Healthcare procurement + Bidding and tendering + Data exports

MERICS Top 5

1. Bulk buying: Healthcare authority expands centralized procurement

At a glance: The National Healthcare Security Administration released measures to enhance the coordination between local governments on centralized procurement. Also known as volume-based procurement (VBP), centralized procurement refers to the purchase of pharmaceuticals and medical consumables in large quantities at reduced prices. The policy aims to:

- Have all provinces carry out at least one batch of centralized procurement for pharmaceuticals by the end of 2024, bringing the total number of drugs acquired through VBP at the provincial and national level up to 500 from 450 currently

- Strengthen the national coordination of centralized procurement policies at the provincial level

- Prevent local protection and discrimination against suppliers based on ownership, place of registration, size, or other unreasonable conditions

- Counter corruption, through more rigorous application of centralized procurement arrangements, so that local governments adhere to the agreed volume, price, etc.

MERICS comment: Since 2019, Beijing has gradually expanded the centralized procurement of pharmaceuticals and medical consumables. This approach has brought about substantial decreases in the cost of some medical products and is seen to combat corruption in the healthcare system. However, the excessive focus on price means that lower quality, potential less effective and riskier drugs and consumables could be selected as part of the scheme.

Officially, centralized procurement should not discriminate against foreign firms. But in practice it puts them at a disadvantage and advances the government’s localization efforts. Foreign firms are often unable to meet the drastic price reductions required to participate. Securing market share under such circumstances may require selling products at a loss. Following the introduction of VBP for artificial joints in 2021, the share of domestically produced products increased to 58.4 percent in 2022, up from 30 percent in 2020.

