The bumpy road ahead in China for Germany's carmakers

Key findings

- Germany’s carmakers and policymakers share an interest in the long-term success of the German automotive industry. However, they are no longer aligned on how best to achieve this goal and to calibrate exposure and entanglement with China.

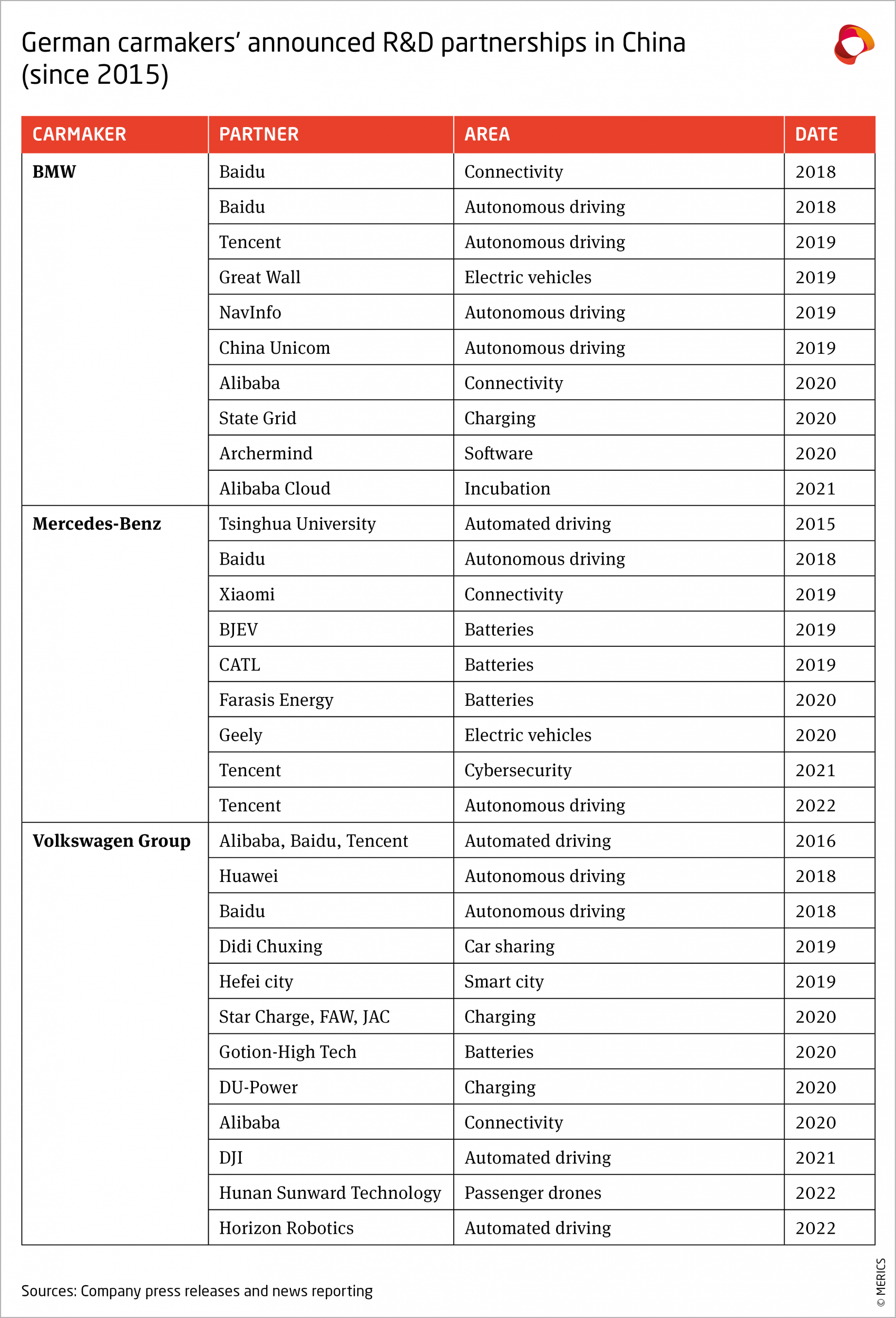

- German carmakers are deepening their integration into China's innovation system. By establishing partnerships with Chinese tech companies and increasing investment into research and development (R&D), they are trying to retain their market shares in China's emerging electric vehicle (EV) market.

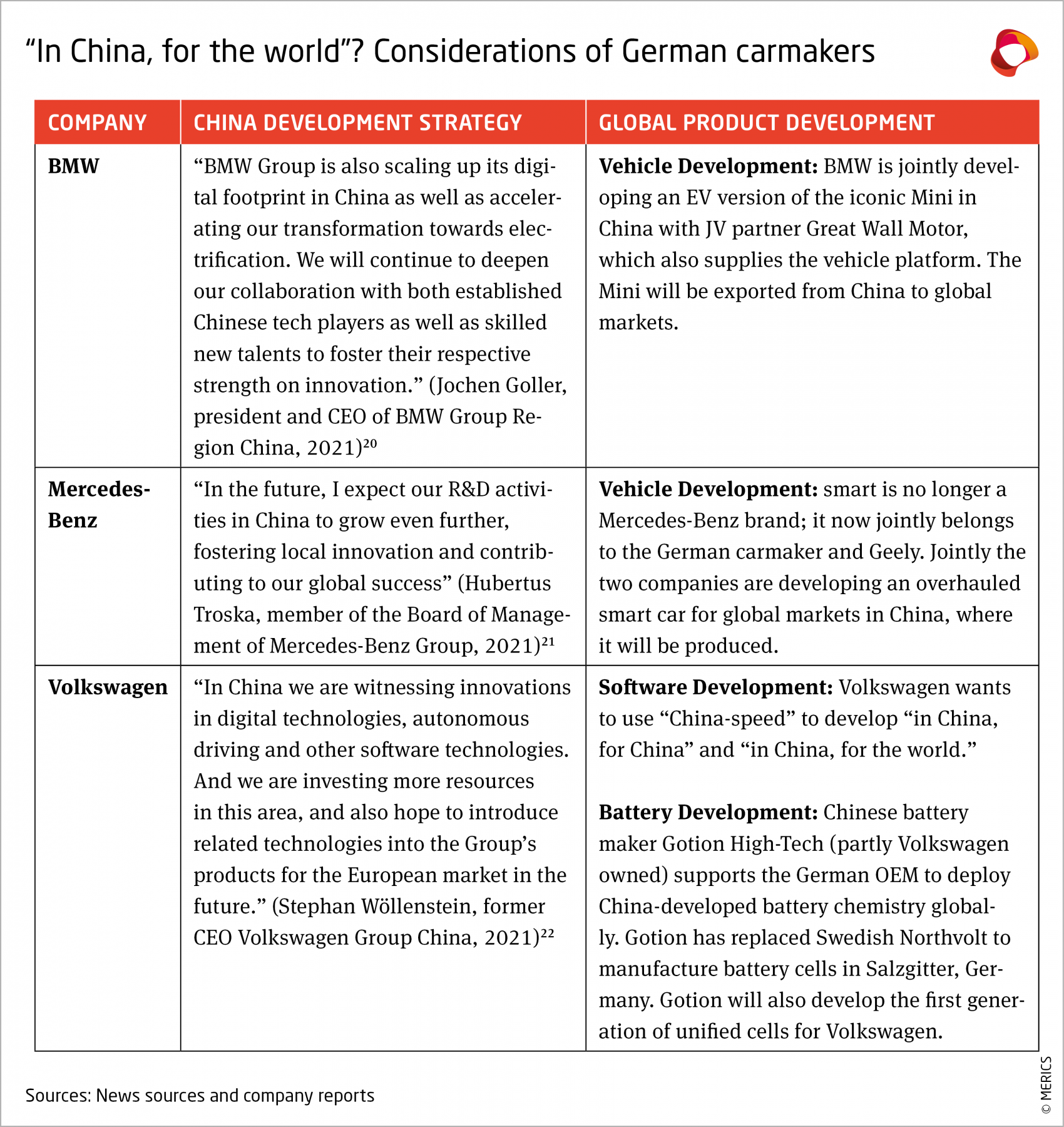

- For some technologies, German carmakers are moving away from a “in China, for China” R&D strategy to what could become an “in China, for the world” one. They are increasing their product development and research activities in China not just for the local market but for the global one, too.

- Their new China investments could help German carmakers remain globally competitive and even outpace their rivals. However, the political and geopolitical circumstances of the last 30 years with regard to China have changed, and their deeper integration now takes place in a radically different environment.

- The new China investments of German carmakers could disrupt their strategic alignment with their country’s policymakers. While the investments could help them retain their global competitiveness, these might also benefit China’s economy more than Germany’s.

- German carmakers are in a bind between holding back on further investments in China and potentially losing global competitiveness. A greater entanglement in Beijing’s goals can potentially alienate key stakeholders including in government and civil society as well as investors.

