Real economy digitalization + Energy sector upgrade + Supply chains

MERICS Top 5

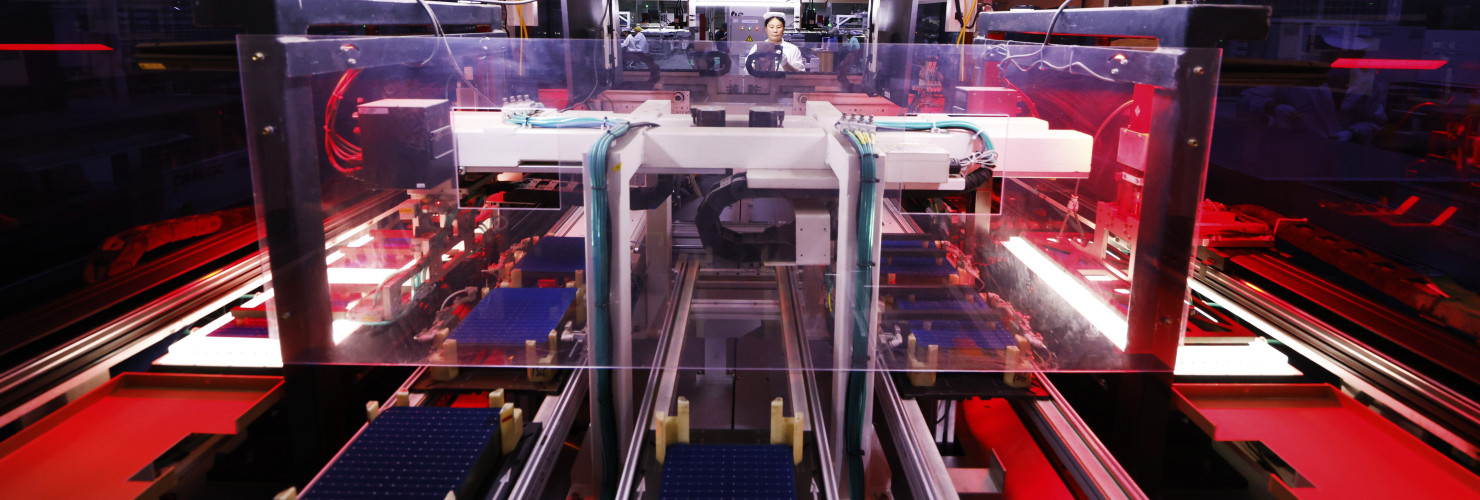

1. “Matchmaker state”: Mating SMEs and MNCs while fostering real economy digitalization

At a glance: Two recent documents touch on different aspects of the Chinese state’s role as a ‘matchmaker’ along the country’s innovation chain. The Ministry of Industry and Information Technology (MIIT) and three other agencies published a notice on promoting integration between Small and Medium Enterprises (SMEs) and Multi-National Corporations (MNCs). Key aspects include:

- Building industrial clusters that integrate SMEs and larger enterprises into interwoven value chains

- Helping export-oriented SMEs to explore new markets through larger partners

The MIIT also released instructions on the ‘Hundred cities and thousand parks’ activity for 2025 to integrate the industrial Internet into industrial parks. Key aspects include:

- Integrating industrial and software firms plus financiers in industrial parks

- Guiding companies to adopt technologies under the umbrella of the industrial Internet, such as 5G, time-sensitive networks and industrial optical networks.

MERICS comment: The two policies reflect the central government’s efforts to create a whole, integrated innovation chain as it pursues technological self-reliance and a global dominance in manufacturing.

Industrial parks and clusters belong to the category of development zones, a key feature of China’s industrial policy for decades. One of their key functions is to channel state direction: They are focal points for Beijing’s ‘matchmaking’ efforts to generate synergies from better integration of different parts of China’s innovation chain. For instance, by matching industrial software firms with manufacturing companies, Beijing hopes to create a virtuous cycle in which industrial parks create centralized demand for industrial software, increased demand then leads to better software, which leads to better factories, and yet more demand for better industrial software, all while improving China’s competitiveness.

For European companies, both policies could bring opportunities as well as risks. On the one hand, they could benefit from integrating this industrial software into their operations and realizing productivity gains – if allowed to. Or they could profit from being ‘match-made’ with promising Chinese SMEs (e.g., through licensed production or by bringing them into supplier networks). However, if they help Chinese SMEs to go global, they could create future competition in Europe and in third markets. Moreover, if eligible, European industrial software companies may be tempted to participate in ‘Hundred cities and thousand parks’. They should bear in mind that foreign technology firms are permitted only a limited role in the Chinese market and only one tailored to fit Beijing’s long-term ambitions.

