Investigating state support for China’s medical technology companies

Medical technologies are a key focus of China's industrial policy strategy and central to Beijing’s plans to move up the value chain. To spur on the development of local firms and promote self-reliance in this highly innovative sector, Chinese officials are steering research into key technologies and offering financial assistance to promising firms. In addition, biased procurement processes and regulatory barriers are limiting market access opportunities for foreign firms.

This study seeks to quantify the value of state support in China's MedTech sector. While data limitations obscure the impact of market access barriers, it shows that measurable forms of financial support directed to Chinese MedTech firms have grown about five times between 2017 and 2022. Beijing is facilitating the rise of increasingly competitive domestic players, posing a challenge for foreign firms both in China as well as abroad.

Research for this study was supported by MedTech Europe. MedTech Europe is the European trade association for the medical technology industry including diagnostics, medical devices and digital health. Its members are national, European and multinational companies as well as a network of national medical technology associations who research, develop, manufacture, distribute and supply health-related technologies, services and solutions. Click here for more information on MERICS standards to maintain independence in research and editing.

You can read the Executive Summary below or download the full report as a PDF:

Executive Summary

For over a decade, China has viewed the medical technology sector (MedTech) as a core priority in its industrial policy strategy. The sector is central to Beijing’s plans to move up the value chain and embodies its ambitions to promote innovation, industrial modernization and digitalization. Its strategic value has increased further in tandem with rising living standards and the greater healthcare demands of China’s aging population. Policy support is actively facilitating the rise of domestic players and poses a growing challenge for foreign MedTech firms.

Distortions in the medical technology sector flourish due to growing policy support

The government is committed to advancing local industrial capabilities in this prominent, high-tech sector, which remains dominated by foreign suppliers. Consequently, high-end medical devices featured among the Made in China 2025 key industries released in 2015. Dedicated development plans for the medical device sector have been released in every five-year period since 2012.

The implementation of such plans has led to the rise of increasingly competitive Chinese firms, while also creating distortions within China’s home market and, by extension, in global markets too. Key facets of the sophisticated support system established in the MedTech sector include:

- Policy guidance: The government calls on officials to cultivate Chinese brands, set global standards and leverage the huge domestic MedTech market (worth EUR 135 billion in 2022) to attract foreign firms.1

- Financial measures: Companies benefit from subsidies, assistance with R&D funding, tax concessions, additional equity provided through state guidance, etc.

- Innovation focus: Public research labs, national manufacturing innovation centers and subsidized platforms are deployed to develop advanced medical technologies.

Officially, these measures benefit the whole sector without discriminating against foreign firms active in China. But in practice, Chinese firms tend to benefit the most, due to an overall political climate focused on self-reliance and import replacement. The following measures, for example, are indicative of discrimination against foreign companies:

- Biased procurement: Local content requirements and the shift toward volume-based procurement (i.e., purchasing a high volume of products at lower prices) increase the hurdles for foreign manufacturers in China’s market.

- Localization of value chains: Foreign firms are pressured to locate their production and R&D activities within China, or risk exclusion.

- Regulatory barriers: For instance, China’s rules mandating approval in the ‘country of origin’ significantly delay regulatory clearance for imported products as they must first gain approval either in the country where the market authorization holder is based or in the country of manufacture.

Financial support measures give China’s MedTech firms a significant boost

China is developing a new blend of state capitalism to guide financial markets toward national technological priorities. The government has increased tax incentives for R&D investment and guided financial markets to allocate capital to innovative companies. The results are apparent in the MedTech sector.

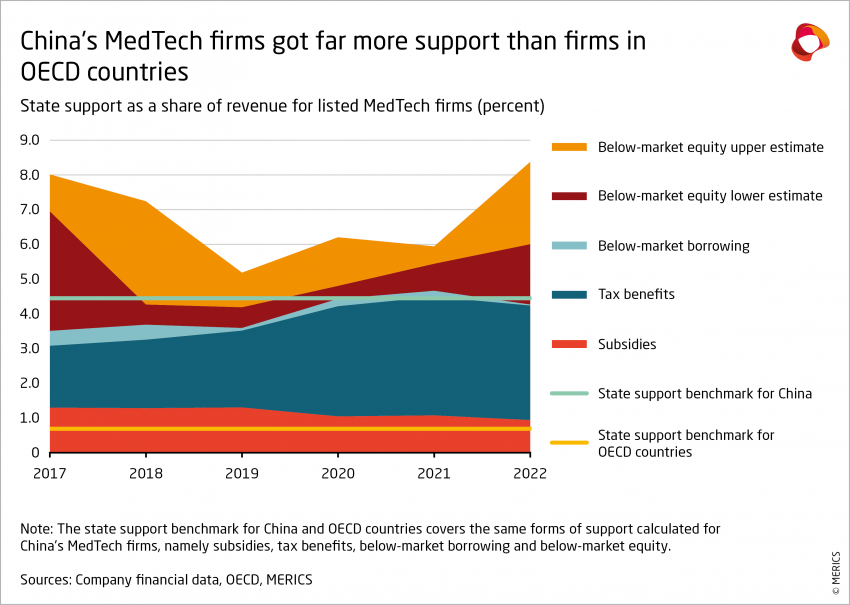

Based on the financial data of 122 Chinese MedTech firms listed on the Shanghai, Shenzhen and Beijing stock exchanges, it is possible to calculate the value of direct subsidies, tax benefits, below-market borrowing and, more roughly, below-market equity.2 The results show that:

- Between 2017 and 2022, the 122 firms have seen their access to government support increase about five times, from EUR 655 million to EUR 2.8 – 3.8 billion (from CNY 5 billion to CNY 20 – 27 billion).

- Over the same period, measured state support was equivalent to about 6 percent of firm revenue, plus or minus 0.8 percentage points based on the estimate for below-market equity. Put another way, state support directed to China’s MedTech companies was worth approximately 28 percent of company net profit, or 77 percent of R&D expenses.

These results indicate that China provides significantly more state support than other advanced economies. According to the OECD, between 2005 and 2019, the same forms of support amounted to approximately 4.45 percent of revenue for firms in China on average in 13 sectors, compared to just 0.69 percent of revenue for firms in OECD countries.

In addition, about 10 percent of government R&D spending, or EUR 5.6 billion (CNY 40 billion) was spent on medical technology in 2022. This figure was calculated based on the relative importance of medical technology in China’s S&T Megaprojects, the National Key R&D Program and projects funded through the Natural Science Foundation of China.

These measurements do not cover all forms of state support afforded to MedTech firms in China. Some distortions within China’s MedTech market are particularly difficult to track, such as the industrial policy guidance and regulatory hurdles described above. However, this data is already enough to show that China's state support distorts MedTech markets.

Chinese firms are increasing their presence in third markets

China’s growing role in the international MedTech trade reflects a trend toward increased competition in third markets. In 2000, China made up less than 3 percent of global trade in MedTech products by value. By 2021, China accounted for 12.4 percent of exports and 8 percent of imports. Key insights from the trade data include:

- China increased its share of global exports in a broad range of product categories, such as medical consumables, patient aids and dental products, where it accounted for about 20 percent of global exports in 2021. It also made advances in diagnostic imaging (11 percent of global exports) and became the top exporter of medical syringes in 2021.

- China’s rise in global MedTech exports seems to have impacted US exports most. China’s share of global exports rose from 2.3 percent in 2000 to 12.4 percent in 2021, while the US share fell from 36.5 percent to 22.5 percent. Meanwhile, the share enjoyed by the EU (up from 25.4 percent to 26.9 percent) and other important exporters grew slightly over this period.3

The reasons why US exports have been more impacted than EU ones may stem from more product overlap, a stronger tendency toward offshoring by US-based firms in recent years, or EU firms’ greater resilience, thanks to brand reputation and standards. In any case, EU firms are likely to face greater competition as Chinese firms move into more high-end MedTech products and improve quality standards.

Indeed, China is striving to develop local firms to cover all segments of the MedTech industry and supply chain. Local firms will probably acquire more domestic market share before setting their sights on internationalization. Firms such as Mindray (a manufacturer of patient monitoring, in vitro diagnostic, and imaging equipment) and United Imaging (a producer of imaging equipment) are already global players.

China’s MedTech SMEs, particularly Little Giant firms that enjoy special government backing, will pose a growing challenge for foreign firms. The lines between private and state ownership are becoming blurrier under China’s current economic model, which tries to blend market forces with state intervention. Little Giant companies – of which there are approximately 320 in the MedTech sector, including Endovastec, Sinomed and iRay Technology – are developing local alternatives to imported products and looking to expand overseas as well.

The plentiful state aid and protectionism outlined in this report are likely to provide ongoing boosters to the competitiveness of China’s MedTech players in third markets. The home market advantage afforded to these firms can be projected overseas. Chinese firms can more readily lower margins abroad to secure market share. Such price competition also risks reducing rivals’ profitability and their ability to fund further R&D. The high degree of state support within China poses an increasing challenge for all non-Chinese firms around the globe and one that could hinder advances in innovation.

- Endnotes

-

1 Witmed, “China’s Medical Device Market Is the Second Largest in the World at 958.2 Billion! 中国医械市场全球第二,规模9582 亿!,” May 4, 2023, http://www.cn-witmed.com/list/13/6215.html.

2 | Tax benefits include tax deductions for R&D activities and preferential tax rates for high-tech firms. Below-market borrowing refers to loans provided with discounted interest rates. Below-market equity refers to additional equity contributions made to firms through state actors or government guidance. Due to the opaque nature of this form of state support, we provide a lower (more conservative) and upper (more realistic) estimate of its potential extent.

3 | The other important exporters are Japan, Malaysia, Mexico, Singapore and South Korea