4. Beijing advances technological self-reliance by all means

You are reading chapter 4 of the report "The party knows best: Aligning economic actors with China's strategic goals". Click here to go back to the table of contents.

Key findings

- Tech self-reliance in a geopolitically focused economy is the central goal that Xi has in his economic agenda.

- A whole-of-nation approach aims to close tech gaps and make China less dependent on foreign actors Xi believes aim to hold China back.

- Taking hold of the innovation chain, the party-state guides and supports each actor to gain tech effectiveness and market efficiency, while centralizing and streamlining everything from basic research to commercialization.

- Beijing will promote indigenous solutions where it can, even at the expense of efficiency, but will also welcome foreign investors in areas where China’s tech gap is largest – better to have secure, onshored foreign technology providers than rely on easily targeted imports.

- China is using its dominance in raw materials and is also seeking disruptive technologies where it can lead, to be used as trump cards in international technology rivalries.

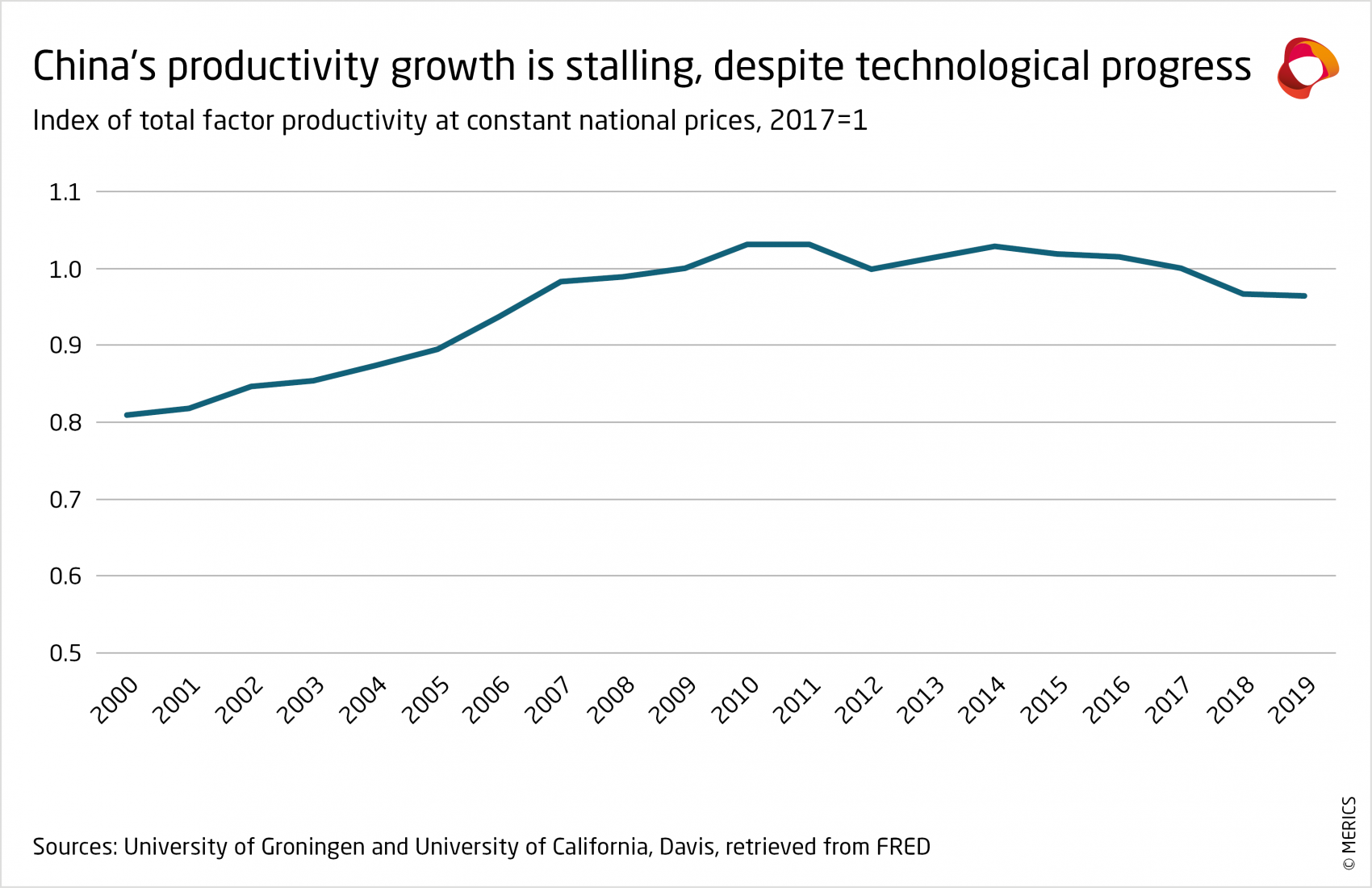

Xi’s geopolitically focused political economy is on full display in the way innovation is being pursued in China, as well as how the country’s innovation dividend is materializing. Considering the remarkable progress that China has made in advancing itself as a technological great power, there would normally be an expectation that total factor productivity would have climbed as the returns on innovation gains kick in. Instead, total factor productivity has trended downward, begging the question of where the dividend has gone.23 Rather than going towards productivity, much of it has gone towards Xi’s tech self-reliance goals. This is because in most technologies, China is playing catch up in terms of tech effectiveness, but it has enjoyed extensive access to foreign technology – in previous years, Chinese firms could simply acquire the foreign technology to maximize their return, which could bring productivity growth. Instead, Xi has set the country on a path where, in many key areas, it is more important that companies expensively develop that tech themselves. Had China instead focused on its own comparative advantages and accepted interdependencies on others in areas where it lagged, the innovation dividend would likely have moved the needle up on productivity, but instead, it has only gone to closing tech gaps (see Exhibit 9).