Articles: Notice on Organizing the 2025 Industrial Internet Integration into Industrial Parks "Hundred Cities and Thousands of Parks" Activity (工业和信息化部办公厅关于组织开展2025年工业互联网一体化进园区“百城千园行”活动的通知) (Link), Notice on Launching the 2025 "100 Events and 10,000 Enterprises" Large, Medium and Small Enterprise Integration Matchmaking Activities (工业和信息化部办公厅 国务院国资委办公厅 国家知识产权局办公室 全国工商联办公厅关于开展2025年“百场万企”大中小企业融通对接活动的通知) (Link)

Issuing bodies: MIIT; MIIT, SASAC, SIPO, CFIC

Date: April 17, 2025; May 23, 2025

2. Energy: China enlists private firms to upgrade the sector and sustain growth

At a glance: The National Energy Administration (NEA) issued measures to promote the private economy in the energy sector. The measures call for improvements in market access to create a level playing field. Private companies are encouraged to:

- Invest in energy infrastructure projects such as nuclear power plants, hydropower, oil and gas storage facilities, liquefied natural gas terminals

- Invest in emerging areas like new energy storage, virtual power plants, charging infrastructure and smart microgrids

- ‘Go global’ and carry out green energy projects related to areas such as wind power, photovoltaic, hydrogen energy, and energy storage in overseas markets

MERICS comment: Traditional energy fields like oil, gas, the power grid and nuclear power have long been dominated by state-owned enterprises (SOEs). Private companies face severe obstacles to entering these sectors, including institutional guarantees of resource allocation for SOEs or restricted access to financing. However, private companies are important drivers of innovation, especially in digital and emerging technologies. Their know-how is likely to be needed for the smart upgrading of old coal mines or power plants. The NEA notice reflects a broader trend in favor of using private companies to upgrade technology and boost innovation in SOEs, while retaining the SOEs hegemony over central sectors of the economy.

The measures will reinforce China’s rapidly growing new energy industry. In 2024, clean-energy sectors made up more than 10 per cent of China’s GDP for the first time; investment in solar power generation capacity grew by 28 per cent and nuclear power generation capacity grew by 49 per cent on the same basis. In new energy fields, private companies are already leaders, making up 60 per cent of wind power manufacturers and 70 per cent of the production capacity in photovoltaics in China.

China’s success poses serious competition risks to European companies, even as Chinese firms provide Europe with cheap, green energy products. With China already dominant in the global photovoltaics market, new data shows that Chinese wind and hydropower companies have recently started to venture into Europe as well.

Article: Notice on Several Measures to Promote the Development of the Private Economy in the Energy Sector (国家能源局关于促进能源领域民营经济发展若干举措的通知) (Link)

Issuing body: NEA

Date: April 28, 2025

3. Efficiency and resilience: China digitalizes supply chains

At a glance: The Ministry of Commerce (MOFCOM) and seven other agencies released an action plan for the development of digital and smart supply chains. It aims to integrate the real and the digital economy by utilizing artificial intelligence (AI), the Internet of Things (IoT), and blockchain technologies to enhance demand forecasting, risk perception, as well as improve the efficiency and the resilience of supply chain processes. Key goals are:

- Cultivate 100 digital and smart supply chain leading companies by 2030

- Promote the application of IoT and AI technology in manufacturing and build smart factories and smart supply chains

- Build smart and digital supply chains together with countries along the Belt and Road Initiative (BRI) and of the Regional Comprehensive Economic Partnership (RCEP) to strengthen cross-border e-commerce and logistics

MERICS comment: To build resilient supply chains, China first requires a general understanding of its strengths and vulnerabilities. Integrating AI into the sector will enable a better distinction between the two. The collected data could be used for high-precision mapping of specific sectors. For instance, it could help to identify sectors whose overreliance on limited suppliers creates vulnerabilities versus those where it is merely about cost efficiency without a looming threat of dependence.

Once Beijing has a clear picture of advanced supply chains, China can pursue efficiency where it is most attainable – even as overcapacity, excessive subsidies and a tolerance for loss making remain embedded into its broader economic model. Chinese firms could refine their logistics chains by maximizing the benefits from logistics, inventory control and risk forecasting. Greater capacity in demand and risk forecasting could be generally beneficial for non-geopolitical reasons. Disturbances from natural disasters, market disruptions or strikes could potentially be identified in advance, enabling the swift preparation of countermeasures, thereby making supply chains more resilient to external shocks.

Lastly, digitalization of value chains would also allow China to use more finely calibrated trade defense/offense tools in its relationships with other countries. Having accurate data would help China counteract the United States and develop more sophisticated measures for tracking end-use/end-user rules. In many ways this would replicate the US system for export controls and end user rules aimed at ensuring export controls are not circumvented by a product being sold downstream to a user the controls are intended to target. This was one aspect of China’s use of rare earth element export controls in the most recent round of US-China trade frictions – some European companies reportedly faced intense questioning about end-uses as part of the licensing process. Better digital mapping of value chains could improve Beijing’s ability to impose such controls.

