China’s innovation ecosystem: Right for many, but not for all

Report by European Chamber of Commerce in China and MERICS

After decades of being able to take technological cooperation with China at corporate, academic, and political levels for granted, the last few years have seen a shift towards more critical viewpoints of such engagement in the capitals of liberal market democracies. As technology becomes an increasingly central point of friction between Europe and China, it is imperative to hone a sharp-eyed understanding of the role that European companies play in China’s innovation ecosystem.

Based on a survey among members of the European Chamber of Commerce in China (EUCCC), the report aims at contributing to fill in this knowledge gap and map out examples of research and development (R&D) footprints that European companies have in the Chinese market, as well as implications for the business community and policymakers.

Essential takeaways

- Most respondents find considerable value in participating in China’s innovation ecosystem, and are keen to expand research and development (R&D) activities and further integrate them with their global strategies to make the most of China’s strong talent pool, its speed of commercialisation of new technologies, and the potential of combining European hardware excellence with Chinese software expertise.

- Respondents in sectors where China is encouraging investment and onshoring—like chemicals, industrial machinery and automotive—are mostly going ‘all-in’ – increasing their R&D investments in China and maximising the value they can derive in the market for their local offerings and global ones.

- Others that enjoy open markets or even the red-carpet treatment are taking a ‘hedged bets’ approach – maximizing the value of a large R&D footprint in China while keeping core technology and innovation in their home markets to limit leakage.

- Firms in sectors under increasing pressure from China’s state-planners, such as in information and communications technology, are the most pessimistic, and their R&D strategies reflect the diminishing and lacklustre opportunities they can find in a regulatory environment that no longer needs or wants them competing against national champions.

- Key recommendation for companies: As is always the case for foreign companies considering their position in China, firms should first map their current and future positions against Beijing’s strategic goals, then determine how to maximise the opportunities of a vibrant innovation ecosystem while minimising the leakage and theft risks that may result from having a larger or more comprehensive R&D footprint in the market.