The tech self-reliance priority has now been cemented in place. Now facing a showdown with the US and its allies, Xi has called for a “New type of whole-of-nation approach” (新型举国体制) in the 2020 Central Economic Work Conference to close technology gaps and rid China of its dependency on the foreign actors he believes intend to contain his country.24

Several clear patterns in these efforts have emerged in the national strategy: First, closing gaps across as many strategic technologies as possible. Second, in strategic technologies where China has achieved effective competitiveness, protecting market share from foreign competition so indigenous firms can achieve market efficiency. Third, in strategic technologies where China remains far behind, attracting foreign investment where possible and continuing to import from abroad where necessary.

4.1 Innovate everything, everywhere, all at once

In an attempt to better align innovation and industry, the CCP is setting up new hierarchies within the economy. By mixing tested methods with a stronger embrace of “technocratic laboratory capitalism” – a form of capitalism that operates in a highly controlled environment – the CCP aims to increase centralization and coordination of economic actors. While higher levels of political control may hinder innovation of privately owned companies, the CCP is also attempting to integrate them into China’s evolving innovation ecosystem, including networking them with national research institutions, universities and other companies.

The government has also recognized the private sectors strength in emerging technology and incentivizes technology development and competition by reducing their financial risk. The new type of centralized administration of innovation aims to accelerate innovation in strategic areas by aligning the private and state sectors in pursuing national strategic targets.

Ministries and relevant departments play a crucial role in developing the required plans, including roadmaps, timetables and responsibilities. The plans set the framework for direct and indirect financial incentives that help steer market actors toward the most efficient way to reach targets. In sectors where POEs dominates, they compete for full government support, currently especially seen in semiconductors, but previously for electric vehicles (EVs).

Likewise, in sectors where SOEs dominate, they are expected to help reach goals by transforming themselves into profitable drivers of innovation. This is consistent with the emphasis on POEs and SOEs as pillars of the Chinese economy outlined in the 2013 Third Plenum. Increasingly, both are operating in a similar environment with the CCP exerting control over their operational direction regardless of their ownership.