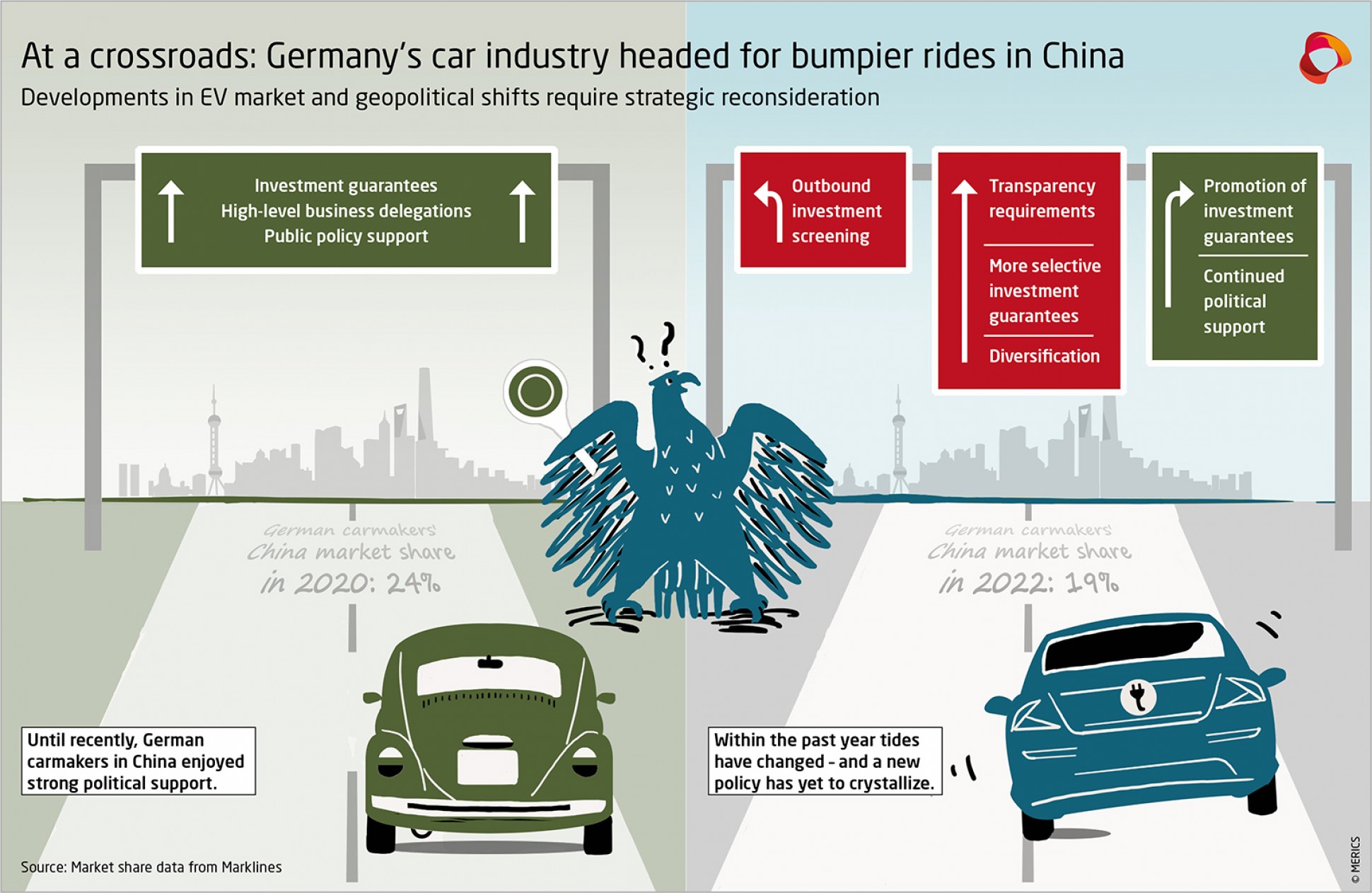

- Under these circumstances, Germany’s government should reconsider the logic of what has come to be called automotive foreign policy. Going forward, what is good for German carmakers in China might not be good for Germany (and Europe). Policymakers should assess the new realities and fine-tune government support mechanisms, such as investment guarantees, for the long-term benefit of the German economy.

1. Strategic alignment between Germany’s government and car industry is no longer a given

The deep entanglement of Germany’s automotive companies in China has long been a main driver of Berlin’s China policy. CEOs of German carmakers have been frequent participants in government-organized trips to China. All-cabinet government consultations were used to shape corridors for future cooperation, for instance, on autonomous driving.

Germany’s government has frequently lobbied on behalf of the country’s automotive industry and used foreign economic policy tools to create a supportive environment. The logic for this has long been that what is good for German carmakers in China is also good for Germany (and Europe). After all, in Germany the automotive sector accounts for nearly 10 percent of GDP, 40 percent of research and development (R&D) spending and employs 800,000 people in manufacturing.

However, the combination of a more assertive China and emerging Chinese competition create new risks for this long-standing symbiotic relationship. While there is a lot of uncertainty in their boardrooms, Germany’s carmakers still want to increase investment and deepen their R&D footprint in China. Meanwhile, many policymakers increasingly highlight growing economic dependencies, human rights, and geopolitical concerns, often with an undercurrent of fear that Europe could lose its industrial competitiveness.

Government and carmakers still share an interest in the long-term success of the automotive industry. But strategic alignment on how best to achieve this goal and to calibrate exposure and entanglement with China is no longer a given. Concerns about the country are proliferating. China’s recent economic coercion of Lithuania by severing its trade relationship, Germany and China’s diverging views of Russia’s invasion of Ukraine, and concerns related to the human rights situation in China and the future of Hong Kong or Taiwan are issues that cannot be swept under the carpet.

The changed political climate in Germany is already affecting carmakers’ China investments. In May 2022, the government denied Volkswagen’s request to prolong the investment guarantees – a form of political risk insurance – for some of its China investments, due to the possibility that this could support human right abuses.1 Furthermore, considering the vulnerabilities exposed in Germany’s relations with Russia, politicians have become more vocal in calling on carmakers to diversify away from and to reduce their dependence on China.2

The shift in Sino-German relations has not gone unnoticed by Germany’s three big carmakers: BMW, Mercedes-Benz, and Volkswagen. They debate the topic internally and their managers are aware of the challenges in terms of business outlook and political environment. Nevertheless, these companies are doubling down on their already substantial investments in China. As they rapidly lose to the country’s emerging electric vehicle (EV) companies, and as global high-tech decoupling tendencies become more pronounced, the three carmakers seem to consider greater local presence a rational response.

Volkswagen calls China “the second home market.”3 In June this year, BMW opened its fourth factory in the country while Audi’s new joint venture (JV) with FAW broke ground on its plant in Changchun.4 Germany’s automotive investment stock in China increased by 65 percent between 2015 and 2020 to total EUR 33.6 billion.5

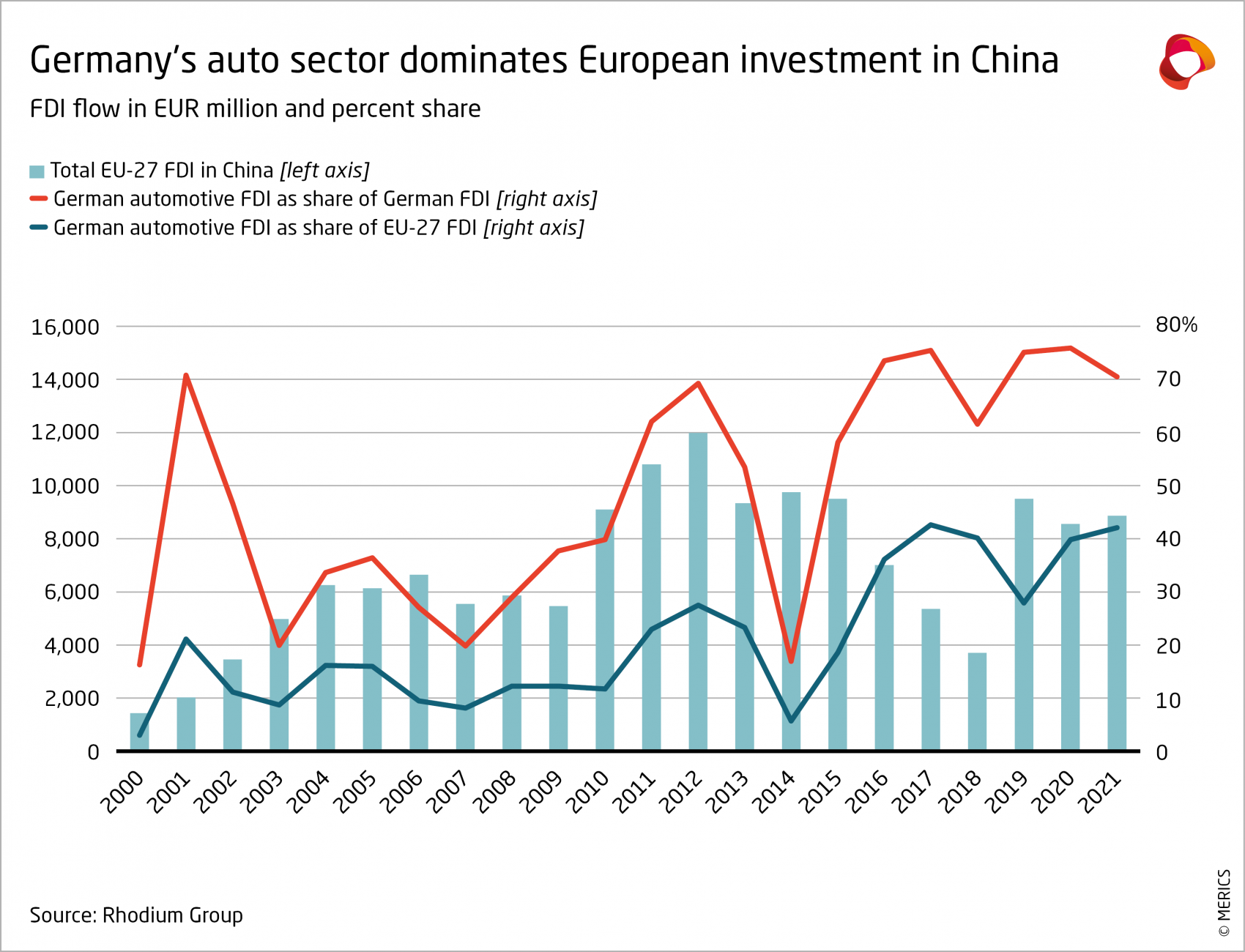

China is also the exception to the trend of Germany’s falling automotive FDI: without it, Germany’s total automotive FDI stock would have fallen by EUR 5.8 billion over the same period.6 Carmakers are the key players to watch in this story, as they have an outsized role in investment relations – when they set up new plants, the suppliers usually follow.

The investment decisions of the three carmakers are by no means just an issue for Germany. The country’s automotive sector is the centerpiece in EU-China economic relations. In 2021, its investment accounted for 42 percent of EU FDI in China. At the same time, the industry losing global market shares would have severe implications for manufacturing networks throughout Europe, due to the cross-border nature of its value chain.

It would be easy to blame the carmakers for the slow unraveling of the industry’s strategic alignment with at least some stakeholders in the government as a result of blindly pursuing short-term profit and ignoring political change in China. But the issue is more complex. China is not only a sales market for Germany’s carmakers; it has become the world’s leading EV market, and it may well be the linchpin for their global competitiveness. In other words, success in China could be instrumental to secure profits for reinvestment and maintain the strength of German companies in their home and third markets.

