New industry workplans + "Made in China" + Energy storage

MERICS' Top 5

1. Staying the course: China’s industry workplans show investment remains prioritized over consumption

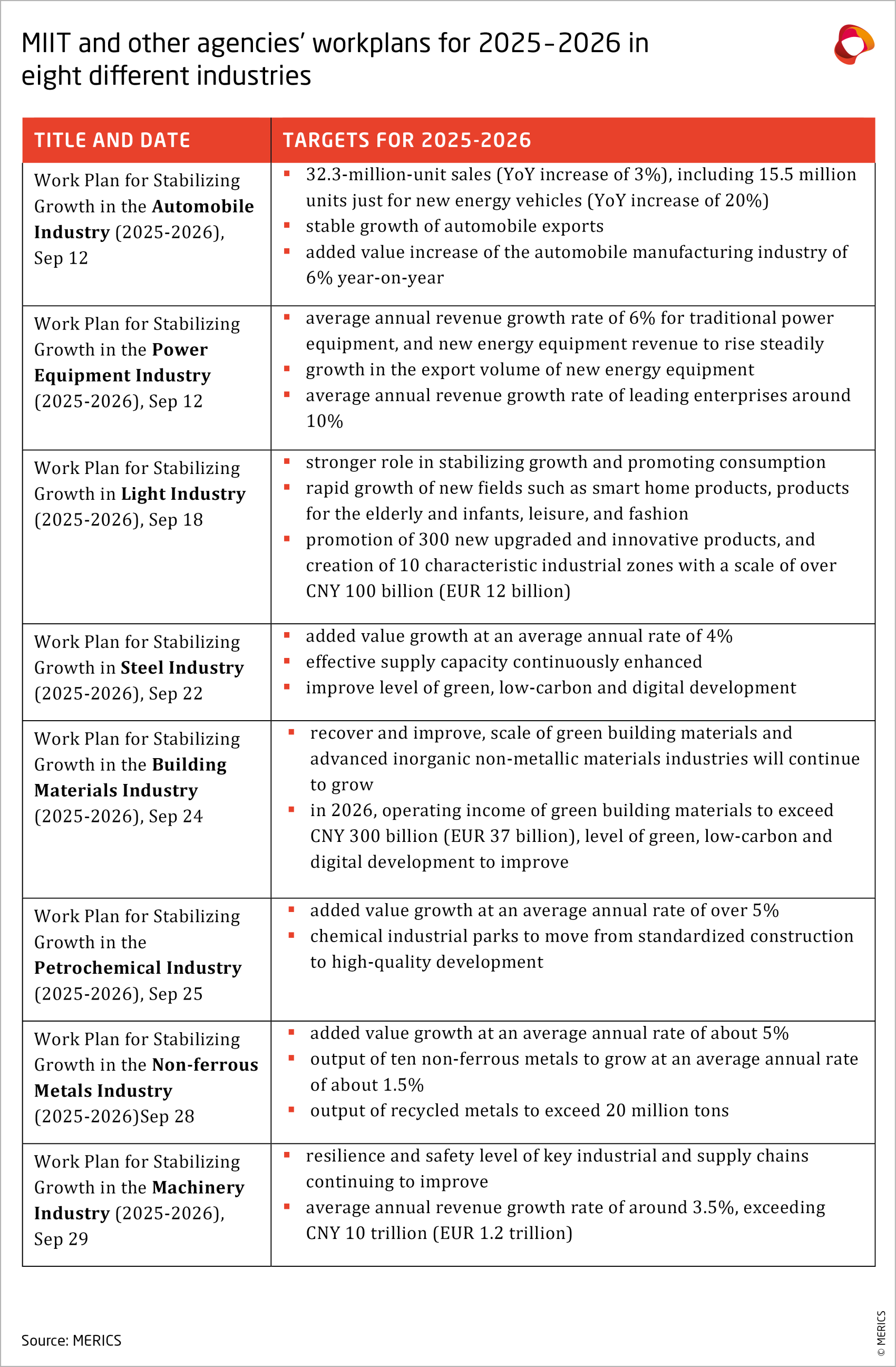

At a glance: The Ministry of Industry and Information Technology (MIIT) and several other departments issued workplans targeting eight specific industries, which set out growth targets for 2025 and 2026 (see exhibit 1 for more detail).