Yet, it is not simply down to POEs and SOEs to contribute to the leadership’s call for innovation. In line with the whole-of-nation approach, Beijing has been refining its approach to bringing the party-state and the scientific community in at early stages and then fostering commercialization at the corporate end of China’s innovation chain. The intention of the innovation chain is to centralize and streamline everything from the earliest basic research to eventual commercialization, first in terms of tech effectiveness and then market efficiency, all with the party-state guiding and supporting each actor along the way.

Encapsulating the whole-of-nation approach is the role that larger POEs and SOEs are also meant to play in the innovation chain. This includes expectations that they support the scientific community in the research phase, and often also invest – either in their own subsidiaries (which then benefit from tech transfer) or in startups (providing much needed capital and business support). For China’s startups seen as having the potential to close the technology gap in key areas, that support can also come through China’s “Little Giants Initiative.” Little Giants provides extensive support to qualifying SMEs through the innovation chain model and by connecting them with financial markets like the Beijing Stock Market (see the case study on the Little Giant company Leaderdrive at the end of this chapter). In 2022, 40 percent of listings on the Shanghai, Shenzhen and Beijing stock exchanges were made by Little Giant companies.25

4.2 Taking indigenous champions from tech effectiveness to market efficiency

As innovation is often a contest of incremental improvements, technology that is one or two steps behind the cutting edge can still achieve much of what its most advanced version can. An EV with a range of 200 km can fulfil most of the same needs of commuter drivers as an EV with a range of 300 km. And a chip made with the 22 nm process can achieve in a smart phone much, but certainly not all, of the same functionality as a 14 nm version.

Even if the more advanced tech can do some things its lesser version cannot, there is still enough overlap to satisfy many customers. Obviously, Beijing would like to be on the cutting edge in many technologies, but it will often settle first for getting close enough to produce most of the desired applications of a given tech.

This tried and true formula has been demonstrated most clearly in the area of high-speed rail (HSR) technology. China’s ambition to create an HSR network was hampered by a lack of expertise and technology to build domestic models. Foreign HSR companies were invited into the market and required to enter JVs and transfer technology to local players such as northern and southern rolling stock companies CNR and CSR. Brands like Kawasaki, Alstom, Siemens and Bombardier all jumped into the market hoping to become the dominant players.

Over time, CNR and CSR merged into a single monopolistic giant CRRC which then had access to all of the transferred foreign tech and eventually caught up and managed to produce technologically effective alternatives to the foreign brands. It didn’t take long for the procurement system in charge of purchasing engines and rolling stock to favor CRRC over its foreign competitors, effectively pushing them out of the market aside from some niche tech related to HSR. Since then, China’s HSR network has dwarfed all others. Anyone who has ridden the CRRC Fuxing “(national) Rejuvenation” line, which is the exclusive intellectual property of CRRC, can tell you how its speed and smooth ride make European high-speed rail feel outdated.

A similar story is currently playing out with Huawei, which has overtaken its rivals in 5G technology and now enjoys a protected home market to build out almost entirely without foreign competition. Beyond that, Huawei is central to Beijing’s strategic ambition to close other technology gaps, and the company is covered in a case study at the end of this chapter.

Some of the same rules that are benefiting Huawei as sources of protection in its home market are also applicable to other sectors. Xi’s ambition to securitize China in every possible way have created regulatory and other means to drive out undesirable foreign competition in certain industries, but also to compel the rest of the foreign business community and local firms to integrate with indigenous tech in affected areas.

This is happening most sharply in the Critical Information Infrastructure (CII) (关键信息基础设施) space, where suppliers of relevant information communications technology (ICT) and digital solutions must be whitelisted by a multitude of government bodies for customers designated as CII operators. The rules have a massive negative impact on foreign suppliers and operators. The former report to the European Chamber of Commerce that they face far higher levels of scrutiny than their local competitors, while the latter say they often need to gut their hardware and software used globally and furnish their China operations with indigenous solutions.

A less deep-cutting, but more widespread, source of protectionism is the autonomous and controllable (A&C) (自主可控) campaign, which aims to ensure value chains that can go it alone if needed. Importantly, as more and more industries undergo digitalization and rely more on networking and automation, there is a higher likelihood they will fall under greater scrutiny as operators. It is hard to imagine that Beijing will allow highly automated chemical plants (in a country with a history of exploding chemical plants) or autonomous vehicles to operate without much more oversight and intervention from authorities.