This report provides an assessment of the German carmakers’ case for more investment in China, as well as an analysis of the opportunities and risks that arise from deepening ties with the country for them and the government.

2. China’s innovative EV market provides opportunities and risks for German carmakers

China’s automotive market has become increasingly innovative and characterized by homegrown technological advances. That has put the German carmakers on the back foot. To retain their competitiveness, they believe they need to tap into China’s innovation ecosystem and deepen their investment footprint in the country.

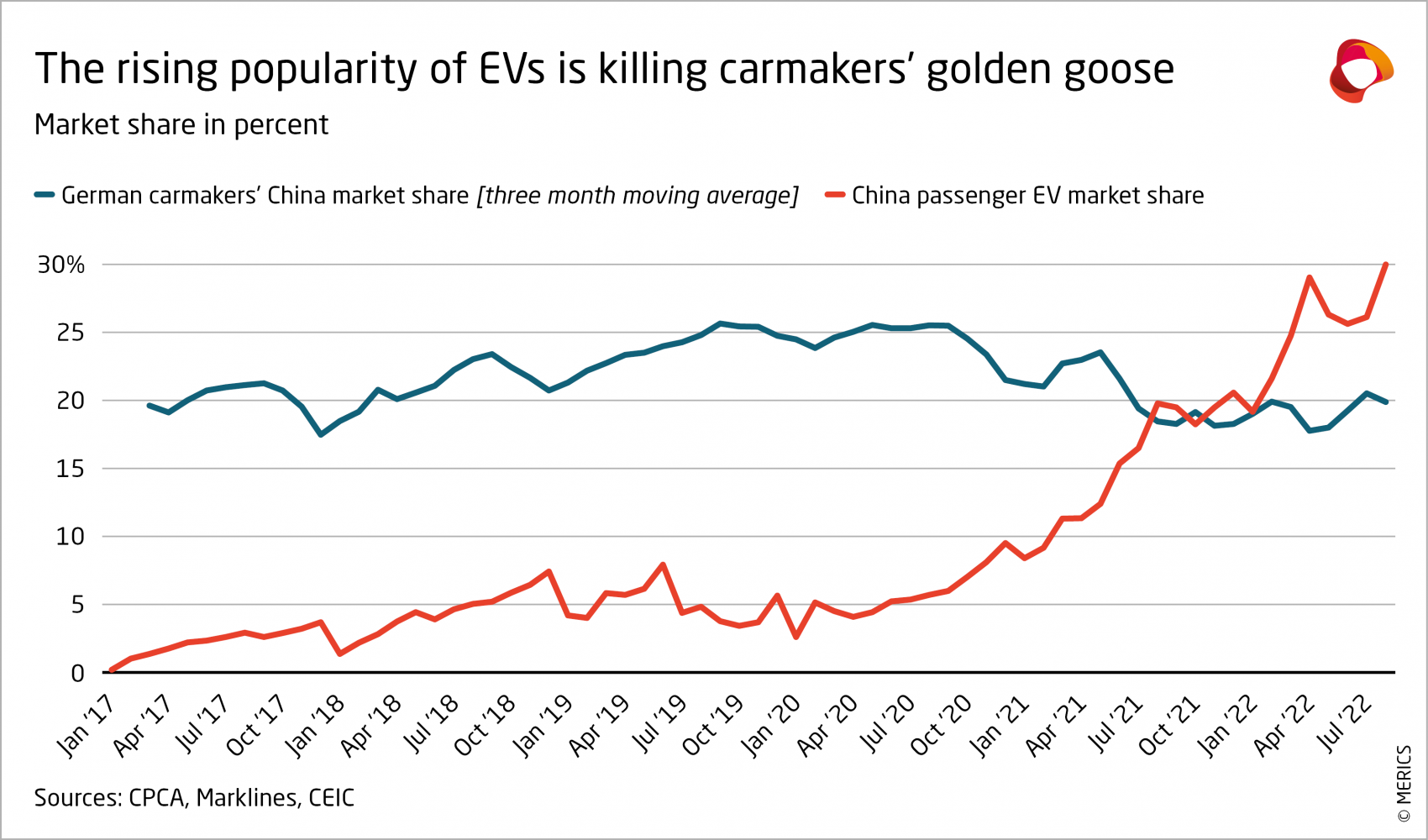

The most significant factor contributing to this emerging reversal of fortunes is China’s rise as the world’s leading market for EVs. Over 55 percent of all EVs drive on Chinese roads,7 and one out of four new cars sold in China is powered by an electric battery.8 At the same time, the capital injections of German carmakers are now also focused on producing and developing EVs.

Investment trend 1: Greater autonomy through more equity

China’s government believes that its carmakers are ready to benefit from international competition and it supports foreign investments in its EV sector. Hence, it has relaxed restrictions on foreign investment, which has allowed German carmakers to increase equity stakes in their Chinese joint ventures. They have been eagerly making use of these policy changes to increase their profit margins and decision-making power.

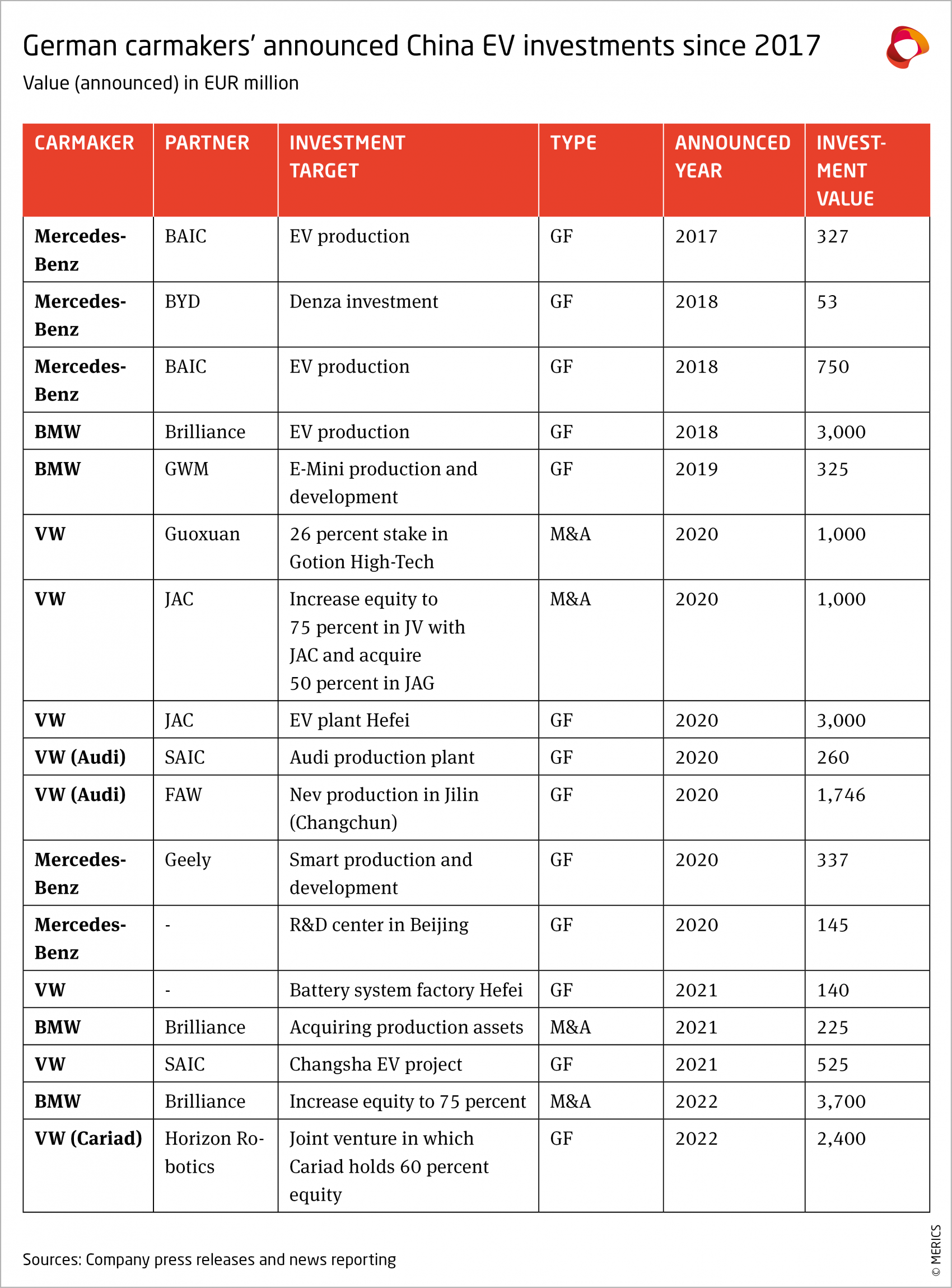

Prime examples include BMW increasing its equity stake in its JV with Brilliance Automotive from 50 to 75 percent for EUR 3.7 billion and Volkswagen entering into a JV with JAC Motor. The latter is entirely focused on EV production and development, with Volkswagen having a 75 percent majority stake (it also has a 50 percent stake in JAC Motors parent, JAC Group).