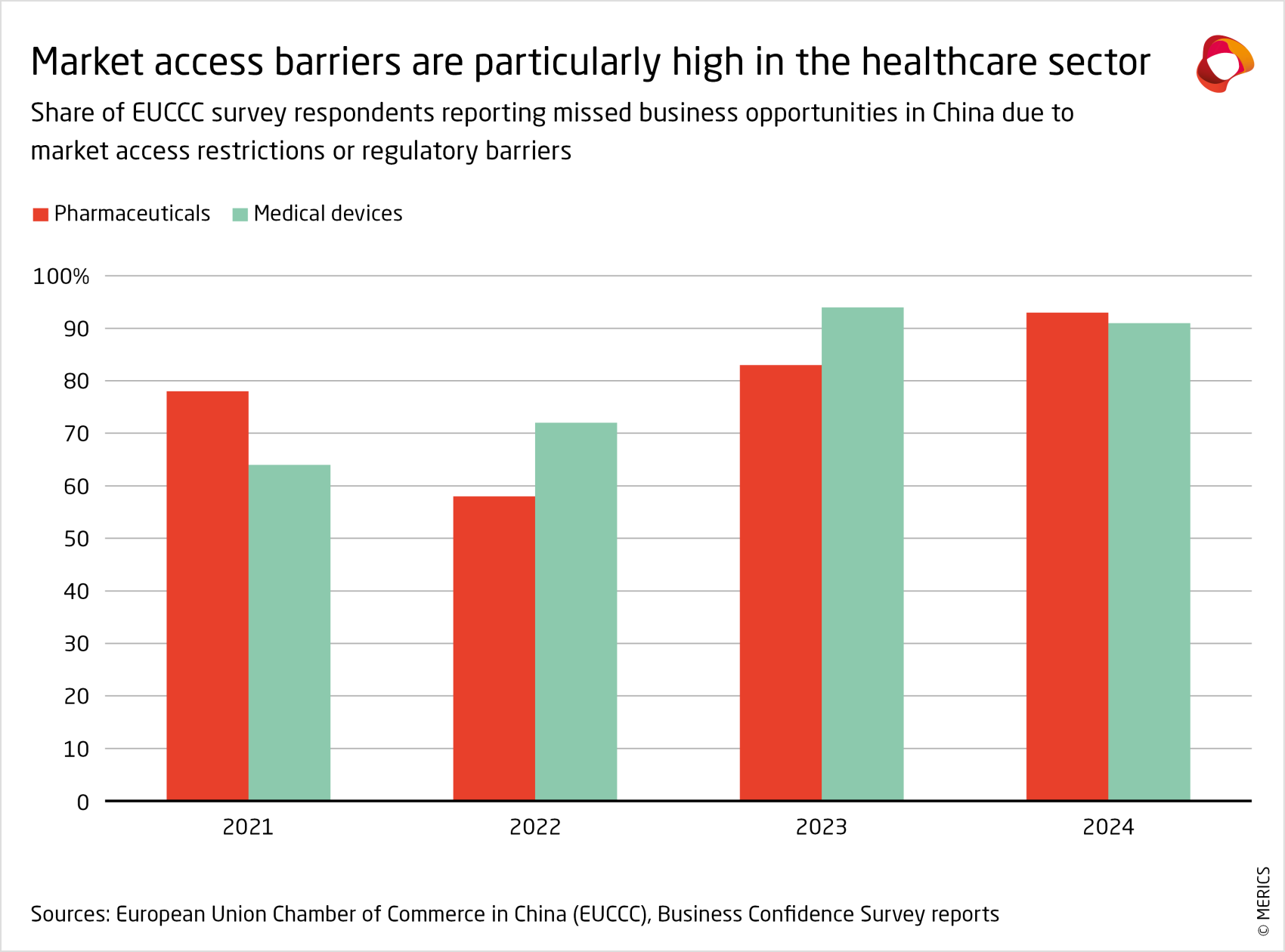

Market access is becoming ever more challenging for foreign pharma and medical device companies in China (see exhibit below). In addition to the expansion of VBP, hospital executives in China report that implementation of Document 551, a local content checklist including hundreds of medical items, is becoming more strict. The government’s corruption crackdown on the healthcare sector could also make hospitals more cautious in contracting foreign firms as suppliers, lest they be seen as engaging in corrupt practices for choosing a more expensive option.

Article: Notice on Strengthening Regional Collaboration to Improve the Quality and Expansion of Centralized Purchasing of Pharmaceuticals in 2024 (国家医疗保障局办公室关于加强区域协同做好2024年医药集中采购提质扩面的通知) (Link)

Issuing body: NHSA

Date: May 20, 2024

2. State Council vows to make bidding and tendering fairer

At a glance: The State Council issued instructions to improve the administration of national bidding and tendering practices. The document aims to address problems private businesses and foreign firms have had with bidding and tendering processes with actions aimed to:

- Standardize bidding processes by streamlining regulations and approval, licensing, and registration processes

- Reduce restrictions and barriers which hinder bidding processes, including unlawful restrictions based on bidders’ geographical location or ownership

- Increase the punishment for illegal activities such as excluding and restricting potential bidders, illegal subcontracting, bribery, and collusion in bidding

- Develop a system for addressing complaints, and enhanced dispute resolution mechanisms and support for businesses to safeguard their rights

MERICS comment: Tendering and bidding processes are a huge business in China and are especially important in sectors where the state dominates demand, such as telecommunications and healthcare. Private and foreign firms have often faced obstacles preventing them from securing a share of the tendering pie, due to favoritism, local protectionism, and corruption. In the past, bidding requirements have been established which impede qualified bidders through unreasonable procurement rules or other forms of manipulation. As such, the harsher punishments for illegal activities and enhanced dispute mechanisms are much awaited.

On May 1, the first ever mechanism for reviewing the fairness of bidding and tendering policies came into effect, and now, with this announcement, it seems that the central government has made improving impartiality of bidding and tendering processes a core focus. The document calls for accelerating the revision to the Tendering and Bidding Law – on ice since being issued for comments in 2019 – as well as the Government Procurement Law.

The EU’s activation of the International Procurement Instrument in April – launching an investigation into procurement practices in the medical device sector in China – increases the pressure on Beijing to improve market access for foreign companies. But it remains to be seen if the promises of fair and open competition will materialize. Officials previously assured foreign firms they would work to create a level playing field in government procurement back in 2021, yet little concrete action has been taken since.

Article: Opinions on Innovating and Improving Institutional Mechanisms to Promote the Standardized and Healthy Development of the Bidding Market (国务院办公厅关于创新完善体制机制推动招标投标市场规范健康发展的意见) (Link)

Issuing body: State Council

Date: May 8, 2024

3. Green channels: Shanghai publishes whitelist for general data exports

At a glance: Shanghai’s pilot free-trade zone Lingang New Area published a whitelist of general data that can be transferred overseas without security assessments by local authorities. The catalog covers three tech sectors – intelligent connected vehicles, biomedicine and public funds – and applies to all enterprises and institutions registered within Lingang New Area for a pilot period of one year. The key features of the whitelist include:

- Permission for data adhering to the criteria to flow freely, once data processors have registered with the Lingang New Area Management Committee

- Categorization of data types according to 11 scenarios such as transnational production and manufacturing, global research and development and after sales service records

- Exclusion of data related to China’s critical infrastructure or personal information from the list

MERICS comment: The publication of the whitelist can be seen as a response to the State Council calling for the establishment of “green channels” for qualified data exports. Since the Cyberspace Administration of China’s (CAC) strict regulation on cross-border data transfers came into effect in 2022, several international companies have struggled with compliance costs and delays caused by certain ambiguities of the regulation, such as the unclear definition of important data. In March, the CAC published a document easing rules for international data transfer in relation to trade, showing that Beijing is currently working to find a balance between control over data flows and the required openness necessary for international business.