4.3 Drawing in foreign tech where possible, importing it where necessary

It is impossible to talk about China’s own tech self-reliance ambitions without also covering the very dependencies on foreign technologies it seeks to remedy.

Where China remains too far behind foreign technology providers, it approaches self-reliance through opening up. The onshoring of foreign technology brings that tech within China’s borders and under Beijing’s jurisdiction – a much preferred choice to importing it and being subject to potential restrictions from the US or elsewhere. This can mean removing restrictions, but also rolling out the red carpet with additional support measures to incentivize onshoring. While a variety of external restrictions make it impossible, Beijing would eagerly provide abundant support to companies on the cutting edge in the semiconductor value chain – firms like TSMC, ASML, Nikon, and Intel could effectively name their price if they onshored their most advanced production.

A similar situation emerged for foreign chemical makers BASF and Exxon Mobil when they each announced plans in 2018 to build plants valued at USD 10 billion in Guangdong. These chemical plants will produce highly advanced chemicals for customers in China that previously would have been imported – which would potentially have subjected them to disruption. To facilitate this investment, Beijing approved 100 percent foreign ownership for each investment, something that had never before happened in China.

Finally, China will reluctantly continue to import foreign technology where it has no other choice – though it will simultaneously focus efforts on closing the tech gap in these areas. This is most widely the case in the semiconductor space, where China must import the most cutting-edge chips that empower its own innovation system and its exports, albeit with much greater difficulty since the October 2022 restrictions on US chip tech and the early 2023 joint agreement of the US, Japan, and the Netherlands to restrict exports of the most advanced lithography machines. However, this applies to far more technologies than Beijing would like. Just to name a few:

- Due to their status as military contractors in the US and Europe, many of Airbus and Boeing’s suppliers are only allowed to export certain components to Chinese passenger airliner aspirant COMAC

- A multitude of European and Japanese industrial machinery makers will only export their most cutting-edge products to China

- Legions of hidden champions/so-called Mittelstand firms that fill niche roles as the primary (or even sole) providers of certain components have the luxury of a seller’s market and are under no pressure to onshore.

4.4 Seeking tech supremacy, China has used dominance in manufacturing and raw materials as leverage

In one of his signature speeches, Some Major Problems Facing Medium to Long Term National Economic and Social Development (国家中长期经济社会发展战略若干重大问题) published in Qiushi (the CCP’s theory journal) in late 2020, but originally delivered in April 2020, Xi expounded on his vision for China that was very technology-centric.26 Coming out of the intense initial lockdowns at the start of the pandemic, the speech called first for a resilient domestic market to decrease reliance on foreign demand and second for localized value chains and secure technology access. One plank for achieving secure technology access is by catching up and overtaking the technological high grounds so that Beijing will have deterrence through a sort of technological mutually assured destruction position. Specifically, Xi envisions “assassin’s mace” technologies – the Chinese equivalent of a trump card, something which can be unexpectedly thrown into a contest or a fight that changes the dynamic.

The ambition is to establish China as the dominant tech supplier for an emerging technology that will be in high demand globally. From that position, Beijing would control its own tech bottleneck which it could credibly use against other markets, much in the way Washington uses the semiconductor bottleneck to gain a hold on China. The effect would be deterrence – so the US would think twice about cutting China off from its chip technology lest China cut the US off from its bottleneck technology. This could be in AI, quantum computing, life sciences, or new materials – anything China is currently on the edge of and which could become critical in empowering not just one or two end products, but multiple value chains, and a country’s innovative capacity itself.