MERICS comment: The workplans show Beijing is sticking to its focus on the growth and upgrading of the manufacturing sector. The growth targets exceed 10 per cent for some subsectors, such as for NEVs (+20 per cent unit sales), or leading power equipment companies (+10 per cent revenue growth). Targets for entire industries range from 3.5 percent to 6 per cent. These are not excessive targets measured by China’s policymaking norms but still strikingly high for industries already suffering overcapacity and overproduction. It signals the government is not planning a harsh crackdown on overcapacities. Although the workplans do call for tackling problems, such as disorderly competition and price wars, the proposed measures, including capacity management and industry self-regulation, are mostly vague. By contrast, the growth targets are not, suggesting officials will pursue these more strongly.

Likewise, Beijing’s continued commitment to manufacturing growth makes any substantial reorientation towards consumption unlikely. Granted, it often features as a key ambition in high-level party meetings and documents. Strengthening consumption was listed as the second most important economic task for 2024 in the readout from the 2023 Central Economic Work Conference (CEWC) and elevated to the top spot one year later. Yet, Beijing’s subsequent fiscal stimulus measures, estimated at 1.6 per cent of China’s GDP in 2025, mainly went towards public investment, with only 0.5 per cent of GDP directly earmarked for households.

Even consumer goods trade-in programs, intended to boost consumption, are supply-side focused and do not improve fundamental consumer confidence. Doing so would require more resolute measures to increase household income. Beyond that, most of the workplans do feature sections on boosting internal demand and consumption, but this is framed as way to absorb excess capacity, rather than rebalancing towards a consumption-led macroeconomic model. In sum, consumption can be expected to feature prominently again in the readout from the upcoming CEWC in December, but this is unlikely to be followed by substantial policy changes, let alone a shift to consumption-led growth.

For European companies and policymakers, the result is more fierce competition in sectors where China has the greatest overcapacities, at least in the short run. They can also expect increased competition from Chinese firms in global markets, especially in autos and new energy equipment, where China’s plans explicitly call for more exports.

Articles: Work Plan for Stabilizing Growth in the Automobile Industry (2025-2026) (Link); Work Plan for Stabilizing Growth in the Power Equipment Industry (2025-2026) (Link); Work Plan for Stabilizing Growth in Light Industry (2025-2026) (Link); Work Plan for Stabilizing Growth in the Steel Industry (2025-2026) (Link); Work Plan for Stabilizing Growth in the Building Materials Industry (2025-2026) (Link); Work Plan for Stabilizing Growth in the Petrochemical Industry (2025-2026) (Link); Work Plan for Stabilizing Growth in the Non-ferrous Metals Industry (2025-2026) (Link); Work Plan for Stabilizing Growth in the Machinery Industry (2025-2026) (Link)

2. The State Council sets deadline for implementing “Made in China" rules in government procurements

At a glance: The State Council further specified the rules to shape the selection of goods purchased through future government procurement. “Domestic products” will receive a 20 percent discount in the bidding evaluations. The regulation takes effect on 1 January 2026, with an implementation transition period of three to five years. To qualify for the discount, companies must meet the following requirements:

- Products must be substantially manufactured in China, not merely assembled or packaged there. By 2031, regulators will define the proportion of the product’s total cost that must be attributable to components or raw materials produced within China. They will first consult with companies and industry associations.

- For certain strategic or sensitive products, key components and manufacturing processes must also be completed within China.

- If the procurement involves a package of products, the entire bid will receive the 20 percent discount in the bidding evaluation process as long as at least 80 percent of a bid’s total value qualifies as “domestic products”.

MERICS comment: Previously, the government procurement law stated government procurement should favor domestic goods without defining them clearly. Foreign companies were already disadvantaged in public procurement, for instance through technical product standards tailored to suit local companies by local governments.

The new regulation steps up pressure on companies to localize their production lines in China. It favors enterprises already localizing in the country because it sets clearer limits for local protectionism. For companies that already have a high degree of localization, it has the benefit of greater clarity, which could be an improvement on vague rules and regulations or bad practices by local officials.

However, firms that export to or assemble in China could face significant problems once the specific local-content thresholds are issued. The new rules could lock them out of China’s procurement markets, unless they take the hugely risky step of localizing more of their core technology. With China’s government procurement amounting to CNY 3.38 trillion (about USD 477 billion) in 2024, this is a potentially momentous decision for them.

The scope of entities covered by “government procurement” has not been clearly defined. The 2022 Draft Government Procurement Law aims to expand this scope to include “public-welfare-oriented” state-owned enterprises (SOEs). If these revisions are adopted, the range of enterprises subject to the regulation could broaden accordingly.