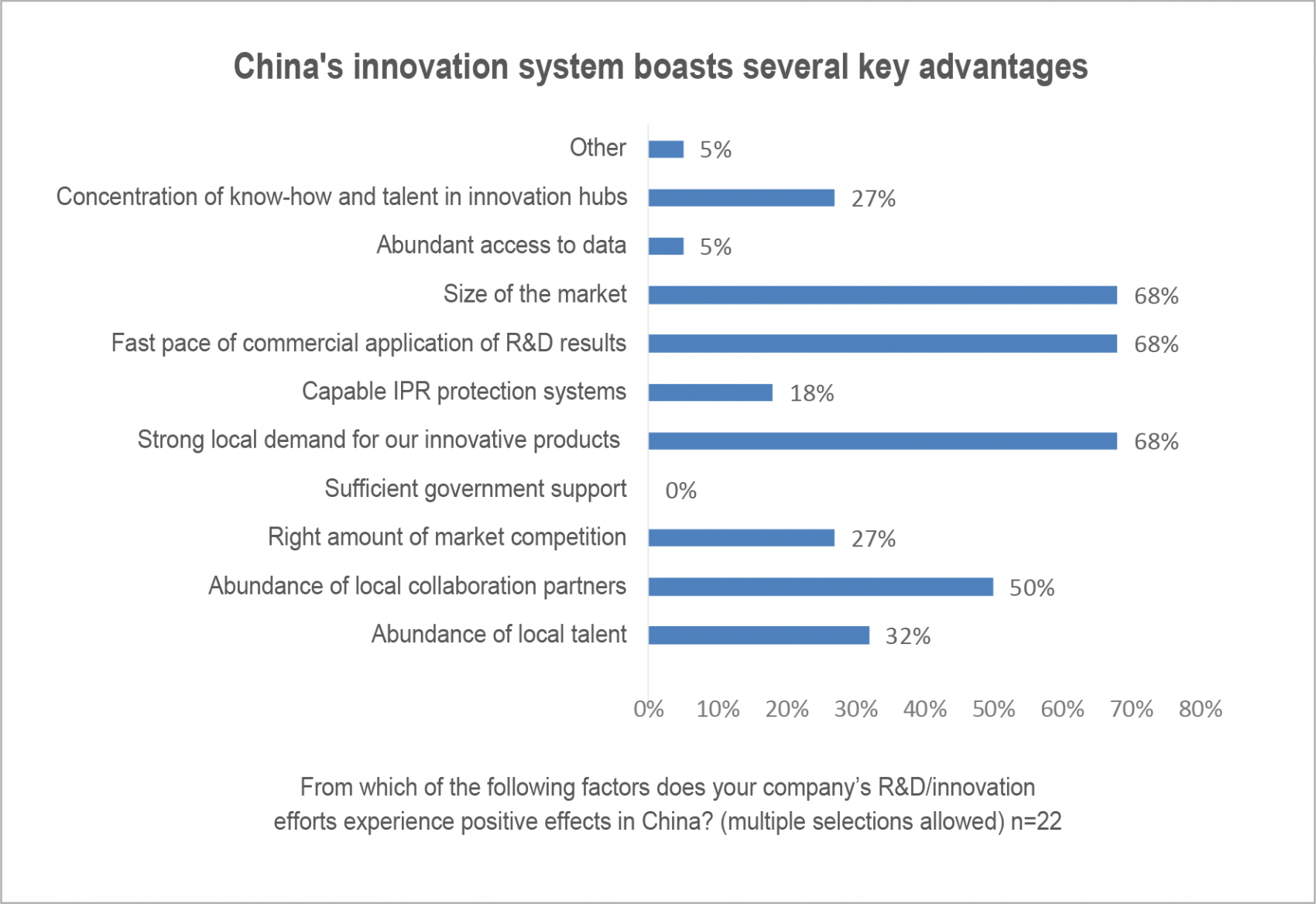

European companies recognise that China’s R&D ecosystem is increasingly vibrant and has many advantages over the rest of the world. Among the advantages most commonly cited was the number and variety of collaboration partners, which ranged from established national champions to companies that are part of China’s vibrant start-up ecosystem as well as inventive scientists and researchers. Survey respondents also widely praised the size of the market (68%) and the fast pace of commercial application of R&D results (68%).