For now, that also means other technologies that can drive deterrence. Beijing’s early 2023 crafting of restrictions on outbound intellectual property related to photovoltaic (solar panels) tech opens the door to a kind of export control over a key technology for the green transition – and one where China holds around 80 percent of the global market share in the full value chain for solar panels.27 28 Meanwhile, on July 3, 2023, China’s Ministry of Commerce announced export controls on gallium and germanium-related materials on the grounds that they have dual-use applications.29 China produces around two-thirds of the world’s germanium, and 97 percent of its gallium, with each mineral being the base for a variety of applications in semiconductor, optics, and electronics more generally.30 This came after the Netherlands announced details of its own restrictions on exports of cutting edge lithography machines aligned with the US and Japan. Beijing clearly had prepared its own response and kept it ready to play at the right moment as a possible deterrent – gallium, for example, is essential for cutting-edge chip wafers made by Japanese firms, used by Korean and Taiwanese chipmakers, all made with Japanese and Dutch lithography machines.

Case Study: Leaderdrive, one of Beijing’s “Little Giants”

Alexander Brown

Leaderdrive (Leader Harmonious Drive Systems (绿的谐波)) is a private SME and producer of harmonic reducers, a type of core component for robots. Beijing has long sought to build up domestic capabilities in robotics core technologies, where foreign firms dominate.31

Robots and CNC (computer numerical control) machines are among the ten key industries included in the Made in China 2025 strategy. Beijing set targets for indigenous Chinese firms to occupy 50 and 70 percent of the domestic market for industrial robots by 2020 and 2025, respectively. It is also aiming to increase localized production of core robotics components to 50 and 80 percent by 2020 and 2025, respectively.32

But the industry has so far failed to meet the government’s expectations. In 2020, the domestic market share of indigenous brands in industrial robot production was about one quarter.33 With regard to core components in 2020, the localization rate of reducers, servo systems and controllers had reached about 36 percent, 25 percent and 31 percent, respectively.34

Hence, the robotics sector is one where China’s dreams of technological self-reliance remain unfulfilled. This is particularly the case in upstream components, where Leaderdrive has the potential to fill a gap in China’s domestic supply chain.

Abundant guidance throughout the innovation chain

Little Giant program: Leaderdrive was included in the first batch of Little Giant (小巨人) firms, announced in 2019.35 Little Giant companies are high-tech SME firms with strong innovation capabilities operating in niche markets. The designation grants companies special access to government support and encourages both public and private sector actors to facilitate the companies’ growth, which includes not only extensive support mechanisms, but also guidance mechanisms that the firms can tap into.

Government subsidies: Since gaining the Little Giant title, Leaderdrive received CNY 78 million in subsidies between 2019 and 2022, accounting for 6 percent of its revenue over this period. Subsidies amounted to just 3 percent of revenue during the period 2017-2018.36

Equity financing: The company received a large windfall following its listing on the STAR market in August 2020, where it raised CNY 1.06 billion in capital. It has received direct equity investments from private and public investors, including government guidance funds. For instance, the Advanced Manufacturing Investment Fund is the third largest shareholder in the company, holding 5 percent.37

R&D support: Leaderdrive has developed long-term collaborative partnerships with several universities, including Harbin Institute of Technology, Shanghai Jiao Tong University and Southeast University. It led a National Key R&D program project into robotic reducer manufacturing launched in 2017, with CNY 13.4 million in funding support from the central government.38

Customer base: Beijing encourages large firms to build stronger links to high-tech SMEs and support their growth. Leaderdrive counts some of the largest indigenous producers of industrial robots such as Siasun, Estun, STEP Electric and Huashu Robot among its key customers.

Manufacturing Champion program: In 2021, Leaderdrive was further recognized as a Manufacturing Champion (制造业单项冠军), essentially one step above a Little Giant company. This marks it as a leading manufacturing company in a specific subsector and further underlines its importance to the government.39

Leaderdrive as a success story for ccp guidance to further national goals

Leaderdrive’s growth trajectory has accelerated since its selection as a Little Giant. The company’s revenue more than doubled and its assets more than tripled between 2019 and 2022. In 2021, Leaderdrive accounted for 25 percent of the domestic harmonic reducer market, ranking second.40 Among the three main core components of industrial robots (reducers, controllers and servo systems), reducers are the only ones where a Chinese firm has a significant market share (above five percent).41