Article: Notice on Implementing Domestic Product Standards and Related Policies in Government Procurement (国务院办公厅关于在政府采购中实施本国产品标准及相关政策的通知) (Link)

Issuing body: State Council

Date: September 30, 2025

3. NDRC energy storage plan zaps new stimulus into battery industry

At a glance: The National Development and Reform Commission (NDRC) announced a Special Action Plan for construction of new grid-level energy storage systems. Most of this will take the form of lithium-ion batteries. But the new plan also promotes alternative new storage technologies, such as sodium-ion and solid-state batteries, as well as non-battery storage, including thermal and flywheel systems. With an ambitious target of 180 GW installed capacity – more than doubling China’s current storage space – the plan has the potential to transform China’s energy infrastructure:

- Backed by CNY 250 billion (around EUR 30 billion), Beijing aims to construct 180 GW of new energy storage capacity by 2027. (For comparison, Europe currently has 91 GW storage online – most of which is pumped-storage hydropower.)

- While lithium-ion batteries remain the mainstay, the plan explicitly promotes solid-state, sodium-ion, and other storage technologies.

- Market and pricing reforms will allow storage providers to independently participate in electricity markets, creating arbitrage opportunities.

MERICS comment: Even with the largest battery industry in the world, China has struggled to construct enough storage to keep up with the amount of renewable energy it generates. In the first half of 2025, supply far exceeded demand, as wind and solar curtailment rates reached 6.6 percent, and 5.7 percent respectively – up from 3.9 percent and 3 percent in 2024. The new plan is designed to reduce these frictions on China’s renewable energy markets.

With new investment for the energy storage industry, as well as far-ranging administrative and commercial incentives to bring new storage capacity online, the Special Action Plan will further accelerate growth in the battery sector. This is particularly true for lithium-ion batteries, which already account for 95 per cent of installed capacity. With 85 percent of global battery cell production capacity in 2023, China leads the world in lithium-ion battery production. Battery making gets much cheaper with scale – and China boasts the two single largest, vertically-integrated battery manufacturers in the world: In EV batteries, CATL and BYD commanded global market shares of 37.9 percent and 17.2 percent in 2024 respectively.

The plan will boost China’s competitiveness in other energy storage technology. Europe is already dependent on China in existing green technology. Although unlikely to catch up where Chinese companies are already dominant, European firms may be able to compete in emerging storage technology, beyond lithium-ion batteries, if governments decide to step up policy support.

Article: Special Action Plan for the Construction of New Energy Storage Scale (2025-2027) (新型储能规模化建设专项行动方案) (Link)

Issuing body: NDRC

Date: September 12, 2025

4. State Council’s new clinical trial regulations may test biopharma

At a glance: The State Council issued new guidelines for clinical trials of ‘new biomedical technologies’, which are novel methods at the cellular and molecular level that assess health status, prevent or treat diseases, or promote health. The new rules tighten regulatory oversight of clinical trials, improve patient safety standards and centralize more decision-making power in Beijing. Changes include:

- The National Health Commission (NHC) will supervise clinical research on and application of new biomedical technologies.

- Clinical trials must strengthen formal risk management and ethics protocols, and keep records for at least 30 years after trial completion, or face fines and other penalties.

- A changed relationship between risk management and innovation, moving the regulatory paradigm from “strict in, wide out” to “wide in, strict out” to facilitate R&D while tightening oversight of outcomes.

MERICS comment: This year alone, Chinese biotech companies struck licensing deals worth over USD 85 billion with pharmaceutical multinationals – the highest number ever. As we noted earlier this year, the Chinese biotech sector is in an upswing, in large part due to how cheap and easy it is to run clinical trials.

The new guidelines represent a policy shift away from a “strict in, wide out” approach towards “wide in, strict out”. It will become easier to conduct R&D, but security and ethical thresholds increase as research gets translated into marketable products. Beijing is most likely seeking a better balance between risk and innovation, boosting research incentives while limiting risks to the wider population. At the same time, it likely aims to increase the reliability of domestic trial results, so that trials conducted in China can become recognized overseas and facilitate market entry of Chinese products.

The new clinical trial rules refine the existing regulatory framework and give the NHC more control over new biomedical technologies. This should inject more stability and predictability into a system known for its regulatory uncertainty. But it also further consolidates regulatory prerogatives in Beijing, part of a broader drive for unified national markets that has been a key feature of President Xi Jinping’s tenure.

For European companies, these changes may bring more products from China into global markets and increased competition. Additionally, European-developed products might need to comply with these new rules to be eligible for export to China.

