EU: De-risking as the new mantra for defining relations to China

You are reading the EU chapter from the ETNC Report 2023 "From a China strategy to no strategy at all - Exploring the diversity of European approaches". Go back to the main page.

By François Chimits, Francesca Ghiretti and Grzegorz Stec

The geopolitical challenges of the past years highlight the dimensions of competition and systemic rivalry in the EU’s approach to China. The shift has been translated in the adoption of a series of policies, positions and strategies that officially do not target China, but seek to resolve many of the concerns vis a vis China. De-risking is the new go to mantra when direction is needed for the development of the relationship with China. Despite the progress made in finding an appropriate and updated response to the challenges and, sometimes, opportunities present in the bilateral relationship, the EU continues to struggle with developing a clear and strongly coordinated approach. Differences exist on three mains axes: the traditional division between Brussels and member states, the difference between member states and finally, the differences between institutional preferences within Brussels’ institutions. If the EU and member states seek to have an effective approach to China that brings benefits, they must aim for more internal and external coordination and cohesion.

The action: Geopolitical dynamics highlight systemic rivalry

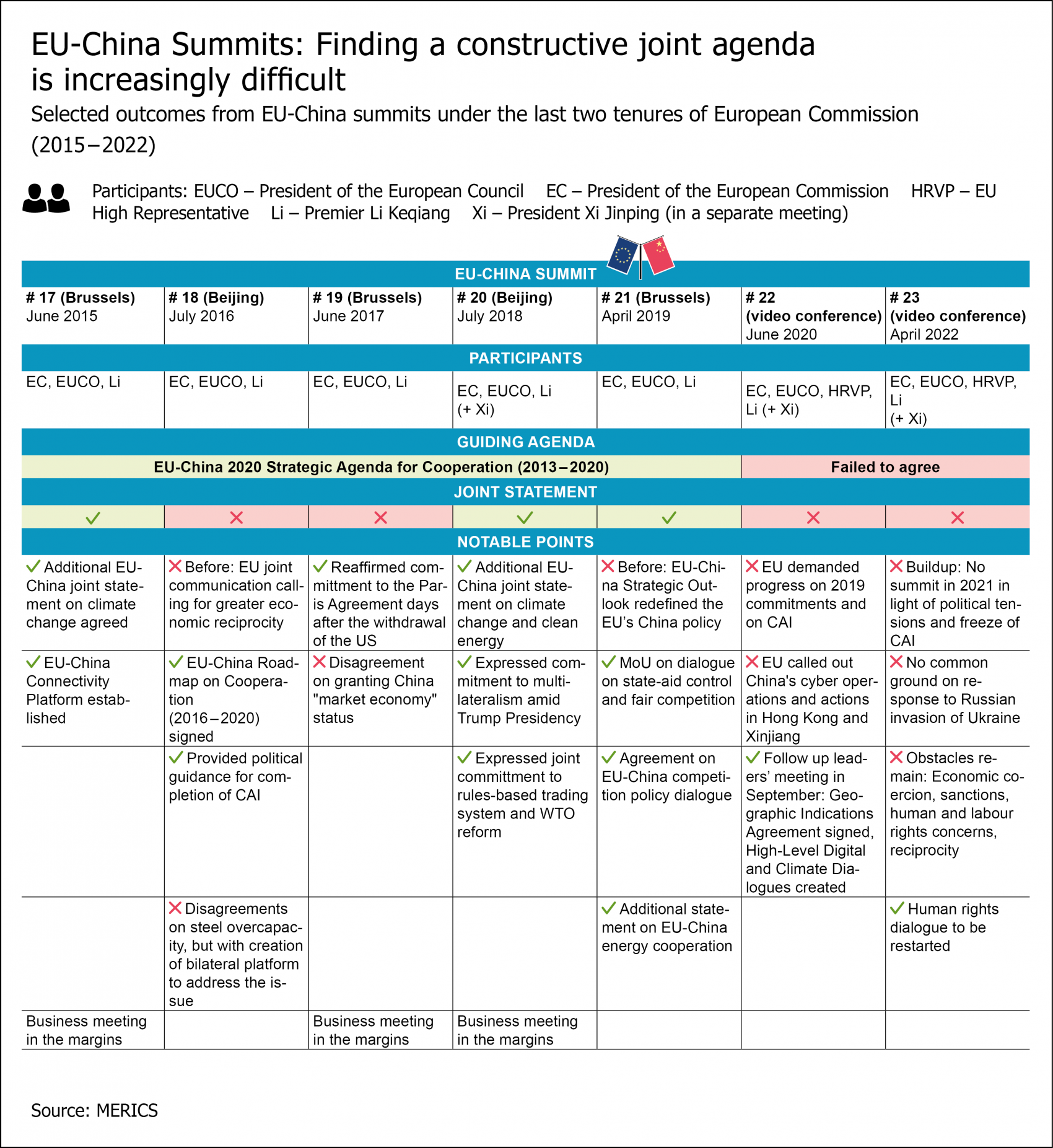

The EU’s three-pronged partner, economic competitor and systemic rival approach remains at the core of its China policy, but it is the rivalrous and competitive dimensions that have gained prominence in recent years. This shift follows the burst of the Covid-19 pandemic, the closure of China for more than two years, the controversies of China’s violation of human rights in Xinjiang (and the subsequent exchange of sanctions), the introduction of the National Security Law in Hong Kong, the escalations in the Taiwan Strait and ultimately China’s lack of condemnation of Russia’s invasion of Ukraine. This led to bilateral EU-China exchanges to increasingly focus on damage control rather than seeking points for constructive engagement (see Exhibit 2). The EU is, therefore, pondering a rcalibration of its China policy without overhauling the logic of its three-pronged approach. Taking the spotlight is “de-risking” bilateral relations and defining the bloc’s position more clearly amid increasing geopolitical tension.