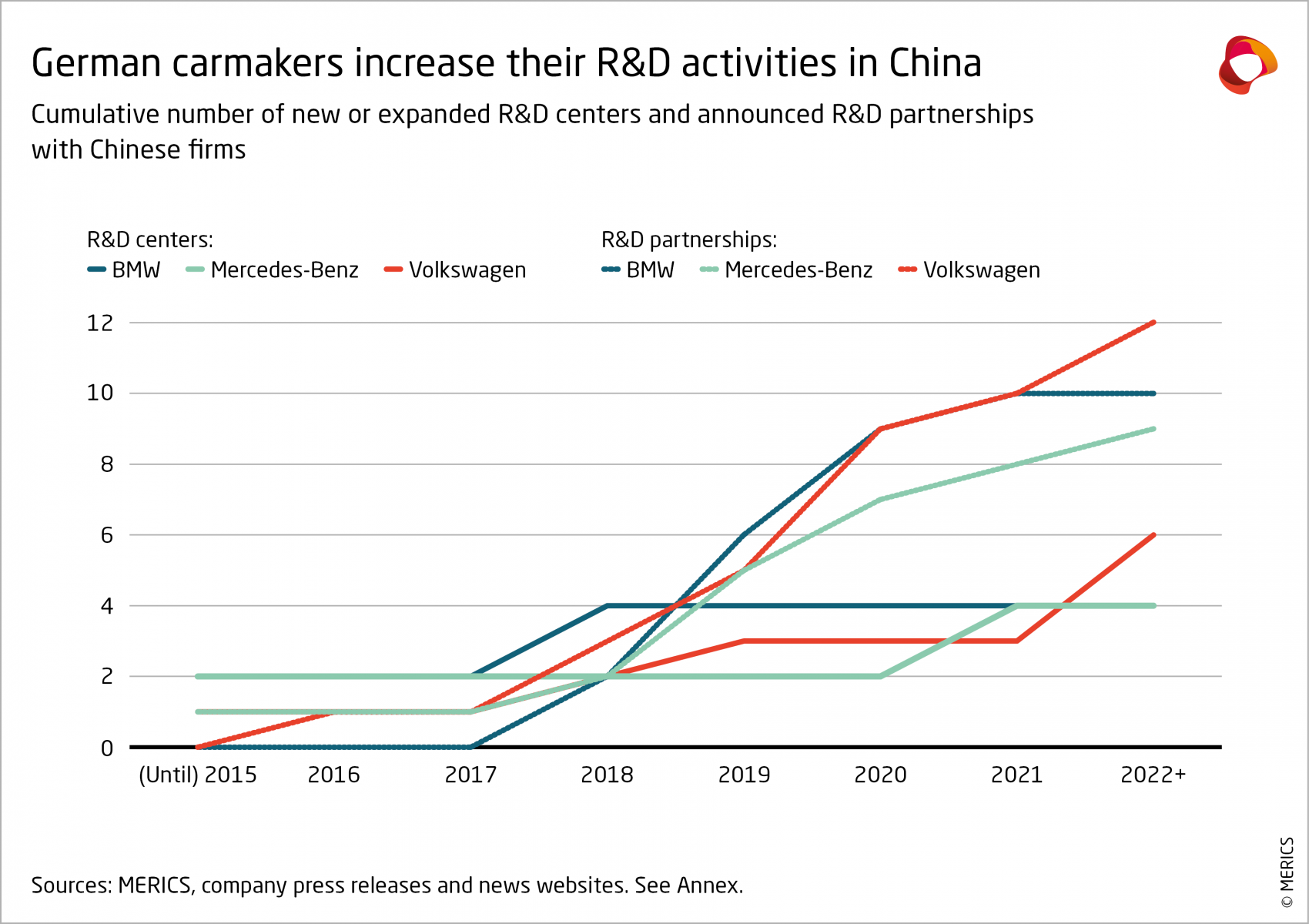

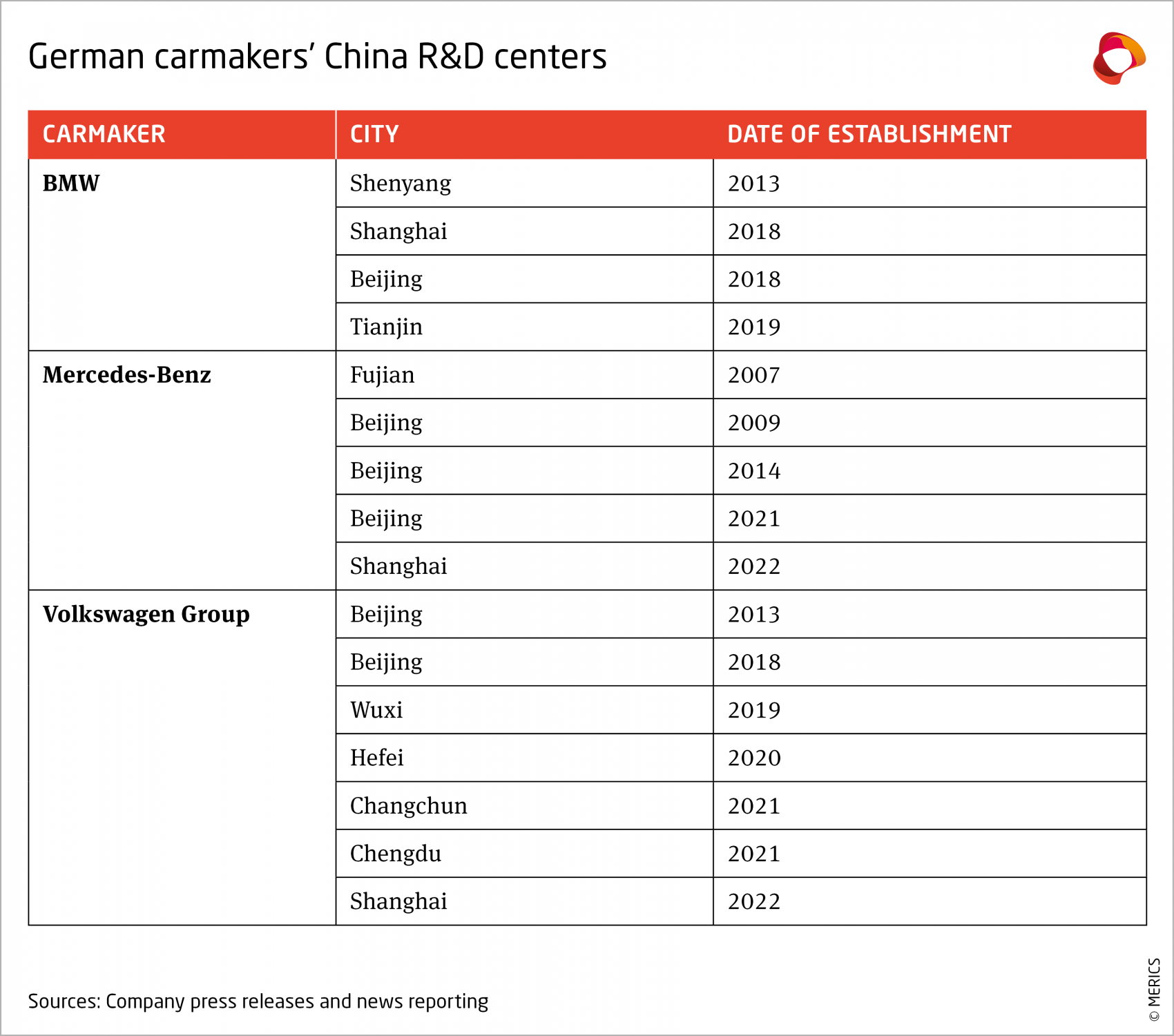

Investment trend 2: Transform China into one of their automotive R&D hubs

The biggest change in German carmakers’ investment patterns in China is that they are channeling significant amounts into local R&D. Volkswagen’s software subsidiary, CARIAD, is now located in Beijing, making it the company’s first non-European R&D hub. Plans are afoot to double current employee numbers to 1,200 by 2023, with then-CEO Herbert Diess in July 2022 forecasting “several thousand more software people in China” in the coming years.9 Mercedes-Benz is spending heavily on its new 55,000 sq. m. China tech center in Beijing – almost double the size of its recently opened battery e-Campus in Stuttgart (see Exhibit 2).

In previous decades, German carmakers only undertook minimal research in the country. Fearing technology leakage, they located as little development as possible in China, for instance, to build slightly longer and more comfortable cars for Chinese customers. Now, their greater worry is to fall further behind Chinese competitors. The days where nearly all core product development took place in Munich, Stuttgart, or Wolfsburg are over.

Investment trend 3: Tap into China’s technology ecosystem

In addition to R&D investments, the three carmakers are also looking for partners in China’s technology ecosystem. They want to pair their hardware know-how with Chinese software skills through development partnerships.

As part of what has been described as Germany’s “automotive foreign policy,” the government had signaled its support for such technology partnerships.10 Today, all three carmakers collaborate with Baidu, while BMW has also formed a JV with the Chinese software developer Archermind. More such collaborations are likely – for example, BMW and Alibaba Cloud are running a joint innovation base in Shanghai with the aim to “scout high-potential startups to match their innovative solutions with BMW Group’s needs.”11

For the moment, these partnerships are focused on a narrow set of technologies: batteries and digital solutions. Non-Chinese firms like Bosch and Qualcomm remain key suppliers of most other hardware stacks for the German carmakers. But Chinese partners are clearly becoming more integral to their product development (EV batteries and, prospectively, semiconductors). At the same time, some Chinese partners like Baidu are starting to enter the car business themselves, making them potential rivals too.

Investment motivation 1: Stave off pressure from Chinese competitors

A key reason behind this pattern of changing investments and partnerships is that German carmakers want to fend off their biggest crisis yet in China. They have recently been caught off-guard by severe losses in market share in the country as consumers turn to buying EVs. Their market shares in China and EV sales there are inversely related – the more EVs that are sold, the lower their market share. In the period from January to May 2022, it was down 24 percent compared to the same period in 2020 (see Exhibit 3, Exhibit 4).