Article: Regulations on the Administration of Clinical Research and Clinical Translational Applications of Biomedical New Technologies (生物医学新技术临床研究和临床转化应用管理条例) (Link)

Issuing body: State Council

Date: October 10, 2025

5. China’s future tech ambitions overlap with EU agenda

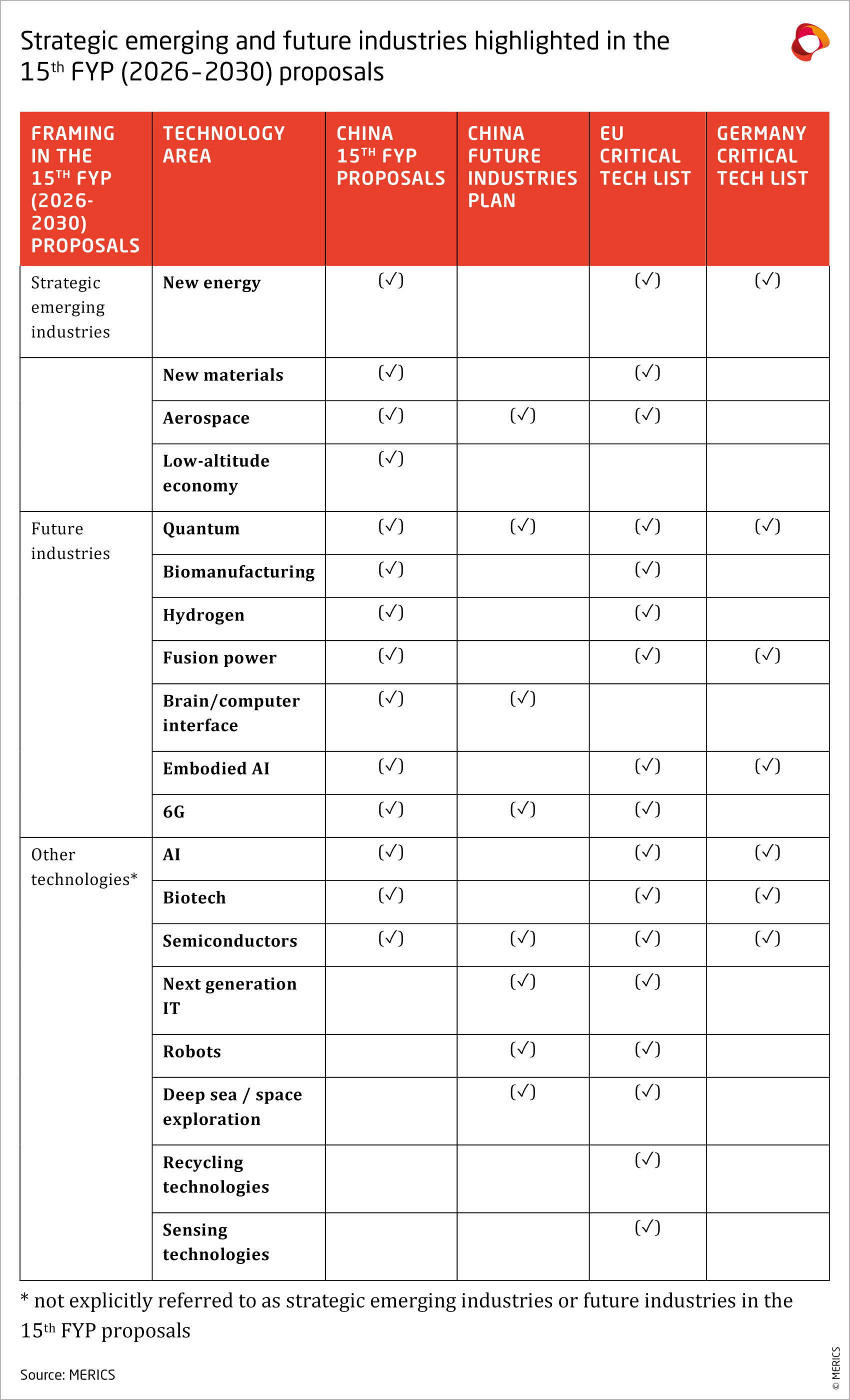

At a glance: The senior party leadership has updated the pick of key technologies to act as new economic growth drivers and deliver on strategic objectives. In the recommendations for the forthcoming Five-Year Plan, the Central Committee of the Chinese Communist Party listed 11 strategic emerging technologies and future industries (see exhibit 2). To foster development, the proposals instruct officials to:

- Implement industrial innovation projects and large-scale application demonstrations for new technologies, new products, and new scenarios

- Explore diverse technological paths, viable business models, and market regulation

- Innovate regulatory approaches, develop venture capital, and establish mechanisms for increasing investment and sharing risks in future industries

- Promote the development of high-tech small and medium-sized enterprises and cultivate unicorn enterprises

MERICS comment: China has long promoted core industries it deems as central to its industrial modernization and technological development. It began with the State Council’s plan to foster strategic emerging industries in 2010. In 2020, Xi Jinping introduced the term “future industries” to refer to nascent technologies with huge potential, and China released its first dedicated future industries plan in January 2024.