Russia’s invasion of Ukraine in February 2022 came only a few weeks after Beijing and Moscow signed their “no-limit partnership”. Nonetheless, as the war unfolded, Brussels’ high-level personalities like EU High Representative for Foreign Affairs and Security Policy, Josep Borrel, expressed at various points their hopes for China to mediate the conflict. Those hopes were met by China’s lack of condemnation of Russia and Chinese media amplifying Russia’s propaganda messages such as that of the war being sparked by NATO expansion. As Beijing restarted in-person diplomatic exchanges in autumn 2022 and even more so following the abandonment of its zero-Covid policy, China’s representatives, including the newly appointed ambassador, Fu Cong, attempted to convince Europeans that the country maintains a neutral stance in the conflict. A narrative on which Beijing doubled down with the release of its position paper on “the Political Settlement of the Ukraine Crisis” in February.

Fu Cong further signaled interest in rekindling engagement with the EU and suggested to revive the Comprehensive Agreement on Investments (CAI) that was shelved by the EU in 2021 following Beijing’s retaliatory sanctions on European groups and parliamentarians related to the gross human rights abuses in Xinjiang. The idea of revamping CAI has been endorsed by the German Chancellery, while Ursula Von der Leyen made clear that CAI, in its current form, does not mirror the EU’s current interests and thus any conversation on the matter would have to take that as a starting point.

On the other side, the transatlantic agenda on China, while enlivened under the Biden administration, remains highly complicated. The Trade and Technology Council has undeniably facilitated coordination between the EU and the US, the prime example being the swift imposition of sanctions against Russia. However, the recognition by the US of China as a national security threat highlights an important underlying difference between the American approach and that of the EU. Indeed, while systemic rivalry may have come to occupy a much larger role than partner, the EU and its members do not recognize China as a national security challenge.

The catch-all nature of the three-pronged approach provides a wide degree of latitude to Brussels and member states on the direction of their respective China policy, but such flexibility carries a fundamental pitfall. The EU and its member states deprive themselves of the possibility to debate and set clear priorities for a more coordinated and united approach to China. Consequently, not only the EU lacks clarity over the priorities within its relationship with China, but also it lacks a real buy in from its member states.