Article: Special Action Plan for Accelerating the Development of Digital and Smart Supply Chains (商务部等8部门关于印发《加快数智供应链发展专项行动计划》的通知) (Link)

Issuing bodies: MOFCOM, NDRC, MOE, MIIT, MOT, MARA, STA, NDA

Date: May 21, 2025

4. China aims to digitalize its pharmaceutical industry

At a glance: The MIIT and six other departments issued a plan for the digital and smart transformation of the pharmaceutical industry for 2025-2030. The policy focuses on integrating new generation information technology into the pharma sector to advance enterprises’ competitiveness and improve drug safety and quality. It entails strengthening R&D and creating a common data pool among pharmaceutical enterprises and research institutes, among other things. Primary goals include:

- Establish 30 new digital standards for the pharmaceutical industry, build at least 100 digital and smart pharmaceutical and medical device factories, and construct five pharmaceutical industrial parks by 2027

- Complete digital and smart transformation of large companies and create a digital and intelligent ecosystem for the pharmaceutical industry by 2030

MERICS comment: China is actively promoting its biotechnological rise. A digital and intelligent pharmaceutical industry will significantly improve China’s standing in the international market. Integrating AI into the sector will enable China to speed up biomedical data processing, improve existing drugs and reduce testing failures. Additionally, AI implementation promises reduced development costs, as well as more crafted patient recruitment and personalized drug development. All these make the Chinese pharma sector more attractive for both buyers and investors. And while Europe has a strong regulatory environment and growing collaboration with China, it still lags behind both the United States and China and remains vulnerable to the lack of AI competitiveness in the R&D sphere.

When it comes to data pooling, China has a huge advantage because of its population size and large pool of disease-specific hospitals, which brings a greater concentration of patients for clinical trials and easier access to data needed for AI learning and prediction accuracy. This type of healthcare infrastructure is very specific to China – it contrasts to the system of general hospitals found in the EU, which puts great importance on data protection, preventing rapid AI advances.

This policy trend towards industry digitalization shows how advanced Chinese policymakers are in their understanding of the importance of technology implementation into the real economy. This is highlighted by the Politburo study session on AI, where policymakers and party members seek a better understanding of AI and the possible benefits of its practical application.

It is important for European legislators to adopt a similar approach to policy making to have a chance of keeping pace with their Chinese counterparts, particularly by facilitating the domestic environment for AI development and capital investment.

Article: Implementation Plan for the Digital and Smart Transformation of the Pharmaceutical Industry (2025-2030)工业和信息化部等七部门关于印发《医药工业数智化转型实施方案(2025—2030年)》的通知 (Link)

Issuing Body: MIIT, MOFCOM, NHC, NHIA, SATCM, SFDA

Date: April 3, 2025

5. China moves to support the digital transformation of light industries

At a glance: The MIIT published a plan for the digital transformation of light industries using, for instance, data sharing platforms, AI, 5G and other advanced ICT technologies. Targeted sectors include home appliances, furniture, lighting, papermaking, leather, and light industry machinery.

Key actions to achieve the plan’s goals, such as an adoption rate of digital R&D and design tools in key light industry enterprises of 90 per cent by 2027, include:

- Integrate new-generation IT through the adoption of data management platforms in firms and industry-specific roadmaps for digital innovation

- Promote high-end technologies, create industrial hubs with advanced digital infrastructure (5G, data centers, etc.) and promote data sharing within these hubs

- Enforce compliance with standards, issue guidelines, evaluations and benchmarks

MERICS comment: The plan highlights China’s commitment to integrating traditional industries into the broader vision of “Chinese-style modernization” that President Xi Jinping has put at the heart of policymaking. It aims at transforming traditionally low-tech, labor-intensive sectors (e.g. furniture, lighting, papermaking, leather) into high-tech hubs amid increasing competitive pressure from lower-income countries in these sectors. If China succeeds in fostering digital innovation in light industries using AI, information sharing and emulation among actors, it could lead to challenges from ‘new champions’ in segments that Western companies currently dominate. It could also help boost efficiency in these sectors.

Domestically, the policy could benefit companies on both sides of the equation by boosting demand for digital transformation providers and stimulating efficiency gains for companies adopting it. This kind of ‘virtuous cycle’ is increasingly common in China’s industrial policy. Domestically, it risks widening social disparities, as employees in these sectors may be difficult to reposition into more technology-intensive jobs. The plan therefore announces major investment in the training of new engineers.