The Lingang New Area is a representative pilot project created to provide more clarity for companies regarding data transfers. The drafting process of the list involved the survey of over a hundred companies. International car manufacturers such as Tesla and Porsche were part of the working group compiling the list. In January, the administration already showcased a set of measures for a classified and hierarchical management of data exports, dividing it in three different risk categories, which follows the central government’s classification of core data, important data, and general data. In addition to the extension of sectors covered and updating of the whitelist of general data, it is expected that a negative list for important data requiring security checks will also be published.

Article: List of Scenarios for Cross-Border Transfers of General Data Involving Intelligent Connected Vehicles, Biomedicine and Public Funding (Trial),(上海)自由贸易试验区临港新片区智能网联汽车 / 生物医药 / 公募基金领域数据跨境场景化一般数据清单(试行), (Link 1, Link 2, Link 3)

Issuing body: Lingang New Area Management Committee

Date: May 16, 2024

4. Easing the transfer of genetic samples to speed up drug discovery

At a glance: The National Healthcare Commission (NHC) is about to relax controls on handling human genetic resources, reported Caixin, indicating that this would include both genetic materials like organs, tissues and cells, as well as the related data and information. Officials said that reforms will:

- Raise thresholds for when administrative approval is required, from 3,000 up to 10,000 samples, reducing the administrative burden for healthcare start-ups

- Clarify the definition of “foreign entities” so that Chinese firms that are run by overseas returnees or that have Hong Kong or Macao majority owners are also exempt from administrative approval

- Streamline and optimize the application process

These changes will be part of revisions to the “Detailed Rules for the Implementation of the Regulation on the Administration of Human Genetic Resources”. Responsibility for the process was formally shifted to the NHC on May 1, as part of reforms to the Ministry of Science and Technology.

MERICS comment: The proposed changes are part of Beijing’s efforts to unleash growth and innovation in the pharmaceutical sector by reducing regulatory barriers. More so than in many other sectors, foreign firms stand to benefit from these planned reforms. China wants faster access to the best treatments, and for its research organizations to participate in multiregional clinical trials. Multinationals also have an incentive to include China in these trials, as its size and centralized system could make trials relatively straightforward and affordable.

However, the Chinese government also insists on an approval system whenever foreign entities are involved in collecting human genetic data. Although this process was simplified in 2019, it is still about three months slower than in other countries, and approval is regularly denied. This adds uncertainty to what already is a very costly and uncertain process. Ultimately, multinational pharma firms prefer countries with fewer regulatory hurdles for their medical trials. International investors also invest less in Chinese drug developers because foreign ownership tends to complicate approval processes.

Therefore, Chinese commentators have argued that the current regulations harm China’s ability to benefit from global innovation networks. Although these voices are on the ascent, improvements for foreign firms will be limited by the 2019 Regulations on the Management of Human Genetic Resources and the 2020 Biosecurity Law.

Article: China Set to Ease Controls on Genetic Resources to Plug Biotech Innovation Gap (基因监管酝酿变革为大健康产学研松绑) (Link 1) (Link 2)

Source: Caixin

Date: May 20, 2024

5. Supply chain guidelines emphasize collaboration, efficiency, and security

At a glance: The Ministry of Industry and Information Technology (MIIT) and two other agencies issued guidelines for improving supply chain management in the manufacturing sector. The guidelines are oriented towards enterprises, industry associations and local authorities dealing in high-end, green, and digital manufacturing industries. Key goals outlined in the document include:

- Strengthen cooperation and collaboration within industries, including between large and small firms, and jointly reshape upstream and downstream processes to eliminate unnecessary costs and waste

- Promote the digitalization of supply chains and green supply chain measures, such as carbon footprint accounting, and improve the resilience and security of supply chains

- Build a global supply chain network for enterprises, such as joint international logistics infrastructure

- Encourage industry associations and professional organizations to monitor progress on these targets using a dedicated index system attached to the policy

MERICS comment: The guidelines combine a multitude of Beijing’s ambitions, from industrial upgrading, to decarbonization, to industrial resilience and security. Front and center is the goal to increase efficiency, through the implementation of digital technologies to monitor supply chains and broader logistical cooperation between firms. Increased data collection and analysis would also assist authorities in crafting future industrial policies. For instance, the ability to track activities right along the supply chain would be necessary for China if it is to move to a full-life cycle carbon footprint tracking system, which has been under discussion since 2022.