Against the backdrop of diplomatic reopening and China’s attempts to bring the relationship with the EU back on track, it will become increasingly important for the EU to clarify its priorities. The past two years have witnessed the EU asserting itself more decisively and adopting a series of policies that better defend its interests also in face of challenges posed by China. On March 30, Commission President Ursula von der Leyen gave a speech on China in which she reiterated the core role of de-risking in the EU’s approach towards China and announced the launch of an economic security strategy. De-risking, nonetheless, remains highly undefined, and risks displaying the same pitfalls of the catch-all tripartite approach if it the contours are not defined in due course.

Admittedly, the EU had been building up its domestic geoeconomic toolbox, even before de-risking or the economic security strategy were publicly proposed by President von der Leyen. While none of the following policies are formally targeting China, each have a China angle.

- The International Procurement Instrument, allowing member states to ban products and firms from a country without a reciprocal de jure access to its public procurement, was finalized and formally launched.

- The Anti-foreign Subsidy legislation, allowing the EU to apply its domestic state aid

- rules to foreign firms in the single market, was also finalized.

- The Anti-coercion Instrument is undergoing negotiations between the Commission, the Council and the Parliament.

- Negotiations on the Anti-forced Labor instrument have been dynamic, with the Commission having fielded its own proposition while the Parliament and the Council are still working on theirs.

- In 2022, the EU also launched the Chips Act, focused on boosting the EU semiconductor sector.

- In 2023, the Commission launched the Critical Raw Material Act, which seeks to secure EU access to critical materials.

- In 2023, the Commission is also expected to launch an Economic security strategy in June, with China being the elephant in the room of many of the topics likely to be covered, be it dependencies, the screening of investments or export control.

Also, relaxation of state aid rules established under Covid were extended by a year. This reinforces the recent uptick in industrial policy efforts geared towards mitigating the external dependencies that the Commission identified in 2021. Industrial Policy of Common European Interest (IPCEI) – the main European instrument for pro-active industrial policies – has allowed for significant advancement on semiconductors and batteries with EU funding. Industrial policy on green hydrogen was launched too. Discussions over other ones – cloud, semiconductors (again), solar and health products - have also been dynamic.

Trade agreement discussions were also revived to foster diversification and rule-based order, leading to the conclusion of negotiations with New-Zealand as well as Chile, and the (re) launch of formal discussions with India, Indonesia and Thailand.

In addition to developing its toolbox, the EU has started implementing existing tools. No less than seven new trade defense instrument (TDIs) investigations have been opened or finalized against Chinese goods or subsidies over 2022, with at least five older ones being renewed and two anti-circumventions applied. This sets China on track to remain the most impacted partner of EU TDIs (68 percent of cases at the end of 2021), and to see a continued increase of the share of its exports to Europe being subject of TDIs (at roughly 13 percent in 2021, versus around 6 from 2000 to 2010).

In terms of substance, the Commission has maintained its more stringent implementation regarding the broad definition of public bodies, below-market financing, and transnational subsidies. The EU also opened two cases at the WTO against Chinese practices regarding the international value of Chinese domestic judication on patents and the economic coercion of Beijing against Lithuania.