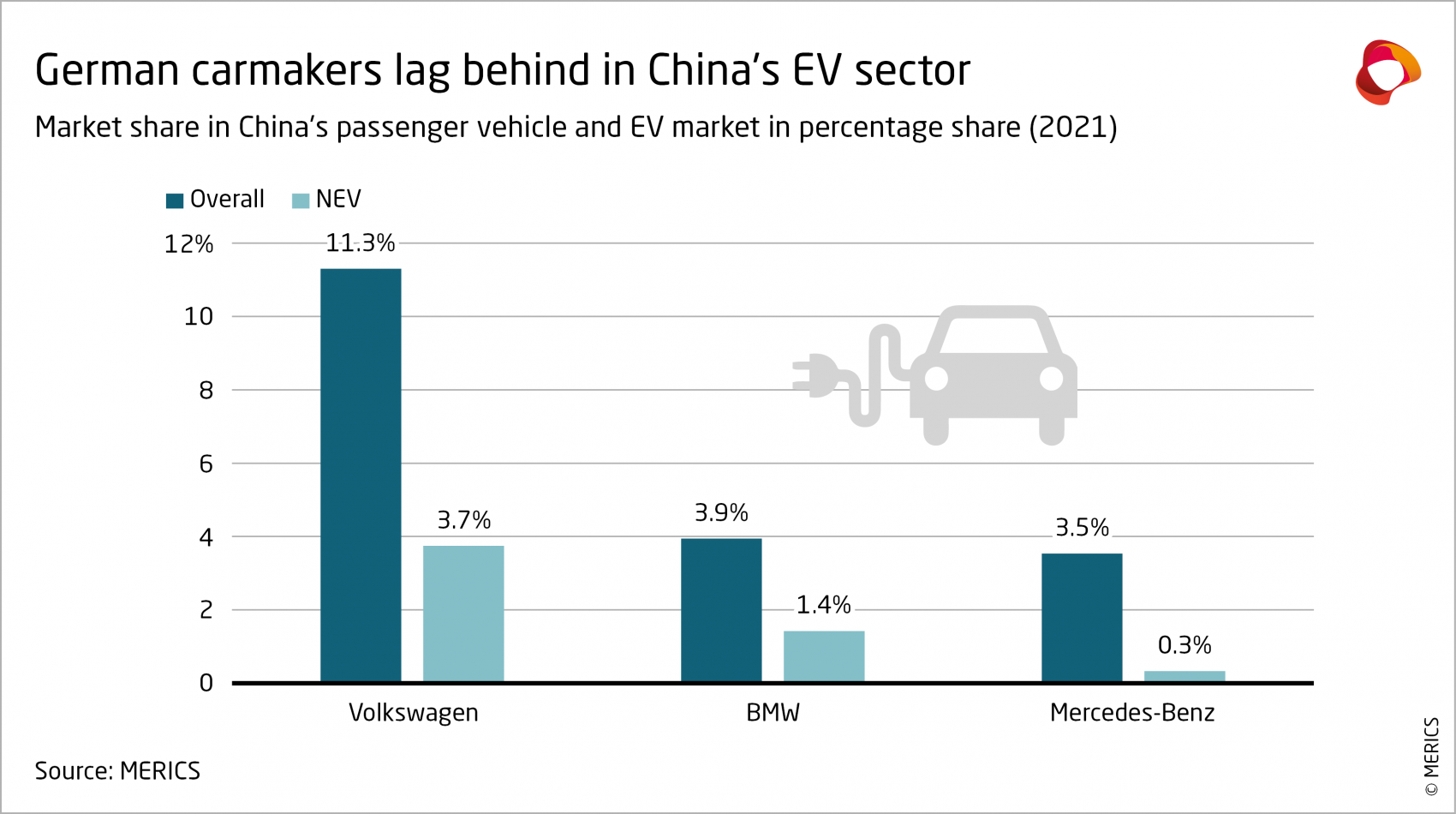

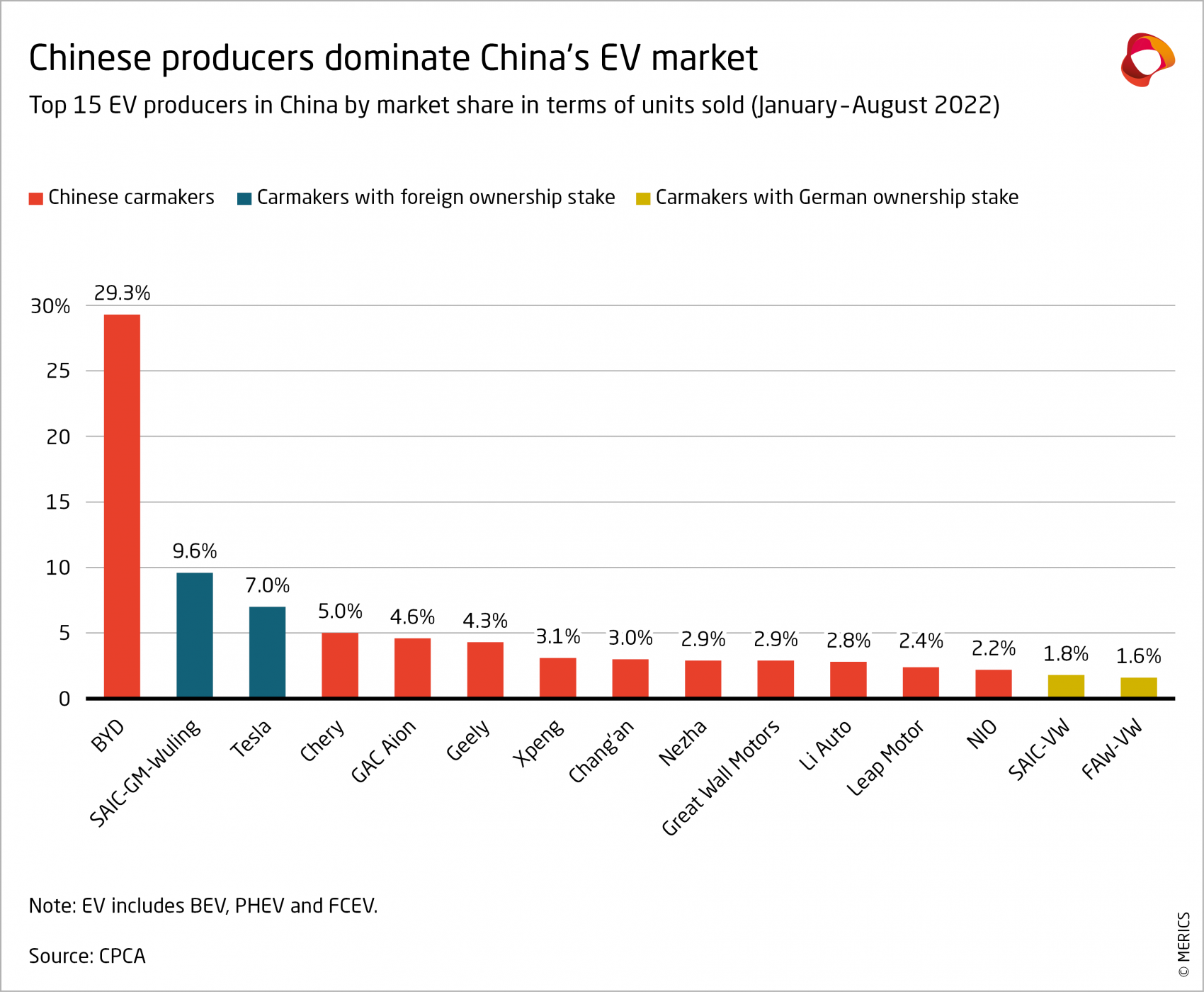

Domestic companies have been the main beneficiaries of the shift to EVs in the Chinese market. Among the top 15 EV producers in China, only four can be considered to have foreign ownership. In 2021, BMW and Mercedes-Benz had market shares of less than 0.3 percent in China’s EV market, having sold fewer than 10,000 units each in a market of 3.3 million units. Volkswagen fared better but still only had a 3.7 percent share of the EV market, compared to 11.3 percent of the overall market (see Exhibit 5).

The weakness of German carmakers in China’s EV market seems to have its roots in a lack of supply and demand. On the supply side, BMW, Mercedes-Benz and Volkswagen only started to offer EV models in China very recently, and when they did so they failed to connect with the younger and more tech-focused Chinese consumers who prefer Tesla and domestic alternatives.

BMW, Mercedes-Benz, and Volkswagen have become accustomed to high China revenues, with roughly a fifth of their global revenue originating in the country.12 But their Chinese EV competitors, with heavy government support, will eat not only into their China market shares, but also into their global ones. Using this domestic advantage, companies like BYD have a good shot at becoming internationally successful.

Investment motivation 2: Leverage China’s innovation ecosystem globally

The German carmakers are looking beyond the current crisis and want to integrate themselves into China’s attractive R&D and technology landscape to take advantage of the following five factors.