For European companies, the plan is likely to drive competition risks for those facing competition from Chinese firms that have the government weighing in on their side with continuous upgrading. However, for European companies that rely on importing Chinese light manufacturing goods for wholesale and retail, cheaper and better made Chinese goods could be a positive.

Article: Implementation plan for the digital transformation of light industry (关于印发轻工业数字化转型实施方案的通知) (Link)

Issuing Bodies: MIIT, MOE, SAMR

Date: March 28, 2025

Noteworthy

Policy news

- March 27: The MIIT issued a notice on opening the ‘Enterprise Innovation Points System’ service platform and granting access to government departments or direct access for enterprises. The ‘Enterprise Innovation Points System’ aims to connect innovative companies with benefits, such as better financing opportunities (MIIT notice).

- April 2: The National Development and Reform Commission (NDRC) and five other departments issued an action plan for the heat pump industry. It envisages energy efficiency improvements to heat pump products of more than 20 per cent by 2030, and technological breakthroughs in high-power, high-temperature heat pumps, high-efficiency compressors, and new refrigerants (NDRC action plan).

- April 28: The MIIT released the 2025 edition of typical cases of smart manufacturing, which serve as the basis for construction of smart factories and the creation of smart manufacturing standard systems. The edition contains 40 typical scenarios across eight links (MIIT notice).

- April 29: The NDRC and two other agencies published instructions on removing market access barriers set up by government departments on different administrative levels. These include violations of market and investment access rules for foreign companies (NDRC notice).

- May 7: The Ministry of Finance (MOF) issued a notice on carrying out the third batch of pilot work for the digital transformation of SMEs. The 34 pilot cities that will be selected in 2025 are tasked with upgrading traditional industries, promoting strategic emerging industries, and selecting SMEs in key links of the industrial chain (MOF notice).

- May 14: The MIIT released instructions for selecting the seventh batch of ‘Little giant’ companies in 2025. Applications by companies with an annual operating income of less than CNY 50 million will not be accepted this time (MIIT notice).

- May 14: The Ministry of Science and Technology (MOST) and six other agencies issued policy measures to construct a financial system focused on science and technology and to boost China’s self-reliance in science and technology. The measures include setting up an institutional coordination mechanism between seven different departments to improve policy effectiveness, consistency, and information sharing (MOST notice).

- June 4: The MIIT and the Chinese Academy of Sciences (CAS) published a call for applications to ‘unveil the list’ related to high-performance bioreactors. Successful applications are expected to produce innovative research solutions in the three categories of reactor systems, key components and consumables, and industrial operating systems (MIIT and CAS application call).

Corporate news

- February 24: Alibaba Group announced that it will invest USD 53 billion in cloud computing and AI over the next three years. The company wants to integrate AI across its various business segments, including enterprise and consumer applications, as well as e-commerce, to improve the customer experience and boost growth (Euronews).

- March 12: Mercedes-Benz is partnering with Hesai to develop smart cars for global markets. Hesai is China’s leading maker of lidar sensors, which are important for automakers as they are part of many self-driving systems under development (Reuters).

- March 21: AstraZeneca is investing USD 2.5 billion in a research and development hub in Beijing, in a bid to partner with the city’s cutting-edge biology and AI scene and deliver innovative medicines worldwide. The move follows a string of scandals, including the arrest of AstraZeneca’s China president in 2024 (Reuters).

- March 31: The Civil Aviation Administration of China issued the first air operator certificates in the country’s autonomous passenger drone sector, a major step in boosting the ‘low-altitude economy’. Two companies, EHang Holdings and Hefei Hey Airlines, can now offer commercial passenger services in unmanned aerial vehicles (SCMP).

- May 15: MOST announced the establishment of a national venture capital guidance fund to support strategic emerging industries. The fund will run for 20 years and provide CNY one trillion (USD 138 billion) to innovative firms (Yicai Global).

- May 26: Chinese chipmaker Hygon Information Technology and server manufacturer Dawning Information Industry announced plans to merge through an all-share swap amid China’s drive for self-reliance. Sugon and a group of state-owned investors already hold nearly 45 per cent of Hygon (Caixin Global).

- May 28: A survey by the European Chamber of Commerce in China found that 71 per cent of respondents perceive China’s economic slowdown as the biggest challenge to their business in the Chinese market, while only 47 per cent cite the US-China trade war. According to the survey, a record 63 per cent also reported missed business opportunities in 2024 due to regulatory and market access barriers (Financial Times).

- June 6: The European Union will restrict Chinese medical device manufacturers’ access to public procurement in the single market through the use of the International Procurement Instrument. The measure is a response to EU medical companies’ increasingly limited access to public procurement in China (Euronews).

The authors would like to thank Anna Cruz, Research Intern in the MERICS Economy and Industry Program from April to June 2025, for her contributions to this MERICS China Industries.