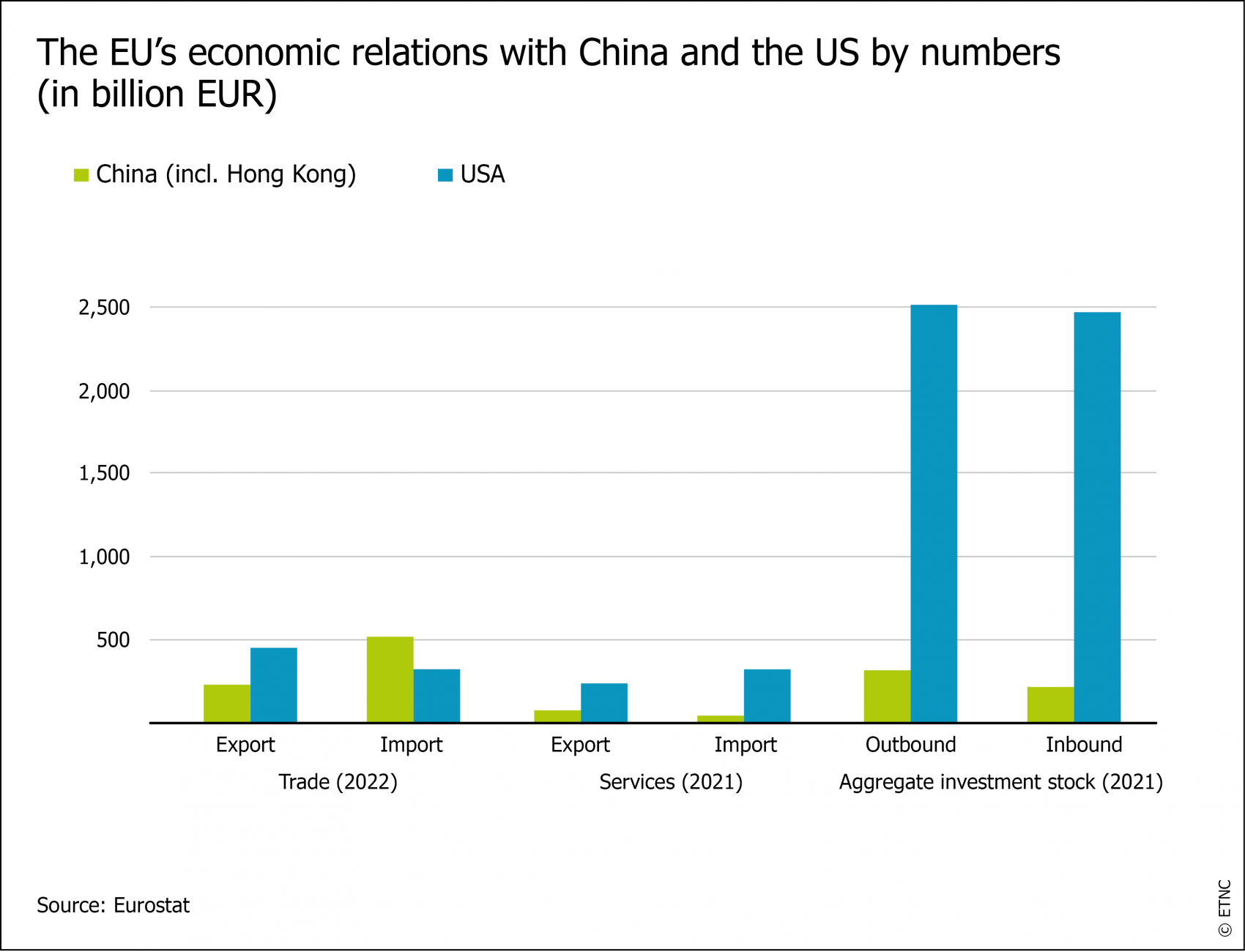

Beyond the rhetoric, EU-China economic integration is intensifying, but it still lags well behind the US (see graphic). Chinese exports to the EU were dynamic, growing at more than 8 percent over 2022, while imports were down by the same amount. In the meantime, European FDI in China have seen their second most dynamic year ever in 2022 according to Rhodium Group. More strict financial flows are harder to assess, but it is safe to assume that international European investors have not departed from peers and have unwound some of their positions in Chinese financial markets following the Ukraine invasion. This has not prevented European financial institutions from continuing to expand their activities in China as Beijing continues the slow opening-up of its financial sector.

The actors: EU on China – who is who and what is what?

The EU’s China policy largely plays out through relevant frameworks. These include the annual EU-China summit bringing together the EU and PRC leadership and a series of high-level dialogues (strategic, economic and trade, environment and climate, digital and people-to-people) that connect HRVP or the relevant Commissioners with their Chinese counterparts. Rarely groundbreaking, those semi-institutionalized meetings are nevertheless fundamental to structure European positions and facilitate discussions on China.

The European institutions have made a considerable effort to put China higher on the EU’s agenda over the last years developing a toolbox of China related policies and strategic documents that include attempts at aligning the position of member states on China. These include the dedicated EU-China Strategic Outlook (2019), Indo-Pacific Strategy (September 2021) or Strategic Compass (March 2022). The most recent efforts include the speech on China given by European Commission President Ursula Von der Leyen on March 30 and the discussion of a new position paper on China.