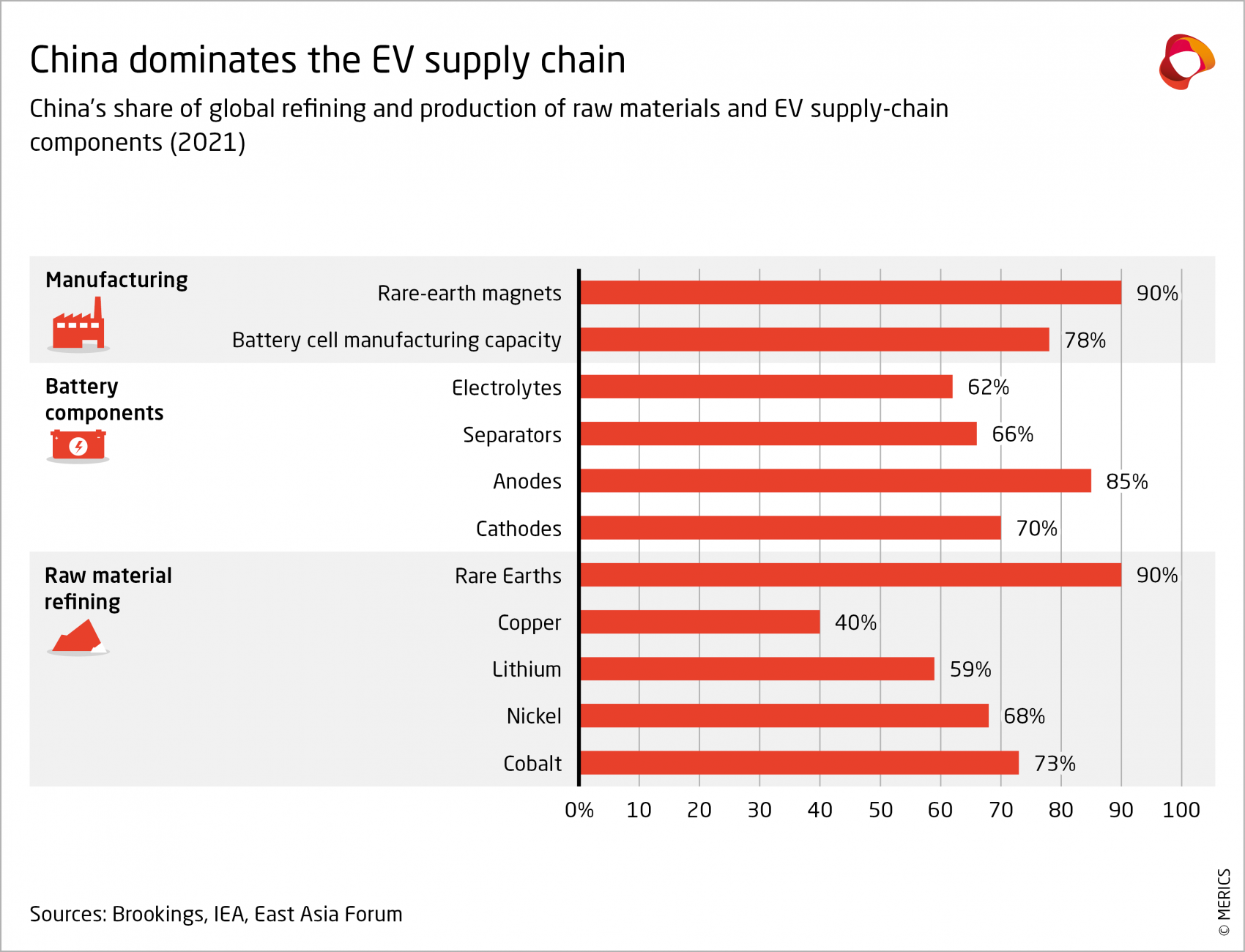

- China’s EV supply-chain dominance: Through industrial policy and massive state financing, China has extended its control over the entire EV supply chain (see Exhibit 6). This makes it extremely attractive for German carmakers to set up R&D centers to collaborate with leading Chinese companies in the EV supply chain, just as they have been doing with their internal combustion engine suppliers in Germany.

- Government support for innovation: China currently spends 2.44 percent of GDP13 on R&D (more than the EU average) and has plans to increase this by 7 percent annually until 2025. The country, having pioneered the large-scale adoption of EV purchasing subsidies to fuel innovation, plans now to move from a state- to a market-driven EV sector by phasing out subsidies next year. As part of a business-to-government data- sharing scheme, China-based EV manufacturers are required to share mechanical data – for instance, on driving performance–that firms and researchers can access.14 Government support for AI innovation also greatly increases the innovation capacity of local firms and the attractiveness of China-based R&D activities.15

- A dynamic market environment: China leads the world in the number of available EV models. Chinese consumers can choose between 298 models, which is 62 percent more than in Europe and 373 percent more than in the United States.16

- Collaboration opportunities: There are areas where the German carmakers can learn from Chinese companies.17 While they are still trying to catch up in EVs, their Chinese competitors have moved on to focus more on digital solutions. Tech giants like Baidu and Xiaomi have entered the EV sector and bring with them a culture of faster development cycles. Car development now takes two to three rather than four to five years.18

- Local government support: China’s local officials vie for the attention of multinational companies by removing regulatory barriers in technology development. This is most pronounced in autonomous driving. In 2018, Volkswagen-owned Audi announced a new R&D and testing center in Wuxi, in Jiangsu province, because of advantageous local conditions for autonomous driving testing. As part of its research, Audi is tightly embedding itself in Wuxi’s tech ecosystem and now partners with the province’s Ministry of Public Security, the Wuxi Police, Huawei, Horizon Robotics, and China Mobile.19

To leverage this attractive R&D environment, German carmakers are moving away from an “in China, for China” strategy to what for certain technologies could become an “in China, for the world” model. But this will not happen across all technologies. In digital connectivity, for instance, China is almost completely decoupled from the rest of the world due to its Great Firewall. But for batteries or automotive software development, there is a case to be made for moving parts of the development from Europe to China because of the country’s comparative leadership in those technologies (see Exhibit 7).

3. German carmakers’ investments and R&D activities under changing frameworks

While the investment and R&D activities of German carmakers in China could prove instrumental for them to retain their dominance in the country and beyond, this increasing integration is coming at a time of major geopolitical shifts.

The environment in which the carmakers operate has changed drastically during the last three decades. China has not only become more repressive internally, as evidenced by events in Xinjiang. It also increasingly exerts economic pressure externally, as shown by its trade boycotts against Australia, Lithuania, and Taiwan.

In the case of Lithuania, China demonstrated that the automotive sector is not exempt from economic coercion when it pressured the German automotive parts supplier Continental to cut business ties in the Baltic state.23

Some countries have ramped up restrictions on trade with China, adding complexity for multinationals doing business there. The United States has sanctioned several Chinese companies, and other countries have tightened export controls and employed new instruments to combat Chinese attempts to transfer technology or distort global markets.

Russia’s invasion of Ukraine has signaled just how quickly economic ties can unravel in the case of a major geopolitical crisis. In their strategic assessment, German carmakers must balance the opportunities arising from increasing their R&D spending in China, which by no means guarantees an improvement in market shares, against the emerging economic and political risks involved.

The decisions that German carmakers make today to retain their competitiveness have direct consequences not only for Germany’s economy but also for Europe’s since their highly specialized value chains stretch across European borders.

Notable opportunities for Germany’s carmakers and economy because of deeper integration in China include:

- Global competitiveness: Greater R&D spending in China can help German carmakers stay competitive in the country and globally. That can help prevent Chinese companies from accruing global market shares in crucial technologies – such as EVs, batteries, and autonomous vehicles (AVs) – from the base of a huge and otherwise largely uncontested home market.

- Innovative edge: German carmakers can absorb new ideas and technologies from China and add them to their global product portfolio. This is particularly important in battery technology and digitization, where China is more competitive than Europe. Other foreign carmakers are more hesitant to use China for global product development, which could give German ones a competitive edge.

- Supply-chain resilience: In a volatile geopolitical environment, cooperation with Chinese tech giants could help German carmakers retain access to China’s market and become less reliant on US tech companies, that have been able to push German OEMs into entering revenue-sharing agreements.24 It could also increase their resilience against Beijing’s requirement that certain “autonomous and controllable” technologies should be sourced locally.

- Job protection: Volkswagen claims that EUR 4 billion of its profits made in China flow back to Germany annually, which helps employ 20,000 to 30,000 engineers at home.25 The exact number of jobs linked to revenues in China remains contentious, as most German cars sold there are produced there, but there is certainly some benefit in terms of German employment.

Notable risks for Germany’s carmakers and economy include:

- Stuck in China: In recent years, China has rolled out several policies that could restrict the export of technologies, including AI and autonomous driving capabilities, and restrict cross-border data transfers. The automotive sector is at the center of the cross- border data-management regulations and was the first to see targeted regulation. This clearly complicates the sharing of automotive data and could also derail the export of China-developed R&D.

- Upgrading of competitors: While China has improved its protection regime for intellectual property rights (IPR), this still has major weaknesses by design, particularly when it comes to trade secrets. Entering into cooperation agreements with Chinese tech companies that often have car-building ambitions therefore bears the risk of technology leakage.

- Greater vulnerability: Geopolitical conflicts can have severe consequences for companies. For instance, in 2021, Renault sold 18 percent of its cars in Russia; in early 2022 it was forced to sell its majority stake in local carmaker Avtovaz to a Russian science institute for just one ruble.26 The more German carmakers invest in China and are reliant on the country for technology development and revenue, the more leverage Beijing has over them.

- Human rights violations: China’s technology leaders are deeply involved in Beijing’s suppressive measures against parts of the population. For instance, Volkswagen’s technology partner DJI, a drone maker, is accused and sanctioned by the US Treasury of assisting in the surveillance of Muslim minorities in Xinjiang.27 Such cooperation could lead to consumer backlash outside China, if not outright sanctions by the United States and other countries.

4. Car manufacturers could become delinked from the German economy

“After this round of Chinese EVs takes off, the next country to clash with us will not be the United States, but Germany, because we will probably take a large part of German carmakers market share.”28 (Yao Yang 姚洋)

This quote by influential Chinese economist Yang Yao underscores that China is anticipating conflict with Germany over the automotive sector. Indeed, to increase their leverage, Chinese policymakers are eager to facilitate a greater dependence of German OEMs on China, not just economically, but also technologically.

The new China investments by German carmakers also harbor the potential to weaken Germany’s automotive industry. In other words, what benefits German carmakers in China, might not benefit Germany.

The three developments described below highlight how it could be mainly China that benefits from these latest investments. German carmakers safeguarding their market share in the country through increased investments and offshoring R&D could come at the cost of eroding Germany’s manufacturing and innovation capacity, which would play into China’s wider industrial policy goals.

1. Bringing high value-added activities to China rather than Germany

More R&D in China could help retain German carmakers’ competitiveness and profits, which if channeled back to Germany could help employ engineers at home. But things could play out differently in ways that would be detrimental for Germany in three ways. First, the profits of German carmakers in China might increasingly finance R&D activities based there. For example, some of the 20,000 to 30,000 China-bankrolled Volkswagen engineers in Germany might find themselves replaced by software developers in CARIAD in Beijing or engineers in the company’s Hefei R&D center. Second, the beneficial effects of new technological knowledge could increasingly play out in China. Third, it is unclear whether China-developed technologies will always be able to be brought back to Germany to upgrade local industry and production processes.

For the foreseeable future, German carmakers will continue to do the bulk of their R&D at headquarters, but in emerging fields such as autonomous driving, software, and batteries it could increasingly take place in China because of competitive advantages and a more dynamic market environment. To save costs, carmakers will try to utilize economies of scale and only develop specific technologies once, for global markets.

Volkswagen’s battery R&D activities in China illustrate this trend. 80 percent of the company’s global EV models will use a new “unified cell,”29 co-developed with its Chinese technology partner Gotion High-Tech.30 This means cost savings of up to 50 percent for Volkswagen but comes at the price of relying on China-developed technology for global EV models.

German carmakers are not the only companies seeking to increase their R&D spending in China. Recent surveys have found that German and European companies are eager to participate in China’s innovation ecosystem.31 A substantial share of German firms in China already conduct research (25 percent) and development (33 percent) for global markets there, and the majority of German and European firms in the country planned to increase their China R&D spending in 2022.