The firm has been lauded by the Chinese Institute of Electronics for its success in achieving breakthroughs in “bottleneck” technologies and developing robotics core components.42 According to Zhang Yuwen, deputy general manager of Leaderdrive, the company is fulfilling the mission Beijing has ascribed to it. Through its high-quality, reliable and relatively cheap products, it has successfully reduced the dependence of Chinese robot makers on high-end harmonic reducers imported from Japan.43

Case Study: Huawei’s base station tech overtakes foreign competitors

Alexander Brown

Huawei Technologies (华为技术) is the flag bearer of China’s progress in high-tech manufacturing. It is one of the first private Chinese firms to become a global leader in high-tech goods. In 2012, it became the largest telecommunications equipment producer in the world.44 Its products underpin the telecommunications infrastructure in China, deemed to be of critical importance for national security. The company’s leadership in 5G technology, supported by heavy investment in R&D and innovation, has enabled China to roll out the latest network technology far more quickly than other advanced economies. This will support digitalization and greater productivity across all sectors, from manufacturing, to transport and health. Since 2018, when Huawei was directly targeted by technology restrictions imposed by the US, Huawei has led the charge in efforts to build up self-reliance. It has moved swiftly to replace hardware and software previously sourced directly or indirectly from the US, either through developing its own technology or by supporting other domestic firms.

Frontline levels of support from the party-state

Technology transfer: In exchange for market access, foreign telecommunications firms were required to share intellectual property with domestic firms such as Huawei, facilitating its early development.45

Protected market: Priority access to contracts for the rollout of telecommunications equipment in China has provided a huge market for Huawei and helped it to scale up. As of 2022, China accounted for over 60 percent of the world’s 5G base stations.46

Policy banks: Tens of billions of US dollars have been granted to Huawei and its international customers to support projects overseas.47

Grants and tax incentives: A review conducted by the Wall Street Journal suggests the company has received USD 46 billion from loans, credit lines and other support from state lenders. Tax incentives saved Huawei as much as USD 25 billion between 2008 and 2018.48 Subsidies granted to Huawei more than doubled in 2022 to reach over RMB 6.5 billion (approximately USD 950 million).49

Facilitated divestment: Beijing acted as an “investor of first resort” to transfer Huawei’s HONOR brand assets to a non-Huawei entity, to bring them outside the scope of US sanctions.50

Economic coercion: Chinese officials have on multiple occasions threatened to retaliate should Huawei be excluded from supplying equipment to markets overseas countries.51

Government backing smoothed the way for Huawei’s transformation into a technology powerhouse. The company is among China’s most innovative firms and most prolific generators of invention patents.52 It has successfully entered markets all over the world, and to a large degree European countries still use Huawei technology in their 5G networks, although this may not last.53 Ultimately Huawei’s ties to the government and its home market advantages have caused pushback overseas and are beginning to restrict its access to some markets in advanced economies. The company has been drawn into the center of China’s stormy relationship with the US.

Huawei’s fight for survival amid the US technology embargo embodies the Chinese government’s fears for the country as a whole. Over the past few years, it has made significant progress in fully localizing its supply chains. Ren Zhengfei, the company’s founder, says domestic alternatives have been found for more than 13,000 components and over 4,000 circuit boards redesigned.54 In the realm of industrial software, Huawei has switched to its own MetaERP (enterprise resource planning system), thus replacing US vendors.55 The company is also active in the semiconductor space. It has become a leading supplier of AI chips for the domestic market and is leading local advances in electronic design automation tools for chips.56 What’s more, in 2019 Huawei launched a semiconductor investment fund which has backed over 80 local firms.57

Most importantly for Beijing’s goals, Huawei and SMIC had jointly worked on near-7 nano-meter chip technology, which seems to have yielded effective, though likely not efficient, results. In early September, 2023, Huawei unveiled its new Mate 60 Pro smartphone, which uses Kirin 9000-S chips made by SMIC. While a tear-down of the technologies in the phone are ongoing at time of writing, it suggests that major progress has been made through indigenous innovation.