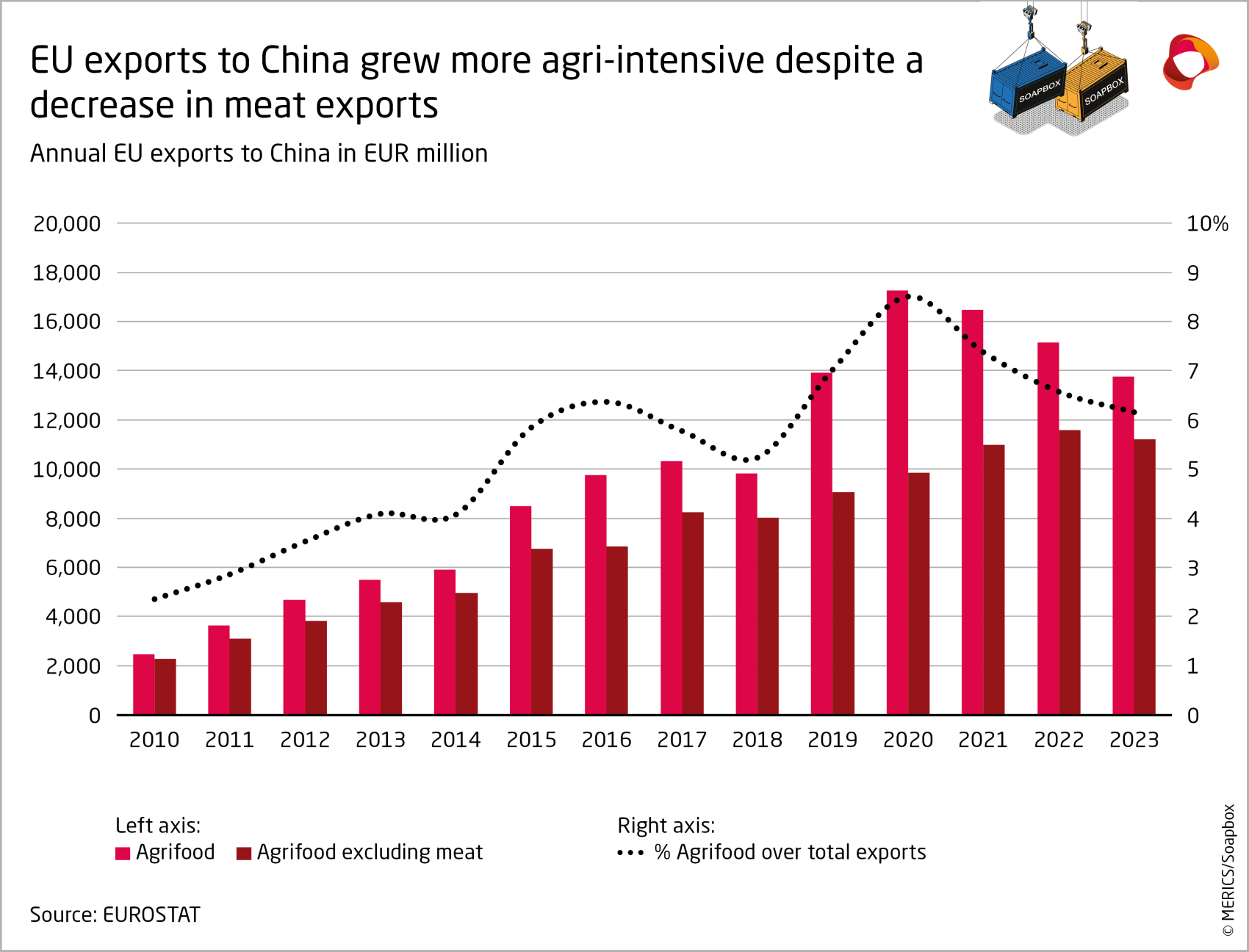

Over the past decade, European exports to China have grown more agriculture intensive. From 2013 to 2023, agrifood products went from four to eight percent of all EU exports to China, reaching EUR 14 billion last year. The 2020-2021 peak was merely fuelled by an exceptional pork shortage in China after the African swine fever pandemic.

Agriculture exports are concentrated in a few EU member states, amplifying the political impact of such measures. France, the Netherlands, Germany, Spain and Denmark make up more than 80 percent of all annual EU agriculture exports to China. The exports of each of those countries except Germany make up more than ten percent of their total exports to China. Agriculture exports are also a key pillar of trade with the PRC for other, smaller European economies, such as Cyprus, Bulgaria or Estonia.

MERICS expert François Chimits:

It might appear unwise to so openly reveal your Achilles heel to Beijing. But the real weakness may lie closer to home. It does not take an expert to see that agriculture exports are one of the most politically charged areas that can be leveraged against European leaders. Even in the very unlikely case this was not clear to Beijing, recent farmer protests once again show just how responsive European politicians are to demands from the sector. The latest visit to China by German Chancellor Olaf Scholz, who cut deals to ensure market access for German beef, pork and apples, illustrates the political significance of those sectors, even for a country where agriculture makes up only 1.4 percent of its exports to China.

The EU agriculture commissioner hopes to convince Beijing that agriculture is a strategic sector for security, hence requiring special protection. Such sectors are exactly those Beijing focuses on when threatening and imposing sanctions. This is even more puzzling as the Europeans are themselves targeting sectors they view as distorted by Chinese government subsidies – trains, electric vehicles, solar panels, and chemicals – which can easily be marked as strategic.