China encourages foreign companies’ R&D investments, based on the rationale that these can help it keep its lead in EVs and AVs and set international standards as well as make foreign firms more dependent on the Chinese market.32 President Xi Jinping has said: “If you contribute to innovation in China, China will fully support you, regardless of where you come from.”33

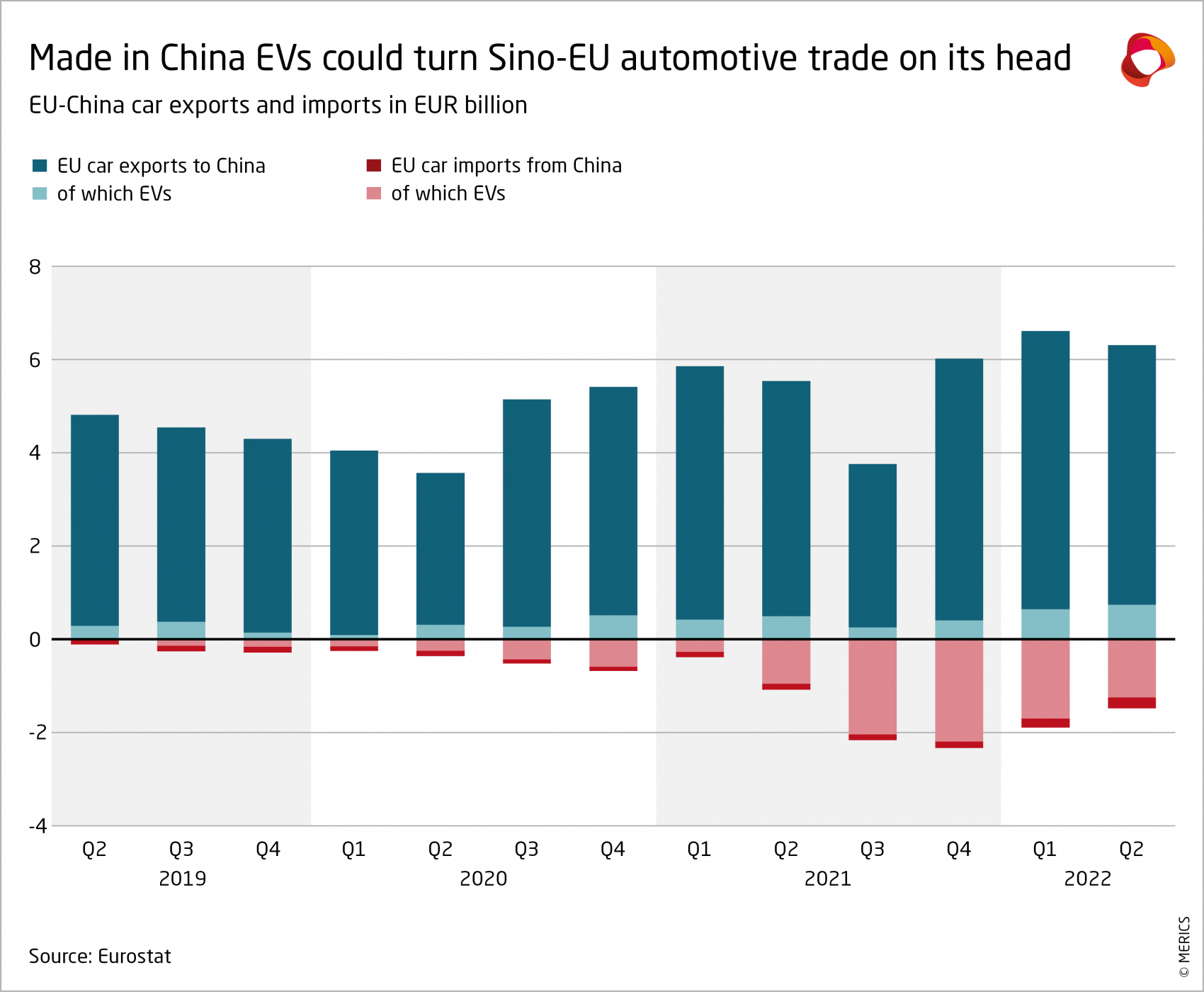

Trend 2: German carmakers help turn Sino-EU automotive trade on its head

German carmakers are increasingly eager to use their production plants in China for exports and, thus, to transform the country into an export hub. Those plans could harm Germany’s, and Europe’s, industrial base.

BMW exports its iX3 model from Shenyang and plans to produce the E-Mini in China for global markets. Mercedes-Benz aims to export its smart brand from China. Volkswagen is reportedly pondering whether to produce its ID.6 SUV in China for European customers.34

EV exports from China could turn the Sino-EU automotive trade on its head, with the EU quickly already a net importer of EVs. German carmakers production for export in China can quickly translate into less production in Germany and Europe, which could bring about severe consequences. In 2019, automotive exports made up 10 percent of the EU’s exports and a third of its trade surplus. Fewer automotive exports from Germany and Europe could put local employment, investment and innovation at stake.

The plan of German carmakers to export EVs from China is also a perfect fit with the country’s industrial policy. Beijing supports China-based carmakers with subsidies, preferential treatment, and policies to ramp up production for exports.35 The most prominent policies, such as the 14th Five-Year Plan, include goals for increased exports of high-value-added goods, such as EVs.36 (see Exhibit 8).

Trend 3: Involuntarily supporting the rise of Chinese suppliers

The rise of EVs and digitalization in China’s automotive sector threatens the existence of traditional German suppliers. There is a high likelihood that German carmakers will turn to Chinese suppliers to retain their global competitiveness. This would be a considerable risk for the German economy.

German carmakers could involuntarily facilitate China’s industrial upgrading and help Chinese companies go global. Many of their collaboration partners, such as CATL or DJI, have benefitted from China’s industrial policies or are tied to China’s military upgrading agenda.

German carmakers could help their Chinese suppliers export their technology stacks as part of Chinese vehicles or factories globally. This is most pronounced in the battery space, with companies like CATL, Svolt, and Envision AESC setting up plants in Europe to supply German and other European carmakers. The rise of these companies is directly related to collaboration with German carmakers. CATL has said it has “learnt a lot from BMW,” particularly from the company’s high standards.37 Further upstream, Chinese battery equipment manufacturers like LEAD are equipping German carmakers’ battery plants in Europe.38

Similar developments are afoot in automated driving. Volkswagen is collaborating with Chinese drone-maker DJI. A jointly developed car with automated driving technology could find their way onto global markets. Then-CEO of Volkswagen Group China, Stephan Wöllenstein, said in 2021 that he would like China-developed autonomous driving and software products to find uses in Europe.39 However, DJI has been blacklisted by the US government for alleged human rights abuses. The risk of such a collaboration for Volkswagen is that it could be sanctioned by the US government.

Overall, Sino-German R&D collaborations and supplier ties help promote Beijing’s agenda. China’s government explicitly encourages Chinese companies in the automotive value chain to “strengthen strategic cooperation with foreign enterprises” and to “jointly develop international and domestic markets.”40 The deeper integration of German carmakers in China does not only help the country absorb global value chains, it also enables Chinese companies to internationalize their standards and influence future technologies.

- Endnotes

-

1 | Hage, Simon and Traufetter, Gerald (2022). Bundesregierung verwehrt VW Garantien für Investitionen in China. May 27. https://www.spiegel.de/wirtschaft/vw-in-china-bundesregierung-lehnt- investitionsgarantie-ab-menschenrechte-a-71be6d36-6b8e-4aed-bb2a-e132c31eb8e9 Accessed: October 12, 2022

2 | T-Online (2022). Habeck kündigt neue China-Handelspolitik an. September 13. https://www.t-online. de/nachrichten/ausland/internationale-politik/id_100052602/robert-habeck-kuendigt-neue-china- handelspolitik-an.html Accessed: October 12, 2022

3 | Volkswagen (2015). China: The second home market of the Volkswagen Group. June 8. https://www. volkswagenag.com/presence/investorrelation/publications/presentations/2015/06-june/2015-06-08_ China%20The%20second%20home%20market%20of%20the%20Volkswagen%20Group.pdf Accessed: October 12, 2022

4 | Monika (2022). Audi, FAW’s NEV joint venture to break ground on plant in Changchun this month. June 24. https://autonews.gasgoo.com/m/70020697.html Accessed: October 12, 2022

Railly News (2022). BMW Opens New Factory in Shenyang https://raillynews.com/2022/06/bmw-new- factory-acti-in-shenyang/ Accessed: October 12, 2022

5 | Deutsche Bundesbank (2022). https://www.bundesbank.de/dynamic/action/de/statistiken/zeitreihen- datenbanken/zeitreihen-datenbank/723452/723452?tsId=BBFDV.A.DO.CN.S1.PSC.NO.D.F.ALL. EUR.I.V._X.C29.1&listId=www_sesbop_aw3_2_1c1_c_s1&dateSelect=2020 Accessed: October 12, 2022

6 | Deutsche Bundesbank (2022). https://www.bundesbank.de/dynamic/action/de/statistiken/ zeitreihen-datenbanken/zeitreihen-datenbank/723452/723452?listId=www_sesbop_aw3_2_1c1_c_ w1&tsId=BBFDV.A.DO.W1.S1.PSC.NO.D.F.ALL.EUR.I.V._X.C29.1&dateSelect=2020 Accessed: October 12, 2022

7 | IEA (2022). Global EV Outlook: Trends in electric light-duty vehicles. May. https://www.iea.org/reports/ global-ev-outlook-2022/trends-in-electric-light-duty-vehicles Accessed: October 12, 2022

8 | Pontes, José (2022). Electric Car Market — 31% Market Share In May!. June 24. https://cleantechnica. com/2022/06/24/china-electric-car-market-31-market-share-in-may/ Accessed: October 12, 2022

9 | Diess, Herbert (2022). China will be one of the drivers of growth and technology in the NEWAUTO world. July. https://www.linkedin.com/posts/herbertdiess_china-newauto-activity- 6950008962855395330-Z3cH Accessed: October 12, 2022

10 | Bundesministerium für Verkehr und Digitale Infrastruktur (2018). https://www.bmvi.de/SharedDocs/ DE/Anlage/DG/gemeinsame-absichtserklaerung-zum-vernetzten-und-automatisierten-fahren-deutsch. pdf? blob=publicationFile Accessed: October 12, 2022