Although there is a great deal of continuity in the technology areas targeted by these policy initiatives, the changes are revealing. Quantum, biotechnology and hydrogen were once again included as priority sectors. The low-altitude economy (which covers things like cargo drones and drone-like passenger aircraft), brain/computer interfaces and fusion power were new additions. New-energy vehicles were not included for the first time: China’s electric vehicle sector has matured and no longer needs targeted government support to thrive.

Nearly all sectors in China’s recent selection of emerging and future technologies are also identified by the EU and Germany as crucial to their economic prosperity and security (see exhibit 2). The only two areas which do not feature in Europe’s strategy are low-altitude economy and brain/computer interfaces. In all other areas, European policymakers, businesses and researchers will need to manage the balance between competition and collaboration with Chinese researchers and companies. For instance, more robust frameworks may be needed to prevent R&D conducted in Europe being first commercialized in China.

Article: Recommendations of the Central Committee of the Communist Party of China for Formulating the 15th Five-Year Plan for National Economic and Social Development (中共中央关于制定国民经济和社会发展第十五个五年规划的建议) (Link)

Issuing body: Central Committee of the Chinese Communist Party

Date: October 28, 2025

Noteworthy

Policy news

- August 26: The State Council issued opinions on the “artificial intelligence +” campaign, which aims to deepen the application of AI especially in the following six areas: science and technology, industry, consumption quality, people's livelihood and well-being, governance capabilities, and global cooperation. (State Council opinions)

- August 28: The NDRC released a draft for comments on the regulation of enterprise technology centers. These are organizations within companies which are tasked with conducting research and drive its commercialization, among other things. Companies have to meet several conditions for establishing these centers, such as having at least 150 R&D staff. (NDRC notice)

- September 4: The Ministry of Agriculture and Rural Affairs (MARA) and the MIIT published opinions on the verification and application of innovative agricultural machinery products. The opinions set some qualitative targets for 2027 and 2030, such as shortening research and development cycles. (MARA opinions)

- September 22: The MIIT and the NDRC released guidelines for the high-quality development of industrial parks, with emphasis on strengthening industrial chains, greening, efficient land use, and enhancing industrial technological innovation capabilities. (MIIT notice)

- October 11: The MIIT and six other departments published an implementation plan for promoting the development of service-oriented manufacturing, a business model which creates product-plus-service solutions to create additional value for the customer. Goals for 2028 include the establishment of 50 leading brands and of 100 innovation and development hubs. (MIIT notice)

- October 22: The MIIT and the State Administration for Market Regulation (SAMR) invited applications for “unveiling the list” of smart manufacturing system solutions in 2025. The goal is to find smart manufacturing solutions for key industries, including raw materials, high-end equipment, consumer goods, and electronic information. (MIIT notice)

Corporate news

- September 9: Chinese EV maker Xpeng announced at the IAA Mobility that it will open a research and development center in Munich, which would be its ninth R&D facility overall and its first in Europe, after R&D centers in China and the United States. (electrive)

- September 23: Regulators permitted initial public offerings for three still-unprofitable technology companies on the Star Market, a tech focused stock index. The clearance proceeded under Star Market’s fifth standard, a channel aimed at supporting science and technology companies that may deliver important technological breakthroughs. It poses no conditions on profitability but requires companies’ core business to have been approved by central government authorities. (Shanghai Stock Exchange)

- September 27: CATL, a leading producer of advanced batteries, announced it will send 2,000 workers to construct a EUR 4 billion battery plant in Spain under a joint venture with Stellantis. (Financial Times)

- October 10: Ming Yang, one of China’s largest privately owned turbine makers, announced its intention to invest GBP 1.5 billion (EUR 1.7 billion) in a plant in Scotland. The company said the goal is to serve offshore wind projects in Europe and other markets. The project is still subject to final regulatory approval from the British government. (Financial Times)

- October 14: The Dutch government took control of chipmaker Nexperia, a subsidiary of the Chinese company Wingtech, by invoking the Goods Availability Act. The government said it did so because Nexperia was showing signs of serious governance shortcomings and the Netherlands needs to preserve the availability of crucial technology in Europe. (BBC)

- November 6: German luxury carmaker Porsche opened its first integrated R&D center outside Germany in Shanghai. The center is intended to boost innovation, by combining Porsche’s engineering excellence with China’s digital ecosystem. The company sees this step as a milestone in its “in China, for China” strategy. (Porsche Newsroom)