Equally important, from Beijing’s perspective, are the guidelines’ objectives to enhance supply chain resilience and security, through early warning mechanisms, diversification, stockpiling, and other risk management practices. Against the backdrop of geoeconomic fragmentation and uncertainty, these measures serve to ensure a buffer against the impact of any shocks or disruptions.

In practical terms, the impact of these guidelines for Chinese firms will likely be increased operational costs as they are pushed to invest more in managing their supply chains and coordinating with other firms. While these measures may help to create more efficient and resilient industrial supply chains, in the long-term, they come at the cost of additional regulatory burden for companies.

Article: Guidelines for Improving the Supply Chain Management Level of Manufacturing Enterprises (Trial)(三部门关于印发《制造业企业供应链管理水平提升指南(试行)》的通知) (Link)

Issuing bodies: MIIT, MOT, MOFCOM

Date: May 20, 2024

Noteworthy

Policy news

- May 11: The National Development and Reform Commission (NDRC) issued instructions for local branches to monitor the energy consumption and energy efficiency of major energy consuming work units in their jurisdiction and carry out equipment renewal projects (NDRC notice)

- May 16: The China National Intellectual Property Administration (CNIPA) published 110 tasks to complete in 2024, covering legislation, policies and regulations, to strengthen, intellectual property (IP) protection, administration, and use of IP market mechanisms (CNIPA notice)

- May 17: According to insiders, the MIIT has asked automakers such as SAIC Motor, BYD, Dongfeng Motor, GAC Motor and FAW Group to increase the local procurement share of automotive chips to 20 or 25 percent by 2025; the current localization rate of automotive chips is only about ten percent (Nikkei Asia article)

- May 20: The NDRC released guidelines on the development of smart cities, with goals to deepen the digital transformation of cities through to 2027 and 2030 (NDRC notice)

- May 22: The MIIT issued guidelines for the development of a service-oriented manufacturing standard system, aiming to formulate and revise 20 related standards by 2025 (MIIT notice)

- May 24: The MIIT released the final version of the trial rules for data security risk assessments in the industrial sector, which apply from June 1 onwards (MIIT notice, MERICS coverage of the draft regulations)

- May 27: The CNIPA published an implementation plan for building up China’s IP protection system through to 2035, which emphasizes the need to protect the IP rights of core technologies related to national security and ensure the security of industrial supply chains (CNIPA notice)

- May 27: The National Health Commission released instructions for officials to strengthen oversight of pharmaceutical production and distribution, to accelerate the adoption of volume-based procurement, and combat corrupt practices (NHC notice)

Corporate news

- May 2-3: US law firm Mayer Brown announced that it will split from its China operations, ending a 15-year partnership; US law firm Sidley Austin said that it will close its Shanghai office, consolidating its China operations in Hong Kong and Beijing (Nikkei Asia article, Reuters article)

- May 7: TotalEnergies and Sinopec signed a cooperation deal on climate efforts, pledging to join forces in R&D on biofuels, hydrogen, and carbon capture and storage technologies (Reuters article, Shanghai securities news article)

- May 10: China’s CRRC Corporation Limited unveiled the country’s first smart heavy-load electric locomotive, which can transport nearly 280,000 tons more load annually compared to traditional electric locomotives (S&T Daily article)

- May 13: COMAC announced progress in the development of China’s first independently developed intercontinental passenger aircraft, the C929; the company said that a prototype of the plane will soon be complete, with test flights to follow (S&T Daily article)

- May 15: Researchers in China successfully produced a high-density microwave interconnect module, a crucial component for China’s third-generation superconducting quantum computer which was previously only available from foreign countries (S&T Daily article)

- May 21: Chinese tech giants Alibaba and Baidu engaged in a price war regarding large-language models used to power generative AI products; Alibaba announced price cuts of up to 97 percent, after which Baidu followed by making two of its language models free for all business users (Reuters article, Lianhe Zaobao article)

- May 23: According to an insider, Boeing’s plane deliveries to China have been delayed in recent weeks due to a Chinese regulator review of batteries powering the cockpit voice recorder; Boeing told investors last month that it still expects to deliver most inventoried planes by the end of the year (Reuters article, Guancha article)