11 | BMW Group (2021). BMW Startup Garage China opens Joint Innovation Base with Alibaba Cloud in Shanghai. May 21. https://www.press.bmwgroup.com/global/article/detail/T0332923EN/bmw-startup- garage-china-opens-joint-innovation-base-with-alibaba-cloud-in-shanghai?language=en Accessed: October 12, 2022

12 | Zenglein, Max. J. (2020). Mapping and Recalibrating Europe’s Economic Interdependence with China . November 18. https://merics.org/sites/default/files/2020-11/Merics%20ChinaMonitor_Mapping%20and%20recalibrating_1.pdf Accessed: October 12, 2022

13 | Xinhua (2022). China's spending on R&D reaches new high in 2021. January 26. https://english.www.gov.cn/archive/statistics/202201/26/content_WS61f0de8cc6d09c94e48a44d1.html Accessed: October 12, 2022

14 | Martens, Bertin and Bo Zhao (2021). “Data access and regime competition: A case study of car data sharing in China.” Big Data & Society: July-December. https://journals.sagepub.com/doi/ pdf/10.1177/20539517211046374 Accessed: October 12, 2022

15 | Beraja, Martin et al. (2021). AI-tocracy. November. https://www.nber.org/papers/w29466 Accessed: October 12, 2022

16 | IEA (2022). Global EV Outlook: Trends in electric light-duty vehicles. May. https://www.iea.org/reports/ global-ev-outlook-2022/trends-in-electric-light-duty-vehicles Accessed: October 12, 2022

17 | Freitag, Michael (2022). "Wir glauben, dass unsere Präsenz Positives bewirkt". May 30. https://www. manager-magazin.de/unternehmen/autoindustrie/volkswagen-in-china-wie-ralf-brandstaetter-der- falle-entkommen-will-a-ef6cfeb8-2a32-4c90-92d8-97812fb431fe Accessed: October 12, 2022

18 | Global Times (2022). Baidu-backed JIDU unveils ROBO-01, its first concept robocar, echoing Tesla’s Model-Y. June 9. https://www.globaltimes.cn/page/202206/1267679.shtml?id=11 Accessed: October 12, 2022

19 | Audi China (2018). 奥迪中国在无锡获得首批自动驾驶测试牌照 (Audi China receives first batch of autonomous driving test licenses in Wuxi) https://www.audichina.cn/cn/brand/zh/news/2018/2018- 09-14.html Accessed: October 12, 2022

20 | BMW Group (2021). BMW Startup Garage China opens Joint Innovation Base with Alibaba Cloud in Shanghai. May 21. https://www.press.bmwgroup.com/global/article/detail/T0332923EN/bmw- startup-garage-china-opens-joint-innovation-base-with-alibaba-cloud-in-shanghai?language=en Accessed: October 12, 2022

21 | Mercedes-Benz group media (2021). Daimler strengthens R&D footprint in China with new Tech Center in Beijing. October 20. https://group-media.mercedes-benz.com/marsMediaSite/en/instance/ko/ Daimler-strengthens-RD-footprint-in-China-with-new-Tech-Center-in-Beijing.xhtml?oid=51684811 Accessed: October 12, 2022

22 | Feng Sihan (2021). 大众集团如何下好先手棋?(How does the Volkswagen Group make a good first move?). Beijing: Xinhuanet. http://www.xinhuanet.com/auto/2021-01/22/c_1127011712.htm Accessed: October 12, 2022

23 | Sytas, Andrius and O’Donenell, John (2021). EXCLUSIVE China pressures Germany's Continental to cut out Lithuania – sources. December 17. https://www.reuters.com/world/china/exclusive-china-asks- germanys-continental-cut-out-lithuania-sources-2021-12-17/ Accessed: October 12, 2022

24 | Holtermann, Felix (2022). Nvidia-Chef: "Mercedes wird die wertvollste Luxusmarke des Planeten werden“. May 27. https://www.handelsblatt.com/technik/it-internet/chiphersteller-nvidia-chef- mercedes-wird-die-wertvollste-luxusmarke-des-planeten-werden/28378564.html Accessed: October 12, 2022

25 | Hage, Simon and Klusmann, Steffen (2022). "Ohne die Geschäfte mit China würde die Inflation noch weiter explodieren". June 30. https://www.spiegel.de/wirtschaft/vw-chef-herbert-diess-ohne-die- geschaefte-mit-china-wuerde-die-inflation-noch-weiter-explodieren-a-c237d7ff-d73b-4d78-8c88- fbd50c88e0ee Accessed: October 12, 2022

26 | Van Overstraeten, Benoit; Guillaume, Gilles and Carey, Nick (2022). Renault sells Russia's Avtovaz stake, but leaves room for return. May 16. https://www.reuters.com/markets/deals/renault-sells-its- stake-russias-avtovaz-option-buy-it-back-2022-05-16/ Accessed: October 12, 2022

27 | Feng, Coco and Fromer, Jacob (2021). US sanctions DJI and AI firms including Megvii over alleged Xinjiang human rights abuses. December 17. https://www.scmp.com/tech/big-tech/article/3159808/ us-sanctions-dji-and-ai-firms-including-megvii-over-alleged-xinjiang Accessed: October r 12, 2022

28 | Yao Yang姚洋(2022).中国经济的韧性 (The resilience of China's economy). September 29. https://m. aisixiang.com/data/136820-2.html Accessed: October 12, 2022

29 | Volkswagen (2022). Batterie und schnelles Laden – Schlüssel zum Erfolg. September 26. https://www. volkswagenag.com/de/strategy/battery-charging.html Accessed: October 12, 2022

30 | Volkswagen (2021). Volkswagen Konzern und Gotion High-Tech gehen Industrialisierung von Batteriezellfertigung in Deutschland gemeinsam an. July 13. https://www.volkswagenag.com/de/ news/2021/07/volkswagen-group-and-gotion-high-tech-team-up-to-industrialize-b.html Accessed: October 12, 2022

31 | AHK Greater China (2022). German Innovation From China Going Global Amid a Complex Innovation Ecosystem - German Chamber’s Innovation Survey 2022. June 28. https://china.ahk.de/de/news/news- details/german-innovation-from-china-going-global-amid-a-complex-innovation-ecosystem-german- chambers-innovation-survey-2022 Accessed: October 12, 2022

32 | China’s central planning body, the National Development and Reform Commission (NDRC), has streamlined the approval process for foreign investments in areas such as the R&D and manufacturing of cathode materials for batteries, electric or fuel cell engines. The Ministry of Commerce (MOFCOM) announced that foreign R&D centers in China are particularly welcome. See: https://www.ndrc.gov. cn/xxgk/zcfb/tz/202103/t20210322_1269960.html?code=&state=123; Accessed: October 12, 2022 Dezan Shira & Associates (2020). Encouraged Industries for Foreign Investment (Edition 2020) https:// www.china-briefing.com/news/wp-content/uploads/2021/01/Catalogue-of-Encouraged-Industries-for- Foreign-Investment-Edition-2020.pdf; Accessed: October 12, 2022 Ministry of Commerce (2021). 商 务部印发围绕构建新发展格局做好稳外资工作的通知(The Ministry of Commerce issued a notice on stabilizing foreign investment around building a new development pattern ). March 1. http://www.mofcom.gov.cn/ article/ae/ai/202103/20210303041579.shtml. Accessed: October 12, 2022

33 | Xinhua News Agency (2021). 习近平:抓创新不问“出身”,只要能为国家作出贡献都会全力支持 (Xi Jinping: Focusing on innovation does not ask "origin", as long as it can contribute to the country, it will give full support). March 25. http://www.xinhuanet.com/politics/leaders/2021-03/25/c_1127252417.htm Accessed: October 12, 2022

34 | Dittmer, Diana (2021). Autos aus China für Europa? Insider: VW-Spitze bereitet Zäsur vor. October 28. https://www.n-tv.de/wirtschaft/Insider-VW-Spitze-bereitet-Zaesur-vor-article22893285.html Accessed: October 12, 2022

35 | Sebastian, Gregor and Chimits, François (2022). "Made in China" electric vehicles could turn Sino-EU trade on its head. May 30. https://merics.org/en/short-analysis/made-china-electric-vehicles-could- turn-sino-eu-trade-its-head Accessed: October 12, 2022

36 | Xinhua News Agency (2021). 中华人民共和国国民经济和社会发展第十四个五年规划和2035年远景目标纲 要 (The 14th Five-Year Plan for National Economic and Social Development of the People's Republic of China and Outline of the Vision for 2035). March 13.http://www.gov.cn/xinwen/2021-03/13/ content_5592681.htm Accessed: October 12, 2022

37 | Sanderson, Henry (2022). Volt Rush. S.l.: Oneworld Publications.

38 | LEAD (2022). LEAD is dominating the global market! Signed 20GWh contract with Volkswagen. June 21. https://www.leadchina.cn/en/english-lead-is-dominating-the-global-market-signed-20gwh-contract-with-volkswagen/ Accessed: October 12, 2022

39 | Feng Sihan (2021). 大众集团如何下好先手棋?(How does the Volkswagen Group make a good first move?). Beijing: Xinhuanet. http://www.xinhuanet.com/auto/2021-01/22/c_1127011712.htm Accessed: October 12, 2022

40 | Xinhua News Agency (2017).《汽车产业中长期发展规划》全文 (Full text of the mid- to long-term automotive industry development plan). April 25. https://web.archive.org/web/20220717161826/ http://www.xinhuanet.com/auto/2017-04/25/c_1120869697.htm Accessed: October 12, 2022

41 | Zenglein, Max J. (2022). Battered in Russia, companies need to be more transparent about risks in China. March 30. https://merics.org/de/kommentar/battered-russia-companies-need-be-more- transparent-about-risks-china Accessed: October 12, 2022

42 | Zhang Yan and Baptista, Eduardo (2022). China says automakers must have licences for mapping data in smart cars. September 1. https://www.reuters.com/business/autos-transportation/china-says- automakers-must-have-licences-mapping-data-smart-cars-2022-09-01/ Accessed: October 12, 2022

Acknowledgements

The author would like to thank the participants of a workshop in August, interview partners and MERICS colleagues who gave valuable feedback and suggestions.