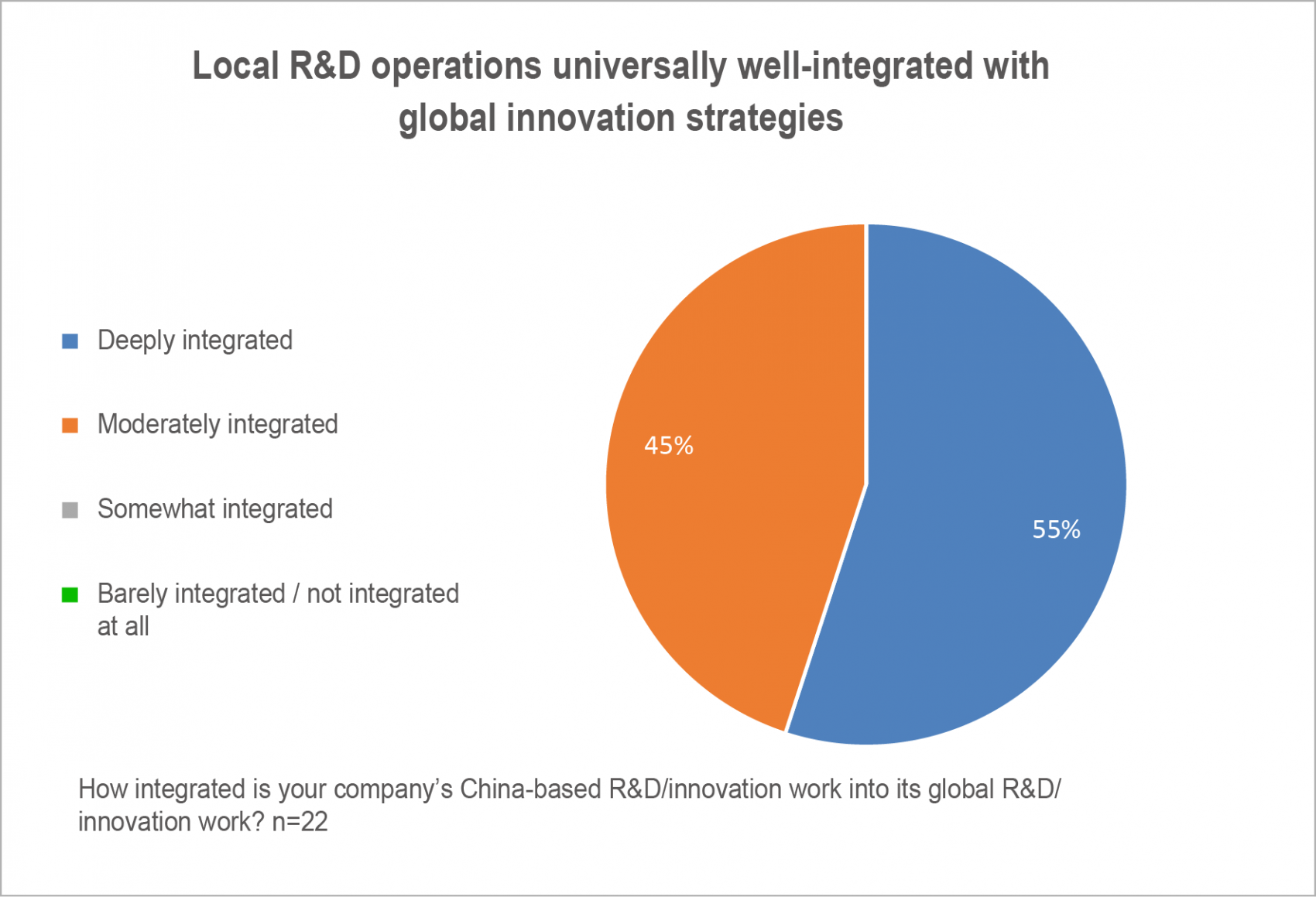

Respondents report increasingly high integration between their China-based innovation work and their global efforts. Participating companies also noted the mature nature of their China-based R&D activities, with a majority using their local innovation capacity to refine existing products, as well as to create new goods and services alongside new business models and operational improvements. This stands in contrast to the early days of European companies doing innovation in China almost exclusively for localisation of products developed in home markets.

While positive factors were considerably more common among respondents, some negative aspects emerged as well, including: weak intellectual property rights (IPR) protection systems (32%); an unlevel playing field for foreign companies (27%); negative sentiment in companies’ home markets towards R&D in China (23%); and insufficient local talent (18%), which specifically referred to challenges in finding suitable hardware engineers, as reported by many of the interviewees.

Those that reported unequal access to government support (82% of respondents) noted several causes, including: opaque or unclear application information/processes for accessing grants and subsidies (58%); administrative challenges not faced by local companies (42%); support schemes that are not publicly announced, but communicated only to local companies (37%); and explicit rules preventing foreign companies from accessing support (26%).

However, while participants in both the survey and interviews held positive overall views on doing innovation work in China, the benefits that European companies can derive from their participation very much depends on the sector they are in. The potential opportunities and rewards of participation must be soberly weighed against the associated risks. In other words, China’s R&D environment is a microcosm of its overall market – it is not for everyone.

In that sense, the generally positive findings of the surveys and interviews must be viewed in the context of the industries that are the most represented in this study’s limited sample size, which are chemicals (29% of total respondents), automotive (13%) and machinery (16%). These industries are ones in which European companies have experienced considerable success in the China market and enjoyed improved market access and increasingly favourable conditions in recent years. Meanwhile, industries languishing in the ‘cargo hold’—like information and communication technology (ICT), telecommunications and all things digital—find themselves increasingly squeezed out of the market, and are struggling with local R&D as a result.

This report is part of a series of projects supported and funded by the German Ministry of Education and Research (as part of the grant under funding reference number 01DO21014B), and is done in collaboration with the European Chamber and MERICS, along with input from partners at Ruhr University Bochum (RUB), and the University of Duisburg-Essen (UDE).

This report is part of a series of projects supported and funded by the German Ministry of Education and Research (as part of the grant under funding reference number 01DO21014B), and is done in collaboration with the European Chamber and MERICS, along with input from partners at Ruhr University Bochum (RUB), and the University of Duisburg-Essen (UDE).