The EU’s China policy is shaped through an institutionalized and semi-institutionalized negotiations process between a plethora of actors playing different roles within the EU system. The level of their engagement and influence differs depending on level of competences of European institutions in the given field.

For instance, where the EU has exclusive competences – such as on customs procedures, competition and common commercial policies – the agency of the Commission and the European Parliament are the strongest, making the EU’s policies on China most robust. Similarly, this grants strong impact to the DG Trade and International Trade Committee (INTA) in shaping the EU’s China policy.

The relatively diluted competences in the realm of common foreign policies and security mean that the member-states led European Council and Council of the EU hold the final say. The controversial unanimity requirement creates a significant hurdle to developing a united position in general, and towards China in particular. A few member states have now advanced a proposal to move away from unanimity in foreign and security policy in favor of an approach based on qualified majority.

That is just the latest of a number of changes that are quietly emerging within the EU. The speech on China by Commission President Ursula Von der Leyen is an example of how the European Commission and her Cabinet more specifically are trying to broaden their influence in foreign policy matters, even when they go beyond the strict competence of the Commission. However, the importance and complexity of dealing with China is blurring such divisions.

In all of this the European Parliament has come to occupy the role of watchdog, making sure the other institutions do not forget about China’s violation of human rights and the risks the bilateral relationship carries.

The future: The EU has some way to go to reach a consistent approach towards China

Four years after the Strategic Outlook, three years after the beginning of the Covid pandemic, and two after the first strategic dependency report, the EU is still missing a clear approach on China. This has not prevented the bloc from developing multiple actions and initiatives on the matter, as detailed above. Nevertheless, the lack of a clear approach and framework creates risks of inconsistencies between sectors and of frictions between European partners further down the road.

The lack of the “de-risking” concept’s formalization increases risks as the reopening of China and Beijing’s shift of rhetoric will create economic opportunities that have already led to a renewed push for a more cooperative approach. The recent more assertive stance and measures towards economic distortions and challenges coming from China occurred during a closed-up zero-Covid China.

As it is, the EU has yet to showcase how “to walk, chew gum and play chess at the same time” with China. More concretely, the Europeans need to demonstrate how they can simultaneously pursue all three of the systemic rival line, de-risking in economic relations and the maximization of their economic benefit in China. The economic situation in China is motivating Beijing’s friendlier communication mode towards the EU. Despite the lack of hope for any significant changes in terms of substance and goals, European leaders and communities have already been signaling a deeper engagement with China that does not seem to consider the real risks China poses to the EU.

Against this backdrop, it will remain crucial to invest more effectively in coordinating with like-minded partners on Chinese behaviors that undermine the rule-based international order and developing an appealing offer to third countries.

In the context of cooperation with like-minded partners, the EU should develop a clearer list of actions and objectives it wants to pursue in relation to China, including red lines on what is not acceptable both in terms of objectives and implementation. Then there comes the question of engagement with developing economies. The Global Gateway initiative branded as the key EU’s engagement tool for boosting relations with partners from developing countries requires more robust implementation and clearer strategic messaging. The EU still needs to develop a consistent and convincing message and offer to demonstrate why its vision of the international system, challenged by China, is also beneficial to those partners that find themselves courted by Beijing.

Spotlight on Taiwan

Under its One China policy, the EU recognizes the People’s Republic of China, but reserves the right to develop relations with Taiwan that do not amount to recognition of statehood. Over the past months these relations have been developing with several key topics driving the EU’s Taiwan file:

- The Council and the EEAS are developing a set of coordinated response measures to a potential spike of tensions in the Taiwan Strait.

- While the Commission is not interested in negotiating a Bilateral Investment Agreement with Taipei arguing that the Taiwanese market is already quite open, it has launched annual EU-Taiwan Trade and Investment Dialogues (since 2021) and upgraded (in 2022) the EU-Taiwan Trade and Investment Economic Dialogue to the ministerial/director-general level.

- The EU seeks to expand cooperation with Taiwanese actors in the semiconductor industry.

- The EEAS and relevant committees of the EP increase knowledge exchanges on China’s foreign information manipulation activities.