Update

Chinese manufacturing overcapacity – will Brussels’ burning topic of the day lead to meaningful countermeasures tomorrow?

A new hot topic has been added to Brussels’ ongoing debate about China – manufacturing overcapacity. China’s industrial stimulus package during the Covid-19 pandemic and the decline of its real estate market have generated a big disparity between Chinese manufacturing capacity and demand. With the US increasingly closed to Chinese goods, Europe is becoming the prime destination for the Chinese surplus in high-end goods. Challenged by Chinese competitors in many traditionally Western-dominated sectors and under pressure from high energy prices, European industries cannot afford to mismanage the problem.

What you need to know:

- Europe has a problem: China holds the world record in both the share of global industrial value-added (the selling price of a product minus its production cost) – around 30 to 35 percent – and trade surplus – around USD 823 billion in 2023. This investment-prone and consumption-repressive economic model is not sustainable for China’s trading partners because it leads to a surplus in production that can only be consumed abroad.

- Pinpointing overcapacity is necessary, but not always easy: As striking as the headline numbers are, overcapacity varies from sector to sector. In industries like solar panels, legacy semiconductors and batteries, current and planned capacity seem to exceed Chinese domestic demand by quite a significant margin. In other industries, such as electric vehicles, the case of overcapacity is not so obvious – and should be distinguished from the scrutiny of subsidies.

- Beijing does not see that it has a capacity problem: Unlike in previous times of manufacturing overcapacity, Beijing does not appear inclined to cooperate with its trading partners. On his trip to Europe at the beginning of May, President Xi Jinping resolutely stuck to the official line that “there is no such thing as China's overcapacity problem."

- This round of overcapacity is more worrying for Europe: As Chinese overcapacity is concentrated on sectors making high-end products, it poses a more direct challenge to European companies than earlier cycles. Some Chinese companies have developed a technological edge in some of these sectors and others have built up excess capacities in “green” industries vital for the transition to a low-carbon future. This makes a blanket ban on imports of Chinese manufacturing surpluses into the European Union impractical.

Quick take: The increasingly difficult US-China relationship could convince Xi that Western worries about Chinese manufacturing overcapacity are just another ruse to hinder China’s economic development. To get China’s leadership to engage with the problem, Europe needs to stick to the appropriate and proportionate tools of the rules-based international order. Overcapacity is not an economic security issue, but one about free and fair competition, an area in which the EU has developed an effective toolbox. But the pervasive spillovers of Chinese economic distortions also require coordination with the many countries facing the same challenge – and the clear-eyed understanding that not every threatened sector ought to be protected.

Read more:

- Rhodium Group: Overcapacity at the gate

- CNBC: EU's von der Leyen echoes Yellen's calls for tough stance on Chinese overcapacity

- Official Chinese government website: Xi says there is no such thing as “China's overcapacity”

- The White House: Fact sheet: President Biden takes action to protect American workers and businesses from China’s unfair trade practices

- Bloomberg: US-Europe gripes on China overcapacity aren’t all backed by data

SHORT TAKES

A flurry of agreements and contracts for Xi in Hungary: The last stop of Xi Jinping’s tour in Europe earlier this month saw the signature of multiple agreements. No less than 18 memoranda of understanding (MOUs) between the two nations have been signed, from an Economic and Trade Cooperation zone to Joint Laboratories or Investment Cooperation in Green Development. Firms also got a few deals, with cloud cooperation for Huawei or investment funds with the Chinese state-owned train producer CRRC.

- China Trade Monitor: China and Hungary tighten links

- Xinhua: Outcome list of President Xi Jinping's state visit to Hungary

China investigating plastics dumping by the EU, US, Japan and Taiwan: On May 19, China's Ministry of Commerce announced an anti-dumping investigation of the plastics chemical polyoxymethylene in China, allegedly carried out by the four countries. Preliminary findings established dumping margins of 24 percent for the European goods. The Chinese authorities have a year to conclude a case that might well be a first reprisal for recent tariffs on Chinese products by the four targeted countries.

Concerns over potential censorship at the University of Latvia: The university organizing this year’s Baltic Alliance for Asian Studies conference reportedly rejected discussions on Hong Kong, Taiwan, Tibet, and other “controversial” topics. With welcome remarks and the keynote speech by China’s Ambassador to Latvia and a Chinese government advisor, the likelihood of external pressure is high. This case exemplifies the broader challenge to academic freedom in Europe posed by cooperation with Chinese institutions.

- LSM.LV [LV]: Due to concerns about academic censorship, higher education institutions refuse to participate in the Asian Studies Conference at the University of Latvia

- X: Thread by Ivana Karásková on academic censorship

US overtakes China as Germany’s top trading partner: Data from the German statistics office shows that exports and imports between Germany and the US totalled EUR 63 billion in the first quarter of 2024 – EUR three billion more than German trade with China. The change is driven in part by China and Germany making more goods domestically.

China extends visa-free travel for Europeans until the end of 2025: Visa-free travel for European citizens was set to end in December. Holders of passports from Austria, Belgium, France, Germany, Hungary, Ireland, Italy, Luxembourg, the Netherlands, Spain and Switzerland can now enjoy low-bureaucracy visits of up to 15 days for an extra year.

- The State Council of the PRC: China extends visa exemption for 12 countries to promote exchanges